Professional Documents

Culture Documents

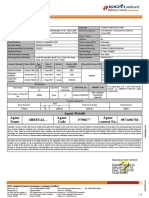

No. Particulars No. Introduction To Derivatives

No. Particulars No. Introduction To Derivatives

Uploaded by

Harshad PatelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

No. Particulars No. Introduction To Derivatives

No. Particulars No. Introduction To Derivatives

Uploaded by

Harshad PatelCopyright:

Available Formats

1

CONTENTS

Chapter Particulars Page

No.

No.

1 Introduction to Derivatives

Derivatives Defined……………………………………………………………. 3

The participants in a derivative market ……………………………………….. 5

Types of Derivatives…………………………………………………………... 5

History of Derivatives…………………………………………………………. 8

Derivative Market in India…………………………………………………….. 11

Introduction to Forward Contract……………………………………………… 14

Introduction to Futures………………………………………………………… 16

Introduction to Option…………………………………………………………. 19

Pricing of futures ……………………………………………………………… 22

Pricing of Options……………………………………………………………... 22

2 Clearing & Settlement

Clearing Banks………………………………………………………………… 24

Clearing Members…………………………………………………………....... 24

Clearing Mechanism………………………………………………………… 25

Settlement Schedule…………………………………………………………… 27

Settlement Price………………………………………………………………... 27

Settlement Mechanism………………………………………………………… 28

Settlement Procedure…………………………………………………………... 32

3 Basic Pay-offs

Pay-off for Buyer of Call option………………………………………………. 32

Pay-off for Writer of Call option………………………………………………. 32

Pay-off for Buyer of Put option………………………………………………... 33

Pay-off for Writer of Put option……………………………………………...... 34

Pay-off for Buyer of Nifty Future……………………………………………... 35

Pay-off for Seller of Nifty Future……………………………………………… 35

4 Trading in Derivative

Future and Option trading System ……………………………………………. 37

Entities in trading System……………………………………………………... 37

Corporate hierarchy……………………………………………………………. 38

Order types and condition……………………………………………………... 39

5 The Risk Management System of Derivatives

Shri S.V. Patel College of Computer Science & Business Management

2

INTRODUCTION

The term "Derivative" indicates the value which is entirely "derived" from the value of the assets

such as securities, commodities, bullion, currency, live stock or anything else. In other words,

Derivative means a forward, future, option or any other hybrid contract of pre determined fixed

duration, linked for the purpose of contract fulfillment to the value of a specified real or financial

asset or to an index of securities.

Derivatives have been included in the definition of Securities in The Securities Contracts

(Regulations) Act, as a security derived from a debt instrument, share, loan, whether secured or

unsecured, risk instrument or contract for differences or any other form of security; a contract

which derives its value from the prices, or index of prices, of underlying securities.

Shri S.V. Patel College of Computer Science & Business Management

3

Derivatives include options and futures. Certain options are short-term in nature and are issued

by investors. These options may be long-term in nature and are issued by companies in the

process of financing their activities. The trading in derivatives are things of US origin and in US

the Organized exchanges began trading in options on equities in 1973 and on debt from 1982.

‘Derivatives’ initially, had its reference to the bank transaction when banks created deposits out

of primary deposits. The primary deposit is received by banks and the same is lent on book

credit. The bank does not give cash to the borrower but provides him with a cheque book and

allows him to draw for payment. When these cheques presented in the bank, they create deposits

and they were referred to as the derivatives. In a similar fashion, the stocks are traded in

exchanges either as spot – delivery against payment or on forward market – delivery on future

payment. This may or may not happen, but the purpose is to prevent any fall in price of stocks

which is insurance the risk of volatility in prices. The derivatives market consists of forward

contract, futures contract, options trading and swaps market.

Derivatives Defined

Derivative is a product whose value is derived from the value of one or more basic variables,

called bases underlying asset, index, or reference rate, in a contractual manner, the underlying

asset can be equity, fore, commodity or any other asset. For example, wheat farmers may wish to

sell their harvest at a future date to eliminate the risk of a change in prices by that date. Such a

transaction is an example of derivatives. The price of this derivative is driven by the spot price of

wheat which is the “underlying”.

In the Indian context the Securities Contracts Regulation Act, 1956(SCRA) defines

“derivative’ to include”-

1. A security derived from a debt instrument, share, and loan whether secured or unsecured,

risk instrument or contract for differences or any other form of security.

2. A contract, which derives its value from the prices, or index of prices, of underlying

securities.

Derivatives are securities under the SCRA and hence the regulatory framework under the SCRA

governs the trading of derivatives.

Shri S.V. Patel College of Computer Science & Business Management

4

Structure of Derivative Markets

Derivative trading in India takes place either on a separate and independent Derivative Exchange

or on a separate segment of an existing Stock Exchange. Derivative Exchange/Segment function

as a Self-Regulatory Organization (SRO) and SEBI acts as the oversight regulator. The

clearing & settlement of all trades on the Derivative Exchange/Segment would have to be

through a Clearing Corporation/House, which is independent in governance and membership

from the Derivative Exchange/Segment.

Economic functions of a derivatives market:

The derivatives market performs a number of economic functions:

1. It helps in transferring risks from risk averse people to risk oriented people.

2. It helps in the discovery of future as well as current prices.

3. It catalyzes entrepreneurial activity.

4. It increase the volume traded in markets because of participation of risk averse people in

greater number.

5. It increases savings and investment in the long run.

The participants in a derivative market

Hedgers

Use futures or options markets to reduce or eliminate the risk associated with price of an asset.

Speculators

Shri S.V. Patel College of Computer Science & Business Management

5

Use futures and options contracts to get extra leverage in betting on future movements in the

price of an asset. They can increase both the potential gains and potential losses by usage of

derivatives in a speculative venture.

Arbitragers

Arbitragers are in business to take advantage of a discrepancy between prices in two different

markets. If, for example, they see the futures price of an asset getting out of line with the cash

price, they will take offsetting positions in the two markets to lock in a profit.

Types of Derivatives

Forwards

A forward contract is a customized contract between two entities, where Settlement takes place

on a specific date in the future at today’s pre-agreed price.

Futures

A futures contract is an agreement between two parties to buy or sell an asset at a certain time in

the future at a certain price. Futures contracts are special types of forward contracts in the sense

that the former are standardized exchange-traded contracts

Options

Options are of two types - calls and puts. Calls give the buyer the right but not the obligation to

buy a given quantity of the underlying asset, at a given price on or before a given future date.

Puts give the buyer the right, but not the obligation to sell a given quantity of the underlying

asset at a given price on or before a given date.

Warrant

Options generally have lives of up to one year; the majority of options traded on options

exchanges having a maximum maturity of nine months. Longer-dated options are called warrants

and are generally traded over-the-counter.

Shri S.V. Patel College of Computer Science & Business Management

6

LEAPS

The acronym LEAPS means Long-Term Equity Anticipation Securities. These are options

having a maturity of up to three years.

Baskets

Basket options are options on portfolios of underlying assets. The underlying asset is usually a

moving average or a basket of assets. Equity index options are a form of basket options.

Swaps

Swaps are private agreements between two parties to exchange cash flows in the future

according to a prearranged formula. They can be regarded as portfolios of forward contracts.

There are two types of Swaps: Interest rate swaps & Currency swaps.

1. Interest rate swaps

These entail swapping only the interest related cash flows between the parties in the same

currency.

2. Currency swaps

These entail swapping both principal and interest between the parties, with the cash flows in one

direction being in a different currency than those in the opposite direction.

Swaptions

Swaptions are options to buy or sell a swap that will become operative at the expiry of the

options. Thus a swaption is an option on a forward swap. Rather than have calls and puts, the

swaptions market has receiver swaptions and payer swaptions. A receiver swaption is an option

to receive fixed and pay floating. A payer swaption is an option to pay fixed and receive floating.

Shri S.V. Patel College of Computer Science & Business Management

7

Types of Derivatives

Derivatives

FORWARD OPTIONS FUTURE SWAP

CALL PUT CURRENCY INTEREST RATE

History of Derivatives

The history of derivatives is quite colorful and surprisingly a lot longer than most people think.

Forward delivery contracts, stating what is to be delivered for a fixed price at a specified place

on a specified date, existed in ancient Greece and Rome. Roman emperors entered forward

contracts to provide the masses with their supply of Egyptian grain. These contracts were also

undertaken between farmers and merchants to eliminate risk arising out of uncertain future prices

of grains. Thus, forward contracts have existed for centuries for hedging price risk.

Shri S.V. Patel College of Computer Science & Business Management

8

The first organized commodity exchange came into existence in the early 1700’s in Japan. The

first formal commodities exchange, the Chicago Board of Trade (CBOT), was formed in 1848

in the US to deal with the problem of ‘credit risk’ and to provide centralized location to negotiate

forward contracts. From ‘forward’ trading in commodities emerged the commodity ‘futures’.

The first type of futures contract was called ‘to arrive at’. Trading in futures began on the CBOT

in the 1860’s. In 1865, CBOT listed the first ‘exchange traded’ derivatives contract, known as

the futures contracts. Futures trading grew out of the need for hedging the price risk involved in

many commercial operations. The Chicago Mercantile Exchange (CME), a spin-off of CBOT,

was formed in 1919, though it did exist before in 1874 under the names of ‘Chicago Produce

Exchange’ (CPE) and ‘Chicago Egg and Butter Board’ (CEBB).

The first financial futures to emerge were the currency in 1972 in the US. The first foreign

currency futures were traded on May 16, 1972, on International Monetary Market (IMM), a

division of CME. The currency futures traded on the IMM are the British Pound, the Canadian

Dollar, the Japanese Yen, the Swiss Franc, the German Mark, the Australian Dollar, and the Euro

dollar. Currency futures were followed soon by interest rate futures. Interest rate futures

contracts were traded for the first time on the CBOT on October 20, 1975. Stock index futures

and options emerged in 1982. The first stock index futures contracts were traded on Kansas City

Board of Trade on February 24, 1982.The first of the several networks, which offered a trading

link between two exchanges, was formed between the Singapore International Monetary

Exchange (SIMEX) and the CME on September 7, 1984.

Options are as old as futures. Their history also dates back to ancient Greece and Rome. Options

are very popular with speculators in the tulip craze of seventeenth century Holland. Tulips, the

brightly coloured flowers, were a symbol of affluence; owing to a high demand, tulip bulb prices

shot up. Dutch growers and dealers traded in tulip bulb options. There was so much speculation

that people even mortgaged their homes and businesses. These speculators were wiped out when

the tulip craze collapsed in 1637 as there was no mechanism to guarantee the performance of the

option terms.

Shri S.V. Patel College of Computer Science & Business Management

9

The first call and put options were invented by an American financier, Russell Sage, in 1872.

These options were traded over the counter. Agricultural commodities options were traded in the

nineteenth century in England and the US. Options on shares were available in the US on the

over the counter (OTC) market only until 1973 without much knowledge of valuation. A group

of firms known as Put and Call brokers and Dealer’s Association was set up in early 1900’s to

provide a mechanism for bringing buyers and sellers together.

On April 26, 1973, the Chicago Board options Exchange (CBOE) was set up at CBOT for the

purpose of trading stock options. It was in 1973 again that black, Merton, and Scholes invented

the famous Black-Scholes Option Formula. This model helped in assessing the fair price of an

option which led to an increased interest in trading of options. With the options markets

becoming increasingly popular, the American Stock Exchange (AMEX) and the Philadelphia

Stock Exchange (PHLX) began trading in options in 1975.

The market for futures and options grew at a rapid pace in the eighties and nineties. The collapse

of the Bretton Woods regime of fixed parties and the introduction of floating rates for currencies

in the international financial markets paved the way for development of a number of financial

derivatives which served as effective risk management tools to cope with market uncertainties.

The CBOT and the CME are two largest financial exchanges in the world on which futures

contracts are traded. The CBOT now offers 48 futures and option contracts (with the annual

volume at more than 211 million in 2001).The CBOE is the largest exchange for trading stock

options. The CBOE trades options on the S&P 100 and the S&P 500 stock indices. The

Philadelphia Stock Exchange is the premier exchange for trading foreign options.

The most traded stock indices include S&P 500, the Dow Jones Industrial Average, the Nasdaq

100, and the Nikkei 225. The US indices and the Nikkei 225 trade almost round the clock. The

N225 is also traded on the Chicago Mercantile Exchange.

Shri S.V. Patel College of Computer Science & Business Management

10

Derivative Market in India

The first step towards introduction of derivatives trading in India was the promulgation of the

Securities Laws Ordinance, 1995, which withdrew the prohibition on options in securities. The

market for derivatives however did not take off as there was no regulatory framework to govern

trading of derivatives. SEBI set up a 24-member committee under the Chairmanship of Dr. L.C.

Gupta on November 18, 1996 to develop appropriate regulatory framework of derivatives trading

in India. The committee submitted its report on March 17, 1998 prescribing necessary pre

conditions for introduction of derivatives trading in India.

Shri S.V. Patel College of Computer Science & Business Management

11

The committee recommended that derivatives should be declared as “securities’ so that

regulatory framework applicable to trading of ‘securities’ could also govern trading of securities.

SEBI also set up a group in June 1998 under the Chairmanship of Prof J.R. Varma, to

recommend measures for risk containment in derivatives market in India. The report which was

submitted in October 1998, worked out the operational details of margining system methodology

for charging initial margins, broker net worth deposit requirement and real time monitoring

requirements.

The SCRA was amended in December 1999 to include derivatives within the ambit of

‘securities’ and the regulatory framework were developed for governing derivatives trading. The

act also made it clear that derivatives shall be legal and valid only if such contracts are traded on

a recognized stock exchange thus precluding OTC derivatives. The government also reclined in

March 2000 the three-decade-old notification, which prohibited forward trading in securities.

Derivatives trading commenced in India in June 2000 after SEBI granted the final approval to

this effect in May 2000. SEBI permitted the derivative segments of two stock exchanges NSE

and BSE and their clearing House Corporation to commence trading and settlement in approved

derivatives contracts to begin with SEBI approved trading in index futures contracts based on

S&P CNX Nifty and BSE-30 (Sensex) index. This was followed by approval for trading inn

options based on theses tow indexes options on individual securities. The trading in index

options commenced June 2001 and the trading in options on individual securities commenced in

July 2001. Futures contracts on individual stocks were launched in November 2001. Trading and

settlement in derivative contract is done in accordance with the rules, bye laws and regulations of

the respective exchanges ands their clearing house corporation duly approved by SEBI and

notified in the official gazette.

1991 Liberalisation process initiated.

14 December 1995 NSE asked SEBI for permission to trade index

futures.

Shri S.V. Patel College of Computer Science & Business Management

12

18 November 1996 SEBI setup L.C.Gupta Committee to draft a

policy framework for index futures.

11 May 1998 L.C.Gupta Committee submitted report.

7 July 1999 RBI gave permission for OTC forward rate

agreements (FRAs) and interest rate swaps.

24 May 2000 SIMEX chose Nifty for trading futures and

options on an Indian index.

25 May 2000 SEBI gave permission to NSE and BSE to do

index futures trading.

9 June 2000 Trading of BSE Sensex futures commenced at

BSE.

12 June 2000 Trading of Nifty futures commenced at NSE.

25 September 2000 Nifty futures trading commenced at SGX.

2 June 2001 Individual Stock Options & Derivatives

Recommendations of L.C.Gupta Committee on Derivatives

The committee was set up by SEBI in November 1996 to develop the appropriate regulatory

framework for the derivatives trading in India. The committee concern was with the financial

derivatives in general and in particular about the equity derivatives. The committee consisted of

24 members which were from various fields of financial sector. The following were the main

recommendations of the committee:

1. The committee strong favored the introduction of the derivatives trading in India with a view

to provide the hedging to the institutions and the general investors.

Shri S.V. Patel College of Computer Science & Business Management

13

2. The committee recommended that there should be two level of regulatory framework, one is

at the exchange level and the second level is that of the SEBI level.

3. The committee observed that the regulation of SEBI was of overlapping nature and that they

should be studied in detail and then made applicable to the derivatives segment.

4. The committee observed that Mutual funds which are the big players in the capital market

should be allowed to work in the derivatives segment but made it clear that they can use the

derivatives market only for the purpose of hedging and not for speculation.

5. The committee favored the introduction of the simple variants of the derivatives first so that

the market players can understand the product and then proceed with the gradual introduction

of the complex products of derivatives.

6. The committee further recommended that “derivatives” to be included in the definition of

securities under the Securities Contract Regulations Act (SCRA) to enable the trading in

derivatives in its products of options and futures.

Introduction to Forward Contract

A forward contract is an agreement to buy or sell an asset on a specified date for a specified

price. One of the parties to the contract assumes a long position and agrees to buy the

underlying asset on a certain specified future date for a certain specified price. The other party

assumes a short position and agrees to sell the asset on the same date for the same price. Other

contract details like delivery date, price and quantity are negotiated bilaterally by the parties to

the contract. The forward contracts are normally traded outside the exchanges.

The salient features of forward contracts are :

Shri S.V. Patel College of Computer Science & Business Management

14

They are bilateral contracts and hence exposed to counter-party risk.

Each contract is custom designed, and hence is unique in terms of contract size, expiration date

and the asset type and quality.

The contract price is generally not available in public domain.

On the expiration date, the contract has to be settled by delivery of the asset.

If the party wishes to reverse the contract, it has to compulsorily go to the same counter-party,

which often results in high prices being charged.

However forward contract in certain markets have become very standardized as in the case of

foreign exchange thereby reducing transaction costs and increasing transaction volume. This

process of standardization reaches its limit in the organized futures market.

Forward contract are very useful heeding and speculation. The classic hedging application would

be that of an exporter who expects to receive payment in dollar three months later. He is exposed

to the risk of exchange rate fluctuations. By using the currency forward market to sell dollars

forward he can lock on to a rate today and reduce his uncertainty. Similarly an importer who is

required to make a payment in dollars two months hence can reduce his exposure to exchange

rate fluctuations by buying dollars forward.

If a speculator has information or analysis, which forecasts an upturn in a price then he can go

long on the forward market instead of the cash market. The speculator would go long on the

forward, wait for the price to raise and then take a reversing transaction to book profits.

Speculators may well be required to deposit a margin upfront. Hoverer this is generally a

relatively small proportion of the value of the assets underlying the forward contract. The use of

forward markets here supplies leverage to the speculator.

Shri S.V. Patel College of Computer Science & Business Management

15

Limitations of Forward Markets

Lack of centralization of trading

Liquidity and

Counter party risk.

In the first two of these the basic problem is that of too much flexibility and generally. The

forward markets like a real estate market in that any two consenting adults can form contracts

against each other. This often makes them design terms of the deal which are very convenient

that specific situation, but makes the contract non tradable.

Counter party risk arises from the possibility of default by nay on party to the transactions. When

one of the two sides to the transaction declares bankruptcy the other suffers. Even when forward

markets trade standardized contracts and hence avoid the problem of illiquidity, still the counter

party risk remains a very serious issue.

Introduction to Futures

Futures markets were designed to solve the problems that exist in forward markets. A futures

contract is an agreement between two parties to buy or sell an asset at a certain time in the future

at a certain price. But unlike forward contracts the futures contracts are standardized and

exchange traded. To facilitate liquidity in the futures contracts, the exchange specifies certain

standard features of the contract. It is a standardized contract with standard underlying

instrument a standard quantity and quality of the underlying instrument that can be delivered,

(which can be used for reference purposes in settlement) and a standard timing of such

Shri S.V. Patel College of Computer Science & Business Management

16

settlement. A futures contract may be offset prior to maturity by entering into an equal and

opposite transaction. More than 99% of futures transactions are offset this way.

The standardized items in futures contract are;

Quantity of the underlying

Quality of the underlying

The first exchange that traded financial derivatives was launched in Chicago in the year1972. A

division if the Chicago Mercantile exchanges it was called the International Monetary Market

(IMM) and traded currency futures.

The brain behind this was a man called Leo Melamed acknowledged as the Father of financial

futures who was then the Chairman of the Chicago Mercantile Exchange.

Future Terminology

Spot price: The price at which an asset trades in the spot market.

Future price: The price at which the future contract trades in the futures market.

Contract cycle: The period over which a contract trades. The index futures contacts on the NSE

have one month, two months and three months expiry cycle s, which expire on the last Thursday

of the month. Thus a January expiration contract expires on the last Thursday of January and

February expiration contract ceases trading on the last Thursday of February. On the Friday

following the last Thursday a new contract having a three-month expiry is introduced for trading.

Expiry date: It is the date specified in the futures contract. This is the last day on which the

contract will be traded, at the end of which it will cease to exist.

Contract size: The amount of asset that has to be delivered under on contract. For instance, the

contract size on NSE’s futures markets is 200 Nifties.

Shri S.V. Patel College of Computer Science & Business Management

17

Basis: In the context of financial futures, basis can be defined as the futures price minus the spot

price. The will be d different basis for each delivery month for each contract. In a normal market,

basis will be positive. This reflects that futures prices normally exceed spot prices.

Cost of carry: The relationship between futures prices and spot prices can be summarized in

terms of what is known as the cost of carry. This measures the storage cost plus the interest that

is paid to finance the asset less the income earned on the asset.

Initial margin: The amount that must be deposited in the margin account at the time a future a

contract is first entered into is known as initial margin.

Mark to market: In the futures market at the end of each trading day the margin account

adjusted to reflect the investor gain or loss depending upon the futures closing price. This is

called mark to market.

Maintenance margin: This is somewhat lower than the initial margin. This is set to ensure that

the balance in the margin account never becomes negative. If the balance in the margin account

falls below the maintenance margin the investor receives a margin call and is expected to top up

the margin account to the initial margin level before trading commences on the next day.

Distinction between Futures and Forwards Contracts

FEATURES FORWARD CONTRACT FUTURE CONTRACT

Operational Mechanism Traded directly between two Traded on the exchanges.

parties (not traded on the

exchanges).

Contract Specifications Differ from trade to trade. Contracts are standardized

contracts.

Counter-party risk Exists. Exists. However, assumed by the

clearing corp., which becomes

Shri S.V. Patel College of Computer Science & Business Management

18

the counter party to all the

trades or unconditionally

guarantees their settlement.

Liquidation Profile Low, as contracts are tailor High, as contracts are

made contracts catering to the standardized exchange traded

needs of the needs of the contracts.

parties.

Price discovery Not efficient, as markets are Efficient, as markets are

scattered. centralized and all buyers and

sellers come to a common

platform to discover the price.

Examples Currency market in India. Commodities, futures, Index

Futures and Individual stock

Futures in India

Introduction to Options

A derivative transaction that gives the option holder the right but not the obligation to buy or sell

the underlying asset at a price, called the strike price, during a period or on a specific date in

exchange for payment of a premium is known as ‘option’. Underlying asset refers to any asset

that is traded. The price at which the underlying is traded is called the ‘strike price’.

There are two types of options i.e., CALL OPTION & PUT OPTION.

Call Option

A contract that gives its owner the right but not the obligation to buy an underlying asset- stock

or any financial asset, at a specified price on or before a specified date is known as a ‘Call

option’. The owner makes a profit provided he sells at a higher current price and buys at a lower

future price.

Put Option

Shri S.V. Patel College of Computer Science & Business Management

19

A contract that gives its owner the right but not the obligation to sell an underlying asset- stock

or any financial asset, at a specified price on or before a specified date is known as a ‘Put

option’. The owner makes a profit provided he buys at a lower current price and sells at a higher

future price. Hence, no option will be exercised if the future price does not increase.

Put and calls are almost always written on equities, although occasionally preference shares,

bonds and warrants become the subject of options.

Option Terminology

Index options: Theses options have the index as the underlying some options are European

while others are American like index futures contract index options contracts are also cash

settled.

Stock options: Stock options are options on individual stock. Options currently trade on over

500 stocks in Untied States. A contract gives the holder the right to buy or sell shares at the

specified price.

Buyer of an option: The buyer of an option is the one who by paying the options premium buys

the right but not the obligation to exercise his options on the seller writers.

Writer of an option: The writer of a call put options is the one who receives the options

premium ands is there by obliged to sell buy the asset if the buyer exercises on him.

Option price: Option price is the price, which the option buyer pays to the option seller. It is

also referred to as the option premium.

Expiration date: The date specified in the options contract is known as the expiration date the

exercise date, the strike date or the maturity

Strike price: The price specified in the options contract is known as the strike price or the

exercise price.

Shri S.V. Patel College of Computer Science & Business Management

20

American options: American options are options that can be exercised at any time up to the

expiration date most exchange-traded options are American.

European options: European options are options that can be exercised only on the expiration

date itself. Index options are European options.

In The Money option: An In The Money (ITM) option is an option that would lead to a positive

cash flow to the holder if the were exercised immediately a call option on the index is said to be

in the money when the current index stand at la level higher than the strike price is spot price

strike price. If the index is much higher than the strike price, the call is said to be deep ITM. In

the case of a put, the put is ITM if the index is below the strike price.

At The Money option: An At the Money (ATM) option is an option that would lead to zero

cash flow if it were exercised immediately. An option on the index is at the money when the

current index equals the strike price (I.E. spot price=strike price).

Out of The Money option: An Out of The Money (OTM) option is an option that would lead to

a negative cash flow it was exercised immediately. A call option on the index is out of the money

when the current index stands at a level, which is less than the strike price. I.e. spot price=Strike

price. If the index is much lower than the strike price the call is said to be deep OTM. In the case

of a put the put is OTM if the index is above the strike price.

Intrinsic value of an option: The option premium can be broken down into two components

intrinsic value a time value. The intrinsic value of a call is the mount the option is ITM if it is

ITM. If the call is OTM, its intrinsic value is zero. Putting it another way the intrinsic value of a

call is Max (O, St-K), which means the intrinsic value of call is the greater of O or (St) K is the

strike priced St is the spot price.

Time value of an option: The time value of an option is the difference between its premium

and its intrinsic value. Both calls and puts have time value an option OTM or ATM has only time

Shri S.V. Patel College of Computer Science & Business Management

21

value. Usually the maximum time value exists when the options Atm. The longer the time to

expiration the greater is an options time value alleles’ equal at expiration an option should have

no time value.

Pricing of futures

Pricing of a future contract is very simple. Using the cost-of-carry logic, we calculate the fair

value of the future contract. Every time the observed price deviates from the fair value,

arbitragers would enter into trades to capture the arbitrage profit. This in turn would push the

future price back to its fair value. The cost of carry model used for pricing future given below:

F = S * e rt

Where: F = theoretical futures price

S = value of the underlying index

r = Cost of financing (using continuously compounded interest rate)

t = time till expiration in year

e =2.71828

Example:

Shri S.V. Patel College of Computer Science & Business Management

22

Security XYZ Ltd. Trades in the spot market at Rs. 1150. Money can be invested 11% p.a. the

fair value of one-month future contract on XYZ is calculated as follows:

F = S * e rt

= 1150*e0.11*1/12

= 1160

Pricing of Options

An option gives the buyer a right but not an obligation to exercise on the seller. The worst that

can happen to a buyer is the loss of the premium paid by him. His down side is limited to this

premium, but his upside is potentially unlimited. This optionality is precious and has a value,

which is expressed in term of an option price. Just like in order free market, it is the supply and

demand in the secondary market that drives the price of an option.

There are various models which help us get close to the true price of an option. Most of these are

variants of the celebrated Black-Scholes model for pricing European options. Today most

calculators and spread-sheets come with a built-in Black-Scholes options pricing formula.

The Black-Scholes formulas for the prices of European calls and puts on a non-dividend paying

stock are:

C = SN (d1) - Xe-rT N (d2)

P = Xe-rT N (-d2) - SN (-d1)

Where d1 = ln S/X + (r + 2 /2) T

d2 = d1 - T

The Black-Scholes equation is done in continuous time. This required continuous

compounding. Example: if the interest rate per annum is 12 %, you need to use ln 1.12.

N () is the cumulative normal distribution. N(d1) is called the delta of the option which is a

measure of change in option price with respect to change in the price of the underlying

assets.

Shri S.V. Patel College of Computer Science & Business Management

23

a measure of volatility is the annualized standard deviation of continuously compounded

returns on the underlying. When daily sigma is given, that need to be converted into

annualized sigma.

Sigmaannual = Sigmadaily * Number of trading days per year. On an average there are 250

trading days in a year.

X is the exercise price, S the spot price and T the time to expiration measured in a year.

Clearing & Settlement

National Securities Corporation Limited (NSCCL) undertakes clearing and settlement of all

trades executed on the futures and options (F&O) segment of the NSE. It also acts as legal

counter party to all trades on the F&O segment and guarantees their financial settlement.

1. Clearing Banks

NSCCL has empanelled 13 clearing banks namely Axis Bank Ltd., Bank of India, Canara Bank,

Citibank N.A, HDFC Bank, Hongkong & Shanghai Banking Corporation Ltd., ICICI Bank, IDBI

Bank, IndusInd Bank, Kotak Mahindra Bank, Standard Chartered Bank, State Bank of India and

Union Bank of India.

Every Clearing Member is required to maintain and operate clearing accounts with any of the

Shri S.V. Patel College of Computer Science & Business Management

24

empanelled clearing banks at the designated clearing bank branches. The clearing accounts are to

be used exclusively for clearing & settlement operations.

2. Clearing Members

A Clearing Member (CM) of NSCCL has the responsibility of clearing and settlement of all

deals executed by Trading Members (TM) on NSE, who clear and settle such deals through

them. Primarily, the CM performs the following functions:

Clearing: Computing obligations of all his TM's i.e. determining positions to settle.

Settlement: Performing actual settlement. Only funds settlement is allowed at present in Index

as well as Stock futures and options contracts

Risk Management: Setting position limits based on upfront deposits / margins for each TM and

monitoring positions on a continuous basis.

Types of Clearing Members

Trading Member-Clearing Member (TM-CM)

A Clearing Member who is also a TM. Such CMs may clear and settle their own proprietary

trades, their clients’ trades as well as trades of other TM’s & Custodial Participants.

Professional Clearing Member (PCM)

A CM who is not a TM. Typically banks or custodians could become a PCM and clear and settle

for TM’s as well as of the Custodial Participants

Self Clearing Member (SCM)

A Clearing Member who is also a TM. Such CMs may clear and settle only their own proprietary

trades and their clients’ trades but cannot clear and settle trades of other TM’s.

Shri S.V. Patel College of Computer Science & Business Management

25

Clearing Member Eligibility Norms

Net worth of at least Rs.300 lakhs. The net worth requirement for a CM who clears and

settles only deals executed by him is Rs. 100 lakhs.

Deposit of Rs. 50 lakhs to NSCCL which forms part of the security deposit of the CM.

Additional incremental deposits of Rs.10 lakhs to NSCCL for each additional TM in case the

CM undertakes to clear and settle deals for other TMs.

3. Clearing Mechanism

The clearing mechanism essentially involves working out open positions and obligations of

clearing (self-clearing/trading-cum-clearing/professional clearing) members. This position is

considered for exposure and daily margin purpose. The open positions of CMs are arrived at by

aggregating the open positions of all the TMs and all custodial participants clearing through him,

in contracts in which they have traded. A TMs open position is arrived at as the summation of his

proprietary open position and clients open positions in the contracts in which he has traded.

While entering orders on the trading system, TMs are required to identity the orders, whether

proprietary (if they are their own trades) or client (if entered on behalf of clients) through

‘Pro/Cli’ indicator provided in the order entry screen. Proprietary positions are calculated on the

basis (buy-sell) for each contract. Clients’ positions are arrived a by summing together net (buy –

sell) positions of each individual client. A TMs open position is the sum of proprietary open

position, client open long position and client open short position.

1. Proprietary position of trading member Madanbhai on day 1

Trading member Madanbhai trades in the futures & options segment for himself and two of his

clients. The table shows his proprietary position.

Note: A buy position ‘200@1000’ means 200 units bought at the rate of Rs.1000.

Trading member Madanbhai

Buy Sell

Proprietary positions 200@1000 400@1010

Shri S.V. Patel College of Computer Science & Business Management

26

2. Client position of trading member Madanbhai on day 1

Trading member Madanbhai trades in the futures & options segment for himself and two of his

clients. The table shows his clients positions.

Trading member Madanbhai

Buy Open Sell Close Sell Open Buy Close

Client position

Client A 400@1109 200@1000

Client B 600@1100 200@1099

3. Proprietary position of trading member Madanbhai on Day 2

Assume that the position on Day 1 is carried forward to the next trading day and the following

trades are also executed.

Trading member Madanbhai

Buy Sell

Proprietary positions 200@1000 400@1010

4. Client position of trading member Madanbhai on day 2

Trading member Madanbhai trades in the futures and options segment for himself and two of his

clients. The table shows his client position on Day 2

Trading member Madanbhai

Buy Open Sell Close Sell Open Buy Close

Client position

Client A 400@1109 200@1000

Client B 600@1100 400@1099

Shri S.V. Patel College of Computer Science & Business Management

27

The proprietary open position on day 1 is simply = Buy – Sell = 200- 400 = 200 short. The

open position for client A = Buy (O) – Sell (C) = 400 –200 = 200 long, i.e. he has a long

position of 200 units. The open position for Client B = shell (O) – Buy (C) = 600-200 = 400

short, i.e. he has a short position of 400 units. Now the total open position of the trading member

Madanbhai at end on day 1 is 200 (his proprietary open position on net basis) plus 600 (the

Client open positions on gross basis) i.e. 800.

The proprietary open position at end of day 1 is 200 short. The end of day open position for

proprietary trades undertaken on day 2 is 200 short. Hence the net open proprietary position at

the end of day 2 is 400 short. Similarly, Client A’s open position at the end of day 1 is 200 long.

The end of day open position for trades done by Client A on day2 is 200 long. Hence the net

open position for Client A at the end of day 2 is 400 long. Client B’s open position at the end of

day 1 is 400 short. The end of day open position for trades done by Client B on day 2 is 200

short. Hence the net open position for Client B at the end of day 2 is 600 short. The net open

position for the trading member at the end of day 2 is sum of the proprietary open position and

client open positions. It worked out to be 400 +400+ 600, i.e. 1400.

4. Settlement Schedule

The settlement of trades is on T+1 working day basis.

Members with a funds pay-in obligation are required to have clear funds in their primary clearing

account on or before 10.30 a.m. on the settlement day. The payout of funds is credited to the

primary clearing account of the members thereafter.

5. Settlement Price

Product Settlement Schedule

Shri S.V. Patel College of Computer Science & Business Management

28

Futures Contracts Daily Closing price of the futures contracts on the trading

on Index or Settlement day. (closing price for a futures contract shall be

Individual Security calculated on the basis of the last half an hour

weighted average price of such contract)

Un-expired illiquid Daily Theoretical Price computed as per formula F=S * ert

futures contracts Settlement

Futures Contracts Final Closing price of the relevant underlying index /

on Index or Settlement security in the Capital Market segment of NSE, on

Individual the last trading day of the futures contracts.

Securities

Options Contracts Final Exercise Closing price of such underlying security (or index)

on Index and Settlement on the last trading day of the options contract.

Individual

Securities

6. Settlement Mechanism

The entire future and option contract are cash settled, i.e. through exchange of cash. The

underlying for index future/option of the nifty index cannot be delivered. These contracts,

therefore, have to be settled in cash. Future and option on individual securities can be delivered

as in the spot market. However, it has been currently mandated that stock option and future

would also be cash settled. The settlement amount for a CM is netted across all their TMs/clients,

with respect to their obligations on MTM, premium and exercise settlement.

Settlement of future contract

Future contract have two types of settlements, the MTM settlement which happen on a

continuous basis at the end of each day, and the final settlement which happens on the last

trading day of the future contract.

MTM settlement

All future contracts for each member are marked-to-market (MTM) to the daily settlement price

of the relevant futures contract at the end of each day. The profit or losses are computed as the

difference between:

Shri S.V. Patel College of Computer Science & Business Management

29

1. The trade price and the day’s settlement price for contracts executed during the day but not

squared up.

2. The previous day’s settlement price and the current day’s settlement price for bought

forward contract.

3. The buy price and the sell price for contracts executed during the day and squared up.

F = S * e rt

Where: F = theoretical futures price

S = value of the underlying index

r = rate of interest (MIBOR)

t = time to expiration

e =2.71828

Final settlement for futures

On the expiry day of the future contracts, after the close of the trading hours, NSCCL marks all

positions of a CM to the final settlement price and the resulting profit or loss is settled in cash.

Final settlement profit or loss amount is debited or credited to the relevant CM’s clearing bank

account on the day following expiry day of the contract.

Settlement of future contract

Option contracts have three types of settlements, daily premium settlement, exercise settlement,

interim exercise settlement in case of option contracts on securities and final settlement.

Daily premium settlement

Buyer of an option is obligated to pay the premium towards the options purchased by him.

Similarly, the seller of an option is entitled to receive the premium for the option sold by him.

The premium payable amount and the premium receivable amount are netted to compute the net

premium payable or receivable amount for each client for each option contract.

Shri S.V. Patel College of Computer Science & Business Management

30

Exercise settlement

Although most option buyer and seller close out their options positions by an offsetting closing

transaction, an understanding of exercise can help an option buyer determine whether exercise

might be more advantageous than an offsetting sale of an option. There is always a possibility of

an option seller being assigned an exercise. Once an exercise of an option has been assigned to

an option seller, the option seller is bound to fulfill his obligation (meaning, pay the cash

settlement amount in the case of cash-settled option) even though he may not yet have been

notified of the assignment.

Interim exercise settlement

Interim exercise settlement takes place only for option contracts on securities. An investor can

exercise his in-the-money options at any time during trading hours, through his trading member.

Interim exercise settlement is effected for such options at the close of the trading hours, on the

day of exercise. Valid exercised option contract are assigned to short position in the option

contract with the same series (i.e. having the same underlying, same expiry date and same strike

price), on a random basis, at the client level. The CM who has exercised the option receives the

exercise settlement value per unit of the option from the CM who has been assigned the option

contract.

Final exercise settlement

Final exercise settlement is effected for all open long in-the-money strike price options existing

at the close of trading hours, on the expiration day of the option contract. All such long positions

are exercised and automatically assigned to short positions in option contract with the same

series, on a random basis. The investor who ha long in the money options on the expiry date will

receive the exercise settlement value per unit of the option from the investor who has been

assigned the option contract.

4. Settlement Procedure

Clearing members who opt to pay the Daily MTM settlement on a T+0 basis would compute

such settlement amounts on a daily basis and make the amount of funds available in their

Shri S.V. Patel College of Computer Science & Business Management

31

clearing account before the end of day on T+0 day. Failure to do so would tantamount to non

payment of daily MTM settlement on a T+0 bases. Further, partial payment of daily MTM

settlement would also be considered as non payment of daily MTM settlement on a T+0 basis.

These would be construed as non compliance and penalties applicable for fund shortages from

time to time would be levied.

A penalty of 0.07 % of the margin amount at end of day on T+0 would be levied on the clearing

members. Further, the benefit of scaled down margins shall not be available in case of non

payment of daily MTM settlement on a T+0 basis from the day of such default to the end of the

relevant quarter.

Basic Pay-off

Option pays-offs

1. Pay-off for Buyer of call option

Pay-off diagram below represents the effective pay-off of a long call position of an option at the

time of the expiry date. It looks at the option from the point of view of buyer.

Profit

200

6000 6100

Nifty

5950 6050

-200

Shri S.V. Patel College of Computer Science & Business Management

32

Loss

The figure shows the profits or losses for the buyer of the call option of Nifty at the strike of

6000. As can be seen, as the spot Nifty raises, the call option in in-the-money. It will generate

positive cash flow and the investor will get profit to the extent of the difference between the spot

and the strike price.

However if nifty falls below the strike price of 6000, he let the option expire. His losses are

limited to the extent of the premium he paid for buying the option.

2. Pay-off for writer of call option

Option seller has limited profit potential and potentially unlimited risk. Pay-off diagram below

represents the effective pay-off of a short call position of an option at the time of the expiry date.

It looks at the option from the point of view of seller.

Profit

200

5950 6050

Nifty

6000 6100

-200

Loss

The figure shows the profits or losses for the seller of Nifty 6000 call option. As the spot Nifty

rises, the call option is in-the-money and the writer starts making losses. If Nifty closes above the

strike of 6000, the buyer would exercise his option on the writer who would suffer a loss to the

extent of the difference between the Nifty close and the strike price.

Shri S.V. Patel College of Computer Science & Business Management

33

The loss that can be incurred by the writer of the option is potentially unlimited; whereas the

maximum profit is limited to the extent of the up-front option premium is charged by him.

3. Pay-off for buyer of put option

Profit

200

5950

5800 Nifty

6000 6050

-200

Loss

The figure shows the profits or losses for the buyer of a Nifty 6000 put option. As can be seen, as

the spot Nifty falls, the put option in-the-money. If Nifty closes below the strike of 6000, the

buyer would exercise his option and profit to the extent of the difference between the strike price

and Nifty-close. The profit possible on this option can be high as the strike price.

However if nifty rises above the strike price of 6000, he let the option expire. His losses are

limited to the extent of the premium he paid for buying the option.

4. Pay-off for writer of put option

The figure shows the profits or losses for the seller of a Nifty 6000 put option. As can be seen,

as the spot Nifty falls, the put option in-the-money and the writer starts making losses. If Nifty

closes below the strike of 6000, the buyer would exercise his option on the writer who would

suffer a loss to the extent of the difference between the strike price and Nifty-close.

Profit

200

Shri S.V. Patel College of Computer Science & Business Management

34

5950

5800 Nifty

6000 6050

-200

Loss

The loss can be incurred by the writer of the option is a maximum extent of the strike price

whereas the maximum profit is limited to the extent of the up-front option premium is charged

by him.

Future pay-offs

1. Payoff for a buyer of the Nifty future

Profit

5800

Nifty

Loss

Shri S.V. Patel College of Computer Science & Business Management

35

The figure shows the profit or loss for a long future position. The investors buy futures when the

index was at 5800. If the index goes up, his future position starts making profit. If index falls, his

future position starts showing losses.

2. Payoff for a Seller of the Nifty future

1111

Profit

5800 Nifty

Loss

The figure shows the profit or loss for a short future position. The investors sold futures when the

index was at 5800. If the index goes down, his future position starts making profit. If index rises,

his future position starts showing losses.

Shri S.V. Patel College of Computer Science & Business Management

36

Trading in Derivative

Future and Option trading system

The futures and options trading system of NSE, called NEAT-F&O trading system, provides a

fully automated screen based trading for Nifty futures and options and stock futures and options

on a nation wide basis as well as an online monitoring and surveillance mechanism. It supports

an order driven market and provides complete transparency of trading operations. It is similar to

that of trading of equities in the cash market segment.

The software for the F&O market has been developed to facilitate efficient and transparent

trading in futures and options instruments. Keeping in view the familiarity of trading members

with the current capital market trading system, modifications have been performed in the existing

capital market trading system so as to make it suitable for trading futures and options.

Shri S.V. Patel College of Computer Science & Business Management

37

Entities in the trading system

There are four entities in the trading system. Trading members, clearing members, professional

clearing members and participants.

5. Trading members

Trading members are members of NSE. They can trade either on their own account or on behalf

of their clients including participants. The exchange assigns a trading member ID to each

trading member. Each member can have more than one use. The number of users allowed for

each trading member is notified by the exchange from time to time. Each user of a trading

member must be registered with the exchange and is assigned a unique user ID. The unique

trading member ID functions as a reference for all orders, trades of different users. This ID is

common for all users of a particular trading member. It is the responsibility of the trading

member to maintain adequate control over persons having access to the firms User ID.

6. Clearing members

Clearing members are members of NSCCL. They carry out risk management activities and

confirmation inquiry of trades through the trading system.

7. Professional clearing members

A professional clearing members is a clearing member who is not a trading member. Typically

banks and custodian become professional clearing members and clear and settle for their trading

members.

8. Participants

Shri S.V. Patel College of Computer Science & Business Management

38

A participant is a client of trading members like financial institutions. These clients may trade

through multiple trading members but settle through a single clearing member.

Corporate hierarchy

In the F&O trading software, a trading member has the facility of defining a hierarchy amongst

users of the system. This hierarchy comprises corporate manager, branch manager and dealer.

1. Corporate manager

The term ‘Corporate manager’ is assigned to a user placed at the highest level in a trading firm.

Such a user can perform all the functions such as order and trade related activities, receiving

reports for all branches of the trading member firm and also all dealers of the firm. Additionally,

a corporate manager can define exposure limits for the branches of the firm. This facility is

available only to the corporate manager.

2. Branch manager

The branch manager is a term assigned to a user who is placed under the corporate manager.

Such a user can perform and view order and trade related activities for all dealers under that

branch.

3. Dealer

Dealers are users at the lower most level of the hierarchy. A Dealer can perform view order and

trade related activities only for one self and dose not have access to information on other dealers

under either the same branch or other branches.

Order types and conditions

Shri S.V. Patel College of Computer Science & Business Management

39

The system allows the trading members to enter orders with various conditions attached to them

as per their requirements. These conditions are broadly divided into the following categories;

1. Time conditions

2. Price conditions

3. Other conditions

Several combinations of the above are allowed thereby providing enormous flexibility to the

uses. The order types and conditions are given below.

1. Time conditions

Day order

A day order, as the name suggest is an order which is valid for the day on which it is entered. If

the order is not executed during the day, the system cancels the order automatically at the end of

the day.

Immediate or Cancel (IOC)

An IOC order allows the user to buy or sell a contract as soon as the order is released into the

system failing which the order is cancelled from the system. Partial match is possible for the

order, and the unmatched portion of the order is cancelled immediately.

2. Price conditions

Stop loss

This facility allows the user to release an order into the system, after the market price of the

security reaches or crosses a threshold price E. G. if for stop loss buy order, the trigger is

1027.00, the limit price is 1030.00, and the market last traded price is 1023.00, then this order is

released into the system once the market price reaches or exceeds 1027.00, This order is added to

the regular lot book with time or triggering as the time stamp as a limit order of 1030.00. For the

stop loss sell order the trigger price has to be greater than the limit price.

Shri S.V. Patel College of Computer Science & Business Management

40

3. Other conditions

Market Price

Market orders are orders for which no price is specified at the time the order is entered {i.e. price

is market price} for such orders, the system determines the price.

Trigger price

Price at which an order gets triggered from the stop loss book.

Limit price

Price of the orders after triggering from stop loss book.

Pro

Pro means that the orders are entered on the trading member’s own account.

Cli

Cli means that the trading member enters the orders on behalf of a client.

Placing order on the trading system

For both the future and the option market, while entering orders on the trading system, members

are required to identify order as being proprietary or client order. Proprietary order should be

identified as ‘Pro’ and those of client should be identified as ‘Cli’. Apart from this, in the case of

‘Cli’ trades, the client account number should also be provided.

Shri S.V. Patel College of Computer Science & Business Management

41

Risk Management system of Derivative

Margin system adopted by Exchanges in India

The initial margin is required to be paid by the person taking the risk. However, an option buyer

risk is limited to the amount of the premium. Thus, as a rule, an option buyer does not pay the

margin. He only pays the premium to the options seller at the time of buying the option. Options

sellers, futures buyers and futures sellers have potentially unlimited risk and hence have to pay

the initial margin. Options traders trading in vertical spreads and time spreads have to pay a

much lower margin than normal options writers.

In India, NSE and BSE use the margin system called as the Standardized Portfolio Analysis

(SPAN) developed by the Chicago Mercantile Exchange (CME), Chicago, USA. The objective

of SPAN is to identify the overall risk in a portfolio of futures and options contracts for each

member. The system treats futures and options contracts uniformly, while recognizing the non-

Shri S.V. Patel College of Computer Science & Business Management

42

linearity of the payoffs of options portfolios and the consequential unique exposures associated

with them. SPAN is used to determine margin requirements. Its main objective is to determine

the largest loss that a portfolio might reasonably suffer from one day to the next.

The underlying market price, the volatility of the underlying instrument and the time to

expiration are important factors that directly affect the value of options at a given point in time.

A change in these factors affects the value of the futures and options in a portfolio. This system

is scientific and takes into consideration traders total long and short positions. It takes into the

market price of the underlying asset, the volatility o f the underlying asset, and the time to

expiration of the contract entered into. It also considers whether it is a long or short position.

The options and futures portfolio is analyzed as a whole and the net risk taken by the trader is

considered. Thus a naked options seller will have to pay much more margin than a trader who

has short options positions and also long options positions of a different strike price.

The calculation process is definitely much more systematic than an arbitrary margin rate system.

Derivatives contracts of a more volatility underlying asset have larger margin requirements, and

a derivatives contract on the same underlying with more time to expiry will also have a higher

margin requirement. There are a series of complex steps and procedures for calculating the final

margin amount. However, CME PC-SPAN software makes the calculations of margins very

simple. All that the broker back office has to do is to feed in the investors’ position at the end of

the day into the computer and they can get the final net margin requirement of the trader with the

click of the button. Initial margin is also payable in the form of specified securities. The list of

such securities is approved by SEBI and is updated regularly. A haircut specified by the

regulatory authorities’ sis applied to the value of the securities. This is very beneficial as the

investor paying the margin in the form of money will not earn interest, whereas if he deposits

securities like the government bonds as margin he will keep earning interest on them.

NSCCL-SPAN

The objective of NSCCL-SPAN is to identify over all risk on a portfolio of all futures and

options contracts for each member. The system treats futures and options contracts uniformly,

while at the same time recognizing the unique exposures associated with options portfolios. Like

Shri S.V. Patel College of Computer Science & Business Management

43

extremely deep out of the money short position and inter month risk. Its over riding objective is

to determine the largest loss that a portfolio might reasonably to expected to suffer from one day

to the next day based on 99% VaR methodology. SPAN considers uniqueness of option

portfolios. The following actors affect the value of an option.

The following factors affect the value of an option

Underlying market price

Strike price

Volatility of underlying instrument

Time to expiration

Interest rate

As these factors change, the value of options maintained within a portfolio also changes. Thus,

SPAN constructs scenarios of probable changes underlying prices and volatilities in order to

identify the largest loss a portfolio might suffer fro one day to the next. It then sets the margin

requirement to cover his one-day loss. The complex calculations (e.g. the pricing of options) in

SPAN are executed by NSCCL. The results of these calculations are called risk arrays. Risk

arrays, and other necessary data inputs for margin calculation are provided to members daily in a

file called the SPAN risk parameter file. Member can apply the data contained in the risk

parameter files, to their specific portfolios of futures and options contracts, to determine their

SPAN margin requirements. Hence, members need not execute complex option pricing

calculations, which are performed by NSCCL. SPAN has the ability to estimate risk for

combined futures and options portfolios, and also re-value the same under various scenarios of

change in market conditions.

Margins

Derivatives segment uses margins as one of the important measures for the risk management

purpose. In order to control the trading activities and to prevent the speculative activities the

exchange imposes several types of margins to safe guard the interest of the genuine investors and

Shri S.V. Patel College of Computer Science & Business Management

44

for the proper development of the overall market. The following types of margins are imposed

for the purpose of risk management:-

1. Initial margin

This is the amount of money taken first time to safe guard the interest of the trading member.

The initial margin is charged at the time of opening of account in the options and futures

segment. The usual practice followed by the investment solution providers is to charges

Rs.10,000 in case of opening of an options account and Rs. 50,000 in case of opening a futures

account.

2. Maintenance margin

This is the minimum amount of margin required in the client account at all the times. When the

margin in the client account goes beyond the maintenance margin a call is made to the client by

the broker that the margin needs to be brought back to the original level of initial margin and the

client is required to provide the required margin immediately to the broker otherwise the broker

will close the account of the client and will not allow him to operate him anymore. It is a usual

practice to charge 75 per cent of the initial margin as the maintenance margin. For example if the

initial margin is Rs. 10,000 then its 75 per cent i.e. Rs. 7500 is considered as the maintenance

margin and if the margin money goes below Rs. 7500 then the client is required to bring the

required amount of money.

3. Value at Risk Margin

This is the margin which the exchange calculates on the basis of the volatility of the stock price

movement and it is decided on the movement of the stock prices during a particular day. This

margin is sent by the file to all the brokers three times a day or five times a day depending upon

the volatility of the stock. The value at risk margin may vary from 15 per cent to say 25 per cent.

When there is high volatility in the stock prices the value at risk margin is also charged at a high

level. This margin is imposed to have control over the speculative activities and to prevent the

traders from the over trading.

4. Special margin

Shri S.V. Patel College of Computer Science & Business Management

45

This margin is charged when the exchanges observed some abnormal movement in the prices of

the stock prices. This type of margin is imposed by the exchange by giving notice in the

newspaper and by informing the clients through the file sent through the internet to the brokers.

Recently on 9th December 2003 the Bombay stock exchange and the National Stock Exchange

imposed at special margin of 10 per cent on 35 scripts of A group while 71 scripts of B1, B2 and

Z group has been imposed a margin 25 per cent.

5. Mark to Market margin

The profit or loss of the investor open position is calculated on a daily basis and the is called as

mark to market (MTM). The daily profit/loss is credited or debited to the investors account on a

daily basis. A penalty is levied by the exchange on the clearing member in case of non-collection

of the initial or MTM margin and the open position of the investor is closed, irrespective of

whether he makes a profit or loss. The penalty is charged even if the client brings in the margin

later. The clearing member collects these penalties levied by the exchange from such a client. To

avoid such situations, the investors generally pay 10 to 15 per cent more than the margin

requirement. This practice not only precludes the possibility of a penalty being levied but also

meets the possibility of an additional margin requirement in the case of an increase by the

clearing house or daily MTM requirement.

6. Exposure Margin

Exchanges may levy an exposure margin over and above the initial margin as a second line of

defense. This margin may vary from 5 per cent to 20 per cent depending on the stock. This may

be increased by the exchanges as and when necessary by giving notices to the clearing members.

The clearing members in turn have to collect the same from the trading members and the clients

and pass them on to the exchanges. The exchanges do take such actions in time of volatility. The

main purpose of such an exercise is to reduce any excessive speculation in the market. However,

the negative effect of increasing the margins is that it results in the forced liquidations of

positions, thereby bringing down the market, at least temporarily.

7. Ad hoc margin

Shri S.V. Patel College of Computer Science & Business Management

46

The exchanges may levy an adhoc margin on investors who have large positions in the

derivatives segment. The exchanges send notices to the clearing members to collect such margins

from these investors.

The above margins are collected upfront from the clients so that there is no excess position

taking by the clients and the liquidity of the members is also safeguarded. Whenever the market

wide limit on a particular stock touches 80 per cent of the total limit allowed on that particular

day then the margins are doubled that is if the margins comes to Rs. 25000 then it is doubled and

becomes Rs. 50,000. On 14th October 2003 the following scripts had touched 80 per cent market

wide limit and so the margins were doubled.

1. ACC (82%) 6. Nalco (91%)

2. Arvind Mills (98%) 7. NIIT (84%)

3. Digital Global (85%) 8. PNB (83%)

4. IPCL (84%) 9. Polaris (93%)

5. Mastek (100%) 10. SCI (96%)

POSITION LIMITS

Position limits have been specified by SEBI at the trading member, client, market and the FII

levels to prevent any manipulation and excess position taking.

Trading Member position limits

There is a position limit in derivative contracts on an index of 15 % of the open position or Rs.

100 crores whichever is higher. The position limit in derivative contracts on an individual stock

is 7.5 % of the open interest in that underlying on the exchange or Rs. 50 crores whichever is

higher.

Client level position limit

Any client either individually or in group with other investor if acquires more than 15 % of the

total open interest in all the futures and options contract taken together then he has to inform the

Clearing Corporation and if he does not do so then it would attract penalty in the form of fine.

Market wide position limits

Shri S.V. Patel College of Computer Science & Business Management

47

The market wide limit of open position in terms of the number of units of underlying stock on all

the futures and options contract on particular stocks is lower of 30 times the average number of

shares traded daily, during the previous calendar month, in the capital market segment of the

exchange or 10 % of the number shares held by the non-promoters that is 10% of the free float in

terms of the number of shares of the company.

Position limit for FIIs

In case of the index related derivative products the position limit is 15% of open interest in all

futures and option contract or Rs. 100 crores whichever is higher. In case of stock related

derivative products the position limit is 7.5% of open interest in all the futures and options

contracts or Rs. 50 crores whichever is higher.

Margin collection and violations

Clearing members are provided with terminals of the futures and options segment to monitor the

trades of all the trading members and clients. Through this, clearing members can set the

exposure limits for trading members and clients; the trading facility is withdrawn whenever a

trading member exceeds exposure limits. The initial margin amount on the positions taken by the

clearing member is computed for the each trade. The initial margin amount is reduced from the

effective deposits of the clearing member with the Clearing Corporation. Once 70, 80 and 90 per

cent of the effective deposits are consumed; the member receives a warning message on his

terminal. The clearing facility is withdrawn the moment 100 per cent is consumed. The liquid net

worth of the clearing member at any point of time should not be less than Rs. 50 lakhs. The

withdrawal of the clearing facility in case of violations will apply to the trading facility of all

trading members clearing and settling through that clearing member.

The margin amount on the positions taken by the trading member is also computed on a real time

basis and compared with the trading member limit set by his clearing member. Here also the

initial margin amount is reduced from the trading member limit, set by the clearing member.