Professional Documents

Culture Documents

Solved Firm L Has 500 000 To Invest and Is Considering Two

Solved Firm L Has 500 000 To Invest and Is Considering Two

Uploaded by

Anbu jaromiaCopyright:

Available Formats

You might also like

- Economics: Paper 2 How The Economy WorksDocument3 pagesEconomics: Paper 2 How The Economy Worksyufm2008No ratings yet

- Solutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDocument7 pagesSolutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDiya ReddyNo ratings yet

- Chap 06Document30 pagesChap 06Tim JamesNo ratings yet

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- Solved Minden Corporation Wants To Open A Branch Operation in EasternDocument1 pageSolved Minden Corporation Wants To Open A Branch Operation in EasternAnbu jaromiaNo ratings yet

- Problem 11.3Document1 pageProblem 11.3SamerNo ratings yet

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved in Each of The Following Cases Discuss How The TaxpayersDocument1 pageSolved in Each of The Following Cases Discuss How The TaxpayersAnbu jaromiaNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingDocument1 pageSolved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingAnbu jaromiaNo ratings yet

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- Solved Investor B Has 100 000 in An Investment Paying 9 PercentDocument1 pageSolved Investor B Has 100 000 in An Investment Paying 9 PercentAnbu jaromiaNo ratings yet

- Solved Company K Has A 30 Percent Marginal Tax Rate and PDFDocument1 pageSolved Company K Has A 30 Percent Marginal Tax Rate and PDFAnbu jaromiaNo ratings yet

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (27)

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (11)

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- KEY WORDS - Income TaxationDocument23 pagesKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNo ratings yet

- Partnership TaxationDocument4 pagesPartnership TaxationTet AleraNo ratings yet

- Solved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHDocument1 pageSolved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHAnbu jaromiaNo ratings yet

- Homework ES 2 Solution ACCT 553Document5 pagesHomework ES 2 Solution ACCT 553Mohammad IslamNo ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Quiz On Income TaxationDocument2 pagesQuiz On Income TaxationVergel Martinez100% (1)

- Finance Applications and Theory 4th Edition Cornett Test BankDocument21 pagesFinance Applications and Theory 4th Edition Cornett Test Bankkilter.murk0nj3mx100% (40)

- Full Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full ChapterDocument36 pagesFull Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full Chaptercategory.torskhwbgd100% (22)

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Taxation of IncomeDocument10 pagesTaxation of IncomeDavis Deo KagisaNo ratings yet

- Solved The ABC Co Earned 10 Million Before Interest and TaxesDocument1 pageSolved The ABC Co Earned 10 Million Before Interest and TaxesAnbu jaromiaNo ratings yet

- Taxnz118 - Assumed Knowledge Quiz 08042019Document12 pagesTaxnz118 - Assumed Knowledge Quiz 08042019Wasir RahmanNo ratings yet

- Chapter 2 Corporations IntDocument64 pagesChapter 2 Corporations IntRachel Sayson100% (1)

- MOD L S: Corporat: U E AXE EDocument2 pagesMOD L S: Corporat: U E AXE EAnonymous JqimV1ENo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- CSM - CHP 12 - Accounting For Income TaxDocument4 pagesCSM - CHP 12 - Accounting For Income TaxaseppahrudinNo ratings yet

- Principles of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions ManualDocument23 pagesPrinciples of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions Manualbosomdegerml971yf100% (20)

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (30)

- Corp Tax FA20Document17 pagesCorp Tax FA20Wajih RehmanNo ratings yet

- CH 16Document36 pagesCH 16DrellyNo ratings yet

- Solved Investor W Has The Opportunity To Invest 500 000 in ADocument1 pageSolved Investor W Has The Opportunity To Invest 500 000 in AAnbu jaromiaNo ratings yet

- Full Download PDF of Solution Manual For Principles of Taxation For Business and Investment Planning 2020 Edition, 23rd Edition, Sally Jones Shelley Rhoades-Catanach Sandra Callaghan All ChapterDocument30 pagesFull Download PDF of Solution Manual For Principles of Taxation For Business and Investment Planning 2020 Edition, 23rd Edition, Sally Jones Shelley Rhoades-Catanach Sandra Callaghan All Chaptergetifagava100% (5)

- Scan 0084Document2 pagesScan 0084Anonymous JqimV1ENo ratings yet

- Part - 1 - Dashboard - Accounting For Income TaxesDocument4 pagesPart - 1 - Dashboard - Accounting For Income TaxesbagayaobNo ratings yet

- Q&A Summary - Bridge Act (Rev. 10-21-08)Document2 pagesQ&A Summary - Bridge Act (Rev. 10-21-08)Steve Kimball100% (1)

- Solved Henrietta Transfers Cash of 75 000 and Equipment With A FairDocument1 pageSolved Henrietta Transfers Cash of 75 000 and Equipment With A FairAnbu jaromiaNo ratings yet

- TAXATIONDocument83 pagesTAXATIONKofo IswatNo ratings yet

- Taxation Law Mock BarDocument8 pagesTaxation Law Mock BarKC ManglapusNo ratings yet

- Final IBF (Numerical) Chapter 2, 5 & 15Document13 pagesFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanNo ratings yet

- Solved Continue With The Results of Problem 35 Prepare The GaapDocument1 pageSolved Continue With The Results of Problem 35 Prepare The GaapAnbu jaromiaNo ratings yet

- CorporationDocument83 pagesCorporationAlson Keith L CastroNo ratings yet

- Tony Blair's TaxDocument4 pagesTony Blair's TaxOluwafunmilayo AkapoNo ratings yet

- CFAP 5 ATAX Model PaperDocument5 pagesCFAP 5 ATAX Model PaperMuhammad Usama SheikhNo ratings yet

- Icaew Cfab Pot 2018 Sample ExamDocument30 pagesIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Test Bank For Canadian Income Taxation 2017 2018 Canadian 20Th Edition Buckwold Isbn 1259275809 9781259275807 Full Chapter PDFDocument32 pagesTest Bank For Canadian Income Taxation 2017 2018 Canadian 20Th Edition Buckwold Isbn 1259275809 9781259275807 Full Chapter PDFcarl.ramos277100% (12)

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (35)

- Partnerships 240306 184235Document14 pagesPartnerships 240306 184235dilhani sheharaNo ratings yet

- Principles of Business TaxationDocument10 pagesPrinciples of Business TaxationMuhammad Yasir GondalNo ratings yet

- Incorporation and ProductivityDocument2 pagesIncorporation and ProductivityCato InstituteNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- GVC Diagnostic - Mapping - EBRD RegionDocument6 pagesGVC Diagnostic - Mapping - EBRD Regionuyennnp204022cNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSk AzamNo ratings yet

- Impact of Globalization On Pharmaceutical IndustryDocument15 pagesImpact of Globalization On Pharmaceutical IndustrySneha Tawsalkar50% (2)

- Jim Roppel Market Action 4Document1 pageJim Roppel Market Action 4LNo ratings yet

- Analysis of Share Buyback From: Lodha Developer's Deutsche Bank Private EquityDocument5 pagesAnalysis of Share Buyback From: Lodha Developer's Deutsche Bank Private EquityVrajesh ChitaliaNo ratings yet

- Mankiw Macro Ch10 AnswerDocument4 pagesMankiw Macro Ch10 Answerjohnny kashburnNo ratings yet

- Swot ShanDocument4 pagesSwot Shanq_burhan_a33% (3)

- 5171-Article Text-21985-1-10-20230831Document17 pages5171-Article Text-21985-1-10-20230831aii aiiNo ratings yet

- Globalization and International InvestmentDocument38 pagesGlobalization and International InvestmentDương Nguyễn Nhật QuỳnhNo ratings yet

- CampDocument70 pagesCampLyle RabasanoNo ratings yet

- P03B. Government Budget & Fiscal PolicyDocument4 pagesP03B. Government Budget & Fiscal PolicyNhư ÝNo ratings yet

- Topic 3 - International Monetary System and Balance of PaymentsDocument53 pagesTopic 3 - International Monetary System and Balance of PaymentsM.Hatta Dosen StiepanNo ratings yet

- Finmar NotesDocument1 pageFinmar NotesAlinah AquinoNo ratings yet

- Pay Slip - 607043 - Jul-22Document1 pagePay Slip - 607043 - Jul-22Supriya KandukuriNo ratings yet

- 2023 12 12 Trim Econ - Economy in Data December 2023Document66 pages2023 12 12 Trim Econ - Economy in Data December 2023Ananda Ilham FirdausNo ratings yet

- Quizzer On Withholding of Annual Tax Compensation IncomeDocument5 pagesQuizzer On Withholding of Annual Tax Compensation IncomeRyDNo ratings yet

- Todaro12e PPT CH02Document42 pagesTodaro12e PPT CH02jam linganNo ratings yet

- Eiken Grade Pre1 2021.5.30 AnswerDocument1 pageEiken Grade Pre1 2021.5.30 AnswerNaomi T.No ratings yet

- Wa0009.Document2 pagesWa0009.thakurrohansingh240No ratings yet

- Assigment 1 Malaysian EcoDocument3 pagesAssigment 1 Malaysian EcoVanessa SajiliNo ratings yet

- Characteristics of Underdeveloped EconomyDocument2 pagesCharacteristics of Underdeveloped EconomySurabhi Sharma75% (4)

- Import and Export Tax CodesDocument7 pagesImport and Export Tax CodesshtummalaNo ratings yet

- Economics ProjectDocument10 pagesEconomics ProjectbhavikNo ratings yet

- INR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EArnav KalraNo ratings yet

- IB PPT-1 (ReplDocument12 pagesIB PPT-1 (ReplKunal M CNo ratings yet

- June GST MasterDocument60 pagesJune GST MasterKshitij TrivediNo ratings yet

- Socio Economic GrowthDocument3 pagesSocio Economic GrowthniteshNo ratings yet

- Public Health Budget (2012-2022)Document3 pagesPublic Health Budget (2012-2022)Fahim HasnatNo ratings yet

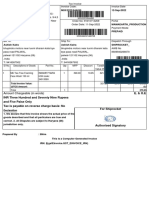

Solved Firm L Has 500 000 To Invest and Is Considering Two

Solved Firm L Has 500 000 To Invest and Is Considering Two

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Firm L Has 500 000 To Invest and Is Considering Two

Solved Firm L Has 500 000 To Invest and Is Considering Two

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Firm L has 500 000 to invest and is considering

two

Firm L has $500,000 to invest and is considering two alternatives. Investment A would pay 6

percent ($30,000 annual before-tax cash flow). Investment B would pay 4.5 percent ($22,500

annual before-tax cash flow). The return on Investment A is taxable, while the return on

Investment B is tax exempt. Firm […]

Assume that Congress amends the tax law to provide for a maximum 20 percent rate on royalty

income. Calculate the annual tax savings from this new preferential rate to each of the following

taxpayers. a. Ms. A, who is in a 39.6 percent marginal tax bracket and receives $8,000 royalty

[…]

Refer to the facts in the preceding problem. At the beginning of the year, Mr. L could have

invested his $50,000 in Business Z with an 8 percent annual return. However, this return would

have been ordinary income rather than capital gain. a. Considering the fact that Mr. L could […]

Mr. G has $15,000 to invest. He is undecided about putting the money into tax-exempt

municipal bonds paying 3.5 percent annual interest or corporate bonds paying 4.75 percent

annual interest. The two investments have the same risk. a. Which investment should Mr. G

make if his marginal tax rate is […]

GET ANSWER- https://accanswer.com/downloads/page/1530/

Moto Inc. pays state income tax at a 6 percent rate and federal income tax at a 34 per-cent rate.

Moto recently engaged in a transaction in Country N, which levied a $97,300 tax on the

transaction. This year, Moto generated $2.738 million net income before consideration of any

tax. […]

Company EJ plans to build a new plant to manufacture bicycles. EJ sells its bicycles in the

world market for $400 per bike. It could locate the plant in Province P, which levies a 20 percent

tax on business income. On the basis of the cost of materials and labor […]

Firm W, which has a 34 percent marginal tax rate, plans to operate a new business that should

generate $40,000 annual cash flow/ordinary income for three years (years 0, 1, and 2).

Alternatively, Firm W could form a new taxable entity (Entity N) to operate the business. Entity N

would […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1530/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Economics: Paper 2 How The Economy WorksDocument3 pagesEconomics: Paper 2 How The Economy Worksyufm2008No ratings yet

- Solutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDocument7 pagesSolutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDiya ReddyNo ratings yet

- Chap 06Document30 pagesChap 06Tim JamesNo ratings yet

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- Solved Minden Corporation Wants To Open A Branch Operation in EasternDocument1 pageSolved Minden Corporation Wants To Open A Branch Operation in EasternAnbu jaromiaNo ratings yet

- Problem 11.3Document1 pageProblem 11.3SamerNo ratings yet

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved in Each of The Following Cases Discuss How The TaxpayersDocument1 pageSolved in Each of The Following Cases Discuss How The TaxpayersAnbu jaromiaNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingDocument1 pageSolved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingAnbu jaromiaNo ratings yet

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- Solved Investor B Has 100 000 in An Investment Paying 9 PercentDocument1 pageSolved Investor B Has 100 000 in An Investment Paying 9 PercentAnbu jaromiaNo ratings yet

- Solved Company K Has A 30 Percent Marginal Tax Rate and PDFDocument1 pageSolved Company K Has A 30 Percent Marginal Tax Rate and PDFAnbu jaromiaNo ratings yet

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- Deduct From Book Income: - B - T F Dul - .Document2 pagesDeduct From Book Income: - B - T F Dul - .Zeyad El-sayedNo ratings yet

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (27)

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (11)

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- KEY WORDS - Income TaxationDocument23 pagesKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNo ratings yet

- Partnership TaxationDocument4 pagesPartnership TaxationTet AleraNo ratings yet

- Solved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHDocument1 pageSolved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHAnbu jaromiaNo ratings yet

- Homework ES 2 Solution ACCT 553Document5 pagesHomework ES 2 Solution ACCT 553Mohammad IslamNo ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Quiz On Income TaxationDocument2 pagesQuiz On Income TaxationVergel Martinez100% (1)

- Finance Applications and Theory 4th Edition Cornett Test BankDocument21 pagesFinance Applications and Theory 4th Edition Cornett Test Bankkilter.murk0nj3mx100% (40)

- Full Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full ChapterDocument36 pagesFull Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full Chaptercategory.torskhwbgd100% (22)

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Taxation of IncomeDocument10 pagesTaxation of IncomeDavis Deo KagisaNo ratings yet

- Solved The ABC Co Earned 10 Million Before Interest and TaxesDocument1 pageSolved The ABC Co Earned 10 Million Before Interest and TaxesAnbu jaromiaNo ratings yet

- Taxnz118 - Assumed Knowledge Quiz 08042019Document12 pagesTaxnz118 - Assumed Knowledge Quiz 08042019Wasir RahmanNo ratings yet

- Chapter 2 Corporations IntDocument64 pagesChapter 2 Corporations IntRachel Sayson100% (1)

- MOD L S: Corporat: U E AXE EDocument2 pagesMOD L S: Corporat: U E AXE EAnonymous JqimV1ENo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- CSM - CHP 12 - Accounting For Income TaxDocument4 pagesCSM - CHP 12 - Accounting For Income TaxaseppahrudinNo ratings yet

- Principles of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions ManualDocument23 pagesPrinciples of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions Manualbosomdegerml971yf100% (20)

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (30)

- Corp Tax FA20Document17 pagesCorp Tax FA20Wajih RehmanNo ratings yet

- CH 16Document36 pagesCH 16DrellyNo ratings yet

- Solved Investor W Has The Opportunity To Invest 500 000 in ADocument1 pageSolved Investor W Has The Opportunity To Invest 500 000 in AAnbu jaromiaNo ratings yet

- Full Download PDF of Solution Manual For Principles of Taxation For Business and Investment Planning 2020 Edition, 23rd Edition, Sally Jones Shelley Rhoades-Catanach Sandra Callaghan All ChapterDocument30 pagesFull Download PDF of Solution Manual For Principles of Taxation For Business and Investment Planning 2020 Edition, 23rd Edition, Sally Jones Shelley Rhoades-Catanach Sandra Callaghan All Chaptergetifagava100% (5)

- Scan 0084Document2 pagesScan 0084Anonymous JqimV1ENo ratings yet

- Part - 1 - Dashboard - Accounting For Income TaxesDocument4 pagesPart - 1 - Dashboard - Accounting For Income TaxesbagayaobNo ratings yet

- Q&A Summary - Bridge Act (Rev. 10-21-08)Document2 pagesQ&A Summary - Bridge Act (Rev. 10-21-08)Steve Kimball100% (1)

- Solved Henrietta Transfers Cash of 75 000 and Equipment With A FairDocument1 pageSolved Henrietta Transfers Cash of 75 000 and Equipment With A FairAnbu jaromiaNo ratings yet

- TAXATIONDocument83 pagesTAXATIONKofo IswatNo ratings yet

- Taxation Law Mock BarDocument8 pagesTaxation Law Mock BarKC ManglapusNo ratings yet

- Final IBF (Numerical) Chapter 2, 5 & 15Document13 pagesFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanNo ratings yet

- Solved Continue With The Results of Problem 35 Prepare The GaapDocument1 pageSolved Continue With The Results of Problem 35 Prepare The GaapAnbu jaromiaNo ratings yet

- CorporationDocument83 pagesCorporationAlson Keith L CastroNo ratings yet

- Tony Blair's TaxDocument4 pagesTony Blair's TaxOluwafunmilayo AkapoNo ratings yet

- CFAP 5 ATAX Model PaperDocument5 pagesCFAP 5 ATAX Model PaperMuhammad Usama SheikhNo ratings yet

- Icaew Cfab Pot 2018 Sample ExamDocument30 pagesIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Test Bank For Canadian Income Taxation 2017 2018 Canadian 20Th Edition Buckwold Isbn 1259275809 9781259275807 Full Chapter PDFDocument32 pagesTest Bank For Canadian Income Taxation 2017 2018 Canadian 20Th Edition Buckwold Isbn 1259275809 9781259275807 Full Chapter PDFcarl.ramos277100% (12)

- Canadian Income Taxation Canadian 20th Edition Buckwold ISBN Test BankDocument11 pagesCanadian Income Taxation Canadian 20th Edition Buckwold ISBN Test Bankbennie100% (35)

- Partnerships 240306 184235Document14 pagesPartnerships 240306 184235dilhani sheharaNo ratings yet

- Principles of Business TaxationDocument10 pagesPrinciples of Business TaxationMuhammad Yasir GondalNo ratings yet

- Incorporation and ProductivityDocument2 pagesIncorporation and ProductivityCato InstituteNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- GVC Diagnostic - Mapping - EBRD RegionDocument6 pagesGVC Diagnostic - Mapping - EBRD Regionuyennnp204022cNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSk AzamNo ratings yet

- Impact of Globalization On Pharmaceutical IndustryDocument15 pagesImpact of Globalization On Pharmaceutical IndustrySneha Tawsalkar50% (2)

- Jim Roppel Market Action 4Document1 pageJim Roppel Market Action 4LNo ratings yet

- Analysis of Share Buyback From: Lodha Developer's Deutsche Bank Private EquityDocument5 pagesAnalysis of Share Buyback From: Lodha Developer's Deutsche Bank Private EquityVrajesh ChitaliaNo ratings yet

- Mankiw Macro Ch10 AnswerDocument4 pagesMankiw Macro Ch10 Answerjohnny kashburnNo ratings yet

- Swot ShanDocument4 pagesSwot Shanq_burhan_a33% (3)

- 5171-Article Text-21985-1-10-20230831Document17 pages5171-Article Text-21985-1-10-20230831aii aiiNo ratings yet

- Globalization and International InvestmentDocument38 pagesGlobalization and International InvestmentDương Nguyễn Nhật QuỳnhNo ratings yet

- CampDocument70 pagesCampLyle RabasanoNo ratings yet

- P03B. Government Budget & Fiscal PolicyDocument4 pagesP03B. Government Budget & Fiscal PolicyNhư ÝNo ratings yet

- Topic 3 - International Monetary System and Balance of PaymentsDocument53 pagesTopic 3 - International Monetary System and Balance of PaymentsM.Hatta Dosen StiepanNo ratings yet

- Finmar NotesDocument1 pageFinmar NotesAlinah AquinoNo ratings yet

- Pay Slip - 607043 - Jul-22Document1 pagePay Slip - 607043 - Jul-22Supriya KandukuriNo ratings yet

- 2023 12 12 Trim Econ - Economy in Data December 2023Document66 pages2023 12 12 Trim Econ - Economy in Data December 2023Ananda Ilham FirdausNo ratings yet

- Quizzer On Withholding of Annual Tax Compensation IncomeDocument5 pagesQuizzer On Withholding of Annual Tax Compensation IncomeRyDNo ratings yet

- Todaro12e PPT CH02Document42 pagesTodaro12e PPT CH02jam linganNo ratings yet

- Eiken Grade Pre1 2021.5.30 AnswerDocument1 pageEiken Grade Pre1 2021.5.30 AnswerNaomi T.No ratings yet

- Wa0009.Document2 pagesWa0009.thakurrohansingh240No ratings yet

- Assigment 1 Malaysian EcoDocument3 pagesAssigment 1 Malaysian EcoVanessa SajiliNo ratings yet

- Characteristics of Underdeveloped EconomyDocument2 pagesCharacteristics of Underdeveloped EconomySurabhi Sharma75% (4)

- Import and Export Tax CodesDocument7 pagesImport and Export Tax CodesshtummalaNo ratings yet

- Economics ProjectDocument10 pagesEconomics ProjectbhavikNo ratings yet

- INR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EDocument1 pageINR Three Hundred and Seventy Nine Rupees and Five Paise Only Tax Is Payable On Reverse Charge Basis: No E. & O.EArnav KalraNo ratings yet

- IB PPT-1 (ReplDocument12 pagesIB PPT-1 (ReplKunal M CNo ratings yet

- June GST MasterDocument60 pagesJune GST MasterKshitij TrivediNo ratings yet

- Socio Economic GrowthDocument3 pagesSocio Economic GrowthniteshNo ratings yet

- Public Health Budget (2012-2022)Document3 pagesPublic Health Budget (2012-2022)Fahim HasnatNo ratings yet