Professional Documents

Culture Documents

Solved in December 20x1 Ann S 12 Year Old Cousin Susan Came To Live

Solved in December 20x1 Ann S 12 Year Old Cousin Susan Came To Live

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved in December 20x1 Ann S 12 Year Old Cousin Susan Came To Live

Solved in December 20x1 Ann S 12 Year Old Cousin Susan Came To Live

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) In December 20×1 Ann s 12 year old cousin

Susan came to live

In December 20×1, Ann’s 12-year-old cousin, Susan, came to live with her after Susan’s

parents met a sudden death in a car accident. In 20×2, Ann provided all normal support (e. g.,

food, clothing, education) for Susan. Ann did not formally adopt Susan. If Susan lived in the

household for […]

One important problem that faces a tax researcher is interpretation of the Internal Revenue

Code. Comment on each of the following interpretation problems: a. Exceptions to a Code

section b. Words that connect phrases, such as “and” and “or” c. Recent changes in the Code

d. Effective dates e. Words […]

Tom and Donna were divorced three years ago. At the time of their divorce, they owned a

residence whose value had significantly increased during the marriage. Tom remained half-

owner of the house, but he moved out and allowed Donna to continue living in the house. In the

current year, Tom […]

Formulate a search query to determine whether your client is required to capitalize fringe

benefits and general overhead that is attributable to employees who are building an addition to

your client’s factory during a “slack time” at work. Give an example of an online search query

using only the following […]

GET ANSWER- https://accanswer.com/downloads/page/1568/

Formulate a search query to determine the provisions of the treaty between the United States

and Germany relative to graduate fellowship income received by a business student during a

summer internship with the German Department of Price Controls. Give an example of an online

search query using only the following […]

On December 1, 2014, Ericka receives $ 18,000 for three months’ rent (December 2014,

January 2015, and February 2015) for an office building. List as many tax research issues as

you can to determine the tax con-sequences of this transaction. Do not attempt to answer any

of the questions you […]

In the current year, Dave receives stock worth $ 125,000 from his employer. The stock is

restricted and cannot be sold by Dave for seven years. Dave estimates the stock will be worth $

300,000 after the seven years. List as many tax research issues as you can to determine […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1568/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solved Stan Rented An Office Building To Clay For 3 000 PerDocument1 pageSolved Stan Rented An Office Building To Clay For 3 000 PerAnbu jaromiaNo ratings yet

- Solved Plot The Expected Real Interest Rate Since 1979 by SubtractingDocument1 pageSolved Plot The Expected Real Interest Rate Since 1979 by SubtractingM Bilal SaleemNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Beacon Signals Company Maintains and Repairs Warning Lights Such As PDFDocument1 pageSolved Beacon Signals Company Maintains and Repairs Warning Lights Such As PDFAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- chp04 CevapDocument3 pageschp04 CevapdbjnNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Employers Often Include Covenants Not To Compete in Employment ContractsDocument1 pageSolved Employers Often Include Covenants Not To Compete in Employment ContractsAnbu jaromiaNo ratings yet

- Solved David A Cpa For A Large Accounting Firm Often WorksDocument1 pageSolved David A Cpa For A Large Accounting Firm Often WorksAnbu jaromiaNo ratings yet

- Solved Latesha A Single Taxpayer Had The Following Income and DeductionsDocument1 pageSolved Latesha A Single Taxpayer Had The Following Income and DeductionsAnbu jaromiaNo ratings yet

- Solved Mclelland Inc Reported Net Income of 175 000 For 2019 andDocument1 pageSolved Mclelland Inc Reported Net Income of 175 000 For 2019 andAnbu jaromiaNo ratings yet

- Solved Pete and Mary Run A Firm That Packs Coffee BeansDocument1 pageSolved Pete and Mary Run A Firm That Packs Coffee BeansM Bilal SaleemNo ratings yet

- Solved Ashley Projects That She Can Get 100 000 Cash Per Year PDFDocument1 pageSolved Ashley Projects That She Can Get 100 000 Cash Per Year PDFAnbu jaromiaNo ratings yet

- Solved One of Your Clients Is Planning To Start A BusinessDocument1 pageSolved One of Your Clients Is Planning To Start A BusinessAnbu jaromiaNo ratings yet

- Solved Discovered An Error in Computing A Commission Received Cash FromDocument1 pageSolved Discovered An Error in Computing A Commission Received Cash FromAnbu jaromiaNo ratings yet

- Solved DR Quinn DR Rose and DR Tanner Are Dentists WhoDocument1 pageSolved DR Quinn DR Rose and DR Tanner Are Dentists WhoAnbu jaromiaNo ratings yet

- Solved Given The Following Facts About Sammie Bright Calculate His PreliminaryDocument1 pageSolved Given The Following Facts About Sammie Bright Calculate His PreliminaryAnbu jaromiaNo ratings yet

- Solved Suppose Taxes Are Related To Income Level As FollowsDocument1 pageSolved Suppose Taxes Are Related To Income Level As FollowsM Bilal SaleemNo ratings yet

- Solved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFDocument1 pageSolved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFAnbu jaromiaNo ratings yet

- Solved Calculate The Yield To Maturity For Each of The FollowingDocument1 pageSolved Calculate The Yield To Maturity For Each of The FollowingM Bilal SaleemNo ratings yet

- Solved Mountain Breeze Supplies Air Filters To The Retail Market andDocument1 pageSolved Mountain Breeze Supplies Air Filters To The Retail Market andM Bilal SaleemNo ratings yet

- Solved Your Company Sponsors A 401 K Plan Into Which You DepositDocument1 pageSolved Your Company Sponsors A 401 K Plan Into Which You DepositM Bilal SaleemNo ratings yet

- Solved A Suppose That Banks Have Decided They Need To KeepDocument1 pageSolved A Suppose That Banks Have Decided They Need To KeepM Bilal SaleemNo ratings yet

- Solved Waterfront Hotels Corporation in Boston Offers A Job To CarolDocument1 pageSolved Waterfront Hotels Corporation in Boston Offers A Job To CarolAnbu jaromiaNo ratings yet

- Solved You Re A Commodity Trader and You Ve Just Heard A ReportDocument1 pageSolved You Re A Commodity Trader and You Ve Just Heard A ReportM Bilal SaleemNo ratings yet

- Solved This Semester Hung Lee Took Four 3 Credit Courses at RiversideDocument1 pageSolved This Semester Hung Lee Took Four 3 Credit Courses at RiversideM Bilal SaleemNo ratings yet

- Solved When The Government Runs A Budget Deficit Funds Flow FromDocument1 pageSolved When The Government Runs A Budget Deficit Funds Flow FromM Bilal SaleemNo ratings yet

- Solved State Whether Each of The Following Payments Is A TaxDocument1 pageSolved State Whether Each of The Following Payments Is A TaxAnbu jaromiaNo ratings yet

- Solved Consider The Problem A Society Faces If It Wants ToDocument1 pageSolved Consider The Problem A Society Faces If It Wants ToM Bilal SaleemNo ratings yet

- Solved Two Independent Random Samples of Annual Starting Salaries For IndividualsDocument1 pageSolved Two Independent Random Samples of Annual Starting Salaries For IndividualsAnbu jaromiaNo ratings yet

- Solved The Federal Government Gives Huge Rewards For Taking Action ToDocument1 pageSolved The Federal Government Gives Huge Rewards For Taking Action ToAnbu jaromiaNo ratings yet

- Solved It S True That Unexpected Inflation Redistributes Wealth From Creditors ToDocument1 pageSolved It S True That Unexpected Inflation Redistributes Wealth From Creditors ToM Bilal SaleemNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved Lia Chen and Martin Monroe Formed A Partnership Dividing IncomeDocument1 pageSolved Lia Chen and Martin Monroe Formed A Partnership Dividing IncomeAnbu jaromiaNo ratings yet

- Solved From The Partial Worksheet For Josh S Supplies in Figure 12 15Document1 pageSolved From The Partial Worksheet For Josh S Supplies in Figure 12 15Anbu jaromiaNo ratings yet

- Solved Discuss The Leaky Bucket Analogy Page 456 With Your ClassmatesDocument1 pageSolved Discuss The Leaky Bucket Analogy Page 456 With Your ClassmatesM Bilal SaleemNo ratings yet

- Solved A Calculate Jimmy S and Zenda S Marginal Utility of Wealth Schedules BDocument1 pageSolved A Calculate Jimmy S and Zenda S Marginal Utility of Wealth Schedules BM Bilal SaleemNo ratings yet

- Solved Carlos Opens A Dry Cleaning Store During The Year He PDFDocument1 pageSolved Carlos Opens A Dry Cleaning Store During The Year He PDFAnbu jaromiaNo ratings yet

- Solved How Would Each of The Following Likely Affect The RealDocument1 pageSolved How Would Each of The Following Likely Affect The RealM Bilal SaleemNo ratings yet

- Solved Leonard Grant Is The Sole Shareholder of Great Yards CorporationDocument1 pageSolved Leonard Grant Is The Sole Shareholder of Great Yards CorporationAnbu jaromiaNo ratings yet

- Solved Teal Inc Owns Total Assets of 100 Million and ItDocument1 pageSolved Teal Inc Owns Total Assets of 100 Million and ItAnbu jaromiaNo ratings yet

- Solved John and Marsha Are Married and Filed A Joint ReturnDocument1 pageSolved John and Marsha Are Married and Filed A Joint ReturnAnbu jaromiaNo ratings yet

- Solved Simon Is Single and A Stockbroker For A Large InvestmentDocument1 pageSolved Simon Is Single and A Stockbroker For A Large InvestmentAnbu jaromiaNo ratings yet

- Solved The President and Vice President of Usa Corporation Receive BenefitsDocument1 pageSolved The President and Vice President of Usa Corporation Receive BenefitsAnbu jaromiaNo ratings yet

- Acct 417 Dawn Taylor Is Currently Employed byDocument3 pagesAcct 417 Dawn Taylor Is Currently Employed byDoreenNo ratings yet

- Holes R Us A Blasting Services Company Has The FollowingDocument1 pageHoles R Us A Blasting Services Company Has The FollowingM Bilal SaleemNo ratings yet

- Solved Many Domestically Owned Apparel Manufacturers Buy Their Garments Overseas SewDocument1 pageSolved Many Domestically Owned Apparel Manufacturers Buy Their Garments Overseas SewM Bilal SaleemNo ratings yet

- Solved Many Domestically Owned Apparel Manufacturers Buy Their Garments Overseas SewDocument1 pageSolved Many Domestically Owned Apparel Manufacturers Buy Their Garments Overseas SewM Bilal SaleemNo ratings yet

- Solved Hamid Owns and Lives in A Duplex He Rents TheDocument1 pageSolved Hamid Owns and Lives in A Duplex He Rents TheAnbu jaromiaNo ratings yet

- Solved Predict What Each of The Following Events Would Do ToDocument1 pageSolved Predict What Each of The Following Events Would Do ToM Bilal SaleemNo ratings yet

- Solved Erp Projects Are Expensive and Risky Why Did Keda DecideDocument1 pageSolved Erp Projects Are Expensive and Risky Why Did Keda DecideAnbu jaromiaNo ratings yet

- Solved One View of The Consumption Function Is That Workers HaveDocument1 pageSolved One View of The Consumption Function Is That Workers HaveM Bilal SaleemNo ratings yet

- Solved Explain How A Person Who Falls Into The Ranks ofDocument1 pageSolved Explain How A Person Who Falls Into The Ranks ofM Bilal SaleemNo ratings yet

- Solved MR and Mrs Lund and Their Two Children Ben andDocument1 pageSolved MR and Mrs Lund and Their Two Children Ben andAnbu jaromiaNo ratings yet

- Solved Richie Is A Wealthy Rancher in Texas He Operates HisDocument1 pageSolved Richie Is A Wealthy Rancher in Texas He Operates HisAnbu jaromiaNo ratings yet

- Solved Laurie Gladin Owns Land and A Building That She HasDocument1 pageSolved Laurie Gladin Owns Land and A Building That She HasAnbu jaromiaNo ratings yet

- Solved Firewood Prices in Places From Northern California To Boston andDocument1 pageSolved Firewood Prices in Places From Northern California To Boston andM Bilal SaleemNo ratings yet

- Solved Describe The Contrasting Views of The Keynesians and The MonetarDocument1 pageSolved Describe The Contrasting Views of The Keynesians and The MonetarM Bilal SaleemNo ratings yet

- A A P F S: Djusting Ccounts AND Reparing Inancial TatementsDocument39 pagesA A P F S: Djusting Ccounts AND Reparing Inancial TatementsBoo LeNo ratings yet

- Solved Robbins Inc Owns The Following Assets at The Balance SheetDocument1 pageSolved Robbins Inc Owns The Following Assets at The Balance SheetAnbu jaromiaNo ratings yet

- Become Middle-Class Plus: Insert Growth Multipliers Into Your Life: Financial Freedom, #157From EverandBecome Middle-Class Plus: Insert Growth Multipliers Into Your Life: Financial Freedom, #157No ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- This Study Resource Was: Universiti Teknologi Mara Common Test 1 Answer SchemeDocument4 pagesThis Study Resource Was: Universiti Teknologi Mara Common Test 1 Answer SchemeSyazryna AzlanNo ratings yet

- Mahaveer Enterprises: Tax InvoiceDocument1 pageMahaveer Enterprises: Tax InvoiceAyush SrivastavNo ratings yet

- Oil & Gas Industry FINALDocument21 pagesOil & Gas Industry FINALAshutosh KashyapNo ratings yet

- MCQ Chap 4Document6 pagesMCQ Chap 4Diệu QuỳnhNo ratings yet

- 5 Year PlanDocument16 pages5 Year Planashutosh kumarNo ratings yet

- Economics Paper 2 SLDocument9 pagesEconomics Paper 2 SLjreallsnNo ratings yet

- Q92 - Balance of PaymentDocument3 pagesQ92 - Balance of PaymentcelinebcvNo ratings yet

- Is The Banking Sector An Attractive One To Bring in Foreign Investment in NepalDocument4 pagesIs The Banking Sector An Attractive One To Bring in Foreign Investment in NepalSandesh ShahNo ratings yet

- Backward and Forward Linkage Between The Agriculture, EcoDocument11 pagesBackward and Forward Linkage Between The Agriculture, Ecomediquip50% (4)

- Business Cycle ProjectDocument6 pagesBusiness Cycle ProjectarunNo ratings yet

- Afghanistan Economic Monitor 25 April 2023Document11 pagesAfghanistan Economic Monitor 25 April 2023Mustafa NasiriNo ratings yet

- Zarai Taraqiati Bank Limited VisionDocument4 pagesZarai Taraqiati Bank Limited VisionAhmad MalikNo ratings yet

- 2024 January Monthly Chart PackDocument17 pages2024 January Monthly Chart PackChris StarcherNo ratings yet

- (Kuliah 9) Global Cash FlowDocument14 pages(Kuliah 9) Global Cash FlowMuhammad FakhriNo ratings yet

- 254 AssignmentDocument3 pages254 AssignmentSavera Mizan ShuptiNo ratings yet

- Shandong Longheng International Trade Co.,Ltd: Commercial InvoiceDocument2 pagesShandong Longheng International Trade Co.,Ltd: Commercial InvoiceJose LahozNo ratings yet

- Structure of EconomyDocument17 pagesStructure of EconomyRishab Jain 2027203No ratings yet

- ECON NotesDocument15 pagesECON Noteszing GoblaNo ratings yet

- For Three Consecutive YearsDocument2 pagesFor Three Consecutive YearsAllen KateNo ratings yet

- ECO121 Questions C23-28ADocument5 pagesECO121 Questions C23-28ATrần Quang NinhNo ratings yet

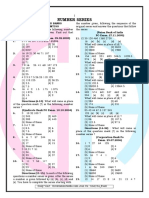

- Number SeriesDocument72 pagesNumber SeriesAmit RajdhanNo ratings yet

- Big Emerging Market ChinaDocument4 pagesBig Emerging Market ChinaPurvi PassaryNo ratings yet

- Macroeconomics I GDP: Prof. Marta Kightley, Instytut Ekonomii Politycznej, Prawa I Polityki Gospodarczej, KzifDocument18 pagesMacroeconomics I GDP: Prof. Marta Kightley, Instytut Ekonomii Politycznej, Prawa I Polityki Gospodarczej, KzifVeronika AlieksieienkoNo ratings yet

- Gache, Rosette L. 3-BSA-1 Business Taxation Activity 7 P 6.1 Gross GiftsDocument5 pagesGache, Rosette L. 3-BSA-1 Business Taxation Activity 7 P 6.1 Gross GiftsMystic LoverNo ratings yet

- The Tertiary Sector of The EconomyDocument3 pagesThe Tertiary Sector of The Economyruchigarg13No ratings yet

- Macroeconomics Assignment 1 Rameez Muhammad Ahsan & Hamza Omar IqbalDocument4 pagesMacroeconomics Assignment 1 Rameez Muhammad Ahsan & Hamza Omar Iqbalrameez ahsanNo ratings yet

- Characteristics Indian EconomyDocument4 pagesCharacteristics Indian EconomypranavNo ratings yet

- International Trading Systems CworldDocument30 pagesInternational Trading Systems CworldDennis Raymundo100% (1)

- Presentation On: of Top 5 Private BanksDocument23 pagesPresentation On: of Top 5 Private BanksTarunveerNo ratings yet