Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsSri Aravindar Arts & Science College Sedarapet Post, Vanur

Sri Aravindar Arts & Science College Sedarapet Post, Vanur

Uploaded by

saravananThis document is an exam for a class on the basics of GST (Goods and Services Tax) in India. The exam contains two sections: Section A with 4 short answer questions worth 5 marks each for a total of 20 marks. Section B contains 2 long answer questions worth 15 marks each for a total of 30 marks. The exam covers topics such as recovery and liability to pay tax, interest on refunds, comparing CGST and SGST, transitional provisions for taxpayers, settlement of cases, positive and negative aspects of GST, electronic commerce and dispute resolution mechanisms under GST.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- A Complete Guide to M.C.Q (Class-10, Mathematics): CBSE MCQ Series, #1From EverandA Complete Guide to M.C.Q (Class-10, Mathematics): CBSE MCQ Series, #1No ratings yet

- All Que PapersDocument13 pagesAll Que Papersyashs.2124No ratings yet

- CESC Mysore Apprentice Notification 2024Document4 pagesCESC Mysore Apprentice Notification 2024surekha mbNo ratings yet

- GST Course 27-03-2020 PDFDocument2 pagesGST Course 27-03-2020 PDFNaveen AppsNo ratings yet

- Perpajakan - UTS - Selasa 19.00 - SA - Genap - Islamiah - 2022Document2 pagesPerpajakan - UTS - Selasa 19.00 - SA - Genap - Islamiah - 2022RianNo ratings yet

- GUIDELINE SWAYAM EXAM 2 UpdatedDocument30 pagesGUIDELINE SWAYAM EXAM 2 UpdatedchthakorNo ratings yet

- Bcoe 131 (E)Document4 pagesBcoe 131 (E)Ashok KushwahaNo ratings yet

- Eco 123Document3 pagesEco 123shadabkhanskNo ratings yet

- CCIC Academic ScheduleDocument1 pageCCIC Academic SchedulePavanNo ratings yet

- Nsep Code 62Document29 pagesNsep Code 62lakshya dadhichNo ratings yet

- CMW Paper Advertisment 03.02.2017Document2 pagesCMW Paper Advertisment 03.02.2017mahendranmaheNo ratings yet

- Tamil Nadu Public Service CommissionDocument33 pagesTamil Nadu Public Service CommissionMohaideen SubaireNo ratings yet

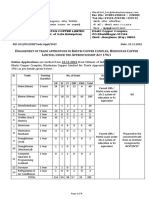

- Municipal Corporation of Greater Mumbai Central Purchase Department 566, N.M.Joshi Marg, Byculla (West), Mumbai - 400 011Document71 pagesMunicipal Corporation of Greater Mumbai Central Purchase Department 566, N.M.Joshi Marg, Byculla (West), Mumbai - 400 011Karan SadhwaniNo ratings yet

- Acc312 SummerDocument1 pageAcc312 SummerAdeyemo KingsleyNo ratings yet

- Don Bosco Income Tax 20.10.2020Document1 pageDon Bosco Income Tax 20.10.2020prasanna JNo ratings yet

- Brochure-Int-MTech-2023-24-Copy 22-02-2023Document12 pagesBrochure-Int-MTech-2023-24-Copy 22-02-2023Pratyush AnandNo ratings yet

- ..AA SYLLABUS 2 Year PDFDocument41 pages..AA SYLLABUS 2 Year PDFKingNo ratings yet

- LW 18 603 Professional EthicsDocument2 pagesLW 18 603 Professional Ethicsganesh yerguntlaNo ratings yet

- Taxation Sec B May 2024 1703584499Document8 pagesTaxation Sec B May 2024 1703584499abhishekkapse654No ratings yet

- 8th Semester Questions (Mid Final) - Autumn20Document13 pages8th Semester Questions (Mid Final) - Autumn20Abrar Alam ChowdhuryNo ratings yet

- E K C C, H C L, A A 1961: NO: HCL/KCC/HR/Trade Appt/2022 Date - 28.06.2022Document4 pagesE K C C, H C L, A A 1961: NO: HCL/KCC/HR/Trade Appt/2022 Date - 28.06.2022DineshNo ratings yet

- Course Structure Bachelor of Commerce Under CBCS Scheme 2019Document19 pagesCourse Structure Bachelor of Commerce Under CBCS Scheme 2019Arfath BaigNo ratings yet

- Tamil Nadu Public Service CommissionDocument36 pagesTamil Nadu Public Service CommissionPalani AppanNo ratings yet

- ArpanDocument2 pagesArpanUtsav SinghNo ratings yet

- Eco 14Document3 pagesEco 14Deepak GautamNo ratings yet

- Https WWW - Onlinesbi.com Sbicollect Remittance Remittanceredirecturl - HTM PDFDocument1 pageHttps WWW - Onlinesbi.com Sbicollect Remittance Remittanceredirecturl - HTM PDFKumar ShashankNo ratings yet

- 0 638047137913450000 NoticeFILEDocument4 pages0 638047137913450000 NoticeFILEMohit MishraNo ratings yet

- Rajasthan Electronics & Instruments Limited: Shaping Rural India Through Electronics, Energy and IT SolutionsDocument4 pagesRajasthan Electronics & Instruments Limited: Shaping Rural India Through Electronics, Energy and IT SolutionsSk RajNo ratings yet

- Notification ECIL Project Engineer PostsDocument4 pagesNotification ECIL Project Engineer Postsaryan banchhorNo ratings yet

- Advt 31 2019Document2 pagesAdvt 31 2019Samiullah MohammedNo ratings yet

- Advt - No. 21 2020Document2 pagesAdvt - No. 21 2020Debashis MahantaNo ratings yet

- Part-II (Semester III & IV) 12.3.18Document23 pagesPart-II (Semester III & IV) 12.3.18Asif KhanNo ratings yet

- MonuDocument2 pagesMonumonu singhNo ratings yet

- Certificate Course On Goods and Service Tax 2017 18Document1 pageCertificate Course On Goods and Service Tax 2017 18A S Krishna MurthyNo ratings yet

- Bangladesh Army University of Science and Technology (BAUST)Document4 pagesBangladesh Army University of Science and Technology (BAUST)Sharmin UrmeeNo ratings yet

- 32 2022 Bursar Eng 1Document48 pages32 2022 Bursar Eng 1Lingammal RajaNo ratings yet

- Adobe Scan 2 Mar 2023Document2 pagesAdobe Scan 2 Mar 2023Nitish DebbarmaNo ratings yet

- TIIC Recruitment 2018 For 43 Senior Officer VacanciesDocument9 pagesTIIC Recruitment 2018 For 43 Senior Officer VacanciesTopRankersNo ratings yet

- Advt 29 2019Document2 pagesAdvt 29 2019Samiullah MohammedNo ratings yet

- GST UgDocument3 pagesGST UgmythilibhuvaneswariNo ratings yet

- DM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhDocument50 pagesDM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhGHAPRC RUDRAPURNo ratings yet

- College of Food Technology SaralgaonDocument2 pagesCollege of Food Technology Saralgaonpradnya kambleNo ratings yet

- DM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhDocument50 pagesDM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhGHAPRC RUDRAPURNo ratings yet

- Universal College of Nursing: Iimb Post, Arekere, BangaloreDocument1 pageUniversal College of Nursing: Iimb Post, Arekere, Bangaloremelby2604No ratings yet

- FS & DM EnglishDocument44 pagesFS & DM EnglishVasan VasanNo ratings yet

- DTCN1Document139 pagesDTCN1Gargi VermaNo ratings yet

- SSC CGL Exam Pattern 2023 For Tier 1and Tier 2 (Revised)Document5 pagesSSC CGL Exam Pattern 2023 For Tier 1and Tier 2 (Revised)Sonam RanaNo ratings yet

- Post - Detail - Information RI ARI AMINDocument18 pagesPost - Detail - Information RI ARI AMINHarish MohantyNo ratings yet

- Place of Posting:i) Gandhinagar, Okha & Porbandar-GujaratDocument5 pagesPlace of Posting:i) Gandhinagar, Okha & Porbandar-GujaratBhojaraj HNo ratings yet

- Oil and Natural Gas Corporation LimitedDocument7 pagesOil and Natural Gas Corporation LimitedRonnie HunterNo ratings yet

- MGCUDocument68 pagesMGCUnilepreet9No ratings yet

- Sports Items Raichur Tender-2Document21 pagesSports Items Raichur Tender-2Pradeep SreedharanNo ratings yet

- Ad Fisries EngDocument40 pagesAd Fisries EngSuresh JNo ratings yet

- Exam FormDocument2 pagesExam Formvaibhavbhosale694No ratings yet

- Faculty of Engineering Scheme of Instruction & Examination: Osmania University, Hyderabad - 500 007 2019Document41 pagesFaculty of Engineering Scheme of Instruction & Examination: Osmania University, Hyderabad - 500 007 2019Mohammed Asif Kattimani MechanicalNo ratings yet

- Open Competitive Examination For Recruitment To The Grade III of The Sri Lanka Agricultural Service - 2021 (New Applicants)Document5 pagesOpen Competitive Examination For Recruitment To The Grade III of The Sri Lanka Agricultural Service - 2021 (New Applicants)Chathura WickramaNo ratings yet

- Agcl Get MTDocument4 pagesAgcl Get MTMriganabh SarmaNo ratings yet

- Binder 3Document91 pagesBinder 3Tasmay Enterprises100% (1)

- Non Ex Web Ad - English-19-07-2023Document7 pagesNon Ex Web Ad - English-19-07-2023Nagavenus DuggiNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Unit - 3-30Document30 pagesUnit - 3-30saravananNo ratings yet

- Indian Economy - Ii Unit - 2Document15 pagesIndian Economy - Ii Unit - 2saravananNo ratings yet

- Unit - 2 - Demand and Supply AnalysisDocument29 pagesUnit - 2 - Demand and Supply AnalysissaravananNo ratings yet

- Unit - 3 - Consumer EquilibriumDocument17 pagesUnit - 3 - Consumer Equilibriumsaravanan100% (1)

- Distinguish Between: Sl. No. Stock FlowDocument3 pagesDistinguish Between: Sl. No. Stock FlowsaravananNo ratings yet

- Unit - 3Document10 pagesUnit - 3saravananNo ratings yet

- Notes On National IncomeDocument9 pagesNotes On National IncomesaravananNo ratings yet

- 3.evolution of MoneyDocument16 pages3.evolution of MoneysaravananNo ratings yet

- Lesson-1 Developmet - Ok - 9Document9 pagesLesson-1 Developmet - Ok - 9saravananNo ratings yet

- Rural EconomicsDocument8 pagesRural EconomicssaravananNo ratings yet

- Report On Food ScarcityDocument1 pageReport On Food ScarcitysaravananNo ratings yet

Sri Aravindar Arts & Science College Sedarapet Post, Vanur

Sri Aravindar Arts & Science College Sedarapet Post, Vanur

Uploaded by

saravanan0 ratings0% found this document useful (0 votes)

18 views1 pageThis document is an exam for a class on the basics of GST (Goods and Services Tax) in India. The exam contains two sections: Section A with 4 short answer questions worth 5 marks each for a total of 20 marks. Section B contains 2 long answer questions worth 15 marks each for a total of 30 marks. The exam covers topics such as recovery and liability to pay tax, interest on refunds, comparing CGST and SGST, transitional provisions for taxpayers, settlement of cases, positive and negative aspects of GST, electronic commerce and dispute resolution mechanisms under GST.

Original Description:

Original Title

Gst

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is an exam for a class on the basics of GST (Goods and Services Tax) in India. The exam contains two sections: Section A with 4 short answer questions worth 5 marks each for a total of 20 marks. Section B contains 2 long answer questions worth 15 marks each for a total of 30 marks. The exam covers topics such as recovery and liability to pay tax, interest on refunds, comparing CGST and SGST, transitional provisions for taxpayers, settlement of cases, positive and negative aspects of GST, electronic commerce and dispute resolution mechanisms under GST.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageSri Aravindar Arts & Science College Sedarapet Post, Vanur

Sri Aravindar Arts & Science College Sedarapet Post, Vanur

Uploaded by

saravananThis document is an exam for a class on the basics of GST (Goods and Services Tax) in India. The exam contains two sections: Section A with 4 short answer questions worth 5 marks each for a total of 20 marks. Section B contains 2 long answer questions worth 15 marks each for a total of 30 marks. The exam covers topics such as recovery and liability to pay tax, interest on refunds, comparing CGST and SGST, transitional provisions for taxpayers, settlement of cases, positive and negative aspects of GST, electronic commerce and dispute resolution mechanisms under GST.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

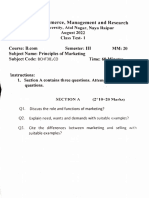

SRI ARAVINDAR ARTS & SCIENCE COLLEGE

Sedarapet post, Vanur

II CONTINUOUS INTERNAL ASSESSMENT EXAMINATION OCTOBER 2019

BASICS OF GST- MCM31

Year & Class: II M.Com. Date:00/10/2019

Duration: 2hrs Max Marks:50

Section-A (4 x 5 = 20)

Answer All Questions

1 a. Make a note on recovery and liability to pay tax

b. Elucidate intrset on refumds

2 a. Compare CGST & SGST

b. Differentiate Audit and inspection

3 a. What is the transitional provision of tax payers?

b. Make a note on liability to pay

4 a. Make a note on settlement of cases

b. Compare interest, offences and penalties

Section-B (2 x 15 = 30)

Answer any TWO Questions

5. What are positive and negative aspects of GST?

6. Give the meaning of electronic commerce and describe the working of electronic

commerce

7. State the meaning of dispute resolution mechanism, explain the approaches and features of

dispute resolution mechanism.

8. Explain the procedure for value of taxable goods and services

You might also like

- A Complete Guide to M.C.Q (Class-10, Mathematics): CBSE MCQ Series, #1From EverandA Complete Guide to M.C.Q (Class-10, Mathematics): CBSE MCQ Series, #1No ratings yet

- All Que PapersDocument13 pagesAll Que Papersyashs.2124No ratings yet

- CESC Mysore Apprentice Notification 2024Document4 pagesCESC Mysore Apprentice Notification 2024surekha mbNo ratings yet

- GST Course 27-03-2020 PDFDocument2 pagesGST Course 27-03-2020 PDFNaveen AppsNo ratings yet

- Perpajakan - UTS - Selasa 19.00 - SA - Genap - Islamiah - 2022Document2 pagesPerpajakan - UTS - Selasa 19.00 - SA - Genap - Islamiah - 2022RianNo ratings yet

- GUIDELINE SWAYAM EXAM 2 UpdatedDocument30 pagesGUIDELINE SWAYAM EXAM 2 UpdatedchthakorNo ratings yet

- Bcoe 131 (E)Document4 pagesBcoe 131 (E)Ashok KushwahaNo ratings yet

- Eco 123Document3 pagesEco 123shadabkhanskNo ratings yet

- CCIC Academic ScheduleDocument1 pageCCIC Academic SchedulePavanNo ratings yet

- Nsep Code 62Document29 pagesNsep Code 62lakshya dadhichNo ratings yet

- CMW Paper Advertisment 03.02.2017Document2 pagesCMW Paper Advertisment 03.02.2017mahendranmaheNo ratings yet

- Tamil Nadu Public Service CommissionDocument33 pagesTamil Nadu Public Service CommissionMohaideen SubaireNo ratings yet

- Municipal Corporation of Greater Mumbai Central Purchase Department 566, N.M.Joshi Marg, Byculla (West), Mumbai - 400 011Document71 pagesMunicipal Corporation of Greater Mumbai Central Purchase Department 566, N.M.Joshi Marg, Byculla (West), Mumbai - 400 011Karan SadhwaniNo ratings yet

- Acc312 SummerDocument1 pageAcc312 SummerAdeyemo KingsleyNo ratings yet

- Don Bosco Income Tax 20.10.2020Document1 pageDon Bosco Income Tax 20.10.2020prasanna JNo ratings yet

- Brochure-Int-MTech-2023-24-Copy 22-02-2023Document12 pagesBrochure-Int-MTech-2023-24-Copy 22-02-2023Pratyush AnandNo ratings yet

- ..AA SYLLABUS 2 Year PDFDocument41 pages..AA SYLLABUS 2 Year PDFKingNo ratings yet

- LW 18 603 Professional EthicsDocument2 pagesLW 18 603 Professional Ethicsganesh yerguntlaNo ratings yet

- Taxation Sec B May 2024 1703584499Document8 pagesTaxation Sec B May 2024 1703584499abhishekkapse654No ratings yet

- 8th Semester Questions (Mid Final) - Autumn20Document13 pages8th Semester Questions (Mid Final) - Autumn20Abrar Alam ChowdhuryNo ratings yet

- E K C C, H C L, A A 1961: NO: HCL/KCC/HR/Trade Appt/2022 Date - 28.06.2022Document4 pagesE K C C, H C L, A A 1961: NO: HCL/KCC/HR/Trade Appt/2022 Date - 28.06.2022DineshNo ratings yet

- Course Structure Bachelor of Commerce Under CBCS Scheme 2019Document19 pagesCourse Structure Bachelor of Commerce Under CBCS Scheme 2019Arfath BaigNo ratings yet

- Tamil Nadu Public Service CommissionDocument36 pagesTamil Nadu Public Service CommissionPalani AppanNo ratings yet

- ArpanDocument2 pagesArpanUtsav SinghNo ratings yet

- Eco 14Document3 pagesEco 14Deepak GautamNo ratings yet

- Https WWW - Onlinesbi.com Sbicollect Remittance Remittanceredirecturl - HTM PDFDocument1 pageHttps WWW - Onlinesbi.com Sbicollect Remittance Remittanceredirecturl - HTM PDFKumar ShashankNo ratings yet

- 0 638047137913450000 NoticeFILEDocument4 pages0 638047137913450000 NoticeFILEMohit MishraNo ratings yet

- Rajasthan Electronics & Instruments Limited: Shaping Rural India Through Electronics, Energy and IT SolutionsDocument4 pagesRajasthan Electronics & Instruments Limited: Shaping Rural India Through Electronics, Energy and IT SolutionsSk RajNo ratings yet

- Notification ECIL Project Engineer PostsDocument4 pagesNotification ECIL Project Engineer Postsaryan banchhorNo ratings yet

- Advt 31 2019Document2 pagesAdvt 31 2019Samiullah MohammedNo ratings yet

- Advt - No. 21 2020Document2 pagesAdvt - No. 21 2020Debashis MahantaNo ratings yet

- Part-II (Semester III & IV) 12.3.18Document23 pagesPart-II (Semester III & IV) 12.3.18Asif KhanNo ratings yet

- MonuDocument2 pagesMonumonu singhNo ratings yet

- Certificate Course On Goods and Service Tax 2017 18Document1 pageCertificate Course On Goods and Service Tax 2017 18A S Krishna MurthyNo ratings yet

- Bangladesh Army University of Science and Technology (BAUST)Document4 pagesBangladesh Army University of Science and Technology (BAUST)Sharmin UrmeeNo ratings yet

- 32 2022 Bursar Eng 1Document48 pages32 2022 Bursar Eng 1Lingammal RajaNo ratings yet

- Adobe Scan 2 Mar 2023Document2 pagesAdobe Scan 2 Mar 2023Nitish DebbarmaNo ratings yet

- TIIC Recruitment 2018 For 43 Senior Officer VacanciesDocument9 pagesTIIC Recruitment 2018 For 43 Senior Officer VacanciesTopRankersNo ratings yet

- Advt 29 2019Document2 pagesAdvt 29 2019Samiullah MohammedNo ratings yet

- GST UgDocument3 pagesGST UgmythilibhuvaneswariNo ratings yet

- DM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhDocument50 pagesDM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhGHAPRC RUDRAPURNo ratings yet

- College of Food Technology SaralgaonDocument2 pagesCollege of Food Technology Saralgaonpradnya kambleNo ratings yet

- DM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhDocument50 pagesDM/M.CH Courses: Postgraduate Institute of Medical Education and Research ChandigarhGHAPRC RUDRAPURNo ratings yet

- Universal College of Nursing: Iimb Post, Arekere, BangaloreDocument1 pageUniversal College of Nursing: Iimb Post, Arekere, Bangaloremelby2604No ratings yet

- FS & DM EnglishDocument44 pagesFS & DM EnglishVasan VasanNo ratings yet

- DTCN1Document139 pagesDTCN1Gargi VermaNo ratings yet

- SSC CGL Exam Pattern 2023 For Tier 1and Tier 2 (Revised)Document5 pagesSSC CGL Exam Pattern 2023 For Tier 1and Tier 2 (Revised)Sonam RanaNo ratings yet

- Post - Detail - Information RI ARI AMINDocument18 pagesPost - Detail - Information RI ARI AMINHarish MohantyNo ratings yet

- Place of Posting:i) Gandhinagar, Okha & Porbandar-GujaratDocument5 pagesPlace of Posting:i) Gandhinagar, Okha & Porbandar-GujaratBhojaraj HNo ratings yet

- Oil and Natural Gas Corporation LimitedDocument7 pagesOil and Natural Gas Corporation LimitedRonnie HunterNo ratings yet

- MGCUDocument68 pagesMGCUnilepreet9No ratings yet

- Sports Items Raichur Tender-2Document21 pagesSports Items Raichur Tender-2Pradeep SreedharanNo ratings yet

- Ad Fisries EngDocument40 pagesAd Fisries EngSuresh JNo ratings yet

- Exam FormDocument2 pagesExam Formvaibhavbhosale694No ratings yet

- Faculty of Engineering Scheme of Instruction & Examination: Osmania University, Hyderabad - 500 007 2019Document41 pagesFaculty of Engineering Scheme of Instruction & Examination: Osmania University, Hyderabad - 500 007 2019Mohammed Asif Kattimani MechanicalNo ratings yet

- Open Competitive Examination For Recruitment To The Grade III of The Sri Lanka Agricultural Service - 2021 (New Applicants)Document5 pagesOpen Competitive Examination For Recruitment To The Grade III of The Sri Lanka Agricultural Service - 2021 (New Applicants)Chathura WickramaNo ratings yet

- Agcl Get MTDocument4 pagesAgcl Get MTMriganabh SarmaNo ratings yet

- Binder 3Document91 pagesBinder 3Tasmay Enterprises100% (1)

- Non Ex Web Ad - English-19-07-2023Document7 pagesNon Ex Web Ad - English-19-07-2023Nagavenus DuggiNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Unit - 3-30Document30 pagesUnit - 3-30saravananNo ratings yet

- Indian Economy - Ii Unit - 2Document15 pagesIndian Economy - Ii Unit - 2saravananNo ratings yet

- Unit - 2 - Demand and Supply AnalysisDocument29 pagesUnit - 2 - Demand and Supply AnalysissaravananNo ratings yet

- Unit - 3 - Consumer EquilibriumDocument17 pagesUnit - 3 - Consumer Equilibriumsaravanan100% (1)

- Distinguish Between: Sl. No. Stock FlowDocument3 pagesDistinguish Between: Sl. No. Stock FlowsaravananNo ratings yet

- Unit - 3Document10 pagesUnit - 3saravananNo ratings yet

- Notes On National IncomeDocument9 pagesNotes On National IncomesaravananNo ratings yet

- 3.evolution of MoneyDocument16 pages3.evolution of MoneysaravananNo ratings yet

- Lesson-1 Developmet - Ok - 9Document9 pagesLesson-1 Developmet - Ok - 9saravananNo ratings yet

- Rural EconomicsDocument8 pagesRural EconomicssaravananNo ratings yet

- Report On Food ScarcityDocument1 pageReport On Food ScarcitysaravananNo ratings yet