Professional Documents

Culture Documents

Solved Lee Is Starting A Small Lawn Service On The Advice

Solved Lee Is Starting A Small Lawn Service On The Advice

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Lee Is Starting A Small Lawn Service On The Advice

Solved Lee Is Starting A Small Lawn Service On The Advice

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Lee is starting a small lawn service On the

advice

Lee is starting a small lawn service. On the advice of his accountant, Lee has formed a

corporation and made an S corporation election. The accountant has asked Lee to consider

electing a fiscal year ending on the last day in February. The accountant pointed out that Lee’s

business is […]

John owns a small farm on a lake. A local developer offers John $400,000 cash for his farm.

The developer believes John’s farm will be very attractive to home buyers because it is on a

lake. After John turns down the initial offer, the developer offers to pay John $250,000 […]

Lana operates a real estate appraisal service business in a small town serving local lenders.

After noting that lenders must pay to bring in a surveyor from out of town, she completes a

course and obtains a surveyor’s license that enables her to provide this service also. She now

provides […]

Judy’s Cars, Inc., sells collectible automobiles to consumers. She employs the specific

identification inventory valuation method. Prices are negotiated by Judy and individual

customers. Judy accepts trade-ins when she sells an automobile. Judy negotiates the allowance

for trade with the customer. Occasionally, Judy finds that it can take two or […]

GET ANSWER- https://accanswer.com/downloads/page/1431/

Roberta, a sole proprietor who uses the calendar year as her tax year, acquires and places in

service two business machines during 2015. Machine C, a 7-year asset, was acquired on

January 20, 2015, for $95,000 and Machine D, a 5-year asset, was acquired on August 1, 2015,

for $50,000. […]

Robert is a sole proprietor who uses the calendar year as his tax year. On July 20, 2015 he

acquired and placed in service a business machine, a 7-year asset, for $50,000. No other

property was acquired in 2015. a. What is the amount of depreciation allowed in 2015 and […]

Thom Jones (SSN 000-00-1111) is an unincorporated manufacturer of widgets. He uses the

LCM method to value his inventory and reports the following for 2014: Complete Thom’s 2014

Form 4562 and Schedule C of Form 1040, assuming Thom elects to expense the maximum

amount possible under Sec. 179 but elects […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1431/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFDocument1 pageSolved Assuming A 25 Percent Tax Rate Compute The After Tax Cost PDFAnbu jaromiaNo ratings yet

- VSDC LAC Test Keys v4 - 8Document2 pagesVSDC LAC Test Keys v4 - 8Nirvana Munar Meneses100% (2)

- Susan S Consulting Experienced The Following Transactions For 2013 Its FirstDocument1 pageSusan S Consulting Experienced The Following Transactions For 2013 Its FirstCharlotteNo ratings yet

- Balance Sheet Owner's Equity Statemen T Income Stateme NT Statement of Cash FlowsDocument2 pagesBalance Sheet Owner's Equity Statemen T Income Stateme NT Statement of Cash FlowsSesmaNo ratings yet

- Leila Durkin An Architect Opened An Office On May 1Document1 pageLeila Durkin An Architect Opened An Office On May 1M Bilal SaleemNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Mission Statement of BataDocument5 pagesMission Statement of BataArbab Usman Khan0% (1)

- Slaying The DragonDocument5 pagesSlaying The DragonMarkus ChNo ratings yet

- Solved During 2015 Rita Acquired and Placed in Service Two AssetsDocument1 pageSolved During 2015 Rita Acquired and Placed in Service Two AssetsAnbu jaromiaNo ratings yet

- D22 TX ZAF FinalDocument14 pagesD22 TX ZAF FinalmunyaradziNo ratings yet

- Solved The Revenues and Expenses of Sentinel Travel Service For TheDocument1 pageSolved The Revenues and Expenses of Sentinel Travel Service For TheAnbu jaromiaNo ratings yet

- Solved The Epbo For Branch Industries at The End of 2018Document1 pageSolved The Epbo For Branch Industries at The End of 2018Anbu jaromiaNo ratings yet

- FA - Excercises & Answers PDFDocument17 pagesFA - Excercises & Answers PDFRasanjaliGunasekera100% (1)

- Problem Set 1 UpdatedDocument2 pagesProblem Set 1 UpdatedRubab MirzaNo ratings yet

- Solved Laurie Gladin Owns Land and A Building That She HasDocument1 pageSolved Laurie Gladin Owns Land and A Building That She HasAnbu jaromiaNo ratings yet

- Business Studies Chapter 6 - Grade 10Document4 pagesBusiness Studies Chapter 6 - Grade 10Maneesha DulanjaliNo ratings yet

- Solved Rick Is A Sole Proprietor Who Has A Small BusinessDocument1 pageSolved Rick Is A Sole Proprietor Who Has A Small BusinessAnbu jaromiaNo ratings yet

- Solved The Outstanding Stock in Red Blue and Green Corporations EachDocument1 pageSolved The Outstanding Stock in Red Blue and Green Corporations EachAnbu jaromiaNo ratings yet

- Solved Richie Is A Wealthy Rancher in Texas He Operates HisDocument1 pageSolved Richie Is A Wealthy Rancher in Texas He Operates HisAnbu jaromiaNo ratings yet

- Solved Mno Is A Calendar Year Taxpayer On March 1 MnoDocument1 pageSolved Mno Is A Calendar Year Taxpayer On March 1 MnoAnbu jaromiaNo ratings yet

- Lecture 2 Student Rules of Debit and CreditDocument14 pagesLecture 2 Student Rules of Debit and CreditSaloni GargNo ratings yet

- Accounting Equation, Transaction Analysis and Preparation of Financial StatementDocument10 pagesAccounting Equation, Transaction Analysis and Preparation of Financial Statementশুভ MitraNo ratings yet

- Spalatorie AutoDocument17 pagesSpalatorie AutomindrumihaiNo ratings yet

- IPCC - November 2014Document11 pagesIPCC - November 2014suhaib1282No ratings yet

- Solved David A Cpa For A Large Accounting Firm Often WorksDocument1 pageSolved David A Cpa For A Large Accounting Firm Often WorksAnbu jaromiaNo ratings yet

- Chapter 1 - Some Basic QuestionsDocument6 pagesChapter 1 - Some Basic QuestionsBracu 2023No ratings yet

- Solved Charger Inc Has The Following Items For The Current Year PDFDocument1 pageSolved Charger Inc Has The Following Items For The Current Year PDFAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Lesson 02 - Practice of Book Keeping Including Ledgers and Trial BalanceDocument3 pagesLesson 02 - Practice of Book Keeping Including Ledgers and Trial Balancepulitha kodituwakkuNo ratings yet

- Accounting Eng 5+6 المحاضرة الخامسة والسادسةDocument26 pagesAccounting Eng 5+6 المحاضرة الخامسة والسادسة01326567536mNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Solved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnDocument1 pageSolved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnAnbu jaromiaNo ratings yet

- Dan Oliver Worked As An Accountant at A Local AccountingDocument1 pageDan Oliver Worked As An Accountant at A Local Accountinghassan taimourNo ratings yet

- Assignment 1 Solution Mech 313Document2 pagesAssignment 1 Solution Mech 313Parv SinghNo ratings yet

- Financial Account FIA 141 HomeworkDocument2 pagesFinancial Account FIA 141 HomeworkhotpokerchipsNo ratings yet

- Accounting Principle1Document17 pagesAccounting Principle1DivyaNo ratings yet

- Bank BootcampDocument3 pagesBank BootcampKumar AnandNo ratings yet

- PA301Q Financial Accounting 2Document11 pagesPA301Q Financial Accounting 2maybeNo ratings yet

- ch10 Kieso IFRS4 PPTDocument61 pagesch10 Kieso IFRS4 PPT1234778No ratings yet

- Singh Company Started Business On January 1 2011 The FollowingDocument1 pageSingh Company Started Business On January 1 2011 The FollowingTaimour HassanNo ratings yet

- Weygandt Kimmel Keiso 9 EditionDocument11 pagesWeygandt Kimmel Keiso 9 EditionShuvro ChakravortyNo ratings yet

- Rocket Singh CaseDocument3 pagesRocket Singh Casewww.tejashrai1072000No ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Home Work - 2017Document1 pageHome Work - 2017AA BB MMNo ratings yet

- Walters Corporation Was Formed During 2013 by John Walters JohnDocument1 pageWalters Corporation Was Formed During 2013 by John Walters JohnAmit PandeyNo ratings yet

- Solved in December Dan Sells Unlisted Stock With A Cost ofDocument1 pageSolved in December Dan Sells Unlisted Stock With A Cost ofAnbu jaromiaNo ratings yet

- 1.1 - Accounting in ActionDocument12 pages1.1 - Accounting in ActionarjunaidbdNo ratings yet

- ACC101 Chap 1&2 TemplateDocument11 pagesACC101 Chap 1&2 Templatenguyencongnamtn1708No ratings yet

- Accounting EquationDocument36 pagesAccounting EquationHadi HarizNo ratings yet

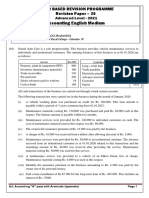

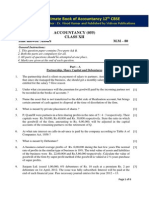

- Accounting English Medium: Paper Based Revision Programme Revision Paper - 35Document5 pagesAccounting English Medium: Paper Based Revision Programme Revision Paper - 35Malar SrirengarajahNo ratings yet

- Assignment OneDocument6 pagesAssignment OneUser50% (2)

- Tutorial 05Document3 pagesTutorial 05Janidu KavishkaNo ratings yet

- PresenterDocument26 pagesPresenterDurkhanai ZebNo ratings yet

- Solved Since The 1990 Revision of Article 4 A Bank IsDocument1 pageSolved Since The 1990 Revision of Article 4 A Bank IsAnbu jaromiaNo ratings yet

- Solved An Analysis of The Transactions of Rutherford Company For The PDFDocument1 pageSolved An Analysis of The Transactions of Rutherford Company For The PDFAnbu jaromiaNo ratings yet

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- Prati AccountancyDocument2 pagesPrati AccountancyMohan NjNo ratings yet

- Mefa Mid 2Document4 pagesMefa Mid 2Vadlamudi DhyanamalikaNo ratings yet

- The Accounting Equation and The Balance SheetDocument5 pagesThe Accounting Equation and The Balance SheetMuhammad Ben Mahfouz Al-ZubairiNo ratings yet

- AA015 Chapter 2 Quiz 1Document5 pagesAA015 Chapter 2 Quiz 1norismah isaNo ratings yet

- Test Your Understanding Question #1Document3 pagesTest Your Understanding Question #1Tedla Guye75% (8)

- EP60010 Funding New Venture PDFDocument2 pagesEP60010 Funding New Venture PDFRajat AgrawalNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- UBX Cloud - VEEAM Cloud Backup SlickDocument2 pagesUBX Cloud - VEEAM Cloud Backup SlickmohamedalihashNo ratings yet

- The Danube 3D: Europeity and EuropeismDocument14 pagesThe Danube 3D: Europeity and EuropeismcursantcataNo ratings yet

- Annual Report 2020 V3Document179 pagesAnnual Report 2020 V3Uswa KhurramNo ratings yet

- Asian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromDocument3 pagesAsian Paints: Sales Turnover: Sales Turnover of The Asian Paints Is Shows The Remarkable Increase FromHarsh AryaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Pavan KumarNo ratings yet

- Fouts Def 2nd Production of DocumentsDocument88 pagesFouts Def 2nd Production of Documentswolf woodNo ratings yet

- TED Taiye SelasiDocument4 pagesTED Taiye SelasiMinh ThuNo ratings yet

- Indian Institute of Information Technology, Surat: SVNIT Campus, Ichchanath, Surat - 395007Document1 pageIndian Institute of Information Technology, Surat: SVNIT Campus, Ichchanath, Surat - 395007gopalgeniusNo ratings yet

- Brown 2003Document12 pagesBrown 2003sziágyi zsófiaNo ratings yet

- Group Practice Agency AuthorizationDocument2 pagesGroup Practice Agency AuthorizationAurangzeb JadoonNo ratings yet

- Chiquita Motion To Dismiss For Forum Non ConveniensDocument59 pagesChiquita Motion To Dismiss For Forum Non ConveniensPaulWolfNo ratings yet

- ExampleDocument3 pagesExampleAhad nasserNo ratings yet

- BIR Form 1604EDocument2 pagesBIR Form 1604Ecld_tiger100% (2)

- Lesson 3 Module 3 Lec - Data Security AwarenessDocument16 pagesLesson 3 Module 3 Lec - Data Security AwarenessJenica Mae SaludesNo ratings yet

- Digest Partnership CaseDocument12 pagesDigest Partnership Casejaynard9150% (2)

- Thomson Reuters Eikon BrochureDocument5 pagesThomson Reuters Eikon BrochureIvon BacaicoaNo ratings yet

- SP 70Document75 pagesSP 70Barbie Turic100% (2)

- Nnadili v. Chevron U.s.a., Inc.Document10 pagesNnadili v. Chevron U.s.a., Inc.RavenFoxNo ratings yet

- Global WarmingDocument50 pagesGlobal WarmingLeah Oljol RualesNo ratings yet

- MLCFDocument27 pagesMLCFMuhammad HafeezNo ratings yet

- M607 L01 SolutionDocument7 pagesM607 L01 SolutionRonak PatelNo ratings yet

- STUDENT 2021-2022 Academic Calendar (FINAL)Document1 pageSTUDENT 2021-2022 Academic Calendar (FINAL)Babar ImtiazNo ratings yet

- 03 Tiongson Cayetano Et Al Vs Court of Appeals Et AlDocument6 pages03 Tiongson Cayetano Et Al Vs Court of Appeals Et Alrandelrocks2No ratings yet

- Mobilia Products, Inc. v. Umezawa, 452 SCRA 736Document15 pagesMobilia Products, Inc. v. Umezawa, 452 SCRA 736JNo ratings yet

- Islam A Case of Mistaken Identity.Document29 pagesIslam A Case of Mistaken Identity.AndrewNo ratings yet

- Exotic Options: Options, Futures, and Other Derivatives, 6Document26 pagesExotic Options: Options, Futures, and Other Derivatives, 6Pankeshwar JangidNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet