Professional Documents

Culture Documents

Waldum Company Purchased Packaging Equipment On January 5 2012 For

Waldum Company Purchased Packaging Equipment On January 5 2012 For

Uploaded by

Amit Pandey0 ratings0% found this document useful (0 votes)

9 views1 pageWaldum Company purchased packaging equipment on January 5, 2012 for $135,000. The equipment was expected to have a useful life of 3 years or 18,000 operating hours, with a residual value of $13,500. It was used for 8,600 hours in 2012, 5,300 hours in 2013, and 4,100 hours in 2014. The document asks to calculate depreciation expense for the years 2012-2014 using straight-line, units-of-output, and double-declining balance methods and identify which yields the highest depreciation in 2012 and over the 3-year period.

Original Description:

upload

Original Title

Waldum Company Purchased Packaging Equipment on January 5 2012 For

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWaldum Company purchased packaging equipment on January 5, 2012 for $135,000. The equipment was expected to have a useful life of 3 years or 18,000 operating hours, with a residual value of $13,500. It was used for 8,600 hours in 2012, 5,300 hours in 2013, and 4,100 hours in 2014. The document asks to calculate depreciation expense for the years 2012-2014 using straight-line, units-of-output, and double-declining balance methods and identify which yields the highest depreciation in 2012 and over the 3-year period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views1 pageWaldum Company Purchased Packaging Equipment On January 5 2012 For

Waldum Company Purchased Packaging Equipment On January 5 2012 For

Uploaded by

Amit PandeyWaldum Company purchased packaging equipment on January 5, 2012 for $135,000. The equipment was expected to have a useful life of 3 years or 18,000 operating hours, with a residual value of $13,500. It was used for 8,600 hours in 2012, 5,300 hours in 2013, and 4,100 hours in 2014. The document asks to calculate depreciation expense for the years 2012-2014 using straight-line, units-of-output, and double-declining balance methods and identify which yields the highest depreciation in 2012 and over the 3-year period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

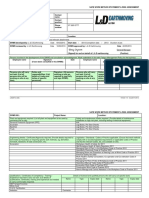

Waldum Company purchased packaging equipment on

January 5 2012 for

Waldum Company purchased packaging equipment on January 5, 2012, for $135,000. The

equipment was expected to have a useful life of three years, or 18,000 operating hours, and a

residual value of $13,500. The equipment was used for 8,600 hours during 2012, 5,300 hours in

2013, and 4,100 hours in 2014.Instructions1. Determine the amount of depreciation expense for

the years ended December 31, 2012, 2013, and 2014, by (a) The straight-line method, (b) The

units-of-output method, (c) The double-declining-balance method. Also determine the total

depreciation expense for the three years by each method. The following columnar headings are

suggested for recording the depreciation expense amounts:2. What method yields the highest

depreciation expense for 2012?3. What method yields the most depreciation over the three-year

life of theequipment?

View Solution:

Waldum Company purchased packaging equipment on January 5 2012 for

SOLUTION-- http://solutiondone.online/downloads/waldum-company-purchased-packaging-

equipment-on-january-5-2012-for/

Unlock answers here solutiondone.online

Powered by TCPDF (www.tcpdf.org)

You might also like

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- ADIT TP 2023-06 QuestionsDocument6 pagesADIT TP 2023-06 QuestionsSalih MansoorNo ratings yet

- Audit Report NewDocument15 pagesAudit Report NewRoshna HaroonNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- 3 DepreciationDocument23 pages3 Depreciationkazuto100% (2)

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Waylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Document1 pageWaylander Coatings Company Purchased Waterproofing Equipment On January 6 2015Muhammad ShahidNo ratings yet

- In Recent Years Howard Company Has Purchased Three Machines BecauseDocument1 pageIn Recent Years Howard Company Has Purchased Three Machines Becausetrilocksp SinghNo ratings yet

- Warhol Company Acquired A Plant Asset at The Beginning ofDocument1 pageWarhol Company Acquired A Plant Asset at The Beginning ofM Bilal SaleemNo ratings yet

- SCM Green Logistics in McDonalds ScribdDocument6 pagesSCM Green Logistics in McDonalds ScribdArun Sanal100% (1)

- Methods of DepreciationDocument7 pagesMethods of DepreciationSomashish NaskarNo ratings yet

- Batool Abbas-Constructs and Items of Improved ModelDocument3 pagesBatool Abbas-Constructs and Items of Improved ModelBatool AbbasNo ratings yet

- CSR AssignmentDocument61 pagesCSR AssignmentAkanksha KumariNo ratings yet

- Cost AccountingDocument61 pagesCost AccountingyoihkbsNo ratings yet

- The Kordell Company Started Business On January 1 2013 inDocument1 pageThe Kordell Company Started Business On January 1 2013 inAmit PandeyNo ratings yet

- Cost Accnt. Lesson 1Document23 pagesCost Accnt. Lesson 1peter banjaoNo ratings yet

- Summary - Wellington ChemicalsDocument2 pagesSummary - Wellington ChemicalsSHAILY KASAUNDHANNo ratings yet

- Depreciation AssignmentDocument13 pagesDepreciation AssignmentfarisktsNo ratings yet

- Combining Organizational Preformance With Sustainable Development Issues - The Lean and Green Project Benchmarking RepositoryDocument11 pagesCombining Organizational Preformance With Sustainable Development Issues - The Lean and Green Project Benchmarking RepositoryNuriaNo ratings yet

- Dowtherm Heat Transfer FluidsDocument16 pagesDowtherm Heat Transfer FluidsUdaya ZorroNo ratings yet

- FINAL - FS ReportDocument3 pagesFINAL - FS ReportFRANCINE THEA LANTAYANo ratings yet

- Model Policy: Use and Disposal of SolventsDocument3 pagesModel Policy: Use and Disposal of SolventsSophie-Louise MercedesNo ratings yet

- Depreciation Activity (Math of InvestmentDocument2 pagesDepreciation Activity (Math of InvestmentRCNo ratings yet

- Depresiasi & Deplesi KiesoDocument5 pagesDepresiasi & Deplesi KiesoAnggi KurniawanNo ratings yet

- Safety Quiz For The Month of April 2013Document3 pagesSafety Quiz For The Month of April 2013Mohamed SaidNo ratings yet

- Module 2 - Applying Appropriate Sealant AdhesiveDocument5 pagesModule 2 - Applying Appropriate Sealant AdhesiveHoney Mae Binarao BuliagNo ratings yet

- Impairment Roland Company Uses Special Strapping Equipment in It PDFDocument1 pageImpairment Roland Company Uses Special Strapping Equipment in It PDFAnbu jaromiaNo ratings yet

- Adams Inc Acquires Clay Corporation On January 1 2012 inDocument1 pageAdams Inc Acquires Clay Corporation On January 1 2012 inMiroslav GegoskiNo ratings yet

- Cost Analysis of Apollo Tyres: Submitted byDocument24 pagesCost Analysis of Apollo Tyres: Submitted byNikhil AgarwalNo ratings yet

- Air Cargo ManagementDocument17 pagesAir Cargo ManagementmeaowNo ratings yet

- Chapter 02 Part 01Document49 pagesChapter 02 Part 01Ryan Delos ReyesNo ratings yet

- Case StudyDocument3 pagesCase StudyJeien SantiagoNo ratings yet

- Hom WorkDocument1 pageHom WorkAla'a A ShakirNo ratings yet

- Part B F5 RevisionDocument6 pagesPart B F5 RevisionMazni HanisahNo ratings yet

- CDR Questionnaire - ArcolubDocument10 pagesCDR Questionnaire - ArcolubOmaya TariqNo ratings yet

- Fewer Gels MeanDocument2 pagesFewer Gels MeanjuscoNo ratings yet

- Code of Good PracticeDocument24 pagesCode of Good PracticeOmar valdesNo ratings yet

- Log208 Jan 2022 ToaDocument4 pagesLog208 Jan 2022 ToaumaNo ratings yet

- Writing Articles: How To Save The Environment/River - Wordlist Wordlist Meaning in BMDocument3 pagesWriting Articles: How To Save The Environment/River - Wordlist Wordlist Meaning in BMD'maya AreyNo ratings yet

- W2S2 Cost Terms, Concepts and Classifications Seminar QuestionsDocument4 pagesW2S2 Cost Terms, Concepts and Classifications Seminar QuestionsGuzi OvidiuNo ratings yet

- BCOC-138 E Block-4 2Document171 pagesBCOC-138 E Block-4 2karnrajritik456No ratings yet

- Unit 12Document33 pagesUnit 12kaserahk11No ratings yet

- HRM Ass 3 FinalDocument7 pagesHRM Ass 3 FinalUsman GhaniNo ratings yet

- Universiti Kebangsaan Malaysia by Dr. Shahrul Mohd NadzirDocument4 pagesUniversiti Kebangsaan Malaysia by Dr. Shahrul Mohd NadzirNora Mahirah RashidNo ratings yet

- Focus ON Powder Coatings: LegislationDocument1 pageFocus ON Powder Coatings: Legislation3056vivekNo ratings yet

- CDP Climate Change ResponseDocument91 pagesCDP Climate Change ResponsevisutsiNo ratings yet

- M02-Use Tools, Equipment and Measuring InstrumentsDocument80 pagesM02-Use Tools, Equipment and Measuring InstrumentsGizaw TadesseNo ratings yet

- Question & Answer Booklet: Test 1Document6 pagesQuestion & Answer Booklet: Test 1Nur Hidayatul ShafiqahNo ratings yet

- This Study Resource Was: 1. Identification of The ProblemDocument4 pagesThis Study Resource Was: 1. Identification of The ProblemmanavNo ratings yet

- Doug Ingram: General ManagerDocument14 pagesDoug Ingram: General ManagerArshad Rashid ShahNo ratings yet

- Heavy Duty Engine SCR WorkshopDocument12 pagesHeavy Duty Engine SCR Workshopddi11No ratings yet

- Colloc Merp 22Document5 pagesColloc Merp 22Amina MbodjNo ratings yet

- MIAE 380 Project ReportDocument38 pagesMIAE 380 Project ReportAhmed alnajjariNo ratings yet

- Dynamatic TechDocument255 pagesDynamatic TecharunNo ratings yet

- 2-Factors Affecting The Selection of Construction Equipment PDFDocument17 pages2-Factors Affecting The Selection of Construction Equipment PDFAli Tavakoli Nia100% (1)

- Solutiondone 475Document1 pageSolutiondone 475trilocksp SinghNo ratings yet

- Network of Stand-By Oil Spill Response Vessels: Drills and Exercises Annual Report 2013Document37 pagesNetwork of Stand-By Oil Spill Response Vessels: Drills and Exercises Annual Report 2013Alan PereiraNo ratings yet

- Preliminary Marketing ReportDocument21 pagesPreliminary Marketing ReportMark HannemannNo ratings yet

- Alko Case StudyDocument6 pagesAlko Case Studymathieu100% (1)

- 13 - HOLCIM Occupational Safety and Health Uwe BarkmannDocument22 pages13 - HOLCIM Occupational Safety and Health Uwe Barkmannhuylan2204No ratings yet

- Circular Economy - Close The LoopDocument4 pagesCircular Economy - Close The Loop20PGPIB064AKSHAR PANDYANo ratings yet

- Circular Economy: Assessment and Case StudiesFrom EverandCircular Economy: Assessment and Case StudiesNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet