Professional Documents

Culture Documents

Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500

Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500

Uploaded by

Anbu jaromiaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500

Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Office equipment that cost 67 000 had

accumulated depreciation of 22 500

Office equipment that cost 67 000 had accumulated depreciation of 22 500 Office equipment

that cost $67,000 had accumulated depreciation of $22,500 when it sold for $38,600. Using this

information, indicate the items to be reported on the state- ment of cash flows prepared using

the direct method. Office equipment […]

Sales reported on the statement of income were 51 300 The Sales reported on the statement of

income were $51,300. The accounts receivable balance decreased $4,100 over the year.

Determine the amount of cash received from customers to be included in the operating section

under the direct method. Sales reported […]

Truly Inc reported the following data Net income 18 Truly Inc. reported the following data: Net

income ………………………………………$180,000 Depreciation expense ……………………………. 40,0

disposal of equipment ………………….. 12,400 Increase in accounts receivable ………………….. 12,100

Increase in accounts payable …………………….. 5,900 Prepare the Cash Flows from Operating

Activities section of […]

Watson Corporation s statement of financial position data for current assets Watson

Corporation’s statement of financial position data for current assets and liabili- ties were as

follows: Adjust net income of $320,000 for changes in operating assets and liabilities to arrive at

net cash flow from operating activities using the […]

GET ANSWER- https://accanswer.com/downloads/page/1616/

Cozy Corporation s accumulated depreciation furniture increased by 5 000 and 1 300 of Cozy

Corporation’s accumulated depreciation-furniture increased by $5,000, and $1,300 of patents

were amortized between balance sheet dates. Cozy had no purchases or sales of tangible or

intangible assets during the year. In addition, the statement of […]

A long term investment in bonds with a cost of 70 000 A long-term investment in bonds with a

cost of $70,000 was sold for $84,000 cash. (a) What was the gain or loss on the sale? (b) What

was the effect of the transaction on cash flows? (c) How […]

Amore Inc had the following cost and fair market values Amore Inc. had the following cost and

fair market values for their investments: Instructions 1. Journalize the year-end revaluation

entries required by Amore Inc. 2. Prepare the relevant current and non-current sections of the

statement of financial position for Amore […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1616/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Solved A Company Reports The Following Income Before Income Tax 4 000 000 Interest Expense PDFDocument2 pagesSolved A Company Reports The Following Income Before Income Tax 4 000 000 Interest Expense PDFAnbu jaromiaNo ratings yet

- CH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Document71 pagesCH 23 Statementofcashflowssolutionsinteraccounting16thedition-171116132124Lina SakhiNo ratings yet

- Prelim ExamDocument12 pagesPrelim ExamCyd Chary Limbaga BiadnesNo ratings yet

- Solved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsDocument1 pageSolved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsAnbu jaromiaNo ratings yet

- Solved For The Year 2017 Dumas Company S Gross Profit Was 96 000Document1 pageSolved For The Year 2017 Dumas Company S Gross Profit Was 96 000Anbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- APSR-17.7Annual Verification CertificateDocument2 pagesAPSR-17.7Annual Verification CertificatekkkothaNo ratings yet

- Solved Robbins Inc Owns The Following Assets at The Balance SheetDocument1 pageSolved Robbins Inc Owns The Following Assets at The Balance SheetAnbu jaromiaNo ratings yet

- Individual Assignment OneDocument3 pagesIndividual Assignment OnefeyselNo ratings yet

- CMA Part 1Document11 pagesCMA Part 1Aaron Abano100% (1)

- CMA Part 1Document7 pagesCMA Part 1Aaron AbanoNo ratings yet

- Solved Suppose Morrison Corp S Breakeven Point Is Revenues of 1 100 000 Fixed CostsDocument1 pageSolved Suppose Morrison Corp S Breakeven Point Is Revenues of 1 100 000 Fixed CostsAnbu jaromiaNo ratings yet

- Solved The Following Statement of Cash Flows For Shasta Inc WasDocument1 pageSolved The Following Statement of Cash Flows For Shasta Inc WasAnbu jaromiaNo ratings yet

- Here and On Page 88 Are Financial Statements of EdmistonDocument1 pageHere and On Page 88 Are Financial Statements of EdmistonM Bilal SaleemNo ratings yet

- TO Accounting: PembahasanDocument17 pagesTO Accounting: PembahasanFitria Ramadhani AyuningtyasNo ratings yet

- Accounting Process HandoutsDocument6 pagesAccounting Process HandoutsMichael BongalontaNo ratings yet

- 1 - Financial - Managerial Acc Assignment Mba WeekendDocument3 pages1 - Financial - Managerial Acc Assignment Mba Weekendadabotor7No ratings yet

- ACCT 101 Chapter 12 HandoutDocument5 pagesACCT 101 Chapter 12 Handoutpaul ndhlovuNo ratings yet

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Document7 pagesACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Cash Flow StatementDocument6 pagesCash Flow StatementMUINDI MUASYA KENNEDY D190/18836/2020No ratings yet

- Solved The Quality Office Furniture Company Has Compiled The Year S RevenueDocument1 pageSolved The Quality Office Furniture Company Has Compiled The Year S RevenueM Bilal SaleemNo ratings yet

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerribleNo ratings yet

- Financial Statement Data For Dickerson Manufacturing Company For The CurrentDocument1 pageFinancial Statement Data For Dickerson Manufacturing Company For The Currenttrilocksp SinghNo ratings yet

- Xii Acc Worksheetss-30-55Document26 pagesXii Acc Worksheetss-30-55Unknown patelNo ratings yet

- Student Name: Student ID: Class: DateDocument4 pagesStudent Name: Student ID: Class: DateKinNo ratings yet

- Excercise Sheet Lectures 1 and 2 Spring 2022Document16 pagesExcercise Sheet Lectures 1 and 2 Spring 2022Mohamed ZaitoonNo ratings yet

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayNo ratings yet

- Cebu Cpar Practical Accounting 1 Cash Flow - UmDocument9 pagesCebu Cpar Practical Accounting 1 Cash Flow - UmJomarNo ratings yet

- Cashflow Statements - 15 Questions With AnswersDocument6 pagesCashflow Statements - 15 Questions With AnswersRob WangNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- Dwnload Full Managerial Accounting 14th Edition Warren Solutions Manual PDFDocument12 pagesDwnload Full Managerial Accounting 14th Edition Warren Solutions Manual PDFcongruesteppedl943n100% (13)

- Exam 2 SolutionsDocument5 pagesExam 2 Solutions123xxNo ratings yet

- Solved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachDocument1 pageSolved Review The Transactions Listed in E3 1 For Wolfe LTD Instructions Classify EachAnbu jaromiaNo ratings yet

- Managerial Accounting 14th Edition Warren Solutions ManualDocument25 pagesManagerial Accounting 14th Edition Warren Solutions ManualGailLarsennqfb100% (55)

- Special Accounting Topics For Business CombinationDocument4 pagesSpecial Accounting Topics For Business CombinationMixx MineNo ratings yet

- Accounting 203 Chapter 13 TestDocument3 pagesAccounting 203 Chapter 13 TestAnbang XiaoNo ratings yet

- Solved The Following Selected Information Is Presented For Okanagan Corporation ForDocument1 pageSolved The Following Selected Information Is Presented For Okanagan Corporation ForAnbu jaromiaNo ratings yet

- Solved The December 31 2018 Adjusted Trial Balance For The BlueDocument1 pageSolved The December 31 2018 Adjusted Trial Balance For The BlueAnbu jaromiaNo ratings yet

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaNo ratings yet

- Chapter 3 Cfs SubsequentDocument48 pagesChapter 3 Cfs SubsequentFasiko AsmaroNo ratings yet

- Solved Refer To The Financial Information Given in E13 7 For PuffyDocument1 pageSolved Refer To The Financial Information Given in E13 7 For PuffyAnbu jaromiaNo ratings yet

- QuizDocument5 pagesQuizhappystoneNo ratings yet

- Accounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDocument8 pagesAccounting Tools For Business Decision Making 6th Edition Kimmel Solutions ManualDrMartinSmithbxnd100% (43)

- Financial Accounting ProjectDocument9 pagesFinancial Accounting ProjectL.a. LadoresNo ratings yet

- Solved Marie and Ethan Form Roundtree Corporation With The Transfer ofDocument1 pageSolved Marie and Ethan Form Roundtree Corporation With The Transfer ofAnbu jaromiaNo ratings yet

- AssignmentDocument2 pagesAssignmentOsama YaghiNo ratings yet

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoNo ratings yet

- Bacc 237 Assignment Two (Multiple Choice)Document10 pagesBacc 237 Assignment Two (Multiple Choice)TarusengaNo ratings yet

- The Following Data Were Taken From The Balance Sheet Accounts PDFDocument1 pageThe Following Data Were Taken From The Balance Sheet Accounts PDFAnbu jaromiaNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Solved The Statement of Cash Flows For The Year Ended DecemberDocument1 pageSolved The Statement of Cash Flows For The Year Ended DecemberAnbu jaromiaNo ratings yet

- Problems Series B: InstructionsDocument1 pageProblems Series B: Instructionscons theNo ratings yet

- Solved Every Individual Employee in An Organization Plays A Role inDocument1 pageSolved Every Individual Employee in An Organization Plays A Role inAnbu jaromiaNo ratings yet

- Form6 Mock ExamDocument7 pagesForm6 Mock Examkya.pNo ratings yet

- Solutions To Multiple Choice Questions, Exercises and ProblemsDocument30 pagesSolutions To Multiple Choice Questions, Exercises and ProblemsJan SpantonNo ratings yet

- Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsDocument2 pagesExercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsThaa Manitha DinataNo ratings yet

- 400 - 221 AVANZADA15Purchase Pooling Comparison Date of Acq 9CDocument3 pages400 - 221 AVANZADA15Purchase Pooling Comparison Date of Acq 9Ckarenxiomara7No ratings yet

- Solved Mchale Company Does Business in Two Customer Segments Retail andDocument1 pageSolved Mchale Company Does Business in Two Customer Segments Retail andAnbu jaromiaNo ratings yet

- Chapter 2. Understanding The Income StatementDocument10 pagesChapter 2. Understanding The Income StatementVượng TạNo ratings yet

- C 5 A: P U B A: Hapter Cquisitions Urchase and Se of Usiness SsetsDocument17 pagesC 5 A: P U B A: Hapter Cquisitions Urchase and Se of Usiness SsetsKenKdwNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- You Have To Choose The Best Answer To Each Questions From The Alternatives GivenDocument5 pagesYou Have To Choose The Best Answer To Each Questions From The Alternatives Givenaida FitriahNo ratings yet

- Compania de Naveira Nedelka Sa V Tradex Internacional SaDocument3 pagesCompania de Naveira Nedelka Sa V Tradex Internacional SaAbhishek RaiNo ratings yet

- Define Sales ProcessDocument15 pagesDefine Sales Processwww.GrowthPanel.com100% (5)

- Fazendo Dinheiro Com A FotografiaDocument132 pagesFazendo Dinheiro Com A FotografiaGiuseppe DecaroNo ratings yet

- Coral Hobbyist MagazineDocument48 pagesCoral Hobbyist MagazineSal EmbNo ratings yet

- Oppositional Inference: Northwesternuniversity, IncDocument3 pagesOppositional Inference: Northwesternuniversity, IncDanica CumlatNo ratings yet

- 737NG Genfam PresentationDocument48 pages737NG Genfam PresentationMiklós Meixner100% (1)

- IEHG - Encoding Guide 2.2.0 (2010) PDFDocument281 pagesIEHG - Encoding Guide 2.2.0 (2010) PDFMarcelo L. OliveraNo ratings yet

- A Glossary of The Words and Phrases of Furness North Lancashire 1000216573Document272 pagesA Glossary of The Words and Phrases of Furness North Lancashire 1000216573Mohammad WaseemNo ratings yet

- Astro A50 Headset ManualDocument14 pagesAstro A50 Headset ManualkanesmallNo ratings yet

- ManualDocument6 pagesManualCleber SouzaNo ratings yet

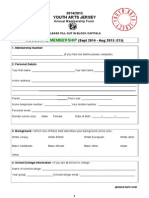

- Youth Arts Jersey - MembershipDocument2 pagesYouth Arts Jersey - MembershipSteve HaighNo ratings yet

- Manual de Manutenção DCF 80Document366 pagesManual de Manutenção DCF 80João Paulo MerloNo ratings yet

- Cook and Serve Challenge 2024 Sponsorship Packages and Awards DinnerDocument3 pagesCook and Serve Challenge 2024 Sponsorship Packages and Awards DinnercarlateacherhellologosNo ratings yet

- Canadian Solar IncDocument15 pagesCanadian Solar IncjeffchegzodNo ratings yet

- SPM Bi Jan RM 4Document6 pagesSPM Bi Jan RM 4lailaiketongNo ratings yet

- David Copeland-Jackson IndictmentDocument12 pagesDavid Copeland-Jackson IndictmentWashington ExaminerNo ratings yet

- Job Satisfaction PHD Thesis PDFDocument8 pagesJob Satisfaction PHD Thesis PDFBuySchoolPapersOnlineLowell100% (2)

- ContingentWorker OffboardingTicketDocument7 pagesContingentWorker OffboardingTicketSonia Cuenca AcaroNo ratings yet

- Project Report HospitalDocument90 pagesProject Report HospitalSaket ModiNo ratings yet

- Unit Title Reading and Use of English WritingDocument1 pageUnit Title Reading and Use of English WritingAOCNo ratings yet

- Bissell 1967Document82 pagesBissell 1967engr_usman04No ratings yet

- Bloodborne Rulebook FinalDocument28 pagesBloodborne Rulebook FinalDan L'étron TurconNo ratings yet

- Grade 9 Third Quarterly ExamDocument7 pagesGrade 9 Third Quarterly ExamJohaira AcotNo ratings yet

- 28 ESL Discussion TopicsDocument21 pages28 ESL Discussion TopicsMaruthi Maddipatla50% (2)

- The Science of EtymologyDocument274 pagesThe Science of Etymologynatzucow100% (5)

- Flames of War - Romanian-Late-MunteDocument6 pagesFlames of War - Romanian-Late-MunteJon BoyeNo ratings yet

- Europapa - Joost KleinDocument4 pagesEuropapa - Joost KleinEvert MostertNo ratings yet

- State v. Carveiro, Ariz. Ct. App. (2015)Document5 pagesState v. Carveiro, Ariz. Ct. App. (2015)Scribd Government DocsNo ratings yet