Professional Documents

Culture Documents

Your Business Name Goes Here : Sensitivity Analysis Template

Your Business Name Goes Here : Sensitivity Analysis Template

Uploaded by

Ma Naw Ayer CompanyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Your Business Name Goes Here : Sensitivity Analysis Template

Your Business Name Goes Here : Sensitivity Analysis Template

Uploaded by

Ma Naw Ayer CompanyCopyright:

Available Formats

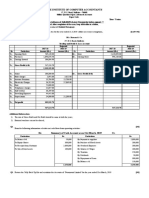

Use this template to show the impact of particular changes on your business plan.

Sample figures are included in the version

displayed below.

Sensitivity analysis template

Your business name goes here…

100% 110% 110% 95% 90%

Sales €120,000 €120,000 €132,000 €132,000 €114,000 €108,000

Cost of sales €54,000 €59,400 €59,400 €51,300 €48,600

Gross margin (profit) 55.0% €66,000 €72,600 €72,600 €62,700 €59,400

Wages & Salaries €5,000 €6,000 €8,000 €8,000 €7,000

Sales and marketing €6,000 €7,000 €8,000 €9,000 €10,000

Administration expenses €6,000 €7,000 €9,000 €8,000 €7,555

Operating expenses €17,000 €20,000 €25,000 €25,000 €24,555

Depreciation €5,000 €6,000 €7,000 €5,000 €4,000

Operating income €44,000 €46,600 €40,600 €32,700 €30,845

Interest on loans €1,000 €995 €855 €1,100 €1,500

Net Profit before tax €43,000 €45,605 €39,745 €31,600 €29,345

Note:

[Light Grey coloured cells require figures to be inserted]

[By changing the % in Row 6, columns D, E, F , G and H you can see the effect a change in Sales will have on your

Net Profit before tax]

[By changing the Gross margin % in cell B9 you can see the effect on your Gross margin (profit) figure]

Disclaimer We do not accept any liability for the information or consequences of any actions taken based on the information contained on this

website. You should not rely on any information contained on the website in relation to a specific issue or decision without taking financial,

banking, investment or other advice from an appropriately qualified professional adviser. We take no responsibility for the accuracy of information

contained in the materials contained on this website and we do not make any representations or warranties in respect of such information. Please

refer to our Terms of Use for further details.

You might also like

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (2)

- Principles of Corporate Finance 11th Edition Brealey Solutions Manual 1Document9 pagesPrinciples of Corporate Finance 11th Edition Brealey Solutions Manual 1fausto100% (57)

- Case 5Document12 pagesCase 5JIAXUAN WANGNo ratings yet

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- MBA641 Managerial Accounting Case Study #3Document3 pagesMBA641 Managerial Accounting Case Study #3risvana rahimNo ratings yet

- Unit Economics Template Angel of SwedenDocument16 pagesUnit Economics Template Angel of Swedenmiguel.mora.grgNo ratings yet

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- Cases 3 - Berlin Novanolo G (29123112)Document4 pagesCases 3 - Berlin Novanolo G (29123112)catatankotakkuningNo ratings yet

- Phuket Beach - Team 1Document6 pagesPhuket Beach - Team 1Eduardo ChacónNo ratings yet

- ACC401-Basic Conso SPLDocument4 pagesACC401-Basic Conso SPLOhene Asare PogastyNo ratings yet

- Clever Consulting CompanyDocument4 pagesClever Consulting CompanyKhushi GargNo ratings yet

- January February March Beginning Cash BalanceDocument6 pagesJanuary February March Beginning Cash BalanceALBERTO MARIO CHAMORRO PACHECONo ratings yet

- Eastermarginalcosting 2020Document22 pagesEastermarginalcosting 2020GodfreyFrankMwakalingaNo ratings yet

- ACCTG 7 Chapter 9 Problems 1 and 2Document10 pagesACCTG 7 Chapter 9 Problems 1 and 2freaann03No ratings yet

- S5FIN563 ExamDocument5 pagesS5FIN563 ExamVera DobrinaNo ratings yet

- Individual Assignment 2B - Aisyah Nuralam 29123362Document5 pagesIndividual Assignment 2B - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Financial-Management Adil AliDocument15 pagesFinancial-Management Adil AliAdil AliNo ratings yet

- Homework 1 Corporate FinanceDocument13 pagesHomework 1 Corporate Financehugogameiro7No ratings yet

- Seatwork 4 - Decentralized OperationsDocument3 pagesSeatwork 4 - Decentralized OperationsJessaLyza CordovaNo ratings yet

- Absorption Costing V Marginal CostingDocument4 pagesAbsorption Costing V Marginal CostingastaimanfNo ratings yet

- Case 5-33 (Pittman) - 1Document12 pagesCase 5-33 (Pittman) - 1MOHAK ANANDNo ratings yet

- Interim Report For The 4 Quarter and Year-End 2020: 1 January To 31 December 2020Document9 pagesInterim Report For The 4 Quarter and Year-End 2020: 1 January To 31 December 2020Elias TalaniNo ratings yet

- COST VOLUME PROFIT ANALYSIS ExercisesDocument5 pagesCOST VOLUME PROFIT ANALYSIS ExercisesjenieNo ratings yet

- SCM Chapter 7Document4 pagesSCM Chapter 7mini moniNo ratings yet

- Winners' Financial ModelDocument5 pagesWinners' Financial ModelARCHIT KUMARNo ratings yet

- Fixed Costs $15,000 Variable Costs $8,627: Sales Revenue $29,502Document3 pagesFixed Costs $15,000 Variable Costs $8,627: Sales Revenue $29,502Umair KamranNo ratings yet

- Acc 2112: Accounting Theory and Practice Assignment (February 2021)Document6 pagesAcc 2112: Accounting Theory and Practice Assignment (February 2021)Ranson MerciecaNo ratings yet

- I. ANALYSIS. Assess The Current Status of The Company by Referring To The Given Problem andDocument3 pagesI. ANALYSIS. Assess The Current Status of The Company by Referring To The Given Problem andTRISHA NICOLE NISPEROSNo ratings yet

- Angler Gaming PLC Q3 Report 2020 FINALDocument9 pagesAngler Gaming PLC Q3 Report 2020 FINALEmil Elias TalaniNo ratings yet

- ProblemsDocument11 pagesProblemsMohamed RefaayNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- Tugas Pertemuan 4Document6 pagesTugas Pertemuan 4Nisrina ChairunnisaNo ratings yet

- Financials - Spirit - YTD FinalDocument1 pageFinancials - Spirit - YTD FinalGuisela YaselgaNo ratings yet

- Estimated Revenues: Year Year 2 Year 3 Operation Programme Currency: EURDocument21 pagesEstimated Revenues: Year Year 2 Year 3 Operation Programme Currency: EURAdrian PetcuNo ratings yet

- Akm 3Document5 pagesAkm 3naylaphuiamazonaNo ratings yet

- Angler Gaming PLC Q1 Report 2021 FINALDocument9 pagesAngler Gaming PLC Q1 Report 2021 FINALAnton HenrikssonNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialEsani DeNo ratings yet

- She DianeDocument4 pagesShe DianeShenna Mae LibradaNo ratings yet

- Homework Chapter 5Document5 pagesHomework Chapter 5Trung Kiên NguyễnNo ratings yet

- Profit and Loss ProjectionDocument1 pageProfit and Loss ProjectionAbel GetachewNo ratings yet

- Task 17 - 20Document4 pagesTask 17 - 20Ton VossenNo ratings yet

- Tugas 20.445cs4Document8 pagesTugas 20.445cs4ina aktNo ratings yet

- Acorn Q2022 AAT L3 ManagementAccountingTechniques MockExamThree Task5&6 TaskActivitiesAndSolutionsDocument21 pagesAcorn Q2022 AAT L3 ManagementAccountingTechniques MockExamThree Task5&6 TaskActivitiesAndSolutionsPeo KeletsoNo ratings yet

- Operating ExposureDocument27 pagesOperating Exposureashu khetanNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- Pm-Section D - BudgetingDocument43 pagesPm-Section D - BudgetingAlbee Koh Jia YeeNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Pepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Document2 pagesPepsi-Cola Products Philippines Inc: - Income Statement For The Year 2014-2017Graciel Dela CruzNo ratings yet

- Managerial Accounting FiDocument32 pagesManagerial Accounting FiJo Segismundo-JiaoNo ratings yet

- Financial ModelingDocument4 pagesFinancial ModelingUsha KarkiNo ratings yet

- 5-Year Financial Plan - Manufacturing 1Document8 pages5-Year Financial Plan - Manufacturing 1tulalit008No ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- ENGR 3322 Written Report 3Document3 pagesENGR 3322 Written Report 3Darwin LomibaoNo ratings yet

- Book 1Document1 pageBook 1pdpgptjb6jNo ratings yet

- Income Statement Account Year 1 Year 2 Year 3 Year 4 Year 5Document1 pageIncome Statement Account Year 1 Year 2 Year 3 Year 4 Year 5Anonymous OWNHEhtDNo ratings yet

- Excel Crash Course - Book1 - Complete: Strictly ConfidentialDocument5 pagesExcel Crash Course - Book1 - Complete: Strictly ConfidentialGaurav KumarNo ratings yet

- Slide Show MKTGDocument26 pagesSlide Show MKTGAzad MohammedNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- The Valuation of Digital Intangibles: Technology, Marketing and InternetFrom EverandThe Valuation of Digital Intangibles: Technology, Marketing and InternetNo ratings yet

- Financial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedDocument24 pagesFinancial Ratio Analysis of Square Pharmaceuticals Limited: Asif AhmedMD. MUNTASIR MAMUN SHOVONNo ratings yet

- Presentation On Government BudgetingDocument2 pagesPresentation On Government BudgetingSherry Gonzales ÜNo ratings yet

- Digital Marketing PPT - 2021 - ConsellingDocument32 pagesDigital Marketing PPT - 2021 - ConsellingDolly DharmshaktuNo ratings yet

- FInal Quiz 1 Finman 2aDocument6 pagesFInal Quiz 1 Finman 2aella alfonsoNo ratings yet

- Marketing Department of Parle: BiscuitsDocument5 pagesMarketing Department of Parle: BiscuitsradhikaNo ratings yet

- Melihat Sisi Pengusaha Sosial Dengan Bottle Refill Station Sebagai Solusi Pengendalian Kemasan Sekali Pakai Untuk Kelestarian LingkunganDocument18 pagesMelihat Sisi Pengusaha Sosial Dengan Bottle Refill Station Sebagai Solusi Pengendalian Kemasan Sekali Pakai Untuk Kelestarian LingkunganCuters TresnoNo ratings yet

- International Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFDocument34 pagesInternational Economics 9Th Edition Appleyard Solutions Manual Full Chapter PDFedward.archer149100% (20)

- Summary Notes - Property Relations & Estate Tax Credit and Distributable EstateDocument3 pagesSummary Notes - Property Relations & Estate Tax Credit and Distributable EstateKiana FernandezNo ratings yet

- The Institute of Computer AccountantsDocument1 pageThe Institute of Computer AccountantsankitNo ratings yet

- CitibankDocument20 pagesCitibankjosh321No ratings yet

- Mba Project With CertificateDocument72 pagesMba Project With CertificateNandan Khanvilkar100% (1)

- Business Studies Self Study-Guide - Forms of OwnershipDocument32 pagesBusiness Studies Self Study-Guide - Forms of OwnershipurielNo ratings yet

- Capital Structure, Capitalisation and LeverageDocument53 pagesCapital Structure, Capitalisation and LeverageCollins NyendwaNo ratings yet

- Key Research Issues in Supply Chain & Logistics Management: 2030Document24 pagesKey Research Issues in Supply Chain & Logistics Management: 2030Amit Oza0% (1)

- Assignment 1 Project BMW AutomobilesDocument21 pagesAssignment 1 Project BMW AutomobileslavaniaNo ratings yet

- 5.4 Industrial Revolution Spreads, 1750-1900Document2 pages5.4 Industrial Revolution Spreads, 1750-1900todNo ratings yet

- Perpetual Inventory System: Rona O. Tolentino Bsom-1DDocument7 pagesPerpetual Inventory System: Rona O. Tolentino Bsom-1DRonaNo ratings yet

- Razelle Ann B. Dapilaga 11 Abm, Peter DruckerDocument3 pagesRazelle Ann B. Dapilaga 11 Abm, Peter DruckerJasmine ActaNo ratings yet

- New Form Inc 33 Spice e MoaDocument16 pagesNew Form Inc 33 Spice e MoaPooja Thakur0% (1)

- IFA s1 QDocument8 pagesIFA s1 QКсения НиколоваNo ratings yet

- Poultry Meat Supply Chains in CameroonDocument17 pagesPoultry Meat Supply Chains in CameroonAyoniseh CarolNo ratings yet

- Answers MYP 2 - Midterm 1 (2022 - 2023)Document4 pagesAnswers MYP 2 - Midterm 1 (2022 - 2023)Arzu HuseynNo ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- Kuaishou Technology Announces Fourth Quarter and Full Year 2021 Financial ResultsDocument4 pagesKuaishou Technology Announces Fourth Quarter and Full Year 2021 Financial Resultsmuhamad.ariapujaNo ratings yet

- The Next Commodity Supercycle - October 2020Document76 pagesThe Next Commodity Supercycle - October 2020Variant Perception Research88% (17)

- List of Banks, HQS, Heads and Slogans 2016: Public Sector BankDocument2 pagesList of Banks, HQS, Heads and Slogans 2016: Public Sector BankANNENo ratings yet

- Pre Final Examination On Regulatory FrameworkDocument2 pagesPre Final Examination On Regulatory FrameworkAmy Grace MallillinNo ratings yet

- Discuss The Type of Diversification Strategy The Conglomerate Is Using. List Down All The Subsidiary Companies To Support Your Answer. (10 Points)Document8 pagesDiscuss The Type of Diversification Strategy The Conglomerate Is Using. List Down All The Subsidiary Companies To Support Your Answer. (10 Points)Ryujin LeeNo ratings yet

- Louis Vouitton in Japan, Ivey Case: January 2012Document9 pagesLouis Vouitton in Japan, Ivey Case: January 2012Asaf RajputNo ratings yet