Professional Documents

Culture Documents

Paycheck Protection Program 2.0 FAQ

Paycheck Protection Program 2.0 FAQ

Uploaded by

KFOROriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paycheck Protection Program 2.0 FAQ

Paycheck Protection Program 2.0 FAQ

Uploaded by

KFORCopyright:

Available Formats

Travis Watkins Tax - Maverick Rork

405-780-1219

maverick@taxhelpok.com

January 12, 2021

For Immediate Release:

PAYCHECK PROTECTION PROGRAM 2.0 TO OPEN TOMORROW FOR OKLAHOMA SMALL

BUSINESSES

A second round of the fully forgivable Paycheck Protection Program (“PPP”) is scheduled to open

Wednesday, January 13, 2021. It will provide small businesses with a combined $285 billion of relief for

those hit hardest by the pandemic.

What businesses qualify?

Companies who have fewer than 300 employees

Show at least a 25% reduction in gross receipts in the first, second or third quarter of 2020

compared to the same quarter in 2019.

Maximum loan sizes for this round are $2 million

Applicants must have utilized the full amount of their initial draw PPP loan on or before the

expected date of the second draw PPP loan is disbursed.

Sustained 25% reduction in gross receipts in any quarter of 2020 when compared to the

same quarter in 2019, or the full year of 2020 when compared to 2019

These businesses will also be able to apply for a separate loan for each location, given each individual

location is a separate legal entity.

New: The PPP program has been updated to now include eligibility for certain housing cooperatives,

news organizations, section 501(c)(6) organizations, and Economic Injury Disaster Loan (“EIDL”)

recipients.

Is my business eligible if it received PPP 1.0 in 2020?

Yes, the business is not otherwise ineligible if it received PPP 1.0 funds. In fact, if there was a mistake

that shorted the business money on PPP 1.0, businesses may apply for the underpayment.

What benefits are available?

Qualified businesses are eligible to receive a fully refundable loan (that turns into a grant) equal to 2.5x

their average annual payroll for 2019 or 2020, at the business’ option. Restaurants, hotels, and other

businesses categorized under NAICS code 72, will be eligible to receive 3.5x their average payroll.

What do I need to apply for PPP 2.0?

Financial statements for January 1, 2019 to December 31, 2019, and year to date from January 1, 2020;

profit and loss statements for those same periods and bank statements; All 2019 and 2020 employee

payroll reports (940, 941, W-2’s, payroll summaries and details, as well as state unemployment reports).

What if a business does not have the forms mentioned above?

No funding can occur. Reach out immediately to a qualified accountant or tax attorney who can prepare

these reports and returns quickly and accurately.

Will PPP again be an SBA loan that may become a forgivable grant?

Yes, if the business uses the money over 24 weeks from funding for payroll (60% minimum), rent,

utilities, mortgage interest, covered property damage cots, covered supplier costs and covered worker

protection expenditures. There will also be a streamlined forgiveness process for loans under $150,000.

Will PPP expenses be deductible? Yes, this is a complete reversal in policy from the Department of the

Treasury’s previous position. Business owners were facing large taxable windfalls since the business

could not deduct payroll, utilities, rent and mortgage interest. Now, they can!

Will there be more money available for the SBA’s non-forgivable Emergency Impact Disaster

Loan (EIDL) as well? Yes, $20 billion has been earmarked to supplement this program as well.

*If you would like to schedule an interview with Travis Watkins, please contact our

Media Coordinator/COO, Maverick Rork at (405) 780-1219

You might also like

- Paypal User AgreementDocument34 pagesPaypal User Agreementspark4uNo ratings yet

- Kendall Morgan Indictment - LeFlore CountyDocument3 pagesKendall Morgan Indictment - LeFlore CountyKFOR100% (1)

- OSDH 2021 Report ResponseDocument18 pagesOSDH 2021 Report ResponseKFORNo ratings yet

- Resentencing MotionDocument10 pagesResentencing MotionKFOR0% (1)

- Victor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Document4 pagesVictor M Orozco 8860 SW 123 CT APT K310 Miami FL 33186Wa Riz LaiNo ratings yet

- Georgia Absentee Ballots SettlementDocument7 pagesGeorgia Absentee Ballots SettlementLaw&Crime100% (1)

- COVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsDocument4 pagesCOVID-19 Federal Assistance Summary of Benefits For Churches and IndividualsKirk PetersenNo ratings yet

- How to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2From EverandHow to Raise your Credit Score: Proven Strategies to Repair Your Credit Score, Increase Your Credit Score, Overcome Credit Card Debt and Increase Your Credit Limit Volume 2No ratings yet

- Financing An Overseas Veterinary Education For U.S. CitizensDocument7 pagesFinancing An Overseas Veterinary Education For U.S. Citizensscott quakkelaar100% (1)

- Tarlac - San Antonio - Business Permit - NewDocument2 pagesTarlac - San Antonio - Business Permit - Newarjhay llave100% (1)

- 7 Steps To Getting A Mayor's Permit - Business Registration - Full SuiteDocument13 pages7 Steps To Getting A Mayor's Permit - Business Registration - Full Suitekjhenyo218502100% (1)

- FAQ in Day To Day BankingDocument17 pagesFAQ in Day To Day BankingKuwar WaliaNo ratings yet

- P Segment LoansDocument192 pagesP Segment Loansgee emm100% (1)

- Mobey Forum Whitepaper - The MPOS Impact PDFDocument32 pagesMobey Forum Whitepaper - The MPOS Impact PDFDeo ValenstinoNo ratings yet

- Funding Your COL AccountDocument17 pagesFunding Your COL AccountAnne ReyesNo ratings yet

- EziDebit - DDR Form - CompletePTDocument2 pagesEziDebit - DDR Form - CompletePTAndrewNeilYoungNo ratings yet

- Promotion Material 2023-2024-11-20Document10 pagesPromotion Material 2023-2024-11-20CREDIT BHARATPURNo ratings yet

- Diamond AccountDocument2 pagesDiamond AccountJagadeesh YathirajulaNo ratings yet

- Insight Global Informs Individuals of Data IncidentDocument3 pagesInsight Global Informs Individuals of Data IncidentKristina KoppeserNo ratings yet

- CFPB Your Money Your Goals Choosing Paid ToolDocument6 pagesCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrNo ratings yet

- Organization Registration Checklist: Steps To Complete To Register An Organization Completed?Document3 pagesOrganization Registration Checklist: Steps To Complete To Register An Organization Completed?primeromilitarNo ratings yet

- Business Loan Application - NEWDocument8 pagesBusiness Loan Application - NEWSarah AndersonNo ratings yet

- Credit Management: Adeel Nasir Lecturer (Commerce) Punjab University Jhelum CampusDocument34 pagesCredit Management: Adeel Nasir Lecturer (Commerce) Punjab University Jhelum CampusZindgiKiKhatirNo ratings yet

- Policy On Loan Classification and ProvisioningDocument9 pagesPolicy On Loan Classification and Provisioningmsa_1302100% (3)

- List of Outstanding Springfield Property TaxesDocument3 pagesList of Outstanding Springfield Property TaxesMassLive100% (1)

- IDS Fortune Next ExpressDocument8 pagesIDS Fortune Next ExpressseenubhaiNo ratings yet

- One SiteDocument2 pagesOne SiteVanessa Burbano AyalaNo ratings yet

- Disclosure.3433.en USDocument4 pagesDisclosure.3433.en USRakibNo ratings yet

- Protecting Your Credit Score ActDocument4 pagesProtecting Your Credit Score ActLashon SpearsNo ratings yet

- Verification of AdvancesDocument12 pagesVerification of AdvancesAvinash SinyalNo ratings yet

- Wells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Document24 pagesWells Fargo RVS Desktop Appraisal Instructions and Requirements 09feb10Frank GregoireNo ratings yet

- Speci AL Pensi ON PlanDocument1 pageSpeci AL Pensi ON PlanCollin RibarNo ratings yet

- TLD Auto Car Financing Barre VTDocument3 pagesTLD Auto Car Financing Barre VTBarre ATLNo ratings yet

- Equifax Aftermath NotesDocument2 pagesEquifax Aftermath Notesnope123nopeNo ratings yet

- Buyers CreditDocument2 pagesBuyers Creditrao_gmailNo ratings yet

- CBA Full-Year ResultsDocument156 pagesCBA Full-Year ResultsTim MooreNo ratings yet

- W56KGZ-20-Q-6044 Blast Barrier Solicitation PDFDocument36 pagesW56KGZ-20-Q-6044 Blast Barrier Solicitation PDFSadiq BashaNo ratings yet

- Direct Deposit Authorization Form Siribeswainms51serivices331gmailDocument1 pageDirect Deposit Authorization Form Siribeswainms51serivices331gmailmikeNo ratings yet

- Sample Credit ReportDocument16 pagesSample Credit ReportNam Khuu100% (1)

- 2019 Federal Tax Return Summary: Total IncomeDocument3 pages2019 Federal Tax Return Summary: Total IncomerayNo ratings yet

- SAR FormatDocument13 pagesSAR FormatAbhimanyu YadavNo ratings yet

- HDFC Jumbo Loan Terms and ConditionsDocument3 pagesHDFC Jumbo Loan Terms and ConditionssagarNo ratings yet

- Credit Card Statement: Syed Ali Hyder ZaidiDocument1 pageCredit Card Statement: Syed Ali Hyder ZaidiAli Hyder ZaidiNo ratings yet

- Jessica LaplaceDocument2 pagesJessica Laplacejtm3323No ratings yet

- QR Merchant Application FormDocument2 pagesQR Merchant Application FormМєяяїгг ВєяиндяԁNo ratings yet

- Financing Your Business in GhanaDocument40 pagesFinancing Your Business in GhanaKodwoPNo ratings yet

- Disclosure and Release Form-SignedDocument2 pagesDisclosure and Release Form-SignedDalitsoChapemaNo ratings yet

- Assignment 4 - Credit Card Reconciliation - Angela CreagmileDocument6 pagesAssignment 4 - Credit Card Reconciliation - Angela Creagmileapi-471231467100% (1)

- Definition of 'Home Loan'Document3 pagesDefinition of 'Home Loan'Anonymous 3ThnaQKJ4yNo ratings yet

- Credit Management - Reading MaterialsDocument10 pagesCredit Management - Reading Materialsmesba_17No ratings yet

- Personal Financial Statement 2637980Document3 pagesPersonal Financial Statement 2637980Alexander Weir-WitmerNo ratings yet

- Exotel 2FA nOTP EBook.Document19 pagesExotel 2FA nOTP EBook.farzadNo ratings yet

- 1-Deposit TransactionDocument3 pages1-Deposit TransactionjieNo ratings yet

- Payment AgreementDocument1 pagePayment AgreementForeclosure FraudNo ratings yet

- PrintableDocument2 pagesPrintableapi-309082881No ratings yet

- Cash 1099Document6 pagesCash 1099Shub OutNo ratings yet

- EpayitonlineDocument4 pagesEpayitonlineAleem Ahmad RindekharabatNo ratings yet

- Federal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesDocument29 pagesFederal Register / Vol. 77, No. 44 / Tuesday, March 6, 2012 / Proposed RulesMarketsWikiNo ratings yet

- Sbi Home Loan Application FormDocument5 pagesSbi Home Loan Application FormDhawan SandeepNo ratings yet

- Working and Manipulation of Credit Rating in India Shambhu 13th FebDocument49 pagesWorking and Manipulation of Credit Rating in India Shambhu 13th FebShambhu KumarNo ratings yet

- BillSTMT 4588260000514267Document3 pagesBillSTMT 4588260000514267Fahad AhmedNo ratings yet

- Retail Banking Consumer Banking - I: Syed Fazal AzizDocument34 pagesRetail Banking Consumer Banking - I: Syed Fazal AzizamiraleemNo ratings yet

- Loan ApplicationDocument5 pagesLoan Applicationkhalid khayNo ratings yet

- Federal Indian Boarding School Initiative Investigative ReportDocument106 pagesFederal Indian Boarding School Initiative Investigative ReportKTUL - Tulsa's Channel 8100% (1)

- OK Supreme Court Ruling On St. Isidore Charter SchoolDocument27 pagesOK Supreme Court Ruling On St. Isidore Charter SchoolKFORNo ratings yet

- Stitt LawsuitDocument33 pagesStitt LawsuitKFORNo ratings yet

- Phmsa Comment FinalDocument11 pagesPhmsa Comment FinalKFORNo ratings yet

- Ia - Ep: Court Clerk'S Office - Okc Corporation Commission OF OklahomaDocument8 pagesIa - Ep: Court Clerk'S Office - Okc Corporation Commission OF OklahomaKFORNo ratings yet

- Agreed Order - FiledDocument5 pagesAgreed Order - FiledKFORNo ratings yet

- Dept of Health Web FinalDocument26 pagesDept of Health Web FinalKFORNo ratings yet

- SB 1142 SummaryDocument3 pagesSB 1142 SummaryKFORNo ratings yet

- HB 3127 (Rep. Sean Roberts)Document1 pageHB 3127 (Rep. Sean Roberts)The Equality Network (TEN)No ratings yet

- CMS ReportDocument9 pagesCMS ReportKFOR100% (1)

- ComplaintDocument87 pagesComplaintKFORNo ratings yet

- Oklahoma National Guard RulingDocument29 pagesOklahoma National Guard RulingKFOR0% (1)

- Oklahoma County Grand Jury Indictment CF-2021-5624 Terry O'Donnell and Teresa O'DonnellDocument41 pagesOklahoma County Grand Jury Indictment CF-2021-5624 Terry O'Donnell and Teresa O'DonnellKFORNo ratings yet

- Meghan ExhibitDocument3 pagesMeghan ExhibitKFORNo ratings yet

- Federal Contractor Vaccine Mandate Letter To POTUSDocument6 pagesFederal Contractor Vaccine Mandate Letter To POTUSthe kingfishNo ratings yet

- Seeworth Academy 21 Web FinalDocument52 pagesSeeworth Academy 21 Web FinalKFORNo ratings yet

- Gardner ExhibitDocument8 pagesGardner ExhibitKFORNo ratings yet

- Doctor ExhibitDocument110 pagesDoctor ExhibitKFORNo ratings yet

- Preliminary InjunctionDocument21 pagesPreliminary InjunctionKFORNo ratings yet

- Quapaw Reservation DecisionDocument17 pagesQuapaw Reservation DecisionKFORNo ratings yet

- United States Court of Appeals For The Tenth CircuitDocument11 pagesUnited States Court of Appeals For The Tenth Circuitdillon-richardsNo ratings yet

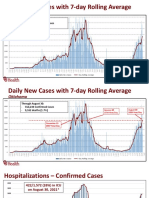

- Daily New Cases With 7-Day Rolling Average: OklahomaDocument4 pagesDaily New Cases With 7-Day Rolling Average: OklahomaKFORNo ratings yet

- Application For County Grand Jury - Oklahoma County File Stamped and CertifiedDocument7 pagesApplication For County Grand Jury - Oklahoma County File Stamped and CertifiedKFORNo ratings yet

- List of Election Symbols Alloted Political Party9220Document5 pagesList of Election Symbols Alloted Political Party9220Muhammad Usman KhanNo ratings yet

- Test Bank For Fundamentals of Anatomy and Physiology 3rd Edition Donald C RizzoDocument35 pagesTest Bank For Fundamentals of Anatomy and Physiology 3rd Edition Donald C Rizzotithly.decamplh56c7100% (48)

- Case Study: Equitas MicroDocument4 pagesCase Study: Equitas MicropvassiliadisNo ratings yet

- Tendernotice 1Document104 pagesTendernotice 1Rohan DeyNo ratings yet

- Powers of Police Under CR - PC 1973Document12 pagesPowers of Police Under CR - PC 1973Abhishek Mani TripathiNo ratings yet

- Lucas Bols PDFDocument8 pagesLucas Bols PDFmisanthropoNo ratings yet

- Dharmendra Pradhan - WikipediaDocument25 pagesDharmendra Pradhan - WikipediaSrinath SrNo ratings yet

- Capital Structure, Corporate Governance, and Agency Costs: Elsa Imelda and Dewi Ayu PatriciaDocument5 pagesCapital Structure, Corporate Governance, and Agency Costs: Elsa Imelda and Dewi Ayu PatriciaariNo ratings yet

- Epik 50-State Notification (Final)Document2 pagesEpik 50-State Notification (Final)NEWS CENTER MaineNo ratings yet

- Legal Responses To Cyber Bullying and Sexting in South AfricaDocument20 pagesLegal Responses To Cyber Bullying and Sexting in South AfricaJacques HammanNo ratings yet

- Electoral Roll - 2013 State (S16) Mizoram: 1 - Details of RevisionDocument26 pagesElectoral Roll - 2013 State (S16) Mizoram: 1 - Details of RevisionKca Khawlhring ChunthangNo ratings yet

- Credit Transactions DigestsDocument266 pagesCredit Transactions DigestsDianne YcoNo ratings yet

- Templates Joomla 1.5Document47 pagesTemplates Joomla 1.5Décio Luiz RochaNo ratings yet

- Offer Letter InfosysDocument12 pagesOffer Letter Infosysaashnapiya00No ratings yet

- "Go To Joseph" (Gen 41:55) - A Spiritual Reflection On St. Joseph!Document3 pages"Go To Joseph" (Gen 41:55) - A Spiritual Reflection On St. Joseph!Jas AmalNo ratings yet

- LettersDocument58 pagesLettersah106No ratings yet

- 021 Admin Assistant-3 Myitkyina 1Document1 page021 Admin Assistant-3 Myitkyina 1draftdelete101 errorNo ratings yet

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- High Court Visit Report1Document11 pagesHigh Court Visit Report1Nischal BhattaraiNo ratings yet

- CISA Exam Prep Domain 2-2019Document122 pagesCISA Exam Prep Domain 2-2019poornima24100% (1)

- Centeno v. Villalon Pornillos Case DigestDocument1 pageCenteno v. Villalon Pornillos Case DigestNasrullah GuiamadNo ratings yet

- Beh Hel Jko "DK"Document5 pagesBeh Hel Jko "DK"pinky271994No ratings yet

- UBFB3023 Tutorial 11 A Jan 10Document9 pagesUBFB3023 Tutorial 11 A Jan 10Phang Chen DeNo ratings yet

- Constantino Vs Cuisia Digest PDFDocument1 pageConstantino Vs Cuisia Digest PDFSecret SecretNo ratings yet

- Job Tax Credit AuditDocument63 pagesJob Tax Credit AuditZachary HansenNo ratings yet

- Institute of Accountancy ArushaDocument4 pagesInstitute of Accountancy ArushaAurelia RijiNo ratings yet

- Exodus, Volume II of Commentaries On The PentateuchDocument608 pagesExodus, Volume II of Commentaries On The PentateuchChalcedon Foundation92% (13)

- Your accounts at а glance: ► Your balances оn 10 Oct 2023Document10 pagesYour accounts at а glance: ► Your balances оn 10 Oct 2023steam2210721No ratings yet

- Forrest Gump: Themes of Tolerance & EqualityDocument20 pagesForrest Gump: Themes of Tolerance & EqualityWalter Klinger100% (5)