Professional Documents

Culture Documents

Solved Radioco A Domestic Corporation Owns 100 of Tvco A Manufacturing

Solved Radioco A Domestic Corporation Owns 100 of Tvco A Manufacturing

Uploaded by

Anbu jaromiaCopyright:

Available Formats

You might also like

- NCB Deposit SlipDocument2 pagesNCB Deposit Slipgeeman97870% (1)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- Financial Statement Analysis Paper ExampleDocument7 pagesFinancial Statement Analysis Paper ExampleUsaid Khan100% (1)

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Accounting 202 Chapter 14 TestDocument2 pagesAccounting 202 Chapter 14 TestLương Thế CườngNo ratings yet

- Solved Firm L Has 500 000 To Invest and Is Considering TwoDocument1 pageSolved Firm L Has 500 000 To Invest and Is Considering TwoAnbu jaromiaNo ratings yet

- 1taxation of Miners Lecture 2022Document104 pages1taxation of Miners Lecture 2022precious mountainsNo ratings yet

- Solved Continue With The Results of Problem 35 Prepare The GaapDocument1 pageSolved Continue With The Results of Problem 35 Prepare The GaapAnbu jaromiaNo ratings yet

- 11 Handout 1Document4 pages11 Handout 1Jeffer Jay GubalaneNo ratings yet

- CSM - CHP 12 - Accounting For Income TaxDocument4 pagesCSM - CHP 12 - Accounting For Income TaxaseppahrudinNo ratings yet

- Solved in Each of The Following Cases Discuss How The TaxpayersDocument1 pageSolved in Each of The Following Cases Discuss How The TaxpayersAnbu jaromiaNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Taxnz118 - Assumed Knowledge Quiz 08042019Document12 pagesTaxnz118 - Assumed Knowledge Quiz 08042019Wasir RahmanNo ratings yet

- Erroneous Foreign Earned Income Exclusion ClaimsDocument40 pagesErroneous Foreign Earned Income Exclusion ClaimstaxesforexpatsNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Deffered TaxDocument20 pagesDeffered TaxRasel AshrafulNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved GT Inc S Net Income Before Tax On Its Financial StatementsDocument1 pageSolved GT Inc S Net Income Before Tax On Its Financial StatementsAnbu jaromiaNo ratings yet

- T2 Corporation - Income Tax Guide 2009Document118 pagesT2 Corporation - Income Tax Guide 2009Oleksiy KovyrinNo ratings yet

- Income TaxesDocument45 pagesIncome TaxesNatalie CheungNo ratings yet

- AYB320 0122 Week3Document40 pagesAYB320 0122 Week3Linh ĐanNo ratings yet

- Problem 9Document1 pageProblem 9reemy13No ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Income Tax 2Document12 pagesIncome Tax 2You're WelcomeNo ratings yet

- SCS 0975 - Module 1 SMB2018Document13 pagesSCS 0975 - Module 1 SMB2018Deion BalakumarNo ratings yet

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- Solved The Epbo For Branch Industries at The End of 2018Document1 pageSolved The Epbo For Branch Industries at The End of 2018Anbu jaromiaNo ratings yet

- AC2101 Seminar 7-8 Deferred Tax OutlineDocument33 pagesAC2101 Seminar 7-8 Deferred Tax OutlinelynnNo ratings yet

- Deferred Tax Accounting PDFDocument4 pagesDeferred Tax Accounting PDFJayedNo ratings yet

- Taxation of Business Entities 4Th Edition Spilker Test Bank Full Chapter PDFDocument67 pagesTaxation of Business Entities 4Th Edition Spilker Test Bank Full Chapter PDFKelseyWeberbdwk100% (11)

- Accounting For Income Taxes (IAS 12) - 1Document8 pagesAccounting For Income Taxes (IAS 12) - 1Skyleen Jacy VikeNo ratings yet

- Part - 1 - Dashboard - Accounting For Income TaxesDocument4 pagesPart - 1 - Dashboard - Accounting For Income TaxesbagayaobNo ratings yet

- Assigment 3Document20 pagesAssigment 3swati raghuvansiNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- SolutionsDocument16 pagesSolutionsapi-3817072100% (2)

- Finance Act Era Critical Evaluation 1 1Document22 pagesFinance Act Era Critical Evaluation 1 1Folawiyo AgbokeNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesNo ratings yet

- Lesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Document25 pagesLesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Alkhair SangcopanNo ratings yet

- King Company Began Operations at The Beginning of 2008 TheDocument1 pageKing Company Began Operations at The Beginning of 2008 TheM Bilal SaleemNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- Session 11 Income TaxesDocument13 pagesSession 11 Income TaxesNhânNo ratings yet

- Colombia Tax ReformDocument6 pagesColombia Tax ReformshadiafeNo ratings yet

- Topic 5 - Deferred Tax A231Document57 pagesTopic 5 - Deferred Tax A231ZulhafiziNo ratings yet

- Icaew Cfab Pot 2018 Sample ExamDocument30 pagesIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- Deferred TaxDocument5 pagesDeferred TaxRAKSHIT CHAUHANNo ratings yet

- Accounting For Income TaxesDocument12 pagesAccounting For Income TaxesRMG Career Society BDNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (23)

- Chapter 10Document14 pagesChapter 10GODNo ratings yet

- Chapter 8 - Income TaxesDocument6 pagesChapter 8 - Income TaxesHaddy GayeNo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesSilvia alfonsNo ratings yet

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- Taxes Practice ProblemsDocument10 pagesTaxes Practice ProblemsmikeNo ratings yet

- IAS 12 Income Taxes (2021)Document18 pagesIAS 12 Income Taxes (2021)Tawanda Tatenda HerbertNo ratings yet

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaDocument22 pagesIndian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- Topic 5 Deferred TaxDocument45 pagesTopic 5 Deferred TaxFuchoin Reiko100% (1)

- Tutorial 12 (Exercise)Document1 pageTutorial 12 (Exercise)Vidya IntaniNo ratings yet

- Ias 12Document45 pagesIas 12Reever RiverNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Appendix 1: Glossary of International Accounting Standards TerminologyDocument2 pagesAppendix 1: Glossary of International Accounting Standards TerminologySabrina LeeNo ratings yet

- VanguardDocument2 pagesVanguardRobert CastilloNo ratings yet

- Session 15 Hand OutDocument54 pagesSession 15 Hand OutRashi ChoudharyNo ratings yet

- Chapter 10 - Profitability AnalysisDocument46 pagesChapter 10 - Profitability AnalysisMega Nurjannah Ahmad100% (1)

- Working Capital QuizDocument3 pagesWorking Capital QuizHarshit GoyalNo ratings yet

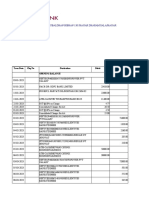

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- Answers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security ValuationDocument8 pagesAnswers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security Valuationimamoody1No ratings yet

- Vol - 6 07-May-2021 - Weekly Valuation NewsDocument2 pagesVol - 6 07-May-2021 - Weekly Valuation Newskaali1985yahoocomNo ratings yet

- Mayes 8e CH01 Problem SetDocument12 pagesMayes 8e CH01 Problem SetRamez AhmedNo ratings yet

- Fundamentals OF Accounting: Ms. Maryvin M. Maluya, CPA, CTTDocument35 pagesFundamentals OF Accounting: Ms. Maryvin M. Maluya, CPA, CTTAmalia Tamayo YlananNo ratings yet

- Margin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikDocument12 pagesMargin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikmusiboyinaNo ratings yet

- 21 Inventory Management Kpis To Track 1Document4 pages21 Inventory Management Kpis To Track 1Stefanie DutraNo ratings yet

- Investment Banking Interview Guide: Course OutlineDocument20 pagesInvestment Banking Interview Guide: Course OutlineTawhid SyedNo ratings yet

- Acctg Adjusting EntriesDocument109 pagesAcctg Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- Investment and Security Analysis by Charles P Jones Chapter 1 - Tabish Khan From KohatDocument9 pagesInvestment and Security Analysis by Charles P Jones Chapter 1 - Tabish Khan From KohatTabish KhanNo ratings yet

- South Central Africa Top CompaniesDocument16 pagesSouth Central Africa Top CompaniesaddyNo ratings yet

- S4HANA Asset Accounnting NotesDocument60 pagesS4HANA Asset Accounnting NotesJaved IqbalNo ratings yet

- Vbhuiiy.Chapter 6-ANALYSIS OF RISK AND RETURN: Multiple Choice 108 題Document28 pagesVbhuiiy.Chapter 6-ANALYSIS OF RISK AND RETURN: Multiple Choice 108 題Mohsin BashirNo ratings yet

- TCDN Quiz 2 Quiz 3Document2 pagesTCDN Quiz 2 Quiz 3nguyenyen231700No ratings yet

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- Chapter-2 Amalgamation of Companies (As-14) SolutionsDocument64 pagesChapter-2 Amalgamation of Companies (As-14) SolutionsRaja DasNo ratings yet

- Financial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsDocument7 pagesFinancial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsSidharth AnandNo ratings yet

- Rsm433 Case 6Document2 pagesRsm433 Case 6LeahHuangNo ratings yet

- Calstrs-The 2011 Private Equity Secondaries Review Sample PagesDocument21 pagesCalstrs-The 2011 Private Equity Secondaries Review Sample PagesJitta thegreatNo ratings yet

- Pa e q323 Investor PresentationDocument40 pagesPa e q323 Investor PresentationJ JuniorNo ratings yet

- FR Question Paper 1 MAY 2017Document16 pagesFR Question Paper 1 MAY 2017MBaralNo ratings yet

Solved Radioco A Domestic Corporation Owns 100 of Tvco A Manufacturing

Solved Radioco A Domestic Corporation Owns 100 of Tvco A Manufacturing

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Radioco A Domestic Corporation Owns 100 of Tvco A Manufacturing

Solved Radioco A Domestic Corporation Owns 100 of Tvco A Manufacturing

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) RadioCo a domestic corporation owns 100 of

TVCo a manufacturing

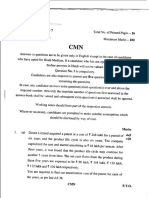

RadioCo, a domestic corporation, owns 100% of TVCo, a manufacturing facility in Ireland. TVCo

has no operations or activities in the United States. The U.S. tax rate is 35%, and the Irish tax

rate is 15%. For the current year, RadioCo earns $200,000 in taxable income from its U.S.

operations. […]

Sam Taggart, the CEO of Skate, Inc., has reviewed Skate’s tax return and its financial

statement. He notices that both the Schedule M–3 and the rate reconciliation in the income tax

note provide a reconciliation of tax information. However, he sees very little correspondence

between the two schedules. Outline the […]

Jill is the CFO of PorTech, Inc. PorTech’s tax advisers have recommended two tax planning

ideas that will each provide $5 million of current-year cash tax savings. One idea is based on a

timing difference and is expected to reverse in full10 years in the future. The other idea creates

[…]

Lily Enterprises acquires another corporation. This acquisition created $30 million of goodwill for

both book and tax purposes. The $30 million in goodwill is amortized over 15 years for tax

purposes but is not deductible for book purposes unless impaired. Will this book-tax difference

create a permanent or temporary book-tax […]

GET ANSWER- https://accanswer.com/downloads/page/1080/

Cortel, Inc., hopes to report a total book tax expense of $90,000 in the current year. This

$90,000 expense consists of $160,000 in current tax expense and a $70,000 tax benefit related

to the expected future use of an NOL by Cortel. If the auditors determine that a valuation

allowance […]

Using the facts of Problem 18, determine the 2015 end-of-year balance in Mini’s deferred tax

asset and deferred tax liability balance sheet accounts. In problem Mini, in Problem 16, reports

$800,000 of pretax book net income in 2015. Mini did not deduct any bad debt expense for book

purposes but […]

Mini, in Problem 16, reports $800,000 of pretax book net income in 2015. Mini did not deduct

any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for tax

purposes. Mini records no other temporary or permanent differences. Assuming that the U.S.

tax rate is […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1080/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- NCB Deposit SlipDocument2 pagesNCB Deposit Slipgeeman97870% (1)

- SAP FICO T-CODE - XLSX FINAL 2021Document23 pagesSAP FICO T-CODE - XLSX FINAL 2021Raju Bothra100% (2)

- Financial Statement Analysis Paper ExampleDocument7 pagesFinancial Statement Analysis Paper ExampleUsaid Khan100% (1)

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Accounting 202 Chapter 14 TestDocument2 pagesAccounting 202 Chapter 14 TestLương Thế CườngNo ratings yet

- Solved Firm L Has 500 000 To Invest and Is Considering TwoDocument1 pageSolved Firm L Has 500 000 To Invest and Is Considering TwoAnbu jaromiaNo ratings yet

- 1taxation of Miners Lecture 2022Document104 pages1taxation of Miners Lecture 2022precious mountainsNo ratings yet

- Solved Continue With The Results of Problem 35 Prepare The GaapDocument1 pageSolved Continue With The Results of Problem 35 Prepare The GaapAnbu jaromiaNo ratings yet

- 11 Handout 1Document4 pages11 Handout 1Jeffer Jay GubalaneNo ratings yet

- CSM - CHP 12 - Accounting For Income TaxDocument4 pagesCSM - CHP 12 - Accounting For Income TaxaseppahrudinNo ratings yet

- Solved in Each of The Following Cases Discuss How The TaxpayersDocument1 pageSolved in Each of The Following Cases Discuss How The TaxpayersAnbu jaromiaNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Taxnz118 - Assumed Knowledge Quiz 08042019Document12 pagesTaxnz118 - Assumed Knowledge Quiz 08042019Wasir RahmanNo ratings yet

- Erroneous Foreign Earned Income Exclusion ClaimsDocument40 pagesErroneous Foreign Earned Income Exclusion ClaimstaxesforexpatsNo ratings yet

- TAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFDocument25 pagesTAX (2 of 2) Preweek B94 - Questionnaire - Solutions PDFSilver LilyNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

- Deffered TaxDocument20 pagesDeffered TaxRasel AshrafulNo ratings yet

- Solved Corporation R Signed A Contract To Undertake A Transaction ThatDocument1 pageSolved Corporation R Signed A Contract To Undertake A Transaction ThatAnbu jaromiaNo ratings yet

- Solved GT Inc S Net Income Before Tax On Its Financial StatementsDocument1 pageSolved GT Inc S Net Income Before Tax On Its Financial StatementsAnbu jaromiaNo ratings yet

- T2 Corporation - Income Tax Guide 2009Document118 pagesT2 Corporation - Income Tax Guide 2009Oleksiy KovyrinNo ratings yet

- Income TaxesDocument45 pagesIncome TaxesNatalie CheungNo ratings yet

- AYB320 0122 Week3Document40 pagesAYB320 0122 Week3Linh ĐanNo ratings yet

- Problem 9Document1 pageProblem 9reemy13No ratings yet

- TAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)Document7 pagesTAXATION: Improperly Accumulated Earnings Tax (IAET) 2020 Improperly Accumulated Earnings Tax (IAET)YashNo ratings yet

- Income Tax 2Document12 pagesIncome Tax 2You're WelcomeNo ratings yet

- SCS 0975 - Module 1 SMB2018Document13 pagesSCS 0975 - Module 1 SMB2018Deion BalakumarNo ratings yet

- Canadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test BankDocument13 pagesCanadian Income Taxation 2014 2015 Planning and Decision Making Canadian 17th Edition Buckwold Test Bankalisonfernandezmerzigfkap100% (15)

- Solved The Epbo For Branch Industries at The End of 2018Document1 pageSolved The Epbo For Branch Industries at The End of 2018Anbu jaromiaNo ratings yet

- AC2101 Seminar 7-8 Deferred Tax OutlineDocument33 pagesAC2101 Seminar 7-8 Deferred Tax OutlinelynnNo ratings yet

- Deferred Tax Accounting PDFDocument4 pagesDeferred Tax Accounting PDFJayedNo ratings yet

- Taxation of Business Entities 4Th Edition Spilker Test Bank Full Chapter PDFDocument67 pagesTaxation of Business Entities 4Th Edition Spilker Test Bank Full Chapter PDFKelseyWeberbdwk100% (11)

- Accounting For Income Taxes (IAS 12) - 1Document8 pagesAccounting For Income Taxes (IAS 12) - 1Skyleen Jacy VikeNo ratings yet

- Part - 1 - Dashboard - Accounting For Income TaxesDocument4 pagesPart - 1 - Dashboard - Accounting For Income TaxesbagayaobNo ratings yet

- Assigment 3Document20 pagesAssigment 3swati raghuvansiNo ratings yet

- Taxation of CorporationsDocument78 pagesTaxation of CorporationsGlory Mhay67% (12)

- SolutionsDocument16 pagesSolutionsapi-3817072100% (2)

- Finance Act Era Critical Evaluation 1 1Document22 pagesFinance Act Era Critical Evaluation 1 1Folawiyo AgbokeNo ratings yet

- IASSS16e Ch16.Ab - AzDocument33 pagesIASSS16e Ch16.Ab - AzLovely DungcaNo ratings yet

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesNo ratings yet

- Lesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Document25 pagesLesson 3 MGT207 Escape From Taxation Prepared by SKM (Additional)Alkhair SangcopanNo ratings yet

- King Company Began Operations at The Beginning of 2008 TheDocument1 pageKing Company Began Operations at The Beginning of 2008 TheM Bilal SaleemNo ratings yet

- Ey Ireland Early Payment of 2020 Excess Randd Tax CreditsDocument5 pagesEy Ireland Early Payment of 2020 Excess Randd Tax CreditsharryNo ratings yet

- Session 11 Income TaxesDocument13 pagesSession 11 Income TaxesNhânNo ratings yet

- Colombia Tax ReformDocument6 pagesColombia Tax ReformshadiafeNo ratings yet

- Topic 5 - Deferred Tax A231Document57 pagesTopic 5 - Deferred Tax A231ZulhafiziNo ratings yet

- Icaew Cfab Pot 2018 Sample ExamDocument30 pagesIcaew Cfab Pot 2018 Sample ExamAnonymous ulFku1vNo ratings yet

- Deferred TaxDocument5 pagesDeferred TaxRAKSHIT CHAUHANNo ratings yet

- Accounting For Income TaxesDocument12 pagesAccounting For Income TaxesRMG Career Society BDNo ratings yet

- Canadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test BankDocument15 pagesCanadian Income Taxation Planning and Decision Making Canadian 17th Edition Buckwold ISBN Test Bankbennie100% (23)

- Chapter 10Document14 pagesChapter 10GODNo ratings yet

- Chapter 8 - Income TaxesDocument6 pagesChapter 8 - Income TaxesHaddy GayeNo ratings yet

- Accounting For Income TaxesDocument4 pagesAccounting For Income TaxesSilvia alfonsNo ratings yet

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- Taxes Practice ProblemsDocument10 pagesTaxes Practice ProblemsmikeNo ratings yet

- IAS 12 Income Taxes (2021)Document18 pagesIAS 12 Income Taxes (2021)Tawanda Tatenda HerbertNo ratings yet

- Indian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaDocument22 pagesIndian Accounting Standard 12: © The Institute of Chartered Accountants of IndiaRITZ BROWNNo ratings yet

- CAS QuizDocument6 pagesCAS QuizLeng ChhunNo ratings yet

- Topic 5 Deferred TaxDocument45 pagesTopic 5 Deferred TaxFuchoin Reiko100% (1)

- Tutorial 12 (Exercise)Document1 pageTutorial 12 (Exercise)Vidya IntaniNo ratings yet

- Ias 12Document45 pagesIas 12Reever RiverNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- Appendix 1: Glossary of International Accounting Standards TerminologyDocument2 pagesAppendix 1: Glossary of International Accounting Standards TerminologySabrina LeeNo ratings yet

- VanguardDocument2 pagesVanguardRobert CastilloNo ratings yet

- Session 15 Hand OutDocument54 pagesSession 15 Hand OutRashi ChoudharyNo ratings yet

- Chapter 10 - Profitability AnalysisDocument46 pagesChapter 10 - Profitability AnalysisMega Nurjannah Ahmad100% (1)

- Working Capital QuizDocument3 pagesWorking Capital QuizHarshit GoyalNo ratings yet

- XXXX96 01 01 2023to28 08 2023Document18 pagesXXXX96 01 01 2023to28 08 2023dabu choudharyNo ratings yet

- Answers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security ValuationDocument8 pagesAnswers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security Valuationimamoody1No ratings yet

- Vol - 6 07-May-2021 - Weekly Valuation NewsDocument2 pagesVol - 6 07-May-2021 - Weekly Valuation Newskaali1985yahoocomNo ratings yet

- Mayes 8e CH01 Problem SetDocument12 pagesMayes 8e CH01 Problem SetRamez AhmedNo ratings yet

- Fundamentals OF Accounting: Ms. Maryvin M. Maluya, CPA, CTTDocument35 pagesFundamentals OF Accounting: Ms. Maryvin M. Maluya, CPA, CTTAmalia Tamayo YlananNo ratings yet

- Margin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikDocument12 pagesMargin of Safety in Stock Investing: A Complete Guide - DR Vijay MalikmusiboyinaNo ratings yet

- 21 Inventory Management Kpis To Track 1Document4 pages21 Inventory Management Kpis To Track 1Stefanie DutraNo ratings yet

- Investment Banking Interview Guide: Course OutlineDocument20 pagesInvestment Banking Interview Guide: Course OutlineTawhid SyedNo ratings yet

- Acctg Adjusting EntriesDocument109 pagesAcctg Adjusting EntriesDaisy Marie A. RoselNo ratings yet

- Investment and Security Analysis by Charles P Jones Chapter 1 - Tabish Khan From KohatDocument9 pagesInvestment and Security Analysis by Charles P Jones Chapter 1 - Tabish Khan From KohatTabish KhanNo ratings yet

- South Central Africa Top CompaniesDocument16 pagesSouth Central Africa Top CompaniesaddyNo ratings yet

- S4HANA Asset Accounnting NotesDocument60 pagesS4HANA Asset Accounnting NotesJaved IqbalNo ratings yet

- Vbhuiiy.Chapter 6-ANALYSIS OF RISK AND RETURN: Multiple Choice 108 題Document28 pagesVbhuiiy.Chapter 6-ANALYSIS OF RISK AND RETURN: Multiple Choice 108 題Mohsin BashirNo ratings yet

- TCDN Quiz 2 Quiz 3Document2 pagesTCDN Quiz 2 Quiz 3nguyenyen231700No ratings yet

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- Chapter-2 Amalgamation of Companies (As-14) SolutionsDocument64 pagesChapter-2 Amalgamation of Companies (As-14) SolutionsRaja DasNo ratings yet

- Financial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsDocument7 pagesFinancial Management Assignment: Du Pont Analysis On HERO MOTO CORP. and HONDA MotorsSidharth AnandNo ratings yet

- Rsm433 Case 6Document2 pagesRsm433 Case 6LeahHuangNo ratings yet

- Calstrs-The 2011 Private Equity Secondaries Review Sample PagesDocument21 pagesCalstrs-The 2011 Private Equity Secondaries Review Sample PagesJitta thegreatNo ratings yet

- Pa e q323 Investor PresentationDocument40 pagesPa e q323 Investor PresentationJ JuniorNo ratings yet

- FR Question Paper 1 MAY 2017Document16 pagesFR Question Paper 1 MAY 2017MBaralNo ratings yet