Professional Documents

Culture Documents

Solved Refer To The Facts in The Preceding Problem Petro Inc

Solved Refer To The Facts in The Preceding Problem Petro Inc

Uploaded by

Anbu jaromiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Refer To The Facts in The Preceding Problem Petro Inc

Solved Refer To The Facts in The Preceding Problem Petro Inc

Uploaded by

Anbu jaromiaCopyright:

Available Formats

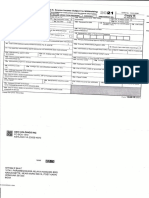

(SOLVED) Refer to the facts in the preceding problem Petro

Inc

Refer to the facts in the preceding problem. Petro Inc. pays $125,000 deferred compensation to

Mr. G in 2019, the year of his retirement. a. How much compensation income does Mr. G

recognize in 2019? b. What is Petro’s tax deduction for the payment to Mr. G? c. What is […]

Mr. G is the CFO of Petro Inc. This year, his salary was $625,000. Petro paid him $500,000

during the year and accrued an unfunded liability to pay him the $125,000 balance in the year

he retires at age 60. a. How much compensation income does Mr. G recognize this […]

Ms. Jost participates in her employer’s Section 401(k) plan, which obligates the employer to

contribute 25 cents for every dollar that an employee elects to contribute to the plan. This year,

Ms. Jost’s salary is $110,000, and she elects to contribute the maximum to her Section 401(k)

account. a. How […]

Mr. Tib is employed by RQA Inc. This year, Mr. Tib incurred $3,160 of employment-related

entertainment expenses and $4,750 of employment-related moving expenses. Mr. Tib’s AGI

before consideration of these expenses was $61,000, he itemizes deductions, and his marginal

tax rate is 25 percent. In each of the following cases, […]

GET ANSWER- https://accanswer.com/downloads/page/1494/

Ms. C paid $500 of union dues and $619 for small tools used on the job. In each of the following

cases, compute her after-tax cost of these employment-related expenses. a. Ms. C’s employer

paid her a $1,119 reimbursement. b. Ms. C received no reimbursement. Her AGI is $16,450,

she […]

In 2008 (year 0), Mrs. L exercised a stock option by paying $100 per share for 225 shares of

ABC stock. The market price at date of exercise was $312 per share. In 2015, she sold the 225

shares for $480 per share. Assuming that Mrs. L is in the […]

In 2006, BB granted an incentive stock option (ISO) to Mr. Y to buy 8,000 shares of BB stock at

$7 per share for 10 years. At date of grant, BB stock was trading on the AMEX for $6.23 per

share. In 2015, Mr. Y exercised the option when BB’s […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1494/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- CH 4 & 5 Extra Practic Summer 2023Document9 pagesCH 4 & 5 Extra Practic Summer 2023Ruth KatakaNo ratings yet

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Solved Marcy Tucker Received The Following Items This Year Determine ToDocument1 pageSolved Marcy Tucker Received The Following Items This Year Determine ToAnbu jaromiaNo ratings yet

- Question and Answer - 14Document31 pagesQuestion and Answer - 14acc-expert0% (2)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Question SamplesDocument10 pagesQuestion SamplesJinu JosephNo ratings yet

- Solved MG Is An Accrual Basis Corporation in 2015 It WroteDocument1 pageSolved MG Is An Accrual Basis Corporation in 2015 It WroteAnbu jaromiaNo ratings yet

- ICAP Income Tax Numericals Regards Awais Ali PDFDocument52 pagesICAP Income Tax Numericals Regards Awais Ali PDFInam Ul Haq Minhas0% (2)

- Fringe Benefits and Fringe Benefit Tax ExercisesDocument3 pagesFringe Benefits and Fringe Benefit Tax Exercisesaj lopezNo ratings yet

- Solved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsDocument1 pageSolved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsAnbu jaromiaNo ratings yet

- Solved Repeat Worked Out Problem 10 4 Page 328 But Assume That Inangela SDocument1 pageSolved Repeat Worked Out Problem 10 4 Page 328 But Assume That Inangela SM Bilal SaleemNo ratings yet

- Consolidations-Subsequent To The Date of Acquisition: Multiple Choice QuestionsDocument199 pagesConsolidations-Subsequent To The Date of Acquisition: Multiple Choice QuestionsMarwa HassanNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Socialism in Philosophy of Education WEEK 11 - 14Document18 pagesSocialism in Philosophy of Education WEEK 11 - 14E MORTOLA100% (4)

- Solved in 2010 BT Granted A Nonqualified Stock Option To MsDocument1 pageSolved in 2010 BT Granted A Nonqualified Stock Option To MsAnbu jaromiaNo ratings yet

- Solved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHDocument1 pageSolved This Year FGH Partnership Generated 600 000 Ordinary Business Income FGHAnbu jaromiaNo ratings yet

- Solved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyDocument1 pageSolved Sixteen Years Ago Ms Cole Purchased A 500 000 Insurance PolicyAnbu jaromiaNo ratings yet

- Solved MR Alm Earned A 61 850 Salary and Recognized A 5 600Document1 pageSolved MR Alm Earned A 61 850 Salary and Recognized A 5 600Anbu jaromiaNo ratings yet

- Solved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroDocument1 pageSolved Ms Reid Borrowed 50 000 From A Broker To Purchase LeroAnbu jaromiaNo ratings yet

- Solved Determine Whether The Following Items Represent Taxable Income A As TheDocument1 pageSolved Determine Whether The Following Items Represent Taxable Income A As TheAnbu jaromiaNo ratings yet

- Solved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsDocument1 pageSolved Nolan Inc Had Taxable Income of 400 000 in 2019 ItsAnbu jaromiaNo ratings yet

- Solved On January 1 2014 Leo Paid 15 000 For 5 PercentDocument1 pageSolved On January 1 2014 Leo Paid 15 000 For 5 PercentAnbu jaromiaNo ratings yet

- Solved in January Ms NW Projects That Her Employer Will WithholdDocument1 pageSolved in January Ms NW Projects That Her Employer Will WithholdAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Taxation - Assignment #1 Winter 2021: UestionsDocument8 pagesTaxation - Assignment #1 Winter 2021: UestionsAssignment &ExamsNo ratings yet

- Solved Mclelland Inc Reported Net Income of 175 000 For 2019 andDocument1 pageSolved Mclelland Inc Reported Net Income of 175 000 For 2019 andAnbu jaromiaNo ratings yet

- Solved The Webster Company Has Just Paid A Dividend of 5 25Document1 pageSolved The Webster Company Has Just Paid A Dividend of 5 25Anbu jaromiaNo ratings yet

- Solved The State Spartan Corporation Is Considering Two Mutually ExclusDocument1 pageSolved The State Spartan Corporation Is Considering Two Mutually ExclusM Bilal SaleemNo ratings yet

- Solved Indigo Inc A Personal Service Corporation Has The Following TypesDocument1 pageSolved Indigo Inc A Personal Service Corporation Has The Following TypesAnbu jaromiaNo ratings yet

- KEY WORDS - Income TaxationDocument23 pagesKEY WORDS - Income TaxationQueenVictoriaAshleyPrietoNo ratings yet

- Taxation Law 1 Compiled QuestionsDocument4 pagesTaxation Law 1 Compiled QuestionsTiffany HuntNo ratings yet

- Solved Richie Is A Wealthy Rancher in Texas He Operates HisDocument1 pageSolved Richie Is A Wealthy Rancher in Texas He Operates HisAnbu jaromiaNo ratings yet

- Payroll Accounting 2015 1st Edition Landin Test Bank DownloadDocument84 pagesPayroll Accounting 2015 1st Edition Landin Test Bank DownloadTommie Clemens100% (18)

- Solved Several Years Ago PTR Purchased Business Equipment For 50 000 PTR SDocument1 pageSolved Several Years Ago PTR Purchased Business Equipment For 50 000 PTR SAnbu jaromiaNo ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- 407 Exam 2 CH 4 5 Spr13 W o AnswDocument7 pages407 Exam 2 CH 4 5 Spr13 W o AnswMolly SmithNo ratings yet

- Midterm ReviewDocument11 pagesMidterm Reviewjack lambNo ratings yet

- University of Zimbabwe 2020 July/August Examinations: Faculty: CommerceDocument9 pagesUniversity of Zimbabwe 2020 July/August Examinations: Faculty: CommercePanashe BotaNo ratings yet

- Solved Diane and Peter Were Divorced in 2010 The Divorce AgreementDocument1 pageSolved Diane and Peter Were Divorced in 2010 The Divorce AgreementAnbu jaromiaNo ratings yet

- Tax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Document5 pagesTax Return Project Situation - Cohen Tax Year 2015 - Fall 2016Shivani Jani0% (3)

- Solved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFDocument1 pageSolved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFAnbu jaromiaNo ratings yet

- Solved Lake Corporation Has Some Severe Cash Flow Problems You Are TheDocument1 pageSolved Lake Corporation Has Some Severe Cash Flow Problems You Are TheAnbu jaromiaNo ratings yet

- ACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The QuestionDocument26 pagesACCT217 - Sample Exam 2: Identify The Choice That Best Completes The Statement or Answers The Questionphilker21No ratings yet

- Solved Refer To The Information For Crafty Corporation Below Crafty Corporation IssuedDocument1 pageSolved Refer To The Information For Crafty Corporation Below Crafty Corporation IssuedAnbu jaromiaNo ratings yet

- Solved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFDocument1 pageSolved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFAnbu jaromiaNo ratings yet

- Advance Tax Planning and Fiscal Policy Nov 07Document10 pagesAdvance Tax Planning and Fiscal Policy Nov 07DRTIMORENo ratings yet

- Principles of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions ManualDocument23 pagesPrinciples of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions Manualbosomdegerml971yf100% (20)

- AICPA - CPA Reg 2017Document12 pagesAICPA - CPA Reg 2017Gene'sNo ratings yet

- Taxable Income Lecturer: Mr. S.RameshDocument4 pagesTaxable Income Lecturer: Mr. S.RameshthineshlaraNo ratings yet

- Western Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Document2 pagesWestern Leyte College of Ormoc, Inc. Prelim Exam in Taxation I October 10, 2020Marc William SorianoNo ratings yet

- Running Head: Aspects of C Corporation 1Document5 pagesRunning Head: Aspects of C Corporation 1Rosalia Anabell LacuestaNo ratings yet

- Solved Laurie Gladin Owns Land and A Building That She HasDocument1 pageSolved Laurie Gladin Owns Land and A Building That She HasAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved On May 10 2011 Somerton Inc Grants Louise A NonqualifiedDocument1 pageSolved On May 10 2011 Somerton Inc Grants Louise A NonqualifiedAnbu jaromiaNo ratings yet

- Fringe Benefit TaxDocument5 pagesFringe Benefit TaxMjhayeNo ratings yet

- Solved MR and Mrs Soon Are The Sole Shareholders of SWDocument1 pageSolved MR and Mrs Soon Are The Sole Shareholders of SWAnbu jaromiaNo ratings yet

- Part 1Document15 pagesPart 1exoloneloveNo ratings yet

- 1)Document2 pages1)Tom BinfieldNo ratings yet

- Solved During April Rain Gear Unlimited Produced 5 500 Umbrellas From MylonDocument1 pageSolved During April Rain Gear Unlimited Produced 5 500 Umbrellas From MylonAnbu jaromiaNo ratings yet

- Solved The Revenues and Expenses of Sentinel Travel Service For TheDocument1 pageSolved The Revenues and Expenses of Sentinel Travel Service For TheAnbu jaromiaNo ratings yet

- Fire Your Over-Priced Financial Advisor and Retire SoonerFrom EverandFire Your Over-Priced Financial Advisor and Retire SoonerRating: 5 out of 5 stars5/5 (1)

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved Who Are The Parties The Plaintiffs and The Defendant inDocument1 pageSolved Who Are The Parties The Plaintiffs and The Defendant inAnbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved Which of The Following Statements Accurately Describes An Efficient TaxDocument1 pageSolved Which of The Following Statements Accurately Describes An Efficient TaxAnbu jaromiaNo ratings yet

- Solved Which of The Following Taxpayers Must File A 2015 Return ADocument1 pageSolved Which of The Following Taxpayers Must File A 2015 Return AAnbu jaromiaNo ratings yet

- Solved While Crossing A Public Highway in The City Joel WasDocument1 pageSolved While Crossing A Public Highway in The City Joel WasAnbu jaromiaNo ratings yet

- 2022 Property Tax Exemption FormDocument5 pages2022 Property Tax Exemption FormsplouffevachonNo ratings yet

- Paternity LeaveDocument24 pagesPaternity LeaveLei AdapNo ratings yet

- Fawcett Institute Provides One On One Training To Individuals Who Pay TuitionDocument1 pageFawcett Institute Provides One On One Training To Individuals Who Pay TuitionTaimur Technologist0% (1)

- The Rule of Ethiopian Tax-ProfessionalDocument36 pagesThe Rule of Ethiopian Tax-ProfessionalMinaw BelayNo ratings yet

- Unit 14 - Quantity & MoneyDocument14 pagesUnit 14 - Quantity & MoneyVan NguyenNo ratings yet

- Government Non-Bank Financial InstitutionsDocument7 pagesGovernment Non-Bank Financial InstitutionsJAMES CRISTOFER TARROZA0% (1)

- Commissioner of Internal Revenue V Algue Inc: #1 G.R. No. L-28896 February 17, 1988Document2 pagesCommissioner of Internal Revenue V Algue Inc: #1 G.R. No. L-28896 February 17, 1988Fred GoNo ratings yet

- What's Available, How To Qualify, and Where To Apply: Government Assistance ProgramsDocument5 pagesWhat's Available, How To Qualify, and Where To Apply: Government Assistance ProgramsJonhmark AniñonNo ratings yet

- COBA Newsletter 0408 (GH-31)Document16 pagesCOBA Newsletter 0408 (GH-31)Albany Times UnionNo ratings yet

- Solved On January 1 of The Current Year Scott Borrows 80 000Document1 pageSolved On January 1 of The Current Year Scott Borrows 80 000Anbu jaromiaNo ratings yet

- KMP Remuneration ICSIDocument21 pagesKMP Remuneration ICSISwetha SubramanianNo ratings yet

- Income Tax Payment Challan: PSID #: 35390320Document1 pageIncome Tax Payment Challan: PSID #: 35390320zeshanNo ratings yet

- Compassionate Appointment Approved Merit Point System and FormsDocument10 pagesCompassionate Appointment Approved Merit Point System and FormssoorayshNo ratings yet

- Internship ReportDocument56 pagesInternship Reportsharma.harshita2019No ratings yet

- Process Payroll EXAMDocument10 pagesProcess Payroll EXAMJemal SeidNo ratings yet

- ACCO 20063 Homework 2 Trial Balance Exercises, Computation of A, LDocument4 pagesACCO 20063 Homework 2 Trial Balance Exercises, Computation of A, LVincent Luigil AlceraNo ratings yet

- MAS Financial-RatiosDocument4 pagesMAS Financial-RatiosJulius Lester AbieraNo ratings yet

- Syam Bhat BioDocument5 pagesSyam Bhat BioSanjay BhatNo ratings yet

- Learning Objective 11-1: Chapter 11 Current Liabilities and PayrollDocument50 pagesLearning Objective 11-1: Chapter 11 Current Liabilities and PayrollMarqaz MarqazNo ratings yet

- IT PPT For F.Y 2023-24Document24 pagesIT PPT For F.Y 2023-24pritesh.ks1409No ratings yet

- 66 - (G.R. No. 167679. July 22, 2015)Document29 pages66 - (G.R. No. 167679. July 22, 2015)alda hobisNo ratings yet

- No Name T1 2022Document42 pagesNo Name T1 2022Indo -CanadianNo ratings yet

- TD Bank Canada StatementDocument1 pageTD Bank Canada Statementalihaider890701No ratings yet

- Ch24 Berk 4ce IsmDocument3 pagesCh24 Berk 4ce IsmZhichang ZhangNo ratings yet

- Discovery Life Funeral BrochureDocument5 pagesDiscovery Life Funeral BrochureAdamNo ratings yet

- Malawi Tax Incentives Handbook-Vol 3 - June 20221Document34 pagesMalawi Tax Incentives Handbook-Vol 3 - June 20221vincentNo ratings yet

- Exercise 1. Choose The Correct Alternative To Complete Each SentenceDocument8 pagesExercise 1. Choose The Correct Alternative To Complete Each SentenceGliqeria PlasariNo ratings yet

- ch08 2023 Determing Pay and BenefitsDocument20 pagesch08 2023 Determing Pay and BenefitsAbram TinNo ratings yet

- Liheap 1Document6 pagesLiheap 1Lauren ZaleNo ratings yet