Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

43 viewsTaxation Paper 2021 ODD 1,3,5,7,9

Taxation Paper 2021 ODD 1,3,5,7,9

Uploaded by

Yasir AminMr. Ali has a basic salary of Rs. 60,000 per month. He receives various allowances and benefits from his employer including free accommodation, medical treatment, a bonus of Rs. 130,000, an entertainment allowance of Rs. 80,000, and a house rent allowance of Rs. 300,000. The question asks to calculate Mr. Ali's income tax payable based on this information.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Module 1 Homework - MadrazoDocument41 pagesModule 1 Homework - MadrazoJayann Danielle Madrazo80% (5)

- Chapter-3: Practical ProblemsDocument2 pagesChapter-3: Practical ProblemsMd. Rokon KhanNo ratings yet

- Activity / Assignment: Answer and SolutionDocument3 pagesActivity / Assignment: Answer and SolutionMa. Alexandria Palma0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Roshan BSLDocument7 pagesRoshan BSLroshan satpathyNo ratings yet

- Tax Midterm Practise SolutionsDocument5 pagesTax Midterm Practise SolutionsShan Ali ShahNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- Individual b4 B PracticeDocument4 pagesIndividual b4 B Practicedavid.ellis1245No ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Taxation NotesDocument33 pagesTaxation NotesNaina AgarwalNo ratings yet

- Tally With GST - 231003 - 111251Document4 pagesTally With GST - 231003 - 111251Gargi BhardwajNo ratings yet

- ACCCOB1 - (Module 1)Document36 pagesACCCOB1 - (Module 1)Andrei AngNo ratings yet

- Trial Balance (Group 6) PDFDocument1 pageTrial Balance (Group 6) PDFLiam SantosNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Journal-Trial Balance ASM Medical ClinicDocument7 pagesJournal-Trial Balance ASM Medical ClinicJasmine Acta100% (1)

- Practice Exercise - Journalizing Government Accounting Transactions-NAVEDocument12 pagesPractice Exercise - Journalizing Government Accounting Transactions-NAVEJanielle NaveNo ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- National University of Computer and Emerging Sciences, Lahore CampusDocument5 pagesNational University of Computer and Emerging Sciences, Lahore CampusFaizan AhmadNo ratings yet

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDocument3 pagesBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedNo ratings yet

- Symphony Theater SolutionDocument4 pagesSymphony Theater SolutionVinayak SinglaNo ratings yet

- 4 5Document7 pages4 5Jyan GayNo ratings yet

- ABM 3 Quarterly ExamDocument2 pagesABM 3 Quarterly ExamLenyBarrogaNo ratings yet

- Set VIDocument2 pagesSet VIArihant DagaNo ratings yet

- Assignment-2 - Mid Term Paxi Ko AssignmentDocument5 pagesAssignment-2 - Mid Term Paxi Ko Assignmenty.yubaraj001No ratings yet

- Aug 1 Cash 85000 0 Office Equipment 30000 F. de Asis, Capital 880000 Initial InvestmentDocument14 pagesAug 1 Cash 85000 0 Office Equipment 30000 F. de Asis, Capital 880000 Initial InvestmentMadelynne CastilloNo ratings yet

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocument9 pagesMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Assessment 2 - Jan 2020 Revised PDFDocument3 pagesAssessment 2 - Jan 2020 Revised PDFDarrel SamueldNo ratings yet

- Activity Midterm 1 Income TaxDocument1 pageActivity Midterm 1 Income TaxAngelica MijaresNo ratings yet

- Gross Income 52,000.00 AnswerDocument2 pagesGross Income 52,000.00 AnswerKarl SilayanNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- Problem 2: Posting: Cuengco, Jhon Clark CDocument2 pagesProblem 2: Posting: Cuengco, Jhon Clark CJhon Clark CuengcoNo ratings yet

- Xi Accounting Set 2Document6 pagesXi Accounting Set 2aashirwad2076No ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- OLFU For Simplified Accounting For Sole Proprietorship in Preparation of Financial Statements Practice Problems WorksheetDocument4 pagesOLFU For Simplified Accounting For Sole Proprietorship in Preparation of Financial Statements Practice Problems WorksheetJANNA RAZONNo ratings yet

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Total IncomeDocument4 pagesTotal IncomeSiddharth VaswaniNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- Exercises-Journalizing - Posting, Trial BalanceDocument2 pagesExercises-Journalizing - Posting, Trial BalanceRIANE PADIERNOSNo ratings yet

- 365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsDocument3 pages365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsMihir HareetNo ratings yet

- Incomw Tax Practical QuestionDocument2 pagesIncomw Tax Practical Questionnikhilnexus22No ratings yet

- Illustration 1 and 2 Salary - 21-22 Nov 2023Document5 pagesIllustration 1 and 2 Salary - 21-22 Nov 2023Chinmay HarshNo ratings yet

- Activity 2 Income TaxationDocument5 pagesActivity 2 Income TaxationEd HernandezNo ratings yet

- 15 Term Test 1 (QP)Document6 pages15 Term Test 1 (QP)iamneonkingNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- 3DMC Income Tax Assignment 1Document30 pages3DMC Income Tax Assignment 1Sato TsuyoshiNo ratings yet

- C 1Document10 pagesC 1biniamNo ratings yet

- Taxation of IndividualsDocument18 pagesTaxation of IndividualsŁÖVË GÄMËNo ratings yet

- Quiz Allowable DeductionsDocument18 pagesQuiz Allowable DeductionsceistNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Assignment On TaxationDocument2 pagesAssignment On TaxationKal KalNo ratings yet

- Final Account 2Document2 pagesFinal Account 2Abdurrauf IbrahimNo ratings yet

- Calculate:: Instructions To Be FollowedDocument1 pageCalculate:: Instructions To Be FollowedYasir AminNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- Please Follow The Instructions CarefullyDocument3 pagesPlease Follow The Instructions CarefullyYasir AminNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- BRM Paper Mcom MorningDocument3 pagesBRM Paper Mcom MorningYasir AminNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- Organisation: The Strategy Group'S Value Proposition Design Tool™Document1 pageOrganisation: The Strategy Group'S Value Proposition Design Tool™Yasir AminNo ratings yet

- Management Asiment PepsiDocument19 pagesManagement Asiment PepsiYasir AminNo ratings yet

Taxation Paper 2021 ODD 1,3,5,7,9

Taxation Paper 2021 ODD 1,3,5,7,9

Uploaded by

Yasir Amin0 ratings0% found this document useful (0 votes)

43 views4 pagesMr. Ali has a basic salary of Rs. 60,000 per month. He receives various allowances and benefits from his employer including free accommodation, medical treatment, a bonus of Rs. 130,000, an entertainment allowance of Rs. 80,000, and a house rent allowance of Rs. 300,000. The question asks to calculate Mr. Ali's income tax payable based on this information.

Original Description:

Tax

Original Title

Taxation paper 2021 ODD 1,3,5,7,9 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMr. Ali has a basic salary of Rs. 60,000 per month. He receives various allowances and benefits from his employer including free accommodation, medical treatment, a bonus of Rs. 130,000, an entertainment allowance of Rs. 80,000, and a house rent allowance of Rs. 300,000. The question asks to calculate Mr. Ali's income tax payable based on this information.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

43 views4 pagesTaxation Paper 2021 ODD 1,3,5,7,9

Taxation Paper 2021 ODD 1,3,5,7,9

Uploaded by

Yasir AminMr. Ali has a basic salary of Rs. 60,000 per month. He receives various allowances and benefits from his employer including free accommodation, medical treatment, a bonus of Rs. 130,000, an entertainment allowance of Rs. 80,000, and a house rent allowance of Rs. 300,000. The question asks to calculate Mr. Ali's income tax payable based on this information.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

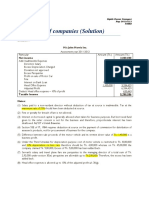

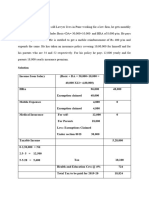

FINAL TERM PAPER Subject: Business Taxation M.Com.

Semester: 3rd

Session: 2019-2021 Time: 120 Minutes Marks: 50 Course

Instructor: Dr. Attari Muhammad Umer

Answers must be comprehensive with all relevant and supporting calculations/notes.

Q. No 03: Marks: 10

Mr. Ali has basic salary of Rs.60000 per month. He is also provided free accommodation and

medical treatment by the company for all dependants. Calculate his Income-Tax payable.

Bonus Rs.130, 000

Entertainment allowance 80,000

House rent allowance 300000

Dearness allowance 100,000

Tax paid by employer 50,000

Zakat was paid 280,000

Re-imbursement of internet bill (used for office) 40,000

Encashment against un-availed leave 25,000

Medical Allowance 75,000

Telephone bills ( Tax 3000) paid by employee himself 36,000

Tax paid on cash withdrawal from bank 4,000

Hotel bills paid by company relating to official duties 48,000

Furniture acquired from company at Price 100,000

( Fair market Value is 1,50,000)

Salary of gardener and cook paid by Company Rs. 40,000

Income from facilities attached with the accommodation 50,000

Donation to Approved Charity Rs. 100,000

Q. no. 4

Q. no. 5. Calculate the sales tax payable by Mr. Anees from his particulars and details of

transactions as follows:

You might also like

- Module 1 Homework - MadrazoDocument41 pagesModule 1 Homework - MadrazoJayann Danielle Madrazo80% (5)

- Chapter-3: Practical ProblemsDocument2 pagesChapter-3: Practical ProblemsMd. Rokon KhanNo ratings yet

- Activity / Assignment: Answer and SolutionDocument3 pagesActivity / Assignment: Answer and SolutionMa. Alexandria Palma0% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Roshan BSLDocument7 pagesRoshan BSLroshan satpathyNo ratings yet

- Tax Midterm Practise SolutionsDocument5 pagesTax Midterm Practise SolutionsShan Ali ShahNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Midterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Document6 pagesMidterm Summative Examination (B-FND003) (ECO11 & ENR11) - Set A (Answers, Jan Marwin G. Alindog)Vaseline QtipsNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- Individual b4 B PracticeDocument4 pagesIndividual b4 B Practicedavid.ellis1245No ratings yet

- Taxation Module 3: Numerical Problems Income From Business or ProfessionDocument5 pagesTaxation Module 3: Numerical Problems Income From Business or ProfessionShankar HunnurNo ratings yet

- Taxation NotesDocument33 pagesTaxation NotesNaina AgarwalNo ratings yet

- Tally With GST - 231003 - 111251Document4 pagesTally With GST - 231003 - 111251Gargi BhardwajNo ratings yet

- ACCCOB1 - (Module 1)Document36 pagesACCCOB1 - (Module 1)Andrei AngNo ratings yet

- Trial Balance (Group 6) PDFDocument1 pageTrial Balance (Group 6) PDFLiam SantosNo ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Journal-Trial Balance ASM Medical ClinicDocument7 pagesJournal-Trial Balance ASM Medical ClinicJasmine Acta100% (1)

- Practice Exercise - Journalizing Government Accounting Transactions-NAVEDocument12 pagesPractice Exercise - Journalizing Government Accounting Transactions-NAVEJanielle NaveNo ratings yet

- Unit 1 B&P ExamplesDocument9 pagesUnit 1 B&P ExamplesAllaretrashNo ratings yet

- Assessment of Companies (Solution) : Solution 1 M/s John Morris IncDocument8 pagesAssessment of Companies (Solution) : Solution 1 M/s John Morris IncIQBALNo ratings yet

- National University of Computer and Emerging Sciences, Lahore CampusDocument5 pagesNational University of Computer and Emerging Sciences, Lahore CampusFaizan AhmadNo ratings yet

- Business Taxation Past Paper 2017 B.com Part 2 Punjab UniversityDocument3 pagesBusiness Taxation Past Paper 2017 B.com Part 2 Punjab UniversityAdeel AhmedNo ratings yet

- Symphony Theater SolutionDocument4 pagesSymphony Theater SolutionVinayak SinglaNo ratings yet

- 4 5Document7 pages4 5Jyan GayNo ratings yet

- ABM 3 Quarterly ExamDocument2 pagesABM 3 Quarterly ExamLenyBarrogaNo ratings yet

- Set VIDocument2 pagesSet VIArihant DagaNo ratings yet

- Assignment-2 - Mid Term Paxi Ko AssignmentDocument5 pagesAssignment-2 - Mid Term Paxi Ko Assignmenty.yubaraj001No ratings yet

- Aug 1 Cash 85000 0 Office Equipment 30000 F. de Asis, Capital 880000 Initial InvestmentDocument14 pagesAug 1 Cash 85000 0 Office Equipment 30000 F. de Asis, Capital 880000 Initial InvestmentMadelynne CastilloNo ratings yet

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocument9 pagesMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurNo ratings yet

- Solved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)Document45 pagesSolved Past Papers Income Tax Numericals of ICMAP STAGE IV - (2003 TO 2015)muneeb razaNo ratings yet

- Assessment 2 - Jan 2020 Revised PDFDocument3 pagesAssessment 2 - Jan 2020 Revised PDFDarrel SamueldNo ratings yet

- Activity Midterm 1 Income TaxDocument1 pageActivity Midterm 1 Income TaxAngelica MijaresNo ratings yet

- Gross Income 52,000.00 AnswerDocument2 pagesGross Income 52,000.00 AnswerKarl SilayanNo ratings yet

- Tally With GST Workshop Jan 2023 QuestionDocument3 pagesTally With GST Workshop Jan 2023 QuestionAryan GuptaNo ratings yet

- Problem 2: Posting: Cuengco, Jhon Clark CDocument2 pagesProblem 2: Posting: Cuengco, Jhon Clark CJhon Clark CuengcoNo ratings yet

- Xi Accounting Set 2Document6 pagesXi Accounting Set 2aashirwad2076No ratings yet

- San Beda University: Department of Accountancy and TaxationDocument11 pagesSan Beda University: Department of Accountancy and TaxationOG FAMNo ratings yet

- 18515pcc Sugg Paper Nov09 5 PDFDocument16 pages18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNo ratings yet

- OLFU For Simplified Accounting For Sole Proprietorship in Preparation of Financial Statements Practice Problems WorksheetDocument4 pagesOLFU For Simplified Accounting For Sole Proprietorship in Preparation of Financial Statements Practice Problems WorksheetJANNA RAZONNo ratings yet

- Taxable Salary Problem With Solution Part 1Document2 pagesTaxable Salary Problem With Solution Part 1NagadeepaNo ratings yet

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- Question BankDocument31 pagesQuestion BankmahendrabpatelNo ratings yet

- Total IncomeDocument4 pagesTotal IncomeSiddharth VaswaniNo ratings yet

- BCom Business Taxation Income Tax and Sales Tax Numerical 2018Document5 pagesBCom Business Taxation Income Tax and Sales Tax Numerical 2018AHSAN LASHARINo ratings yet

- Exercises-Journalizing - Posting, Trial BalanceDocument2 pagesExercises-Journalizing - Posting, Trial BalanceRIANE PADIERNOSNo ratings yet

- 365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsDocument3 pages365) - The Income Tax Rate Is 40%. Additional Expenses Are Estimated As FollowsMihir HareetNo ratings yet

- Incomw Tax Practical QuestionDocument2 pagesIncomw Tax Practical Questionnikhilnexus22No ratings yet

- Illustration 1 and 2 Salary - 21-22 Nov 2023Document5 pagesIllustration 1 and 2 Salary - 21-22 Nov 2023Chinmay HarshNo ratings yet

- Activity 2 Income TaxationDocument5 pagesActivity 2 Income TaxationEd HernandezNo ratings yet

- 15 Term Test 1 (QP)Document6 pages15 Term Test 1 (QP)iamneonkingNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Corporation Income Tax ProblemsDocument3 pagesCorporation Income Tax ProblemsRandy Manzano50% (2)

- 3DMC Income Tax Assignment 1Document30 pages3DMC Income Tax Assignment 1Sato TsuyoshiNo ratings yet

- C 1Document10 pagesC 1biniamNo ratings yet

- Taxation of IndividualsDocument18 pagesTaxation of IndividualsŁÖVË GÄMËNo ratings yet

- Quiz Allowable DeductionsDocument18 pagesQuiz Allowable DeductionsceistNo ratings yet

- Ganesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)Document11 pagesGanesh Metal Industry Trial Balance, December 31, 2008 Account Debit (RS) Credit (RS)ayushsapkota907No ratings yet

- Assignment On TaxationDocument2 pagesAssignment On TaxationKal KalNo ratings yet

- Final Account 2Document2 pagesFinal Account 2Abdurrauf IbrahimNo ratings yet

- Calculate:: Instructions To Be FollowedDocument1 pageCalculate:: Instructions To Be FollowedYasir AminNo ratings yet

- Financial Reporting Mcom 3 Semester: AssetsDocument2 pagesFinancial Reporting Mcom 3 Semester: AssetsYasir AminNo ratings yet

- Please Follow The Instructions CarefullyDocument3 pagesPlease Follow The Instructions CarefullyYasir AminNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- BRM Paper Mcom MorningDocument3 pagesBRM Paper Mcom MorningYasir AminNo ratings yet

- Topi Csofassi Gnment SDocument4 pagesTopi Csofassi Gnment SYasir AminNo ratings yet

- Organisation: The Strategy Group'S Value Proposition Design Tool™Document1 pageOrganisation: The Strategy Group'S Value Proposition Design Tool™Yasir AminNo ratings yet

- Management Asiment PepsiDocument19 pagesManagement Asiment PepsiYasir AminNo ratings yet