Professional Documents

Culture Documents

BSBFIA401 5: Depreciation Table For 2017 and 2018

BSBFIA401 5: Depreciation Table For 2017 and 2018

Uploaded by

natty0 ratings0% found this document useful (0 votes)

20 views2 pagesThis document contains a depreciation table and calculations for Andrew's Slabs Delivery Truck for the years ending June 30, 2017 and June 30, 2018. It uses the diminishing balance method with a depreciation rate of 30%. In year 1, depreciation expense was $9,000, reducing the carrying amount to $21,000. In year 2, depreciation expense was $6,300, with an accumulated depreciation of $15,300 and a carrying amount of $14,700 at the end of the period. Journal entries are provided to record depreciation expense and accumulated depreciation for the years ended June 30, 2017 and June 30, 2018.

Original Description:

Original Title

BSBFIA401 5

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a depreciation table and calculations for Andrew's Slabs Delivery Truck for the years ending June 30, 2017 and June 30, 2018. It uses the diminishing balance method with a depreciation rate of 30%. In year 1, depreciation expense was $9,000, reducing the carrying amount to $21,000. In year 2, depreciation expense was $6,300, with an accumulated depreciation of $15,300 and a carrying amount of $14,700 at the end of the period. Journal entries are provided to record depreciation expense and accumulated depreciation for the years ended June 30, 2017 and June 30, 2018.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

20 views2 pagesBSBFIA401 5: Depreciation Table For 2017 and 2018

BSBFIA401 5: Depreciation Table For 2017 and 2018

Uploaded by

nattyThis document contains a depreciation table and calculations for Andrew's Slabs Delivery Truck for the years ending June 30, 2017 and June 30, 2018. It uses the diminishing balance method with a depreciation rate of 30%. In year 1, depreciation expense was $9,000, reducing the carrying amount to $21,000. In year 2, depreciation expense was $6,300, with an accumulated depreciation of $15,300 and a carrying amount of $14,700 at the end of the period. Journal entries are provided to record depreciation expense and accumulated depreciation for the years ended June 30, 2017 and June 30, 2018.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

BSBFIA401 5

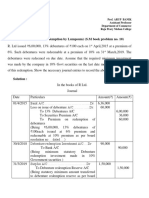

Depreciation table for 2017 and 2018

Andrew’s Slabs Delivery Truck

Asset Cost: $30.000

Less Residual value: N/A

Depreciation Amount: $30.000

Depreciation method: diminishing method

Depreciation Rate: 30%

Year Carrying amount at Depreciation Accumulated Carrying amount

ending beginning Depreciation at end

30/6/2017 30.000 9.000 9.000 21.000

30/6/2018 21.000 6.300 15.300 14.700

Workings for the depreciation calculation

Delivery truck diminishing balance method

Year 1 ( 1/7/2016-30/6/2017) depreciation expense=$30.000*30%=$9.000

Year 2 ( 1/7/2017-30/6/2018) depreciation expense=$21.000*30%=$6.300

General Journal entry on 30 June 2016 for depreciation

Date Accounts Dr $ Cr $

depreciation 6,300

30/6/2018

Motor witches accumulated 6,300

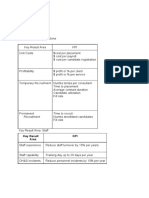

Ledger accounts for Motor Vehicle, Accumulated Depreciation of Motor

Vehicle and Depreciation Expense from 1/7/2016 to 30/6/2017

Motor Vehicle

Date Details Dr $ Cr $ Balance $

1/7/206 Purchase of 30,00 30,000DR

Truck A 0

Motor Vehicle Accumulated Depreciation

Date Details Dr $ Cr $ Balance $

30/6/201 Depercition 9,000 9,000CR

7

30/6/201 Depercition 6,300 15,300CR

8

Depreciation Expenses

Date Details Dr $ Cr $ Balance $

30/6/2017 Accommodated 9,000 9,000DR

Depreciation

Prote & loss 9,000 0

30/6/2018 Accommodated 6,300 6,300DR

Depreciation

Prote & loss 6,300 0

Prote & loss 6,300 0

You might also like

- BSBSUS501 Assessment 1Document7 pagesBSBSUS501 Assessment 1natty100% (1)

- XLSXDocument20 pagesXLSXashibhallau100% (3)

- BSBCUS501 2: Innovative Widgets Customer Support Policy and Procedure - Collecting Market Research PurposeDocument3 pagesBSBCUS501 2: Innovative Widgets Customer Support Policy and Procedure - Collecting Market Research PurposenattyNo ratings yet

- 5 DepDocument2 pages5 Depshreyash436No ratings yet

- Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation MethodsDocument4 pagesJimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation MethodsAngel Kaye Nacionales JimenezNo ratings yet

- Bond Retirement Prior To Maturity A. Illustration 1 - Straight LineDocument27 pagesBond Retirement Prior To Maturity A. Illustration 1 - Straight Linephoebelyn acdogNo ratings yet

- Question No 8: Cost Overhauling Depreciatoin Reducing Bal Method Sold DR Truck A/C Date Details Amount DateDocument6 pagesQuestion No 8: Cost Overhauling Depreciatoin Reducing Bal Method Sold DR Truck A/C Date Details Amount DateEducatry FamNo ratings yet

- Leasing SolveDocument4 pagesLeasing SolveHur TsetsegNo ratings yet

- Problem 1Document10 pagesProblem 1RICHIE MAE SANG-ANNo ratings yet

- Zoom SlidesDocument10 pagesZoom SlidesTuấn Kiệt NguyễnNo ratings yet

- 2.1, 2.2, 2.3, 2.4, 2.9, 2.10, 2.12 KTQTDocument6 pages2.1, 2.2, 2.3, 2.4, 2.9, 2.10, 2.12 KTQTThùy LinhhNo ratings yet

- AE 15 PPE Sample Problems AnswerDocument8 pagesAE 15 PPE Sample Problems AnswerAlma CarioNo ratings yet

- Topic 3 Lease TutorialDocument9 pagesTopic 3 Lease TutorialHakim AzmiNo ratings yet

- DepreciationDocument21 pagesDepreciationxvfidxwmgNo ratings yet

- Solution To Extra Problem Bond: Partial Balance Sheet December 31, 2020Document2 pagesSolution To Extra Problem Bond: Partial Balance Sheet December 31, 2020Anass BNo ratings yet

- Depreciation SolutionsDocument14 pagesDepreciation SolutionsAyush MadurwarNo ratings yet

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- Quize 14Document15 pagesQuize 14Daniella Mae ElipNo ratings yet

- Accounts Ans MTP 2 NOV 2018Document10 pagesAccounts Ans MTP 2 NOV 2018backuphpdv6No ratings yet

- News PapersDocument2 pagesNews PapersAbdulla Al mamunNo ratings yet

- DepreciationDocument3 pagesDepreciationSumanth KumarNo ratings yet

- Acct 112 Chapter 3Document21 pagesAcct 112 Chapter 3Georges-Motsu Moukala ZambaNo ratings yet

- Depreciation of Non-Current Assets - 11Document3 pagesDepreciation of Non-Current Assets - 11Adinda Nathania Damaris SurbaktiNo ratings yet

- Average Due Date SUMS PDFDocument24 pagesAverage Due Date SUMS PDFNivedhitha BalajiNo ratings yet

- R.R. Thulasi Builders (I) PVT LTD., Tools & Machineries Monthly Usage StatementDocument13 pagesR.R. Thulasi Builders (I) PVT LTD., Tools & Machineries Monthly Usage StatementSundaraPandiyanNo ratings yet

- Asistensi 9 - AnswerDocument17 pagesAsistensi 9 - AnswerannisaanoviandiniNo ratings yet

- Tutorial Set 6 SolutionsDocument11 pagesTutorial Set 6 SolutionsAWENABAH THOMASNo ratings yet

- 7-4 PT Pandu Dan PT SadewaDocument5 pages7-4 PT Pandu Dan PT SadewaTeam 1No ratings yet

- Require 1 Require 2: Date Interest PaymentDocument7 pagesRequire 1 Require 2: Date Interest PaymentKiều OanhNo ratings yet

- Revaluation Problems Part 2Document32 pagesRevaluation Problems Part 2XNo ratings yet

- Module 3 DepreciationDocument4 pagesModule 3 DepreciationLouie Jay JadraqueNo ratings yet

- Acc p3 J2023 A Level MsDocument8 pagesAcc p3 J2023 A Level Msnyashamagutsa93No ratings yet

- Depreciation Worksheet Straightline MethodDocument12 pagesDepreciation Worksheet Straightline MethodJamie-Lee O'ConnorNo ratings yet

- Jawaban Inter 1 Modul 9Document4 pagesJawaban Inter 1 Modul 9Sebastian T.MNo ratings yet

- 2014 Final Exam SolutionsDocument6 pages2014 Final Exam SolutionsAyaan Ahaan Malik-WilliamsNo ratings yet

- DepreciationDocument9 pagesDepreciationPriyank JainNo ratings yet

- Repe Model 1 0Document51 pagesRepe Model 1 0Caio HenriqueNo ratings yet

- DepreciationDocument18 pagesDepreciationManuthi HewawasamNo ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- A) Date Description Debit $ Credit $Document5 pagesA) Date Description Debit $ Credit $simranNo ratings yet

- Unit 2 - Accountingformanager - AnanduDocument52 pagesUnit 2 - Accountingformanager - Ananducraziestidiot31No ratings yet

- Fabrisio LTD General Journal 1 Ref/Date Particulars Amount (DR) Amount (CR)Document5 pagesFabrisio LTD General Journal 1 Ref/Date Particulars Amount (DR) Amount (CR)Dan GallagherNo ratings yet

- Kic02 Nhóm9 Topic2 Ktqt1enDocument10 pagesKic02 Nhóm9 Topic2 Ktqt1enLy BùiNo ratings yet

- AccountsA MTP Foundation Oct19Document10 pagesAccountsA MTP Foundation Oct19backuphpdv6No ratings yet

- Chapter 29Document6 pagesChapter 29Shane Ivory ClaudioNo ratings yet

- Journal Date Description Post REF. DebitDocument20 pagesJournal Date Description Post REF. DebitKanika SharmaNo ratings yet

- Problem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Document5 pagesProblem - 2 (Redemption by Lumpsum) (S.M Book Problem No. 10)Gopal DasNo ratings yet

- Lesson 3 Assignment. Intermediate AccountingDocument3 pagesLesson 3 Assignment. Intermediate AccountingVictory BarasaNo ratings yet

- Asistensi 9 - Answer-2Document13 pagesAsistensi 9 - Answer-2annisaanoviandiniNo ratings yet

- 26 LPDocument18 pages26 LPYen YenNo ratings yet

- Provisions, Contingencies and Other Liabilities ProblemsDocument7 pagesProvisions, Contingencies and Other Liabilities ProblemsGiander100% (1)

- Straight Line Method (SLM)Document8 pagesStraight Line Method (SLM)Binod KhatriNo ratings yet

- Loans Receivable Practice (Review)Document6 pagesLoans Receivable Practice (Review)Deviline MichelleNo ratings yet

- WIndi Alifia Herdana - PR PIUTANG WESELDocument3 pagesWIndi Alifia Herdana - PR PIUTANG WESELWindi AlifiaNo ratings yet

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Document4 pagesAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447No ratings yet

- Chandra Gira 071-072 ProjectedDocument8 pagesChandra Gira 071-072 ProjectedBright Tone Music InstituteNo ratings yet

- Birzeit University Faculty of Business Andeconomics Mba Program Managerial Accounting Busa 631 AssignmentDocument3 pagesBirzeit University Faculty of Business Andeconomics Mba Program Managerial Accounting Busa 631 AssignmentDina OdehNo ratings yet

- Total Costs (Actual and Estimated) $ 8,000,000.00 $ 5,600,000.00Document2 pagesTotal Costs (Actual and Estimated) $ 8,000,000.00 $ 5,600,000.00wahdah ulin nafisahNo ratings yet

- Depreciation-2Document9 pagesDepreciation-2divya shindeNo ratings yet

- m7 - Note Sample Problems With Solutions Chs 14 and 15Document6 pagesm7 - Note Sample Problems With Solutions Chs 14 and 15Marie Fe GullesNo ratings yet

- Solution: Working NoteDocument5 pagesSolution: Working NotePradeep NairNo ratings yet

- BSBMGT608 7: Revised Performance Improvement Strategy (Version 2)Document4 pagesBSBMGT608 7: Revised Performance Improvement Strategy (Version 2)natty100% (1)

- Task 2: Develop Options For Continuous Improvement: BSBMGT608 6Document5 pagesTask 2: Develop Options For Continuous Improvement: BSBMGT608 6nattyNo ratings yet

- BSBMGT517 3 Draft Risk Management Plan: Scope of AssessmentDocument2 pagesBSBMGT517 3 Draft Risk Management Plan: Scope of AssessmentnattyNo ratings yet

- Select The Best 2 Answers Which Describe How Storytelling Can Be Used To Help You Communicate Your IdeasDocument8 pagesSelect The Best 2 Answers Which Describe How Storytelling Can Be Used To Help You Communicate Your IdeasnattyNo ratings yet

- FNSACC624 1 Task 1: Written QuestionsDocument2 pagesFNSACC624 1 Task 1: Written QuestionsnattyNo ratings yet

- BSBMGT608 2: A. Supply ChainDocument5 pagesBSBMGT608 2: A. Supply ChainnattyNo ratings yet

- BSBMGT608 8: Key Result Area KPIDocument13 pagesBSBMGT608 8: Key Result Area KPInattyNo ratings yet

- BSBLDR501 1 Develop and Use Emotional Intelligence Practice Tasks Answer BookletDocument2 pagesBSBLDR501 1 Develop and Use Emotional Intelligence Practice Tasks Answer BookletnattyNo ratings yet

- Objectives and Strategies Objectives Strategies: BSBWOR502 2Document3 pagesObjectives and Strategies Objectives Strategies: BSBWOR502 2nattyNo ratings yet

- BSBCUS501 Practice TasksDocument3 pagesBSBCUS501 Practice TasksnattyNo ratings yet

- Select The Best 4 Answers Which Describe How You Can Reflect On and Appraise The Views of OthersDocument3 pagesSelect The Best 4 Answers Which Describe How You Can Reflect On and Appraise The Views of OthersnattyNo ratings yet

- Match The Key Themes, Messages and Positions To Aid in Clarity of Thought and Presentation To The Information Provided (Part 1)Document6 pagesMatch The Key Themes, Messages and Positions To Aid in Clarity of Thought and Presentation To The Information Provided (Part 1)nattyNo ratings yet

- BSBLDR501 2 Task 1: Reflect On Your Emotional Intelligence: Strengths Are A Place Where We Can Practice One of TheDocument2 pagesBSBLDR501 2 Task 1: Reflect On Your Emotional Intelligence: Strengths Are A Place Where We Can Practice One of ThenattyNo ratings yet

- Bsbfia401 4Document3 pagesBsbfia401 4natty100% (1)

- BAS and Instalment Activity Calculations: FNSBKG404 4Document1 pageBAS and Instalment Activity Calculations: FNSBKG404 4nattyNo ratings yet

- Australian Government Pensions Excerpt Defence Force Payments Excerpt UN PaymentsDocument4 pagesAustralian Government Pensions Excerpt Defence Force Payments Excerpt UN PaymentsnattyNo ratings yet

- Bsbfia401 2Document2 pagesBsbfia401 2nattyNo ratings yet

- FNSBKG404 7: Activity 2Document2 pagesFNSBKG404 7: Activity 2nattyNo ratings yet

- FNSBKG404 5Document4 pagesFNSBKG404 5natty100% (1)

- FNSBKG404 1: Activity 1Document3 pagesFNSBKG404 1: Activity 1nattyNo ratings yet

- FNSACC507 10: Factory Overhead ContDocument6 pagesFNSACC507 10: Factory Overhead ContnattyNo ratings yet

- Bsbfia401 3Document2 pagesBsbfia401 3nattyNo ratings yet

- BSBFIA401 1 BSBFIA401 Prepare Financial Reports Practice Task Answer BookletDocument3 pagesBSBFIA401 1 BSBFIA401 Prepare Financial Reports Practice Task Answer Bookletnatty100% (1)

- FNSACC507 7 Task 2 - Case Study and Practical AssessmentDocument3 pagesFNSACC507 7 Task 2 - Case Study and Practical AssessmentnattyNo ratings yet