Professional Documents

Culture Documents

Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 Minutes

Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 Minutes

Uploaded by

Putri Naajihah 4GCopyright:

Available Formats

You might also like

- Maf651 Seminar 2 ReportDocument13 pagesMaf651 Seminar 2 Report2022908185No ratings yet

- 4a. Maf201 Fa - Jul2021 - Q Set1Document9 pages4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielNo ratings yet

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- Ma 2 - Past Year Questions - PMDocument10 pagesMa 2 - Past Year Questions - PMAna FarhanaNo ratings yet

- Group Project GuidelineDocument2 pagesGroup Project Guidelinesyazanii22No ratings yet

- GROUP 1 TAX INCENTIVES (HOTEL & TOURISM) EditedDocument20 pagesGROUP 1 TAX INCENTIVES (HOTEL & TOURISM) Editedmeera yusufNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- URP Income Tax Part SolutionsDocument127 pagesURP Income Tax Part SolutionsSushant MaskeyNo ratings yet

- Maf603-Test 2-Jan 2021-QDocument2 pagesMaf603-Test 2-Jan 2021-QPutri Naajihah 4GNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- Question AIS AssignmentDocument4 pagesQuestion AIS Assignmentfaris ikhwanNo ratings yet

- Test Aud 689 - Apr 2018Document3 pagesTest Aud 689 - Apr 2018Nur Dina AbsbNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- Test 1 Name: Nurul Shafirah Binti Norwadi STUDENT ID: 2019802212 GROUP: BA2425BDocument2 pagesTest 1 Name: Nurul Shafirah Binti Norwadi STUDENT ID: 2019802212 GROUP: BA2425BNurul Shafirah0% (1)

- Solution Far450 - Jun 2014Document7 pagesSolution Far450 - Jun 2014Pablo EkskobaNo ratings yet

- T2 Aud339 July 2021 SS PDFDocument4 pagesT2 Aud339 July 2021 SS PDFNUR LYANA INANI AZMINo ratings yet

- TAX Treatment For TAX267 and TAX317 Budget 2019Document5 pagesTAX Treatment For TAX267 and TAX317 Budget 2019nonameNo ratings yet

- Ch01: Overview of Internal AuditingDocument9 pagesCh01: Overview of Internal AuditingFarah Fazli100% (1)

- GROUP 4 Report MAF682Document18 pagesGROUP 4 Report MAF682Nora ArifahsyaNo ratings yet

- Malaysian Employment Laws HRM581/582: Course InformationDocument7 pagesMalaysian Employment Laws HRM581/582: Course InformationAziraNo ratings yet

- Far570 PresentatiionDocument29 pagesFar570 PresentatiionMuhamad DzulhazreenNo ratings yet

- Solution Maf 635 Dec 2014Document8 pagesSolution Maf 635 Dec 2014anis izzatiNo ratings yet

- Individual Assignment March 2021Document1 pageIndividual Assignment March 2021Muhammad RusydiNo ratings yet

- Reflective Paper MGT430Document5 pagesReflective Paper MGT430AmmarNo ratings yet

- Ind Assignment Fin242 Saiyidah Aisyah Kba1193gDocument15 pagesInd Assignment Fin242 Saiyidah Aisyah Kba1193gsaiyidah AisyahNo ratings yet

- 4 - MAF603 - Cost of CapitalDocument56 pages4 - MAF603 - Cost of CapitalWan WanNo ratings yet

- (Isb548) Assignment 2Document10 pages(Isb548) Assignment 2Ezzah LeeNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Fin533 Group AssignmentDocument23 pagesFin533 Group AssignmentAzwin YusoffNo ratings yet

- Solution Maf503 - Jun 2018Document8 pagesSolution Maf503 - Jun 2018anis izzati100% (1)

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/JULY2020/FAR660/SET1Document6 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/JULY2020/FAR660/SET1auni fildzahNo ratings yet

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- Solution Far670 Dec 2019Document5 pagesSolution Far670 Dec 2019Farissa ElyaNo ratings yet

- MIA By-Laws (On Professional Ethics, Conduct and Practice)Document36 pagesMIA By-Laws (On Professional Ethics, Conduct and Practice)Nur IzzahNo ratings yet

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- Fin 548 Answer SchemeDocument23 pagesFin 548 Answer SchemeDayah Angelofluv100% (1)

- CT Question April 2018Document4 pagesCT Question April 2018Nabila RosmizaNo ratings yet

- SULAM Project Question ListDocument10 pagesSULAM Project Question Listauni fildzahNo ratings yet

- Analisis Misi Pengurusan StrategikDocument4 pagesAnalisis Misi Pengurusan StrategikAienYien LengLeng YengYeng PinkyMeNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- Pitching PDFDocument1 pagePitching PDFkuaci gorengNo ratings yet

- Storyboard: Control Procedure Test of ControlDocument4 pagesStoryboard: Control Procedure Test of ControlhdyhNo ratings yet

- Topic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityDocument7 pagesTopic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityLuqmanulhakim JohariNo ratings yet

- Ent530 - Inahisyam EnterpriseDocument31 pagesEnt530 - Inahisyam EnterpriseAtiqah AzmanNo ratings yet

- Practical Report C2 Adm665 - Athirah 2021120107Document11 pagesPractical Report C2 Adm665 - Athirah 2021120107Liyana AzizNo ratings yet

- Fin544 - Mind Mapping (Chapter 2)Document2 pagesFin544 - Mind Mapping (Chapter 2)nur fatihahNo ratings yet

- Project Report ECO261Document7 pagesProject Report ECO261Amy Joe100% (1)

- Strategic Management Samsung ReportDocument30 pagesStrategic Management Samsung ReportAkshay Patel0% (1)

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Ctu 351Document19 pagesCtu 351afinaramziNo ratings yet

- Contoh - Fin-552-Group-Assignment-Bursa-Marketplace-Stock-Trading-GameDocument22 pagesContoh - Fin-552-Group-Assignment-Bursa-Marketplace-Stock-Trading-GameHuzairul Iqmar ShafiqNo ratings yet

- Notes Ais615Document28 pagesNotes Ais615Bucko BarnesNo ratings yet

- I. Payback Period Same CF Project A Different CF Project BDocument6 pagesI. Payback Period Same CF Project A Different CF Project Bzh12w8No ratings yet

- Solution Far618 - Jul 2017Document10 pagesSolution Far618 - Jul 2017E-cHa PineappleNo ratings yet

- Fin552 - GP AssignmentDocument45 pagesFin552 - GP AssignmentWAN NUR AYUNI ISNINNo ratings yet

- Assignment 1 (Top Fruits Sdn. BHD.)Document20 pagesAssignment 1 (Top Fruits Sdn. BHD.)HunaUe-naNo ratings yet

- Acc407 CH7 PartnershipDocument26 pagesAcc407 CH7 PartnershipBATRISYIA AMANI MUHAMMAD HALIMNo ratings yet

- Implementation of BCG Matrix in Malaysia CompanyDocument20 pagesImplementation of BCG Matrix in Malaysia CompanybubbleteaNo ratings yet

- Solution Dec 2014Document8 pagesSolution Dec 2014anis izzatiNo ratings yet

- Answer Script: Universiti Teknologi Mara Test 1Document7 pagesAnswer Script: Universiti Teknologi Mara Test 1Muhd FakhrullahNo ratings yet

- What Is An Insured DepDocument13 pagesWhat Is An Insured DepRachelle CasimiroNo ratings yet

- Financial Accounting Bbaw2103 FinalDocument18 pagesFinancial Accounting Bbaw2103 FinalmelNo ratings yet

- MNC WordDocument4 pagesMNC WordChristianMarkSebastianNo ratings yet

- Notes in SCM Chapter 3: Product CostingDocument2 pagesNotes in SCM Chapter 3: Product CostingMy PhotographsNo ratings yet

- Fin. Analysis & Project FinancingDocument14 pagesFin. Analysis & Project FinancingBethelhem100% (1)

- Heinrich Research Proposal Final (1) - 1Document76 pagesHeinrich Research Proposal Final (1) - 1Justin Alinafe Mangulama100% (1)

- Connick Company Sells Its Product For 22 Per Unit ItsDocument2 pagesConnick Company Sells Its Product For 22 Per Unit ItsAmit PandeyNo ratings yet

- Cover Letter Fund AccountantDocument4 pagesCover Letter Fund Accountantd0t1f1wujap3100% (1)

- Carlsberg Breweries Annual Report 2022Document123 pagesCarlsberg Breweries Annual Report 2022Sós MelindaNo ratings yet

- The 5 Cs of Credit Underwriting 2010-06Document2 pagesThe 5 Cs of Credit Underwriting 2010-06S.Aji BalaNo ratings yet

- Business Taxation Past Paper 2019 PDFDocument2 pagesBusiness Taxation Past Paper 2019 PDFNouman BaigNo ratings yet

- NC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasDocument48 pagesNC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasFlorinda Gagasa100% (1)

- (Bank Muamalat Indonesia) Training & Development: ZCZB6503 Organization ManagementDocument12 pages(Bank Muamalat Indonesia) Training & Development: ZCZB6503 Organization ManagementMohd AizatNo ratings yet

- Survey Questionnaire For UPI PaymentsDocument3 pagesSurvey Questionnaire For UPI PaymentsArun GautamNo ratings yet

- Blackrock Special Report - Inflation-Linked Bonds PrimerDocument8 pagesBlackrock Special Report - Inflation-Linked Bonds PrimerGreg JachnoNo ratings yet

- Advanced Accounting: Subsidiary Preferred Stock, Consolidated Earnings Per Share, and Consolidated Income TaxationDocument49 pagesAdvanced Accounting: Subsidiary Preferred Stock, Consolidated Earnings Per Share, and Consolidated Income TaxationSt Teresa AvilaNo ratings yet

- Project Template Comparing Tootsie Roll & HersheyDocument16 pagesProject Template Comparing Tootsie Roll & HersheymcmoneysNo ratings yet

- Chap 5Document48 pagesChap 5k60.2113150049No ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Tugas Kelompok Manajemen Keuangan Semester 3Document5 pagesTugas Kelompok Manajemen Keuangan Semester 3IdaNo ratings yet

- IBT002Document6 pagesIBT002Necy AlbuenNo ratings yet

- Engineering EconomicsDocument2 pagesEngineering EconomicsGoverdhan ShresthaNo ratings yet

- Absorption CostingDocument32 pagesAbsorption Costingsknco50% (2)

- Pan HR Solution PVT LTD.: Plot No.9, Sector-4, Vaishali, Ghaziabad (U.P.) 201010Document1 pagePan HR Solution PVT LTD.: Plot No.9, Sector-4, Vaishali, Ghaziabad (U.P.) 201010NOOB GAMERNo ratings yet

- Giggs Mpofu Noma Khu Farm Harvest Tafadzw: What's On Your Mind, Sphasonke?Document1 pageGiggs Mpofu Noma Khu Farm Harvest Tafadzw: What's On Your Mind, Sphasonke?Sphasonke Daniel ZhouNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- Malabanan, Jayvee L - Seatwork #1 PDFDocument2 pagesMalabanan, Jayvee L - Seatwork #1 PDFJv MalabananNo ratings yet

- COL Finance Sample ExamDocument7 pagesCOL Finance Sample ExammedicinenfookiNo ratings yet

Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 Minutes

Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 Minutes

Uploaded by

Putri Naajihah 4GOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 Minutes

Universiti Teknologi Mara Test 2 Course: Corporate Finance Course Code: MAF603 Examination: 9 JANUARY 2021 Time: 1 Hour 15 Minutes

Uploaded by

Putri Naajihah 4GCopyright:

Available Formats

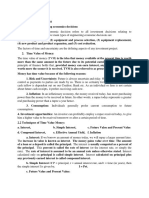

CONFIDENTIAL 1 AC220/JAN 2021/MAF 603

UNIVERSITI TEKNOLOGI MARA

TEST 2

COURSE : CORPORATE FINANCE

COURSE CODE : MAF603

EXAMINATION : 9 JANUARY 2021

TIME : 1 HOUR 15 MINUTES

INSTRUCTIONS TO CANDIDATES

1. This question paper consists of two (2) questions.

2. Write your FULL NAME and STUDENT ID on every pages of your answer paper.

3. Answer ALL questions in English.

4. Submit your answers in a pdf file format to respective GOOGLE CLASSROOM. Use your Full

Name and Student ID as the file name. See example below.

Abdul bin Razak_4C_2018123456

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO SO

This examination paper consists of 3 printed pages

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

CONFIDENTIAL 2 AC220/JAN 2021/MAF 603

QUESTION 1

Kappim Bhd is a levered company that involved in producing metal products. In order to

increase its revenue, the company plans to purchase 2 units of the latest model of furnace

structure from China. The cost of each furnace structure is RM1,450,000 including RM100,000

for transportation cost .

Mr. Fairuz, the vice president of finance has come up with proposed plan on how to raise the

needed funds for the purchase of the furnace structures as presented below:

Sources of funds Proposed issue price Stated Interest Underwriting

or Dividend cost

rate per annum

Redeemable bonds – 12% below 8% 4% on

RM1,000 par value with par value proposed

8 years maturity issue price

Preference shares – 10% above par value 10% 8% on

Par value RM100 per proposed

unit issue price

Ordinary shares EPS RM5 and P/E ratio 3 - 10% on

(inclusive current year proposed

dividends) issue price

The capital structure of Kappim Bhd is considered optimal and it is as follows:

Source of Financing RM

10% Redeemable bonds 2,000,000

8% Preference shares 2,000,000

Ordinary shares 3,500,000

Retained earnings 2,500,000

Last year, the dividends paid to ordinary shareholders was based on the EPS of RM5.00 while

the retention ratio is 70%. The dividend is expected to grow at a constant rate of 4%. The

bonds will be redeemed at par value at the end of the maturity period. Retained earnings

available for reinvestment amounted to RM1,250,000 and the corporate tax rate is 24%.

Required:

a. As the financial manager of the company, Mr. Fairuz asked you to prove him regarding

the cost of raising capital, from the cheapest to the most expensive cost. Compute the

following costs:

i. Cost of bonds

ii. Cost of preference shares

iii. Cost of internal equity

iv. Cost of external equity

(13 marks)

b. If Kappim Bhd were to purchase the furnace structures, which cost of equity it will incur,

kc or knc? Justify your answer.

(3 marks)

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

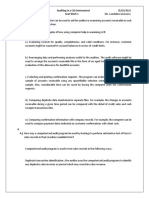

CONFIDENTIAL 3 AC220/JAN 2021/MAF 603

c. Areka Bhd is planning to invest in a new project that is significantly different from its

existing business operations. This company is financed 30% by debt and 70% by equity.

It has identified Mayang Bhd with business operations similar to the proposed investment.

Mayang Bhd has an equity beta of 0.81 and is financed 25% by debt and 75% by equity.

Assume that the risk-free rate of return is 4% per year, and that the equity risk premium is

6% per year. Assume also that all the companies pay tax at a rate of 24% per year.

Calculate a project-specific discount rate for the proposed investment.

(4 marks)

(Total: 20 marks)

QUESTION 2

a. The management team of Amazing Bhd. is considering a financial flexibility in an

investment opportunity. The company would have to raise RM8,000,000 in additional

funds if they were to take up the project. Currently, the company is an all equity and

expects to have perpetual EBIT of RM5,000,000 a year. The existing shareholders of

the company required 8% return for their investment in the company. This investment

opportunity is expected to increase the perpetual EBIT to RM6,000,000. The corporate

tax rate is 24%.

As the corporate financial manager of the company, you have suggested to the Board

of Director that the investment plan is to be financed entirely by 6% convertible bonds.

During the Board of Director meeting, you try to convince them by making statement that

issuing debts will increase the value of company and lower its overall weighted cost of

capital.

Required:

Prove your statements by computing the following:

i. Value of the company before and after capital restructuring.

ii. Overall cost of capital after the restructuring.

(10 marks)

b. ImTech Engineering is involved in construction business. Currently, the company is

ungeared with 40,000 units of ordinary shares outstanding with assets value at

RM1,000,000. The company expects operating income in the current period to be

RM450,000. Suppose that the company can exchange 4,000 unit of ordinary shares for

RM100,000 in debt paying 8% interest, from the standpoint of EPS, would the exchange

be wise? (Assume no tax).

(4 marks)

c. “A firm’s stockholders will never want the firm to invest in projects with negative net

present values”.

Comment on the above statement.

(4 marks)

d. In a world with no taxes, no transaction costs and no costs of financial distress,

“Moderate amount of borrowing will not increase the required return on a firm’s equity”

Is the above statement true or false? Explain.

(2 marks)

(Total: 20 marks)

END OF QUESTION PAPER

© Hak Cipta Universiti Teknologi MARA CONFIDENTIAL

You might also like

- Maf651 Seminar 2 ReportDocument13 pagesMaf651 Seminar 2 Report2022908185No ratings yet

- 4a. Maf201 Fa - Jul2021 - Q Set1Document9 pages4a. Maf201 Fa - Jul2021 - Q Set1Natasha GabrielNo ratings yet

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- Ma 2 - Past Year Questions - PMDocument10 pagesMa 2 - Past Year Questions - PMAna FarhanaNo ratings yet

- Group Project GuidelineDocument2 pagesGroup Project Guidelinesyazanii22No ratings yet

- GROUP 1 TAX INCENTIVES (HOTEL & TOURISM) EditedDocument20 pagesGROUP 1 TAX INCENTIVES (HOTEL & TOURISM) Editedmeera yusufNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- URP Income Tax Part SolutionsDocument127 pagesURP Income Tax Part SolutionsSushant MaskeyNo ratings yet

- Maf603-Test 2-Jan 2021-QDocument2 pagesMaf603-Test 2-Jan 2021-QPutri Naajihah 4GNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- Question AIS AssignmentDocument4 pagesQuestion AIS Assignmentfaris ikhwanNo ratings yet

- Test Aud 689 - Apr 2018Document3 pagesTest Aud 689 - Apr 2018Nur Dina AbsbNo ratings yet

- Far570 Q Test December 2022Document4 pagesFar570 Q Test December 2022fareen faridNo ratings yet

- Test 1 Name: Nurul Shafirah Binti Norwadi STUDENT ID: 2019802212 GROUP: BA2425BDocument2 pagesTest 1 Name: Nurul Shafirah Binti Norwadi STUDENT ID: 2019802212 GROUP: BA2425BNurul Shafirah0% (1)

- Solution Far450 - Jun 2014Document7 pagesSolution Far450 - Jun 2014Pablo EkskobaNo ratings yet

- T2 Aud339 July 2021 SS PDFDocument4 pagesT2 Aud339 July 2021 SS PDFNUR LYANA INANI AZMINo ratings yet

- TAX Treatment For TAX267 and TAX317 Budget 2019Document5 pagesTAX Treatment For TAX267 and TAX317 Budget 2019nonameNo ratings yet

- Ch01: Overview of Internal AuditingDocument9 pagesCh01: Overview of Internal AuditingFarah Fazli100% (1)

- GROUP 4 Report MAF682Document18 pagesGROUP 4 Report MAF682Nora ArifahsyaNo ratings yet

- Malaysian Employment Laws HRM581/582: Course InformationDocument7 pagesMalaysian Employment Laws HRM581/582: Course InformationAziraNo ratings yet

- Far570 PresentatiionDocument29 pagesFar570 PresentatiionMuhamad DzulhazreenNo ratings yet

- Solution Maf 635 Dec 2014Document8 pagesSolution Maf 635 Dec 2014anis izzatiNo ratings yet

- Individual Assignment March 2021Document1 pageIndividual Assignment March 2021Muhammad RusydiNo ratings yet

- Reflective Paper MGT430Document5 pagesReflective Paper MGT430AmmarNo ratings yet

- Ind Assignment Fin242 Saiyidah Aisyah Kba1193gDocument15 pagesInd Assignment Fin242 Saiyidah Aisyah Kba1193gsaiyidah AisyahNo ratings yet

- 4 - MAF603 - Cost of CapitalDocument56 pages4 - MAF603 - Cost of CapitalWan WanNo ratings yet

- (Isb548) Assignment 2Document10 pages(Isb548) Assignment 2Ezzah LeeNo ratings yet

- TEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Document3 pagesTEST FAR670 - OCT2022 (NACAB10B) - 10 Dec 2022Fatin AqilahNo ratings yet

- Fin533 Group AssignmentDocument23 pagesFin533 Group AssignmentAzwin YusoffNo ratings yet

- Solution Maf503 - Jun 2018Document8 pagesSolution Maf503 - Jun 2018anis izzati100% (1)

- Universiti Teknologi Mara Final Assessment: Confidential 1 AC/JULY2020/FAR660/SET1Document6 pagesUniversiti Teknologi Mara Final Assessment: Confidential 1 AC/JULY2020/FAR660/SET1auni fildzahNo ratings yet

- Test FAR 570 Feb 2021Document2 pagesTest FAR 570 Feb 2021Putri Naajihah 4GNo ratings yet

- Solution Far670 Dec 2019Document5 pagesSolution Far670 Dec 2019Farissa ElyaNo ratings yet

- MIA By-Laws (On Professional Ethics, Conduct and Practice)Document36 pagesMIA By-Laws (On Professional Ethics, Conduct and Practice)Nur IzzahNo ratings yet

- Read The Following Excerpt From A Complaint Filed by TheDocument1 pageRead The Following Excerpt From A Complaint Filed by TheLet's Talk With Hassan0% (1)

- Fin 548 Answer SchemeDocument23 pagesFin 548 Answer SchemeDayah Angelofluv100% (1)

- CT Question April 2018Document4 pagesCT Question April 2018Nabila RosmizaNo ratings yet

- SULAM Project Question ListDocument10 pagesSULAM Project Question Listauni fildzahNo ratings yet

- Analisis Misi Pengurusan StrategikDocument4 pagesAnalisis Misi Pengurusan StrategikAienYien LengLeng YengYeng PinkyMeNo ratings yet

- Acc406 - Feb 2021 - Q - Set 1Document14 pagesAcc406 - Feb 2021 - Q - Set 1NABILA NADHIRAH ROSLANNo ratings yet

- Pitching PDFDocument1 pagePitching PDFkuaci gorengNo ratings yet

- Storyboard: Control Procedure Test of ControlDocument4 pagesStoryboard: Control Procedure Test of ControlhdyhNo ratings yet

- Topic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityDocument7 pagesTopic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityLuqmanulhakim JohariNo ratings yet

- Ent530 - Inahisyam EnterpriseDocument31 pagesEnt530 - Inahisyam EnterpriseAtiqah AzmanNo ratings yet

- Practical Report C2 Adm665 - Athirah 2021120107Document11 pagesPractical Report C2 Adm665 - Athirah 2021120107Liyana AzizNo ratings yet

- Fin544 - Mind Mapping (Chapter 2)Document2 pagesFin544 - Mind Mapping (Chapter 2)nur fatihahNo ratings yet

- Project Report ECO261Document7 pagesProject Report ECO261Amy Joe100% (1)

- Strategic Management Samsung ReportDocument30 pagesStrategic Management Samsung ReportAkshay Patel0% (1)

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocument5 pagesFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNo ratings yet

- Ctu 351Document19 pagesCtu 351afinaramziNo ratings yet

- Contoh - Fin-552-Group-Assignment-Bursa-Marketplace-Stock-Trading-GameDocument22 pagesContoh - Fin-552-Group-Assignment-Bursa-Marketplace-Stock-Trading-GameHuzairul Iqmar ShafiqNo ratings yet

- Notes Ais615Document28 pagesNotes Ais615Bucko BarnesNo ratings yet

- I. Payback Period Same CF Project A Different CF Project BDocument6 pagesI. Payback Period Same CF Project A Different CF Project Bzh12w8No ratings yet

- Solution Far618 - Jul 2017Document10 pagesSolution Far618 - Jul 2017E-cHa PineappleNo ratings yet

- Fin552 - GP AssignmentDocument45 pagesFin552 - GP AssignmentWAN NUR AYUNI ISNINNo ratings yet

- Assignment 1 (Top Fruits Sdn. BHD.)Document20 pagesAssignment 1 (Top Fruits Sdn. BHD.)HunaUe-naNo ratings yet

- Acc407 CH7 PartnershipDocument26 pagesAcc407 CH7 PartnershipBATRISYIA AMANI MUHAMMAD HALIMNo ratings yet

- Implementation of BCG Matrix in Malaysia CompanyDocument20 pagesImplementation of BCG Matrix in Malaysia CompanybubbleteaNo ratings yet

- Solution Dec 2014Document8 pagesSolution Dec 2014anis izzatiNo ratings yet

- Answer Script: Universiti Teknologi Mara Test 1Document7 pagesAnswer Script: Universiti Teknologi Mara Test 1Muhd FakhrullahNo ratings yet

- What Is An Insured DepDocument13 pagesWhat Is An Insured DepRachelle CasimiroNo ratings yet

- Financial Accounting Bbaw2103 FinalDocument18 pagesFinancial Accounting Bbaw2103 FinalmelNo ratings yet

- MNC WordDocument4 pagesMNC WordChristianMarkSebastianNo ratings yet

- Notes in SCM Chapter 3: Product CostingDocument2 pagesNotes in SCM Chapter 3: Product CostingMy PhotographsNo ratings yet

- Fin. Analysis & Project FinancingDocument14 pagesFin. Analysis & Project FinancingBethelhem100% (1)

- Heinrich Research Proposal Final (1) - 1Document76 pagesHeinrich Research Proposal Final (1) - 1Justin Alinafe Mangulama100% (1)

- Connick Company Sells Its Product For 22 Per Unit ItsDocument2 pagesConnick Company Sells Its Product For 22 Per Unit ItsAmit PandeyNo ratings yet

- Cover Letter Fund AccountantDocument4 pagesCover Letter Fund Accountantd0t1f1wujap3100% (1)

- Carlsberg Breweries Annual Report 2022Document123 pagesCarlsberg Breweries Annual Report 2022Sós MelindaNo ratings yet

- The 5 Cs of Credit Underwriting 2010-06Document2 pagesThe 5 Cs of Credit Underwriting 2010-06S.Aji BalaNo ratings yet

- Business Taxation Past Paper 2019 PDFDocument2 pagesBusiness Taxation Past Paper 2019 PDFNouman BaigNo ratings yet

- NC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasDocument48 pagesNC Iii Bookkeeping: Prepared By: Jubailyn V. VillegasFlorinda Gagasa100% (1)

- (Bank Muamalat Indonesia) Training & Development: ZCZB6503 Organization ManagementDocument12 pages(Bank Muamalat Indonesia) Training & Development: ZCZB6503 Organization ManagementMohd AizatNo ratings yet

- Survey Questionnaire For UPI PaymentsDocument3 pagesSurvey Questionnaire For UPI PaymentsArun GautamNo ratings yet

- Blackrock Special Report - Inflation-Linked Bonds PrimerDocument8 pagesBlackrock Special Report - Inflation-Linked Bonds PrimerGreg JachnoNo ratings yet

- Advanced Accounting: Subsidiary Preferred Stock, Consolidated Earnings Per Share, and Consolidated Income TaxationDocument49 pagesAdvanced Accounting: Subsidiary Preferred Stock, Consolidated Earnings Per Share, and Consolidated Income TaxationSt Teresa AvilaNo ratings yet

- Project Template Comparing Tootsie Roll & HersheyDocument16 pagesProject Template Comparing Tootsie Roll & HersheymcmoneysNo ratings yet

- Chap 5Document48 pagesChap 5k60.2113150049No ratings yet

- PSU Banks Comparative Analysis FY21Document10 pagesPSU Banks Comparative Analysis FY21Ganesh V0% (1)

- Tugas Kelompok Manajemen Keuangan Semester 3Document5 pagesTugas Kelompok Manajemen Keuangan Semester 3IdaNo ratings yet

- IBT002Document6 pagesIBT002Necy AlbuenNo ratings yet

- Engineering EconomicsDocument2 pagesEngineering EconomicsGoverdhan ShresthaNo ratings yet

- Absorption CostingDocument32 pagesAbsorption Costingsknco50% (2)

- Pan HR Solution PVT LTD.: Plot No.9, Sector-4, Vaishali, Ghaziabad (U.P.) 201010Document1 pagePan HR Solution PVT LTD.: Plot No.9, Sector-4, Vaishali, Ghaziabad (U.P.) 201010NOOB GAMERNo ratings yet

- Giggs Mpofu Noma Khu Farm Harvest Tafadzw: What's On Your Mind, Sphasonke?Document1 pageGiggs Mpofu Noma Khu Farm Harvest Tafadzw: What's On Your Mind, Sphasonke?Sphasonke Daniel ZhouNo ratings yet

- Answer Key Far Assessment Questionairre 1Document22 pagesAnswer Key Far Assessment Questionairre 1Johnfree VallinasNo ratings yet

- Malabanan, Jayvee L - Seatwork #1 PDFDocument2 pagesMalabanan, Jayvee L - Seatwork #1 PDFJv MalabananNo ratings yet

- COL Finance Sample ExamDocument7 pagesCOL Finance Sample ExammedicinenfookiNo ratings yet