Professional Documents

Culture Documents

HO1 Problems and Exercises

HO1 Problems and Exercises

Uploaded by

Guiana WacasCopyright:

Available Formats

You might also like

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- TOP 3-2-045 Small Arms - Hand and Shoulder Weapons and MachinegunsDocument87 pagesTOP 3-2-045 Small Arms - Hand and Shoulder Weapons and Machinegunsktech_stlNo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- PRACTICE MATERIAL - Accounting EquationDocument6 pagesPRACTICE MATERIAL - Accounting EquationWaqar Ahmad100% (1)

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcNo ratings yet

- First Activity - Basic Accounting - Accounting EquationDocument14 pagesFirst Activity - Basic Accounting - Accounting EquationKyleZapantaNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- FABM1 11 Quarter 4 Week 2 Las 2Document1 pageFABM1 11 Quarter 4 Week 2 Las 2Janna PleteNo ratings yet

- Ganibo - Fabm Accounting EquationDocument6 pagesGanibo - Fabm Accounting EquationShereen Mallorca GaniboNo ratings yet

- Worksheet 1 DR CRDocument5 pagesWorksheet 1 DR CRMc Clent CervantesNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfDocument85 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonNo ratings yet

- Book 1Document2 pagesBook 1VIRAY, CRISTIAN JAY V.No ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- Accounting For Sole Proprietorship Problem3-6Document3 pagesAccounting For Sole Proprietorship Problem3-6Rocel Domingo100% (1)

- Activity 2 - FABM1Document2 pagesActivity 2 - FABM1Mary Arlene C. DionisioNo ratings yet

- Chapter 3 Exercises and Problems AnswersDocument6 pagesChapter 3 Exercises and Problems AnswersIskaNo ratings yet

- Sale of Firms Q-2Document3 pagesSale of Firms Q-2kalyanikamineniNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Practice Problem - Week1 3 - WITH ANSWERSDocument2 pagesPractice Problem - Week1 3 - WITH ANSWERSBb ParkNo ratings yet

- Exercise No. 1 - 1ST Sem 2021Document5 pagesExercise No. 1 - 1ST Sem 2021CHRISTEA MAUSISANo ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocument1 pageInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNo ratings yet

- Ganibo - FABM BALANCINGDocument5 pagesGanibo - FABM BALANCINGShereen Mallorca GaniboNo ratings yet

- Accounting Equation ch4Document13 pagesAccounting Equation ch4Ebony Ann delos SantosNo ratings yet

- Accounting Equation ch5Document19 pagesAccounting Equation ch5Ebony Ann delos SantosNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Bahas Latihan TM11-1 2Document7 pagesBahas Latihan TM11-1 2Shely NaNo ratings yet

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Bahas Latihan TM11-1Document7 pagesBahas Latihan TM11-1Julia Pratiwi ParhusipNo ratings yet

- B, Capital After Admission 480,000: Problem 1 #1Document6 pagesB, Capital After Admission 480,000: Problem 1 #1Alizah BucotNo ratings yet

- AccountingDocument5 pagesAccountingLycel BelenNo ratings yet

- WorksheetDocument37 pagesWorksheetKim FloresNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDocument7 pagesSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (50)

- Assignment 1Document4 pagesAssignment 1Mae RocelleNo ratings yet

- Activity Analyzing TransactionsDocument7 pagesActivity Analyzing TransactionsalexamajeranoNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Business Finance - Chapter 2 Assessment 1 - Rudsan T.Document3 pagesBusiness Finance - Chapter 2 Assessment 1 - Rudsan T.Rudsan TurquezaNo ratings yet

- Asistensi 1 Kunci JawabanDocument7 pagesAsistensi 1 Kunci JawabanNur Fitriah Ayuning BudiNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Advanced Accounting 4Document2 pagesAdvanced Accounting 4Tax TrainingNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- FABM AssDocument4 pagesFABM AssJealou HoneyNo ratings yet

- Exercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Document1 pageExercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Yến HuỳnhNo ratings yet

- MODULE 3 Step 1Document7 pagesMODULE 3 Step 1yugyeom rojasNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Assignment No. 6Document14 pagesAssignment No. 6Angela MacailaoNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- Solution DocumentDocument13 pagesSolution DocumentMobeen AhmadNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationGwen Ashley Dela PenaNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PAYROLLDocument10 pagesPAYROLLGuiana WacasNo ratings yet

- This Study Resource Was Shared Via: B. Working Capital ManagementDocument6 pagesThis Study Resource Was Shared Via: B. Working Capital ManagementGuiana WacasNo ratings yet

- Employee Information: Record No. 1 2Document32 pagesEmployee Information: Record No. 1 2Guiana WacasNo ratings yet

- Chapter 6Document6 pagesChapter 6Guiana Wacas100% (2)

- Doremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Document4 pagesDoremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Guiana WacasNo ratings yet

- Chap 8, UnfinishedDocument11 pagesChap 8, UnfinishedGuiana WacasNo ratings yet

- Enumerate The Purpose of Sensory System Evaluation To The Integrity of The Integumentary SystemDocument2 pagesEnumerate The Purpose of Sensory System Evaluation To The Integrity of The Integumentary SystemGuiana WacasNo ratings yet

- Worksheet Reversing EntriesDocument20 pagesWorksheet Reversing EntriesGuiana Wacas100% (1)

- Fol Haws Catering Service Exercise-1Document16 pagesFol Haws Catering Service Exercise-1Guiana WacasNo ratings yet

- Megometro FlukeDocument3 pagesMegometro FlukeFernando CaravanaNo ratings yet

- IBF-ITF-Reederei NORD CBA 2012-2014 PDFDocument29 pagesIBF-ITF-Reederei NORD CBA 2012-2014 PDFGeorge TopoleanuNo ratings yet

- Introduction To Educational Research Connecting Methods To Practice 1St Edition Lochmiller Test Bank Full Chapter PDFDocument32 pagesIntroduction To Educational Research Connecting Methods To Practice 1St Edition Lochmiller Test Bank Full Chapter PDFmargaret.clark112100% (15)

- Drones 06 00019 v2Document19 pagesDrones 06 00019 v2GERALD BRANDI CAINICELA AQUINONo ratings yet

- Mmbg-Iil-Kkp-Es - 2122-04222Document11 pagesMmbg-Iil-Kkp-Es - 2122-04222Blue VisionNo ratings yet

- Emirates Boarding PaasDocument2 pagesEmirates Boarding PaasVaibhav SuranaaNo ratings yet

- Assignment On GarmentDocument18 pagesAssignment On GarmentAhmed BhaiNo ratings yet

- Business PlanDocument28 pagesBusiness PlanAnitaNo ratings yet

- Chapter 5,6 Regression AnalysisDocument44 pagesChapter 5,6 Regression AnalysisSumeshNo ratings yet

- Youtubedownloader CodeDocument3 pagesYoutubedownloader CodeYusa 85No ratings yet

- Vistuc EstatesDocument9 pagesVistuc EstatesLegal CheekNo ratings yet

- Fly Ash BricksDocument6 pagesFly Ash BricksAnil AroraNo ratings yet

- Mechanical Abbreviations and Symbols: Project Number: 629 - 247637Document30 pagesMechanical Abbreviations and Symbols: Project Number: 629 - 247637phlxuNo ratings yet

- Principles of ManagementDocument18 pagesPrinciples of ManagementAnideep SethNo ratings yet

- Questoes Certificado B2 CDocument50 pagesQuestoes Certificado B2 CGIOVANE GOMES SILVA0% (1)

- Fascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting Property. TheDocument27 pagesFascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting Property. TheSushant ShuklaNo ratings yet

- Appendix A: A.1. Three Phase SeparatorDocument48 pagesAppendix A: A.1. Three Phase SeparatorNhaaaeyNo ratings yet

- Jcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Document1 pageJcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Leah C.No ratings yet

- NMR Solvent Data ChartDocument2 pagesNMR Solvent Data ChartNGUYỄN HOÀNG LINHNo ratings yet

- Application of GA For Optimal Location of FACTS Devices For Steady State Voltage Stability Enhancement of Power SystemDocument7 pagesApplication of GA For Optimal Location of FACTS Devices For Steady State Voltage Stability Enhancement of Power SystemSuryaNo ratings yet

- 4.1 Elizabeth Kolsky - Codification and The Rule of Colonial DifferenceDocument10 pages4.1 Elizabeth Kolsky - Codification and The Rule of Colonial DifferenceManju NadgerNo ratings yet

- VG5 Series Installation & Quick-Start Manual: (Revision F)Document113 pagesVG5 Series Installation & Quick-Start Manual: (Revision F)Edward Oswaldo Martinez RochaNo ratings yet

- Cisco Networking Academy Program Ccna: ISBN-13 TitleDocument5 pagesCisco Networking Academy Program Ccna: ISBN-13 TitlechrisgrooveNo ratings yet

- Notes Ones Twos ComplementDocument4 pagesNotes Ones Twos Complementindula123No ratings yet

- A Demonstration Plan in EPP 6 I. Learning OutcomesDocument4 pagesA Demonstration Plan in EPP 6 I. Learning Outcomeshezil CuangueyNo ratings yet

- Home Automation SystemDocument10 pagesHome Automation SystemrutvaNo ratings yet

- Sap Cpi Roadmap 2023Document7 pagesSap Cpi Roadmap 2023Emar AliNo ratings yet

- Preparing For GO!Enterprise MDM On-Demand Service: This Guide Provides Information On - .Document11 pagesPreparing For GO!Enterprise MDM On-Demand Service: This Guide Provides Information On - .Jarbas SpNo ratings yet

- 2023-06-28Document1,532 pages2023-06-28X YzNo ratings yet

HO1 Problems and Exercises

HO1 Problems and Exercises

Uploaded by

Guiana WacasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

HO1 Problems and Exercises

HO1 Problems and Exercises

Uploaded by

Guiana WacasCopyright:

Available Formats

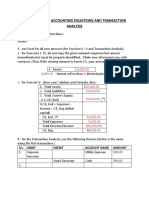

HO1 - Introduction to Accounting AE 100

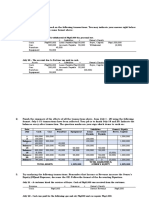

Exercise 1: Identify the effects (Increase or Decrease) of the following transactions on the assets, liabilities and

owners’ equity or capital

Assets Liabilities OE

1. Purchased office supplies by paying cash Increase (Office

supplies)

Decrease (Cash)

2. Purchased inventory on account. Increase Decrease

3. Paid the utilities bill. Decrease Decrease(expense)

4. The owner withdrew money from business Decrease Decrease(drawings)

for personal use.

5. Bought a building. Paid half of the price in Increase (building) Increase

cash and the balance as note payable. Decrease (cash)

6. Received cash from one of the clients who Increase Increase (revenue)

owed to the company.

7. Paid salary to the staff. Decrease Decrease (expense)

8. Earned service revenue on account. Increase Increase (revenue)

9. Lost equipment in fire. Decrease Decrease (expense)

Exercise 2: Show the effects of the following transactions on the assets, liabilities and capital accounts. Compute

the balances of the accounts after every transaction.

A. Started the business with P150,000 cash investment.

B. Purchased furniture and fixture for P25,000 cash.

C. Purchased merchandise inventory amounting to P75,000 (P50,000 cash; P25,000 credit).

D. Sold merchandise costing 15,000 for P17,000 cash.

E. Sold merchandise costing P10,000 for P10,500 on credit.

F. Paid utilities P2,500 utilities expense.

G. Withdrawal of owner of P1,000.

H. Collected the receivable from transaction E.

I. Paid advertising expense worth 2,500.

J. Invested additional P5,000 cash.

Assets Liabilities Capital

Cash Accounts Inventory Fixed Accounts Owner’s Withdr Revenues Expenses

Receivable Assets Payable Capital awals

A 150,000 150,000

Balance 150,000 150,000

s

B -25,000 25,000

Balance 125,000 25,000 150,000

s

C -50,000 75,000 25,000

Balance 75,000 75,000 25,000 25000 150,000

s

D 17,000 17,000

Balance 92,000 75,000 25,000 25,000 150,000 17,000

s

E 10,500 10,500

Balance 92,000 10,500 75,000 25,000 25,000 150000 27,500

s

F -2,500 -2,500

Balance 89,500 10,500 75,000 25,000 25,000 150,000 27,500 -2500

s

G -1000 -1000

Balance 88,500 10,500 75,000 25,000 25,000 150,000 -1000 27,500 -2500

s

H 10,500 -10,500

Balance 99000 0 75,000 25,000 25,000 150,000 -1000 27,500 -2500

s

I -2,500 -2500

Balance 96500 0 75,000 25,000 25,000 150,000 -1000 27,500 -5000

s

HO1 - Introduction to Accounting AE 100

J 5000 5000

Balance 101500 0 75,000 25,000 25,000 155000 -1000 27,500 -5000

s

79000+75000+25000= 25,000+150,000+27,500-2,500

201500=201500

Exercise 3: Fill in the unknown values in the accounting equation for each entity (in Php).

Assets Liabilities Owners’ Equity

Company A 288.600 185.400 103.200

Company B 32.950 15.950 17.000

Company C 16.340 5.960 10.380

Exercise 4: Multiple Choice

1. During the year 2002, the assets of Murray Company decreased by Php20,000, and its liabilities decreased by

Php7,000. If the ending balance of the Stockholders’ Equity account was Php70,000, the beginning balance must be:

a. Php57,000.

b. Php83,000.

c. Php87,000.

d. Php97,000.

2. If total stockholders’ equity decreased by Php5,000 during a year and total liabilities increased by Php14,000 during the

year, the total assets must have

a. increased by Php19,000 during the year.

b. decreased by Php19,000 during the year.

c. increased by Php9,000 during the year.

d. decreased by Php9,000 during the year.

3. The total assets of Brennan Company equals three times its total liabilities. If the stockholders' equity is Php120,000,

the total assets must be

a. Php60,000.

b. Php180,000.

c. Php240,000.

d. Php360,000.

You might also like

- AHM13e Chapter - 02 - Solution To Problems and Key To CasesDocument23 pagesAHM13e Chapter - 02 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- TOP 3-2-045 Small Arms - Hand and Shoulder Weapons and MachinegunsDocument87 pagesTOP 3-2-045 Small Arms - Hand and Shoulder Weapons and Machinegunsktech_stlNo ratings yet

- 605701b41234414fbf70f2a0d6734ae1Document3 pages605701b41234414fbf70f2a0d6734ae1BabaNo ratings yet

- PRACTICE MATERIAL - Accounting EquationDocument6 pagesPRACTICE MATERIAL - Accounting EquationWaqar Ahmad100% (1)

- CHAPTER 3 (Accounting Equation)Document5 pagesCHAPTER 3 (Accounting Equation)lcNo ratings yet

- First Activity - Basic Accounting - Accounting EquationDocument14 pagesFirst Activity - Basic Accounting - Accounting EquationKyleZapantaNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- FABM1 11 Quarter 4 Week 2 Las 2Document1 pageFABM1 11 Quarter 4 Week 2 Las 2Janna PleteNo ratings yet

- Ganibo - Fabm Accounting EquationDocument6 pagesGanibo - Fabm Accounting EquationShereen Mallorca GaniboNo ratings yet

- Worksheet 1 DR CRDocument5 pagesWorksheet 1 DR CRMc Clent CervantesNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015pdfDocument85 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015pdfGenevieve Anne AlagonNo ratings yet

- Book 1Document2 pagesBook 1VIRAY, CRISTIAN JAY V.No ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- Accounting For Sole Proprietorship Problem3-6Document3 pagesAccounting For Sole Proprietorship Problem3-6Rocel Domingo100% (1)

- Activity 2 - FABM1Document2 pagesActivity 2 - FABM1Mary Arlene C. DionisioNo ratings yet

- Chapter 3 Exercises and Problems AnswersDocument6 pagesChapter 3 Exercises and Problems AnswersIskaNo ratings yet

- Sale of Firms Q-2Document3 pagesSale of Firms Q-2kalyanikamineniNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Practice Problem - Week1 3 - WITH ANSWERSDocument2 pagesPractice Problem - Week1 3 - WITH ANSWERSBb ParkNo ratings yet

- Exercise No. 1 - 1ST Sem 2021Document5 pagesExercise No. 1 - 1ST Sem 2021CHRISTEA MAUSISANo ratings yet

- Problem No 5 (Acctg. 1)Document5 pagesProblem No 5 (Acctg. 1)Ash imoNo ratings yet

- Instructions: Amazon Seller Buys Printer Supplies For $29 With CashDocument1 pageInstructions: Amazon Seller Buys Printer Supplies For $29 With CashJorge FloresNo ratings yet

- Ganibo - FABM BALANCINGDocument5 pagesGanibo - FABM BALANCINGShereen Mallorca GaniboNo ratings yet

- Accounting Equation ch4Document13 pagesAccounting Equation ch4Ebony Ann delos SantosNo ratings yet

- Accounting Equation ch5Document19 pagesAccounting Equation ch5Ebony Ann delos SantosNo ratings yet

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons theNo ratings yet

- Financial and Managerial Accounting PDFDocument1 pageFinancial and Managerial Accounting PDFcons theNo ratings yet

- Bahas Latihan TM11-1 2Document7 pagesBahas Latihan TM11-1 2Shely NaNo ratings yet

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Bahas Latihan TM11-1Document7 pagesBahas Latihan TM11-1Julia Pratiwi ParhusipNo ratings yet

- B, Capital After Admission 480,000: Problem 1 #1Document6 pagesB, Capital After Admission 480,000: Problem 1 #1Alizah BucotNo ratings yet

- AccountingDocument5 pagesAccountingLycel BelenNo ratings yet

- WorksheetDocument37 pagesWorksheetKim FloresNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- ACT #4 - Jewel Ann C. Penaranda - ACT213Document20 pagesACT #4 - Jewel Ann C. Penaranda - ACT213JEWELL ANN PENARANDA100% (1)

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDocument7 pagesSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (50)

- Assignment 1Document4 pagesAssignment 1Mae RocelleNo ratings yet

- Activity Analyzing TransactionsDocument7 pagesActivity Analyzing TransactionsalexamajeranoNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Business Finance - Chapter 2 Assessment 1 - Rudsan T.Document3 pagesBusiness Finance - Chapter 2 Assessment 1 - Rudsan T.Rudsan TurquezaNo ratings yet

- Asistensi 1 Kunci JawabanDocument7 pagesAsistensi 1 Kunci JawabanNur Fitriah Ayuning BudiNo ratings yet

- PDF Solution Manual Partnership Amp Corporation 2014 2015 PDFDocument91 pagesPDF Solution Manual Partnership Amp Corporation 2014 2015 PDFGarp BarrocaNo ratings yet

- Advanced Accounting 4Document2 pagesAdvanced Accounting 4Tax TrainingNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- FABM AssDocument4 pagesFABM AssJealou HoneyNo ratings yet

- Exercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Document1 pageExercise of Chapter 1 - Introduction To Accounting and Businesses - Page 45Yến HuỳnhNo ratings yet

- MODULE 3 Step 1Document7 pagesMODULE 3 Step 1yugyeom rojasNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Assignment No. 6Document14 pagesAssignment No. 6Angela MacailaoNo ratings yet

- Accbp100 3rd Exam AnswersDocument8 pagesAccbp100 3rd Exam AnswersAlthea Marie OrtizNo ratings yet

- Solution DocumentDocument13 pagesSolution DocumentMobeen AhmadNo ratings yet

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDocument9 pagesAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNo ratings yet

- Accounting EquationDocument4 pagesAccounting EquationGwen Ashley Dela PenaNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- PAYROLLDocument10 pagesPAYROLLGuiana WacasNo ratings yet

- This Study Resource Was Shared Via: B. Working Capital ManagementDocument6 pagesThis Study Resource Was Shared Via: B. Working Capital ManagementGuiana WacasNo ratings yet

- Employee Information: Record No. 1 2Document32 pagesEmployee Information: Record No. 1 2Guiana WacasNo ratings yet

- Chapter 6Document6 pagesChapter 6Guiana Wacas100% (2)

- Doremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Document4 pagesDoremi Partnership: Do, Capital (20%) Re, Capital (30%) Mi, Capital (50%)Guiana WacasNo ratings yet

- Chap 8, UnfinishedDocument11 pagesChap 8, UnfinishedGuiana WacasNo ratings yet

- Enumerate The Purpose of Sensory System Evaluation To The Integrity of The Integumentary SystemDocument2 pagesEnumerate The Purpose of Sensory System Evaluation To The Integrity of The Integumentary SystemGuiana WacasNo ratings yet

- Worksheet Reversing EntriesDocument20 pagesWorksheet Reversing EntriesGuiana Wacas100% (1)

- Fol Haws Catering Service Exercise-1Document16 pagesFol Haws Catering Service Exercise-1Guiana WacasNo ratings yet

- Megometro FlukeDocument3 pagesMegometro FlukeFernando CaravanaNo ratings yet

- IBF-ITF-Reederei NORD CBA 2012-2014 PDFDocument29 pagesIBF-ITF-Reederei NORD CBA 2012-2014 PDFGeorge TopoleanuNo ratings yet

- Introduction To Educational Research Connecting Methods To Practice 1St Edition Lochmiller Test Bank Full Chapter PDFDocument32 pagesIntroduction To Educational Research Connecting Methods To Practice 1St Edition Lochmiller Test Bank Full Chapter PDFmargaret.clark112100% (15)

- Drones 06 00019 v2Document19 pagesDrones 06 00019 v2GERALD BRANDI CAINICELA AQUINONo ratings yet

- Mmbg-Iil-Kkp-Es - 2122-04222Document11 pagesMmbg-Iil-Kkp-Es - 2122-04222Blue VisionNo ratings yet

- Emirates Boarding PaasDocument2 pagesEmirates Boarding PaasVaibhav SuranaaNo ratings yet

- Assignment On GarmentDocument18 pagesAssignment On GarmentAhmed BhaiNo ratings yet

- Business PlanDocument28 pagesBusiness PlanAnitaNo ratings yet

- Chapter 5,6 Regression AnalysisDocument44 pagesChapter 5,6 Regression AnalysisSumeshNo ratings yet

- Youtubedownloader CodeDocument3 pagesYoutubedownloader CodeYusa 85No ratings yet

- Vistuc EstatesDocument9 pagesVistuc EstatesLegal CheekNo ratings yet

- Fly Ash BricksDocument6 pagesFly Ash BricksAnil AroraNo ratings yet

- Mechanical Abbreviations and Symbols: Project Number: 629 - 247637Document30 pagesMechanical Abbreviations and Symbols: Project Number: 629 - 247637phlxuNo ratings yet

- Principles of ManagementDocument18 pagesPrinciples of ManagementAnideep SethNo ratings yet

- Questoes Certificado B2 CDocument50 pagesQuestoes Certificado B2 CGIOVANE GOMES SILVA0% (1)

- Fascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting Property. TheDocument27 pagesFascinating Numbers: Some Numbers of 3 Digits or More Exhibit A Very Interesting Property. TheSushant ShuklaNo ratings yet

- Appendix A: A.1. Three Phase SeparatorDocument48 pagesAppendix A: A.1. Three Phase SeparatorNhaaaeyNo ratings yet

- Jcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Document1 pageJcpenney Mini-Case 1. What Strategy Was The New Ceo at Jcpenney Seeking To Implement Given The Generic Strategies Found in Chapter 4?Leah C.No ratings yet

- NMR Solvent Data ChartDocument2 pagesNMR Solvent Data ChartNGUYỄN HOÀNG LINHNo ratings yet

- Application of GA For Optimal Location of FACTS Devices For Steady State Voltage Stability Enhancement of Power SystemDocument7 pagesApplication of GA For Optimal Location of FACTS Devices For Steady State Voltage Stability Enhancement of Power SystemSuryaNo ratings yet

- 4.1 Elizabeth Kolsky - Codification and The Rule of Colonial DifferenceDocument10 pages4.1 Elizabeth Kolsky - Codification and The Rule of Colonial DifferenceManju NadgerNo ratings yet

- VG5 Series Installation & Quick-Start Manual: (Revision F)Document113 pagesVG5 Series Installation & Quick-Start Manual: (Revision F)Edward Oswaldo Martinez RochaNo ratings yet

- Cisco Networking Academy Program Ccna: ISBN-13 TitleDocument5 pagesCisco Networking Academy Program Ccna: ISBN-13 TitlechrisgrooveNo ratings yet

- Notes Ones Twos ComplementDocument4 pagesNotes Ones Twos Complementindula123No ratings yet

- A Demonstration Plan in EPP 6 I. Learning OutcomesDocument4 pagesA Demonstration Plan in EPP 6 I. Learning Outcomeshezil CuangueyNo ratings yet

- Home Automation SystemDocument10 pagesHome Automation SystemrutvaNo ratings yet

- Sap Cpi Roadmap 2023Document7 pagesSap Cpi Roadmap 2023Emar AliNo ratings yet

- Preparing For GO!Enterprise MDM On-Demand Service: This Guide Provides Information On - .Document11 pagesPreparing For GO!Enterprise MDM On-Demand Service: This Guide Provides Information On - .Jarbas SpNo ratings yet

- 2023-06-28Document1,532 pages2023-06-28X YzNo ratings yet