Professional Documents

Culture Documents

BSA 3202 Topic 1 - Investment in Associates

BSA 3202 Topic 1 - Investment in Associates

Uploaded by

Francis AbuyuanCopyright:

Available Formats

You might also like

- Financial Asset FV Martin SalipadaDocument18 pagesFinancial Asset FV Martin SalipadaKaren Joy Magsayo100% (2)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho100% (2)

- AC 1201 - Financial Assets at Fair ValueDocument14 pagesAC 1201 - Financial Assets at Fair ValueCarmelou Gavril Garcia Climaco100% (5)

- Palmones Adrio B. Investment in Equity SecuritiesDocument18 pagesPalmones Adrio B. Investment in Equity SecuritiesAndrei GoNo ratings yet

- Activity 2 Investments in Equity SecuritiesDocument4 pagesActivity 2 Investments in Equity SecuritiesVi Vid100% (5)

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- FINAL-Investment in AssociateDocument16 pagesFINAL-Investment in AssociateJessa75% (4)

- Investments in Associates FA AC OverviewDocument85 pagesInvestments in Associates FA AC OverviewHannah Shaira Clemente73% (11)

- Chapter16 Equity Investments PDFDocument69 pagesChapter16 Equity Investments PDFRomuell BanaresNo ratings yet

- Intermediate Accounting Volume 1 Valix, Peralta and Valix (2020)Document69 pagesIntermediate Accounting Volume 1 Valix, Peralta and Valix (2020)Romuell Banares100% (3)

- AssignmentDocument3 pagesAssignmentFrancis Abuyuan100% (1)

- Revisiting The Jalong Ambush Site (Hussars)Document41 pagesRevisiting The Jalong Ambush Site (Hussars)stmcipohNo ratings yet

- Cash Receipts System Narrative 2010 v3Document4 pagesCash Receipts System Narrative 2010 v3cristel jane FullonesNo ratings yet

- Financial Asset at Amortized CostDocument20 pagesFinancial Asset at Amortized CostJudith Gabutero0% (1)

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocument3 pagesMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- INVESTMENTS With AnswersDocument3 pagesINVESTMENTS With AnswersShaira BugayongNo ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Chapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Document5 pagesChapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Reinalyn Mendoza75% (4)

- Requirement A.: Acquisation of The BondsDocument3 pagesRequirement A.: Acquisation of The BondsMaria LicuananNo ratings yet

- 13 Equity Investment Talusan UsmanDocument18 pages13 Equity Investment Talusan UsmanTakuriNo ratings yet

- Lesson 3A Investments: ContentsDocument19 pagesLesson 3A Investments: ContentsSimon PeterNo ratings yet

- Financial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CDocument15 pagesFinancial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CLiana100% (2)

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- Investment in Equity Securities 2Document26 pagesInvestment in Equity Securities 2Mhelka Tiodianco0% (1)

- AmortizationDocument20 pagesAmortizationJudith Gabutero100% (2)

- Seatwork - Module 1Document5 pagesSeatwork - Module 1Alyanna Alcantara100% (1)

- Chapter16 BuenaventuraDocument11 pagesChapter16 BuenaventuraAnonn100% (1)

- Chap14 ProblemsDocument8 pagesChap14 ProblemsYen YenNo ratings yet

- IA Terminal Output 1Document8 pagesIA Terminal Output 1Jannefah Irish Saglayan100% (1)

- INVESTMENTS ReviewerDocument35 pagesINVESTMENTS ReviewerRyze100% (1)

- Petty Cash - Imprest and Fluctuating SystemDocument4 pagesPetty Cash - Imprest and Fluctuating SystemNika Bautista100% (1)

- Chapter 19 20Document11 pagesChapter 19 20Kyle Francine BoloNo ratings yet

- Problems - Mariztine B. ADocument12 pagesProblems - Mariztine B. AMariztine MirandillaNo ratings yet

- Effective Interest MethodDocument2 pagesEffective Interest MethodKurt Del RosarioNo ratings yet

- #18 Reclassification of Financial AssetsDocument3 pages#18 Reclassification of Financial AssetsZaaavnn VannnnnNo ratings yet

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Lesson 3A. Investment On Securities - Please PrintDocument13 pagesLesson 3A. Investment On Securities - Please PrintHail DeityNo ratings yet

- Investment in AssociateDocument7 pagesInvestment in AssociatenenzzmariaNo ratings yet

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocument4 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 Investmenttite ko'y malake100% (1)

- Seatwork 2B ASSIGNDocument5 pagesSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- P1 CompreDocument3 pagesP1 CompreCris Tarrazona CasipleNo ratings yet

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- Chapter 15 Financial Asset at Fair ValueDocument7 pagesChapter 15 Financial Asset at Fair ValueRujean Salar Altejar100% (1)

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- 17 - Investment-In Associate (Basic Principles)Document44 pages17 - Investment-In Associate (Basic Principles)KhenNo ratings yet

- Chapter 18 Investment in AssociateDocument5 pagesChapter 18 Investment in AssociateEllen MaskariñoNo ratings yet

- Chapter 17 - Investment in Associate PDFDocument14 pagesChapter 17 - Investment in Associate PDFTurks100% (1)

- Conceptual Framework and Accounting StandardsDocument27 pagesConceptual Framework and Accounting Standards박은하No ratings yet

- Module 1 Investment in AssociateDocument7 pagesModule 1 Investment in AssociateCharice Anne VillamarinNo ratings yet

- Chap 24 - Investment in Associate - Basic Principle Fin Acct 1 - Barter Summary Team PDFDocument5 pagesChap 24 - Investment in Associate - Basic Principle Fin Acct 1 - Barter Summary Team PDFSuper JhedNo ratings yet

- IntaccDocument19 pagesIntaccMelita CarriedoNo ratings yet

- Investment in AssociateDocument3 pagesInvestment in AssociatePat RFNo ratings yet

- Foreign Currency Translation Dayag 2021Document32 pagesForeign Currency Translation Dayag 2021Francis AbuyuanNo ratings yet

- Topic 1 - Assurance EngagementsDocument19 pagesTopic 1 - Assurance EngagementsFrancis AbuyuanNo ratings yet

- Topic 3 - Audits of Historical Financial InformationDocument19 pagesTopic 3 - Audits of Historical Financial InformationFrancis AbuyuanNo ratings yet

- LAWDocument5 pagesLAWFrancis AbuyuanNo ratings yet

- Award Certificates EDITABLE 1Document7 pagesAward Certificates EDITABLE 1Ruby Ann Gervacio GimenezNo ratings yet

- INSTA September 2023 Current Affairs Quiz Questions 1Document10 pagesINSTA September 2023 Current Affairs Quiz Questions 1rsimback123No ratings yet

- Introduction - Online Car Booking Management SystemDocument5 pagesIntroduction - Online Car Booking Management SystemTadese JegoNo ratings yet

- Economic Survey 2017-18Document350 pagesEconomic Survey 2017-18Subhransu Sekhar SwainNo ratings yet

- LABELDocument2 pagesLABELerinNo ratings yet

- Chapter On 'Aqidah - SH Abdulqadir Al-JilaniDocument12 pagesChapter On 'Aqidah - SH Abdulqadir Al-JilaniUjjal MazumderNo ratings yet

- EWRFDocument1 pageEWRFHarini Sybel CullenNo ratings yet

- ProjectDocument3 pagesProjectKimzee kingNo ratings yet

- Comparative Relationship Between Traditional Architecture and Modern ArchitectureDocument24 pagesComparative Relationship Between Traditional Architecture and Modern ArchitectureGem nuladaNo ratings yet

- Alex. Hamilton Vs Thomas JeffersonDocument4 pagesAlex. Hamilton Vs Thomas JeffersonRhett Hunt100% (1)

- 31-07-2020 - The Hindu Handwritten NotesDocument16 pages31-07-2020 - The Hindu Handwritten NotesnishuNo ratings yet

- Mini Cases DireccionamientoDocument2 pagesMini Cases DireccionamientoJuliet Suesca0% (1)

- Startup Ecosystem in IndiaDocument17 pagesStartup Ecosystem in IndiaDimanshu BakshiNo ratings yet

- FINA3010 Assignment1Document5 pagesFINA3010 Assignment1Hei RayNo ratings yet

- Week 1, Hebrews 1:1-14 HookDocument9 pagesWeek 1, Hebrews 1:1-14 HookDawit ShankoNo ratings yet

- Aipmt Round 3Document335 pagesAipmt Round 3AnweshaBoseNo ratings yet

- Lecture Notes On Vat As AmendedDocument7 pagesLecture Notes On Vat As Amendedbubblingbrook100% (1)

- Outstanding-Performance-in-SOCIAL SCIENCE-1Document16 pagesOutstanding-Performance-in-SOCIAL SCIENCE-1Tyron Rex SolanoNo ratings yet

- Law of Torts and Consumer Protection Act: NegligenceDocument30 pagesLaw of Torts and Consumer Protection Act: NegligenceSoumyadeep Mitra100% (6)

- Media Release 3665 (English) 14 08 14Document2 pagesMedia Release 3665 (English) 14 08 14ElPaisUyNo ratings yet

- Customer Satisfaction On TATA Motors-7Document40 pagesCustomer Satisfaction On TATA Motors-7VampsiukNo ratings yet

- Online Writing SampleDocument2 pagesOnline Writing SampleSamson_Lam_9358No ratings yet

- Other Hands - Issue #15-16, Supplement PDFDocument8 pagesOther Hands - Issue #15-16, Supplement PDFAlHazredNo ratings yet

- Vinayyak - CV - Sap - ExpDocument3 pagesVinayyak - CV - Sap - ExpmanikandanNo ratings yet

- Malankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDocument26 pagesMalankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDr. Thomas Kuzhinapurath100% (6)

- Criminalogy and Penology Aditya KumarDocument9 pagesCriminalogy and Penology Aditya KumarTejaswi BhardwajNo ratings yet

- Assessment Form: Monitoring The Functionality of City/Municipal Council For The Protection of Children (C/MCPC)Document3 pagesAssessment Form: Monitoring The Functionality of City/Municipal Council For The Protection of Children (C/MCPC)dilg libmananNo ratings yet

- P2mys 2009 Jun ADocument14 pagesP2mys 2009 Jun Aamrita tamangNo ratings yet

BSA 3202 Topic 1 - Investment in Associates

BSA 3202 Topic 1 - Investment in Associates

Uploaded by

Francis AbuyuanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BSA 3202 Topic 1 - Investment in Associates

BSA 3202 Topic 1 - Investment in Associates

Uploaded by

Francis AbuyuanCopyright:

Available Formats

BSA 3202 Accounting for Business Combination Investment in Associates

Module 1 – Investment in Associates

Intercorporate share investment

An intercorporate share investment is the purchase of the equity shares of one entity by another entity. In other

words, it is a case of one entity investing in another entity through the acquisition of share capital.

An entity may purchase enough shares of another entity in order to exert significant influence over the financial

and operating policies of the investee entity.

Significant influence

The assessment of significant influence is a matter of judgment. Significance influence is the power to

participate in the financial and operating policy decisions of the investee but not control or joint control over

those policies.

If the investor holds, directly or indirectly through subsidiaries, 20% or more of the voting power of the investee,

it is presumed that the investor has significant influence, unless it can be clearly demonstrated that this is not

the case.

Conversely, if the investor holds directly or indirectly through subsidiaries, less than 20%, the voting power of

the investee, it is presumed that the investor does not have significant influence, unless such influence can be

clearly demonstrated.

A substantial or majority ownership by another investor does not necessarily preclude an investor from having

significant influence. Beyond the mere 20% threshold of ownership, PAS 28, paragraph 6, provides that the

existence of significant influence is usually evidenced by the following factors:

a. Representation in the board of directors

b. Participation in policy making process

c. Material transactions between the investors and the investee

d. Interchange of managerial personnel

e. Provision of essential technical information

Potential voting rights

An entity may own share warrants, debt or equity instruments that are convertible into ordinary shares have the

potential, if exercised or converted, to give the entity additional voting power over the financial and operating

policies of another entity.

PAS 28, paragraph 7, provides that the existence of such potential voting rights is considered in assessing

whether an entity has significant influence.

The potential voting rights should be currently exercisable or convertible. Potential voting rights are not

currently exercisable or convertible when the rights cannot be exercised or converted until future date or until

the occurrence of a future event.

However, when potential voting rights exist, the investor's share of profit or loss of the investee and of changes

in the investee's equity is determined on the basis of "present ownership interest" and does not reflect the

possible exercise or conversion of potential voting rights.

Loss of significant influence

An entity loses significant influence over an investee when it loses the power to participate in the financial and

operating policy decisions of the investee. The loss of significant influence can occur, with or without change in

the absolute or relative ownership interest.

For example, the loss of significant influence could occur when an associate becomes subject to control of a

government, court, administrator or regulator. The loss of significant influence could also occur as a result of a

contractual agreement.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Equity method

The equity method is based on the economic relationship between the investor and the investee. The investor

and the investee are viewed as a single economic unit. The equity method is applicable when the investor has

a significance influence over the investee.

Accounting procedures

a. The investment is initially recognized at cost.

b. The carrying amount is increased by the investor's share of the profit of the investee and decreased by

the investor's share of the loss of the investee. The investor's share of the profit or loss of the investee

is recognized as investment income.

c. Distributions or dividends received from an equity investee reduce the carrying amount of the

investment.

d. Note that the investment must be in ordinary shares. If the investment is in preference shares, the

equity method is not appropriate regardless of the percentage because the preference share is a

nonvoting equity. The investment in preference shares may be accounted for as at fair value through

profit or loss or at fair value through other comprehensive income or at cost.

e. Technically, if the investor has significant influence over the investee, the investee is said to be an

associate. Accordingly, under the equity method, the investment in ordinary shares should be

appropriately described as investment in associate.

f. The investment in associate accounted for using the equity method shall be classified as noncurrent

asset.

Illustration – equity method

1. On January 1, 2020, an investor purchased 20,000 shares of the 100,000 outstanding ordinary shares of

another entity at P200 per share. The investment represents 20% equity interest and the investor has a

significant influence over the investee. The acquisition cost is equal to the carrying amount of the net assets

acquired.

Investment in associate 4,000,000

Cash 4,000,000

2. The investee reported net income of P5,000,000 for 2020. The investor recognized a share of the net

income of the investee equal to 20% of P5,000,000 or P1,000,000.

Investment in associate 1,000,000

Investment income 1,000,000

3. Received a 25% share dividend from the investee on December 31, 2020.

Memo — Received 5,000 ordinary shares as 25% share dividend on 20,000 original shares. Shares now

held, 25,000 shares.

Note that the 20% equity interest is not affected by the share dividend. The equity interest is the same before

and after the share dividend.

4. The investee reported a net loss of P 1,000,000 for 2021. The investor recognized a share in the net loss of

the investee equal to 20% of P1,000,000 or P200,000.

Loss on investment 200,000

Investment in associate 200,000

5. The investee declared and paid a cash dividend of P2,500,000 on ordinary shares on December 31, 2021.

The investor recognized a share in the cash dividend paid by the investee equal to 20% of P2,500,000 or

P500,000.

Cash 500,000

Investment in associate 500,000

Under the equity method, cash dividend is not an income but a return or reduction of investment.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Excess of cost over carrying amount

An accounting problem arises if the investor pays more or less for an investment than the carrying amount of

underlying net assets.

For example, if the earning potential of the investee is abnormally high, the current value of the investee's net

assets is frequently higher than their carrying amount. If the investor pays more than the carrying amount of

the net assets acquired, the difference is commonly known as "excess of cost over carrying amount" and may

be attributed to the following:

a. Undervaluation of the investee's assets, such as building, land and inventory.

b. Goodwill

In practice, it is often difficult to determine which specific identifiable assets are undervalued.

If the assets of the investee are fairly valued, accountants frequently attribute the excess of cost over carrying

amount of the underlying net assets to goodwill.

If the excess is attributable to undervaluation of depreciable asset, it is amortized over the remaining life of the

depreciable asset.

If the excess is attributable to undervaluation of land, it is not amortized because the land is nondepreciable.

The amount is expensed when the land is sold.

If the excess is attributable to inventory, the amount is expensed when the inventory is already sold.

If the excess is attributable to goodwill, it is included in the carrying amount of the investment and not

amortized.

However, the entire investment in associate including the goodwill is tested for impairment at the end of each

reporting period.

Illustration

At the beginning of the current year, an investor purchased 20% of the outstanding ordinary shares of an

investee for P5,000,000. The net assets of the investee on the date of acquisition are fairly valued except for a

depreciable asset for which the fair value is P2,000,000 greater than its carrying amount. Any remaining

excess is attributable to goodwill.

The carrying amount of the investee's net assets was P20,000,000. The investor therefore paid P1,000,000 in

excess of the carrying amount of net assets, computed as follows:

Acquisition cost 5,000,000

Carrying amount of net assets acquired

(20% x P20,000,000) 4,000,000

Excess of cost over carrying amount 1,000,000

The excess is attributable to the following:

Undervaluation of depreciable asset of

investee with remaining life 5 years

(20% x P2,000,000) 400,000

Goodwill – remainder 600,000

Excess of cost over carrying amount 1,000,000

The journal entry to amortize the "excess of cost" attributable to the undervaluation of depreciable asset is as

follows:

Investment income 80,000

Investment in associate 80,000

(400,000/5 years)

When depreciable and intangible assets of the investee are undervalued, depreciation and amortization are

naturally understated resulting to overstatement of the investee's net income. Thus, the investor should

decrease investment income.

The "excess of cost" attributable to goodwill is not amortized. The goodwill is included in the carrying amount of

the investment in associate.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Excess of net fair value over cost

PAS 28, paragraph 32, provides that any excess of the investor's share of the net fair value of the associate's

identifiable assets and liabilities over the cost of the investment is included as income in the determination of

the investor's share of the associate's profit or loss in the period in which the investment is acquired.

Appropriate adjustments to the investor's share of the associate's profit or loss after acquisition are also made

to account, for example, for depreciation of depreciable assets based on their fair value on the acquisition date.

Illustration

At the beginning of the current year, an investor purchased 40% of the ordinary shares outstanding of an

investee for P15,000,000 when the net assets of the investee amounted to P30,000,000. At acquisition date,

the carrying amounts of the identifiable assets and liabilities of the investee were equal to their fair value,

except for the following:

a. Equipment whose fair value was P7,000,000 greater than carrying amount.

b. Inventory whose fair value was P2,500,000 greater than carrying amount.

The equipment has a remaining life of 4 years and the inventory was all sold during the current year. The

investee reported net income of P20,000,000 for the current year and paid P5,000,000 cash dividend at year-

end.

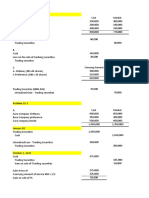

Computation

Acquisition cost 15,000,000

Carrying amount of net assets 12,000,000

Excess of cost over carrying amount 3,000,000

Excess attributable to equipment

(40% x P7,000,000) (2,800,000)

Excess attributable to inventory

(40%x P2,500,000) (1,000,000)

Excess net fair value over cost (800,000)

Journal entries

1. To record the investment:

Investment in associate 15,000,000

Cash 15,000,000

2. To record the share in net income:

Investment in associate 8,000,000

Investment income 8,000,000

(40% x P 20,000,000)

3. To record the share in cash dividend:

Cash (40% x P5,000,00) 2,000,000

Investment in associate 2,000,000

4. To record the amortization of the excess attributable to the equipment:

Investment income 700,000

Investment in associate 700,000

(2,800,000 / 4 years)

5. To record the amortization of the excess attributable to inventory:

Investment income 1,000,000

Investment in associate 1,000,000

The excess is fully "expensed" because all the inventory was already sold during the year.

6. To record the "excess net fair value" as investment income:

Investment in associate 800,000

Investment income 800,000

The (total) net investment income can also be computed for the year as:

Share in net income 8,000,000

Amortization of excess attributable to equipment (700,000)

Amortization of excess attributable to inventory (1,000,000)

Excess net fair value 800,000

Net investment income 7,100,000

Investee with heavy losses

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

PAS 28, paragraph 38, provides that if an investor's share of losses of an associate equals or exceeds the

carrying amount of an investment, the investor discontinues recognizing its share of further losses. The

investment is reported at nil or zero value.

The carrying amount of the investment in associate is not just the balance of the account "investment in

associate". The carrying amount of the investment in associate also includes other long-term interests in an

associate, such as long-term receivables, loans and advances, and investment in preference shares.

However, trade receivables and any long-term receivables for which adequate collateral exists, such as

secured loans, are excluded from the carrying amount of an investment in associate.

Additional losses are provided for or a liability is recognized, to the extent that the investor has incurred legal or

constructive obligations or made payments on behalf of the associate.

If the associate subsequently reports income, the investor resumes including its share of such income after its

share of the income equals the share of losses not recognized.

Illustration

On January 1, 2020, an investor acquired 25% of the ordinary shares of an associate for P5,000,000. On this

date, the identifiable assets and liabilities of the associate were measured at fair value and there is no goodwill

arising from the acquisition.

The profits and losses made by the associate over the first 5 years of operations were:

Profit (loss) Investor’s share

2020 (1,000,000) (250,000)

2021 (10,000,000) (2,500,000)

2022 (12,000,000) (3,000,000)

2023 2,000,000 500,000

2024 2,500,000 625,000

Journal entries

2020 Investment in associate 5,000,000

Cash 5,000,000

Loss on investment 250,000

Investment in associate 250,000

2021 Loss on investment 2,500,000

Investment in associate 2,500,000

2022 Loss on investment 2,250,000

Investment in associate 2,250,000

Acquisition cost 5,000,000

Loss on investment:

2020 (250,000)

2021 (2,500,000)

Carrying amount – January 1, 2022 2,250,000

The investor's share in the loss of the associate for 2022 is P3,000,000. However, the loss to be recognized

cannot exceed the carrying amount of the investment of P2,250,000. The investment is reduced to zero.

2023 No entry

Share in the loss for 2022 (3,000,000)

Loss recognized in 2022 (2,250,000)

Unrecognized loss in 2022 (750,000)

Share in profit for 2023 500,000

Remaining unrecognized loss (250,000)

If the associate subsequently reports profit, the investor resumes recognizing its share of profit only after the

share of profit equals the share of losses not previously recognized.

2024 Investment in associate 375,000

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Investment income 375,000

Share in profit for 2024 625,000

Remaining unrecognized loss (250,000)

Share in profit to be recognized in 2024 375,000

Impairment loss

If there is an indication that an investment in associate may be impaired, PAS 28, paragraph 40, requires that

an impairment loss shall be recognized whenever the carrying amount of the investment in associate exceeds

recoverable amount.

The recoverable amount is measured as the higher between fair value less cost of disposal and value in use.

Fair value is the price that would be received to sell an asset in an orderly transaction between market

participants at the measurement date.

Value in use is the present value of the estimated future cash flows expected to arise from the continuing use

of an asset and from its ultimate disposal. The value in use of an investment in associate is the investor’s

share in either of the following:

a. Present value of estimated future cash flows expected to be generated by the investee, including cash

flows from operations of the investee and the proceeds on the ultimate disposal of the investment.

b. Present value of the estimated future cash flows expected to arise from dividends to be received from

the investment and from its ultimate disposal.

Under appropriate assumptions, both methods give the same result. PAS 28, paragraph 42, states that since

goodwill is not separately recognized from the investment amount, the impairment loss recognized is applied to

the investment as a whole.

The recoverable amount of an investment in associate is assessed for each individual associate.

An exception is when an individual associate does not generate cash inflows from continuing use that are

largely independent of those from other assets of the reporting entity.

Investee with preference shares

When an associate has outstanding cumulative preference shares, the investor shall compute its share of

earnings or losses after deducting the preference dividends, whether or not such dividends are declared.

When an associate has outstanding noncumulative preference shares, the investor shall compute its share of

earnings after deducting the preference dividends only when declared.

For example, an investee reported the following capital accounts at the beginning of current year:

Preference share capital, 12% cumulative,

P100 par, 50,000 shares issued 5,000,000

Ordinary share capital, P50 par, 500,000 shares

authorized and 200,000 shares issued 10,000,000

Retained earnings 5,000,000

On same date, an investor acquired 40,000 ordinary shares of the investee representing a 20% interest for

P3,000,000. The net assets of the investee are fairly valued.

The investee reported net income of P2,000,000 for the current year and paid cash dividends of P500,000 to

ordinary shareholders and the preference dividends at the preference rate.

Journal entries for current year

1. To record the investment:

Investment in associate 3,000,000

Cash 3,000,000

2. To record the share in net income:

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Investment in associate 280,000

Investment income 280,000

Net income 2,000,000

Preference dividend (12% x 5,000,000) (600,000)

Net income to ordinary share 1,400,000

Share in net income (20% x 1,400,000) 280,000

3. To record the share in cash dividend:

Cash (20% x 500,000) 100,000

Investment in associate 100,000

Other changes in equity

Adjustments to the carrying amount of the investment in associate may be necessary for changes in the

investor's proportionate interest in the investee arising from changes in the investee's equity that have not

been recognized in the investee's profit or loss.

Such changes include those arising from revaluation of property, plant and equipment and from foreign

exchange translation differences.

The investor's share of those changes is recognized directly in equity of the investor.

Illustration

The investment in associate is 20% as a consequence of which the investor has significant influence over the

investee. The investee reported the following for the current year:

Net income 6,000,000

Dividend paid 2,000,000

Revaluation surplus 3,000,000

Journal entries for current year

1. Share in net income:

Investment in associate 1,200,000

Investment income 1,200,000

(20% x 6,000,000)

2. Share in dividend paid:

Cash (20% x 2,000,000) 400,000

Investment in associate 400,000

3. Share in revaluation surplus:

Investment in associate 600,000

Revaluation surplus – investee 600,000

(20% x 3,000,000)

Adjustment of investee's operations

a. The most recent available financial statements of the associate are used by the investor in applying the

equity method. When the reporting dates of the investor and the investee are different, the associate

shall prepare for the use of the investor financial statements as of the same date as the financial

statements of the investor unless it is impracticable to do so. In any case, the difference between the

reporting date of the associate and that of the investor shall be no more than three months.

b. If an associate uses accounting policies other than those of the investor, adjustments shall be made to

conform the associate's accounting policies to those of the investor.

c. Profits and losses resulting from upstream and downstream transactions between an investor and an

associate are recognized in the investor's financial statements only to the extent of the unrelated

investors' interests in the associate. The investor's share in the associate's profits and losses resulting

from these transactions is eliminated.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Upstream transactions

Upstream transactions are sales of assets from an associate to the investor. For example, the associate sells

inventory or noncurrent asset to the investor. The unrealized profit from these transactions must be eliminated

in determining the investor's share in the profit or loss of the associate.

Sale of inventory from associate to investor

On January 1, 2020, an investor acquired 20% interest in an investee, enabling the investor to exercise

significant influence over the investee. On this date, the identifiable assets and liabilities of the investee is

recorded at fair value.

During the year, the investee reported net income of P2,000,000 and paid no dividend. Also, during the year,

the investee sold inventory costing P200,000 for P300,000 to the investor. The inventory is unsold by the

investor on December 31, 2020.

Ignoring income tax, the investor's share in the profit of the associate for 2020 is determined as:

Net income for 2020 2,000,000

Unrealized profit on ending inventory

on 12/31/2020 (100,000)

Adjusted net income 1,900,000

Investor's share (20% x 1,900,000) 380,000

Or another approach can be used:

Share in net income (20% x 2,000,000) 400,000

Share in unrealized profit(20% x 100,000*) (20,000)

Investor's share 380,000

Sale price 300,000

Cost of inventory 200,000

*Unrealized profit on ending inventory 100,000

The journal entry to recognize the investor's share in the profit of the associate for 2020 is:

Investment in associate 380,000

Investment income 380,000

Continuing the illustration, the investee reported net income of P2,500,000 for 2021.

The inventory sold by the associate to the investor in 2020 is subsequently sold by the investor in 2021.

The investor's share in the profit of the associate for 2021 is determined as:

Net income for 2021 2,500,000

Realized profit on beginning inventory 100,000

Adjusted net income 2,600,000

Investor's share (20% x 2,600,000) 520,000

The journal entry to recognize the investor's share in the profit of the associate for 2021 is:

Investment in associate 520,000

Investment income 520,000

Downstream transactions

Downstream transactions are sales of assets from the investor to an associate. Unquestionably, the unrealized

profit from these transactions must be also eliminated as prescribed by Paragraph 28 of PAS 28.

The accounting issue is how to eliminate the unrealized profit from downstream transactions. Unfortunately,

PAS 28 does not offer a crystal clear guidance on the accounting issue. Up to this writing, this issue is still the

subject of a discussion paper for an IFRIC interpretation.

It is believed that computation of the investor's share in the profit of the associate and the journal entries are

exactly the same whether upstream or downstream. The point is that the unrealized profit must be eliminated

in determining the investor's share in the profit or loss of the associate.

There is no good argument for this approach apart from simplicity and the economic relationship of the investor

and the associate viewed as a "single economic entity".

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Sale of depreciable asset

On January 1, 2020, an investor acquired 20% interest in an associate. During the year, the investee sold an

equipment with carrying amount of P4,500,000 to the investor for P7,000,000.

The equipment has a remaining useful life of 5 years. The investee reported net income of P6,000,000 for

2020. Ignoring income tax, the investor's share in the profit of the associate in 2020 is determined as:

Net income for 2020 6,000,000

Unrealized profit on sale of equipment (2,500,000)

Realized profit on sale of equipment

(2,500,000 / 5 years) 500,000

Adjusted net income 4,000,000

Investor's share (20% x 4,000,000) 800,000

Sale price of equipment 7,000,000

Carrying amount (4,500,000)

Unrealized profit on sale of equipment 2,500,000

Note that the profit on the sale of the equipment is unrealized because the equipment is not sold to an

unrelated party.

The profit on the sale of the equipment is realized as the asset is used or over the remaining life of the asset.

Thus, as the equipment is depreciated on a straight-line basis over a 5-year period, one-fifth of the profit is also

realized each year. After a 5-year period, the whole of the profit is realized.

Continuing the illustration, if the investee reported net income of P8,000,000 for 2021, the investor's share in

the profit of the associate in 2021 is determined as:

Net income for 2021 8,000,000

Realized profit on sale of equipment 500,000

Adjusted net income 8,500,000

Investor's share (20% x 8,500,000) 1,700,000

Discontinuance of equity method – change from equity

PAS 28, paragraph 22, provides that an investor shall discontinue the use of the equity method from the date

that it ceases to have significant influence over an associate. Consequently, the investor shall account for the

investment as follows:

a. Financial asset at fair value through profit or loss.

b. Financial asset at fair value through other comprehensive income.

c. Nonmarketable investment at cost or investment in unquoted equity instrument.

PAS 28, Basis for Conclusion 18, requires an investor that continues to have significant influence over an

associate to apply the equity method even if the associate is operating under severe long-term restrictions that

significantly impair the ability to transfer funds to the investor. Significant influence must be lost before the

equity method ceases to be applicable.

Measurement after loss of significant influence

PAS 28, paragraph 22, provides that on the date the significant influence is lost, the investor shall measure any

retained investment in associate at fair value.

The difference between the carrying amount of the retained investment at the date the significant influence is

lost and the fair value of the retained investment shall be included in profit or loss.

Of course, the difference between the net proceeds from disposal of part of the investment and the carrying

amount of the investment sold is also included in profit or loss.

Paragraph 22 further provides that the fair value of the investment at the date it ceases to be an associate shall

be regarded as the fair value on initial recognition as a financial asset.

Illustration

An entity purchased 30,000 ordinary shares of the 100,000 outstanding shares of another entity representing

30% interest several years ago. At year-end, the investment in associate has a carrying amount of P6,000,000.

On the same date, the investor sold 20,000 shares for net proceeds of P5,000,000 resulting to a loss of

significant influence. The quoted market price for such investment is P260 per share on the date of sale.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Journal entries

1. To record the sale of 20,000 shares or 20% interest (20,000 / 100,000):

Cash 5,000,000

Investment in associate 4,000,000

Gain on sale of investment 1,000,000

Sale price 5,000,000

Carrying amount of 20,000 shares sold

(20,000 / 30,000 x P6,000,000) 4,000,000

Gain on sale 1,000,000

2. To remeasure the retained investment of 10,000 shares or 10% interest (10,000 / 100,000):

Investment in associate 600,000

Gain from remeasurement to fair value 600,000

Fair value of shares retained (10,000 x 260) 2,600,000

Carrying amount of retained investment

(6,000,000-4,000,000) 2,000,000

Gain from remeasurement 600,000

The gain from remeasurement to fair value is included in profit or loss.

3. To reclassify the retained investment as financial asset at fair value through profit or loss.

Financial asset – FVPL 2,600,000

Investment in associate 2,600,000

Equity method not applicable

PAS 28, paragraph 17, provides that an investment in associate shall not be accounted for using the equity

method if the investor is a parent that is exempt from preparing consolidated financial statements or if all of the

following apply:

a. The investor is a wholly-owned subsidiary, or a partially owned subsidiary of another entity and the

other owners do not object to the investor not applying the equity method.

b. The investor's debt and equity instruments are not traded in a public market or "over the counter"

market.

c. The investor did not file or it is not in the process of filing financial statements with the SEC for the

purpose of issuing any class of instruments in a public market.

d. The ultimate or any intermediate parent of the investor produces consolidated financial statements

available for public use that comply with Philippine Financial Reporting Standards.

In these circumstances, the investment is accounted for as follows:

a. Financial asset at fair value through profit or loss.

b. Financial asset at fair value through other comprehensive income.

c. Nonmarketable investment at cost or investment in unquoted equity instrument.

Associate held for sale

PAS 28, paragraph 20, provides that if the investment in associate is classified as held for sale, it is accounted

for in accordance with PFRS 5. The investment in associate classified as held for sale shall be measured at

the lower of carrying amount and fair value less cost of disposal.

Investment of less than 20%

If the investor holds, directly or indirectly, through subsidiaries less than 20% of the voting power of the

investee, it is presumed that the investor does not have significant influence, unless such influence can be

clearly demonstrated.

Accounting for investment of less than 20%

a. Fair value method

This is applicable to financial asset measured at fair value through profit or loss and financial asset

measured at fair value through other comprehensive income.

b. Cost method

The cost method is usually applied with respect to investment in unquoted equity instrument or

nonmarketable equity investment.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Under the fair value and cost method, the investor does not share in the profit or loss of the investee because

of the legal relationship between the investor and the investee. The investor and the investee are independent

of the other.

Accordingly, dividends received by the investor from the investee are accounted for as dividend income.

Dividend from preacquisition retained earnings

There is no longer a distinction between preacquisition dividends and postacquisition dividends. In applying the

fair value and cost method, dividends received from an investee are recognized as dividend income,

regardless of whether the dividends originated from preacquisition retained earnings or postacquisition

retained earnings.

Illustration – cost method

1. On January 1, 2020, an investor purchased 10,000 shares of the 100,000 outstanding ordinary shares of

another entity at P200 per share. The investment is unquoted and represents a 10% equity interest.

Investment in shares 2,000,000

Cash 2,000,000

2. The investee reported net income of P1,000,000 for 2020.

No entry is required. The investor does not recognize a share in the net income of the investee.

3. The investor received a 20% share dividend on December 31, 2020.

Memo – Received 2,000 ordinary shares from investee as 20% share dividend on 10,000 original shares.

Shares now held, 12,000 shares.

4. The investee reported a net loss of for 2021.

No entry is required. The investor does not recognize a share in the net loss of the investee.

5. The investee declared and paid a cash dividend of P1,500,000 on December 31, 2021.

Cash (10% x P1,500,000) 150,000

Dividend income 150,000

6. The investor sold 3,000 ordinary shares at P250 per share on December 31, 2021.

Cash 750,000

Investment in shares 500,000

Gain on sale of investment 250,000

Sale price (3,000 x 250) 750,000

Less: Cost of shares sold

(3,000 / 12,000 x 2,000,000) 500,000

Gain on sale of investment 250,000

Investment in associate achieved in stages

An investor owned a 10% interest in an investee on January 1, 2020. The investor acquired additional 10%

interest in the same investee on January 1, 2021 enabling the investor to exercise significant influence over the

investee.

In 2020, the investment is accounted for under the cost or fair value method. However, in 2021, the investment

must be accounted for under the equity method because the investee is now an associate.

This scenario or phenomenon is known as "investment in associate achieved in stages."

The investment in associate achieved in stages is not covered by PAS 28. However, this is parallel to a

business combination achieved in stages. PFRS 3, paragraph 42, provides that in a business combination

achieved in stages, the acquirer shall remeasure the previously held equity interest at fair value and recognize

the resulting gain or loss in profit or loss.

By inference, this "fair value approach" should be followed when an associate is acquired in stages.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Fair value approach

a. The existing interest in the associate is remeasured at fair value with any change in fair value included in

profit or loss.

b. However, if the existing interest is accounted for at fair value through other comprehensive income, any

unrealized gain or loss at the date the investee becomes an associate is reclassified to retained earnings.

c. The fair value of the existing interest plus the cost of the additional interest acquired constitutes the total cost

of the investment for the initial application of the equity method.

d. The total cost of the investment for the initial application of the equity method minus the carrying amount of

the net assets acquired at the date significant influence is obtained equals excess of cost over carrying amount

or excess net fair value.

Illustration – Cost method to equity method

On January 1, 2020, an investor acquired a 10% interest in an investee for P2,000,000. The investment is

accounted for under the cost method because the investment is unquoted.

On January 1, 2022, the investor acquired a further 20% interest in the investee for P4,000,000. On such date,

the carrying amount of the net assets of the investee is P18,000,000.

Any excess of cost over carrying amount is attributable to an undervalued equipment with remaining useful life

of 5 years.

On January 1, 2022, the 10% existing investment has a fair value of P2,500,000.

The investee reported the following net income and dividends:

Net income Cash dividend

2020 2,000,000 800,000

2021 3,000,000 1,000,000

2022 4,000,000 2,000,000

Journal entries

2020

Investment in shares 2,000,000

Cash 2,000,000

Cash (10% x 800,000) 80,000

Dividend income 80,000

2021

Cash (10% x 1,000,000) 100,000

Dividend income 100,000

2022

1. To record the new 20% interest:

Investment in associate 4,000,000

Cash 4,000,000

2. To remeasure the 10% existing interest at fair value:

Investment in shares 500,000

Gain on remeasurement to equity 500,000

(2,500,000 - 2,000,000)

3. To reclassify the 10% existing interest:

Investment in associate 2,500,000

Investment in shares 2,500,000

4. To record the share in 2022 net income:

Investment in associate 1,200,000

Investment income 1,200,000

(30% x 2,000,000)

5. To record the share in 2022 cash dividend:

Cash 600,000

Investment in associate 600,000

6. To record the amortization of excess of cost:

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Investment income 220,000

Investment in associate 220,000

Fair value of 10% existing interest 2,500,000

Cost of 20% new interest 4,000,000

Total cost of investment 6,500,000

Carrying amount of net assets acquired

(30% x 18,000,000) 5,400,000

Excess of cost attributable to equipment 1,100,000

Amortization (1,100,000 / 5) 220,000

Illustration – Fair value method to equity method

On January 1, 2020, an investor acquired a 10% interest in an investee for P3,000,000. The investment is

accounted for at fair value through other comprehensive income.

The fair value of the investment on December 31, 2020 is P4,000,000.

On January 1, 2021, the investor acquired a further 30% interest in the investee for P8,500,000. On such date,

the carrying amount of the net assets of the investee is P25,000,000. The fair value of net assets of the

investee is equal to carrying amount. Any excess of cost over carrying amount is attributable to goodwill.

The investee reported the following net income and cash dividend:

Net income Cash dividend

2020 5,000,000 3,500,000

2021 6,000,000 4,000,000

Journal entries

2020

Financial asset – FVOCI 3,000,000

Cash 3,000,000

Cash (10% x 3,500,000) 350,000

Dividend income 350,000

Financial asset – FVOCI 1,000,000

Unrealized gain – OCI 1,000,000

Fair value – December 31, 2020 4,000,000

Carrying amount 3,000,000

Unrealized gain – OCI 1,000,000

2021

1. To record new 30% interest:

Investment in associate 8,500,000

Cash 8,500,000

2. To reclassify the unrealized gain to retained earnings:

Unrealized gain – OCI 1,000,000

Retained earnings 1,000,000

Application Guidance of PFRS 9, paragraph B5.7.1, provides that amount recognized in other comprehensive

income for financial asset measured at fair value through other comprehensive income is not subsequently

reclassified to profit or loss. The cumulative gain or loss is transferred directly to retained earnings.

3. To reclassify the 10% interest:

Investment in associate 4,000,000

Financial asset – FVOCI 4,000,000

4. To record the share in 2021 net income:

Investment in associate 2,400,000

Investment income 2,400,000

(40% x 6,000,000)

5. To record the share in 2021 cash dividend:

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Cash (40% x 4,000,000) 1,600,000

Investment in associate 1,600,000

6. The excess of cost over carrying amount attributable to goodwill is not amortized.

Fair value of 10% existing interest 4,000,000

Cost of 30% new interest 8,500,000

Total cost of investment 12,500,000

Carrying amount of net assets acquired

(40% x 25,000,000) 10,000,000

Goodwill – not amortized 2,500,000

SAMPLE PROBLEMS

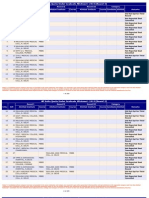

Problem 1

At the beginning of current year, Cynosure Company purchased 40% of the ordinary shares of another entity

for P3,500,000 when the net assets acquired amounted to P7,000,000.

At acquisition date, the carrying amounts of the identifiable assets and liabilities of the investee were equal to

their fair

value, except for equipment for which the fair value was P1,500,000 greater than carrying amount and

inventory whose fair value was P500,000 greater than cost.

The equipment has a remaining life of 4 years and the inventory was all sold during the current year.

The investee reported net income of P4,000,000 and paid P1,000,000 dividends during the current year.

Required:

a. Prepare journal entries for the current year.

b. Compute the investment income for the current year.

Problem 2

Czar Company acquired a 40% interest in Film Company for P 1,700,000 on January 1, 2020.

The shareholders' equity of Film Company on January 1 and December 31, 2020 is as follows:

January 1 December 31

Share capital 3,000,000 3,000,000

Revaluation surplus 1,300,000

Retained earnings 1,000,000 1,500,000

On January 1, 2020, all the identifiable assets and liabilities of Film Company were recorded at fair value.

Film Company reported profit of P650,000, after income tax expense of P 350,000 and paid dividends of

P150,000 to

shareholders during the current year.

The revaluation surplus is the result of the revaluation of land recognized by Film Company on December 31,

2020.

Additionally, depreciation is provided by Film Company on the diminishing balance method whereas Czar

Company uses the straight-line.

Had Film Company used the straight line, the accumulated depreciation would be increased by P200,000. The

tax rate is

30%.

Required:

a. Prepare journal entries for the current year to recognize the transactions relating to the investment in

associate.

b. Determine the carrying amount of the investment in associate on December 31, 2020.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

BSA 3202 Accounting for Business Combination Investment in Associates

Problem 3

On January 1, 2017, Angelic Company acquired as a long-term investment for P 7,000,000 a 40% interest in

an investee when the fair value of the net assets was P 17,500,000. The investee reported the following net

losses:

2017 5,000,000

2018 7,000,000

2019 8,000,000

2020 4,000,000

On January 1, 2019, Angelic Company made cash advances of P2,000,000 to the investee. On December 31,

2020, it is not expected that Angelic Company will provide further financial support for the investee.

Required: Prepare journal entries from 2017 to 2020 in relation to the investment in associate.

Problem 4

Glorious Company acquired 40% interest in an associate, Alta Company, for P5,000,000 on January 1, 2020.

At the acquisition date, there were no differences between fair value and carrying amount of identifiable assets

and liabilities.

Alta Company reported net income of P2,000,000 for 2020 and P3,000,000 for 2021.

On December 31, 2020 and 2021, Alta Company paid cash dividend of P800,000 and P 1,000,000,

respectively.

a. On January 1, 2020, Alta Company sold an equipment costing P 500,000 to Glorious Company for P

800,000. Glorious Company applies a 10% straight line depreciation.

b. On July 1, 2021, Alta Company sold an equipment for P900,000 to Glorious Company. The carrying

amount of the equipment is P500,000 at the time of sale. The remaining life of the equipment is 5 years

and Glorious Company uses the straight-line depreciation.

c. On December 1, 2021, Alta Company sold an inventory to Glorious Company for P 2,800,000. The

inventory had a cost of P 2,000,000 and was still on hand on December 31, 2021.

Required:

a. Determine the investor's share in the profit of the associate for 2020.

b. Determine the investor's share in the profit of the associate for 2021.

c. Prepare journal entries on the books of Glorious Company in relation to the investment in associate.

d. Determine the carrying amount of the investment in associate on December 31, 2021.

Problem 5

On January 1, 2020, Jam Company reported as long-term investments the following unquoted equity shares:

Dale Company, 5,000 ordinary shares (1% interest) 1,250,000

Ever Company, 10,000 ordinary shares (2% interest)1,600,000

Fox Company, 25,000 ordinary shares (10% interest)2,000,000

1. On May 1, 2020, Dale Company issued a 10% share dividend.

2. On November 1, 2020, Dale Company paid a cash dividend of P20 per share.

3. Oh January 1, 2020, Jam Company paid P5,000,000 for 50,000 additional ordinary shares of Fox

Company which represented a 20% investment in Fox Company. The fair value of all of Fox's identifiable

assets net of liabilities was equal to their carrying amount of P20,000,000. Jam Company's initial 10%

interest of 25,000 ordinary shares of Fox Company was acquired on January 1, 2019 for P2,000,000. The

10% interest was accounted for under cost method. On January 1, 2020, this 10% existing interest had a

fair value of P2,400,000.

4. Fox Company reported net income of P6,000,000 for 2020, and paid dividend of P20 per share on

December 31, 2020.

Required:

a. Compute the goodwill arising from acquisition on January 1, 2020.

b. Prepare journal entries for 2020.

c. Present the investments in equity securities on December 31, 2020.

Source: Valix, C. (2019). Intermediate accounting, Volume 1. Manila: GIC Enterprise.

You might also like

- Financial Asset FV Martin SalipadaDocument18 pagesFinancial Asset FV Martin SalipadaKaren Joy Magsayo100% (2)

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho100% (2)

- AC 1201 - Financial Assets at Fair ValueDocument14 pagesAC 1201 - Financial Assets at Fair ValueCarmelou Gavril Garcia Climaco100% (5)

- Palmones Adrio B. Investment in Equity SecuritiesDocument18 pagesPalmones Adrio B. Investment in Equity SecuritiesAndrei GoNo ratings yet

- Activity 2 Investments in Equity SecuritiesDocument4 pagesActivity 2 Investments in Equity SecuritiesVi Vid100% (5)

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- FINAL-Investment in AssociateDocument16 pagesFINAL-Investment in AssociateJessa75% (4)

- Investments in Associates FA AC OverviewDocument85 pagesInvestments in Associates FA AC OverviewHannah Shaira Clemente73% (11)

- Chapter16 Equity Investments PDFDocument69 pagesChapter16 Equity Investments PDFRomuell BanaresNo ratings yet

- Intermediate Accounting Volume 1 Valix, Peralta and Valix (2020)Document69 pagesIntermediate Accounting Volume 1 Valix, Peralta and Valix (2020)Romuell Banares100% (3)

- AssignmentDocument3 pagesAssignmentFrancis Abuyuan100% (1)

- Revisiting The Jalong Ambush Site (Hussars)Document41 pagesRevisiting The Jalong Ambush Site (Hussars)stmcipohNo ratings yet

- Cash Receipts System Narrative 2010 v3Document4 pagesCash Receipts System Narrative 2010 v3cristel jane FullonesNo ratings yet

- Financial Asset at Amortized CostDocument20 pagesFinancial Asset at Amortized CostJudith Gabutero0% (1)

- Memo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesDocument3 pagesMemo - Received 500 Ordinary Shares From Investee As 10% Share Dividend On 5000 Original Shares. Shares Now Held, 5500 SharesRey Joyce AbuelNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- INVESTMENTS With AnswersDocument3 pagesINVESTMENTS With AnswersShaira BugayongNo ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Chapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Document5 pagesChapter 41 - Reclassification of Financial Asset: PROBLEM 41 - 3 (IFRS - From The Amortized Cost To FVOCI)Reinalyn Mendoza75% (4)

- Requirement A.: Acquisation of The BondsDocument3 pagesRequirement A.: Acquisation of The BondsMaria LicuananNo ratings yet

- 13 Equity Investment Talusan UsmanDocument18 pages13 Equity Investment Talusan UsmanTakuriNo ratings yet

- Lesson 3A Investments: ContentsDocument19 pagesLesson 3A Investments: ContentsSimon PeterNo ratings yet

- Financial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CDocument15 pagesFinancial Asset at Fair Value Problem 21-1 (IFRS) : Solution 21-1 Answer CLiana100% (2)

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- Investment in Equity Securities 2Document26 pagesInvestment in Equity Securities 2Mhelka Tiodianco0% (1)

- AmortizationDocument20 pagesAmortizationJudith Gabutero100% (2)

- Seatwork - Module 1Document5 pagesSeatwork - Module 1Alyanna Alcantara100% (1)

- Chapter16 BuenaventuraDocument11 pagesChapter16 BuenaventuraAnonn100% (1)

- Chap14 ProblemsDocument8 pagesChap14 ProblemsYen YenNo ratings yet

- IA Terminal Output 1Document8 pagesIA Terminal Output 1Jannefah Irish Saglayan100% (1)

- INVESTMENTS ReviewerDocument35 pagesINVESTMENTS ReviewerRyze100% (1)

- Petty Cash - Imprest and Fluctuating SystemDocument4 pagesPetty Cash - Imprest and Fluctuating SystemNika Bautista100% (1)

- Chapter 19 20Document11 pagesChapter 19 20Kyle Francine BoloNo ratings yet

- Problems - Mariztine B. ADocument12 pagesProblems - Mariztine B. AMariztine MirandillaNo ratings yet

- Effective Interest MethodDocument2 pagesEffective Interest MethodKurt Del RosarioNo ratings yet

- #18 Reclassification of Financial AssetsDocument3 pages#18 Reclassification of Financial AssetsZaaavnn VannnnnNo ratings yet

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Lesson 3A. Investment On Securities - Please PrintDocument13 pagesLesson 3A. Investment On Securities - Please PrintHail DeityNo ratings yet

- Investment in AssociateDocument7 pagesInvestment in AssociatenenzzmariaNo ratings yet

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocument4 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNo ratings yet

- Module 3 InvestmentDocument12 pagesModule 3 Investmenttite ko'y malake100% (1)

- Seatwork 2B ASSIGNDocument5 pagesSeatwork 2B ASSIGNYzzabel Denise L. Tolentino100% (1)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- Financial Asset at Fair ValueDocument4 pagesFinancial Asset at Fair ValueDianna DayawonNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- P1 CompreDocument3 pagesP1 CompreCris Tarrazona CasipleNo ratings yet

- MODULE 2 - Discussion and Sample ProblemsDocument15 pagesMODULE 2 - Discussion and Sample ProblemsUSD 654No ratings yet

- Chapter 15 Financial Asset at Fair ValueDocument7 pagesChapter 15 Financial Asset at Fair ValueRujean Salar Altejar100% (1)

- Investment in Bonds / Financial Assets at Amortized CostDocument1 pageInvestment in Bonds / Financial Assets at Amortized CostSteffanie Olivar0% (1)

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- 17 - Investment-In Associate (Basic Principles)Document44 pages17 - Investment-In Associate (Basic Principles)KhenNo ratings yet

- Chapter 18 Investment in AssociateDocument5 pagesChapter 18 Investment in AssociateEllen MaskariñoNo ratings yet

- Chapter 17 - Investment in Associate PDFDocument14 pagesChapter 17 - Investment in Associate PDFTurks100% (1)

- Conceptual Framework and Accounting StandardsDocument27 pagesConceptual Framework and Accounting Standards박은하No ratings yet

- Module 1 Investment in AssociateDocument7 pagesModule 1 Investment in AssociateCharice Anne VillamarinNo ratings yet

- Chap 24 - Investment in Associate - Basic Principle Fin Acct 1 - Barter Summary Team PDFDocument5 pagesChap 24 - Investment in Associate - Basic Principle Fin Acct 1 - Barter Summary Team PDFSuper JhedNo ratings yet

- IntaccDocument19 pagesIntaccMelita CarriedoNo ratings yet

- Investment in AssociateDocument3 pagesInvestment in AssociatePat RFNo ratings yet

- Foreign Currency Translation Dayag 2021Document32 pagesForeign Currency Translation Dayag 2021Francis AbuyuanNo ratings yet

- Topic 1 - Assurance EngagementsDocument19 pagesTopic 1 - Assurance EngagementsFrancis AbuyuanNo ratings yet

- Topic 3 - Audits of Historical Financial InformationDocument19 pagesTopic 3 - Audits of Historical Financial InformationFrancis AbuyuanNo ratings yet

- LAWDocument5 pagesLAWFrancis AbuyuanNo ratings yet

- Award Certificates EDITABLE 1Document7 pagesAward Certificates EDITABLE 1Ruby Ann Gervacio GimenezNo ratings yet

- INSTA September 2023 Current Affairs Quiz Questions 1Document10 pagesINSTA September 2023 Current Affairs Quiz Questions 1rsimback123No ratings yet

- Introduction - Online Car Booking Management SystemDocument5 pagesIntroduction - Online Car Booking Management SystemTadese JegoNo ratings yet

- Economic Survey 2017-18Document350 pagesEconomic Survey 2017-18Subhransu Sekhar SwainNo ratings yet

- LABELDocument2 pagesLABELerinNo ratings yet

- Chapter On 'Aqidah - SH Abdulqadir Al-JilaniDocument12 pagesChapter On 'Aqidah - SH Abdulqadir Al-JilaniUjjal MazumderNo ratings yet

- EWRFDocument1 pageEWRFHarini Sybel CullenNo ratings yet

- ProjectDocument3 pagesProjectKimzee kingNo ratings yet

- Comparative Relationship Between Traditional Architecture and Modern ArchitectureDocument24 pagesComparative Relationship Between Traditional Architecture and Modern ArchitectureGem nuladaNo ratings yet

- Alex. Hamilton Vs Thomas JeffersonDocument4 pagesAlex. Hamilton Vs Thomas JeffersonRhett Hunt100% (1)

- 31-07-2020 - The Hindu Handwritten NotesDocument16 pages31-07-2020 - The Hindu Handwritten NotesnishuNo ratings yet

- Mini Cases DireccionamientoDocument2 pagesMini Cases DireccionamientoJuliet Suesca0% (1)

- Startup Ecosystem in IndiaDocument17 pagesStartup Ecosystem in IndiaDimanshu BakshiNo ratings yet

- FINA3010 Assignment1Document5 pagesFINA3010 Assignment1Hei RayNo ratings yet

- Week 1, Hebrews 1:1-14 HookDocument9 pagesWeek 1, Hebrews 1:1-14 HookDawit ShankoNo ratings yet

- Aipmt Round 3Document335 pagesAipmt Round 3AnweshaBoseNo ratings yet

- Lecture Notes On Vat As AmendedDocument7 pagesLecture Notes On Vat As Amendedbubblingbrook100% (1)

- Outstanding-Performance-in-SOCIAL SCIENCE-1Document16 pagesOutstanding-Performance-in-SOCIAL SCIENCE-1Tyron Rex SolanoNo ratings yet

- Law of Torts and Consumer Protection Act: NegligenceDocument30 pagesLaw of Torts and Consumer Protection Act: NegligenceSoumyadeep Mitra100% (6)

- Media Release 3665 (English) 14 08 14Document2 pagesMedia Release 3665 (English) 14 08 14ElPaisUyNo ratings yet

- Customer Satisfaction On TATA Motors-7Document40 pagesCustomer Satisfaction On TATA Motors-7VampsiukNo ratings yet

- Online Writing SampleDocument2 pagesOnline Writing SampleSamson_Lam_9358No ratings yet

- Other Hands - Issue #15-16, Supplement PDFDocument8 pagesOther Hands - Issue #15-16, Supplement PDFAlHazredNo ratings yet

- Vinayyak - CV - Sap - ExpDocument3 pagesVinayyak - CV - Sap - ExpmanikandanNo ratings yet

- Malankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDocument26 pagesMalankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDr. Thomas Kuzhinapurath100% (6)

- Criminalogy and Penology Aditya KumarDocument9 pagesCriminalogy and Penology Aditya KumarTejaswi BhardwajNo ratings yet

- Assessment Form: Monitoring The Functionality of City/Municipal Council For The Protection of Children (C/MCPC)Document3 pagesAssessment Form: Monitoring The Functionality of City/Municipal Council For The Protection of Children (C/MCPC)dilg libmananNo ratings yet

- P2mys 2009 Jun ADocument14 pagesP2mys 2009 Jun Aamrita tamangNo ratings yet