Professional Documents

Culture Documents

Cheryla Davis@usda Gov

Cheryla Davis@usda Gov

Uploaded by

Morgan IngramOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cheryla Davis@usda Gov

Cheryla Davis@usda Gov

Uploaded by

Morgan IngramCopyright:

Available Formats

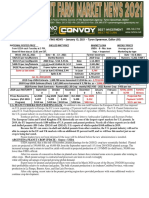

PEANUT MARKETING NEWS – February 1, 2021 – Tyron Spearman, Editor (12)

AMS NEEDS PEANUT PRODUCTS - The Agricultural Marketing Service has issued Solicitation 2000007551, 12-3J14-21-B-

0157 for the procurement of Peanut Products: Please note bids are due Tuesday, February 9, 2021 by 9:00 a.m. Central Time.

Questions regarding this procurement should be directed to the following contact:

Cheryl A. Davis, cheryla.davis@usda.gov, (816) 926-3377.

This Acquisition is: Unrestricted, Small business set-aside up to 50 percent for PEANUT BUTTER SMOOTH 12/18

ounce and Drums. Up to 75 percent 6/5#. Program will set aside of peanut butter smooth for small business set-aside through

noncompetitive letter RFP only. Service-Disabled Veteran-Owned Small Business SDVOSB will be 3 percent of total pounds of

small business set-aside for the invitation.

CHECKING OUT OTHER PEANUT BUTTER MARKETS - The American Peanut Council recently completed a Global

Market Opportunity Assessment for Peanut Butter with the goal of better understanding potential for increasing exports.

The research was carried out by Euromonitor International and is divided into two parts. The first is a scorecard tool

which provides a quantitative assessment of 70 markets. The rankings/scores are based on five factors: demand potential, market

position, economic environment, regulatory environment, and competitive landscape.

The second part of the research is a qualitative "deep dive" into ten markets which were selected from the initial rankings

for the best potential: South Africa, the United Kingdom, China, Brazil, the Philippines, France, Saudi Arabia, Germany, Japan,

and South Korea. It includes information gathered from desk research, trade interviews, and store audits in each country. The

results of this project are extensive and informative, and APC officials hope that you find them useful. The research will be posted

on APC’s members only section of www.peanutsusa.com.

SOUTH CAROLINA PRODUCTION – For some reason (High Tech?) the SC peanut virtual meeting link published in PFMN

11 did not work. We have attached the link here in case some tries to click the link in Tyron's newsletter and it does not work.

https://www.eventbrite.com/e/peanut-production-program-tickets-

135909895155?utm_campaign=new_attendee&utm_medium=email&utm_source=eb_email&utm_term=event_name

UPDATE ON INDIA PEANUTS; WORLD’S SECOND LARGEST PEANUT PRODUCER – India’s peanut area estimates

are revised downward. USDA estimates India peanut production at 6.5 million metric tons, down nearly 4 percent from 2019,

mainly a result of lower yields. Harvested area is revised down to 5.6 million hectares, down 3 percent from last month, due to

slow planting in the top rabi areas, but up nearly 15 percent from last year. Yield is estimated at 1.16 metric tons per hectare,

down 9 percent from last year.

There are two peanut-growing seasons in India: kharif and rabi. The kharif crop accounts for 85 percent of the total

output and is typically planted in late June and harvested in October. The rabi crop is planted in late October through January and

harvested in April. Currently, rabi season peanuts are being planted. A late season withdrawal of the monsoon provided good soil

moisture for rabi planting. Reservoirs in the rabi planting areas are at least 75 percent of capacity.

The Ministry of Agriculture Planting Progress report (January 1, 2021) indicated rabi planting at 10 percent below the 5-

year average. A late-season cyclone negatively impacted the major rabi producing areas in the south-east regions of Tamil Nadu.

In Telangana, late cotton harvesting has likely displaced peanut planting. (For more information, please contact

Arnella.Trent@usda.gov.)

PEANUT CONTRACTS - Peanut buying points are reporting some action on peanut contracts. Farmers are having to watch

other commodity prices along with some higher peanut contract prices. Here is a summary:

SOUTHEAST - $475 per ton for runner type peanuts, each buying point has an allocation that has to be distributed to customers.

Premiums include additional $25 per ton for seed production, $25 or $50 per ton for High Oleic.

Limits – Some contracts limit total to 50% of last year’s production.

Options – Runner Pool - $425 per ton now and dividends will be determined at the end of the season.

Mini-Max Runner Pool – Pool has $400 per ton minimum and $500 per ton Max – This week - $475 ton.

VIRGINIA-CAROLINA - $520 per on Virginia type with limits/ $510 per ton on Virginia type. Some areas have $25 per ton

premium for irrigated.

$475 per ton for runner type plus $25 for High Oleic, if available. $25 more per ton as a seed

producer.

SOUTHWEST – No Report

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Shangri La Hotel LTD Case Study-Report2Document4 pagesShangri La Hotel LTD Case Study-Report2Emy Cabunducan100% (1)

- Mumbai Data CFODocument288 pagesMumbai Data CFOPreet Tiwari100% (1)

- Kamapala Business ProposalDocument4 pagesKamapala Business ProposalIbrahim Olasunkanmi AbduLateefNo ratings yet

- Pakistan ATE ListDocument8 pagesPakistan ATE ListZaid Ahmad0% (1)

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- AUDIT Important Questions Nov-23Document1 pageAUDIT Important Questions Nov-23simranNo ratings yet

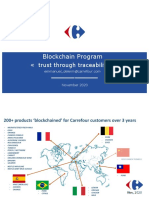

- Trust Through Traceability - CarrefourDocument5 pagesTrust Through Traceability - CarrefourjunojoxNo ratings yet

- Textiles 20190330 EDocument11 pagesTextiles 20190330 EPaul Bao Vinciano NguyenNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Epe Foam Sheet Extrusion Line Epe Foam Sheet Extruder Pe Foam MachineDocument5 pagesEpe Foam Sheet Extrusion Line Epe Foam Sheet Extruder Pe Foam Machinewaleed alqatabNo ratings yet

- Js3 New Agric NoteDocument142 pagesJs3 New Agric Notemoses ndutimiNo ratings yet

- Overview of Management Services Exercises and MCDocument3 pagesOverview of Management Services Exercises and MCAbi PiNo ratings yet

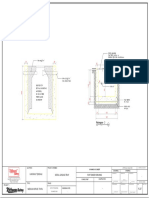

- 9.detail Grease TrapDocument1 page9.detail Grease TrapHarum Tirta JayaNo ratings yet

- PAS B.INGGRIS XI & XII NewDocument7 pagesPAS B.INGGRIS XI & XII NewBunda RinaNo ratings yet

- Corporate ProfileDocument14 pagesCorporate Profiledhanush s100% (1)

- Leopards Courior Sevice ReportDocument17 pagesLeopards Courior Sevice ReportMuhammadAqeelChNo ratings yet

- EEE Assignment 6Document5 pagesEEE Assignment 6shirleyNo ratings yet

- Leading Lights Navigating Traditional Industries With AIDocument211 pagesLeading Lights Navigating Traditional Industries With AIJosip LazarevskiNo ratings yet

- PDF BMC FinalDocument17 pagesPDF BMC Finalshela may billanesNo ratings yet

- Company Analysis - Britannia Industries Ltd. (Jayraj Agrawal)Document3 pagesCompany Analysis - Britannia Industries Ltd. (Jayraj Agrawal)JAYRAJ AGRAWALNo ratings yet

- SGS Economics and Planning Report - Enterprise Area Review-1Document113 pagesSGS Economics and Planning Report - Enterprise Area Review-1Mac YoungNo ratings yet

- Lolc Holdings PLC - Annual Report 2020/21Document406 pagesLolc Holdings PLC - Annual Report 2020/21sampathmudalige23.promateworldNo ratings yet

- Test Bank For Fundamentals of Investing 12th Edition Scott B Smart Lawrence J Gitman Michael D JoehnkDocument24 pagesTest Bank For Fundamentals of Investing 12th Edition Scott B Smart Lawrence J Gitman Michael D JoehnkKathyChristiancxpy100% (46)

- Technical Visit To: Kubota Malaysia SDN BHDDocument3 pagesTechnical Visit To: Kubota Malaysia SDN BHDNadzri YahayaNo ratings yet

- NSTP Proj. ProposalDocument3 pagesNSTP Proj. Proposalalegarbes PatNo ratings yet

- Dokumen - Tips Hsbcnet Mt940 Id Rev2Document6 pagesDokumen - Tips Hsbcnet Mt940 Id Rev2Emmanuel AristyaNo ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- Indo - Hello Kitty Park Playtime - Pitch Deck 2021Document18 pagesIndo - Hello Kitty Park Playtime - Pitch Deck 2021gsm marcommNo ratings yet

- UniformsDocument8 pagesUniformsSUJATHAMMA YEDDULANo ratings yet

- Bowling Club Rs. 9.71 Million Dec-2019Document17 pagesBowling Club Rs. 9.71 Million Dec-2019Faisal AllanaNo ratings yet

- Application of The Control Framework For The Billing ProcessDocument13 pagesApplication of The Control Framework For The Billing ProcessNadira Fadhila HudaNo ratings yet