Professional Documents

Culture Documents

Syllabus Investment

Syllabus Investment

Uploaded by

Loganathan Krishnasamy0 ratings0% found this document useful (0 votes)

48 views2 pagesThis course helps students understand key concepts and principles of investment and portfolio management. It covers topics like types of investments and securities, analyzing investments using fundamental and technical analysis, and portfolio management concepts like selection, diversification and performance evaluation. The course aims to improve students' ability to analyze financial news and construct portfolios. It will teach students to apply valuation models and understand regulations related to investments.

Original Description:

Investment

Original Title

syllabus investment

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis course helps students understand key concepts and principles of investment and portfolio management. It covers topics like types of investments and securities, analyzing investments using fundamental and technical analysis, and portfolio management concepts like selection, diversification and performance evaluation. The course aims to improve students' ability to analyze financial news and construct portfolios. It will teach students to apply valuation models and understand regulations related to investments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

48 views2 pagesSyllabus Investment

Syllabus Investment

Uploaded by

Loganathan KrishnasamyThis course helps students understand key concepts and principles of investment and portfolio management. It covers topics like types of investments and securities, analyzing investments using fundamental and technical analysis, and portfolio management concepts like selection, diversification and performance evaluation. The course aims to improve students' ability to analyze financial news and construct portfolios. It will teach students to apply valuation models and understand regulations related to investments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

SEMESTER – IV

Course Lecture Tutorial Practical

Type Course Name Category Credit

Code (L) (T) (P)

18BPA Skill Investment and

Based Concept 40 -- - 2

4S10 Portfolio Management

Elective

Preamble: This course helps students understand the key concepts and principles of investment

and portfolio management, which build a solid foundation for further study or career pursuit.

Prerequisite : No prerequisite required

Syllabus:

Unit Course contents Hours

Investment: – Meaning and definition – Nature and scope – Economic and financial

I investment - Investment and speculation – Features of good investment – Investment 08

objectives and constraints – Risk and Return – Concept of time value of money.

Security Market: Features – Primary and secondary market - Stock exchange and its

II functions – BSE, NSE, SEBI, NSDL and its functions – Listing of securities – advantages – 08

Types of indices in Indian stock market.

Investment Alternatives: Bonds – Types and features – Debentures – Types and features –

III Equity and preference shares – Company deposits and its features – Gold and Silver – real 08

estate’s – Mutual funds – Classifications and features –Risk and return – Types of risk

Macro and Micro analysis: Fundamental analysis – Economic analysis – Industry analysis

IV 08

and Company analysis – Basics of Technical analysi

Portfolio Management: Meaning and objectives – Selection and diversification of portfolio –

V 08

Performance evaluation of portfolio – Treynor, Sharpe and Jensen measures (Problems)

Total 40

Text Book(s):

1. Punithavathi Pandian, Security Analysis and Portfolio Management , Vikas Publishing House Private

Ltd, 2nd Edition, 2013.

Reference Book(s):

1. M. Ranganathan and R. Madhumathi, Investment Analysis and Portfolio Management, Pearson

Education (Pvt) Ltd., New Delhi, Edition 2009.

2. S. Kevin, Security Analysis and Portfolio Management, Prentice - Hall of India Pvt Ltd., New Delhi,

11th Edition 2012.

3. Preethi Singh, Investment Management, Himalaya Publishing House, 7th Edition 2015.

4. V. A. Anathani, Security Analysis and Portfolio Management, Himalaya Publishing House, 9 th Revised

Edition 2013.

Learning Methods (*):

Assignment/Seminar/Quiz/Group Discussion/Case-Study/Self-Study Component/etc.,

Focus of Course: Employability

e-Resource/e-Content URL: e-PG Pathshala : http://epgp.inflibnet.ac.in/ NPTEL / Investopedia

Course Designer: K. Loganathan

Assistant Profssor, B.Com (PA) BoS Chairman

Course Out Comes (COs):

On successful completion of the course, the students will be able to:

Blooms Taxonomy

CO No. Course Outcome (CO) Statement

Knowledge Level

To understand the concepts and observe investment regulations and

CO 1 K1

professional conduct of Investments.

To improve their ability to analyze financial articles and news with a critical

CO 2 K2

approach for different types securities.

Students will know how to apply different methods and valuation models to

CO 3 K3

construct and evaluate the securities.

Mapping with program Outcomes:

Cos / POs PO1 PO2 PO3 PO4 PO5 PSO1 PSO2 PSO3 PSO4 PSO5

CO1 S S M S M S S M S S

CO2 M M S S S S S M S S

CO3 M S M M M S S S S S

S-Strong: L-Low: M-Medium

You might also like

- Practical Sap Us PayrollDocument37 pagesPractical Sap Us PayrollBharathk Kld100% (3)

- Investment Analysis and Portfolio ManagementDocument5 pagesInvestment Analysis and Portfolio ManagementNajam Us SaharNo ratings yet

- FIN504 - Equity ResearchDocument15 pagesFIN504 - Equity Researchsurbhi guptaNo ratings yet

- A Call For Unity, A Call To Collective ActionDocument3 pagesA Call For Unity, A Call To Collective ActionVen DeeNo ratings yet

- BBA IV Investment AnanalysisDocument9 pagesBBA IV Investment Ananalysisshubham JaiswalNo ratings yet

- Sapm - Course HandoutsDocument5 pagesSapm - Course Handoutskaranjotsinghgrover89No ratings yet

- Portfolio and Risk AnalyticsDocument7 pagesPortfolio and Risk Analyticspooja pNo ratings yet

- Gujarat Technological UniversityDocument4 pagesGujarat Technological UniversityAnisha KizhppulliNo ratings yet

- Sapm IvDocument7 pagesSapm IvShivangi BhasinNo ratings yet

- 17Mb213 Security Analysis and Portfolio Management: Course ObjectiveDocument2 pages17Mb213 Security Analysis and Portfolio Management: Course ObjectiveAkash BNo ratings yet

- CourseMarial - Ca11cinvestment Analysis and Portfolio ManagementDocument4 pagesCourseMarial - Ca11cinvestment Analysis and Portfolio Managementfash selectNo ratings yet

- Iapm SyllabusDocument5 pagesIapm SyllabusAshish SinghNo ratings yet

- ECON - F412 - 1566 - 1 SapmDocument3 pagesECON - F412 - 1566 - 1 SapmAvNo ratings yet

- NewSyllabus 11620207770081Document4 pagesNewSyllabus 11620207770081Adarsh BhartiNo ratings yet

- 144E2ADocument2 pages144E2Asafeekmohammed385No ratings yet

- 4539221Document3 pages4539221shubham trivediNo ratings yet

- Stock Market Analysis & TradingDocument4 pagesStock Market Analysis & TradingAshish SinghNo ratings yet

- Campus To CorprateDocument2 pagesCampus To CorprateS.Ajay sharunNo ratings yet

- Course Outline IM (1.5) AroraDocument5 pagesCourse Outline IM (1.5) AroraKaranNo ratings yet

- Investment Analysis, Portfolio Management & Wealth ManagementDocument5 pagesInvestment Analysis, Portfolio Management & Wealth Managementkonica chhotwaniNo ratings yet

- M19MC3250 - Sapm UNIT 2 - 00365Document60 pagesM19MC3250 - Sapm UNIT 2 - 00365ashishNo ratings yet

- Investment MGNT SyllabusDocument6 pagesInvestment MGNT Syllabusradhika vermaNo ratings yet

- Econ F315 1923 20240111123625Document5 pagesEcon F315 1923 20240111123625TIRTH ANAND TRIVEDINo ratings yet

- Accounting and Managerial DecisionsDocument2 pagesAccounting and Managerial DecisionsloganathanNo ratings yet

- Equity Fund Management Course Outline TYBBA 2021 22Document5 pagesEquity Fund Management Course Outline TYBBA 2021 22ARYA SHETHNo ratings yet

- Investment Management 2015-16Document6 pagesInvestment Management 2015-16Udayan BhattacharyaNo ratings yet

- Electives in Finance Area For PGDM2015-1Document35 pagesElectives in Finance Area For PGDM2015-1BhoomikaGuptaNo ratings yet

- Fundamentals of Financial Management - Preetha ChandranDocument7 pagesFundamentals of Financial Management - Preetha ChandranAditya KumarNo ratings yet

- Goa Institute of Management: Post Graduate Diploma in Management (PGDM) Term IVDocument4 pagesGoa Institute of Management: Post Graduate Diploma in Management (PGDM) Term IVAKASH BODHANINo ratings yet

- Business ValuationsDocument5 pagesBusiness ValuationsCarrots TopNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityAbhishek ChaturvediNo ratings yet

- Econf421 SapmDocument3 pagesEconf421 SapmYash BhardwajNo ratings yet

- Security Analysis and Portfolio ManagementDocument3 pagesSecurity Analysis and Portfolio Managementharsh dhuwaliNo ratings yet

- Financial EngineeringDocument3 pagesFinancial Engineeringluvnica6348No ratings yet

- Investment Analysis and Portfolio Management: Pre-Requisite: None Course ObjectivesDocument3 pagesInvestment Analysis and Portfolio Management: Pre-Requisite: None Course ObjectivesAmit SrivastavaNo ratings yet

- BAC2684 Financial Statement Analysis - SyllabusDocument15 pagesBAC2684 Financial Statement Analysis - SyllabuspremsuwaatiiNo ratings yet

- IAPM BMS Semester V and VI Syllabus To Be Implememnted 2018 2019Document2 pagesIAPM BMS Semester V and VI Syllabus To Be Implememnted 2018 2019Sagar Talreja IprNo ratings yet

- Outline - Financial ServicesDocument4 pagesOutline - Financial ServicesManan AswalNo ratings yet

- Portfolio Management NotesDocument146 pagesPortfolio Management Notespriyarp5075No ratings yet

- Investment Analysis and Portfolio AnalysisDocument3 pagesInvestment Analysis and Portfolio Analysissonu602sonuNo ratings yet

- Semester - VII: SL - No Course Category Course Code Course Name LTP C H TheoryDocument7 pagesSemester - VII: SL - No Course Category Course Code Course Name LTP C H Theorylalitha lalliNo ratings yet

- FinanceDocument23 pagesFinanceKushal DadhaniaNo ratings yet

- This Study Resource Was: Mohammad Ali Jinnah University KarachiDocument3 pagesThis Study Resource Was: Mohammad Ali Jinnah University Karachirrrr110000No ratings yet

- Fin Zg520 SapmDocument13 pagesFin Zg520 SapmSivasankar ANo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementSrinita MishraNo ratings yet

- Syllabus SAPMDocument1 pageSyllabus SAPMSulthanNo ratings yet

- IBA - Syllabus - PMDocument5 pagesIBA - Syllabus - PMhamna wahabNo ratings yet

- Consumer Behaviour HandoutDocument5 pagesConsumer Behaviour Handoutsamaya pypNo ratings yet

- FINMAN Handout PDFDocument5 pagesFINMAN Handout PDFHimanshu SharmaNo ratings yet

- Integrated Marketing Communication (Handout)Document5 pagesIntegrated Marketing Communication (Handout)samaya pyp100% (1)

- FM 05Document3 pagesFM 05roshandd2001No ratings yet

- 18emba01 Investment Analysis and Portfolio Management 3 0 0 3Document3 pages18emba01 Investment Analysis and Portfolio Management 3 0 0 3ramakrishnanNo ratings yet

- Mba IIIDocument120 pagesMba IIITilak RokrNo ratings yet

- MBA Year 2 Investment and Portfolio Management July 2016 PDFDocument167 pagesMBA Year 2 Investment and Portfolio Management July 2016 PDFrajivNo ratings yet

- Syllabus of Private EquityDocument4 pagesSyllabus of Private EquityDeepanshu MalikNo ratings yet

- Investment ManagementDocument28 pagesInvestment ManagementseemaagiwalNo ratings yet

- Course Outline Financial Markets & InstitutionsDocument6 pagesCourse Outline Financial Markets & Institutionskonica chhotwaniNo ratings yet

- Investment Analysis and Portfolio Management Course Description/ObjectiveDocument2 pagesInvestment Analysis and Portfolio Management Course Description/ObjectiveDaud BilalNo ratings yet

- SAPM Course Outline - Subject To RevisionDocument4 pagesSAPM Course Outline - Subject To RevisionVinay KumarNo ratings yet

- MBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)Document131 pagesMBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)asadNo ratings yet

- Achieving Investment Excellence: A Practical Guide for Trustees of Pension Funds, Endowments and FoundationsFrom EverandAchieving Investment Excellence: A Practical Guide for Trustees of Pension Funds, Endowments and FoundationsNo ratings yet

- Holding CompanyDocument74 pagesHolding CompanyLoganathan KrishnasamyNo ratings yet

- IntroductionDocument17 pagesIntroductionLoganathan KrishnasamyNo ratings yet

- Amalgamation Absorbtion and External ReconstructionDocument11 pagesAmalgamation Absorbtion and External ReconstructionLoganathan KrishnasamyNo ratings yet

- AQAR - Metric-Wise GuidelinesDocument75 pagesAQAR - Metric-Wise GuidelinesLoganathan KrishnasamyNo ratings yet

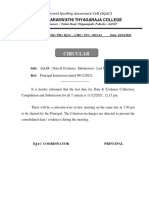

- Circular: Sree Saraswathi Thyagaraja CollegeDocument1 pageCircular: Sree Saraswathi Thyagaraja CollegeLoganathan KrishnasamyNo ratings yet

- MONETA 2021 Concept Doc FinalDocument50 pagesMONETA 2021 Concept Doc FinalLoganathan KrishnasamyNo ratings yet

- Frequently Used Shortcuts: This Table Itemizes The Most Frequently Used Shortcuts in Excel For WindowsDocument3 pagesFrequently Used Shortcuts: This Table Itemizes The Most Frequently Used Shortcuts in Excel For WindowsLoganathan KrishnasamyNo ratings yet

- FINANCIAL MANAGEMENT MODULE 1 6 Capital BudgetingDocument49 pagesFINANCIAL MANAGEMENT MODULE 1 6 Capital BudgetingMarriel Fate CullanoNo ratings yet

- Financial Times UK 2018-05-16Document26 pagesFinancial Times UK 2018-05-16RaycharlesNo ratings yet

- Questions On Budgets SPPU MBA Sem 1Document7 pagesQuestions On Budgets SPPU MBA Sem 1Ketan IngaleNo ratings yet

- International Migrations To Brazil in The 21st CenturyDocument35 pagesInternational Migrations To Brazil in The 21st CenturyMarie DupontNo ratings yet

- Marketing Sales Head Job DescriptionDocument2 pagesMarketing Sales Head Job DescriptionFirst LastNo ratings yet

- Study of Recruitment & Selection Process in Aviva Life Insurance by Saumya MehtaDocument85 pagesStudy of Recruitment & Selection Process in Aviva Life Insurance by Saumya MehtaAmogh Desai100% (2)

- Child LabourDocument2 pagesChild LabourAmy JonesNo ratings yet

- B.arch. Thesis Synopsis 2021-2022Document9 pagesB.arch. Thesis Synopsis 2021-2022Anutosh BajpaiNo ratings yet

- The Global Green Economy ReportDocument65 pagesThe Global Green Economy Reportlee jin huiNo ratings yet

- Merchandising - Definitions, Types Principles and Functions - Retail MarketingDocument26 pagesMerchandising - Definitions, Types Principles and Functions - Retail MarketingriaNo ratings yet

- Nse's Certification in Financial Markets - Options Trading StrategiesDocument60 pagesNse's Certification in Financial Markets - Options Trading Strategiessachindravid100% (1)

- Pengaruh Asosiasi Merek Dan Persepsi Kualitas Terhadap Loyalitas Merek (Studi Kasus Pada Iphone Apple)Document13 pagesPengaruh Asosiasi Merek Dan Persepsi Kualitas Terhadap Loyalitas Merek (Studi Kasus Pada Iphone Apple)Mikael FransNo ratings yet

- BI&analyticsDocument19 pagesBI&analyticssomenath tewaryNo ratings yet

- FIN3004 Tutorial 2 QuestionsDocument2 pagesFIN3004 Tutorial 2 QuestionsLe HuyNo ratings yet

- Ceo Directors UaeDocument15 pagesCeo Directors UaeKiran Kabir83% (6)

- Risk and Return Theory - Capital MarketDocument19 pagesRisk and Return Theory - Capital Markettreasure ROTYNo ratings yet

- Occupation of The Respondents: InterpretationDocument14 pagesOccupation of The Respondents: InterpretationArjun RajNo ratings yet

- Volatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketDocument14 pagesVolatility Clustering, Leverage Effects and Risk-Return Trade-Off in The Nigerian Stock MarketrehanbtariqNo ratings yet

- Custom Clearance Procedures For Imported and Exported GoodsDocument54 pagesCustom Clearance Procedures For Imported and Exported GoodsntamakheNo ratings yet

- Account Opening ProcedureDocument12 pagesAccount Opening ProcedureSalam SarkarNo ratings yet

- Economy Ncert: Alexander Vruce, The Viceroy of British India in 1894Document6 pagesEconomy Ncert: Alexander Vruce, The Viceroy of British India in 1894kiranrvgowdaNo ratings yet

- Money Habits Cheat SheetDocument9 pagesMoney Habits Cheat Sheetned100% (1)

- Wrongful Foreclosure SurveyDocument2 pagesWrongful Foreclosure SurveyForeclosure FraudNo ratings yet

- Clogging The ChannelsDocument4 pagesClogging The ChannelsHarsh ParasrampuriaNo ratings yet

- Biocon India Case StudyDocument7 pagesBiocon India Case StudyAmit Jha100% (1)

- Sub Order LabelsDocument2 pagesSub Order LabelsZeeshan naseemNo ratings yet

- Business Economics Ca Foundation - Paper 4 (Part 1) - Business EconomicsDocument5 pagesBusiness Economics Ca Foundation - Paper 4 (Part 1) - Business EconomicsbnanduriNo ratings yet

- QuestionsDocument28 pagesQuestionssohail merchant100% (1)