Professional Documents

Culture Documents

The Cabinet Papers - Sterling Devalued and The IMF Loan

The Cabinet Papers - Sterling Devalued and The IMF Loan

Uploaded by

Cr0tus0 ratings0% found this document useful (0 votes)

5 views1 pageDevaluing of Sterling and the £3.9 Billion IMF loan (1976)

Original Title

The Cabinet Papers _ Sterling devalued and the IMF loan

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentDevaluing of Sterling and the £3.9 Billion IMF loan (1976)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageThe Cabinet Papers - Sterling Devalued and The IMF Loan

The Cabinet Papers - Sterling Devalued and The IMF Loan

Uploaded by

Cr0tusDevaluing of Sterling and the £3.9 Billion IMF loan (1976)

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

5/24/2019 The Cabinet Papers | Sterling devalued and the IMF loan

Search our website

About us Education Records Information management Archives sector

You are here: Cabinet Papers home > Browse by theme > Finance and the economy > IMF crisis > Sterling devalued and the IMF loan

Sterling devalued and the IMF loan

Devaluation of the pound Content

The left wing of the Labour Party defeated the Public

IMF crisis

Expenditure White Paper in the Commons in March 1976.

Subsequently, Harold Wilson resigned and James Callaghan World recession

took over as Prime Minister. Around this time, investors and the oil crisis

became convinced that the pound was overvalued and that Sterling

the government might devalue. A large-scale sale of sterling devalued and

began, which rapidly lost value against the dollar. the IMF loan

In spite of further efforts to reduce inflation, the pound

continued to lose value, reaching a record low against the

dollar in June 1976. The US Treasury Secretary now agreed

with officials in the International Bank of Settlements that the

pound was undervalued. He offered to partially fund a stand-

by loan of $5.3 billion to support the pound. He insisted,

however, on repayment of the loan by December 1976.

Proposals for further cuts in expenditure and tax increases to

reduce the budge deficit were debated in Cabinet in July. By

September 1976, Britain had already drawn heavily on the

short-term loan and it was apparent that a loan from the IMF

would be necessary to fund repayment.

The 3.9 billion dollar loan

As pressure on the pound continued, the government

approached the IMF for a loan of $3.9 billion in September

1976. This was the largest amount ever requested of the

Fund, which needed to seek additional funds from the US and

Germany. The IMF negotiators demanded heavy cuts in public

expenditure and the budget deficit as a precondition for the

loan. Healey's proposals for a cut of around 20 per cent in the

budget deficit were hotly debated in Cabinet, particularly by

Anthony Crosland and Michael Foot. Eventually they acceded,

as it seemed likely that the refusal of the loan would be

followed by a disastrous run on the pound. Healey announced

the forthcoming reductions in public expenditure to the House

of Commons on 15 December 1976.

Following the agreement with the IMF, the overall economic

and financial picture improved. Interest rates were soon

reduced and the pound quickly appreciated in value. By the

end of 1977, partly as a result of new oil revenues, there

were improvements in the balance of trade. Britain did not

need to draw the full loan from the IMF. Nevertheless, the IMF

crisis reinforced a change in policy orientation away from full

employment and social welfare towards the control of inflation

and expenditure.

Send me The National Archives’ newsletter

A monthly round-up of news, blogs, offers and events.

About our privacy policy

The National Archives Find out more Websites Follow us

https://www.nationalarchives.gov.uk/cabinetpapers/themes/sterling-devalued-imf-loan.htm 1/2

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- CSEC Chemistry Labs (June 2022)Document32 pagesCSEC Chemistry Labs (June 2022)Alonzo Brown67% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Final ThesisDocument74 pagesFinal ThesisPeter Castillo79% (34)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Validation Approach For LIMSDocument9 pagesA Validation Approach For LIMSFred100% (1)

- Ventilator Waveform AnalysisDocument76 pagesVentilator Waveform Analysischtbht100% (1)

- Do Race & Ethnicity Matter in Prosecution (VERA Insttte of Justice)Document24 pagesDo Race & Ethnicity Matter in Prosecution (VERA Insttte of Justice)Cr0tusNo ratings yet

- Cicilline Report On Big Tech MonopoliesDocument450 pagesCicilline Report On Big Tech MonopoliesCr0tusNo ratings yet

- Phill Coleman The Legacy of Operation TailwindDocument2 pagesPhill Coleman The Legacy of Operation TailwindCr0tusNo ratings yet

- British Social Attitudes 34Document206 pagesBritish Social Attitudes 34Cr0tusNo ratings yet

- The CIA and The Cultural Cold War PDFDocument56 pagesThe CIA and The Cultural Cold War PDFCr0tusNo ratings yet

- FINAL Legal Implications of TTIP For The NHS 12 Feb 201511-21864Document22 pagesFINAL Legal Implications of TTIP For The NHS 12 Feb 201511-21864Cr0tusNo ratings yet

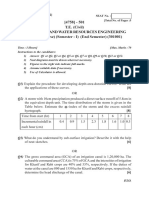

- 1.7tn - 2.2tn: 479bn 607bn 696bn 703bnDocument1 page1.7tn - 2.2tn: 479bn 607bn 696bn 703bnCr0tusNo ratings yet

- Finger Stretching ExerciseDocument1 pageFinger Stretching ExerciseCr0tusNo ratings yet

- Pentagon Papers, The - Volume 5-Critical Essays (Various Authors)Document434 pagesPentagon Papers, The - Volume 5-Critical Essays (Various Authors)Cr0tus100% (2)

- T.E Question Papers (2012 Pattern) May 2015Document297 pagesT.E Question Papers (2012 Pattern) May 2015Prof. Avinash MahaleNo ratings yet

- DEPUTI 4 - Bicara Bumi Mangrove Indonesia Untuk Dunia, Praktik Terbaik Pengelolaan MangroveDocument4 pagesDEPUTI 4 - Bicara Bumi Mangrove Indonesia Untuk Dunia, Praktik Terbaik Pengelolaan MangroveSamuel RahalusNo ratings yet

- What Should PDFDocument20 pagesWhat Should PDFCarlos Charlotte SalvadorNo ratings yet

- Lactate Dehydrogenase (Liquid) Reagent SetDocument2 pagesLactate Dehydrogenase (Liquid) Reagent SetryanNo ratings yet

- Y2 Series: Three Phase Cast Iron MotorDocument4 pagesY2 Series: Three Phase Cast Iron MotorMark Christian TorresNo ratings yet

- Tourniquet Conversion Drew JSOM Fall 2015 Edition-2Document5 pagesTourniquet Conversion Drew JSOM Fall 2015 Edition-2Oleg ShubinNo ratings yet

- University of Caloocan CityDocument9 pagesUniversity of Caloocan CityFudge FajardoNo ratings yet

- Addendum Report 2016Document93 pagesAddendum Report 2016paglafou100% (1)

- Activity 1 - Myths of Aging (Aspuria, Trisha Mae)Document2 pagesActivity 1 - Myths of Aging (Aspuria, Trisha Mae)Trisha Mae AspuriaNo ratings yet

- 1078 HysterH36 21 J3y.00 48.00XM (S) 12Document16 pages1078 HysterH36 21 J3y.00 48.00XM (S) 12Arturo Rengifo100% (1)

- Bio Project Drug Resistance in BacteriaDocument18 pagesBio Project Drug Resistance in BacteriaAKASH ALAMNo ratings yet

- Cod and PodDocument5 pagesCod and PodYasser AshourNo ratings yet

- 3-9 Anatomy Biomechanics ExtensorDocument31 pages3-9 Anatomy Biomechanics ExtensorProfesseur Christian DumontierNo ratings yet

- Contraception Your Questions AnsweredDocument144 pagesContraception Your Questions AnsweredMohamed SaeedNo ratings yet

- Abu Dhabi Recommended Plant PDFDocument30 pagesAbu Dhabi Recommended Plant PDFelmerbarrerasNo ratings yet

- The Glymphatic Pathway in Neurological DisordersDocument20 pagesThe Glymphatic Pathway in Neurological DisordersTeresa BeckNo ratings yet

- Lesson Plan in Top of Stove Cooking Equipment and Baking EquipmentDocument16 pagesLesson Plan in Top of Stove Cooking Equipment and Baking EquipmentNiña Mae SabilloNo ratings yet

- SN Location Machine/Equipment Make Frequency Paln/Actual: Yearly Maintenance Plan - 2021Document2 pagesSN Location Machine/Equipment Make Frequency Paln/Actual: Yearly Maintenance Plan - 2021RiyaZ55No ratings yet

- National Institute of Textile Engineering and Research (NITER)Document6 pagesNational Institute of Textile Engineering and Research (NITER)shahadat hossainNo ratings yet

- Springer Royal Swedish Academy of SciencesDocument7 pagesSpringer Royal Swedish Academy of SciencesEmilianoNo ratings yet

- Cyto 2.4Document5 pagesCyto 2.4Medtech SoonNo ratings yet

- Refractory Installation Preparation Guidelines 2.1 Preparation Prior To The Refractory Installation in The Cement Rotary KilnDocument10 pagesRefractory Installation Preparation Guidelines 2.1 Preparation Prior To The Refractory Installation in The Cement Rotary KilnkING100% (1)

- Hausstatter & Takala 2011Document13 pagesHausstatter & Takala 2011Andrea MarleyNo ratings yet

- Band III Core Word ListDocument40 pagesBand III Core Word ListKatya RipsNo ratings yet

- ASSESSOR ScriptDocument3 pagesASSESSOR ScriptJonalyn Lajera BasayaNo ratings yet

- Spondilitis TB AnakDocument36 pagesSpondilitis TB Anaktry intan kartini50% (2)