Professional Documents

Culture Documents

Angela Corporation A Private Company Acquired All of The Outstanding

Angela Corporation A Private Company Acquired All of The Outstanding

Uploaded by

Amit PandeyCopyright:

Available Formats

You might also like

- Digital Marketing Strategy For Google Merchandise StoreDocument3 pagesDigital Marketing Strategy For Google Merchandise StoreAmar narayanNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Chemistry Book GrADE 7Document30 pagesChemistry Book GrADE 7Widya Kusumaningrum100% (3)

- Saad Karimi (Assignment 1)Document10 pagesSaad Karimi (Assignment 1)pakistan50% (2)

- AssignmentDocument9 pagesAssignmentDr-Mohsin Shahzad0% (4)

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- 02 - Problem Solutions PDFDocument20 pages02 - Problem Solutions PDFadfad15780% (10)

- Pendray Systems Corporation Began Operations On January 1 20y5 AsDocument1 pagePendray Systems Corporation Began Operations On January 1 20y5 AsMiroslav GegoskiNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Banana Yogurt PDFDocument7 pagesBanana Yogurt PDFSunil KrishnappaNo ratings yet

- Ch1 - ExercisesDocument2 pagesCh1 - ExercisesAfon 03No ratings yet

- On January 1 2011 Datalink Inc Issued 100 000-10-10 YearDocument1 pageOn January 1 2011 Datalink Inc Issued 100 000-10-10 YearAmit PandeyNo ratings yet

- Orlando Manufacturing Company Makes Camping Equipment Selected Account Balances ListedDocument1 pageOrlando Manufacturing Company Makes Camping Equipment Selected Account Balances ListedMiroslav GegoskiNo ratings yet

- 1 - Financial - Managerial Acc Assignment Mba WeekendDocument3 pages1 - Financial - Managerial Acc Assignment Mba Weekendadabotor7No ratings yet

- Famba6e Quiz Solutions Mod02 032014Document2 pagesFamba6e Quiz Solutions Mod02 032014kala_kawyaNo ratings yet

- Bailey Corporation Recently Reported The Following Income Statement Dollars AreDocument1 pageBailey Corporation Recently Reported The Following Income Statement Dollars AreMuhammad ShahidNo ratings yet

- On December 31 2015 Hadley Company Provides The Following Pre AuditDocument1 pageOn December 31 2015 Hadley Company Provides The Following Pre AuditMuhammad ShahidNo ratings yet

- Mojakoe Ak2 Uts 2018 PDFDocument17 pagesMojakoe Ak2 Uts 2018 PDFRayhandi AlmerifkiNo ratings yet

- Adams Inc Acquires Clay Corporation On January 1 2017 inDocument2 pagesAdams Inc Acquires Clay Corporation On January 1 2017 inAmit PandeyNo ratings yet

- Selected Financial Information Follows For Maison Corporation For The YearDocument1 pageSelected Financial Information Follows For Maison Corporation For The YearBube KachevskaNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Revenue Recognition: Optional Assignment Characteristics TableDocument10 pagesRevenue Recognition: Optional Assignment Characteristics TableAhmad HuzeinNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- At The Beginning of The Year An Audio Engineer QuitDocument1 pageAt The Beginning of The Year An Audio Engineer Quittrilocksp SinghNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- On January 1 2017 Pinnacle Corporation Exchanged 3 200 000 Cash ForDocument2 pagesOn January 1 2017 Pinnacle Corporation Exchanged 3 200 000 Cash ForAmit PandeyNo ratings yet

- Accountancy Philippines Daily Review For Afar June 04 2020: Q1. AverageDocument7 pagesAccountancy Philippines Daily Review For Afar June 04 2020: Q1. Averagechris layNo ratings yet

- Financial Statement Data of Hiflite Electronics Limited Include The FollowingDocument1 pageFinancial Statement Data of Hiflite Electronics Limited Include The FollowingMuhammad ShahidNo ratings yet

- Homework 1 - BSC 402Document7 pagesHomework 1 - BSC 402Filip Cano100% (1)

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocument1 pageABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNo ratings yet

- DocxDocument17 pagesDocxVy Pham Nguyen KhanhNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- You Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - OnlineDocument1 pageYou Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyNo ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- QUIZ1 - Finacc3Document4 pagesQUIZ1 - Finacc3Jonnie RegalaNo ratings yet

- Extra Applications - Lecture Week 2Document5 pagesExtra Applications - Lecture Week 2Muhammad HusseinNo ratings yet

- CH 4-Model QuestionsDocument17 pagesCH 4-Model Questionsaysilislam528No ratings yet

- Chap 17 Week 1 V1 HW Study Guide 2%Document8 pagesChap 17 Week 1 V1 HW Study Guide 2%Mark KantorovichNo ratings yet

- 1.3.1 Responsibility Acccounting Sample ProblemsDocument4 pages1.3.1 Responsibility Acccounting Sample Problemsdanilynbrmdz0602No ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- ClassworkDocument2 pagesClassworkFolakemi OgunyemiNo ratings yet

- Solved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFDocument1 pageSolved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFAnbu jaromiaNo ratings yet

- Financial Intelligence TrainingDocument56 pagesFinancial Intelligence Trainingbe_kind4allNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Imanuel Xaverdino - 01804220010 - Homework 01Document5 pagesImanuel Xaverdino - 01804220010 - Homework 01Imanuel XaverdinoNo ratings yet

- Financial MGTDocument2 pagesFinancial MGTSohail Liaqat AliNo ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Cooley Textile S 2001 Financial Statements Are Shown Below Cooley Textile IncomeDocument1 pageCooley Textile S 2001 Financial Statements Are Shown Below Cooley Textile IncomeMuhammad ShahidNo ratings yet

- CH 4 In-Class Exercise SOLUTIONSDocument7 pagesCH 4 In-Class Exercise SOLUTIONSAbdullah alhamaadNo ratings yet

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaNo ratings yet

- The Following Account Balances For The Year Ended 30th JuneDocument1 pageThe Following Account Balances For The Year Ended 30th JuneHassan JanNo ratings yet

- PDFDocument76 pagesPDFCoreen BarlowNo ratings yet

- Assignment No 1Document15 pagesAssignment No 1M Naveed SultanNo ratings yet

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Document7 pagesACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Hoyle - Chapter 3 - Class Problem - SolutionsDocument3 pagesHoyle - Chapter 3 - Class Problem - Solutionsyun leeNo ratings yet

- Akm3 Week-10Document5 pagesAkm3 Week-10pizzaanutriaNo ratings yet

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocument10 pagesFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (20)

- FA Mid Term Exam Dec 2022Document3 pagesFA Mid Term Exam Dec 2022ha90665No ratings yet

- Test # 1 Review Material - BACC 152 16th EditionDocument14 pagesTest # 1 Review Material - BACC 152 16th EditionskswNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 405-32B Interco Transactions-Upstream Sale: Depreciable Asset Page 1Document2 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 405-32B Interco Transactions-Upstream Sale: Depreciable Asset Page 1Zenni T XinNo ratings yet

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- ASLH-D (S) B 48 NZDSF (A20SA 53 - 7,3) : Optical Ground Wire (OPGW)Document1 pageASLH-D (S) B 48 NZDSF (A20SA 53 - 7,3) : Optical Ground Wire (OPGW)AHMED YOUSEFNo ratings yet

- Machine Problem 1 TextDocument2 pagesMachine Problem 1 TextNeilmer Elcarte LahoylahoyNo ratings yet

- 9A01709 Advanced Structural AnalysisDocument8 pages9A01709 Advanced Structural AnalysissivabharathamurthyNo ratings yet

- BLDC 1500 2018 BC Building Code-Part 9 Single Family Dwelling BuildingsDocument12 pagesBLDC 1500 2018 BC Building Code-Part 9 Single Family Dwelling BuildingsHamza TikkaNo ratings yet

- Correction Rabattement Part1 Et Part2 ANGLESDocument2 pagesCorrection Rabattement Part1 Et Part2 ANGLESAyman FaroukiNo ratings yet

- The Abcs of Technical WritingDocument30 pagesThe Abcs of Technical WritingMayeng's VlogNo ratings yet

- AIR Conditioner: Installation ManualDocument35 pagesAIR Conditioner: Installation ManualClayton PedroNo ratings yet

- Military Service: The Ministry of Aliyah and Immigrant AbsorptionDocument64 pagesMilitary Service: The Ministry of Aliyah and Immigrant AbsorptionKERVIN6831117No ratings yet

- All of Managers Have Entered The Meeting Room, Except The President Director and Personnel ManagerDocument7 pagesAll of Managers Have Entered The Meeting Room, Except The President Director and Personnel ManagerALIFIA PUSPITANo ratings yet

- Project Report MiniDocument27 pagesProject Report Minisumit gandhi86% (21)

- rfg081573 - MANUAL DE SERVICIO PDFDocument1,207 pagesrfg081573 - MANUAL DE SERVICIO PDFJacob Campos VillanuevaNo ratings yet

- Enum - Singleton Pattern - InstanceOfDocument18 pagesEnum - Singleton Pattern - InstanceOfadarsh rajNo ratings yet

- Rome of Augustus Study GuideDocument41 pagesRome of Augustus Study GuideTheo WilsonNo ratings yet

- ALH - Video Hub - Level3 - Worksheets - AnswerkeyDocument3 pagesALH - Video Hub - Level3 - Worksheets - AnswerkeyJulliana SantosNo ratings yet

- 545 Znshine PDFDocument2 pages545 Znshine PDFDS INSTALAÇÕES ELÉTRICASNo ratings yet

- Research Paper On Drip Irrigation PDFDocument7 pagesResearch Paper On Drip Irrigation PDFafnhkvmnemelfx100% (1)

- Boiling - WikipediaDocument6 pagesBoiling - WikipediaTinidoorNo ratings yet

- Which Psychotropic Medications Induce He PDFDocument9 pagesWhich Psychotropic Medications Induce He PDFnisastNo ratings yet

- Front Axle & SteeringDocument130 pagesFront Axle & Steeringjstdoma /No ratings yet

- IDOC Testing: You Can Test The Idoc Using Idoc Test Tool. Just Follow The Steps AboveDocument3 pagesIDOC Testing: You Can Test The Idoc Using Idoc Test Tool. Just Follow The Steps AboveaximeNo ratings yet

- Syllabus - PAPER 1 - Application of Computer in MediaDocument39 pagesSyllabus - PAPER 1 - Application of Computer in MediaAbubakar shomarNo ratings yet

- TSPSC Vro Vra Exam Pattern 2017Document7 pagesTSPSC Vro Vra Exam Pattern 2017Sk HarrshadNo ratings yet

- Narrative TextDocument6 pagesNarrative TextRoy Altur RobinsonNo ratings yet

- Ala-Too International University 2020-2021 Spring Semester Course Timetable of Management Final ExaminationDocument8 pagesAla-Too International University 2020-2021 Spring Semester Course Timetable of Management Final ExaminationKunduz IbraevaNo ratings yet

- Lab Report Fine Aggregate A13 PDFDocument10 pagesLab Report Fine Aggregate A13 PDFNur NabilahNo ratings yet

- Causes and Prevention of Common Diseases Abd Epidemics in Human Epidemics, Pandemics, and OutbreaksDocument4 pagesCauses and Prevention of Common Diseases Abd Epidemics in Human Epidemics, Pandemics, and OutbreaksFaisal AwanNo ratings yet

- Blue Shield - Platinum Full Ppo 150 12 15Document5 pagesBlue Shield - Platinum Full Ppo 150 12 15api-252555369No ratings yet

Angela Corporation A Private Company Acquired All of The Outstanding

Angela Corporation A Private Company Acquired All of The Outstanding

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Angela Corporation A Private Company Acquired All of The Outstanding

Angela Corporation A Private Company Acquired All of The Outstanding

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Angela Corporation a private company acquired all

of the outstanding

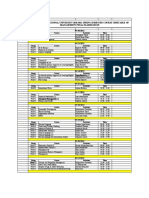

Angela Corporation (a private company) acquired all of the outstanding voting stock of Eddy

Tech, Inc., on January 1, 2018, in exchange for $9,000,000 in cash. At the acquisition date,

Eddy Tech's stockholders' equity was $7,200,000 including retained earnings of $3,000,000. At

the acquisition date, Angela prepared the following fair value allocation schedule for its newly

acquired subsidiary:

Consideration transferred . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $9,000,000

Eddy's stockholder's equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7,200,000

Excess fair over book value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,800,000

To patented technology (5-year remaining life) . . . . . . . . . . . $ 150,000

To trade names (indefinite remaining life) . . . . . . . . . . . . . . . . 500,000

To equipment (8-year remaining life) . . . . . . . . . . . . . . . . . . . . 50,000 . . . . . . 700,000

Goodwill . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .$1,100,000

At the end of 2018, Angela and Eddy Tech report the following amounts from their individually

maintained account balances, before consideration of their parent-subsidiary relationship.

Parentheses indicate a credit balance.

____________________________________________ Angela _______________ Eddy Tech

Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,850,000) . . . . . . . . . . . . . (2,400,000)

Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,200,000 . . . . . . . . . . . . . . .1,300,000

Depreciation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . 425,000 . . . . . . . . . . . . . . . . . 48,000

Amortization expense . . . . . . . . . . . . . . . . . . . . . . . . . . .250,000 . . . . . . . . . . . . . . . . . 12,000

Other operating expenses . . . . . . . . . . . . . . . . . . . . . . . .75,000 . . . . . . . . . . . . . . . . . . 53,750

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,900,000) . . . . . . . . . . . . . . . (986,250)

Required:

Prepare a 2018 consolidated income statement for Angela and its subsidiary Eddy Tech.

Reach out to freelance2040@yahoo.com for enquiry.

Assume that Angela, as a private company, elects to amortize goodwill over a 10-year period?

Angela Corporation a private company acquired all of the outstanding

ANSWER

https://solvedquest.com/angela-corporation-a-private-company-acquired-all-of-the-outstanding/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Digital Marketing Strategy For Google Merchandise StoreDocument3 pagesDigital Marketing Strategy For Google Merchandise StoreAmar narayanNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- SOAL LATIHAN INTER 1 - Chapter 4Document14 pagesSOAL LATIHAN INTER 1 - Chapter 4Florencia May67% (3)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Chemistry Book GrADE 7Document30 pagesChemistry Book GrADE 7Widya Kusumaningrum100% (3)

- Saad Karimi (Assignment 1)Document10 pagesSaad Karimi (Assignment 1)pakistan50% (2)

- AssignmentDocument9 pagesAssignmentDr-Mohsin Shahzad0% (4)

- Assignment After Week 6Document5 pagesAssignment After Week 6MUHAMMAD JAHANGIRNo ratings yet

- 02 - Problem Solutions PDFDocument20 pages02 - Problem Solutions PDFadfad15780% (10)

- Pendray Systems Corporation Began Operations On January 1 20y5 AsDocument1 pagePendray Systems Corporation Began Operations On January 1 20y5 AsMiroslav GegoskiNo ratings yet

- Some Solved Problems and Statement From Tabular AnalysisDocument9 pagesSome Solved Problems and Statement From Tabular AnalysisSubrata RoyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Banana Yogurt PDFDocument7 pagesBanana Yogurt PDFSunil KrishnappaNo ratings yet

- Ch1 - ExercisesDocument2 pagesCh1 - ExercisesAfon 03No ratings yet

- On January 1 2011 Datalink Inc Issued 100 000-10-10 YearDocument1 pageOn January 1 2011 Datalink Inc Issued 100 000-10-10 YearAmit PandeyNo ratings yet

- Orlando Manufacturing Company Makes Camping Equipment Selected Account Balances ListedDocument1 pageOrlando Manufacturing Company Makes Camping Equipment Selected Account Balances ListedMiroslav GegoskiNo ratings yet

- 1 - Financial - Managerial Acc Assignment Mba WeekendDocument3 pages1 - Financial - Managerial Acc Assignment Mba Weekendadabotor7No ratings yet

- Famba6e Quiz Solutions Mod02 032014Document2 pagesFamba6e Quiz Solutions Mod02 032014kala_kawyaNo ratings yet

- Bailey Corporation Recently Reported The Following Income Statement Dollars AreDocument1 pageBailey Corporation Recently Reported The Following Income Statement Dollars AreMuhammad ShahidNo ratings yet

- On December 31 2015 Hadley Company Provides The Following Pre AuditDocument1 pageOn December 31 2015 Hadley Company Provides The Following Pre AuditMuhammad ShahidNo ratings yet

- Mojakoe Ak2 Uts 2018 PDFDocument17 pagesMojakoe Ak2 Uts 2018 PDFRayhandi AlmerifkiNo ratings yet

- Adams Inc Acquires Clay Corporation On January 1 2017 inDocument2 pagesAdams Inc Acquires Clay Corporation On January 1 2017 inAmit PandeyNo ratings yet

- Selected Financial Information Follows For Maison Corporation For The YearDocument1 pageSelected Financial Information Follows For Maison Corporation For The YearBube KachevskaNo ratings yet

- Chapetr 5 - RevisionDocument16 pagesChapetr 5 - Revisionhw17488No ratings yet

- The Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineDocument1 pageThe Following Data Relate To The Prima Company 1 Exhibit: Unlock Answers Here Solutiondone - OnlineAmit PandeyNo ratings yet

- Revenue Recognition: Optional Assignment Characteristics TableDocument10 pagesRevenue Recognition: Optional Assignment Characteristics TableAhmad HuzeinNo ratings yet

- Solutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Document5 pagesSolutions To Problems: 13/e, Solutions Manual (For Instructor Use Only)Adam IngberNo ratings yet

- At The Beginning of The Year An Audio Engineer QuitDocument1 pageAt The Beginning of The Year An Audio Engineer Quittrilocksp SinghNo ratings yet

- FIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFDocument6 pagesFIX ASSET&INTANGIBLE ASSET Kel. 1 AKM 1 PDFAdindaNo ratings yet

- On January 1 2017 Pinnacle Corporation Exchanged 3 200 000 Cash ForDocument2 pagesOn January 1 2017 Pinnacle Corporation Exchanged 3 200 000 Cash ForAmit PandeyNo ratings yet

- Accountancy Philippines Daily Review For Afar June 04 2020: Q1. AverageDocument7 pagesAccountancy Philippines Daily Review For Afar June 04 2020: Q1. Averagechris layNo ratings yet

- Financial Statement Data of Hiflite Electronics Limited Include The FollowingDocument1 pageFinancial Statement Data of Hiflite Electronics Limited Include The FollowingMuhammad ShahidNo ratings yet

- Homework 1 - BSC 402Document7 pagesHomework 1 - BSC 402Filip Cano100% (1)

- ABC Manufacturing Entity Sole Trader Has Provided You With TheDocument1 pageABC Manufacturing Entity Sole Trader Has Provided You With TheMiroslav GegoskiNo ratings yet

- DocxDocument17 pagesDocxVy Pham Nguyen KhanhNo ratings yet

- Financial Analysis 4Document10 pagesFinancial Analysis 4Alaitz GNo ratings yet

- You Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - OnlineDocument1 pageYou Hold A 25 Common Stock Interest in Youownit A: Unlock Answers Here Solutiondone - Onlinetrilocksp SinghNo ratings yet

- Chapters 11 & 12Document4 pagesChapters 11 & 12Manal ElkhoshkhanyNo ratings yet

- Tugas AKM III - Week 3Document6 pagesTugas AKM III - Week 3Rifda AmaliaNo ratings yet

- QUIZ1 - Finacc3Document4 pagesQUIZ1 - Finacc3Jonnie RegalaNo ratings yet

- Extra Applications - Lecture Week 2Document5 pagesExtra Applications - Lecture Week 2Muhammad HusseinNo ratings yet

- CH 4-Model QuestionsDocument17 pagesCH 4-Model Questionsaysilislam528No ratings yet

- Chap 17 Week 1 V1 HW Study Guide 2%Document8 pagesChap 17 Week 1 V1 HW Study Guide 2%Mark KantorovichNo ratings yet

- 1.3.1 Responsibility Acccounting Sample ProblemsDocument4 pages1.3.1 Responsibility Acccounting Sample Problemsdanilynbrmdz0602No ratings yet

- Review Accounting NotesDocument9 pagesReview Accounting NotesJasin LujayaNo ratings yet

- ClassworkDocument2 pagesClassworkFolakemi OgunyemiNo ratings yet

- Solved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFDocument1 pageSolved A Company Manufacturing Hockey Bags Registered Trademarks For 1 000 Cash PDFAnbu jaromiaNo ratings yet

- Financial Intelligence TrainingDocument56 pagesFinancial Intelligence Trainingbe_kind4allNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Imanuel Xaverdino - 01804220010 - Homework 01Document5 pagesImanuel Xaverdino - 01804220010 - Homework 01Imanuel XaverdinoNo ratings yet

- Financial MGTDocument2 pagesFinancial MGTSohail Liaqat AliNo ratings yet

- Quiz 2 - 09.10.18 Set A BDocument4 pagesQuiz 2 - 09.10.18 Set A BRey Joyce AbuelNo ratings yet

- Cooley Textile S 2001 Financial Statements Are Shown Below Cooley Textile IncomeDocument1 pageCooley Textile S 2001 Financial Statements Are Shown Below Cooley Textile IncomeMuhammad ShahidNo ratings yet

- CH 4 In-Class Exercise SOLUTIONSDocument7 pagesCH 4 In-Class Exercise SOLUTIONSAbdullah alhamaadNo ratings yet

- Problem Set 6 BS CS 6Document3 pagesProblem Set 6 BS CS 6Rubab MirzaNo ratings yet

- The Following Account Balances For The Year Ended 30th JuneDocument1 pageThe Following Account Balances For The Year Ended 30th JuneHassan JanNo ratings yet

- PDFDocument76 pagesPDFCoreen BarlowNo ratings yet

- Assignment No 1Document15 pagesAssignment No 1M Naveed SultanNo ratings yet

- ACCT 3110 CH 7 Homework E 4 8 13 19 20 27Document7 pagesACCT 3110 CH 7 Homework E 4 8 13 19 20 27John Job100% (1)

- Hoyle - Chapter 3 - Class Problem - SolutionsDocument3 pagesHoyle - Chapter 3 - Class Problem - Solutionsyun leeNo ratings yet

- Akm3 Week-10Document5 pagesAkm3 Week-10pizzaanutriaNo ratings yet

- Financial and Managerial Accounting 11th Edition Warren Solutions ManualDocument10 pagesFinancial and Managerial Accounting 11th Edition Warren Solutions Manualcharlesdrakejth100% (20)

- FA Mid Term Exam Dec 2022Document3 pagesFA Mid Term Exam Dec 2022ha90665No ratings yet

- Test # 1 Review Material - BACC 152 16th EditionDocument14 pagesTest # 1 Review Material - BACC 152 16th EditionskswNo ratings yet

- Dr. M.D. Chase Long Beach State University Advanced Accounting 405-32B Interco Transactions-Upstream Sale: Depreciable Asset Page 1Document2 pagesDr. M.D. Chase Long Beach State University Advanced Accounting 405-32B Interco Transactions-Upstream Sale: Depreciable Asset Page 1Zenni T XinNo ratings yet

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- ASLH-D (S) B 48 NZDSF (A20SA 53 - 7,3) : Optical Ground Wire (OPGW)Document1 pageASLH-D (S) B 48 NZDSF (A20SA 53 - 7,3) : Optical Ground Wire (OPGW)AHMED YOUSEFNo ratings yet

- Machine Problem 1 TextDocument2 pagesMachine Problem 1 TextNeilmer Elcarte LahoylahoyNo ratings yet

- 9A01709 Advanced Structural AnalysisDocument8 pages9A01709 Advanced Structural AnalysissivabharathamurthyNo ratings yet

- BLDC 1500 2018 BC Building Code-Part 9 Single Family Dwelling BuildingsDocument12 pagesBLDC 1500 2018 BC Building Code-Part 9 Single Family Dwelling BuildingsHamza TikkaNo ratings yet

- Correction Rabattement Part1 Et Part2 ANGLESDocument2 pagesCorrection Rabattement Part1 Et Part2 ANGLESAyman FaroukiNo ratings yet

- The Abcs of Technical WritingDocument30 pagesThe Abcs of Technical WritingMayeng's VlogNo ratings yet

- AIR Conditioner: Installation ManualDocument35 pagesAIR Conditioner: Installation ManualClayton PedroNo ratings yet

- Military Service: The Ministry of Aliyah and Immigrant AbsorptionDocument64 pagesMilitary Service: The Ministry of Aliyah and Immigrant AbsorptionKERVIN6831117No ratings yet

- All of Managers Have Entered The Meeting Room, Except The President Director and Personnel ManagerDocument7 pagesAll of Managers Have Entered The Meeting Room, Except The President Director and Personnel ManagerALIFIA PUSPITANo ratings yet

- Project Report MiniDocument27 pagesProject Report Minisumit gandhi86% (21)

- rfg081573 - MANUAL DE SERVICIO PDFDocument1,207 pagesrfg081573 - MANUAL DE SERVICIO PDFJacob Campos VillanuevaNo ratings yet

- Enum - Singleton Pattern - InstanceOfDocument18 pagesEnum - Singleton Pattern - InstanceOfadarsh rajNo ratings yet

- Rome of Augustus Study GuideDocument41 pagesRome of Augustus Study GuideTheo WilsonNo ratings yet

- ALH - Video Hub - Level3 - Worksheets - AnswerkeyDocument3 pagesALH - Video Hub - Level3 - Worksheets - AnswerkeyJulliana SantosNo ratings yet

- 545 Znshine PDFDocument2 pages545 Znshine PDFDS INSTALAÇÕES ELÉTRICASNo ratings yet

- Research Paper On Drip Irrigation PDFDocument7 pagesResearch Paper On Drip Irrigation PDFafnhkvmnemelfx100% (1)

- Boiling - WikipediaDocument6 pagesBoiling - WikipediaTinidoorNo ratings yet

- Which Psychotropic Medications Induce He PDFDocument9 pagesWhich Psychotropic Medications Induce He PDFnisastNo ratings yet

- Front Axle & SteeringDocument130 pagesFront Axle & Steeringjstdoma /No ratings yet

- IDOC Testing: You Can Test The Idoc Using Idoc Test Tool. Just Follow The Steps AboveDocument3 pagesIDOC Testing: You Can Test The Idoc Using Idoc Test Tool. Just Follow The Steps AboveaximeNo ratings yet

- Syllabus - PAPER 1 - Application of Computer in MediaDocument39 pagesSyllabus - PAPER 1 - Application of Computer in MediaAbubakar shomarNo ratings yet

- TSPSC Vro Vra Exam Pattern 2017Document7 pagesTSPSC Vro Vra Exam Pattern 2017Sk HarrshadNo ratings yet

- Narrative TextDocument6 pagesNarrative TextRoy Altur RobinsonNo ratings yet

- Ala-Too International University 2020-2021 Spring Semester Course Timetable of Management Final ExaminationDocument8 pagesAla-Too International University 2020-2021 Spring Semester Course Timetable of Management Final ExaminationKunduz IbraevaNo ratings yet

- Lab Report Fine Aggregate A13 PDFDocument10 pagesLab Report Fine Aggregate A13 PDFNur NabilahNo ratings yet

- Causes and Prevention of Common Diseases Abd Epidemics in Human Epidemics, Pandemics, and OutbreaksDocument4 pagesCauses and Prevention of Common Diseases Abd Epidemics in Human Epidemics, Pandemics, and OutbreaksFaisal AwanNo ratings yet

- Blue Shield - Platinum Full Ppo 150 12 15Document5 pagesBlue Shield - Platinum Full Ppo 150 12 15api-252555369No ratings yet