Professional Documents

Culture Documents

Contemporary Mathematics For Business and Consumers, Third Edition

Contemporary Mathematics For Business and Consumers, Third Edition

Uploaded by

বিষাক্ত মানবOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Contemporary Mathematics For Business and Consumers, Third Edition

Contemporary Mathematics For Business and Consumers, Third Edition

Uploaded by

বিষাক্ত মানবCopyright:

Available Formats

Contemporary Mathematics for Business and Consumers, Third Edition

Robert A. Brechner

Copyright © 2003 Thomson/South-Western

Level 2

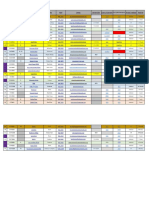

Chapter 11 - Section I - Exercise 30

The First National Bank is offering a 6-year certificate of deposit (CD) at 4% interest,

compounded quarterly; Second National Bank is offering a 6-year CD at 5% interest,

compounded annually.

a. If you were interested in investing $8,000 in one of these CDs, calculate the compound

amount of each offer.

Number of years = 6

Principal = $8,000.00

First National Second National

Periods per year = 4 1

Nominal rate = 4.0% 5.0%

Interest rate per period = 1.0% 5.0%

Compounding periods = 24 6

Table factor = 127% 134%

Compound amount = $10,157.88 $10,720.77

b. What is the annual percentage yield of each CD?

Number of years = 6

Principal = $8,000.00

First National Second National

Periods per year = 4 1

Nominal rate = 4.0% 5.0%

Interest rate per period = 1.0% 5.0%

Compounding periods = 24 6

Table factor = 1.26973 134%

Compound amount = $10,157.88 $10,720.77

Interest = $2,157.88 $2,720.77

APY = 4.06% 5.00%

c. (Optional) If Third National Bank has a 6-year CD at 4.5% interest compounded

monthly, use the compound interest formula to find the compound amount of this offer.

Number of years =

Principal =

Periods per year =

Nominal rate =

Interest rate per period =

Compounding periods =

Amount =

You might also like

- Solved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Document49 pagesSolved Problems in Engineering Economics: CLSU-AE Board Exam Review Materials 1Abas Acmad67% (3)

- Module 6 - Solution To Math ExamDocument38 pagesModule 6 - Solution To Math ExamZulueta Jing MjNo ratings yet

- Lecture Notes - 6 - Methods of ValuationDocument9 pagesLecture Notes - 6 - Methods of ValuationNathaniel Mclean100% (2)

- Chapter 11 ExerciseDocument5 pagesChapter 11 ExerciseJoe DicksonNo ratings yet

- Ps 6Document19 pagesPs 6Da Harlequin GalNo ratings yet

- 3.09 Set 3 Mock Exam ReaDocument5 pages3.09 Set 3 Mock Exam Reabhobot riveraNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Lockheed Tristar Case SolutionDocument3 pagesLockheed Tristar Case SolutionPrakash Nishtala100% (1)

- Cash Flow EstimationDocument9 pagesCash Flow EstimationCassandra ChewNo ratings yet

- JRE300-April 2015 - Final Exam - SOLUTIONS KEYDocument11 pagesJRE300-April 2015 - Final Exam - SOLUTIONS KEYSCR PpelusaNo ratings yet

- F7 Exercise To SendDocument34 pagesF7 Exercise To SendHằng LêNo ratings yet

- Planning and Evaluationl English 2Document38 pagesPlanning and Evaluationl English 2Absa TraderNo ratings yet

- 3Document45 pages3Alex liaoNo ratings yet

- Week 2 WACC RecapDocument54 pagesWeek 2 WACC RecapSTOjedenNo ratings yet

- Fin 440 Chapter 10Document17 pagesFin 440 Chapter 10Mehedi HasanNo ratings yet

- Long Live AssetsDocument16 pagesLong Live AssetsLu CasNo ratings yet

- Chapter 5 SummaryDocument24 pagesChapter 5 SummaryDY CMM GRCNo ratings yet

- Making Investment Decisions With The NPV RuleDocument24 pagesMaking Investment Decisions With The NPV RuleSebine MemmedliNo ratings yet

- 13.4 As 10 Property, Plant & EquipmentDocument7 pages13.4 As 10 Property, Plant & EquipmentAakshi SharmaNo ratings yet

- Record Your Family Name / Initial and Student ID Number in The Spaces Provided BelowDocument8 pagesRecord Your Family Name / Initial and Student ID Number in The Spaces Provided BelowJonathan TanNo ratings yet

- BEPDocument8 pagesBEPHARMANJOT SINGHNo ratings yet

- TasksDocument30 pagesTaskstungotaku23No ratings yet

- AnnuitiesDocument19 pagesAnnuitiesRussel SanguyoNo ratings yet

- Introduction: The Report Is About The Case Study On Project Cash Flow and Capital Budgeting On TheDocument8 pagesIntroduction: The Report Is About The Case Study On Project Cash Flow and Capital Budgeting On TheSyed NawazNo ratings yet

- 5.economic Analysis cb311 Spring-2015Document47 pages5.economic Analysis cb311 Spring-2015ahmedNo ratings yet

- Module 6 AND 7 AnswerDocument30 pagesModule 6 AND 7 AnswerSophia DayaoNo ratings yet

- Exam 1 - VI SolutionsDocument9 pagesExam 1 - VI SolutionsZyraNo ratings yet

- Lecture Engineering Economics FE Review ProblemsDocument23 pagesLecture Engineering Economics FE Review ProblemsLee Song HanNo ratings yet

- Cost AllocationDocument10 pagesCost Allocationtirigotu57No ratings yet

- Technical Article Budgeting - Part 1Document4 pagesTechnical Article Budgeting - Part 1Iqmal khushairiNo ratings yet

- Bai Tap CMQT clc59Document21 pagesBai Tap CMQT clc59Hằng LêNo ratings yet

- Lecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFDocument6 pagesLecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDFjasminetsoNo ratings yet

- Ppde CB407 P4Document25 pagesPpde CB407 P4Ujjwal AnandNo ratings yet

- F9FM-Session05 d08jkbnDocument30 pagesF9FM-Session05 d08jkbnErclanNo ratings yet

- Professional Practice Computation ExplanationDocument4 pagesProfessional Practice Computation ExplanationNathaniel RasosNo ratings yet

- Insurance Company of Latin AmericaDocument17 pagesInsurance Company of Latin Americahmz18113881No ratings yet

- 2010 Sem 2 Final - LatestDocument8 pages2010 Sem 2 Final - LatestArthur NitsopoulosNo ratings yet

- Chapter 3: Feasibility Study CalculationDocument43 pagesChapter 3: Feasibility Study CalculationAbebaw AyeleNo ratings yet

- Production and Marketing of Brrewcoal: An Eco-Briquette From Used Coffee GroundsDocument36 pagesProduction and Marketing of Brrewcoal: An Eco-Briquette From Used Coffee GroundsRayver Chris Villanueva100% (1)

- Module-3 (A) Capital BudgetingDocument62 pagesModule-3 (A) Capital Budgetingvinit PatidarNo ratings yet

- Activity - Capital Investment AnalysisDocument4 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- MSL302 Capital Budgeting Decisions Term Paper Report: Submitted byDocument10 pagesMSL302 Capital Budgeting Decisions Term Paper Report: Submitted bychioqueNo ratings yet

- Module-3 Capital BudgetingDocument47 pagesModule-3 Capital Budgetingvinit PatidarNo ratings yet

- 2009 Sem1Document7 pages2009 Sem1Ella GorelikNo ratings yet

- Time Value of Money 2023 - Part-1Document20 pagesTime Value of Money 2023 - Part-1YAHIA ADELNo ratings yet

- CH (10) - Book AnswersDocument17 pagesCH (10) - Book AnswersabdulraufdghaybeejNo ratings yet

- Cost Benefit AnalysisDocument4 pagesCost Benefit AnalysisSaptiva GoswamiNo ratings yet

- Capital Budgeting ExampleDocument5 pagesCapital Budgeting ExampleVô ThườngNo ratings yet

- Answers: K Aplan P Ublish in GDocument16 pagesAnswers: K Aplan P Ublish in GqqqNo ratings yet

- Cashflows PDFDocument40 pagesCashflows PDFABHISHEK RAJNo ratings yet

- Capital Budgeting EnhancementDocument3 pagesCapital Budgeting EnhancementRio Alexander IbanezNo ratings yet

- Chapter 8Document31 pagesChapter 8laurenbondy44No ratings yet

- F5 RevDocument69 pagesF5 Revpercy mapetereNo ratings yet

- Test #5 Part CDocument2 pagesTest #5 Part CJohn PickleNo ratings yet

- Eq Final 1 SolDocument6 pagesEq Final 1 SolVanya BudhirajaNo ratings yet

- UntitledDocument2 pagesUntitledRedier RedNo ratings yet

- 03 Handout 144Document14 pages03 Handout 144John michael ServianoNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Budget ExcelDocument7 pagesBudget Excelবিষাক্ত মানবNo ratings yet

- 2.4.4.10 Approved Supplier IngredientsDocument6 pages2.4.4.10 Approved Supplier Ingredientsবিষাক্ত মানবNo ratings yet

- Maintenance Work Orders Work Order IdDocument2 pagesMaintenance Work Orders Work Order Idবিষাক্ত মানবNo ratings yet

- (Name) Webex Digital Event - (Date Dec 9, 2021) - (Time 1Pm CST)Document3 pages(Name) Webex Digital Event - (Date Dec 9, 2021) - (Time 1Pm CST)বিষাক্ত মানবNo ratings yet

- HashLabs V3 - Feb 2021 - Financial ProjectionsDocument260 pagesHashLabs V3 - Feb 2021 - Financial Projectionsবিষাক্ত মানবNo ratings yet

- Contemporary Mathematics For Business and Consumers, Third EditionDocument1 pageContemporary Mathematics For Business and Consumers, Third Editionবিষাক্ত মানবNo ratings yet

- NP EX19 CT3c StaciBrunner 2Document7 pagesNP EX19 CT3c StaciBrunner 2বিষাক্ত মানবNo ratings yet

- Contemporary Mathematics For Business and Consumers, Third EditionDocument1 pageContemporary Mathematics For Business and Consumers, Third Editionবিষাক্ত মানবNo ratings yet