Professional Documents

Culture Documents

Let Today Be November 3 2008 A Use The Libor Rate

Let Today Be November 3 2008 A Use The Libor Rate

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Let Today Be November 3 2008 A Use The Libor Rate

Let Today Be November 3 2008 A Use The Libor Rate

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Let today be November 3 2008 a Use the LIBOR

rate

Let today be November 3, 2008.

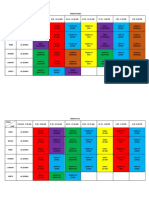

(a) Use the LIBOR rate and the swap data on November 3, 2008 in Table 11.26 and fit the

LIBOR curve.

(b) From the LIBOR discount curve, fit the Ho-Lee model of the interest rates, with quarterly

steps. You can use the LIBOR volatility reported in the text, or estimate the LIBOR volatility

yourself. Data on LIBOR are available on the British Bankers Association Web site

(www.baa.org.uk).

(c) Compare risk neutral expected future interest rates to the continuously compounded interest

rates. How does the difference depend on the assumed volatility of the interest rate? (For each

assumed volatility of the interest rate,

Issuer...................................... HAL Corp.

Rating .................................... AAA

Pricing Date .............................. November 3, 2008

Maturity Date ............................ November 3, 2013 100

Principal.................................... 100

Coupon Frequency ....................... Quarterly

Coupon.....................................5.4% if reference rate within corridor bounds; 0% otherwise 1%

Corridor Lower Bound .................. 1%

Corridor Upper Bound ................... 5%

Reference Rate..............................3 Month LIBOR on previous fixing date

You need to refit the tree to make sure that the tree correctly reflects the forward rates. Do the

exercise for 3 values of volatility).

(d) Compute the value of 1-year, 2-year and 3-year cap. Compare your value with the one in the

data, in Table 11.26.

Reach out to freelance2040@yahoo.com for enquiry.

(e) Compute the value of a 5-year swap (the swap rate in Table 11.26) with quarterly payments

(i.e., assume that both floating and fixed payers pay at quarterly frequency). Is the value of the

swap obtained from the tree what you would expect from first principles?

(f) Use the swap tree computed in Part (e) to compute the value of 1-year, at-the-money

swaption to enter into a 4-year swap.

Let today be November 3 2008 a Use the LIBOR rate

ANSWER

https://solvedquest.com/let-today-be-november-3-2008-a-use-the-libor-rate/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- 4831 S2016 PS2 AnswerKeyDocument9 pages4831 S2016 PS2 AnswerKeyAmy20160302No ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Estacio Vs EstacioDocument14 pagesEstacio Vs EstacioWilfredo100% (2)

- A Complete Solution To The Black-Scholes Option Pricing FormulaDocument12 pagesA Complete Solution To The Black-Scholes Option Pricing FormulaAidan HolwerdaNo ratings yet

- BUSI 353 S18 Assignment 3 All RevenueDocument5 pagesBUSI 353 S18 Assignment 3 All RevenueTanNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Colgate Case StudyDocument10 pagesColgate Case Studyapi-350427360100% (3)

- Kiss Me Hard Before YouDocument43 pagesKiss Me Hard Before YoukimNo ratings yet

- TermStructure Binomial #1Document46 pagesTermStructure Binomial #1Mobin KurianNo ratings yet

- Guo S Solutions To Derivatives Markets Fall 2007Document11 pagesGuo S Solutions To Derivatives Markets Fall 2007Nathaniel ArchibaldNo ratings yet

- Assignment 3 SolutionsDocument5 pagesAssignment 3 SolutionsFaas1337No ratings yet

- Hull Fund 8 e CH 12 Problem SolutionsDocument14 pagesHull Fund 8 e CH 12 Problem SolutionsVandrexz ChungNo ratings yet

- BF - 307: Derivative Securities January 19, 2012 Homework Assignment 1 Suman Banerjee InstructionsDocument3 pagesBF - 307: Derivative Securities January 19, 2012 Homework Assignment 1 Suman Banerjee Instructionssamurai_87No ratings yet

- Actuarial Notation: AnnuitiesDocument12 pagesActuarial Notation: AnnuitiesCallum Thain BlackNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- 2.3 Fra and Swap ExercisesDocument5 pages2.3 Fra and Swap ExercisesrandomcuriNo ratings yet

- Question Bank 2 - SEP2019Document6 pagesQuestion Bank 2 - SEP2019Nhlanhla ZuluNo ratings yet

- Hedge Fund Modelling and Analysis: An Object Oriented Approach Using C++From EverandHedge Fund Modelling and Analysis: An Object Oriented Approach Using C++No ratings yet

- Exam FM-August 2010 Financial Mathematics: Learning Objectives I. Interest TheoryDocument6 pagesExam FM-August 2010 Financial Mathematics: Learning Objectives I. Interest Theory18729No ratings yet

- RR Problems SolutionsDocument5 pagesRR Problems SolutionsShaikh FarazNo ratings yet

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonNo ratings yet

- Business Economics ICFAIDocument20 pagesBusiness Economics ICFAIDaniel VincentNo ratings yet

- Portfolio Theory PDFDocument44 pagesPortfolio Theory PDFDinhkhanh NguyenNo ratings yet

- Beta Leverage and The Cost of CapitalDocument3 pagesBeta Leverage and The Cost of CapitalpumaguaNo ratings yet

- Exam FM Practice Exam 3Document71 pagesExam FM Practice Exam 3nad_nattNo ratings yet

- SOA FM Sample Derivatives QuestionsDocument17 pagesSOA FM Sample Derivatives QuestionsMonica MckinneyNo ratings yet

- Sample Exam QuestionsDocument16 pagesSample Exam QuestionsMadina SuleimenovaNo ratings yet

- Black ScholesDocument62 pagesBlack ScholesBùi Hồng ThảoNo ratings yet

- Evaluating and Hedging Exotic Swap Instruments Via LGMDocument33 pagesEvaluating and Hedging Exotic Swap Instruments Via LGMalexandergirNo ratings yet

- McDonald Chapter2Document9 pagesMcDonald Chapter2kalus00123100% (1)

- Test Bank: Chapter 3 Hedging Strategies Using FuturesDocument2 pagesTest Bank: Chapter 3 Hedging Strategies Using FuturesJocelyn TanNo ratings yet

- Dynamic Forward HedgingDocument37 pagesDynamic Forward HedgingCDNo ratings yet

- Lse FM474Document47 pagesLse FM474Hu HeNo ratings yet

- Credit Loss and Systematic LGD Frye Jacobs 100611 PDFDocument31 pagesCredit Loss and Systematic LGD Frye Jacobs 100611 PDFsgjatharNo ratings yet

- Tutorial 3 QuestionsDocument3 pagesTutorial 3 Questionsguan junyanNo ratings yet

- Log NormalDocument12 pagesLog NormalAlexir86No ratings yet

- Danthine ExercisesDocument22 pagesDanthine ExercisesmattNo ratings yet

- Yield Curve ModelingDocument62 pagesYield Curve ModelingdouglasNo ratings yet

- Fixed Income Portfolio MGMT - Butterfly SpreadsDocument111 pagesFixed Income Portfolio MGMT - Butterfly Spreadssawilson1No ratings yet

- Tutorial 1 Solutions (Modern Portfolio Theory and Investment Analysis)Document5 pagesTutorial 1 Solutions (Modern Portfolio Theory and Investment Analysis)dan westNo ratings yet

- PPT5-Mathematics of FinanceDocument22 pagesPPT5-Mathematics of FinanceRano Acun100% (2)

- Quiz 1 SolutionDocument5 pagesQuiz 1 SolutionPritesh GehlotNo ratings yet

- Investment BKM 5th EditonDocument21 pagesInvestment BKM 5th EditonKonstantin BezuhanovNo ratings yet

- Week 1 Lecture SlidesDocument30 pagesWeek 1 Lecture SlidesPHAT NGUYENNo ratings yet

- OPT SolutionDocument52 pagesOPT SolutionbocfetNo ratings yet

- CAPMDocument34 pagesCAPMadityav_13100% (1)

- Option Pricing and StrategiesDocument10 pagesOption Pricing and StrategiesIvan ChiuNo ratings yet

- Exam June 2009 SolutionsDocument15 pagesExam June 2009 SolutionsesaNo ratings yet

- PJM ARR and FTR MarketDocument159 pagesPJM ARR and FTR MarketfwlwllwNo ratings yet

- Combinepdf PDFDocument65 pagesCombinepdf PDFCam SpaNo ratings yet

- Mathematical Finance End SemDocument4 pagesMathematical Finance End SemmakeshNo ratings yet

- Valuation of Option ModelDocument12 pagesValuation of Option ModelSagar GajjarNo ratings yet

- Matlab Port OptDocument21 pagesMatlab Port OptgauravroongtaNo ratings yet

- Case Scenarios For Taxation Exams ACCT 3050 by RC (2020)Document5 pagesCase Scenarios For Taxation Exams ACCT 3050 by RC (2020)TashaNo ratings yet

- CAPM TheoryDocument11 pagesCAPM TheoryNishakdasNo ratings yet

- Statistical Foundation For Analytics-Module 1Document18 pagesStatistical Foundation For Analytics-Module 1VikramAditya RattanNo ratings yet

- e 51 F 8 F 8 B 4 A 32 Ea 4Document159 pagese 51 F 8 F 8 B 4 A 32 Ea 4Shawn Kou100% (5)

- Dupire Local VolatilityDocument15 pagesDupire Local VolatilityJohn MclaughlinNo ratings yet

- Chapter 7a - Bonds ValuationDocument22 pagesChapter 7a - Bonds ValuationAian CortezNo ratings yet

- Alternative InvestmentDocument7 pagesAlternative InvestmentAbhi Jayakumar100% (1)

- AdviceDocument16 pagesAdviceanon-323978No ratings yet

- Stolyarov MFE Study GuideDocument279 pagesStolyarov MFE Study GuideChamu ChiwaraNo ratings yet

- Simona Svoboda - Libor Market Model With Stochastic Volatility PDFDocument66 pagesSimona Svoboda - Libor Market Model With Stochastic Volatility PDFChun Ming Jeffy TamNo ratings yet

- Structured Financial Product A Complete Guide - 2020 EditionFrom EverandStructured Financial Product A Complete Guide - 2020 EditionNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Vargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentDocument1 pageVargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Abbotsford Law Court Provincial AdvanceDocument108 pagesAbbotsford Law Court Provincial Advancesampv90No ratings yet

- Final Project ThermalDocument21 pagesFinal Project ThermalArizap MoltresNo ratings yet

- tóm tắt sách atomic habitDocument3 pagestóm tắt sách atomic habitPeter SmithNo ratings yet

- Veilofreality Com 2011 04 18 Organic-Portals-Soulless-HuDocument47 pagesVeilofreality Com 2011 04 18 Organic-Portals-Soulless-Huapi-23178167550% (2)

- 3.1.3.2 Batu Saluran KemihDocument64 pages3.1.3.2 Batu Saluran Kemihwinda musliraNo ratings yet

- Jadual Alimah 2021.V3Document6 pagesJadual Alimah 2021.V3maryam cookNo ratings yet

- Derridas Legacies Literature and PhilosophyDocument184 pagesDerridas Legacies Literature and Philosophyinnommable100% (1)

- Jade PresentationDocument11 pagesJade PresentationaaaaaaaNo ratings yet

- After Eating Lunch at The Cheesecake FactoryDocument3 pagesAfter Eating Lunch at The Cheesecake FactoryRahisya MentariNo ratings yet

- Differential Equations & Transforms (BMAT102L)Document19 pagesDifferential Equations & Transforms (BMAT102L)Venkat BalajiNo ratings yet

- Pathophysiology of LeptospirosisDocument8 pagesPathophysiology of LeptospirosistomeyttoNo ratings yet

- Grammar BeGoingTo1 18821-1Document1 pageGrammar BeGoingTo1 18821-1CristinaNo ratings yet

- Okatse Canyon: Mások Ezeket Keresték MégDocument1 pageOkatse Canyon: Mások Ezeket Keresték Mégtom kemNo ratings yet

- (Journal) Iain L. Densten and Judy H. Gray - Leadership Development and Reflection What Is The Connection PDFDocument6 pages(Journal) Iain L. Densten and Judy H. Gray - Leadership Development and Reflection What Is The Connection PDFAzwinNo ratings yet

- CvaDocument170 pagesCvaApril Jumawan ManzanoNo ratings yet

- Zaid Letter To DNI Acting DirectorDocument2 pagesZaid Letter To DNI Acting DirectorNational Content Desk100% (2)

- Chemistry in Pictures - Turn Your Pennies Into "Gold" Rosemarie Pittenger,.Document3 pagesChemistry in Pictures - Turn Your Pennies Into "Gold" Rosemarie Pittenger,.Igor LukacevicNo ratings yet

- Unit 8 Lesson 1: Parts of The BodyDocument2 pagesUnit 8 Lesson 1: Parts of The BodyNguyễn PhúcNo ratings yet

- Nota Ringkas Ict f5 MultimediaDocument13 pagesNota Ringkas Ict f5 MultimediaHemameeraVellasamyNo ratings yet

- Bar Council of India VsDocument19 pagesBar Council of India VsArun VigneshNo ratings yet

- IntrotovedicmathDocument3 pagesIntrotovedicmathmathandmultimediaNo ratings yet

- Hvpe Syl andDocument9 pagesHvpe Syl andosho_peaceNo ratings yet

- Managing Human Resources 7th Edition Gomez-Mejia Solutions Manual DownloadDocument12 pagesManaging Human Resources 7th Edition Gomez-Mejia Solutions Manual DownloadVera Roth100% (26)

- LiberalismDocument3 pagesLiberalismNafis FuadNo ratings yet

- Construction ProductivityDocument9 pagesConstruction ProductivityCristian ZúñigaNo ratings yet

- (123doc) - De-Dap-An-Chuyen-Anh-Tphcm-2008-2009Document14 pages(123doc) - De-Dap-An-Chuyen-Anh-Tphcm-2008-2009Đình HảiNo ratings yet

- Pages From API.5l.2004-A25Document1 pagePages From API.5l.2004-A25A.ANo ratings yet