Professional Documents

Culture Documents

Larissa Has Been Talking With The Company S Directors About The

Larissa Has Been Talking With The Company S Directors About The

Uploaded by

Amit PandeyCopyright:

Available Formats

You might also like

- Mini Case STOCK VALUATIONDocument5 pagesMini Case STOCK VALUATIONRizky Khairunnisa0% (1)

- Answer To The Case StudyDocument11 pagesAnswer To The Case StudyNahidul Islam IU100% (3)

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- PWC Family Business Survey US 2019Document26 pagesPWC Family Business Survey US 2019Business Families Foundation100% (1)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Case Study UnderArmourDocument2 pagesCase Study UnderArmourNey JNo ratings yet

- Pceia NotesDocument6 pagesPceia NotesEileen WongNo ratings yet

- Stock Valuation at Ragan EnginesDocument2 pagesStock Valuation at Ragan EnginesNguyen Do Quyen0% (1)

- Case 4 Stock Valuation 1Document1 pageCase 4 Stock Valuation 1Camesh Janu0% (1)

- Elliotts Letter To MPC 09252019Document3 pagesElliotts Letter To MPC 09252019Tom TsakopoulosNo ratings yet

- Gainesboro CaseDocument6 pagesGainesboro CaseDanny4118100% (2)

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Sanchit - Sharma EX2019 ChallengeYourself 4 3Document4 pagesSanchit - Sharma EX2019 ChallengeYourself 4 3sanchit sharmaNo ratings yet

- Stock Valuation at Ragan Engines CH 9Document2 pagesStock Valuation at Ragan Engines CH 9Maxim Kapin50% (2)

- EAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFDocument2 pagesEAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFGhoul GamingNo ratings yet

- 1 AssignmentsDocument11 pages1 AssignmentsAsad MemonNo ratings yet

- A Evaluate Each of These Alternatives On The Basis ofDocument2 pagesA Evaluate Each of These Alternatives On The Basis oftrilocksp SinghNo ratings yet

- Stock Valuation at Ragan-Minicase PDFDocument2 pagesStock Valuation at Ragan-Minicase PDFGhoul Gaming0% (1)

- The Larry and Barry Guide to Understanding Royalties: The Better Way of Investing in and Financing of BusinessesFrom EverandThe Larry and Barry Guide to Understanding Royalties: The Better Way of Investing in and Financing of BusinessesNo ratings yet

- The Future of Intelligence Is Here (PLTR)Document8 pagesThe Future of Intelligence Is Here (PLTR)monarqueobichoNo ratings yet

- Case Study-ParagonDocument5 pagesCase Study-ParagonDaniyal NasirNo ratings yet

- Papa Murphy's (FRSH) Franchisees Letters From PMFADocument8 pagesPapa Murphy's (FRSH) Franchisees Letters From PMFAronjackson445No ratings yet

- AUDITDocument2 pagesAUDITSonitaNo ratings yet

- Comp DataDocument15 pagesComp Datahelp sNo ratings yet

- ResearchDocument2 pagesResearchMustafa El-gamatyNo ratings yet

- TermsDocument2 pagesTermsAbhijitChandraNo ratings yet

- Answer For Fm2 (2,5,6)Document2 pagesAnswer For Fm2 (2,5,6)Nurul IdayuNo ratings yet

- Setting The Right Stretch TargetsDocument12 pagesSetting The Right Stretch TargetsjohnkwashanaiNo ratings yet

- Answer Case Lawn KingDocument4 pagesAnswer Case Lawn KingPavi Antoni VillaceranNo ratings yet

- AFIN1Document6 pagesAFIN1Abs PangaderNo ratings yet

- Ad Victoriam Named Salesforce Platinum PartnerDocument2 pagesAd Victoriam Named Salesforce Platinum PartnerPR.comNo ratings yet

- Top 5 PositionsDocument15 pagesTop 5 PositionsPradeep RaghunathanNo ratings yet

- At 2Document1 pageAt 2KathleenNo ratings yet

- Neuroscience of Leadership - 1Document34 pagesNeuroscience of Leadership - 1PradeepNo ratings yet

- Topdog SoftwareDocument3 pagesTopdog SoftwareAisyah FitriNo ratings yet

- Practice Final With SolutionsDocument8 pagesPractice Final With SolutionsSammy MosesNo ratings yet

- Chapter 1 TheoryDocument5 pagesChapter 1 TheorySittie Ainna A. UnteNo ratings yet

- RebeccaDocument2 pagesRebeccaridhiNo ratings yet

- Case Analysis - Merit Enterprise CorpDocument1 pageCase Analysis - Merit Enterprise CorpKC LapusNo ratings yet

- Case 1 (Firm and The Financial Manager)Document5 pagesCase 1 (Firm and The Financial Manager)Ghulam HassanNo ratings yet

- Ratan TataDocument18 pagesRatan TataDasuni WeerarathneNo ratings yet

- Artko Capital 2016 Q2 LetterDocument8 pagesArtko Capital 2016 Q2 LetterSmitty WNo ratings yet

- 2019 Benchmark Report: Apac Employment ScreeningDocument24 pages2019 Benchmark Report: Apac Employment ScreeningApoorv SinghalNo ratings yet

- SK-030-053 (Montaha Ayub Vasha)Document4 pagesSK-030-053 (Montaha Ayub Vasha)Md. Sakib HossainNo ratings yet

- Nadir An Unlevered Firm Has Expected Earnings Before Interest andDocument2 pagesNadir An Unlevered Firm Has Expected Earnings Before Interest andAmit PandeyNo ratings yet

- (Hons) - Paper BCH 6.1 - Auditing and Corporate Governance Week 1 - Aruna JhaDocument17 pages(Hons) - Paper BCH 6.1 - Auditing and Corporate Governance Week 1 - Aruna JhaGurdeep SinghNo ratings yet

- Verafin CaseDocument3 pagesVerafin CaseMargaret Tariro MunemwaNo ratings yet

- (Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3Document17 pages(Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3equityanalystinvestor100% (1)

- WAC Report IndividualDocument6 pagesWAC Report IndividualNEHA JENA IPM 2018 BatchNo ratings yet

- Effectiveness of LazadaDocument4 pagesEffectiveness of Lazadahaafiz5arisNo ratings yet

- SAP Ariba Spend AnalyticsDocument4 pagesSAP Ariba Spend Analyticshamza0% (1)

- The Future of The Accounting Industry in 2015Document3 pagesThe Future of The Accounting Industry in 2015JaybeeNo ratings yet

- Illustration Questions Topic 3Document2 pagesIllustration Questions Topic 3LinhLeNo ratings yet

- For ClassDocument1 pageFor ClassArchit Jain Rulz0% (1)

- The Rise and Fall of Satyam Computers Limited John J. Puthenpurackal Associate Professor University of Nevada Las Vegas Department of FinanceDocument2 pagesThe Rise and Fall of Satyam Computers Limited John J. Puthenpurackal Associate Professor University of Nevada Las Vegas Department of FinanceAnonymous QEAJfj4No ratings yet

- Country Hill CaseDocument2 pagesCountry Hill CaseAlisha Anand [JKBS]No ratings yet

- Ebay PayPal Split Analysis: Buy Two Moats For The Price of OneDocument24 pagesEbay PayPal Split Analysis: Buy Two Moats For The Price of OneJason Gilbert100% (3)

- What Happens When Power of Compounding Shakes Hands With Power of PhilosophyDocument2 pagesWhat Happens When Power of Compounding Shakes Hands With Power of PhilosophySai prakash patilNo ratings yet

- Chapter 1 HomeworkDocument2 pagesChapter 1 HomeworkNabila EramNo ratings yet

- Full-Service Digital Agency EZ Rankings To Move From .Org ToDocument4 pagesFull-Service Digital Agency EZ Rankings To Move From .Org ToPR.comNo ratings yet

- Solusi Flinder 3Document4 pagesSolusi Flinder 3Lalang PalambangNo ratings yet

- Aaron de Smet, Et Al.-Performance and HealthDocument12 pagesAaron de Smet, Et Al.-Performance and HealthboonikutzaNo ratings yet

- Boost Your GrowthDNA: How Strategic Leaders Use Growth Genetics to Drive Sustainable Business PerformanceFrom EverandBoost Your GrowthDNA: How Strategic Leaders Use Growth Genetics to Drive Sustainable Business PerformanceNo ratings yet

- Caerus Investors Kate Spade LetterDocument4 pagesCaerus Investors Kate Spade LetterPortiaNo ratings yet

- Summary of Scaling Up: by Verne Harnish | Key Takeaways & AnalysisFrom EverandSummary of Scaling Up: by Verne Harnish | Key Takeaways & AnalysisRating: 4.5 out of 5 stars4.5/5 (2)

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Regional Air Connectivity - KarnatakaDocument43 pagesRegional Air Connectivity - KarnatakaShashank DantuNo ratings yet

- EmitraDocument12 pagesEmitraAkshita JainNo ratings yet

- City/ Location Hotel Brand Hotel NameDocument4 pagesCity/ Location Hotel Brand Hotel NameJagdeep SanghaNo ratings yet

- Micro Assigniment 1Document7 pagesMicro Assigniment 1keting0806No ratings yet

- WBE Brion Service Centre Statement of Financial Position As of December 31, 2019 AssetsDocument4 pagesWBE Brion Service Centre Statement of Financial Position As of December 31, 2019 AssetsCheche Casaljay AmpoanNo ratings yet

- National IncomeDocument30 pagesNational IncomeTaruna Dureja BangaNo ratings yet

- Supplemantary Deed of Pandokhar Food LLPDocument4 pagesSupplemantary Deed of Pandokhar Food LLPakarshit kapoorNo ratings yet

- Public Sector Accounting and Civil Society PPT by Fraol Adula1Document43 pagesPublic Sector Accounting and Civil Society PPT by Fraol Adula1ramr155155No ratings yet

- NCL Expected MCQS 2023Document9 pagesNCL Expected MCQS 2023akhilesh yadavNo ratings yet

- Revamping Project ManagementDocument190 pagesRevamping Project ManagementManoj GuntupalliNo ratings yet

- Thermo Plastics CusdecDocument1 pageThermo Plastics Cusdecjerad.transcoNo ratings yet

- Urbanization and Sustainability in BangaloreDocument17 pagesUrbanization and Sustainability in BangaloreYalandhar ReddyNo ratings yet

- Cincinnati Development Fund PresentationDocument28 pagesCincinnati Development Fund PresentationWVXU NewsNo ratings yet

- 2.5 & 2.6 Demand, Supply, & EquilibriumDocument4 pages2.5 & 2.6 Demand, Supply, & EquilibriumJeyanthyNo ratings yet

- 17th & 18th June 2023 Current AffairsDocument17 pages17th & 18th June 2023 Current AffairsRohan DineshNo ratings yet

- World of Three ZerosDocument4 pagesWorld of Three ZerosEdwinNo ratings yet

- Long Term Financing Decision - KeyDocument6 pagesLong Term Financing Decision - KeykNo ratings yet

- Inter Business Management MCQ 6.5Document4 pagesInter Business Management MCQ 6.5Josphine AbiNo ratings yet

- Teoria de Antenas - Análise e Síntese - 3 Ed - Vol 1 - Constantine A. Balanis - PT-BRDocument182 pagesTeoria de Antenas - Análise e Síntese - 3 Ed - Vol 1 - Constantine A. Balanis - PT-BRRicardoNubiatoNo ratings yet

- Sound Art SpecialDocument32 pagesSound Art SpecialSelçuk Canberk DağtekinNo ratings yet

- 4.2 Accounting For Depreciation and Disposal of Non-Current AssetsDocument10 pages4.2 Accounting For Depreciation and Disposal of Non-Current Assetsnoahsilva374No ratings yet

- Customer Relationship Management: Dr. Ruchi JainDocument30 pagesCustomer Relationship Management: Dr. Ruchi JainNavdeeshSharmaNo ratings yet

- Asian Security Practice - Material and Ideational Influences (PDFDrive)Document1,799 pagesAsian Security Practice - Material and Ideational Influences (PDFDrive)Muhammad Jahanzeb AkmalNo ratings yet

- GST Working May 2022Document20 pagesGST Working May 2022Chandrashekar BNo ratings yet

- Supreme Court CasesDocument4 pagesSupreme Court CasesTanisha AgarwalNo ratings yet

- Lesson 2 - Cross - Border TradingDocument46 pagesLesson 2 - Cross - Border TradingLâm Hồng MaiNo ratings yet

- DRAFT Minutes of TRP Board Meeting Held 2 December 2014Document3 pagesDRAFT Minutes of TRP Board Meeting Held 2 December 2014Joseph GreenNo ratings yet

- Corporate Finance Test 1Document3 pagesCorporate Finance Test 1Kevin VerhagenNo ratings yet

Larissa Has Been Talking With The Company S Directors About The

Larissa Has Been Talking With The Company S Directors About The

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Larissa Has Been Talking With The Company S Directors About The

Larissa Has Been Talking With The Company S Directors About The

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Larissa has been talking with the company s

directors about the

Larissa has been talking with the company’s directors about the future of East Coast Yachts.

To this point, the company has used outside suppliers for various key components of the

company’s yachts, including engines. Larissa has decided that East Coast Yachts should

consider the purchase of an engine manufacturer to allow East Coast Yachts to better integrate

its supply chain and get more control over engine features. After investigating several possible

companies, Larissa feels that the purchase of Ragan Engines, Inc., is a possibility. She has

asked Dan Ervin to analyze Ragan’s value.

Ragan Engines, Inc., was founded nine years ago by a brother and sister—Carrington and

Genevieve Ragan—and has remained a privately owned company. The company manufactures

marine engines for a variety of applications. Ragan has experienced rapid growth because of a

proprietary technology that increases the fuel efficiency of its engines with very little sacrifice in

performance. The company is equally owned by Carrington and Genevieve. The original

agreement between the siblings gave each 150,000 shares of stock.

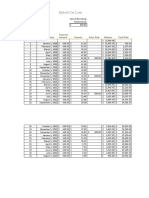

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan

has gathered the following information about some of Ragan’s competitors that are publicly

traded:

.:.

Nautilus Marine Engines’s negative earnings per share (EPS) were the result of an accounting

write-off last year. Without the write-off, EPS for the company would have been $2.07. Last

year, Ragan had an EPS of $5.35 and paid a dividend to Carrington and Genevieve of

$320,000 each. The company also had a return on equity of 21 percent.

Larissa tells Dan that a required return for Ragan of 18 percent is appropriate.

1. Assuming the company continues its current growth rate, what is the value per share of the

company’s stock?

2. Dan has examined the company’s financial statements, as well as examining those of its

competitors. Although Ragan currently has a technological advantage, Dan’s research

indicates that Ragan’s competitors are investigating other methods to improve efficiency. Given

this, Dan believes that Ragan’s technological advantage will last only for the next five years.

After that period, the company’s growth will likely slow to the industry average. Additionally,

Dan believes that the required return the company uses is too high. He believes the industry

average required return is more appropriate. Under Dan’s assumptions, what is the estimated

stock price?

3. What is the industry average price–earnings ratio? What is Ragan’s price–earnings ratio?

Comment on any differences and explain why they may exist.

4. Assume the company’s growth rate declines to the industry average after five years. What

percentage of the stock’s value is attributable to growth opportunities?

5. Assume the company’s growth rate slows to the industry average in five years. What future

return on equity does this imply?

6. Carrington and Genevieve are not sure if they should sell the company. If they do not sell the

company outright to East Coast Yachts, they would like to try and increase the value of the

Reach out to freelance2040@yahoo.com for enquiry.

company’s stock. In this case, they want to retain control of the company and do not want to

sell stock to outside investors. They also feel that the company’s debt is at a manageable level

and do not want to borrow more money. What steps can they take to try and increase the price

of the stock? Are there any conditions under which this strategy would not increase the stock

price?

Larissa has been talking with the company s directors about the

ANSWER

https://solvedquest.com/larissa-has-been-talking-with-the-company-s-directors-about-the/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Mini Case STOCK VALUATIONDocument5 pagesMini Case STOCK VALUATIONRizky Khairunnisa0% (1)

- Answer To The Case StudyDocument11 pagesAnswer To The Case StudyNahidul Islam IU100% (3)

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- PWC Family Business Survey US 2019Document26 pagesPWC Family Business Survey US 2019Business Families Foundation100% (1)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Case Study UnderArmourDocument2 pagesCase Study UnderArmourNey JNo ratings yet

- Pceia NotesDocument6 pagesPceia NotesEileen WongNo ratings yet

- Stock Valuation at Ragan EnginesDocument2 pagesStock Valuation at Ragan EnginesNguyen Do Quyen0% (1)

- Case 4 Stock Valuation 1Document1 pageCase 4 Stock Valuation 1Camesh Janu0% (1)

- Elliotts Letter To MPC 09252019Document3 pagesElliotts Letter To MPC 09252019Tom TsakopoulosNo ratings yet

- Gainesboro CaseDocument6 pagesGainesboro CaseDanny4118100% (2)

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Sanchit - Sharma EX2019 ChallengeYourself 4 3Document4 pagesSanchit - Sharma EX2019 ChallengeYourself 4 3sanchit sharmaNo ratings yet

- Stock Valuation at Ragan Engines CH 9Document2 pagesStock Valuation at Ragan Engines CH 9Maxim Kapin50% (2)

- EAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFDocument2 pagesEAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFGhoul GamingNo ratings yet

- 1 AssignmentsDocument11 pages1 AssignmentsAsad MemonNo ratings yet

- A Evaluate Each of These Alternatives On The Basis ofDocument2 pagesA Evaluate Each of These Alternatives On The Basis oftrilocksp SinghNo ratings yet

- Stock Valuation at Ragan-Minicase PDFDocument2 pagesStock Valuation at Ragan-Minicase PDFGhoul Gaming0% (1)

- The Larry and Barry Guide to Understanding Royalties: The Better Way of Investing in and Financing of BusinessesFrom EverandThe Larry and Barry Guide to Understanding Royalties: The Better Way of Investing in and Financing of BusinessesNo ratings yet

- The Future of Intelligence Is Here (PLTR)Document8 pagesThe Future of Intelligence Is Here (PLTR)monarqueobichoNo ratings yet

- Case Study-ParagonDocument5 pagesCase Study-ParagonDaniyal NasirNo ratings yet

- Papa Murphy's (FRSH) Franchisees Letters From PMFADocument8 pagesPapa Murphy's (FRSH) Franchisees Letters From PMFAronjackson445No ratings yet

- AUDITDocument2 pagesAUDITSonitaNo ratings yet

- Comp DataDocument15 pagesComp Datahelp sNo ratings yet

- ResearchDocument2 pagesResearchMustafa El-gamatyNo ratings yet

- TermsDocument2 pagesTermsAbhijitChandraNo ratings yet

- Answer For Fm2 (2,5,6)Document2 pagesAnswer For Fm2 (2,5,6)Nurul IdayuNo ratings yet

- Setting The Right Stretch TargetsDocument12 pagesSetting The Right Stretch TargetsjohnkwashanaiNo ratings yet

- Answer Case Lawn KingDocument4 pagesAnswer Case Lawn KingPavi Antoni VillaceranNo ratings yet

- AFIN1Document6 pagesAFIN1Abs PangaderNo ratings yet

- Ad Victoriam Named Salesforce Platinum PartnerDocument2 pagesAd Victoriam Named Salesforce Platinum PartnerPR.comNo ratings yet

- Top 5 PositionsDocument15 pagesTop 5 PositionsPradeep RaghunathanNo ratings yet

- At 2Document1 pageAt 2KathleenNo ratings yet

- Neuroscience of Leadership - 1Document34 pagesNeuroscience of Leadership - 1PradeepNo ratings yet

- Topdog SoftwareDocument3 pagesTopdog SoftwareAisyah FitriNo ratings yet

- Practice Final With SolutionsDocument8 pagesPractice Final With SolutionsSammy MosesNo ratings yet

- Chapter 1 TheoryDocument5 pagesChapter 1 TheorySittie Ainna A. UnteNo ratings yet

- RebeccaDocument2 pagesRebeccaridhiNo ratings yet

- Case Analysis - Merit Enterprise CorpDocument1 pageCase Analysis - Merit Enterprise CorpKC LapusNo ratings yet

- Case 1 (Firm and The Financial Manager)Document5 pagesCase 1 (Firm and The Financial Manager)Ghulam HassanNo ratings yet

- Ratan TataDocument18 pagesRatan TataDasuni WeerarathneNo ratings yet

- Artko Capital 2016 Q2 LetterDocument8 pagesArtko Capital 2016 Q2 LetterSmitty WNo ratings yet

- 2019 Benchmark Report: Apac Employment ScreeningDocument24 pages2019 Benchmark Report: Apac Employment ScreeningApoorv SinghalNo ratings yet

- SK-030-053 (Montaha Ayub Vasha)Document4 pagesSK-030-053 (Montaha Ayub Vasha)Md. Sakib HossainNo ratings yet

- Nadir An Unlevered Firm Has Expected Earnings Before Interest andDocument2 pagesNadir An Unlevered Firm Has Expected Earnings Before Interest andAmit PandeyNo ratings yet

- (Hons) - Paper BCH 6.1 - Auditing and Corporate Governance Week 1 - Aruna JhaDocument17 pages(Hons) - Paper BCH 6.1 - Auditing and Corporate Governance Week 1 - Aruna JhaGurdeep SinghNo ratings yet

- Verafin CaseDocument3 pagesVerafin CaseMargaret Tariro MunemwaNo ratings yet

- (Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3Document17 pages(Relaxo Footwear Ltd. - Mcap - Rs. 580 Cr. With FY13e Revenues of Rs. 1036 CR.) Page 2-3equityanalystinvestor100% (1)

- WAC Report IndividualDocument6 pagesWAC Report IndividualNEHA JENA IPM 2018 BatchNo ratings yet

- Effectiveness of LazadaDocument4 pagesEffectiveness of Lazadahaafiz5arisNo ratings yet

- SAP Ariba Spend AnalyticsDocument4 pagesSAP Ariba Spend Analyticshamza0% (1)

- The Future of The Accounting Industry in 2015Document3 pagesThe Future of The Accounting Industry in 2015JaybeeNo ratings yet

- Illustration Questions Topic 3Document2 pagesIllustration Questions Topic 3LinhLeNo ratings yet

- For ClassDocument1 pageFor ClassArchit Jain Rulz0% (1)

- The Rise and Fall of Satyam Computers Limited John J. Puthenpurackal Associate Professor University of Nevada Las Vegas Department of FinanceDocument2 pagesThe Rise and Fall of Satyam Computers Limited John J. Puthenpurackal Associate Professor University of Nevada Las Vegas Department of FinanceAnonymous QEAJfj4No ratings yet

- Country Hill CaseDocument2 pagesCountry Hill CaseAlisha Anand [JKBS]No ratings yet

- Ebay PayPal Split Analysis: Buy Two Moats For The Price of OneDocument24 pagesEbay PayPal Split Analysis: Buy Two Moats For The Price of OneJason Gilbert100% (3)

- What Happens When Power of Compounding Shakes Hands With Power of PhilosophyDocument2 pagesWhat Happens When Power of Compounding Shakes Hands With Power of PhilosophySai prakash patilNo ratings yet

- Chapter 1 HomeworkDocument2 pagesChapter 1 HomeworkNabila EramNo ratings yet

- Full-Service Digital Agency EZ Rankings To Move From .Org ToDocument4 pagesFull-Service Digital Agency EZ Rankings To Move From .Org ToPR.comNo ratings yet

- Solusi Flinder 3Document4 pagesSolusi Flinder 3Lalang PalambangNo ratings yet

- Aaron de Smet, Et Al.-Performance and HealthDocument12 pagesAaron de Smet, Et Al.-Performance and HealthboonikutzaNo ratings yet

- Boost Your GrowthDNA: How Strategic Leaders Use Growth Genetics to Drive Sustainable Business PerformanceFrom EverandBoost Your GrowthDNA: How Strategic Leaders Use Growth Genetics to Drive Sustainable Business PerformanceNo ratings yet

- Caerus Investors Kate Spade LetterDocument4 pagesCaerus Investors Kate Spade LetterPortiaNo ratings yet

- Summary of Scaling Up: by Verne Harnish | Key Takeaways & AnalysisFrom EverandSummary of Scaling Up: by Verne Harnish | Key Takeaways & AnalysisRating: 4.5 out of 5 stars4.5/5 (2)

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- Regional Air Connectivity - KarnatakaDocument43 pagesRegional Air Connectivity - KarnatakaShashank DantuNo ratings yet

- EmitraDocument12 pagesEmitraAkshita JainNo ratings yet

- City/ Location Hotel Brand Hotel NameDocument4 pagesCity/ Location Hotel Brand Hotel NameJagdeep SanghaNo ratings yet

- Micro Assigniment 1Document7 pagesMicro Assigniment 1keting0806No ratings yet

- WBE Brion Service Centre Statement of Financial Position As of December 31, 2019 AssetsDocument4 pagesWBE Brion Service Centre Statement of Financial Position As of December 31, 2019 AssetsCheche Casaljay AmpoanNo ratings yet

- National IncomeDocument30 pagesNational IncomeTaruna Dureja BangaNo ratings yet

- Supplemantary Deed of Pandokhar Food LLPDocument4 pagesSupplemantary Deed of Pandokhar Food LLPakarshit kapoorNo ratings yet

- Public Sector Accounting and Civil Society PPT by Fraol Adula1Document43 pagesPublic Sector Accounting and Civil Society PPT by Fraol Adula1ramr155155No ratings yet

- NCL Expected MCQS 2023Document9 pagesNCL Expected MCQS 2023akhilesh yadavNo ratings yet

- Revamping Project ManagementDocument190 pagesRevamping Project ManagementManoj GuntupalliNo ratings yet

- Thermo Plastics CusdecDocument1 pageThermo Plastics Cusdecjerad.transcoNo ratings yet

- Urbanization and Sustainability in BangaloreDocument17 pagesUrbanization and Sustainability in BangaloreYalandhar ReddyNo ratings yet

- Cincinnati Development Fund PresentationDocument28 pagesCincinnati Development Fund PresentationWVXU NewsNo ratings yet

- 2.5 & 2.6 Demand, Supply, & EquilibriumDocument4 pages2.5 & 2.6 Demand, Supply, & EquilibriumJeyanthyNo ratings yet

- 17th & 18th June 2023 Current AffairsDocument17 pages17th & 18th June 2023 Current AffairsRohan DineshNo ratings yet

- World of Three ZerosDocument4 pagesWorld of Three ZerosEdwinNo ratings yet

- Long Term Financing Decision - KeyDocument6 pagesLong Term Financing Decision - KeykNo ratings yet

- Inter Business Management MCQ 6.5Document4 pagesInter Business Management MCQ 6.5Josphine AbiNo ratings yet

- Teoria de Antenas - Análise e Síntese - 3 Ed - Vol 1 - Constantine A. Balanis - PT-BRDocument182 pagesTeoria de Antenas - Análise e Síntese - 3 Ed - Vol 1 - Constantine A. Balanis - PT-BRRicardoNubiatoNo ratings yet

- Sound Art SpecialDocument32 pagesSound Art SpecialSelçuk Canberk DağtekinNo ratings yet

- 4.2 Accounting For Depreciation and Disposal of Non-Current AssetsDocument10 pages4.2 Accounting For Depreciation and Disposal of Non-Current Assetsnoahsilva374No ratings yet

- Customer Relationship Management: Dr. Ruchi JainDocument30 pagesCustomer Relationship Management: Dr. Ruchi JainNavdeeshSharmaNo ratings yet

- Asian Security Practice - Material and Ideational Influences (PDFDrive)Document1,799 pagesAsian Security Practice - Material and Ideational Influences (PDFDrive)Muhammad Jahanzeb AkmalNo ratings yet

- GST Working May 2022Document20 pagesGST Working May 2022Chandrashekar BNo ratings yet

- Supreme Court CasesDocument4 pagesSupreme Court CasesTanisha AgarwalNo ratings yet

- Lesson 2 - Cross - Border TradingDocument46 pagesLesson 2 - Cross - Border TradingLâm Hồng MaiNo ratings yet

- DRAFT Minutes of TRP Board Meeting Held 2 December 2014Document3 pagesDRAFT Minutes of TRP Board Meeting Held 2 December 2014Joseph GreenNo ratings yet

- Corporate Finance Test 1Document3 pagesCorporate Finance Test 1Kevin VerhagenNo ratings yet