Professional Documents

Culture Documents

VAT - Assignment

VAT - Assignment

Uploaded by

Lealyn CuestaCopyright:

Available Formats

You might also like

- p2 - Guerrero Ch15Document27 pagesp2 - Guerrero Ch15JerichoPedragosa83% (12)

- Solution Manual For Managerial Accounting 6th Edition Jiambalvo 1Document21 pagesSolution Manual For Managerial Accounting 6th Edition Jiambalvo 1nicholas kibet100% (4)

- DocxDocument14 pagesDocxtrisha100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Quiz - Business TaxesDocument4 pagesQuiz - Business TaxesFery Ann C. BravoNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 1.1 Problems On VAT (PRTC) PDFDocument17 pages1.1 Problems On VAT (PRTC) PDFmarco poloNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- VAT QuizzerDocument16 pagesVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- Business Tax - Prelim Exam - Set BDocument6 pagesBusiness Tax - Prelim Exam - Set BRenalyn ParasNo ratings yet

- Tax.M-1403 Value Added Tax Problem 1: AnswerDocument28 pagesTax.M-1403 Value Added Tax Problem 1: Answermichean mabao75% (8)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Week 4 Cultural Mapping and Local Art SceneDocument23 pagesWeek 4 Cultural Mapping and Local Art SceneLealyn CuestaNo ratings yet

- Syndicate 3: Universal Pulp and Paper: West Coast DivisionDocument5 pagesSyndicate 3: Universal Pulp and Paper: West Coast DivisionDina Rachma FebrinaNo ratings yet

- Ross Casebook 2010Document108 pagesRoss Casebook 2010Archibald_Moore100% (3)

- Coffee, Cost Exercise For Managerial AccountingDocument8 pagesCoffee, Cost Exercise For Managerial AccountingRahul Rathi0% (1)

- Tax 2Document3 pagesTax 2Emmanuel DiyNo ratings yet

- 01 Seatwork VAT Subject TransactionDocument2 pages01 Seatwork VAT Subject TransactionJaneLayugCabacunganNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Taxation, Business ExaminationDocument4 pagesTaxation, Business ExaminationKevin Elrey ArceNo ratings yet

- Business Tax - Prelim Exam - Set ADocument7 pagesBusiness Tax - Prelim Exam - Set ARenalyn Paras0% (1)

- Quiz 2 Part 2Document4 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- ApplicationTAX - LecturePROBLEMDocument2 pagesApplicationTAX - LecturePROBLEMAyessa ViajanteNo ratings yet

- Chapter 3-Intro To Bus. TaxDocument8 pagesChapter 3-Intro To Bus. TaxShiNo ratings yet

- Vat OptDocument24 pagesVat OptCharity Venus100% (1)

- VAT QuizzerDocument13 pagesVAT QuizzerGrace Managuelod GabuyoNo ratings yet

- Assignment - VAT On Sale of Services, Use or Lease of Property, ImportationDocument3 pagesAssignment - VAT On Sale of Services, Use or Lease of Property, ImportationBenzon Agojo OndovillaNo ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- Transfer and Business Taxation HOMEWORK 006 (HW006)Document3 pagesTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNo ratings yet

- xP04 Value Added Tax Booklet PDFDocument70 pagesxP04 Value Added Tax Booklet PDFmae KuanNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Chapter 15 PDFDocument11 pagesChapter 15 PDFG & E ApparelNo ratings yet

- Tax 2 - Midterm Quiz 1Document6 pagesTax 2 - Midterm Quiz 1Uy SamuelNo ratings yet

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document10 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Vat Seatwork - NeDocument3 pagesVat Seatwork - NeMarvin San JuanNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- ACT 184 - QUIZ 4 (SET A) - 50 CopiesDocument3 pagesACT 184 - QUIZ 4 (SET A) - 50 CopiesAthena Fatmah AmpuanNo ratings yet

- Corresponding Supporting ScheduleDocument2 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- CH11 - Value Added TaxDocument33 pagesCH11 - Value Added TaxDimple AtienzaNo ratings yet

- Output Vat Quiz - HernandezDocument4 pagesOutput Vat Quiz - HernandezDigna HernandezNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Tax SOLVINGDocument3 pagesTax SOLVINGjr centenoNo ratings yet

- Exercise 5 VATDocument3 pagesExercise 5 VATQuenie De la CruzNo ratings yet

- Act184 Quiz 3Document4 pagesAct184 Quiz 3Cardo DalisayNo ratings yet

- Value Added TaxDocument3 pagesValue Added TaxChristine Igna100% (1)

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Adzu Tax02 A LP 2 VAT AssignmentDocument1 pageAdzu Tax02 A LP 2 VAT AssignmentJustine Paul Pangasi-anNo ratings yet

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- Information For Items 21 & 22Document3 pagesInformation For Items 21 & 22Kurt Morin CantorNo ratings yet

- Problems On TaxationDocument3 pagesProblems On TaxationRandy ManzanoNo ratings yet

- Tax2 Quiz2 FinalsDocument11 pagesTax2 Quiz2 Finalsishinoya keishiNo ratings yet

- Quiz 2 Part 2Document5 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Vat On SaleDocument6 pagesVat On SaleCPAREVIEWNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 221 REQUIREMENT For Summer Class 1Document2 pages221 REQUIREMENT For Summer Class 1Lealyn CuestaNo ratings yet

- ABM and TPSDocument13 pagesABM and TPSLealyn Cuesta0% (1)

- Point of View Research Accounting and Auditing: Dendy Heryanto, Mursalim, Darwis LannaiDocument11 pagesPoint of View Research Accounting and Auditing: Dendy Heryanto, Mursalim, Darwis LannaiLealyn CuestaNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- Contribution of Tax Morale and Compliance Costs To Tax Compliance of Micro and Small Scale Enterprises in GhanaDocument20 pagesContribution of Tax Morale and Compliance Costs To Tax Compliance of Micro and Small Scale Enterprises in GhanaLealyn CuestaNo ratings yet

- Uloa - Let's Analyze Answers: Activity 1Document1 pageUloa - Let's Analyze Answers: Activity 1Lealyn CuestaNo ratings yet

- Residual Income and Business Unit Profitability AnalysisDocument7 pagesResidual Income and Business Unit Profitability AnalysisLealyn CuestaNo ratings yet

- VAT - AssignmentDocument2 pagesVAT - AssignmentLealyn CuestaNo ratings yet

- Let's Analyze Week 4-5Document1 pageLet's Analyze Week 4-5Lealyn CuestaNo ratings yet

- ULO-A Let 'S Check Answers: Activity 1Document1 pageULO-A Let 'S Check Answers: Activity 1Lealyn CuestaNo ratings yet

- ULO-C Let's CheckDocument1 pageULO-C Let's CheckLealyn CuestaNo ratings yet

- ULO-A Let's Analyze Answers: Activity 1Document1 pageULO-A Let's Analyze Answers: Activity 1Lealyn CuestaNo ratings yet

- Feasibility Study FnalDocument108 pagesFeasibility Study FnalLealyn CuestaNo ratings yet

- 200 Pounds BeautyDocument2 pages200 Pounds BeautyLealyn CuestaNo ratings yet

- Household Garbage and Waste Recycling For Sustainable Community: Barangay of Tamia Province of Compostela ValleyDocument5 pagesHousehold Garbage and Waste Recycling For Sustainable Community: Barangay of Tamia Province of Compostela ValleyLealyn CuestaNo ratings yet

- CBM 321 Final Research PaperDocument20 pagesCBM 321 Final Research PaperLealyn CuestaNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleLealyn CuestaNo ratings yet

- Case Digest Final PaperDocument3 pagesCase Digest Final PaperLealyn CuestaNo ratings yet

- FIRST VOYAGE AROUND THE WORLD - Antonio PigafettaDocument67 pagesFIRST VOYAGE AROUND THE WORLD - Antonio PigafettaLealyn CuestaNo ratings yet

- Competency Assessment (ACC 311) PDFDocument14 pagesCompetency Assessment (ACC 311) PDFLealyn CuestaNo ratings yet

- Week 15 To 16 Material and Method in Local Contemporary Art of Select Art FormDocument17 pagesWeek 15 To 16 Material and Method in Local Contemporary Art of Select Art FormLealyn CuestaNo ratings yet

- Week 14 Contermporary Art Form in Applied ArtsDocument19 pagesWeek 14 Contermporary Art Form in Applied ArtsLealyn CuestaNo ratings yet

- Quizbowl FSA and Other FIsDocument30 pagesQuizbowl FSA and Other FIsLealyn CuestaNo ratings yet

- Tax On Idividuals: Practice ProblemsDocument17 pagesTax On Idividuals: Practice ProblemsLealyn CuestaNo ratings yet

- WEEK 5 National Artist Award and Gawad Manlilikha NG BayanDocument46 pagesWEEK 5 National Artist Award and Gawad Manlilikha NG BayanLealyn CuestaNo ratings yet

- Interest RatesDocument38 pagesInterest RatesLealyn CuestaNo ratings yet

- CRM in Banking Sector.Document38 pagesCRM in Banking Sector.desaikrishna24No ratings yet

- Chapter1 Costing PracticeDocument2 pagesChapter1 Costing Practice63D-026-Md Golam Muktadir AsifNo ratings yet

- Chapter 3: Preparation Financial StatementDocument20 pagesChapter 3: Preparation Financial StatementIan BucoyaNo ratings yet

- Home Repair Corp HRC Operates A Building Maintenance and RepairDocument1 pageHome Repair Corp HRC Operates A Building Maintenance and RepairLet's Talk With HassanNo ratings yet

- Ch.1Cost Terms, Concepts, and ClassificationsDocument24 pagesCh.1Cost Terms, Concepts, and ClassificationsDeeb. DeebNo ratings yet

- Critical Mass and International Marketing Strategy: Vern Terpstra, PH.DDocument14 pagesCritical Mass and International Marketing Strategy: Vern Terpstra, PH.D:-*kiss youNo ratings yet

- IKEA Company BackgroundDocument11 pagesIKEA Company Backgroundm96967% (3)

- ACIDocument29 pagesACIRashidul HasanNo ratings yet

- REVIEWERDocument3 pagesREVIEWERMa. Cristina PanganNo ratings yet

- Feasibility Study For The Smart Search Product System Industry and Market AnalysisDocument5 pagesFeasibility Study For The Smart Search Product System Industry and Market Analysissamantha dobaNo ratings yet

- 4 5810dbusinessmarketingbook PDFDocument506 pages4 5810dbusinessmarketingbook PDFMatshele SerageNo ratings yet

- Basics of AccountingDocument11 pagesBasics of Accountingkishenmanocha485No ratings yet

- 19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFDocument4 pages19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFYaswanth KumarNo ratings yet

- ZARA Competitor AnalysisDocument7 pagesZARA Competitor AnalysisMahmoud RefaatNo ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- Module 14Document3 pagesModule 14AstxilNo ratings yet

- Relationship Marketing - PPTX IntroDocument80 pagesRelationship Marketing - PPTX IntroGift MabikaNo ratings yet

- Solutions Manual For COST ACCOUNTINGDocument736 pagesSolutions Manual For COST ACCOUNTINGparatroop666200050% (2)

- TEST I - Multiple Choice: Identify The Correct Answer Among The GivenDocument29 pagesTEST I - Multiple Choice: Identify The Correct Answer Among The GivenGeniza Fatima LipuraNo ratings yet

- Pricing ConceptDocument4 pagesPricing ConceptMia Glenn B. ZarsuelaNo ratings yet

- Upadated Market-AnalyDocument2 pagesUpadated Market-AnalyEdison CabatbatNo ratings yet

- IA 1 - 5 InventoriesDocument8 pagesIA 1 - 5 InventoriesVJ MacaspacNo ratings yet

- Tamanna Sultana TermpaperDocument40 pagesTamanna Sultana TermpaperfahimNo ratings yet

- Setting Standard Costs-Ideal and Practical StandardsDocument2 pagesSetting Standard Costs-Ideal and Practical StandardsAmmar Ul ArfeenNo ratings yet

- Transfer PricingDocument6 pagesTransfer Pricingrpulgam09No ratings yet

VAT - Assignment

VAT - Assignment

Uploaded by

Lealyn CuestaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT - Assignment

VAT - Assignment

Uploaded by

Lealyn CuestaCopyright:

Available Formats

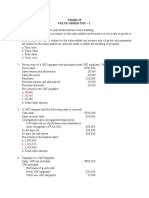

1.

Evelyn, a trader of appliances, made the following sales of goods during the month of March 2013,

exclusive of VAT:

Cash Sales P200,000

Open account sales 100,000

Installment Sales 100,000

Note: Receipt from installment

sales is P20,000

Consignment made: (net of VAT)

January 15, 2013 100,000

February 15, 2013 100,000

March 15, 2013 100,000

Output tax is: ____________________

Problem 2

The following are the data of Davao Appliances Marketing Co. for the last quarter of 2013:

Sales up to December 15, total invoice value P380,800

Purchases up to December 15, net of input taxes 150,000

Additional information:

On December 16, 2013, the Company retired from its business and the inventory valued at

P190,000 remained unsold. There is a deferred input tax from the third quarter of P3,500.

2. How much is the output tax? ________________

3. How much is the total value-added taxes payable by Davao Appliances Marketing Co.?

______________

4. Shok Tong Co. is a manufacturer of beer. During a particular quarter, it had the following

transactions (net of VAT):

January 4, 2013: Consigned beer to a retailer in Quezon City amounting to

P200,000

February 14, 2013: Exported P1,000,000 worth of beer to Japan

February 27, 2013: President of San-Mor Trading celebrated his birthday, consuming

P50,000 worth of beer given to him by the company as a birthday gift

March 20, 2013:Declared property dividend of one case of beer for every 10 shares,

amounting to P150,000

Additional information: From January to March, domestic sales to wholesalers amounted to

P600,000. No beer was returned by the consignee until the end of the quarter.

The output tax for the quarter is:

Questions 5-9 are based on the following information:

A VAT-registered trader has the following transactions:

Sales of good to private entities, net of VAT P2,500,000

Purchases of goods sold to private entities,

Gross of 12%VAT 896,000

Sales to a government owned corporation

(GOCC), net of VAT 1,000,000

Purchases of goods sold to GOCC, net of 12% VAT 700,000

5. How much is the output tax? _________________

6. How much is the standard input tax? _______________

7. How much is the creditable input tax? ___________________

8. How much is the input tax closed to expense (income)? ________________

9. How much is the VAT payable to the BIR? __________________

Tore Inc., a building contractor, showed to you the following data:

Contract Price P5,000,000

Cash Received (VAT included) 2,240,000

Receivables 3,000,000

Advances on other contracts still unearned

(without VAT) 1,000,000

Payments:

For materials, VAT excluded 500,000

For supplies, VAT excluded 100,000

For services of sub-contractors

(VAT included) 1,848,000

10. How much is the value added tax payable?

You might also like

- p2 - Guerrero Ch15Document27 pagesp2 - Guerrero Ch15JerichoPedragosa83% (12)

- Solution Manual For Managerial Accounting 6th Edition Jiambalvo 1Document21 pagesSolution Manual For Managerial Accounting 6th Edition Jiambalvo 1nicholas kibet100% (4)

- DocxDocument14 pagesDocxtrisha100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Quiz - Business TaxesDocument4 pagesQuiz - Business TaxesFery Ann C. BravoNo ratings yet

- Quiz 4 VATDocument3 pagesQuiz 4 VATAsiong Salonga100% (2)

- Joey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATDocument10 pagesJoey, A non-VAT Taxpayer Purchased Merchandise Worth P11,200, VATLeah Isabelle Nodalo DandoyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- 1.1 Problems On VAT (PRTC) PDFDocument17 pages1.1 Problems On VAT (PRTC) PDFmarco poloNo ratings yet

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- VAT QuizzerDocument16 pagesVAT QuizzerAnonymous 2ajCCT03VM50% (6)

- Business Tax - Prelim Exam - Set BDocument6 pagesBusiness Tax - Prelim Exam - Set BRenalyn ParasNo ratings yet

- Tax.M-1403 Value Added Tax Problem 1: AnswerDocument28 pagesTax.M-1403 Value Added Tax Problem 1: Answermichean mabao75% (8)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Week 4 Cultural Mapping and Local Art SceneDocument23 pagesWeek 4 Cultural Mapping and Local Art SceneLealyn CuestaNo ratings yet

- Syndicate 3: Universal Pulp and Paper: West Coast DivisionDocument5 pagesSyndicate 3: Universal Pulp and Paper: West Coast DivisionDina Rachma FebrinaNo ratings yet

- Ross Casebook 2010Document108 pagesRoss Casebook 2010Archibald_Moore100% (3)

- Coffee, Cost Exercise For Managerial AccountingDocument8 pagesCoffee, Cost Exercise For Managerial AccountingRahul Rathi0% (1)

- Tax 2Document3 pagesTax 2Emmanuel DiyNo ratings yet

- 01 Seatwork VAT Subject TransactionDocument2 pages01 Seatwork VAT Subject TransactionJaneLayugCabacunganNo ratings yet

- VatDocument16 pagesVatCPA100% (1)

- Taxation, Business ExaminationDocument4 pagesTaxation, Business ExaminationKevin Elrey ArceNo ratings yet

- Business Tax - Prelim Exam - Set ADocument7 pagesBusiness Tax - Prelim Exam - Set ARenalyn Paras0% (1)

- Quiz 2 Part 2Document4 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- ApplicationTAX - LecturePROBLEMDocument2 pagesApplicationTAX - LecturePROBLEMAyessa ViajanteNo ratings yet

- Chapter 3-Intro To Bus. TaxDocument8 pagesChapter 3-Intro To Bus. TaxShiNo ratings yet

- Vat OptDocument24 pagesVat OptCharity Venus100% (1)

- VAT QuizzerDocument13 pagesVAT QuizzerGrace Managuelod GabuyoNo ratings yet

- Assignment - VAT On Sale of Services, Use or Lease of Property, ImportationDocument3 pagesAssignment - VAT On Sale of Services, Use or Lease of Property, ImportationBenzon Agojo OndovillaNo ratings yet

- Assignment VAT ComputationDocument3 pagesAssignment VAT ComputationAngelyn SamandeNo ratings yet

- Transfer and Business Taxation HOMEWORK 006 (HW006)Document3 pagesTransfer and Business Taxation HOMEWORK 006 (HW006)sora cabreraNo ratings yet

- xP04 Value Added Tax Booklet PDFDocument70 pagesxP04 Value Added Tax Booklet PDFmae KuanNo ratings yet

- VAT ReviewDocument8 pagesVAT ReviewabbyNo ratings yet

- Chapter 15 PDFDocument11 pagesChapter 15 PDFG & E ApparelNo ratings yet

- Tax 2 - Midterm Quiz 1Document6 pagesTax 2 - Midterm Quiz 1Uy SamuelNo ratings yet

- Tax Lecture VATDocument4 pagesTax Lecture VATRozzane Ann RomaNo ratings yet

- Additional Vat MSQ PDFDocument14 pagesAdditional Vat MSQ PDFPrincesNo ratings yet

- Multiple Choice QuestionsDocument14 pagesMultiple Choice QuestionsVince ManahanNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document10 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Quiz 405Document3 pagesQuiz 405Shaika HaceenaNo ratings yet

- Vat Seatwork - NeDocument3 pagesVat Seatwork - NeMarvin San JuanNo ratings yet

- Solutions To Quiz 2 - VAT PAYABLEDocument4 pagesSolutions To Quiz 2 - VAT PAYABLEMark Emil BaritNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- ACT 184 - QUIZ 4 (SET A) - 50 CopiesDocument3 pagesACT 184 - QUIZ 4 (SET A) - 50 CopiesAthena Fatmah AmpuanNo ratings yet

- Corresponding Supporting ScheduleDocument2 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- CH11 - Value Added TaxDocument33 pagesCH11 - Value Added TaxDimple AtienzaNo ratings yet

- Output Vat Quiz - HernandezDocument4 pagesOutput Vat Quiz - HernandezDigna HernandezNo ratings yet

- VAT ReviewDocument10 pagesVAT ReviewRachel LeachonNo ratings yet

- Tax SOLVINGDocument3 pagesTax SOLVINGjr centenoNo ratings yet

- Exercise 5 VATDocument3 pagesExercise 5 VATQuenie De la CruzNo ratings yet

- Act184 Quiz 3Document4 pagesAct184 Quiz 3Cardo DalisayNo ratings yet

- Value Added TaxDocument3 pagesValue Added TaxChristine Igna100% (1)

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Adzu Tax02 A LP 2 VAT AssignmentDocument1 pageAdzu Tax02 A LP 2 VAT AssignmentJustine Paul Pangasi-anNo ratings yet

- Income Taxation On Corporations Exercise Problems BSADocument2 pagesIncome Taxation On Corporations Exercise Problems BSARico, Jalaica B.No ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- Quizzer: Value-Added Tax: Answer: 100k X 12% 12,000Document4 pagesQuizzer: Value-Added Tax: Answer: 100k X 12% 12,000Rogelio Jr A. MacionNo ratings yet

- Information For Items 21 & 22Document3 pagesInformation For Items 21 & 22Kurt Morin CantorNo ratings yet

- Problems On TaxationDocument3 pagesProblems On TaxationRandy ManzanoNo ratings yet

- Tax2 Quiz2 FinalsDocument11 pagesTax2 Quiz2 Finalsishinoya keishiNo ratings yet

- Quiz 2 Part 2Document5 pagesQuiz 2 Part 2Renz CastroNo ratings yet

- VAT - OPT Illustrative ExamplesDocument6 pagesVAT - OPT Illustrative ExamplesFerb CruzadaNo ratings yet

- Vat On SaleDocument6 pagesVat On SaleCPAREVIEWNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 221 REQUIREMENT For Summer Class 1Document2 pages221 REQUIREMENT For Summer Class 1Lealyn CuestaNo ratings yet

- ABM and TPSDocument13 pagesABM and TPSLealyn Cuesta0% (1)

- Point of View Research Accounting and Auditing: Dendy Heryanto, Mursalim, Darwis LannaiDocument11 pagesPoint of View Research Accounting and Auditing: Dendy Heryanto, Mursalim, Darwis LannaiLealyn CuestaNo ratings yet

- Sample ProblemDocument4 pagesSample ProblemLealyn CuestaNo ratings yet

- Contribution of Tax Morale and Compliance Costs To Tax Compliance of Micro and Small Scale Enterprises in GhanaDocument20 pagesContribution of Tax Morale and Compliance Costs To Tax Compliance of Micro and Small Scale Enterprises in GhanaLealyn CuestaNo ratings yet

- Uloa - Let's Analyze Answers: Activity 1Document1 pageUloa - Let's Analyze Answers: Activity 1Lealyn CuestaNo ratings yet

- Residual Income and Business Unit Profitability AnalysisDocument7 pagesResidual Income and Business Unit Profitability AnalysisLealyn CuestaNo ratings yet

- VAT - AssignmentDocument2 pagesVAT - AssignmentLealyn CuestaNo ratings yet

- Let's Analyze Week 4-5Document1 pageLet's Analyze Week 4-5Lealyn CuestaNo ratings yet

- ULO-A Let 'S Check Answers: Activity 1Document1 pageULO-A Let 'S Check Answers: Activity 1Lealyn CuestaNo ratings yet

- ULO-C Let's CheckDocument1 pageULO-C Let's CheckLealyn CuestaNo ratings yet

- ULO-A Let's Analyze Answers: Activity 1Document1 pageULO-A Let's Analyze Answers: Activity 1Lealyn CuestaNo ratings yet

- Feasibility Study FnalDocument108 pagesFeasibility Study FnalLealyn CuestaNo ratings yet

- 200 Pounds BeautyDocument2 pages200 Pounds BeautyLealyn CuestaNo ratings yet

- Household Garbage and Waste Recycling For Sustainable Community: Barangay of Tamia Province of Compostela ValleyDocument5 pagesHousehold Garbage and Waste Recycling For Sustainable Community: Barangay of Tamia Province of Compostela ValleyLealyn CuestaNo ratings yet

- CBM 321 Final Research PaperDocument20 pagesCBM 321 Final Research PaperLealyn CuestaNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleLealyn CuestaNo ratings yet

- Case Digest Final PaperDocument3 pagesCase Digest Final PaperLealyn CuestaNo ratings yet

- FIRST VOYAGE AROUND THE WORLD - Antonio PigafettaDocument67 pagesFIRST VOYAGE AROUND THE WORLD - Antonio PigafettaLealyn CuestaNo ratings yet

- Competency Assessment (ACC 311) PDFDocument14 pagesCompetency Assessment (ACC 311) PDFLealyn CuestaNo ratings yet

- Week 15 To 16 Material and Method in Local Contemporary Art of Select Art FormDocument17 pagesWeek 15 To 16 Material and Method in Local Contemporary Art of Select Art FormLealyn CuestaNo ratings yet

- Week 14 Contermporary Art Form in Applied ArtsDocument19 pagesWeek 14 Contermporary Art Form in Applied ArtsLealyn CuestaNo ratings yet

- Quizbowl FSA and Other FIsDocument30 pagesQuizbowl FSA and Other FIsLealyn CuestaNo ratings yet

- Tax On Idividuals: Practice ProblemsDocument17 pagesTax On Idividuals: Practice ProblemsLealyn CuestaNo ratings yet

- WEEK 5 National Artist Award and Gawad Manlilikha NG BayanDocument46 pagesWEEK 5 National Artist Award and Gawad Manlilikha NG BayanLealyn CuestaNo ratings yet

- Interest RatesDocument38 pagesInterest RatesLealyn CuestaNo ratings yet

- CRM in Banking Sector.Document38 pagesCRM in Banking Sector.desaikrishna24No ratings yet

- Chapter1 Costing PracticeDocument2 pagesChapter1 Costing Practice63D-026-Md Golam Muktadir AsifNo ratings yet

- Chapter 3: Preparation Financial StatementDocument20 pagesChapter 3: Preparation Financial StatementIan BucoyaNo ratings yet

- Home Repair Corp HRC Operates A Building Maintenance and RepairDocument1 pageHome Repair Corp HRC Operates A Building Maintenance and RepairLet's Talk With HassanNo ratings yet

- Ch.1Cost Terms, Concepts, and ClassificationsDocument24 pagesCh.1Cost Terms, Concepts, and ClassificationsDeeb. DeebNo ratings yet

- Critical Mass and International Marketing Strategy: Vern Terpstra, PH.DDocument14 pagesCritical Mass and International Marketing Strategy: Vern Terpstra, PH.D:-*kiss youNo ratings yet

- IKEA Company BackgroundDocument11 pagesIKEA Company Backgroundm96967% (3)

- ACIDocument29 pagesACIRashidul HasanNo ratings yet

- REVIEWERDocument3 pagesREVIEWERMa. Cristina PanganNo ratings yet

- Feasibility Study For The Smart Search Product System Industry and Market AnalysisDocument5 pagesFeasibility Study For The Smart Search Product System Industry and Market Analysissamantha dobaNo ratings yet

- 4 5810dbusinessmarketingbook PDFDocument506 pages4 5810dbusinessmarketingbook PDFMatshele SerageNo ratings yet

- Basics of AccountingDocument11 pagesBasics of Accountingkishenmanocha485No ratings yet

- 19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFDocument4 pages19mba0109-Yaswanth Kumar.s-Da3-Lscm PDFYaswanth KumarNo ratings yet

- ZARA Competitor AnalysisDocument7 pagesZARA Competitor AnalysisMahmoud RefaatNo ratings yet

- Idt AacDocument177 pagesIdt AacVinay KumarNo ratings yet

- Module 14Document3 pagesModule 14AstxilNo ratings yet

- Relationship Marketing - PPTX IntroDocument80 pagesRelationship Marketing - PPTX IntroGift MabikaNo ratings yet

- Solutions Manual For COST ACCOUNTINGDocument736 pagesSolutions Manual For COST ACCOUNTINGparatroop666200050% (2)

- TEST I - Multiple Choice: Identify The Correct Answer Among The GivenDocument29 pagesTEST I - Multiple Choice: Identify The Correct Answer Among The GivenGeniza Fatima LipuraNo ratings yet

- Pricing ConceptDocument4 pagesPricing ConceptMia Glenn B. ZarsuelaNo ratings yet

- Upadated Market-AnalyDocument2 pagesUpadated Market-AnalyEdison CabatbatNo ratings yet

- IA 1 - 5 InventoriesDocument8 pagesIA 1 - 5 InventoriesVJ MacaspacNo ratings yet

- Tamanna Sultana TermpaperDocument40 pagesTamanna Sultana TermpaperfahimNo ratings yet

- Setting Standard Costs-Ideal and Practical StandardsDocument2 pagesSetting Standard Costs-Ideal and Practical StandardsAmmar Ul ArfeenNo ratings yet

- Transfer PricingDocument6 pagesTransfer Pricingrpulgam09No ratings yet