Professional Documents

Culture Documents

Ralph Porter Is in His Early 30s and Is Thinking

Ralph Porter Is in His Early 30s and Is Thinking

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ralph Porter Is in His Early 30s and Is Thinking

Ralph Porter Is in His Early 30s and Is Thinking

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Ralph Porter is in his early 30s and is thinking

Ralph Porter is in his early 30s and is thinking about opening an IRA. He can’t decide whether

to open a traditional/deductible IRA or a Roth IRA, so he turns to you for help.

a. To support your explanation, you decide to run some comparative numbers on the two types

of accounts; for starters, use a 25-year period to show Ralph what contributions of $4,000 per

year will amount to (after 25 years), given that he can earn, say, 10 percent on his money. Will

the type of account he opens have any impact on this amount? Explain.

b. Assuming that Ralph is in the 28 percent tax bracket (and will remain there for the next 25

years), determine the annual and total (over 25 years) tax savings that he’ll enjoy from the

$4,000-a-year contributions to his IRA; contrast the (annual and total) tax savings he’d

generate from a traditional IRA with those from a Roth IRA.

c. Now, fast-forward 25 years. Given the size of Ralph’s account in 25 years (as computed in

part a), assume that he takes it all out in one lump sum. If he’s still in the 30 percent tax

bracket, how much will he have, after taxes, with a traditional IRA, as compared with a Roth

IRA? How the taxes do computed here compare with those computed in part b? Comment on

your findings.

d. Based on the numbers you have computed as well as any other factors, what kind of IRA

would you recommend to Ralph? Explain. Would knowing that maximum contributions are

scheduled to increase to $7,000 per year make any difference in your analysis? Explain.

Ralph Porter is in his early 30s and is thinking

ANSWER

https://solvedquest.com/ralph-porter-is-in-his-early-30s-and-is-thinking/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Business Plan Final FinalDocument22 pagesBusiness Plan Final FinalTony100% (6)

- Project InvesmentDocument25 pagesProject InvesmentDiana InfanteNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Sample Barangay BudgetDocument17 pagesSample Barangay Budgetnilo bia100% (4)

- SMChap 013Document49 pagesSMChap 013testbank100% (5)

- Case Study - The Hair EmporiumDocument2 pagesCase Study - The Hair EmporiumVanessa Lubiano0% (1)

- 22 Wealth MultipliersDocument19 pages22 Wealth MultipliersShantrece MarshallNo ratings yet

- You Have Just Graduated From The Mba Program of ADocument4 pagesYou Have Just Graduated From The Mba Program of AAmit PandeyNo ratings yet

- 1 What Financial Statements Should Rudabeh and Donovan Prepare ToDocument1 page1 What Financial Statements Should Rudabeh and Donovan Prepare ToAmit PandeyNo ratings yet

- Ej. 1 Fin CorpDocument3 pagesEj. 1 Fin CorpChantal AvilesNo ratings yet

- ACCT 424 Final ExamDocument10 pagesACCT 424 Final ExamDeVryHelpNo ratings yet

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Charles Schwab Cash Features Disclosure Statement For Individual InvestorsDocument32 pagesCharles Schwab Cash Features Disclosure Statement For Individual InvestorscadeadmanNo ratings yet

- As A Separate Project Project P You Are ConsideringDocument2 pagesAs A Separate Project Project P You Are ConsideringAmit PandeyNo ratings yet

- Hyper RetirementDocument10 pagesHyper RetirementSekhar MuppuriNo ratings yet

- Acct Project 2 For WebsiteDocument11 pagesAcct Project 2 For Websiteapi-737617959No ratings yet

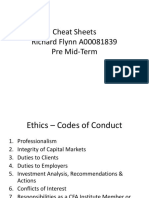

- Cheat Sheets Richard Flynn A00081839 Pre Mid-TermDocument6 pagesCheat Sheets Richard Flynn A00081839 Pre Mid-TermSakura HantoNo ratings yet

- Risk and ReturnDocument55 pagesRisk and ReturnShukri Omar AliNo ratings yet

- Actg328 Msa2Document1,344 pagesActg328 Msa2Carol PagalNo ratings yet

- FORUM 1 Financial Management 2024 - QDocument6 pagesFORUM 1 Financial Management 2024 - QIrfan SetiawanNo ratings yet

- 01Document1 page01veriNo ratings yet

- CompoundDocument6 pagesCompoundHarvey Leo RomanoNo ratings yet

- Ultimate Guide To Investment AccountsDocument14 pagesUltimate Guide To Investment Accountscarece7891No ratings yet

- FHSAsDocument4 pagesFHSAsSara BobowNo ratings yet

- Fin Lit Quiz Answser SV 4Document5 pagesFin Lit Quiz Answser SV 4asifkamal0203No ratings yet

- Fin Lit Quiz Answser SV 4Document5 pagesFin Lit Quiz Answser SV 4asifkamal0203No ratings yet

- Tax Assignment 5Document3 pagesTax Assignment 5Monis KhanNo ratings yet

- Ybor City Tobacco Company Has For Many Years Enjoyed ADocument1 pageYbor City Tobacco Company Has For Many Years Enjoyed AAmit PandeyNo ratings yet

- Assignment No 1 SFA&DDocument6 pagesAssignment No 1 SFA&DSyed Shabbir RizviNo ratings yet

- Tugas Individual 2Document2 pagesTugas Individual 2sherennuramaliaNo ratings yet

- Tell Me About YourselfDocument2 pagesTell Me About YourselfSampda DalviNo ratings yet

- ProblemsDocument20 pagesProblemsReyna BaculioNo ratings yet

- Account ShortNotes - CAB2FDocument171 pagesAccount ShortNotes - CAB2Fmopid68742No ratings yet

- Midterm Examination Guide For Financial Management 1 COVERAGE and Reminders About Each ChapterDocument6 pagesMidterm Examination Guide For Financial Management 1 COVERAGE and Reminders About Each ChapterVince De GuzmanNo ratings yet

- Class 12th Accountancy HHWDocument8 pagesClass 12th Accountancy HHWjainishujain123No ratings yet

- You Have Been Asked To Analyze The Capital Structure ofDocument2 pagesYou Have Been Asked To Analyze The Capital Structure ofAmit PandeyNo ratings yet

- Assignment 11 34Document1 pageAssignment 11 34Michael TungNo ratings yet

- Dissolution ActivityDocument2 pagesDissolution Activitydmpp55676No ratings yet

- Module III Problem Set #1Document4 pagesModule III Problem Set #1wearegamers725No ratings yet

- Sci Bono Mathematics Module 4 5 FinalDocument85 pagesSci Bono Mathematics Module 4 5 FinalLerato bunnyNo ratings yet

- Parcor Exercise GDocument2 pagesParcor Exercise Gpey Pey100% (1)

- Quizzer PartnershipDocument6 pagesQuizzer PartnershipAdrianneHarve100% (2)

- Bai Tap QTTCDocument4 pagesBai Tap QTTCTran PhuongNo ratings yet

- InvestmentsDocument2 pagesInvestmentsKeziah MecarteNo ratings yet

- IRR PracticeDocument5 pagesIRR PracticeRalph ParduchoNo ratings yet

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- Lange and Lopez Have Decided To Form A Partnership TheyDocument1 pageLange and Lopez Have Decided To Form A Partnership TheyM Bilal SaleemNo ratings yet

- Test Bank for Corporations, Partnerships, Estates and Trusts 2020, 43th by Raabe download pdf full chapterDocument54 pagesTest Bank for Corporations, Partnerships, Estates and Trusts 2020, 43th by Raabe download pdf full chapterlenogsefiwa100% (3)

- 33961444Document3 pages33961444Joel Christian MascariñaNo ratings yet

- Retirement Millionaire SecretsDocument25 pagesRetirement Millionaire SecretsdtgsrqNo ratings yet

- Lec 19Document18 pagesLec 19MumtazAhmadNo ratings yet

- Solve The Following Crossword Round Your Final Answers To TheDocument3 pagesSolve The Following Crossword Round Your Final Answers To TheAmit PandeyNo ratings yet

- SAPM ProblemsDocument7 pagesSAPM ProblemsNavleen KaurNo ratings yet

- Assignment 2Document4 pagesAssignment 2imandimahawatte2008No ratings yet

- A - Thread - On - How - Thread - by - Sweatystartup - Jan 23, 21 - From - RattibhaDocument16 pagesA - Thread - On - How - Thread - by - Sweatystartup - Jan 23, 21 - From - RattibhadigiowlmedialabNo ratings yet

- Finance Final ExamDocument3 pagesFinance Final Exambips99No ratings yet

- Annual Eligibility NoticeDocument1 pageAnnual Eligibility Noticecarmen.bensonNo ratings yet

- Reject the 40-40-40 Plan: 40 Hours Per Week, For 40 Years, For 40% Retirement: Financial Freedom, #233From EverandReject the 40-40-40 Plan: 40 Hours Per Week, For 40 Years, For 40% Retirement: Financial Freedom, #233No ratings yet

- CFP TAXDocument15 pagesCFP TAXAmeyaNo ratings yet

- 2015 q1 Fpa Crescent FundDocument41 pages2015 q1 Fpa Crescent FundCanadianValueNo ratings yet

- Ralph Lauren CorporationDocument7 pagesRalph Lauren Corporationapi-660446585No ratings yet

- In An Unrelated Analysis You Have The Opportunity ToDocument2 pagesIn An Unrelated Analysis You Have The Opportunity ToAmit PandeyNo ratings yet

- Calculate The Internal Rate of Return For StudyingDocument6 pagesCalculate The Internal Rate of Return For StudyingNguyen Quoc Bao100% (1)

- FinalDocument97 pagesFinalapi-250595584No ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Easy Peasy Trucking ProfileDocument7 pagesEasy Peasy Trucking ProfileGabby SinghNo ratings yet

- FATCA W9 + Carta para Compartir Información (FATCA)Document2 pagesFATCA W9 + Carta para Compartir Información (FATCA)CarrilloyLawNo ratings yet

- Paying Yourself:: Income Options in Retirement Kyle Andrews February 23, 2017Document33 pagesPaying Yourself:: Income Options in Retirement Kyle Andrews February 23, 2017Brian JonesNo ratings yet

- The State of Working AmericaDocument34 pagesThe State of Working AmericaricardoczNo ratings yet

- Florida General Power of Attorney FormDocument5 pagesFlorida General Power of Attorney FormMainak BhattacharjeeNo ratings yet

- 20 Things Kids Need To Know To Live Financially Smart Lives: Make ChoicesDocument1 page20 Things Kids Need To Know To Live Financially Smart Lives: Make ChoicespenelopegerhardNo ratings yet

- Allocation of Refund (Including Savings Bond Purchases)Document4 pagesAllocation of Refund (Including Savings Bond Purchases)Liza GeorgeNo ratings yet

- Concepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDocument102 pagesConcepts in Federal Taxation 2013 20th Edition Murphy Solutions Manual DownloadDavid Clark100% (21)

- Retirement Income Solutions: A Guide For Plan SponsorsDocument18 pagesRetirement Income Solutions: A Guide For Plan SponsorsHaseeb Razzaq MinhasNo ratings yet

- Four Decades of Senior Household Income Growth: New Evidence From The Survey of Consumer FinancesDocument16 pagesFour Decades of Senior Household Income Growth: New Evidence From The Survey of Consumer FinancesHoover InstitutionNo ratings yet

- Chamber VoiceDocument16 pagesChamber VoiceorhanmcNo ratings yet

- Chpts 1-6 Employee Benefits QuizDocument17 pagesChpts 1-6 Employee Benefits QuizKevin Fernando100% (1)

- TSP 70Document15 pagesTSP 70onetimer64100% (1)

- CparDocument18 pagesCparLes EvangeListaNo ratings yet

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- Instructions For Completing The Citibank IRA Transfer and Direct Rollover FormDocument4 pagesInstructions For Completing The Citibank IRA Transfer and Direct Rollover FormMohd Shahrukh SiddiquiNo ratings yet

- Banking Survival GuideDocument44 pagesBanking Survival Guidetraderpk100% (1)

- w-9 FormDocument4 pagesw-9 Formapi-350005045No ratings yet

- Winter 2011: Crossing The Big Wood RiverDocument12 pagesWinter 2011: Crossing The Big Wood RiverWood River Land TrustNo ratings yet

- HRB 1-6 Quiz Correct AnswersDocument32 pagesHRB 1-6 Quiz Correct Answersfaithlachero13No ratings yet

- Ebook Pearsons Federal Taxation 2023 Individuals, 36e Timothy Rupert, Kenneth Anderson, David HulseDocument55 pagesEbook Pearsons Federal Taxation 2023 Individuals, 36e Timothy Rupert, Kenneth Anderson, David Hulseesource36No ratings yet

- Rpte Step 2012-07-10 Rothschild - AuthcheckdamDocument80 pagesRpte Step 2012-07-10 Rothschild - AuthcheckdamAnonymous Ax12P2srNo ratings yet

- 1370940213binder1Document36 pages1370940213binder1CoolerAdsNo ratings yet

- F 8915Document2 pagesF 8915IRS100% (1)

- Account Transfer RequestDocument6 pagesAccount Transfer RequestDanny VegaNo ratings yet