Professional Documents

Culture Documents

Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3

Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3

Uploaded by

Irvin LevieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3

Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3

Uploaded by

Irvin LevieCopyright:

Available Formats

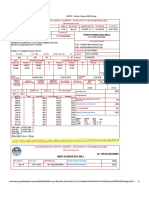

Use the following information to answer items 1 to 3:

During the current year, Wilkins Company reported accounting income P9,000,000 before income tax. The company revealed the following

information for the current year:

Interest income on government bonds 700,000

Depreciation claimed on tax return in excess of depreciation per book 1,300,000

Warranty expense on the accrual basis 600,000

Actual warranty payment 300,000

Income reported from installment sale reported for tax purposes in excess of

income recorded per book 200,000

Income tax rate 30%

1. What is the current tax liability at year-end?

A. 2,250,000 B. 2,490,000 C. 2,700,000 D. 2,910,000

2. What is the (1) deferred tax liability and (2) deferred tax asset at year-end?

A. (1) 150,000; (2) 390,000 B. (1) 390,000; (2) 150,000

C. (1) 60,000; (2) 480,000 D. (1) 480,000; (2) 60,000

3. What is the total income tax expense for the year?

A. 2,250,000 B. 2,490,000 C. 2,700,000 D. 2,910,000

4. On January 1, 2018, Rat Company reported deferred tax liability of P1,000,000 and a deferred tax asset of P400,000. On

December 31, 2018, the company reported a deferred tax liability of P1,500,000 and a deferred tax asset of zero. What is the

deferred tax expense for 2018?

A. 100,000 B. 400,000 C. 500,000 D. 900,000

Use the following information to answer items 5 and 6:

Mekeni Company provided the following information at year-end:

Carrying amount Tax base

Accounts receivable 1,500,000 1,750,000

Motor vehicle 1,650,000 1,250,000

Provision for warranty 120,000 0

Deposit received in advance 150,000 0

The depreciation rates for accounting and taxation are 15% and 25%, respectively. The deposits are taxable when received and warranty

costs are deductible when paid.

An allowance for doubtful debts of P250,000 has been raised against accounts receivable for accounting purposes but such debt are

deductible only when written off as uncollectible. The tax rate is 30%.

5. What amount should be reported as deferred tax liability?

A. 36,000 B. 81,000 C. 120,000 D. 156,000

6. What amount should be reported as deferred tax asset?

A. 36,000 B. 81,000 C. 120,000 D. 156,000

Use the following information to answer items 7 to 12:

Unity Company is in the first year of operations and reported pretax accounting income of P4,000,000. The entity provided the following

information for the first year:

Premium on life insurance of key officer 200,000

Depreciation on tax return in excess of book depreciation 200,000

Interest on municipal bonds 50,000

Warranty expense 40,000

Actual warranty repairs 30,000

Bad debt expense 60,000

Ending balance in allowance for bad debts 40,000

Rent received in advance that will be recognized evenly over the next three years 300,000

7. How much is the accounting profit subject to tax?

A. 3,800,000 B. 4,000,000 C. 4,150,000 D. 4,300,000

8. What is the deferred tax liability at year-end?

A. 60,000 B. 75,000 C. 90,000 D. 105,000

9. What is the deferred tax asset at year-end?

A. 45,000 B. 60,000 C. 75,000 D. 105,000

10. What is the taxable income for the first year?

A. 3,800,000 B. 4,000,000 C. 4,150,000 D. 4,300,000

11. What is the total income tax expense for the first year?

A. 1,200,000 B. 1,245,000 C. 1,290,000 D. 1,335,000

FARQ 218 Page 1 of 3

12. What is the current tax liability at year-end?

A. 1,200,000 B. 1,245,000 C. 1,290,000 D. 1,335,000

Dowell Company reported the following carrying amount of assets and liabilities at year-end:

Property 10,000,000

Plant and equipment 5,000,000

Inventory 4,000,000

Trade receivables 3,000,000

Trade payables 6,000,000

Cash 2,000,000

The value for tax purposes for property and for plant and equipment was P7,000,000 and P4,000,000, respectively. The entity has made

a provision for inventory obsolescence of P2,000,000 which is not allowable for tax purposes. Further, an impairment loss against trade

receivables of P1,000,000 has been made. This charge will not be allowed in the current year for tax purposes. The tax rate is 30%.

13. What amount should be reported as (1) deferred tax liability and (2) deferred tax asset at year-end?

A. (1) 300,000; (2) 0 B. (1) 2,700,000; (2) 0

C. (1) 1,200,000; (2) 900,000 D. (1) 3,600,000 ; (2) 900,000

Use the following information to answer items 14 and 15:

United Emirates Company began operations at the beginning of 2018. At the end of 2018, the company reported P12,000,000 income

before tax in the income statement but only P10,200,000 taxable income in the tax return. Analysis of the P1,800,000 difference revealed

that P1,000,000 was a permanent difference and P800,000 was a temporary tax liability difference related to a current asset. The enacted

tax rate for 2018 and future years is 30%.

14. What is the current tax expense?

A. 3,060,000 B. 3,300,000 C. 3,600,000 D. 3,900,000

15. What is the income tax expense to be reported in the income statement for the year 2018?

A. 3,060,000 B. 3,300,000 C. 3,600,000 D. 3,900,000

Jomari Company reported pre-tax financial income of P400,000 for 2016. In the computation of income taxes, the following data were

gathered:

Non-taxable gain 175,000

Depreciation deducted for tax purposes in excess of depreciation

deducted for book purposes 25,000

Tax payment made during 2016 27,500

Enacted tax rate 35%

16. What amount shall be reported as current tax liability?

A. 42,500 B. 51,250 C. 70,000 D. 78,750

Twinnie Company began operations on January 1, 2015. For external reporting, the company recognized revenue from all sales under

accrual method. However, in the tax return, the entity reported qualifying sales under the installment method. The gross profit on these

installment sales under each method was:

Accrual method Installment method

2015 1,600,000 600,000

2016 2,600,000 1,400,000

The income tax rate is 30%. There are no other temporary or permanent differences.

17. What amount should be reported as deferred tax asset or liability on December 31, 2016?

A. 660,000 asset B. 660,000 liability

C. 360,000 asset D. 360,000 liability

18. Breslin Co. had one temporary difference at the end of 2018 that will reverse and cause taxable amounts of P110,000 in 2019,

and P120,000 in 2020 and 2021. The company had also a deductible temporary difference of P150,000. The pre-tax financial

income for 2018 is P600,000 and the tax rate is 30%. There are no deferred taxes at the beginning of 2018. What is the net

deferred tax expense for 2018?

A. 45,000 B. 60,000 C. 105,000 D. 120,000

Cheng Lao Company located business in two jurisdictions, China and Korea. In both countries, the company has the legal right to offset

the taxes receivable and payable. The following information related to deferred tax assets and liabilities:

Amount Taxing jurisdiction

Deferred tax asset 500,000 China

Deferred tax liability 240,000 Korea

Deferred tax liability 410,000 China

19. How should the company present deferred taxes at year-end?

Deferred tax asset Deferred tax liability

A. 500,000 650,000

B. 0 150,000

C. 90,000 240,000

D. 240,000 90,000

FARQ 218 Page 2 of 3

Use the following information to answer items 20 to 24:

On December 31, 2018, the accounts of Hades Company have the same basis for accounting and tax purposes, except the following:

Carrying amount Tax base

Computer software cost 8,000,000 0

Equipment 24,000,000 30,000,000

Accrued liability – health care 4,000,000 0

In January 2018, the company incurred cost of P12,000,000 in relation to the development of a computer software product. The software

cost was appropriately capitalized and amortized over three years for accounting purposes using straight line. However, the total amount

was expensed in 2018 for tax purposes.

The equipment was acquired on January 1, 2018 for P40,000,000. The economic life is four years without residual value. The equipment

is depreciated using the sum of years’ digits method for accounting purposes and straight line for tax purposes.

In January 2018, the company entered into an agreement with the employees to provide health care benefits. The cost of such plan for

2018 was P4,000,000. This amount was accrued as expense in 2018 for accounting purposes. However, health care benefits are

deductible for tax purposes only when actually paid.

The pre-tax accounting income for 2018 is P26,000,000. The tax rate is 30% and there are no deferred taxes on January 1, 2018.

20. What is the current tax expense for 2018?

A. 4,800,000 B. 7,200,000 C. 7,800,000 D. 8,400,000

21. What is the deferred tax liability on December 31, 2018?

A. 1,200,000 B. 2,400,000 C. 3,000,000 D. 4,200,000

22. What is the deferred tax asset on December 31, 2018?

A. 1,200,000 B. 2,400,000 C. 3,000,000 D. 4,200,000

23. What is the deferred tax expense or benefit for 2018?

A. 600,000 benefit B. 600,000 expense C. 3,000,000 benefit D. 3,000,000 expense

24. What is the total tax expense for 2018?

A. 4,800,000 B. 7,200,000 C. 7,800,000 D. 8,400,000

FARQ 218 Page 3 of 3

You might also like

- Far 2019Document23 pagesFar 2019Princess KeithNo ratings yet

- Affidavit of OptionDocument1 pageAffidavit of OptionAjay Ann De La CruzNo ratings yet

- Intermediate Accounting 2 Quiz 2: You AnsweredDocument10 pagesIntermediate Accounting 2 Quiz 2: You AnsweredRayman MamakNo ratings yet

- Midterm Exam BTT 2ndSemAY2017-2018 SendDocument6 pagesMidterm Exam BTT 2ndSemAY2017-2018 SendelmerNo ratings yet

- Aa1 PDFDocument218 pagesAa1 PDFJohn Brian D. SorianoNo ratings yet

- Chapter 17-Statement of Cash FlowsDocument4 pagesChapter 17-Statement of Cash Flowselizabeth angel100% (1)

- Practical Accounting 1Document11 pagesPractical Accounting 1Jomar VillenaNo ratings yet

- Accrev1 FINAL EXAM 19 20 NO ANSWERSDocument15 pagesAccrev1 FINAL EXAM 19 20 NO ANSWERSGray JavierNo ratings yet

- Retake: Financial Accounting and ReportingDocument21 pagesRetake: Financial Accounting and ReportingJan ryanNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Answers Chapter 13 Quiz.f13Document2 pagesAnswers Chapter 13 Quiz.f13Razel TercinoNo ratings yet

- Ia Test Bank 20 PGDocument20 pagesIa Test Bank 20 PGzee abadillaNo ratings yet

- Auditing Region 10Document32 pagesAuditing Region 10Jan Christopher CabadingNo ratings yet

- Income Taxes Problem SolvingDocument3 pagesIncome Taxes Problem SolvingLara FloresNo ratings yet

- Vat 4Document4 pagesVat 4Allen KateNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- Intermacc Receivables Postlec WaDocument3 pagesIntermacc Receivables Postlec WaClarice Awa-aoNo ratings yet

- BFJPIA Cup 4 Business Law and TaxationDocument8 pagesBFJPIA Cup 4 Business Law and TaxationJerecko Ace ManlangatanNo ratings yet

- Icare Far First Preboard Examinations Batch 3Document14 pagesIcare Far First Preboard Examinations Batch 3Merliza Jusayan100% (1)

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Interacc Word JPDocument28 pagesInteracc Word JPJOCELYN NUEVONo ratings yet

- Discussion 2 Second SemDocument8 pagesDiscussion 2 Second SemEmey Calbay100% (1)

- LagunaDocument8 pagesLagunarandom17341No ratings yet

- Accounting Textbook Solutions - 52Document19 pagesAccounting Textbook Solutions - 52acc-expert0% (1)

- Auditing ProblemsDocument4 pagesAuditing ProblemsCristineJoyceMalubayIINo ratings yet

- Use The Following Information For The Next 2 QuestionsDocument4 pagesUse The Following Information For The Next 2 QuestionsGlen JavellanaNo ratings yet

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesNo ratings yet

- FAR.2829 Bonds Payable PDFDocument3 pagesFAR.2829 Bonds Payable PDFNah HamzaNo ratings yet

- Iac 11 Employee BenefitsDocument5 pagesIac 11 Employee BenefitsNacelleNo ratings yet

- 25781306Document19 pages25781306GuinevereNo ratings yet

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Exercises/Assignments Answer The Following ProblemsDocument22 pagesExercises/Assignments Answer The Following ProblemsLuigi Enderez BalucanNo ratings yet

- Audit of Cash and ReceivablesDocument3 pagesAudit of Cash and ReceivablesTheQUICKbrownFOX100% (2)

- LiabilitiesDocument9 pagesLiabilitiesNeriza maningasNo ratings yet

- BSA35 Quiz 3Document3 pagesBSA35 Quiz 3Raven ShadowsNo ratings yet

- Financial Accounting - ReceivablesDocument7 pagesFinancial Accounting - ReceivablesKim Cristian MaañoNo ratings yet

- TB 5Document2 pagesTB 5Louiza Kyla AridaNo ratings yet

- This Study Resource Was: Problem 1Document7 pagesThis Study Resource Was: Problem 1?????No ratings yet

- IADocument7 pagesIANoreen Ledda100% (1)

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Answers - Module 2Document4 pagesAnswers - Module 2bhettyna noayNo ratings yet

- FinLiab QuizDocument8 pagesFinLiab QuizAeris StrongNo ratings yet

- Business Combination Module 3Document8 pagesBusiness Combination Module 3TryonNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Audit Fot Liability Problem #10Document2 pagesAudit Fot Liability Problem #10Ma Teresa B. CerezoNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- C2 - Premium LiabilityDocument14 pagesC2 - Premium LiabilityMarjorie Tuinkle G. Rivera50% (2)

- CH 11Document69 pagesCH 11Abriel BumatayNo ratings yet

- Equity YyyDocument33 pagesEquity YyyJude SantosNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- Cash and Cash Equivalents: Answer: CDocument142 pagesCash and Cash Equivalents: Answer: CGarp BarrocaNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- ASSIGNMENT - Accounting For Income TaxesDocument5 pagesASSIGNMENT - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxCamille GarciaNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- 7062 - Deferred Income Tax SolvingDocument9 pages7062 - Deferred Income Tax SolvingstrmsantiagoNo ratings yet

- #3 Deferred Taxes PDFDocument3 pages#3 Deferred Taxes PDFjanus lopezNo ratings yet

- Registered Account PresentationDocument20 pagesRegistered Account PresentationNicolas CostaNo ratings yet

- SGLGB Form 3. Technical NotesDocument9 pagesSGLGB Form 3. Technical Notesnenita t. sison100% (2)

- Request For Temporary Extension of Stay (17 February 2020)Document11 pagesRequest For Temporary Extension of Stay (17 February 2020)Focus Photo EnterpriseNo ratings yet

- Klaus Joehle MONEY IS LOVE Book1 3Document349 pagesKlaus Joehle MONEY IS LOVE Book1 3Anna BasiukNo ratings yet

- State of The City Address 2014 of Mayor Belen FernandezDocument49 pagesState of The City Address 2014 of Mayor Belen FernandezbalondagupanNo ratings yet

- Pib India Budget-HighlightsDocument7 pagesPib India Budget-HighlightsKeerthi EkambaramNo ratings yet

- 1CIVEA2020001Document43 pages1CIVEA2020001j.assokoNo ratings yet

- Prj57392171draft of Agreement For Sale Cum Allotment LetterDocument28 pagesPrj57392171draft of Agreement For Sale Cum Allotment LetterPKCL027 Rishabh JainNo ratings yet

- Analysis and Interpretation of Financial Statement As A Managerial Tool ForDocument92 pagesAnalysis and Interpretation of Financial Statement As A Managerial Tool ForMuhammad Akmal HossainNo ratings yet

- Export Invoice: Item Description: Qty: UOM: Curr Unit PriceDocument4 pagesExport Invoice: Item Description: Qty: UOM: Curr Unit PriceAdam GreenNo ratings yet

- Strama PaperDocument105 pagesStrama PaperAnnMendoza100% (1)

- Malawi Growth & Development Strategy, From Poverty To Prosperity (2006 - 2011) )Document291 pagesMalawi Growth & Development Strategy, From Poverty To Prosperity (2006 - 2011) )jmusopoleNo ratings yet

- LESCO - Online Customer Bill Printing PDFDocument1 pageLESCO - Online Customer Bill Printing PDFGulshion Malik100% (1)

- 3911 Taxpayer Statement Regarding Refund: Section IDocument2 pages3911 Taxpayer Statement Regarding Refund: Section IFrancis King SingNo ratings yet

- Tax Geek Tuesday - Death or Retirement of A Partner in A PartnershipDocument14 pagesTax Geek Tuesday - Death or Retirement of A Partner in A PartnershipWenting WangNo ratings yet

- Tax 3rd Assignmnet DigestDocument45 pagesTax 3rd Assignmnet DigestSallen DaisonNo ratings yet

- Sundar Shetty: Eligibility Comes From Efforts, Luck Comes From Opportunities L - 1Document36 pagesSundar Shetty: Eligibility Comes From Efforts, Luck Comes From Opportunities L - 1Abhay GroverNo ratings yet

- Bidding Documents: Balochistan Textbook Board QuettaDocument28 pagesBidding Documents: Balochistan Textbook Board QuettaGânőőķ WäřņäNo ratings yet

- NVT Life Square PricingDocument1 pageNVT Life Square PricingaseerahmedNo ratings yet

- TRANSFER - ISO - CAO Transaction Application Forms - Revised - v02 - 02262018Document1 pageTRANSFER - ISO - CAO Transaction Application Forms - Revised - v02 - 02262018miron68No ratings yet

- Chapter 1-Basic Economic Ideas and Resource AllocationDocument13 pagesChapter 1-Basic Economic Ideas and Resource AllocationKeya NandiNo ratings yet

- Arguments For and Against Protection: Unit HighlightsDocument24 pagesArguments For and Against Protection: Unit HighlightsBivas MukherjeeNo ratings yet

- Scheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Document20 pagesScheme of Amalgmation of GDA Technologies Limited With Larsen & Toubro InfoTech Limited (Company Update)Shyam SunderNo ratings yet

- Foreign Direct Investment in Mongolia An Interactive Case Study (USAID, 2007)Document266 pagesForeign Direct Investment in Mongolia An Interactive Case Study (USAID, 2007)Oyuna Bat-OchirNo ratings yet

- MAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingDocument12 pagesMAhmed 3269 18189 2 Lecture Capital Budgeting and EstimatingSadia AbidNo ratings yet

- Fringe Benefits Tax and de Minimis Benefits: ObjectivesDocument11 pagesFringe Benefits Tax and de Minimis Benefits: ObjectivesChristelle JosonNo ratings yet

- Delpher and Pacheco v. IACDocument2 pagesDelpher and Pacheco v. IACIvan LuzuriagaNo ratings yet

- Mkuchajr ProposalDocument9 pagesMkuchajr ProposalinnocentmkuchajrNo ratings yet

- Solar Park BrochureDocument9 pagesSolar Park BrochurejawadmohsinNo ratings yet