Professional Documents

Culture Documents

SCOMNET - Research Hive - 7 Sept 2020

SCOMNET - Research Hive - 7 Sept 2020

Uploaded by

Jazzy0 ratings0% found this document useful (0 votes)

18 views2 pagesThis document recommends buying shares of Supercomnet Technologies Bhd, a Malaysian healthcare company. It rates the stock as a "Fundamental BUY" and raises its target price to RM2.68 based on strong earnings growth. Supercomnet reported a 45% increase in net profit for the recent quarter and its medical cable segment continues to see resilient growth and new orders. The company is expanding production capacity to meet growing demand for its medical products.

Original Description:

SCOMNET - Research Hive - 7 Sept 2020

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document recommends buying shares of Supercomnet Technologies Bhd, a Malaysian healthcare company. It rates the stock as a "Fundamental BUY" and raises its target price to RM2.68 based on strong earnings growth. Supercomnet reported a 45% increase in net profit for the recent quarter and its medical cable segment continues to see resilient growth and new orders. The company is expanding production capacity to meet growing demand for its medical products.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views2 pagesSCOMNET - Research Hive - 7 Sept 2020

SCOMNET - Research Hive - 7 Sept 2020

Uploaded by

JazzyThis document recommends buying shares of Supercomnet Technologies Bhd, a Malaysian healthcare company. It rates the stock as a "Fundamental BUY" and raises its target price to RM2.68 based on strong earnings growth. Supercomnet reported a 45% increase in net profit for the recent quarter and its medical cable segment continues to see resilient growth and new orders. The company is expanding production capacity to meet growing demand for its medical products.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

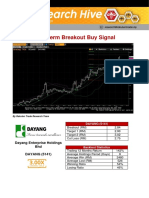

Supercomnet Technologies Bhd

(SCOMNET, 0001)

Supercomnet Technologies Bhd (Fundamental BUY with TP 2.68)

• We continue to favour Supercomnet Technologies Bhd (“Scomnet”) for its resilient earnings outlook and

as a proxy to the recession proof healthcare industry. We are raising our earnings estimates by 19.5% for

FY21 on the back of rising orders from major clients.

• BUY with a revised target price of RM2.68 premised on a 3-year average mean of 34x PER which is at a

discount to Bursa Malaysia Healthcare Index of 43x further supported by a 68% surge in EPS in FY21.

• Scomnet’s recent 2Q20 results were pretty much in-line with our expectations where it reported net

profit of RM5.95m (+45% from previous quarter and +12% from last year) with cumulative RM10m for

1H20.Net margins improved to 24.6% in 2Q20 and cumulative 1H20 to 19% from around 16.0% in FY19. We

believe it is on track to surpass our RM30m forecast in FY20 with the medical cable segment being the

key driver with resilient outlook and impressive pipeline of products to sustain its earnings going forward.

Furthermore, their automotive segment is seeing a recovery post MCO and has landed a new major client

in French PSA Group

• Scomnet is embarking on a multi-year expansion with initial capex of RM7-10m and eventually is

expected to double production capacity catering for their supercharged growth in the medical products

supplying their FDA and EMA approved medical cables to their long serving major key clients namely US

based Edward Lifesciences and Denmark based Ambu and Mermaid Medical. These companies are

major global cardiovascular medical devices companies anchoring Scomnet growth trajectory as

cardiovascular diseases are the number no. 1 cause of death globally according to WHO

• Balance sheet remains healthy with cash pile growing to RM56.6m and zero borrowings. We expect

Scomnet to deliver its strongest ever performance on record with supercharged growth in EPS for +59%

in FY20 and +68.3% in FY21.

This document has been prepared for general circulation based on information obtained from sources believed

to be reliable but we do not make any representations as to its accuracy or completeness. Any

recommendation contained in this document does not have regard to the specific investment objectives,

financial situation and the particular needs of any specific person who may read this document. This document

is for the information of addressees only and is not to be taken in substitution for the exercise of judgement by

addressees and further shall not be re-distributed to any other third party. Rakuten Trade Sdn Bhd accepts no

liability whatsoever for any direct or consequential loss arising from any use of this document or any

solicitations of an offer to buy or sell any securities. Rakuten Trade Sdn Bhd and its associates, their directors,

and/or employees may have positions in, and may affect transactions in securities mentioned herein from time

to time in the open market or otherwise, and may receive brokerage fees or act as principal or agent in dealings

with respect to these companies.

The Contra Trade account allows clients to buy shares based on available cash and/or collateral shares value

after hair cut at a higher multiplier. The multiplier varies according to the type of counters clients intend to buy.

Outstanding purchase(s) in the Contra Account need to be paid and/or settled within 2 (two) trading days after

the transaction date (T), failing which it will be force-sold on T+2.

Published:

RAKUTEN TRADE SDN BHD

Registration No: 199301011963 (266701-P) Kenny Yee Shen Pin

Level 7, Kenanga Tower, 237, Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia Head of Research

You might also like

- Business Plan Foreign Exchange Trading CompanyDocument22 pagesBusiness Plan Foreign Exchange Trading Companyashish163No ratings yet

- Internet Stock Trading and Market Research for the Small InvestorFrom EverandInternet Stock Trading and Market Research for the Small InvestorNo ratings yet

- SCOMNET - Research Hive - 17 Aug 2020Document2 pagesSCOMNET - Research Hive - 17 Aug 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 13 Apr 2020Document2 pagesSCOMNET - Research Hive - 13 Apr 2020JazzyNo ratings yet

- MTAG - Research Hive - 27 Aug 2020Document2 pagesMTAG - Research Hive - 27 Aug 2020JazzyNo ratings yet

- APPASIA - Research Hive - 27 July 2020Document2 pagesAPPASIA - Research Hive - 27 July 2020JazzyNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- HEXTAR - Research Hive - 02 June 2020Document2 pagesHEXTAR - Research Hive - 02 June 2020JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- OPTIMAX - Research Hive - 3 Sept 2020Document2 pagesOPTIMAX - Research Hive - 3 Sept 2020JazzyNo ratings yet

- Mah Sing Group BHD (Trading BUY)Document2 pagesMah Sing Group BHD (Trading BUY)JazzyNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- BSTEAD - Research Hive - 22 Sept 2020Document2 pagesBSTEAD - Research Hive - 22 Sept 2020JazzyNo ratings yet

- Ipo X-RayDocument3 pagesIpo X-Rayrahul kumarNo ratings yet

- Equity 99 Smart LinkDocument3 pagesEquity 99 Smart LinkSachinShingoteNo ratings yet

- PremiumTechnicals-Nov26 15 GammonDocument2 pagesPremiumTechnicals-Nov26 15 GammonWarren RiveraNo ratings yet

- Report On Budget 2012-13Document4 pagesReport On Budget 2012-13Kunal JainNo ratings yet

- Bull Positions Cut On Rate Cut: Punter's CallDocument4 pagesBull Positions Cut On Rate Cut: Punter's CallPraveenNo ratings yet

- RHB Equity 360°: 8 July 2010 (QL, Banks, Kencana Technical: Proton) - 08/07/2010Document3 pagesRHB Equity 360°: 8 July 2010 (QL, Banks, Kencana Technical: Proton) - 08/07/2010Rhb InvestNo ratings yet

- The Main Points of The Article Are Summarised Clearly and SuccinctlyDocument5 pagesThe Main Points of The Article Are Summarised Clearly and SuccinctlyKHAIRIL HAJAR BINTI AHMADNo ratings yet

- RHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Document4 pagesRHB Equity 360° - (Axiata, UMW, Gent Msia, AMMB, MAHB, MBM, Star, Hunza Technical: Gent Msia, Gamuda) - 18/08/2010Rhb InvestNo ratings yet

- Marco Polo Marine: Corporate News FlashDocument3 pagesMarco Polo Marine: Corporate News FlashphuawlNo ratings yet

- E&o - 2013 06 3 - RR - 4qfy13Document3 pagesE&o - 2013 06 3 - RR - 4qfy13Priesilia PresleyNo ratings yet

- L&T Financi L Services: A e H S e e eDocument53 pagesL&T Financi L Services: A e H S e e eNimesh PatelNo ratings yet

- RHB Equity 360° - 1 September 2010 (Benchmarking, Property, Semicon, O&G, Sunway City, Glomac, Maxis, Kurnia Asia, KPJ, KNM Technical: UMW)Document5 pagesRHB Equity 360° - 1 September 2010 (Benchmarking, Property, Semicon, O&G, Sunway City, Glomac, Maxis, Kurnia Asia, KPJ, KNM Technical: UMW)Rhb InvestNo ratings yet

- Press Release: 15 April: Smurfit Kappa Group PLCDocument3 pagesPress Release: 15 April: Smurfit Kappa Group PLCJose RodriguesNo ratings yet

- TechnipFMC Announces Authorization of Additional $300 Million Share Repurchase ProgramDocument2 pagesTechnipFMC Announces Authorization of Additional $300 Million Share Repurchase Programmuhammad ilyasNo ratings yet

- RHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Document4 pagesRHB Equity 360° - 3 August 2010 (PLUS, Semicon, Notion Vtec, Unisem, Axiata, AMMB Technical: MPHB, KNM)Rhb InvestNo ratings yet

- Bekasi Fajar Buy: Keeping A Cautious View Despite Recovery SignsDocument4 pagesBekasi Fajar Buy: Keeping A Cautious View Despite Recovery Signste_gantengNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Thesun 2009-06-12 Page15 Epfs q1 Investment Income Drops 10Document1 pageThesun 2009-06-12 Page15 Epfs q1 Investment Income Drops 10Impulsive collectorNo ratings yet

- SBI Securities Morning Update - 13-10-2022Document5 pagesSBI Securities Morning Update - 13-10-2022deepaksinghbishtNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Group 2 Assignment Marketing Plan Cmi132 FinalDocument18 pagesGroup 2 Assignment Marketing Plan Cmi132 FinalSeanNo ratings yet

- Felda News FlashDocument3 pagesFelda News FlashBimb SecNo ratings yet

- OPENSYS - Investment Idea - 9 June 2020Document2 pagesOPENSYS - Investment Idea - 9 June 2020MegatzimranNo ratings yet

- ICICIdirect NewTelecomPolicy2011 SectorUpdateDocument3 pagesICICIdirect NewTelecomPolicy2011 SectorUpdateSoodamany Ponnu PandianNo ratings yet

- Maintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Document3 pagesMaintain Buy' On M&M - TP Rs.800: Research Notes - Buy M&M, Aban Offshore, L&T, Hold DLF, Reduce Rpower (June 01, 2012)Nas Mall RegisterNo ratings yet

- PERDANA - Research Hive - 13 Jan 2020Document2 pagesPERDANA - Research Hive - 13 Jan 2020JazzyNo ratings yet

- BIMBSec - Dialog Company Update - Higher and Deeper - 20120625Document2 pagesBIMBSec - Dialog Company Update - Higher and Deeper - 20120625Bimb SecNo ratings yet

- SBI Securities Morning Update - 13-01-2023Document7 pagesSBI Securities Morning Update - 13-01-2023deepaksinghbishtNo ratings yet

- Vardhaman Special SteelsDocument5 pagesVardhaman Special SteelsupsahuNo ratings yet

- 37.human Resource Information System Cholamandal InsuranceDocument28 pages37.human Resource Information System Cholamandal InsurancerajNo ratings yet

- Eric Khrom of Khrom Capital 2012 Q1 LetterDocument4 pagesEric Khrom of Khrom Capital 2012 Q1 Letterallaboutvalue100% (1)

- Ijrfm Volume 2, Issue 5 (May 2012) (ISSN 2231-5985) A Study On Market Performance of Selected Telecommunication Companies in IndiaDocument19 pagesIjrfm Volume 2, Issue 5 (May 2012) (ISSN 2231-5985) A Study On Market Performance of Selected Telecommunication Companies in IndiaShubham GuptaNo ratings yet

- Assignment 1Document3 pagesAssignment 1Godfrey PhiriNo ratings yet

- SBI Securities Morning Update - 16-01-2023Document8 pagesSBI Securities Morning Update - 16-01-2023deepaksinghbishtNo ratings yet

- Press Release: CAE Announces Closing of Marketed Public OfferingDocument3 pagesPress Release: CAE Announces Closing of Marketed Public OfferingHiroKoNo ratings yet

- RHB Equity 360° (RHB Equity 360° Technical: Top Glove) - 08/09/2010Document2 pagesRHB Equity 360° (RHB Equity 360° Technical: Top Glove) - 08/09/2010Rhb InvestNo ratings yet

- RHB Equity 360°: 7 July 2010 (Semicon, Banks, PLUS, CBIP Technical: MMC)Document4 pagesRHB Equity 360°: 7 July 2010 (Semicon, Banks, PLUS, CBIP Technical: MMC)Rhb InvestNo ratings yet

- Q2 FY17 Results Update: Power Grid: Company Details: Quarterly HighlightsDocument4 pagesQ2 FY17 Results Update: Power Grid: Company Details: Quarterly Highlightsnabamita pyneNo ratings yet

- Consolidation Time: Punter's CallDocument4 pagesConsolidation Time: Punter's CallNaleep GuptaNo ratings yet

- RHB Equity 360° - 19 July 2010 (O&G, Berjaya Retail Technical: Genting, UEM Land) - 19/7/2010Document3 pagesRHB Equity 360° - 19 July 2010 (O&G, Berjaya Retail Technical: Genting, UEM Land) - 19/7/2010Rhb InvestNo ratings yet

- Market Wizard Newsletter 20-3-2021Document28 pagesMarket Wizard Newsletter 20-3-2021Shyamal TalukdarNo ratings yet

- RHB Equity 360° - 02/03/2010Document4 pagesRHB Equity 360° - 02/03/2010Rhb InvestNo ratings yet

- economic times recoDocument2 pageseconomic times recoptrptrck71No ratings yet

- Banking 2020: Transform yourself in the new era of financial servicesFrom EverandBanking 2020: Transform yourself in the new era of financial servicesNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- FPGROUP - Research Hive - 14 Feb 2020Document2 pagesFPGROUP - Research Hive - 14 Feb 2020JazzyNo ratings yet

- SCOMNET - Research Hive - 13 Apr 2020Document2 pagesSCOMNET - Research Hive - 13 Apr 2020JazzyNo ratings yet

- DAYANG - Research Hive - 21 Jan 2020Document2 pagesDAYANG - Research Hive - 21 Jan 2020JazzyNo ratings yet

- PERDANA - Research Hive - 13 Jan 2020Document2 pagesPERDANA - Research Hive - 13 Jan 2020JazzyNo ratings yet

- TRIMODE - Research Hive - 8 Feb 2021Document2 pagesTRIMODE - Research Hive - 8 Feb 2021JazzyNo ratings yet

- SCOMNET - Research Hive - 17 Aug 2020Document2 pagesSCOMNET - Research Hive - 17 Aug 2020JazzyNo ratings yet

- TCS - Research Hive - 11 Jan 2021Document2 pagesTCS - Research Hive - 11 Jan 2021JazzyNo ratings yet

- MTAG - Research Hive - 27 Aug 2020Document2 pagesMTAG - Research Hive - 27 Aug 2020JazzyNo ratings yet

- Mah Sing Group BHD (Trading BUY)Document2 pagesMah Sing Group BHD (Trading BUY)JazzyNo ratings yet

- CCK - Research Hive - 26 Aug 2020Document2 pagesCCK - Research Hive - 26 Aug 2020JazzyNo ratings yet

- ASIAPLY - Research Hive - 17 Nov 2020Document2 pagesASIAPLY - Research Hive - 17 Nov 2020JazzyNo ratings yet

- APPASIA - Research Hive - 27 July 2020Document2 pagesAPPASIA - Research Hive - 27 July 2020JazzyNo ratings yet

- OPTIMAX - Research Hive - 3 Sept 2020Document2 pagesOPTIMAX - Research Hive - 3 Sept 2020JazzyNo ratings yet

- BSTEAD - Research Hive - 22 Sept 2020Document2 pagesBSTEAD - Research Hive - 22 Sept 2020JazzyNo ratings yet

- HEXTAR - Research Hive - 02 June 2020Document2 pagesHEXTAR - Research Hive - 02 June 2020JazzyNo ratings yet

- Jetlax's CNS Pharmacology Cheat Sheet For The Philippines v6.0 at Bit - Ly - CNSPcol - See Bit - Ly - CNSHandouts For 5.0 CorrectionsDocument61 pagesJetlax's CNS Pharmacology Cheat Sheet For The Philippines v6.0 at Bit - Ly - CNSPcol - See Bit - Ly - CNSHandouts For 5.0 CorrectionsShalimar BasmanNo ratings yet

- Growth Evaluation and Meat Assessment of Native Pig in Romblon Province, PhilippinesDocument7 pagesGrowth Evaluation and Meat Assessment of Native Pig in Romblon Province, PhilippinesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Manual of Temporal Bone DissectionDocument82 pagesManual of Temporal Bone DissectionBungbu Tn100% (4)

- Family Life Group 9Document32 pagesFamily Life Group 9Quỳnh AngNo ratings yet

- Domestic Dogs: Temporal Range: at Least 14,200 Years Ago - PresentDocument35 pagesDomestic Dogs: Temporal Range: at Least 14,200 Years Ago - PresentirayoNo ratings yet

- Spot LightDocument216 pagesSpot LightCristopherZartaNo ratings yet

- Enfield Saheli: Funding NEWSDocument5 pagesEnfield Saheli: Funding NEWSenfieldclubhouseNo ratings yet

- Acronyms and Its Meaning: S/N Acronyms Stand For Explainationa & Meaning Examples TLVDocument2 pagesAcronyms and Its Meaning: S/N Acronyms Stand For Explainationa & Meaning Examples TLVshamroz khanNo ratings yet

- Olea Europaea A Phyto-Pharmacological ReviewDocument5 pagesOlea Europaea A Phyto-Pharmacological ReviewyigalbyNo ratings yet

- Module 2 Project Gap Analysis Strategy For Team #3Document20 pagesModule 2 Project Gap Analysis Strategy For Team #3Mary A. Dillard100% (2)

- Sma Negeri 1 Pare: Understanding Descriptive TextDocument13 pagesSma Negeri 1 Pare: Understanding Descriptive TextAnnisa FujiantiNo ratings yet

- Gordon's Functional HealthDocument2 pagesGordon's Functional HealthReina ArabelleNo ratings yet

- Chapter - 10: Reaching The Age of AdolescenceDocument11 pagesChapter - 10: Reaching The Age of AdolescenceDestroy YtNo ratings yet

- Hotel Majestic Kuala Lumpur Press ReleaseDocument3 pagesHotel Majestic Kuala Lumpur Press Releasesam07rocksNo ratings yet

- Simulation Study of LPG Cooking BurnerDocument3 pagesSimulation Study of LPG Cooking BurnerBensinghdhas Sathiya Dhas100% (1)

- Loctite 270 Eng MsdsDocument16 pagesLoctite 270 Eng Msdstimeforever aymenNo ratings yet

- نموذج ميزانية تدريبDocument2 pagesنموذج ميزانية تدريبعمولةNo ratings yet

- The Importance of Macronutrients & Micronutrients in PlantDocument25 pagesThe Importance of Macronutrients & Micronutrients in Plantmarinihassim100% (5)

- 2007-Current MaxxForce Engine Breakout Harness Reference (EGES545)Document14 pages2007-Current MaxxForce Engine Breakout Harness Reference (EGES545)Enrrique Lara100% (1)

- Gram Positive Cocci: Two GeneraDocument31 pagesGram Positive Cocci: Two GeneraGeorgeNecoară100% (1)

- Adverse Effects of Gadgets On KidsDocument1 pageAdverse Effects of Gadgets On Kidsnicole bejasaNo ratings yet

- Definition of Terms Mine SurveyingDocument2 pagesDefinition of Terms Mine Surveyingaquariuspj25100% (3)

- Chemistry Ibdp Exam Syle QuestionsDocument37 pagesChemistry Ibdp Exam Syle QuestionsGEORGE MATTHEWNo ratings yet

- Gate 2000 CyDocument9 pagesGate 2000 CyYocobSamandrewsNo ratings yet

- Internet of Things Applications: Current and Future DevelopmentDocument34 pagesInternet of Things Applications: Current and Future DevelopmentNithinNo ratings yet

- Pentavitin - DSMDocument3 pagesPentavitin - DSMRnD Roi SuryaNo ratings yet

- Reimagining Public SafetyDocument1 pageReimagining Public SafetyWAVE 3 NewsNo ratings yet

- Improving Fast-Food Restaurants' Method of Operation: Automated Drive-Through Ordering SystemDocument12 pagesImproving Fast-Food Restaurants' Method of Operation: Automated Drive-Through Ordering SystemAllin John FranciscoNo ratings yet

- Clinical Liver Disease - 2022 - Memel - Intermittent Fasting As A Treatment For Nonalcoholic Fatty Liver Disease What IsDocument5 pagesClinical Liver Disease - 2022 - Memel - Intermittent Fasting As A Treatment For Nonalcoholic Fatty Liver Disease What Isarranguezjr5991No ratings yet

- Certificate of Compliance CSA For Fluke 113 - 114 - 115-116-117Document2 pagesCertificate of Compliance CSA For Fluke 113 - 114 - 115-116-117CHARLES BARRAZA100% (1)