Professional Documents

Culture Documents

Answer Key - Midterm Exam

Answer Key - Midterm Exam

Uploaded by

Silvermist AriaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer Key - Midterm Exam

Answer Key - Midterm Exam

Uploaded by

Silvermist AriaCopyright:

Available Formats

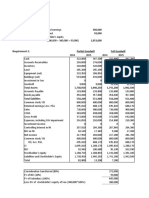

1.

Cost 100,000,000 x 80% 80,000,000

legal expense 3,000,000 x 80% 2,400,000

total 82,400,000

2. cost 100,000,000

legal expense 3,000,000

103,000,000

3. cost 120,000,000 investment property

4. cost none property, plant & equipment

5. fair value 55,000,000

6. net selling price 2,500,000

7. cost 330,000

import 10,000

purch taxs 15,000

transport 5,000

installation 5,000

total 365,000

8. land 855,000 x (300/900) 285,000

warehouse 855,000 x (200/900) 190,000

office building 855,000 x (400/900) 380,000

total 855,000

9. cash price 116,000

installation 2,000

total 118,000

10. invoice price 1,500,000

discount -75,000

freight 25,000

installation 25,000

total 1,475,000

11. 80,000 x 5.712 456,960

12. fair value 35,000,000

legal cost 220,000

total 35,220,000

13. Machine-new 810,000

Accum Depn 600,000

Machine-old 1,200,000

Cash 160,000

Gain 50,000

14. Equipment-new 185,000

Equipment-old 120,000

Cash 65,000

15. Equipment-new 135,000

Cash 65,000

Loss 20,000

Equipment-old 220,000

16. cost 4,000,000

legal fees 50,000

title guarantee 30,000

total 4,080,000

**Note: used as factory site (all other fees charged to new building)

17. purch price 2,500,000

handling cost 200,000

site preparation 600,000

consultants 700,000

dismantling cost 300,000

total 4,300,000

18. cash price 651,460

19. 3-year note 3,000,000

non-interest note:

first payment 1,000,000

1M x 1.69 1,690,000 2,690,000

total 5,690,000

20. Vehicle 420,000

Cash 90,000

Machine 450,000

Gain 60,000

21. Machine 510,000

Vehicle 300,000

Cash 90,000

Gain 120,000

22. Asset R 16,000

Asset Givenup 12,000

Cash 4,000

23. Asset R 15,000

Cash 4,000

Asset Givenup 19,000

24. New truck 1,880,000

Accum Depn 1,200,000

Loss 80,000

Cash 1,560,000

Old truck 1,600,000

25. cost 1,000,000

legal fees 3,480

title insurance 2,400

assessment 6,400

cost to tear down 40,000

proceeds -5,400

total 1,046,880

26. 40 x 10,000 shares 400,000

proceeds -50,000

total 350,000

27. cash price 20,500

cash payment 6,000

fair value 14,500

carrying amount 16,800

loss on exchange 2,300

28. fair value 60,000

cash paid 75,000

total 135,000

29. sinking fund jan 4,500,000

add'l investment 900,000

dividends 150,000

interest revenue 300,000 1,350,000

total 5,850,000

administration cost 50,000

sinking fund dec 5,800,000

30. 5,000,000/5.11 978,500

31. annual deposit (6,000,000/6.34) 946,400

32. annual deposit (5,000,000/5.98) 836,120

33. principal amount 5,000,000

fv of 1 for 6 @ 10% 1.77 multiply

fv of annuity 8,850,000

34. fv at maturity 7,160,000

fv of for 10 @ 6% 1.79 divide

initial investment 4,000,000

35. annual premium 20,000

less:inc in csv:

54,000 - 43,500 10,500

dividend received 3,000 13,500

life insurance exp 6,500

36. premium paid 40,000

less:inc in csv:

108,000 - 87,000 21,000

life insurance exp 19,000

37. cash price-new 2,050,000

less: cash payment 600,000

fv of old mach 1,450,000

less: ca 1,680,000

loss on exchange -230,000

38. ca of truck given 1,200,000

cash received -200,000

cost of new truck 1,000,000

39. fv of shares issued (5,000 x 4,400) 22,000,000

40. fv of ts (100,000x40) 4,000,000

scrap value -50,000

cost 3,950,000

41. fv of bonds (600,000 x 102) 612,000

fv of shares (40,000 x 19) 760,000

total cost 1,372,000

42. dp 400,000

pv of NP (600,000 x 2.58) 1,548,000

shipping 200,000

installation 350,000

cost 2,498,000

43. current market value of land 2,400,000

44. architect fee 950,000

new building 8,000,000

total 8,950,000

45. escrow fee 100,000

property tax 150,000

real estate comm 300,000

cost to be allocated 550,000

cost of bldg 4,000,000

remodeling 500,000

550,000 x 4/5 440,000

total 4,940,000

46. purchase price 2,400,000

cost to tear 240,000

salvage value -20,000

legal fee 15,000

title insurance 10,000

special assessment 30,000

total 2,675,000

47. architect fee 100,000

building contractor 6,000,000

insurance 25,000

total 6,125,000

48. price 1,260,000

shipping 30,000

installation 40,000

testing 50,000

total 1,380,000

49. pv of future payments (200,000 x 5.712) 1,142,400

50. fv of inventory given 2,100,000

cash payment 100,000

total 2,200,000

You might also like

- Engineering Economy 9Th Edition Leland T Blank Full ChapterDocument67 pagesEngineering Economy 9Th Edition Leland T Blank Full Chaptereleanor.gamble412100% (10)

- Iso 8000Document10 pagesIso 8000Laura AydinyanNo ratings yet

- Mystic SportsDocument34 pagesMystic SportshelloNo ratings yet

- Essay QuestionsDocument16 pagesEssay Questionssheldon100% (1)

- Cost Engineers Notebook!!!!!Document5 pagesCost Engineers Notebook!!!!!Anonymous 19hUyem0% (2)

- Chapter 6 - Types of Computer FraudDocument92 pagesChapter 6 - Types of Computer FraudhilmanNo ratings yet

- City BrandDocument27 pagesCity BrandCityNewsToronto100% (1)

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- 20201015012755Document57 pages20201015012755hasharawanNo ratings yet

- Let's Check (ULO J)Document8 pagesLet's Check (ULO J)Kirei MinaNo ratings yet

- CPA 1 - Financial Accounting Dec 2021Document9 pagesCPA 1 - Financial Accounting Dec 2021Asaba GloriaNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- Answer Key: Activity-Based Costing and Service Cost AllocationsDocument5 pagesAnswer Key: Activity-Based Costing and Service Cost AllocationsNoreenNo ratings yet

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Corporate Liquidation and Joint ArrangementDocument7 pagesCorporate Liquidation and Joint ArrangementPaupauNo ratings yet

- Exercise 1 1. P290,000 2. P29,000: SolutionDocument5 pagesExercise 1 1. P290,000 2. P29,000: SolutionSheena MarieNo ratings yet

- Exercise 1 1. P290,000 2. P29,000: SolutionDocument5 pagesExercise 1 1. P290,000 2. P29,000: SolutionSheena MarieNo ratings yet

- Latihan Intercompany Profit Transactions-Plant Assets WS 2Document5 pagesLatihan Intercompany Profit Transactions-Plant Assets WS 2Raihan SalehNo ratings yet

- Answer Key: Activity-Based Costing and Service Cost AllocationsDocument5 pagesAnswer Key: Activity-Based Costing and Service Cost AllocationsNathalie PadillaNo ratings yet

- Answer Key - Module 8 - Activity-Based Costing and Service Cost Allocations 2018Document5 pagesAnswer Key - Module 8 - Activity-Based Costing and Service Cost Allocations 2018Beverlene BatiNo ratings yet

- Keterangan Aset Baru Aset LamaDocument6 pagesKeterangan Aset Baru Aset LamaHalida An NabilaNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Aucap2 Unit 5Document6 pagesAucap2 Unit 5Sel BarrantesNo ratings yet

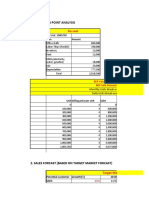

- Breakeven Point Analysis: Fix CostDocument7 pagesBreakeven Point Analysis: Fix CostKankanNguyenNo ratings yet

- Ap 2Document2 pagesAp 2Quỳnh SuniNo ratings yet

- Sharon PLC (Long Question)Document4 pagesSharon PLC (Long Question)Jimmy LimNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Buscom-Asset AcquisitionDocument7 pagesBuscom-Asset AcquisitionRenelyn DavidNo ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- CHAPTER 4 (Accounts)Document14 pagesCHAPTER 4 (Accounts)lcNo ratings yet

- AP 5904Q InvestmentsDocument6 pagesAP 5904Q InvestmentsRhea NograNo ratings yet

- MAS-03 WorksheetDocument32 pagesMAS-03 WorksheetPaupauNo ratings yet

- Installment Method and Accounting Method Steven Richmon T GenerilloDocument4 pagesInstallment Method and Accounting Method Steven Richmon T GenerilloSteven RichmonNo ratings yet

- Answer Key Midterm Examination LabDocument9 pagesAnswer Key Midterm Examination LabAMIKO OHYANo ratings yet

- Chapter 1 Abc Suggested SolutionsDocument7 pagesChapter 1 Abc Suggested SolutionsAlthea Lyn ReyesNo ratings yet

- Problem 15 - 1 Books of German CompanyDocument3 pagesProblem 15 - 1 Books of German CompanyCOCO IMNIDANo ratings yet

- Asawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueDocument22 pagesAsawa Ko Aking Mahal Book Value Fair Value Book Value Fair ValueLyka RoguelNo ratings yet

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroNo ratings yet

- AFAR ST - Consignment and Franchise Op ExercisesDocument4 pagesAFAR ST - Consignment and Franchise Op ExercisesCayden BrookeNo ratings yet

- Category Cost of Asset Accumulated DepreciationDocument10 pagesCategory Cost of Asset Accumulated DepreciationAaliyah ManuelNo ratings yet

- Ast Chapter 1 MCPDocument14 pagesAst Chapter 1 MCPElleNo ratings yet

- BRS3B Assessment Opportunity 1 2019Document11 pagesBRS3B Assessment Opportunity 1 2019221103909No ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Nama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Document5 pagesNama: Putri Nabilah NIM: 041911333169 Tanggal: 27 Maret 2020Putri NabilahNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Kunci Quiz 3 Bond BaruDocument1 pageKunci Quiz 3 Bond BaruKoko D'DemonsongNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Initial Cash Flows Terminal Cash FlowsDocument5 pagesInitial Cash Flows Terminal Cash FlowshannahNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Prctice SetDocument9 pagesPrctice SetAdam CuencaNo ratings yet

- Ans. 677 Corp AcctDocument12 pagesAns. 677 Corp AcctHashimRazaNo ratings yet

- 8-9 Mecca Copy Budget Balance SheetDocument5 pages8-9 Mecca Copy Budget Balance SheetAli Hassan SukheraNo ratings yet

- 5,655.00 Additional Investment Needed/financingDocument23 pages5,655.00 Additional Investment Needed/financingMPCINo ratings yet

- 93 - Final Preaboard AFAR SolutionsDocument11 pages93 - Final Preaboard AFAR SolutionsLeiNo ratings yet

- Quiz AE 120Document10 pagesQuiz AE 120Katrina MalecdanNo ratings yet

- p11 29Document5 pagesp11 29Saeful AzizNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Answer Key Discussion of Sir Paul of PreweekDocument2 pagesAnswer Key Discussion of Sir Paul of PreweekElaine Joyce GarciaNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

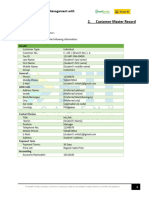

- Customer Master Record: Smartbooks Operations Management With Analytics Workbook Exercise 2.1Document8 pagesCustomer Master Record: Smartbooks Operations Management With Analytics Workbook Exercise 2.1jennicaashley.chua.engNo ratings yet

- Iimka OscmDocument21 pagesIimka OscmSubhash M SubhashNo ratings yet

- Track & Trace Express - DHL - GlobalDocument2 pagesTrack & Trace Express - DHL - GlobalDragimage JenianNo ratings yet

- Audit 02 JournalDocument4 pagesAudit 02 Journalkris salacNo ratings yet

- Assignment - Week4 - Claudia Putri AdiskaDocument6 pagesAssignment - Week4 - Claudia Putri AdiskaClaudia putri AdiskaNo ratings yet

- AA015 Group Assignment Sem 1Document16 pagesAA015 Group Assignment Sem 1ahmadariq33No ratings yet

- 2 Current Issues in Corporate EthicsDocument32 pages2 Current Issues in Corporate EthicsUtkarsh PrasadNo ratings yet

- BEp 19Document1 pageBEp 19demo srinilNo ratings yet

- Week 6 Lecture NotesDocument62 pagesWeek 6 Lecture NotesXuTongNo ratings yet

- Chapter - 3 - The Business Mission ShortDocument22 pagesChapter - 3 - The Business Mission ShortNetsi Yami100% (1)

- Brokerage HousesDocument87 pagesBrokerage HousesSiddiqa AwanNo ratings yet

- Conceptualizing The International For Profit Social EntrepreneurDocument17 pagesConceptualizing The International For Profit Social EntrepreneurPhegasus92No ratings yet

- Himel Point of Sales Design GuidelineDocument16 pagesHimel Point of Sales Design GuidelineKoo Djung TanNo ratings yet

- Erp Case StudyDocument7 pagesErp Case Study207-Sulman TariqNo ratings yet

- Polo S. Pantaleon vs. American Express International, Inc. G.R. No. 174269Document5 pagesPolo S. Pantaleon vs. American Express International, Inc. G.R. No. 174269robdeqNo ratings yet

- Automation and RoboticsDocument8 pagesAutomation and RoboticsRavierMNo ratings yet

- Customs Assessment & Clearance Procedure.1Document55 pagesCustoms Assessment & Clearance Procedure.1Syed RiponNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Case Study 1Document1 pageCase Study 1Fheikel DaudNo ratings yet

- Aace International Scheduling: Critical Path Method (CPM)Document1 pageAace International Scheduling: Critical Path Method (CPM)Sucher EolasNo ratings yet

- SI2112 - Information System Control and Audit: O4 - Tools and Techniques Used in Auditing ITDocument39 pagesSI2112 - Information System Control and Audit: O4 - Tools and Techniques Used in Auditing ITCynthia Herlina LeonardoNo ratings yet

- Case Study 2Document1 pageCase Study 2Mohammad Haroon0% (1)

- Guidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Document90 pagesGuidelines For The Regulation of Insurance Brokers in Nigeria ZERO DRAFT 27.06.2018Gabriel EtimNo ratings yet

- Problems: "Ch. 19-Inventory Theory" LINGO File For Selected ExamplesDocument12 pagesProblems: "Ch. 19-Inventory Theory" LINGO File For Selected ExamplesOmbasNo ratings yet

- Annual Report 2020-2021Document5 pagesAnnual Report 2020-2021Muttia KartikaNo ratings yet