Professional Documents

Culture Documents

Copy B-To Be Filed With Employee's FEDERAL Tax Return

Copy B-To Be Filed With Employee's FEDERAL Tax Return

Uploaded by

Kyle im taken by cailey hand HandCopyright:

Available Formats

You might also like

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- Your Benefit Statement Tax Year 2019Document2 pagesYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- 2019 W2 2020120235817 PDFDocument3 pages2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- Profit Or: Loss From BusinessDocument2 pagesProfit Or: Loss From BusinessBryan Pasqueci100% (2)

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- 120s Az FormDocument19 pages120s Az FormStacey CanaleNo ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- Connery 2021Document22 pagesConnery 2021ytprem agu100% (1)

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsRebecca AtesNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Document3 pagesAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNo ratings yet

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDocument2 pagesU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- G.R. No. 211293, June 04, 2019 Doctrine:: Oriondo vs. COADocument1 pageG.R. No. 211293, June 04, 2019 Doctrine:: Oriondo vs. COAstephanie linajaNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- Paredes Abreu - W2 2021Document1 pageParedes Abreu - W2 2021Sarah ParedesNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Justin w2Document2 pagesJustin w2jusditzNo ratings yet

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesus GarciaNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- 2016 Algeri C Form 1040 Individual Tax Return - RecordsDocument10 pages2016 Algeri C Form 1040 Individual Tax Return - RecordsbrynsteinNo ratings yet

- 2018 Coleman Tax Return PDFDocument46 pages2018 Coleman Tax Return PDFJonathan Brinton100% (1)

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document3 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12memek1123No ratings yet

- U.S. Individual Income Tax Return: Boddu 629-68-1309 SAIDocument3 pagesU.S. Individual Income Tax Return: Boddu 629-68-1309 SAIssi bodduNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- 2021 Tax Return: Prepared ByDocument6 pages2021 Tax Return: Prepared BySolomonNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument8 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Loan AppDocument9 pagesLoan Appanon-209253100% (1)

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Document2 pagesFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- 2019 Turbo Tax ReturnDocument113 pages2019 Turbo Tax Returnjason borneNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Taxes Amy PDFDocument7 pagesTaxes Amy PDFJsjs JsjsjjshshNo ratings yet

- 2018 TaxReturn PDFDocument6 pages2018 TaxReturn PDFDavid LeeNo ratings yet

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNo ratings yet

- W 2Document1 pageW 2Raj SharmaNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- File by Mail Instructions For Your 2020 Federal Tax ReturnDocument18 pagesFile by Mail Instructions For Your 2020 Federal Tax Returnrose owensNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- Diversity in Corporate GovernanceDocument26 pagesDiversity in Corporate GovernanceShameza DavidNo ratings yet

- Ael October 2020 From Atty Loanzon 1Document35 pagesAel October 2020 From Atty Loanzon 1MICHAEL SALINASNo ratings yet

- Chap 3 PPT - The Global Trade EnvironmentDocument30 pagesChap 3 PPT - The Global Trade EnvironmentMuhammad TahaNo ratings yet

- DCDC Doctrine Nato Planning of Ops Ajp 5 PDFDocument200 pagesDCDC Doctrine Nato Planning of Ops Ajp 5 PDFKebede Michael100% (1)

- Grade 11 Civics WEEK 2Document18 pagesGrade 11 Civics WEEK 2BakiNo ratings yet

- Guideline 5-2012 OBSOLESCENCEDocument8 pagesGuideline 5-2012 OBSOLESCENCEigormetaldataNo ratings yet

- Right To Education: International Legal BasisDocument7 pagesRight To Education: International Legal BasisAkshay SarjanNo ratings yet

- The False Promise of Superiority The United States and Nuclear Deterrence After The Cold War James H Lebovic 3 Full Download ChapterDocument51 pagesThe False Promise of Superiority The United States and Nuclear Deterrence After The Cold War James H Lebovic 3 Full Download Chaptercathy.stunkard398100% (11)

- Criminal Appeal No. 231 of 2014, Simon Ndikulyaka VS RDocument16 pagesCriminal Appeal No. 231 of 2014, Simon Ndikulyaka VS RDATIUS DIDACE(Amicus Curiae)⚖️No ratings yet

- Implementation of E-Governance To Improve The Civil Administration Service Quality in Public SectorDocument11 pagesImplementation of E-Governance To Improve The Civil Administration Service Quality in Public SectorChristie YohanaNo ratings yet

- Office of The Sangguniang BarangayDocument3 pagesOffice of The Sangguniang BarangayRalph Christian Lusanta FuentesNo ratings yet

- COI JNTUH SYllabusDocument1 pageCOI JNTUH SYllabusDr Ishrat JahanNo ratings yet

- IV and V. Civil, Political, Economic, Social, and Cultural Rights As Applied in The PhilippinesDocument3 pagesIV and V. Civil, Political, Economic, Social, and Cultural Rights As Applied in The PhilippinesNoel Ephraim AntiguaNo ratings yet

- Overview of The Social ProblemDocument2 pagesOverview of The Social ProblemKent Andrew SaliNo ratings yet

- The Principle of Subsidiarity: Legal BasisDocument6 pagesThe Principle of Subsidiarity: Legal BasisBeethovengg BeethovenggNo ratings yet

- Philippine Case Digests Databank Philippine Case Digests DatabankDocument6 pagesPhilippine Case Digests Databank Philippine Case Digests DatabankMadam JudgerNo ratings yet

- Purchasing PolicyDocument4 pagesPurchasing PolicyBob KilcoyneNo ratings yet

- 1 - Principles of Law - Halim1Document25 pages1 - Principles of Law - Halim1Mashithah AhmadNo ratings yet

- BSBOPS405 Assessment With Link and FeedbackDocument46 pagesBSBOPS405 Assessment With Link and FeedbackAnchisa SarnkhoksungNo ratings yet

- 5 DILG Mandanas Communications Plan and StrategyDocument18 pages5 DILG Mandanas Communications Plan and StrategyChong BianzNo ratings yet

- Tuan Mat Tuan Lonik v. PPDocument7 pagesTuan Mat Tuan Lonik v. PPFongVoonYukeNo ratings yet

- Bacali, Mark Angelo C. - 3bsc6c-Cdi5n-AssignmentDocument13 pagesBacali, Mark Angelo C. - 3bsc6c-Cdi5n-AssignmentJohn Lloyd PalaparNo ratings yet

- MC2021-029 - Galing Pook Awards GuidelinesDocument13 pagesMC2021-029 - Galing Pook Awards GuidelinesMemvi BaurileNo ratings yet

- Corruption - Short EssayDocument3 pagesCorruption - Short Essayhamza saleemNo ratings yet

- RA 7160 - IRR of The Local Government Code PDFDocument294 pagesRA 7160 - IRR of The Local Government Code PDFearlanthonyNo ratings yet

- BPA Undergrad Course Descriptions PDFDocument1 pageBPA Undergrad Course Descriptions PDFLexa Athena GadorNo ratings yet

- Chapter I - MontevideoDocument6 pagesChapter I - MontevideoAlelojo, NikkoNo ratings yet

- Igcse Economics Notes On Market Failure and Government InterventionDocument6 pagesIgcse Economics Notes On Market Failure and Government InterventionYuwu24No ratings yet

- Social Determinants of Health DiscussionDocument58 pagesSocial Determinants of Health DiscussionTercio Estudiantil Famurp100% (1)

Copy B-To Be Filed With Employee's FEDERAL Tax Return

Copy B-To Be Filed With Employee's FEDERAL Tax Return

Uploaded by

Kyle im taken by cailey hand HandOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Copy B-To Be Filed With Employee's FEDERAL Tax Return

Copy B-To Be Filed With Employee's FEDERAL Tax Return

Uploaded by

Kyle im taken by cailey hand HandCopyright:

Available Formats

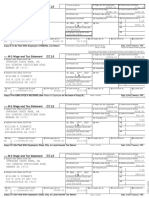

253-91-0348 8015002.2021010590408.

97802

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, Tips, other compensation 2 Federal Income Tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax Withheld

.00 18909.40 1380.86

9 5 Medicare Wages and Tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number (EIN) 12c

TARA G HAND 27-4092761

PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

253-91-0348 1833.93

CLEVES OH 45002-9016

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

KY 318940 1524.96 59.29 .00 .00

KY 318940 .00 .00 1652.95 23.97 HEBRON

Copy B-To be filed with employee’s FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

Visit the IRS Web Site at www.irs.gov/efile

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, Tips, other compensation 2 Federal Income Tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax Withheld

.00 18909.40 1380.86

9 5 Medicare Wages and Tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number (EIN) 12c

TARA G HAND 27-4092761

PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

KY 318940 1524.96 59.29 .00 .00

KY 318940 .00 .00 1652.95 23.97 HEBRON

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, Tips, other compensation 2 Federal Income Tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax Withheld

.00 18909.40 1380.86

9 5 Medicare Wages and Tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071

.00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number (EIN) 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

KY 318940 1524.96 59.29 .00 .00

KY 318940 .00 .00 1652.95 23.97 HEBRON

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, Tips, other compensation 2 Federal Income Tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax Withheld

.00 18909.40 1380.86

9 5 Medicare Wages and Tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

*97802*

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

97802 employee Plan Sick Pay

b Employer Identification Number (EIN) 12c

TARA G HAND 27-4092761 PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

1833.93

CLEVES OH 45002-9016 253-91-0348

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

KY 318940 1524.96 59.29 .00 .00

KY 318940 .00 .00 1652.95 23.97 HEBRON

Copy C for Employee’s Records (See Notice to Employee on back of Copy B.) OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

253-91-0348

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 20747.30 365.15 .00 .00

OH 52774536 .00 .00 412.06 8.66 ANDERSON

Copy B-To be filed with employee’s FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

Visit the IRS Web Site at www.irs.gov/efile

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 20747.30 365.15 .00 .00

OH 52774536 .00 .00 412.06 8.66 ANDERSON

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 12a See instructions for box 12

11 Nonqualified plans

NORCROSS GA 30071 .00 2758.54

.00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 20747.30 365.15 .00 .00

OH 52774536 .00 .00 412.06 8.66 ANDERSON

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761 PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 1833.93

253-91-0348

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 20747.30 365.15 .00 .00

OH 52774536 .00 .00 412.06 8.66 ANDERSON

Copy C for Employee’s Records (See Notice to Employee on back of Copy B.) OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

253-91-0348

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 136.65 1.37 HARRISON

OH 52774536 .00 .00 31.60 .35 MASON

Copy B-To be filed with employee’s FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

Visit the IRS Web Site at www.irs.gov/efile

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 136.65 1.37 HARRISON

OH 52774536 .00 .00 31.60 .35 MASON

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 136.65 1.37 HARRISON

OH 52774536 .00 .00 31.60 .35 MASON

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761 PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 1833.93

253-91-0348

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 136.65 1.37 HARRISON

OH 52774536 .00 .00 31.60 .35 MASON

Copy C for Employee’s Records (See Notice to Employee on back of Copy B.) OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

253-91-0348

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 133.27 2.00 SHARONVILL

OH 52774536 .00 .00 49.56 .74 SPRINGBORO

Copy B-To be filed with employee’s FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

Visit the IRS Web Site at www.irs.gov/efile

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 133.27 2.00 SHARONVILL

OH 52774536 .00 .00 49.56 .74 SPRINGBORO

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 133.27 2.00 SHARONVILL

OH 52774536 .00 .00 49.56 .74 SPRINGBORO

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761 PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 1833.93

253-91-0348

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 133.27 2.00 SHARONVILL

OH 52774536 .00 .00 49.56 .74 SPRINGBORO

Copy C for Employee’s Records (See Notice to Employee on back of Copy B.) OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

253-91-0348

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 20758.55 415.15 SPRINGDALE

OH 52774536 .00 .00 364.35 8.39 WOODLAWN

Copy B-To be filed with employee’s FEDERAL Tax Return This information is being furnished to the Internal Revenue Service. OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

Visit the IRS Web Site at www.irs.gov/efile

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR

10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 2758.54

.00 .00 DD

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

5932 RAINBOW HILL DR PLAN-P125

a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 253-91-0348 1833.93

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 20758.55 415.15 SPRINGDALE

OH 52774536 .00 .00 364.35 8.39 WOODLAWN

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761

PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

253-91-0348 1833.93

CLEVES OH 45002-9016

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 20758.55 415.15 SPRINGDALE

OH 52774536 .00 .00 364.35 8.39 WOODLAWN

Copy 2- To be filed with employee’s State, City, or Local Income Tax Return OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

This information is being furnished to the Internal Revenue Service. If you are required to file a tax return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

CORRECTED( If checked) d Control Number 7 Social Security Tips 1 Wages, tips, other compensation 2 Federal Income tax Withheld

W-2 Wage And Tax Statement 2020 3362.86 22272.26 1495.21

c Employer’s Name, Address, and ZIP code 8 Allocated Tips 3 Social Security Wages 4 Social Security Tax withheld

.00 18909.40 1380.86

9 5 Medicare Wages and tips 6 Medicare Tax Withheld

MIDWEST WAFFLES, INC. 22272.26 323.03

5986 FINANCIAL DR 10 Dependent Care Benefits 11 Nonqualified plans 12a See instructions for box 12

NORCROSS GA 30071 .00 .00 DD 2758.54

e Employee’s Name, Address, and ZIP code 13 Statutory Retirement Third Party 14 Other 12b

employee Plan Sick Pay

b Employer Identification Number 12c

TARA G HAND 27-4092761 PLAN-P125

5932 RAINBOW HILL DR a Employee’s Social Security Number 12d

CLEVES OH 45002-9016 1833.93

253-91-0348

15 State Employer’s State ID Number 16 State Wages, Tips,etc. 17 State Income Tax 18 Local Wages, Tips,etc. 19 Local Income Tax 20 Locality Name

OH 52774536 .00 .00 20758.55 415.15 SPRINGDALE

OH 52774536 .00 .00 364.35 8.39 WOODLAWN

Copy C for Employee’s Records (See Notice to Employee on back of Copy B.) OMB No. 1545-0008 Department of the Treasury - Internal Revenue Service

You might also like

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (1)

- Your Benefit Statement Tax Year 2019Document2 pagesYour Benefit Statement Tax Year 2019sloweddie salazar100% (1)

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- 2019 W2 2020120235817 PDFDocument3 pages2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- Profit Or: Loss From BusinessDocument2 pagesProfit Or: Loss From BusinessBryan Pasqueci100% (2)

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- 120s Az FormDocument19 pages120s Az FormStacey CanaleNo ratings yet

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- Connery 2021Document22 pagesConnery 2021ytprem agu100% (1)

- W-2 Wage and Tax Statement: J-EE Ret - 1983.18Document1 pageW-2 Wage and Tax Statement: J-EE Ret - 1983.18what is thisNo ratings yet

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2018 Payroll EarningsRebecca AtesNo ratings yet

- Monday Debra PYW216S EEDocument2 pagesMonday Debra PYW216S EEDeb LewisNo ratings yet

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Document3 pagesAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNo ratings yet

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDocument2 pagesU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- G.R. No. 211293, June 04, 2019 Doctrine:: Oriondo vs. COADocument1 pageG.R. No. 211293, June 04, 2019 Doctrine:: Oriondo vs. COAstephanie linajaNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- Paredes Abreu - W2 2021Document1 pageParedes Abreu - W2 2021Sarah ParedesNo ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Justin w2Document2 pagesJustin w2jusditzNo ratings yet

- W-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayDocument1 pageW-2 Wage and Tax Statement: Statutory Employee Retirement Plan Third-Party Sick PayJesus GarciaNo ratings yet

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- W-2 Wage and Tax Statement: I I I IDocument1 pageW-2 Wage and Tax Statement: I I I Imichelle analieNo ratings yet

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- 2016 Algeri C Form 1040 Individual Tax Return - RecordsDocument10 pages2016 Algeri C Form 1040 Individual Tax Return - RecordsbrynsteinNo ratings yet

- 2018 Coleman Tax Return PDFDocument46 pages2018 Coleman Tax Return PDFJonathan Brinton100% (1)

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document3 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12memek1123No ratings yet

- U.S. Individual Income Tax Return: Boddu 629-68-1309 SAIDocument3 pagesU.S. Individual Income Tax Return: Boddu 629-68-1309 SAIssi bodduNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- 2021 Tax Return: Prepared ByDocument6 pages2021 Tax Return: Prepared BySolomonNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument8 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Loan AppDocument9 pagesLoan Appanon-209253100% (1)

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Document2 pagesFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- 2019 Turbo Tax ReturnDocument113 pages2019 Turbo Tax Returnjason borneNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Taxes Amy PDFDocument7 pagesTaxes Amy PDFJsjs JsjsjjshshNo ratings yet

- 2018 TaxReturn PDFDocument6 pages2018 TaxReturn PDFDavid LeeNo ratings yet

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNo ratings yet

- W 2Document1 pageW 2Raj SharmaNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Wage and Tax Statement: Last Name SuffDocument1 pageWage and Tax Statement: Last Name SuffDavid RadNo ratings yet

- File by Mail Instructions For Your 2020 Federal Tax ReturnDocument18 pagesFile by Mail Instructions For Your 2020 Federal Tax Returnrose owensNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- Diversity in Corporate GovernanceDocument26 pagesDiversity in Corporate GovernanceShameza DavidNo ratings yet

- Ael October 2020 From Atty Loanzon 1Document35 pagesAel October 2020 From Atty Loanzon 1MICHAEL SALINASNo ratings yet

- Chap 3 PPT - The Global Trade EnvironmentDocument30 pagesChap 3 PPT - The Global Trade EnvironmentMuhammad TahaNo ratings yet

- DCDC Doctrine Nato Planning of Ops Ajp 5 PDFDocument200 pagesDCDC Doctrine Nato Planning of Ops Ajp 5 PDFKebede Michael100% (1)

- Grade 11 Civics WEEK 2Document18 pagesGrade 11 Civics WEEK 2BakiNo ratings yet

- Guideline 5-2012 OBSOLESCENCEDocument8 pagesGuideline 5-2012 OBSOLESCENCEigormetaldataNo ratings yet

- Right To Education: International Legal BasisDocument7 pagesRight To Education: International Legal BasisAkshay SarjanNo ratings yet

- The False Promise of Superiority The United States and Nuclear Deterrence After The Cold War James H Lebovic 3 Full Download ChapterDocument51 pagesThe False Promise of Superiority The United States and Nuclear Deterrence After The Cold War James H Lebovic 3 Full Download Chaptercathy.stunkard398100% (11)

- Criminal Appeal No. 231 of 2014, Simon Ndikulyaka VS RDocument16 pagesCriminal Appeal No. 231 of 2014, Simon Ndikulyaka VS RDATIUS DIDACE(Amicus Curiae)⚖️No ratings yet

- Implementation of E-Governance To Improve The Civil Administration Service Quality in Public SectorDocument11 pagesImplementation of E-Governance To Improve The Civil Administration Service Quality in Public SectorChristie YohanaNo ratings yet

- Office of The Sangguniang BarangayDocument3 pagesOffice of The Sangguniang BarangayRalph Christian Lusanta FuentesNo ratings yet

- COI JNTUH SYllabusDocument1 pageCOI JNTUH SYllabusDr Ishrat JahanNo ratings yet

- IV and V. Civil, Political, Economic, Social, and Cultural Rights As Applied in The PhilippinesDocument3 pagesIV and V. Civil, Political, Economic, Social, and Cultural Rights As Applied in The PhilippinesNoel Ephraim AntiguaNo ratings yet

- Overview of The Social ProblemDocument2 pagesOverview of The Social ProblemKent Andrew SaliNo ratings yet

- The Principle of Subsidiarity: Legal BasisDocument6 pagesThe Principle of Subsidiarity: Legal BasisBeethovengg BeethovenggNo ratings yet

- Philippine Case Digests Databank Philippine Case Digests DatabankDocument6 pagesPhilippine Case Digests Databank Philippine Case Digests DatabankMadam JudgerNo ratings yet

- Purchasing PolicyDocument4 pagesPurchasing PolicyBob KilcoyneNo ratings yet

- 1 - Principles of Law - Halim1Document25 pages1 - Principles of Law - Halim1Mashithah AhmadNo ratings yet

- BSBOPS405 Assessment With Link and FeedbackDocument46 pagesBSBOPS405 Assessment With Link and FeedbackAnchisa SarnkhoksungNo ratings yet

- 5 DILG Mandanas Communications Plan and StrategyDocument18 pages5 DILG Mandanas Communications Plan and StrategyChong BianzNo ratings yet

- Tuan Mat Tuan Lonik v. PPDocument7 pagesTuan Mat Tuan Lonik v. PPFongVoonYukeNo ratings yet

- Bacali, Mark Angelo C. - 3bsc6c-Cdi5n-AssignmentDocument13 pagesBacali, Mark Angelo C. - 3bsc6c-Cdi5n-AssignmentJohn Lloyd PalaparNo ratings yet

- MC2021-029 - Galing Pook Awards GuidelinesDocument13 pagesMC2021-029 - Galing Pook Awards GuidelinesMemvi BaurileNo ratings yet

- Corruption - Short EssayDocument3 pagesCorruption - Short Essayhamza saleemNo ratings yet

- RA 7160 - IRR of The Local Government Code PDFDocument294 pagesRA 7160 - IRR of The Local Government Code PDFearlanthonyNo ratings yet

- BPA Undergrad Course Descriptions PDFDocument1 pageBPA Undergrad Course Descriptions PDFLexa Athena GadorNo ratings yet

- Chapter I - MontevideoDocument6 pagesChapter I - MontevideoAlelojo, NikkoNo ratings yet

- Igcse Economics Notes On Market Failure and Government InterventionDocument6 pagesIgcse Economics Notes On Market Failure and Government InterventionYuwu24No ratings yet

- Social Determinants of Health DiscussionDocument58 pagesSocial Determinants of Health DiscussionTercio Estudiantil Famurp100% (1)