Professional Documents

Culture Documents

TOPIC 1: PDIC LAW (RA 3591, Amended by RA 7400, 9302 and 9576)

TOPIC 1: PDIC LAW (RA 3591, Amended by RA 7400, 9302 and 9576)

Uploaded by

Christine Jotojot0 ratings0% found this document useful (0 votes)

52 views3 pagesThe document discusses the Philippine Deposit Insurance Corporation (PDIC) Law, including that PDIC was established to promote confidence in the banking system by insuring deposits up to PHP 500,000 per depositor. It defines terms like deposits, insured deposits, and different types of accounts. The document also outlines the requirements for filing claims with PDIC such as original evidence of deposits, valid ID, and a signed claim form by the depositor or parent.

Original Description:

Original Title

PDIC-ACA-BACONGA-AJP

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the Philippine Deposit Insurance Corporation (PDIC) Law, including that PDIC was established to promote confidence in the banking system by insuring deposits up to PHP 500,000 per depositor. It defines terms like deposits, insured deposits, and different types of accounts. The document also outlines the requirements for filing claims with PDIC such as original evidence of deposits, valid ID, and a signed claim form by the depositor or parent.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

52 views3 pagesTOPIC 1: PDIC LAW (RA 3591, Amended by RA 7400, 9302 and 9576)

TOPIC 1: PDIC LAW (RA 3591, Amended by RA 7400, 9302 and 9576)

Uploaded by

Christine JotojotThe document discusses the Philippine Deposit Insurance Corporation (PDIC) Law, including that PDIC was established to promote confidence in the banking system by insuring deposits up to PHP 500,000 per depositor. It defines terms like deposits, insured deposits, and different types of accounts. The document also outlines the requirements for filing claims with PDIC such as original evidence of deposits, valid ID, and a signed claim form by the depositor or parent.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

TOPIC 1: PDIC LAW (RA 3591, amended by RA 7400, no owner/holder of any passbook, certificate of

9302 and 9576) deposit, or other evidence of deposit shall be

recognized as a depositor unless determined by

1. What is the purpose of PDIC law?

the Corporation to be an authentic document or

PDIC was established to promote and safeguard the record of the issuing bank

interests of the depositing public by way of providing

5. What is the maximum deposit insurance coverage

insurance coverage on all insured deposits.

(MDIC)?

2. What are the main functions of PDIC?

PDIC shall pay deposit insurance on all valid deposits up

Deposit Insurer to the Maximum Deposit Insurance Coverage of

Co-regulator of Banks Php500,000, per depositor, of a closed bank.

Receiver and Liquidator of Closed Banks Deposits are considered valid upon the determination by

3. What are the public policy objectives of PDIC? the PDIC, based on bank records, that the deposits were

made with a corresponding inflow of cash.

strengthen the mandatory deposit insurance

6. What are covered by PDIC deposit insurance?

coverage system

to generate, preserve, and maintain faith and PDIC insures valid deposits in domestic offices of its

confidence in the country's banking system member banks.

protect it from illegal schemes and

machinations. 1. By Deposit Type:

Savings

4. DEFINE Special Savings

a) Deposit Demand/ Checking

unpaid balance of money or its equivalent received Negotiable Order of Withdrawal (NOW)

by a bank in the usual course of business Certificate of Time Deposits

obliged to give credit to a commercial, checking,

savings, time, or thrift account, evidenced by a 2. By Deposit Account:

passbook, certificate of deposit, or other evidence of Single Account

deposit issued in accordance with BSP Joint Account

any obligation of a bank which is payable at the Account “By”, “In Trust For” (ITF) or “For the

office of the bank located outside of the Philippines Account of” (FAO) another person

shall not be a deposit for any of the purposes of this

Act or included as part of the total deposits or of 3. By Currency:

insured deposit. Philippine peso

Foreign currencies considered as part of BSP’s

b) Insured deposit international reserves

An amount due to any bonafide depositor in an

insured bank as of the date of closure but not to 7. DEFINITION OF ACCOUNTS

exceed Five hundred thousand pesos (P500,000.00).

a) Single accounts

In determining such amount due to any depositor,

there shall be added together all deposits in the Single Accounts are individually owned accounts or

bank account held under one name, either as natural person1

A joint account regardless of whether the or juridical entity2

conjunction ‘and’, ‘or’ ‘and/or’ is used, shall be 1

Natural Person refers to any individual person. Single proprietors

insured separately from any individually owned

are considered natural persons.

deposit account: Provided: 2

Juridical entity refers to a corporation, partnership or cooperative.

1) if the account is held jointly by two or more

natural or juridical persons or entities, the

b) Joint accounts

maximum insured deposit shall be divided into

as many equal shares as there are individuals, Joint Accounts are accounts held under more than one

juridical persons, or entities, unless a different name.

sharing is stipulated in the document of deposit

2) if the account is held by a juridical person or A joint account regardless of whether the

entity jointly with one or more natural persons, conjunction “and”, “or” or “and/or” is used shall be

the maximum insured deposit shall belong insured separately from single accounts.

entirely to such juridical person or entity Unless a different sharing is stipulated in the deposit

the aggregate of the interest of each co-owner documents, the insured amount up to the Maximum

over several joint accounts shall be P500,000.00 Deposit Insurance Coverage of Php500,000 shall be

divided equally between or among co-owners of a b) What are the documents required in support of

joint account. the claim?

The total shares of a co-owner in several joint

ORIGINAL EVIDENCE OF DEPOSITS

accounts may exceed Php500,000 but will only be

savings passbook

insured up to the Maximum Deposit Insurance

certificate of time deposit

Coverage of Php500,000. bank statement

Joint accounts held in the names of a juridical entity used or unused checks

and a natural person shall be presumed to belong ATM card.

solely to the juridical entity.

ONE (1) VALID ORIGINAL PHOTO-BEARING

c) “By”, “ITF” or “FAO” accounts IDENTIFICATION DOCUMENT (ID) with clear

signature of depositor/claimant

In a “By” account, Ana by Ben, Ana is the depositor. (e.g., Driver's License, SSS/GSIS ID, Senior Citizen's

In an “In Trust For” (ITF) account, Ana In Trust For ID, Passport, PRC ID, OWWA/OFW ID, Seaman's ID,

Ben, Ben is the depositor. Alien Certificate of Registration ID, Voter's ID).

In a “For the Account of” (FAO) account, Ana For the

Account of Ben, Ben is the depositor. For depositors below eighteen (18) years old,

photocopy of birth certificate from the Philippine

Statistics Authority (PSA) or a duly certified copy

8. What are the rules in determining accounts issued by the local civil registrar, and valid ID of the

covered? parent.

In the case where a depositor is the sole beneficial

Original copy of a notarized Special Power of

owner of a single, “For the Account of”, “By”, and “In Attorney (SPA) for claimants who are not the

Trust For” accounts, the consolidated balances of these signatories in the bank records. In the case of minor

accounts shall be insured up to Php500,000. depositor, the SPA must be executed by the parent.

The depositor’s total shares in his/her joint accounts Claim Form:

shall be separately insured up to Php500,000. When filing claim during the onsite CSO period,

or during personal filing at the PDIC PAC, a

A depositor with single accounts and joint accounts may system generated Claim Form shall be printed.

have insured deposits of up to Php1,000,000.

When filing through mail, download the PDIC

9. What is compensation or set-off in relation to Claim Form. The claim form needs to be

computing insured deposits? accomplished, signed, and notarized. Depositors

must ensure that the signature on the Claim

In case of a condition that threatens the stability of the Form is similar with the signature in the bank

banking system, the maximum deposit insurance cover records and the valid IDs submitted.

may be adjusted in such amount, for such a period, as

may be determined by unanimous vote of the BOD c) Who should sign the Claim Form?

chaired by the Secretary of Finance, subject to the DEPOSITOR of the account - for depositor 18

approval of the President of the Philippines. years old and above

10. REQUIREMENTS FOR CLAIMS PARENT of depositor below 18 years old

AGENT - in the case of "by" account

a) Who are required to file claims? TRUSTEE - in the case of "In Trust for (ITF)"

account

Depositors:

EACH DEPOSITOR/ACCOUNT HOLDER for

With valid deposit accounts with balances of more

account maintained as "Or", "And/Or" or "And

than P100,000.00

- in the case of joint accounts

With outstanding obligations with the closed bank

AUTHORIZED REPRESENTATIVE/s - for business

either as borrower, co-maker, or as spouse of

entities, deceased depositors and person who

borrower

has Special Power of Attorney (SPA) from the

With incomplete mailing address found in the bank

depositor.

records, or failed to update them through the MAUF

issued by the PDIC 11. What are not covered by PDIC deposit insurance?

With accounts maintained under the name of

business entities The following, whether denominated, documented,

With accounts not eligible for early payment, recorded, or booked as deposit by the bank, are

regardless of type of account and account balance excluded from PDIC deposit insurance (Section 4 (f) of

per advice of PDIC the PDIC Charter):

Who are deceased whose filing of claim is thru the Investment products such as bonds and securities,

legal heirs trust accounts and other similar instruments

Deposit accounts or transactions that:

- Are unfunded, fictitious, or fraudulent

- Constitute and/or emanate from unsafe and

unsound banking practices* as determined by

the PDIC, in consultation with the BSP, after due

notice and hearing and publication of PDIC’s

cease & desist order against such deposit

accounts/transactions

- Are determined to be proceeds of an unlawful

activity as defined in the Anti-Money

Laundering Act (Republic Act 9160, as

amended)

*Unsafe and unsound deposit-related activities include, among

others: (PDIC Regulatory Issuance No. 2011-01)

- Deposit-related practice/activity/transaction without the

approval or adequate controls required under existing

laws, rules, and regulations

- Failure to keep bank records within bank premises

- Granting high interest rates, when bank has: (i) negative

unimpaired capital, or (ii) liquid assets to deposit ratio less

than 10%

- Non-compliance with PDIC regulations

You might also like

- Precise DIY Metro2 Credit Ebook (DC17 - )Document16 pagesPrecise DIY Metro2 Credit Ebook (DC17 - )Tbonds82% (11)

- Bank Account CreationDocument10 pagesBank Account CreationJustin Patenaude100% (15)

- Donors TaxDocument83 pagesDonors TaxAndyvergys Aldrin MistulaNo ratings yet

- Audit of ReceivablesDocument29 pagesAudit of ReceivablesJoseph SalidoNo ratings yet

- Test Bank For Quiz BeeDocument5 pagesTest Bank For Quiz BeeRandy PaderesNo ratings yet

- Quick Notes PezaDocument8 pagesQuick Notes PezaAlexandra GarciaNo ratings yet

- Investment AccountingDocument3 pagesInvestment AccountingMaxineNo ratings yet

- Notes in Preferential TaxationDocument57 pagesNotes in Preferential TaxationJeremae Ann Ceriaco100% (1)

- Auditing Theory Finals PDF FreeDocument11 pagesAuditing Theory Finals PDF FreeMichael Brian TorresNo ratings yet

- Quiz 3 - Problems & SollutionsDocument12 pagesQuiz 3 - Problems & SollutionsRiezel PepitoNo ratings yet

- 2ND Case StudyDocument8 pages2ND Case StudyAnna Azriffah Janary GuilingNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document3 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Mary Joy SumapidNo ratings yet

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipeNo ratings yet

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Document35 pagesLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagNo ratings yet

- VHWODocument6 pagesVHWOJodie Sagdullas100% (1)

- PUP Review Handout 4 OfficialDocument4 pagesPUP Review Handout 4 OfficialDonalyn CalipusNo ratings yet

- Preferential TaxationDocument10 pagesPreferential TaxationAlex OngNo ratings yet

- Unmodified ReportDocument2 pagesUnmodified ReportErica CaliuagNo ratings yet

- Testbank Ch01 02 REV Acc STD PDFDocument7 pagesTestbank Ch01 02 REV Acc STD PDFheldiNo ratings yet

- PFRS 3, Business CombinationsDocument39 pagesPFRS 3, Business Combinationsjulia4razoNo ratings yet

- Theory of Accounts - Valix - CinEquityDocument10 pagesTheory of Accounts - Valix - CinEquityMaryrose Gestoso0% (1)

- ONLINE QUIZ Pledge Morgage and AntichresisDocument2 pagesONLINE QUIZ Pledge Morgage and AntichresisSophia PerezNo ratings yet

- Dissolution and Winding UpDocument110 pagesDissolution and Winding UpHahajaijaNo ratings yet

- TTTDocument6 pagesTTTAngelika BalmeoNo ratings yet

- Partnership QuestionsDocument2 pagesPartnership Questionslachimolaluv chimNo ratings yet

- Manalungsung, Kyrell D.Document3 pagesManalungsung, Kyrell D.Chloe Oberlin100% (1)

- AFAR Review Semi-Finals ExamDocument10 pagesAFAR Review Semi-Finals ExamA PNo ratings yet

- Questionaire 622Document19 pagesQuestionaire 622Nah HamzaNo ratings yet

- Quiz 1B - Cash and Cash Equivalents, Bank ReconciliationDocument9 pagesQuiz 1B - Cash and Cash Equivalents, Bank ReconciliationLorence IbañezNo ratings yet

- Quiz Number 3Document3 pagesQuiz Number 3Lopez, Azzia M.No ratings yet

- SGVDocument6 pagesSGVjeanruedasNo ratings yet

- Toa Cpa ReviewDocument10 pagesToa Cpa ReviewKim ZamoraNo ratings yet

- Quiz 1Document11 pagesQuiz 1VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- Tax Practice Set ReviewerDocument9 pagesTax Practice Set Reviewerjjay_santosNo ratings yet

- Accounting For Income TaxDocument56 pagesAccounting For Income TaxEau Claire DomingoNo ratings yet

- Pas 32 Pfrs 9 Part 2Document8 pagesPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- Bank Secrecy Law 2023Document4 pagesBank Secrecy Law 2023Michael BongalontaNo ratings yet

- Polytechnic University of The Philippines: ST NDDocument10 pagesPolytechnic University of The Philippines: ST NDShania BuenaventuraNo ratings yet

- Buss Law and Regulation Final ExamDocument13 pagesBuss Law and Regulation Final ExamMusiq SoulNo ratings yet

- Auditing Theory-100 Questions - 2015Document20 pagesAuditing Theory-100 Questions - 2015yukiro rinevaNo ratings yet

- FM112 Students Chapter IIDocument12 pagesFM112 Students Chapter IIThricia Mae IgnacioNo ratings yet

- Audit of LiabilitiesDocument12 pagesAudit of LiabilitiesAcier KozukiNo ratings yet

- AFAR - Part 1Document18 pagesAFAR - Part 1Myrna LaquitanNo ratings yet

- Intthry at Long Quiz 1 Answer Key 012718Document12 pagesIntthry at Long Quiz 1 Answer Key 012718Racel DelacruzNo ratings yet

- NFJPIA Online Preboard Exam Tax UnformattedDocument22 pagesNFJPIA Online Preboard Exam Tax UnformattedYietNo ratings yet

- Chapter 35 - Operating Segments Segment ReportingDocument4 pagesChapter 35 - Operating Segments Segment ReportingJoyce Anne GarduqueNo ratings yet

- Acco 20173 Business TaxesDocument26 pagesAcco 20173 Business TaxesBea BonitaNo ratings yet

- Hq03 SalesDocument19 pagesHq03 SalesClarisaJoy SyNo ratings yet

- Budgeting: True/FalseDocument18 pagesBudgeting: True/Falsechris ian LestinoNo ratings yet

- Pdic Law: 1. by Deposit TypeDocument6 pagesPdic Law: 1. by Deposit TypeLeny Joy DupoNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Prepaid Expenses and Deffered ChargesDocument13 pagesPrepaid Expenses and Deffered ChargesKristy Marie Lastimosa Grefalda100% (1)

- Cash To Inventory Reviewer 1Document15 pagesCash To Inventory Reviewer 1Patricia Camille AustriaNo ratings yet

- Secrecy of Bank Deposits Law (Ayn Ruth Notes)Document4 pagesSecrecy of Bank Deposits Law (Ayn Ruth Notes)Ayn Ruth Zambrano Tolentino100% (3)

- Center For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaDocument13 pagesCenter For Review and Special Studies - : Practical Accounting 1/theory of Accounts M. B. GuiaWilsonNo ratings yet

- Computer-Based Accounting Systems: Automating Sales Order Processing With Batch TechnologyDocument5 pagesComputer-Based Accounting Systems: Automating Sales Order Processing With Batch TechnologyHendrikus AndriantoNo ratings yet

- OPTDocument4 pagesOPTMarie MAy MagtibayNo ratings yet

- Classroom Notes On DSTDocument6 pagesClassroom Notes On DSTLalaine ReyesNo ratings yet

- Income Tax For Ind. and CorpDocument11 pagesIncome Tax For Ind. and CorpsophiaNo ratings yet

- PDIC ReportDocument47 pagesPDIC ReportPatrick Go100% (1)

- Philippine Deposit Insurance Corporation: R.A. 3591, AS AMENDED R.A. 9302 R.A. 9576 RA 10846Document40 pagesPhilippine Deposit Insurance Corporation: R.A. 3591, AS AMENDED R.A. 9302 R.A. 9576 RA 10846Aleah Jehan AbuatNo ratings yet

- PDIC Bank SecrecyDocument5 pagesPDIC Bank SecrecyDARRYL AGUSTINNo ratings yet

- 5.0 Audit For InventoriesDocument20 pages5.0 Audit For InventoriesChristine JotojotNo ratings yet

- 3.2 Sales ProceduresDocument2 pages3.2 Sales ProceduresChristine JotojotNo ratings yet

- 4.1 Inventory ProceduresDocument1 page4.1 Inventory ProceduresChristine JotojotNo ratings yet

- MODULE 4 DPA ACA Baconga AJPDocument12 pagesMODULE 4 DPA ACA Baconga AJPChristine JotojotNo ratings yet

- MODULE 7 Labor Standards ACA Baconga AJPDocument4 pagesMODULE 7 Labor Standards ACA Baconga AJPChristine JotojotNo ratings yet

- Sample BDO Updating FormDocument6 pagesSample BDO Updating FormChristine JotojotNo ratings yet

- Abhijeet Panchariya: Advocate Rajasthan High CourtDocument3 pagesAbhijeet Panchariya: Advocate Rajasthan High Courtabhijeet panchariyaNo ratings yet

- Purchase Invoice: Pt. Cipta Graha SejahteraDocument4 pagesPurchase Invoice: Pt. Cipta Graha Sejahterayasmina khoirun nisaNo ratings yet

- Candidate Interview Application FormDocument1 pageCandidate Interview Application FormAlok TiwariNo ratings yet

- Miss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260Document1 pageMiss Nonkumbulo V Shabane Veronica Ward 30 Shoba Location Izingolweni 4260nonkumbuloshabaneNo ratings yet

- Great RecessionDocument4 pagesGreat RecessionRokaya Musrat RahmanNo ratings yet

- DE-F-134 Public Training Request FormDocument1 pageDE-F-134 Public Training Request FormWong Chung MengNo ratings yet

- Custom ApplicationDocument7 pagesCustom ApplicationSachin ChordiyaNo ratings yet

- MIST Admission Instruction-2024Document3 pagesMIST Admission Instruction-2024163059No ratings yet

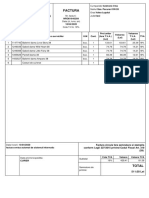

- Factura: Factura Circula Fara Semnatura Si Stampila Conform Legii 227/2015 Privind Codul Fiscal Art. 319Document1 pageFactura: Factura Circula Fara Semnatura Si Stampila Conform Legii 227/2015 Privind Codul Fiscal Art. 319Irina AndronicNo ratings yet

- The Financial Market Environment: All Rights ReservedDocument30 pagesThe Financial Market Environment: All Rights ReservedSajjad RavinNo ratings yet

- Credit Card Line of Agreement and Disclosure StatementDocument4 pagesCredit Card Line of Agreement and Disclosure StatementEdwin RomanNo ratings yet

- Analysis On Customer Service Department Activities Of: HBL, Itahari BranchDocument50 pagesAnalysis On Customer Service Department Activities Of: HBL, Itahari BranchSujan BajracharyaNo ratings yet

- 4 5845754552065723218Document23 pages4 5845754552065723218Mehari TemesgenNo ratings yet

- 138 Mamta Fortune 24 1Document16 pages138 Mamta Fortune 24 1sandeepkumardubhuNo ratings yet

- Digitalization and Security of Online Banking in J&K BankDocument80 pagesDigitalization and Security of Online Banking in J&K BankSyed Mehrooj QadriNo ratings yet

- JomPAY GuideDocument6 pagesJomPAY GuideSai Arein KiruvanantharNo ratings yet

- Bank LIBFCDocument8 pagesBank LIBFCLancau CibaiNo ratings yet

- Institute of Bankers Pakistan: Branch BankingDocument4 pagesInstitute of Bankers Pakistan: Branch BankingMuhammad KashifNo ratings yet

- MIS 107 Final ReportDocument22 pagesMIS 107 Final ReportSanzida Sharmin RifaNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Stephen Ross PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 7th Edition by Stephen Ross PDF Scribdwalter.herbert733100% (53)

- African Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaDocument3 pagesAfrican Interest-Free Banking and Finance Forum Inaugurated in Addis Ababa, EthiopiaAlHuda Centre of Islamic Banking & Economics (CIBE)No ratings yet

- IVY Fee StatementDocument3 pagesIVY Fee StatementIVYNo ratings yet

- Deposit Collection of Nepal Sbi Bank Limited: A Project Work ReportDocument29 pagesDeposit Collection of Nepal Sbi Bank Limited: A Project Work ReportKAMAL POKHREL100% (1)

- Key Fact Statement CorporateDocument7 pagesKey Fact Statement CorporateRAM MAURYANo ratings yet

- In A Partial Fulfillment of Requirement For The Degree of Bachelor of Business Studies (B.B.S)Document6 pagesIn A Partial Fulfillment of Requirement For The Degree of Bachelor of Business Studies (B.B.S)Bishal ChaliseNo ratings yet

- May Monthly Magazine by Kapil KathpalDocument204 pagesMay Monthly Magazine by Kapil Kathpalashisghadai02No ratings yet

- ReferencesDocument9 pagesReferencesBông GấuNo ratings yet

- Cir 210485133300Document2 pagesCir 210485133300Bea LouiseNo ratings yet