Professional Documents

Culture Documents

The RESTAURANTS Act in Budget Reconciliation

The RESTAURANTS Act in Budget Reconciliation

Uploaded by

NewsChannel 9Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The RESTAURANTS Act in Budget Reconciliation

The RESTAURANTS Act in Budget Reconciliation

Uploaded by

NewsChannel 9Copyright:

Available Formats

The RESTAURANTS Act in Budget Reconciliation

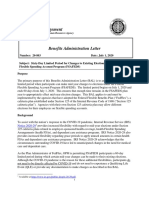

This program is direct grant support for restaurants hit hardest by the pandemic. It can be used alongside the

two rounds of PPP, EIDL, and the Employee Retention Tax Credit to help vulnerable businesses survive the

remainder of this crisis.

Funding Level – $25 billion, can be refilled

Program Administrator – The Small Business Administration (SBA)

Grant Amount Calculation

A. Established Restaurants – 2019 revenue minus 2020 revenue minus PPP loans

B. Restaurants opened in 2019 – Average of 2019 monthly revenues times 12 minus 2020 revenues

Restaurants opened in 2020 – Eligible to receive funding equal to eligible expenses incurred

Grant Maximum – $10 million per restaurant group, $5 million per individual restaurant

Eligible expenses – Payroll and benefits (not including employee compensation exceeding $100,000/year),

mortgage (no prepayment), rent (no prepayment), utilities, maintenance, supplies (including protective

equipment and cleaning materials), food, operational expenses, covered supplier costs as defined by the SBA

under the PPP program, sick leave, and any other expenses deemed essential by the Administrator.

Covered Period – Grants can be spent on eligible expenses from 2/15/20 through 12/31/21 and the

Administrator may extend the period through two years from enactment if conditions warrant.

Who is eligible?

Food service or drinking establishments, including caterers, brewpubs, taprooms, and tasting rooms, that are

not part of an affiliated group with more than 20 locations. An entity cannot be publicly traded or have a

pending application under the Save our Stages program and there are limits on the participation of private

equity funds.

What if I cannot use my full grant on eligible expenses?

It must be returned to the government.

Certification

Recipients must certify that current economic conditions make the grant request necessary, that the funds will

be used retain workers, maintain payroll, and make other payments (as specified above), and that the recipient

is only applying for and would only receive one grant.

Set Asides

$5 billion of the $25 billion total is reserved for restaurants with less than $500,000 in gross receipts in 2019 for

the first 60 days of the program. The SBA Administrator can create other tiers. During the initial 21-day period,

the administrator will prioritize awarding grants to eligible entities that are owned or controlled by women

or Veterans or are socially and economically disadvantaged businesses, as defined by existing SBA codes.

Timing

After budget reconciliation is passed by the House and Senate, the SBA will take some time to set up rules for

the program, after which applications will begin to be made available.

You might also like

- 2021 Syracuse Crime DataDocument31 pages2021 Syracuse Crime DataNewsChannel 9No ratings yet

- Maine Economic Recovery Grant Program - FINAL 8-2020Document10 pagesMaine Economic Recovery Grant Program - FINAL 8-2020NEWS CENTER MaineNo ratings yet

- Same For Everyone.: WWW - Sba.govDocument4 pagesSame For Everyone.: WWW - Sba.govScott AtkinsonNo ratings yet

- The RESTAURANTS Act in Budget ReconciliationDocument1 pageThe RESTAURANTS Act in Budget ReconciliationDave LucasNo ratings yet

- Guide To Restaurant Revitalization FundDocument5 pagesGuide To Restaurant Revitalization FundScott AtkinsonNo ratings yet

- Phase Three CARES Act Summary 3.23.20Document4 pagesPhase Three CARES Act Summary 3.23.20mdshoppNo ratings yet

- CARES Section by Section FINALDocument35 pagesCARES Section by Section FINALamykremer100% (1)

- Supports For Businesses and Individuals in B.CDocument7 pagesSupports For Businesses and Individuals in B.CAbdelkaderNo ratings yet

- Paycheck Protection Program 2.0 FAQDocument2 pagesPaycheck Protection Program 2.0 FAQKFORNo ratings yet

- C Ovid 19 Economic RecoveryDocument3 pagesC Ovid 19 Economic RecoveryJorge Gregorio SeguraNo ratings yet

- C Ovid 19 Economic RecoveryDocument3 pagesC Ovid 19 Economic RecoveryJorge Gregorio SeguraNo ratings yet

- The CARES Act and The Benefits For Small Businesses - March 31 2020Document30 pagesThe CARES Act and The Benefits For Small Businesses - March 31 2020Jonathan FoxNo ratings yet

- The Financial Superintendence Issues Measures To Support Financially Debtors Affected by COVID-19 and Guarantee The Provision of Financial ServicesDocument3 pagesThe Financial Superintendence Issues Measures To Support Financially Debtors Affected by COVID-19 and Guarantee The Provision of Financial ServicesVanessa Fontalvo RenizNo ratings yet

- Healthcare Reform ActDocument3 pagesHealthcare Reform Actpeterlouisanthony7859No ratings yet

- Full Letter: Florida Restaurant Owners Send Letter To Governor Requesting Immediate Economic ReliefDocument7 pagesFull Letter: Florida Restaurant Owners Send Letter To Governor Requesting Immediate Economic ReliefActionNewsJaxNo ratings yet

- Agenda Plus - September 10, 2020 City Council Regular MeetingDocument4 pagesAgenda Plus - September 10, 2020 City Council Regular Meetingsavannahnow.comNo ratings yet

- 60-Day Limited Period For Changes To Existing Elections Under The Federal Flexible Spending Account Program FSAFEDSDocument4 pages60-Day Limited Period For Changes To Existing Elections Under The Federal Flexible Spending Account Program FSAFEDSFedSmith Inc.100% (1)

- Gov LetterDocument3 pagesGov LetterTony GarciaNo ratings yet

- Bocc Meeting Agenda Supplement: This Information Will Be Uploaded and Available On COINDocument18 pagesBocc Meeting Agenda Supplement: This Information Will Be Uploaded and Available On COINABC Action NewsNo ratings yet

- Restaurants ActDocument3 pagesRestaurants ActTravis Gary100% (1)

- Ontario Small Business Support Grant: User Application GuideDocument10 pagesOntario Small Business Support Grant: User Application GuideIfatul AfifahNo ratings yet

- USDA Implements Immediate Measures To Help Rural Residents, Businesses and Communities Affected by COVID-19Document12 pagesUSDA Implements Immediate Measures To Help Rural Residents, Businesses and Communities Affected by COVID-19Morgan IngramNo ratings yet

- Focus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankDocument2 pagesFocus On Ag: Written by Kent Thiesse Farm Management Analyst and Senior Vice President, Minnstar BankFluenceMediaNo ratings yet

- Maine Department of Economic & Community DevelopmentDocument2 pagesMaine Department of Economic & Community DevelopmentNEWS CENTER MaineNo ratings yet

- Dairy Processing and Infrastructure Development FundDocument4 pagesDairy Processing and Infrastructure Development FundSrinivasNo ratings yet

- Healthy Food Dallas Community Solutions NOFADocument7 pagesHealthy Food Dallas Community Solutions NOFARobert Wilonsky100% (1)

- Financing and Developing PACSDocument3 pagesFinancing and Developing PACSSadaf KushNo ratings yet

- By CA Amit BansalDocument22 pagesBy CA Amit BansalSindhuja BhaskaraNo ratings yet

- AnnexureIIIDocument4 pagesAnnexureIIIKenedy KhumukchamNo ratings yet

- Republic Act 9679 Home Development Mutual FundDocument6 pagesRepublic Act 9679 Home Development Mutual Fundmarge carreonNo ratings yet

- Fact Sheet - Health Care - FINALDocument6 pagesFact Sheet - Health Care - FINALsarahkliffNo ratings yet

- I DR Fact Sheet FinalDocument4 pagesI DR Fact Sheet FinalWDIV/ClickOnDetroitNo ratings yet

- ERC DescriptionDocument3 pagesERC Descriptionjasonoutfleet1No ratings yet

- Obama's Proposed Cuts 2011-14Document10 pagesObama's Proposed Cuts 2011-14RJohansen1No ratings yet

- HRM9 Employee Benefits and CompensationDocument11 pagesHRM9 Employee Benefits and CompensationarantonizhaNo ratings yet

- SBA Paycheck Protection ProgramDocument3 pagesSBA Paycheck Protection ProgramDawn TurnerNo ratings yet

- Refinance Scheme Summary by BB (Due To COVID-19)Document2 pagesRefinance Scheme Summary by BB (Due To COVID-19)Suman kunduNo ratings yet

- 'IAS 20' Group 5Document12 pages'IAS 20' Group 5Hashim Ali VirkNo ratings yet

- City of Miami: Small Business Emergency Loan ProgramDocument5 pagesCity of Miami: Small Business Emergency Loan Programal_crespoNo ratings yet

- FY22 Budget Letter Attachment 7.7.21 FinalDocument19 pagesFY22 Budget Letter Attachment 7.7.21 FinalMartin AustermuhleNo ratings yet

- SBI EMI Moratorium FAQsDocument4 pagesSBI EMI Moratorium FAQsCNBCTV18 DigitalNo ratings yet

- Section 125 COVID-19 ReliefDocument7 pagesSection 125 COVID-19 ReliefCore DocumentsNo ratings yet

- Accounting Considerations For Lenders and Borrowers Under The State Bank of Pakistan IntroducedDocument4 pagesAccounting Considerations For Lenders and Borrowers Under The State Bank of Pakistan IntroducedRANA FAKHAR ALINo ratings yet

- Additional Unemployment Insurance Benefits Now Available For Long Term UnemployedDocument3 pagesAdditional Unemployment Insurance Benefits Now Available For Long Term UnemployedPhil AlexanderNo ratings yet

- PCOA Module 4 - Part 2Document3 pagesPCOA Module 4 - Part 2Jan JanNo ratings yet

- Incentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveDocument14 pagesIncentive Pay: Casual Incentives-The Simplicity Inherent in The Casual IncentiveShaine CalabiaNo ratings yet

- Accounting and Reporting For Private Not-For-Profit EntitiesDocument42 pagesAccounting and Reporting For Private Not-For-Profit EntitiesJordan YoungNo ratings yet

- Same For Everyone.: WWW - Sba.govDocument4 pagesSame For Everyone.: WWW - Sba.govBrady MosherNo ratings yet

- Russell Egan 170521 Aged Care Email To QLD CoalitionDocument3 pagesRussell Egan 170521 Aged Care Email To QLD Coalitionrdegan77No ratings yet

- Accounting For Government Grants and Disclosure of Government Assistance: IAS 20Document24 pagesAccounting For Government Grants and Disclosure of Government Assistance: IAS 20cris lu salem100% (1)

- Chap 018Document40 pagesChap 018DimaNo ratings yet

- Comen 20200529Document2 pagesComen 20200529numero2No ratings yet

- BST - FAQ On BNM - Moratorium 6 Months PDFDocument5 pagesBST - FAQ On BNM - Moratorium 6 Months PDFAin AdibahNo ratings yet

- Economic Stimulus Packages in The Uae: Topics CoveredDocument13 pagesEconomic Stimulus Packages in The Uae: Topics CoveredMihir S. KamdarNo ratings yet

- IAM Pension Fund Red Zone FAQDocument9 pagesIAM Pension Fund Red Zone FAQLaborUnionNews.comNo ratings yet

- Subcommittees Chairs Report On Budget ExcerciseDocument21 pagesSubcommittees Chairs Report On Budget ExcercisePhil AmmannNo ratings yet

- USAID/Nigeria Seeking Applications For Small Town WASH ActivityDocument3 pagesUSAID/Nigeria Seeking Applications For Small Town WASH ActivityjosefNo ratings yet

- Reopen with Confidence: A Guide for Restaurants in the COVID-19 EraFrom EverandReopen with Confidence: A Guide for Restaurants in the COVID-19 EraNo ratings yet

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Court of Appeals Officer Brandon Hanks' Claim DismissedDocument12 pagesCourt of Appeals Officer Brandon Hanks' Claim DismissedNewsChannel 9No ratings yet

- Filed Lawsuit - Onondaga County Vs NYCDocument44 pagesFiled Lawsuit - Onondaga County Vs NYCNewsChannel 9No ratings yet

- 2024 FB Season Pricing Flyer 1Document1 page2024 FB Season Pricing Flyer 1NewsChannel 9No ratings yet

- 2022 09 19 DUSA Holiday Calendar 8.5x11Document1 page2022 09 19 DUSA Holiday Calendar 8.5x11NewsChannel 9No ratings yet

- Mammogram Van Upstate Fall ScheduleDocument3 pagesMammogram Van Upstate Fall ScheduleNewsChannel 9No ratings yet

- USPIS Mail Theft FlyerDocument1 pageUSPIS Mail Theft FlyerNewsChannel 9No ratings yet

- CCB Conditional Cultivator Resolution 4.14 Amended v2Document4 pagesCCB Conditional Cultivator Resolution 4.14 Amended v2NewsChannel 9No ratings yet

- Proposed Design For Harvey's GardenDocument6 pagesProposed Design For Harvey's GardenNewsChannel 9No ratings yet

- Syracuse Police Department Courtesy Letter For Those Operating Illegal ATV'sDocument2 pagesSyracuse Police Department Courtesy Letter For Those Operating Illegal ATV'sNewsChannel 9No ratings yet

- Tully Superintendent Letter of ResignationDocument1 pageTully Superintendent Letter of ResignationNewsChannel 9No ratings yet

- The FEIS Cover, Title, and Foreward of The I-81 Viaduct ProjectDocument5 pagesThe FEIS Cover, Title, and Foreward of The I-81 Viaduct ProjectNewsChannel 9No ratings yet

- US History Regents Cancelled 2022Document2 pagesUS History Regents Cancelled 2022NewsChannel 9No ratings yet

- 2021 Columbus Monument Corp V Columbus Monument Corp DECISION ORDER On 155Document30 pages2021 Columbus Monument Corp V Columbus Monument Corp DECISION ORDER On 155NewsChannel 9100% (1)

- Mute Swans DECDocument21 pagesMute Swans DECNewsChannel 9No ratings yet

- Children and Youth Living Below PovertyDocument2 pagesChildren and Youth Living Below PovertyNewsChannel 9No ratings yet

- The FEIS Summary of Alternatives of The I-81 Viaduct ProjectDocument17 pagesThe FEIS Summary of Alternatives of The I-81 Viaduct ProjectNewsChannel 9No ratings yet

- US VA RecommendationsDocument82 pagesUS VA RecommendationsNewsChannel 9No ratings yet

- Mountain Goat Run Road ClosuresDocument1 pageMountain Goat Run Road ClosuresNewsChannel 9No ratings yet

- Independent Football 2022 - Division 2Document1 pageIndependent Football 2022 - Division 2NewsChannel 9No ratings yet

- The FEIS Responses To Comments Received of The I-81 Viaduct ProjectDocument530 pagesThe FEIS Responses To Comments Received of The I-81 Viaduct ProjectNewsChannel 9100% (1)

- The FEIS Executive Summary of The I-81 Viaduct ProjectDocument42 pagesThe FEIS Executive Summary of The I-81 Viaduct ProjectNewsChannel 9No ratings yet

- Syracuse DRI Open CallsDocument9 pagesSyracuse DRI Open CallsNewsChannel 9No ratings yet

- Audit Report of Grant Controls at Onondaga County SheriffDocument21 pagesAudit Report of Grant Controls at Onondaga County SheriffNewsChannel 9No ratings yet

- 2022 ACC Composite Football ScheduleDocument1 page2022 ACC Composite Football ScheduleNewsChannel 9No ratings yet

- McMahon Letter To BassettDocument2 pagesMcMahon Letter To BassettNewsChannel 9No ratings yet

- Emergency Board MeetingDocument2 pagesEmergency Board MeetingNewsChannel 9No ratings yet

- Knight Insight Senior SpotlightDocument2 pagesKnight Insight Senior SpotlightNewsChannel 9No ratings yet

- Onondaga County 2021 BudgetDocument424 pagesOnondaga County 2021 BudgetNewsChannel 9No ratings yet

- Climate Action Council Releases Draft Scoping Plan For Public CommentDocument4 pagesClimate Action Council Releases Draft Scoping Plan For Public CommentNewsChannel 9No ratings yet