Professional Documents

Culture Documents

Caltex (Phils.), Inc. vs. Court of Appeals

Caltex (Phils.), Inc. vs. Court of Appeals

Uploaded by

kaye choiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caltex (Phils.), Inc. vs. Court of Appeals

Caltex (Phils.), Inc. vs. Court of Appeals

Uploaded by

kaye choiCopyright:

Available Formats

Caltex (Phils.), Inc. vs.

Court of Appeals

and Security Bank and Trust Co. G.R.

No. 97753, Aug. 10, 1992

Full Text

FACTS:

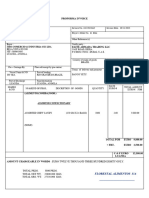

Security bank issued Certificates of Time Deposits to Angel dela Cruz. The same were given by

Dela Cruz to Caltex in connection to his purchase of fuel products of the latter. On a later date,

Dela Cruz approached the bank manager, communicated the loss of the certificates and

requested for a reissuance.

Upon compliance with some formal requirements, he was issued replacements. Thereafter, he

secured a loan from the bank where he assigned the certificates as security. Here comes the

petitioner, averred that the certificates were not actually lost but were given as security for

payment for fuel purchases.

The bank demanded some proof of the agreement but the petitioner failed to comply. The loan

matured and the time deposits were terminated and then applied to the payment of the loan.

Petitioner demands the payment of the certificates but to no avail.

ISSUE:

Whether or not the certificates of time deposits (CTDs) are negotiable instruments?

HELD:

Yes. The Court held that the CTDs are negotiable instruments. The CTDs in question

undoubtedly meet the requirements of the law for negotiability.

The Negotiable Instruments Law provides, an instrument to be negotiable must conform to

certain requirements, hence,

1. It must be in writing and signed by the maker or drawer;

2. Must contain an unconditional promise or order to pay a sum certain in money;

3. Must be payable on demand, or at a fixed or determinable future time;

4. Must be payable to order or to bearer; and

5. Where the instrument is addressed to a drawee, he must be named or otherwise indicated

therein with reasonable certainty.

The documents provide that the amounts deposited shall be repayable to the depositor.

And who, according to the document, is the depositor? It is the “bearer.” The documents do not

say that the depositor is Angel de la Cruz and that the amounts deposited are repayable

specifically to him. Rather, the amounts are to be repayable to the bearer of the documents

or, for that matter, whosoever may be the bearer at the time of presentment.

If it was really the intention of respondent bank to pay the amount to Angel de la Cruz

only, it could have with facility so expressed that fact in clear and categorical terms in the

documents, instead of having the word “BEARER” stamped on the space provided for the name

of the depositor in each CTD. On the wordings of the documents, therefore, the amounts

deposited are repayable to whoever may be the bearer thereof.

Thus, petitioner’s aforesaid witness merely declared that Angel de la Cruz is the depositor

“insofar as the bank is concerned,” but obviously other parties not privy to the

transaction between them would not be in a position to know that the depositor is not the

bearer stated in the CTDs. Hence, the situation would require any party dealing with the CTDs

to go behind the plain import of what is written thereon to unravel the agreement of the

parties thereto through facts aliunde. This need for resort to extrinsic evidence is what is

sought to be avoided by the Negotiable Instruments Law and calls for the application of

the elementary rule that the interpretation of obscure words or stipulations in a contract shall

not favor the party who caused the obscurity.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Proforma Invoice: Itbs-Comercio & Industria (Su) LdaDocument1 pageProforma Invoice: Itbs-Comercio & Industria (Su) LdaClaudio TimoteoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 11.30.21 CBHT File-Stamped Motion, Exhibits and NoticeDocument170 pages11.30.21 CBHT File-Stamped Motion, Exhibits and NoticeAnonymous dHerywYZ8pNo ratings yet

- The SourceDocument2 pagesThe SourceFree FireNo ratings yet

- SpursDocument2 pagesSpurskaye choiNo ratings yet

- LOOKDocument1 pageLOOKkaye choiNo ratings yet

- Deadly 'Black Fungus' Surges Among India's COVID-19 PatientsDocument2 pagesDeadly 'Black Fungus' Surges Among India's COVID-19 Patientskaye choiNo ratings yet

- 8 DRTCDocument1 page8 DRTCkaye choiNo ratings yet

- Fintech May Breed PhilippinesDocument1 pageFintech May Breed Philippineskaye choiNo ratings yet

- Doctrine: A Loan Contract Is A Real Contract, Not Consensual, And, As Such, Is Perfected Only Upon FactsDocument1 pageDoctrine: A Loan Contract Is A Real Contract, Not Consensual, And, As Such, Is Perfected Only Upon Factskaye choiNo ratings yet

- 10 DL HermenegildoDocument1 page10 DL Hermenegildokaye choiNo ratings yet

- Department of Environment and Natural Resources: Travel OrderDocument6 pagesDepartment of Environment and Natural Resources: Travel OrderleahtabsNo ratings yet

- 2nd Amendment RightsDocument94 pages2nd Amendment RightsDaryl BerryNo ratings yet

- The Eyes of Max Carrados PDFDocument7 pagesThe Eyes of Max Carrados PDFPedro FariaNo ratings yet

- Cruz, Et. Al. vs. Cruz, Et. Al. FactsDocument11 pagesCruz, Et. Al. vs. Cruz, Et. Al. FactsRalph Christian UsonNo ratings yet

- AS 1180.10B-1982 Methods of Test For Hose Made From Elastomeric Materials - Determination of Combustion PropaDocument5 pagesAS 1180.10B-1982 Methods of Test For Hose Made From Elastomeric Materials - Determination of Combustion PropaEye Sack ChumleyNo ratings yet

- TLI4801 TL102 AssignmentsDocument5 pagesTLI4801 TL102 Assignmentscedric shibambuNo ratings yet

- Prepared by Bellosillo, Quisumbing and Buena, JJDocument3 pagesPrepared by Bellosillo, Quisumbing and Buena, JJREZIEL CARSANONo ratings yet

- G.R. No. 159508Document8 pagesG.R. No. 159508mehNo ratings yet

- G.R. No. 174462 POTC vs. SandiganbayanDocument11 pagesG.R. No. 174462 POTC vs. Sandiganbayanmursua.doleNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument20 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledkeithnavaltaNo ratings yet

- Februarybooklet 2019 PDFDocument164 pagesFebruarybooklet 2019 PDFSati SinghNo ratings yet

- Joan of ArcDocument6 pagesJoan of Arcromeroflaviax01No ratings yet

- MMDA V Jancom GR 147465Document5 pagesMMDA V Jancom GR 147465Jeng PionNo ratings yet

- Fair's Fair Moral ValuesDocument11 pagesFair's Fair Moral ValuesMoureen Padan18% (11)

- Issue of Shares & DividendsDocument7 pagesIssue of Shares & DividendsBeanka PaulNo ratings yet

- Kabataan v. Comelec, G.R. No. 221318, December 16, 2015Document27 pagesKabataan v. Comelec, G.R. No. 221318, December 16, 2015JMae MagatNo ratings yet

- Republic of The Philippines Quezon City, Metro Manila: Ouse F EpresentativesDocument3 pagesRepublic of The Philippines Quezon City, Metro Manila: Ouse F EpresentativesKabataan Party-ListNo ratings yet

- Po No. 27 - HSS 546 - Chimanlal FienDocument4 pagesPo No. 27 - HSS 546 - Chimanlal FienVenu Gopal SistlaNo ratings yet

- Vijaya Appeal2 1Document7 pagesVijaya Appeal2 1Anilesh TNNo ratings yet

- Strike and Collective Bargaining in IndonesiaDocument8 pagesStrike and Collective Bargaining in Indonesiaandri kusmanaNo ratings yet

- Parliamentary ProcedureDocument6 pagesParliamentary ProcedureSamuel AgyeiNo ratings yet

- Ijbfr V8N2 2014Document132 pagesIjbfr V8N2 2014Suriya SamNo ratings yet

- Janhit Manch V State of MaharashtraDocument12 pagesJanhit Manch V State of MaharashtraVijay Srinivas KukkalaNo ratings yet

- Present Perfect - Already, Yet, Ever, Before, Never 1 - Mode - Solve - Unit 1 - Lesson 2 - Level III Maratón 2020 - MyEnglishLabDocument2 pagesPresent Perfect - Already, Yet, Ever, Before, Never 1 - Mode - Solve - Unit 1 - Lesson 2 - Level III Maratón 2020 - MyEnglishLabANDRES SIGIFREDO GOMEZ FIGUEREDONo ratings yet

- Finals Lea2Document10 pagesFinals Lea2Jennifer PadiernosNo ratings yet

- Case Study Review (Adam Iskandar Bin Azahar) (Am2007006919)Document6 pagesCase Study Review (Adam Iskandar Bin Azahar) (Am2007006919)adam iskandarNo ratings yet

- SLCM Question Answer Book CS Vikas Vohra, YES Academy, PuneDocument364 pagesSLCM Question Answer Book CS Vikas Vohra, YES Academy, PuneTathagat AdalatwaleNo ratings yet