Professional Documents

Culture Documents

Variable vs. Absorption

Variable vs. Absorption

Uploaded by

Kathie LawrenceCopyright:

Available Formats

You might also like

- Numerical Test Tutorial SHL Style - Sample PDFDocument18 pagesNumerical Test Tutorial SHL Style - Sample PDFmk1pv100% (6)

- No More Cold CallingDocument34 pagesNo More Cold Callingnicubelocosov1992No ratings yet

- Responsibility AccountingDocument7 pagesResponsibility AccountingMarilou Olaguir SañoNo ratings yet

- STRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of OperationsDocument61 pagesSTRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of Operationstazeenseema75% (4)

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- Cost AccountingDocument34 pagesCost AccountingRose DallyNo ratings yet

- Cost Accounting 1Document5 pagesCost Accounting 1Jappy QuilasNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingNiño Rey LopezNo ratings yet

- Unit 5: Introduction To Standard CostingDocument15 pagesUnit 5: Introduction To Standard CostingAsim Hasan UsmaniNo ratings yet

- Assignment 1Document9 pagesAssignment 1Yashveer SinghNo ratings yet

- Actual Cost Accounting Records Variances: Standard Costing OverviewDocument3 pagesActual Cost Accounting Records Variances: Standard Costing OverviewDarlene SarcinoNo ratings yet

- Accounting and FinanceDocument4 pagesAccounting and FinanceMuhammad WaqasNo ratings yet

- Standard CostingDocument11 pagesStandard Costingace zeroNo ratings yet

- AIOU8408 Assignment 1 0000603169Document18 pagesAIOU8408 Assignment 1 0000603169Farhan ShakilNo ratings yet

- Cost Volume Profit AnalysisDocument22 pagesCost Volume Profit AnalysisKirai Kiraikenks100% (1)

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Acctg 23 Links For Week 2 3 Topics at Gmeet 2Document24 pagesAcctg 23 Links For Week 2 3 Topics at Gmeet 2Angel MarieNo ratings yet

- UNIT 3 Absorption Variable CostingDocument19 pagesUNIT 3 Absorption Variable Costingannabelle albaoNo ratings yet

- Cost of AccountingDocument4 pagesCost of AccountingAlifian AlfiraziNo ratings yet

- Balakrishnan MGRL Solutions Ch09Document53 pagesBalakrishnan MGRL Solutions Ch09Rachna Menon100% (1)

- Accounting AssignmentDocument20 pagesAccounting AssignmentTimothyNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAreeb Baqai100% (1)

- Standard CostingDocument30 pagesStandard CostingDivine DaduyaNo ratings yet

- Margin of SafetyDocument25 pagesMargin of Safetyayesha baberNo ratings yet

- Shareholder ValueDocument7 pagesShareholder ValueTawanda MakombeNo ratings yet

- The Importance of Cost AccountingDocument1 pageThe Importance of Cost AccountingDushyant TiwariNo ratings yet

- Income Effects of Alternative Cost Accumulation SystemsDocument4 pagesIncome Effects of Alternative Cost Accumulation SystemssserwaddaNo ratings yet

- Absorption Costing and Varibale CostingDocument6 pagesAbsorption Costing and Varibale Costinghoney beeNo ratings yet

- Chart of AccountsDocument9 pagesChart of AccountsMarius PaunNo ratings yet

- Cost Volume Profit AnalysisDocument35 pagesCost Volume Profit AnalysisChairul AnamNo ratings yet

- Assignment - Management AccountingDocument16 pagesAssignment - Management AccountingPriyaNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingDe-graft AustinNo ratings yet

- Cost AccDocument5 pagesCost AccAni TubeNo ratings yet

- Cost Control: Business ExpensesDocument3 pagesCost Control: Business Expensessamuel villaNo ratings yet

- Dolapo Cost Accounting AssignmentDocument3 pagesDolapo Cost Accounting Assignmentfestusatere192No ratings yet

- State Four Underlying Assumptions For Cost-Volume-Profit AnalysisDocument7 pagesState Four Underlying Assumptions For Cost-Volume-Profit Analysismehazabin anamikaNo ratings yet

- Cost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Document12 pagesCost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Ekta AnejaNo ratings yet

- AB-B - Rizky Fadillah Salam - Assignment Week 4 5Document13 pagesAB-B - Rizky Fadillah Salam - Assignment Week 4 5Reta AzkaNo ratings yet

- Cost StructureDocument5 pagesCost StructureTREK APOSTOLNo ratings yet

- Vendmart - TheDocument6 pagesVendmart - TheSagarrajaNo ratings yet

- Break Even Analysis: Costing Systems and Techniques For Engineering CompaniesDocument6 pagesBreak Even Analysis: Costing Systems and Techniques For Engineering Companiesasimrafiq12No ratings yet

- Method of CostingDocument28 pagesMethod of CostingMohammed Imran HossainNo ratings yet

- Management Accountring Unit 3Document38 pagesManagement Accountring Unit 3Vishwas AgarwalNo ratings yet

- Summary Activity Based CostingDocument4 pagesSummary Activity Based CostingliaNo ratings yet

- F5-Abc-1 AccaDocument4 pagesF5-Abc-1 AccaAmna HussainNo ratings yet

- Limitations of Break Even AnalysisDocument4 pagesLimitations of Break Even AnalysissowmyaNo ratings yet

- Karina-Managerial AccountingDocument13 pagesKarina-Managerial AccountingKarinaNo ratings yet

- GAAP Accounting Rules For Expensing SamplesDocument4 pagesGAAP Accounting Rules For Expensing SamplesNataraj ShanoboghNo ratings yet

- Profit Planning and Activity-Based Budgeting - ReportDocument23 pagesProfit Planning and Activity-Based Budgeting - ReportMARIANNE VISTONo ratings yet

- Accounting Summary Report Based On Case Study - 1464 Words - Coursework ExampleDocument2 pagesAccounting Summary Report Based On Case Study - 1464 Words - Coursework Examplemtahir777945No ratings yet

- Zero Based Budgeting - ZBBDocument58 pagesZero Based Budgeting - ZBBTulasi Nadh MtnNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- Chapter 15 - Alternative Inventory Valuation MethodsDocument5 pagesChapter 15 - Alternative Inventory Valuation MethodsLemon VeinNo ratings yet

- .What Is A Fixed Cost and Variable CostDocument4 pages.What Is A Fixed Cost and Variable CostJennelNo ratings yet

- Revised by QadDocument4 pagesRevised by QadMustafe abdiNo ratings yet

- Costing SystemsDocument4 pagesCosting SystemsNeriza PonceNo ratings yet

- Chapter 8 Absorption and Variable Costing and Inventory ManagementDocument49 pagesChapter 8 Absorption and Variable Costing and Inventory ManagementNatanael PakpahanNo ratings yet

- Term Paper: Submitted ToDocument7 pagesTerm Paper: Submitted ToSwagy BoyNo ratings yet

- Cost Avoidance Vs Cost SavingsDocument8 pagesCost Avoidance Vs Cost SavingsChristopher de LeonNo ratings yet

- MATH DLL For Grade 4Document5 pagesMATH DLL For Grade 4Kathie Lawrence100% (4)

- MATH DLL For Grade 4Document5 pagesMATH DLL For Grade 4Kathie LawrenceNo ratings yet

- Finman 2012Document7 pagesFinman 2012Kathie LawrenceNo ratings yet

- Online Game AddictionDocument1 pageOnline Game AddictionKathie LawrenceNo ratings yet

- Supply and DemandDocument1 pageSupply and DemandKathie LawrenceNo ratings yet

- Rice Planting: 6:13 PM PaintingDocument3 pagesRice Planting: 6:13 PM PaintingKathie LawrenceNo ratings yet

- Page - 1Document16 pagesPage - 1Kathie LawrenceNo ratings yet

- Manong Mario Responsible or Liable To The Accident Although It Was His Rest Day?Document2 pagesManong Mario Responsible or Liable To The Accident Although It Was His Rest Day?Kathie LawrenceNo ratings yet

- Strategic ManagementDocument1 pageStrategic ManagementKathie LawrenceNo ratings yet

- Stocks To Buy For The Coming Roaring TwentiesDocument130 pagesStocks To Buy For The Coming Roaring TwentiesvinengchNo ratings yet

- Contract Documents For Tender: Project Name XX-XXDocument36 pagesContract Documents For Tender: Project Name XX-XXmand42No ratings yet

- Real Property Assessment &taxation - Engr NonatoDocument54 pagesReal Property Assessment &taxation - Engr NonatoBrenda Olshopee100% (3)

- Multiple Choice Current AffairsDocument3 pagesMultiple Choice Current AffairsHoward R. MoirangchaNo ratings yet

- Day 8-AssignmentDocument48 pagesDay 8-AssignmentSiddharthNo ratings yet

- Gillette IndiaDocument1 pageGillette IndiaVicky PanditNo ratings yet

- What Do Feb Auto Sales Say About The Economy?: Recovery at StakeDocument20 pagesWhat Do Feb Auto Sales Say About The Economy?: Recovery at StakeSakshi SharmaNo ratings yet

- 7399352Document30 pages7399352Amit BhagatNo ratings yet

- India Prepares - April 2012 (Vol.1 Issue 7)Document96 pagesIndia Prepares - April 2012 (Vol.1 Issue 7)India PreparesNo ratings yet

- Quotation : Terms & ConditionsDocument1 pageQuotation : Terms & ConditionsVenkatesan ManikandanNo ratings yet

- Bidding - The BasicsDocument2 pagesBidding - The BasicsMinni ImmanuelNo ratings yet

- CH 4 Self-Assessment QuestionsDocument4 pagesCH 4 Self-Assessment QuestionsmelNo ratings yet

- Compliance of RICS Code of Practice For Commercial ServiceDocument14 pagesCompliance of RICS Code of Practice For Commercial ServiceAnonymous 5aYupF1YXNo ratings yet

- Balancesheet of Mukund CompanyDocument5 pagesBalancesheet of Mukund CompanyHusen AliNo ratings yet

- Solving Linear EquationsDocument5 pagesSolving Linear EquationsArpit Jain100% (1)

- Example: GM Plans To Produce 3m Vehicles (Q) Using Materials (M $15B), Capital (K $10B), andDocument14 pagesExample: GM Plans To Produce 3m Vehicles (Q) Using Materials (M $15B), Capital (K $10B), andlizz1752No ratings yet

- DeflationDocument1 pageDeflationmlaz2406No ratings yet

- PPE - Initial Measurement - Assignment - No AnswersDocument2 pagesPPE - Initial Measurement - Assignment - No Answersemman neriNo ratings yet

- 46 Key Microeconomics Diagrams For A LevelDocument47 pages46 Key Microeconomics Diagrams For A LevelSaadNo ratings yet

- L5 ABC Classification ExerciseDocument3 pagesL5 ABC Classification ExerciseRohit WadhwaniNo ratings yet

- TSGBEN016F2602AAAA201813Document4 pagesTSGBEN016F2602AAAA201813AliNo ratings yet

- Ali Research 3 (LSCM) - 1Document47 pagesAli Research 3 (LSCM) - 1bezawitwubshetNo ratings yet

- Product Life Cycle Marketing StrategiesDocument15 pagesProduct Life Cycle Marketing StrategiesDheeraj TiwariNo ratings yet

- Chapter 22Document8 pagesChapter 22GONZALES, MICA ANGEL A.No ratings yet

- Proposing A Joint Venture: Useful ExpressionsDocument6 pagesProposing A Joint Venture: Useful ExpressionsCarmel Grace KiwasNo ratings yet

- Prob StatDocument2 pagesProb Stathobiee bieeNo ratings yet

- Starc Modular Power Recliner Sectional Sofa WithDocument1 pageStarc Modular Power Recliner Sectional Sofa WithellamalceaNo ratings yet

Variable vs. Absorption

Variable vs. Absorption

Uploaded by

Kathie LawrenceOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Variable vs. Absorption

Variable vs. Absorption

Uploaded by

Kathie LawrenceCopyright:

Available Formats

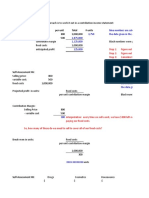

Variable Vs.

Absorption

Most companies use absorption costing at some point in their accounting process. According to

U.S. generally accepted accounting principles, companies must use absorption costing to value

their inventory on financial statements. The Internal Revenue Service requires it for taxes.

However, absorption costing isn't terribly helpful for management decision-making, because it

includes costs that don't have a direct relationship with the product. Because of this, many

companies choose to use variable costing when making strategic decisions.

Understanding The Cost-Volume-Profit Relationship

It's easier to understand the relationship between costs, profits and volume when solely looking at

variable costs. The marginal cost of producing an item may go down after a certain level, because

the company can buy materials in bulk. Workers often become more efficient at a certain level of

production. Variable costing isolates these variables and can help management identify what level

of production is the most profitable. Cost-volume-profit analysis also allows management to

identify the "breakeven" point of production -- the cost below which the company will stop making a

profit.

Comparing Product Lines

It's easier to make decisions about product lines using variable costing. That's because absorption

costing includes fixed costs in the product that may still exist if the company drops the product line.

For example, consider a factory that produces three product lines. Under absorption costing, each

product absorbs one-third of factory manager salaries, factory rent and property tax. However, the

company will still have to pay those costs if they drop one of the product lines, so the product

costs are inflated. In contrast, variable costing allows managers to clearly see the profit affects of

adding and subtracting products.

No Phantom Profits

Income statements based on absorption costing and variable costing look at profits in different

ways. Absorption costing includes overhead expenses in the value of inventory. The problem is,

inventory is presented as an asset on the balance sheet. When a company produces inventory

that it sells, it converts some of those overhead expenses into an asset. This makes expenses

seem lower and creates a phantom profit on the income statement. If managers overestimate the

profitability of product lines, they don't have as much time to correct profitability problems. In

contrast, variable costing expenses overhead costs in the period they were produced so profits

aren't skewe

You might also like

- Numerical Test Tutorial SHL Style - Sample PDFDocument18 pagesNumerical Test Tutorial SHL Style - Sample PDFmk1pv100% (6)

- No More Cold CallingDocument34 pagesNo More Cold Callingnicubelocosov1992No ratings yet

- Responsibility AccountingDocument7 pagesResponsibility AccountingMarilou Olaguir SañoNo ratings yet

- STRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of OperationsDocument61 pagesSTRENGTHENING A COMPANY'S COMPETITIVE POSITION Strategic Moves, Timing, and Scope of Operationstazeenseema75% (4)

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- CMA FullDocument22 pagesCMA FullHalar KhanNo ratings yet

- Cost AccountingDocument34 pagesCost AccountingRose DallyNo ratings yet

- Cost Accounting 1Document5 pagesCost Accounting 1Jappy QuilasNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingNiño Rey LopezNo ratings yet

- Unit 5: Introduction To Standard CostingDocument15 pagesUnit 5: Introduction To Standard CostingAsim Hasan UsmaniNo ratings yet

- Assignment 1Document9 pagesAssignment 1Yashveer SinghNo ratings yet

- Actual Cost Accounting Records Variances: Standard Costing OverviewDocument3 pagesActual Cost Accounting Records Variances: Standard Costing OverviewDarlene SarcinoNo ratings yet

- Accounting and FinanceDocument4 pagesAccounting and FinanceMuhammad WaqasNo ratings yet

- Standard CostingDocument11 pagesStandard Costingace zeroNo ratings yet

- AIOU8408 Assignment 1 0000603169Document18 pagesAIOU8408 Assignment 1 0000603169Farhan ShakilNo ratings yet

- Cost Volume Profit AnalysisDocument22 pagesCost Volume Profit AnalysisKirai Kiraikenks100% (1)

- Absorption and Variable CostingDocument13 pagesAbsorption and Variable CostingalliahnahNo ratings yet

- Acctg 23 Links For Week 2 3 Topics at Gmeet 2Document24 pagesAcctg 23 Links For Week 2 3 Topics at Gmeet 2Angel MarieNo ratings yet

- UNIT 3 Absorption Variable CostingDocument19 pagesUNIT 3 Absorption Variable Costingannabelle albaoNo ratings yet

- Cost of AccountingDocument4 pagesCost of AccountingAlifian AlfiraziNo ratings yet

- Balakrishnan MGRL Solutions Ch09Document53 pagesBalakrishnan MGRL Solutions Ch09Rachna Menon100% (1)

- Accounting AssignmentDocument20 pagesAccounting AssignmentTimothyNo ratings yet

- Variable and Absorption CostingDocument3 pagesVariable and Absorption CostingAreeb Baqai100% (1)

- Standard CostingDocument30 pagesStandard CostingDivine DaduyaNo ratings yet

- Margin of SafetyDocument25 pagesMargin of Safetyayesha baberNo ratings yet

- Shareholder ValueDocument7 pagesShareholder ValueTawanda MakombeNo ratings yet

- The Importance of Cost AccountingDocument1 pageThe Importance of Cost AccountingDushyant TiwariNo ratings yet

- Income Effects of Alternative Cost Accumulation SystemsDocument4 pagesIncome Effects of Alternative Cost Accumulation SystemssserwaddaNo ratings yet

- Absorption Costing and Varibale CostingDocument6 pagesAbsorption Costing and Varibale Costinghoney beeNo ratings yet

- Chart of AccountsDocument9 pagesChart of AccountsMarius PaunNo ratings yet

- Cost Volume Profit AnalysisDocument35 pagesCost Volume Profit AnalysisChairul AnamNo ratings yet

- Assignment - Management AccountingDocument16 pagesAssignment - Management AccountingPriyaNo ratings yet

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_No ratings yet

- UGB253 Management Accounting Business FinalDocument15 pagesUGB253 Management Accounting Business FinalMohamed AzmalNo ratings yet

- What Is Cost AccountingDocument3 pagesWhat Is Cost AccountingDe-graft AustinNo ratings yet

- Cost AccDocument5 pagesCost AccAni TubeNo ratings yet

- Cost Control: Business ExpensesDocument3 pagesCost Control: Business Expensessamuel villaNo ratings yet

- Dolapo Cost Accounting AssignmentDocument3 pagesDolapo Cost Accounting Assignmentfestusatere192No ratings yet

- State Four Underlying Assumptions For Cost-Volume-Profit AnalysisDocument7 pagesState Four Underlying Assumptions For Cost-Volume-Profit Analysismehazabin anamikaNo ratings yet

- Cost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Document12 pagesCost Accounting Project: Submitted By: Palka Jamwal Year Section A Roll No.-784Ekta AnejaNo ratings yet

- AB-B - Rizky Fadillah Salam - Assignment Week 4 5Document13 pagesAB-B - Rizky Fadillah Salam - Assignment Week 4 5Reta AzkaNo ratings yet

- Cost StructureDocument5 pagesCost StructureTREK APOSTOLNo ratings yet

- Vendmart - TheDocument6 pagesVendmart - TheSagarrajaNo ratings yet

- Break Even Analysis: Costing Systems and Techniques For Engineering CompaniesDocument6 pagesBreak Even Analysis: Costing Systems and Techniques For Engineering Companiesasimrafiq12No ratings yet

- Method of CostingDocument28 pagesMethod of CostingMohammed Imran HossainNo ratings yet

- Management Accountring Unit 3Document38 pagesManagement Accountring Unit 3Vishwas AgarwalNo ratings yet

- Summary Activity Based CostingDocument4 pagesSummary Activity Based CostingliaNo ratings yet

- F5-Abc-1 AccaDocument4 pagesF5-Abc-1 AccaAmna HussainNo ratings yet

- Limitations of Break Even AnalysisDocument4 pagesLimitations of Break Even AnalysissowmyaNo ratings yet

- Karina-Managerial AccountingDocument13 pagesKarina-Managerial AccountingKarinaNo ratings yet

- GAAP Accounting Rules For Expensing SamplesDocument4 pagesGAAP Accounting Rules For Expensing SamplesNataraj ShanoboghNo ratings yet

- Profit Planning and Activity-Based Budgeting - ReportDocument23 pagesProfit Planning and Activity-Based Budgeting - ReportMARIANNE VISTONo ratings yet

- Accounting Summary Report Based On Case Study - 1464 Words - Coursework ExampleDocument2 pagesAccounting Summary Report Based On Case Study - 1464 Words - Coursework Examplemtahir777945No ratings yet

- Zero Based Budgeting - ZBBDocument58 pagesZero Based Budgeting - ZBBTulasi Nadh MtnNo ratings yet

- MAS Variable and Absorption CostingDocument11 pagesMAS Variable and Absorption CostingGwyneth TorrefloresNo ratings yet

- Chapter 15 - Alternative Inventory Valuation MethodsDocument5 pagesChapter 15 - Alternative Inventory Valuation MethodsLemon VeinNo ratings yet

- .What Is A Fixed Cost and Variable CostDocument4 pages.What Is A Fixed Cost and Variable CostJennelNo ratings yet

- Revised by QadDocument4 pagesRevised by QadMustafe abdiNo ratings yet

- Costing SystemsDocument4 pagesCosting SystemsNeriza PonceNo ratings yet

- Chapter 8 Absorption and Variable Costing and Inventory ManagementDocument49 pagesChapter 8 Absorption and Variable Costing and Inventory ManagementNatanael PakpahanNo ratings yet

- Term Paper: Submitted ToDocument7 pagesTerm Paper: Submitted ToSwagy BoyNo ratings yet

- Cost Avoidance Vs Cost SavingsDocument8 pagesCost Avoidance Vs Cost SavingsChristopher de LeonNo ratings yet

- MATH DLL For Grade 4Document5 pagesMATH DLL For Grade 4Kathie Lawrence100% (4)

- MATH DLL For Grade 4Document5 pagesMATH DLL For Grade 4Kathie LawrenceNo ratings yet

- Finman 2012Document7 pagesFinman 2012Kathie LawrenceNo ratings yet

- Online Game AddictionDocument1 pageOnline Game AddictionKathie LawrenceNo ratings yet

- Supply and DemandDocument1 pageSupply and DemandKathie LawrenceNo ratings yet

- Rice Planting: 6:13 PM PaintingDocument3 pagesRice Planting: 6:13 PM PaintingKathie LawrenceNo ratings yet

- Page - 1Document16 pagesPage - 1Kathie LawrenceNo ratings yet

- Manong Mario Responsible or Liable To The Accident Although It Was His Rest Day?Document2 pagesManong Mario Responsible or Liable To The Accident Although It Was His Rest Day?Kathie LawrenceNo ratings yet

- Strategic ManagementDocument1 pageStrategic ManagementKathie LawrenceNo ratings yet

- Stocks To Buy For The Coming Roaring TwentiesDocument130 pagesStocks To Buy For The Coming Roaring TwentiesvinengchNo ratings yet

- Contract Documents For Tender: Project Name XX-XXDocument36 pagesContract Documents For Tender: Project Name XX-XXmand42No ratings yet

- Real Property Assessment &taxation - Engr NonatoDocument54 pagesReal Property Assessment &taxation - Engr NonatoBrenda Olshopee100% (3)

- Multiple Choice Current AffairsDocument3 pagesMultiple Choice Current AffairsHoward R. MoirangchaNo ratings yet

- Day 8-AssignmentDocument48 pagesDay 8-AssignmentSiddharthNo ratings yet

- Gillette IndiaDocument1 pageGillette IndiaVicky PanditNo ratings yet

- What Do Feb Auto Sales Say About The Economy?: Recovery at StakeDocument20 pagesWhat Do Feb Auto Sales Say About The Economy?: Recovery at StakeSakshi SharmaNo ratings yet

- 7399352Document30 pages7399352Amit BhagatNo ratings yet

- India Prepares - April 2012 (Vol.1 Issue 7)Document96 pagesIndia Prepares - April 2012 (Vol.1 Issue 7)India PreparesNo ratings yet

- Quotation : Terms & ConditionsDocument1 pageQuotation : Terms & ConditionsVenkatesan ManikandanNo ratings yet

- Bidding - The BasicsDocument2 pagesBidding - The BasicsMinni ImmanuelNo ratings yet

- CH 4 Self-Assessment QuestionsDocument4 pagesCH 4 Self-Assessment QuestionsmelNo ratings yet

- Compliance of RICS Code of Practice For Commercial ServiceDocument14 pagesCompliance of RICS Code of Practice For Commercial ServiceAnonymous 5aYupF1YXNo ratings yet

- Balancesheet of Mukund CompanyDocument5 pagesBalancesheet of Mukund CompanyHusen AliNo ratings yet

- Solving Linear EquationsDocument5 pagesSolving Linear EquationsArpit Jain100% (1)

- Example: GM Plans To Produce 3m Vehicles (Q) Using Materials (M $15B), Capital (K $10B), andDocument14 pagesExample: GM Plans To Produce 3m Vehicles (Q) Using Materials (M $15B), Capital (K $10B), andlizz1752No ratings yet

- DeflationDocument1 pageDeflationmlaz2406No ratings yet

- PPE - Initial Measurement - Assignment - No AnswersDocument2 pagesPPE - Initial Measurement - Assignment - No Answersemman neriNo ratings yet

- 46 Key Microeconomics Diagrams For A LevelDocument47 pages46 Key Microeconomics Diagrams For A LevelSaadNo ratings yet

- L5 ABC Classification ExerciseDocument3 pagesL5 ABC Classification ExerciseRohit WadhwaniNo ratings yet

- TSGBEN016F2602AAAA201813Document4 pagesTSGBEN016F2602AAAA201813AliNo ratings yet

- Ali Research 3 (LSCM) - 1Document47 pagesAli Research 3 (LSCM) - 1bezawitwubshetNo ratings yet

- Product Life Cycle Marketing StrategiesDocument15 pagesProduct Life Cycle Marketing StrategiesDheeraj TiwariNo ratings yet

- Chapter 22Document8 pagesChapter 22GONZALES, MICA ANGEL A.No ratings yet

- Proposing A Joint Venture: Useful ExpressionsDocument6 pagesProposing A Joint Venture: Useful ExpressionsCarmel Grace KiwasNo ratings yet

- Prob StatDocument2 pagesProb Stathobiee bieeNo ratings yet

- Starc Modular Power Recliner Sectional Sofa WithDocument1 pageStarc Modular Power Recliner Sectional Sofa WithellamalceaNo ratings yet