Professional Documents

Culture Documents

Davis Kitchen Supply Produces Stoves For Commercial Kitchens TH

Davis Kitchen Supply Produces Stoves For Commercial Kitchens TH

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Davis Kitchen Supply Produces Stoves For Commercial Kitchens TH

Davis Kitchen Supply Produces Stoves For Commercial Kitchens TH

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: Davis Kitchen Supply produces stoves for

commercial kitchens Th

Davis Kitchen Supply produces stoves for commercial kitchens Th

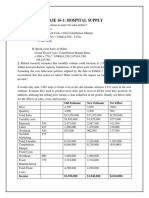

Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and

market the stoves at the company’s normal volume of 6,000 units per month are shown in the

following table.

Unless otherwise stated, assume that no connection exists between the situation described in

each question; each is independent. Unless otherwise stated, assume a regular selling price of

$370 per unit. Ignore income taxes and other costs that are not mentioned in the table or in the

question itself.

Required

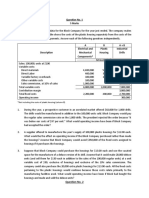

a. Market research estimates that volume could be increased to 7,000 units, which is well within

production capacity limitations if the price were cut from $370 to $325 per unit. Assuming that

the cost behavior patterns implied by the data in the table are correct, would you recommend

taking this action? What would be the impact on monthly sales, costs, and income?

b. On March 1, the federal government offers Davis a contract to supply 1,000 units to military

bases for a March 31 delivery. Because of an unusually large number of rush orders from its

regular customers, Davis plans to produce 8,000 units during March, which will use all available

capacity. If it accepts the government order, it would lose 1,000 units normally sold to regular

customers to a competitor. The government contract would reimburse its “share of March

manufacturing costs” plus pay a $50,000 fixed fee (profit). (No variable marketing costs would

be incurred on the government’s units.) What impact would accepting the government contract

have on March income? (Part of your problem is to figure out the meaning of “share of March

manufacturing costs.”)

c. Davis has an opportunity to enter a highly competitive foreign market. An attraction of the

foreign market is that its demand is greatest when the domestic market’s demand is quite low;

thus, idle production facilities could be used without affecting domestic business. An order for

2,000 units is being sought at a below-normal price to enter this market. For this order, shipping

costs will total $40 per unit; total (marketing) costs to obtain the contract will be $4,000. No other

variable marketing costs would be required on this order, and it would not affect domestic

business. What is the minimum unit price that Davis should consider for this order of 2,000

units?

d. An inventory of 460 units of an obsolete model of the stove remains in the stockroom. These

must be sold through regular channels (thus incurring variable marketing costs) at reduced

prices or the inventory will soon be valueless. What is the minimum acceptable selling price for

these units?

e. A proposal is received from an outside contractor who will make and ship 2,000 stoves per

month directly to Davis’s customers as orders are received from Davis’s sales force. Davis’s

fixed marketing costs would be unaffected, but its variable marketing costs would be cut by 20

Reach out to freelance2040@yahoo.com for enquiry.

percent for these 2,000 units produced by the contractor. Davis’s plant would operate at two-

thirds of its normal level, and total fixed manufacturing costs would be cut by 30 percent. What

in-house unit cost should be used to compare with the quotation received from the supplier?

Should the proposal be accepted for a price (that is, payment to the outside contractor) of $215

per unit?

f. Assume the same facts as in requirement (e) except that the idle facilities would be used to

produce 1,600 modified stoves per month for use in extreme climates. These modified stoves

could be sold for $450 each, while the costs of production would be $275 per unit variable

manufacturing expense. Variable marketing costs would be $50 per unit. Fixed marketing and

manufacturing costs would be unchanged whether the original 6,000 regular stoves were

manufactured or the mix of 4,000 regular stoves plus 1,600 modified stoves were produced.

Should the proposal be accepted for a price of $215 per unit to the outsidecontractor?

Davis Kitchen Supply produces stoves for commercial kitchens Th

ANSWER

https://solvedquest.com/davis-kitchen-supply-produces-stoves-for-commercial-kitchens-th/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- ASCE Design of MarinaDocument375 pagesASCE Design of MarinaHeb Ru100% (1)

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Hospital Supply Inc. - SolutionsDocument5 pagesHospital Supply Inc. - SolutionsMEERA JOSHY 192743650% (4)

- Decision Making 36 Practice Questions SolutionsDocument33 pagesDecision Making 36 Practice Questions SolutionsVias TikaNo ratings yet

- Practice Ques - Incremental Analysis PDFDocument8 pagesPractice Ques - Incremental Analysis PDFDaksh AnejaNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- CH 07 DOitDocument4 pagesCH 07 DOitHanna DizonNo ratings yet

- 1 Ass-2Document13 pages1 Ass-2Kim SooanNo ratings yet

- Docx 1Document10 pagesDocx 1Anna Marie AlferezNo ratings yet

- 4.4 Tutorial Questions 5Document4 pages4.4 Tutorial Questions 5Lee Xing100% (1)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- Marico Supply ChainDocument6 pagesMarico Supply ChainKaran GarciaNo ratings yet

- Hospital SuppliesDocument9 pagesHospital SuppliesGaurav MadanpuriNo ratings yet

- Hospital Supply, Inc.: EXHIBIT 1 Costs Per Unit of Hydraulic HoistsDocument3 pagesHospital Supply, Inc.: EXHIBIT 1 Costs Per Unit of Hydraulic HoistsnirajNo ratings yet

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- CH 11 SolDocument6 pagesCH 11 SolEdson EdwardNo ratings yet

- 4 5852725223857587726Document6 pages4 5852725223857587726survivalofthepolyNo ratings yet

- Windmire Company Manufactures and Sells To Local Wholesalers Approximately 300 000Document1 pageWindmire Company Manufactures and Sells To Local Wholesalers Approximately 300 000Amit PandeyNo ratings yet

- Huc Acc201-Revision Questions May Intake, 2022Document29 pagesHuc Acc201-Revision Questions May Intake, 2022Sritel Boutique HotelNo ratings yet

- Man Acc 1Document6 pagesMan Acc 1Ange Buenaventura SalazarNo ratings yet

- Problems For RecitationDocument4 pagesProblems For RecitationmienecabacunganNo ratings yet

- Jamie KincadeDocument5 pagesJamie KincadeChristine HermawanNo ratings yet

- Decision Making Qns - SolutionDocument8 pagesDecision Making Qns - SolutionDarya KoroviyNo ratings yet

- Make or BuyDocument2 pagesMake or BuytheswingineerNo ratings yet

- Latihan Target CostingDocument7 pagesLatihan Target CostingAlvira FajriNo ratings yet

- Business School - Docx FinalDocument11 pagesBusiness School - Docx FinalMeletios LioulisNo ratings yet

- Addl Prob REL CostDocument6 pagesAddl Prob REL Costjeongjeongwoo28No ratings yet

- CHAPTER 6 ExercisesDocument15 pagesCHAPTER 6 ExercisesMoshir Aly100% (1)

- Section C Part 2 MCQDocument344 pagesSection C Part 2 MCQSaiswetha Bethi100% (1)

- Quiz #2 - BSA 23 Absorp Variable CostingDocument6 pagesQuiz #2 - BSA 23 Absorp Variable CostingShiela Mae Pon AnNo ratings yet

- C. Standard Machine-Hours: AMIS 525 Winter 2011 Pop Quiz - Chapter 8Document3 pagesC. Standard Machine-Hours: AMIS 525 Winter 2011 Pop Quiz - Chapter 8rhsdbujaNo ratings yet

- All But 7Document6 pagesAll But 7bestmoosena100% (2)

- Case Study MANACODocument39 pagesCase Study MANACOAmorNo ratings yet

- BreakevenDocument2 pagesBreakevenAylin ErdoğanNo ratings yet

- Sem1 DR - BRR Case Module1Document4 pagesSem1 DR - BRR Case Module1dhrjmjnNo ratings yet

- Jones Products Manufactures and Sells To Wholesalers Approximately 400 000 PackagesDocument1 pageJones Products Manufactures and Sells To Wholesalers Approximately 400 000 PackagesAmit PandeyNo ratings yet

- Hospital Supplies Inc: Presented By: Sushmita Gahlot - Bhumika AggarwalDocument14 pagesHospital Supplies Inc: Presented By: Sushmita Gahlot - Bhumika AggarwalSushmita GahlotNo ratings yet

- MAC FinalDocument16 pagesMAC Finalvivekbakshi162No ratings yet

- Decision Making 36 Practice Questions & SolutionsDocument33 pagesDecision Making 36 Practice Questions & SolutionsAbdullah Naeem57% (7)

- Assignment 1Document5 pagesAssignment 1sabaNo ratings yet

- Prelim Mas 1-TestDocument16 pagesPrelim Mas 1-TestChrisNo ratings yet

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Test Bank Full Chapter PDFDocument67 pagesManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Test Bank Full Chapter PDFKimberlyLinesrb100% (15)

- Budgeting QuizDocument3 pagesBudgeting QuizMay Grethel Joy PeranteNo ratings yet

- Aactg 15 Relevant CostingDocument7 pagesAactg 15 Relevant CostingRosevelCunananCabrera100% (1)

- ACCT 202 Mock Exam 7Document6 pagesACCT 202 Mock Exam 7Ashley HoltNo ratings yet

- Break Even AnalysisDocument4 pagesBreak Even AnalysisOwen Hudson0% (1)

- MCQin Marginal CostingDocument5 pagesMCQin Marginal CostingnasNo ratings yet

- Chapter 4-Differential Analysis (Q)Document10 pagesChapter 4-Differential Analysis (Q)Vanessa HaliliNo ratings yet

- Assignment Relevant CostingDocument7 pagesAssignment Relevant CostingFreya Dela Calzada0% (1)

- Transfer PricingDocument20 pagesTransfer PricingRia Gabs100% (1)

- ch8-16 y 8-17Document3 pagesch8-16 y 8-17Marie Angely100% (1)

- SESSION 6 - Chapter 14Document8 pagesSESSION 6 - Chapter 14Malefa TsoeneNo ratings yet

- Cma 2Document21 pagesCma 2Jordan DilagNo ratings yet

- CA CHP 4 MC Questions ShareDocument13 pagesCA CHP 4 MC Questions SharedangminhphuonggNo ratings yet

- A 2Document4 pagesA 2sabaNo ratings yet

- Ag Coop Is A Large Farm Cooperative With A Number ofDocument2 pagesAg Coop Is A Large Farm Cooperative With A Number ofAmit PandeyNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingTaha JavaidNo ratings yet

- CVP Tutorial SheetDocument4 pagesCVP Tutorial SheetDaneille Baker0% (1)

- Flexible Budget, Problem Group 30 March 2010Document5 pagesFlexible Budget, Problem Group 30 March 2010antoniustyoNo ratings yet

- Chapter 7 ProblemsDocument4 pagesChapter 7 ProblemsZyraNo ratings yet

- Ch11sol PDFDocument11 pagesCh11sol PDFjjNo ratings yet

- University of Technology School of Business Administration: Cost - Volume - Profit Tutorial SheetDocument7 pagesUniversity of Technology School of Business Administration: Cost - Volume - Profit Tutorial SheetMichelle LindsayNo ratings yet

- 3420 - Midterm Review QuestionsDocument11 pages3420 - Midterm Review QuestionsANKIT SHARMANo ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- Vargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentDocument1 pageVargas Inc Produces Industrial Machinery Vargas Has A Machining DepartmentAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- These NietoYDocument107 pagesThese NietoYAmrik SinghNo ratings yet

- Bme 311Document26 pagesBme 311Jether IgnacioNo ratings yet

- BUSFIN ReviewGuide Part 1Document15 pagesBUSFIN ReviewGuide Part 1Jace100% (4)

- Test Bank Managerial Acc - Ch1Document7 pagesTest Bank Managerial Acc - Ch1Omar HosnyNo ratings yet

- Answers To Questions From Worksheet 2Document8 pagesAnswers To Questions From Worksheet 2Anisha KirlewNo ratings yet

- Target Corps Tarnished Reputation Failure in Canada and Data Breach Case PDFDocument12 pagesTarget Corps Tarnished Reputation Failure in Canada and Data Breach Case PDFmalaNo ratings yet

- ACC 105 SyllabusDocument2 pagesACC 105 Syllabusnaamsagar2019No ratings yet

- 04 Kalyan Rao Konda ApplabsDocument24 pages04 Kalyan Rao Konda ApplabsaustinfruNo ratings yet

- MC 4 Question - A231Document5 pagesMC 4 Question - A231Hafiza ZahidNo ratings yet

- Ghee Industry Analysis in PakistanDocument21 pagesGhee Industry Analysis in PakistanAtif RehmanNo ratings yet

- Turnover RatiosDocument10 pagesTurnover RatiosBOSENo ratings yet

- Sap SCM 5.0 SNP Bootcamp - Day 3Document83 pagesSap SCM 5.0 SNP Bootcamp - Day 3Agnihotri VikasNo ratings yet

- 7 July 2021Document32 pages7 July 2021Aditya PrajapatiNo ratings yet

- Leadership Development Program (LDP)Document4 pagesLeadership Development Program (LDP)Ha Huy CuongNo ratings yet

- Chapter-5: Accounting For Merchandising OperationsDocument39 pagesChapter-5: Accounting For Merchandising OperationsNoel Buenafe JrNo ratings yet

- A Multiple Objective Particle Swarm Optimization Approach For Inventory ClassificationDocument11 pagesA Multiple Objective Particle Swarm Optimization Approach For Inventory ClassificationFernando GómezNo ratings yet

- Rishi INTERNSHIP REPORT LANDMARK GROUP, PDFDocument61 pagesRishi INTERNSHIP REPORT LANDMARK GROUP, PDFParas Mangle100% (1)

- SEED Preparatory Material - OperationsDocument88 pagesSEED Preparatory Material - OperationsArnab ChakrabortyNo ratings yet

- Sap WM Interview Questions and AnswersDocument1 pageSap WM Interview Questions and AnswersRakesh Reddy Gopi ReddyNo ratings yet

- Lesson 1Document3 pagesLesson 1AndreiNo ratings yet

- Collective Risk Model v2021Document21 pagesCollective Risk Model v2021LuisNo ratings yet

- Hotel PMS BrochureDocument11 pagesHotel PMS BrochuremikeNo ratings yet

- Logistics Management (1) CompressedDocument226 pagesLogistics Management (1) CompressedJanavi Khochare100% (1)

- Noreen - Managerial Accounting For Managers 2eDocument13 pagesNoreen - Managerial Accounting For Managers 2eJordanBetelNo ratings yet

- What Is Procurement ManagementDocument30 pagesWhat Is Procurement Managementcompiler&automataNo ratings yet

- Finance Case Study 3Document13 pagesFinance Case Study 3imahhamid32No ratings yet

- Oracle EAMDocument5 pagesOracle EAMh_sleemNo ratings yet

- ExamDocument6 pagesExamYoDariusNo ratings yet