Professional Documents

Culture Documents

% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per Unit

% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per Unit

Uploaded by

Elliot RichardCopyright:

Available Formats

You might also like

- Midterm - Ch. 10, 11Document14 pagesMidterm - Ch. 10, 11Cameron BelangerNo ratings yet

- Model Chapter 12 - ThipDocument14 pagesModel Chapter 12 - ThipThipparatM60% (5)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Nandita Summers Works at ModusDocument3 pagesNandita Summers Works at ModusElliot RichardNo ratings yet

- The Central Valley Company Has Prepared Department Overhead Budgets For BudgetedDocument4 pagesThe Central Valley Company Has Prepared Department Overhead Budgets For BudgetedElliot RichardNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- The IVplast Corporation Uses An Injection Molding Machine To Make A Plastic ProductDocument2 pagesThe IVplast Corporation Uses An Injection Molding Machine To Make A Plastic ProductElliot RichardNo ratings yet

- IProtect Produces Covers For All Makes and Models of IPadsDocument2 pagesIProtect Produces Covers For All Makes and Models of IPadsElliot Richard0% (1)

- Regression Line of Overhead Costs On LaborDocument3 pagesRegression Line of Overhead Costs On LaborElliot Richard100% (1)

- 1MRB520176 Ben RIO580Document20 pages1MRB520176 Ben RIO580alimaghamiNo ratings yet

- Top 20 Countries Found To Have The Most CybercrimeDocument5 pagesTop 20 Countries Found To Have The Most CybercrimeAman Dheer KapoorNo ratings yet

- The Challenges of Managerial Accounting 2Document5 pagesThe Challenges of Managerial Accounting 2therhine100% (2)

- An Assignment On Business Ethics..Document11 pagesAn Assignment On Business Ethics..Rahul Dhurka100% (1)

- Oral Notes Rupesh PillaiDocument172 pagesOral Notes Rupesh PillaiRachit100% (4)

- CH 10 SolDocument7 pagesCH 10 SolNotty SingerNo ratings yet

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Document20 pagesCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- SA - Syl12 - Jun2015 - P8 (1) FDocument16 pagesSA - Syl12 - Jun2015 - P8 (1) FMuhamed Muhsin PNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Paper8 SolutionDocument25 pagesPaper8 SolutionHeba_Al_KhozaeNo ratings yet

- EntornoDocument2 pagesEntornoaggniNo ratings yet

- ACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDocument8 pagesACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDollarNo ratings yet

- CostAccounting - Assignment IDocument11 pagesCostAccounting - Assignment Ifrancisco cavoliNo ratings yet

- Discussion Question 2Document6 pagesDiscussion Question 2Sadhna MaharjanNo ratings yet

- Acctg 6 CH 13Document11 pagesAcctg 6 CH 13Bea TiuNo ratings yet

- Charles AKMENDocument11 pagesCharles AKMENCharles GohNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- Cost Management Accounting Test 6 Ch 6 Test Paper 1670225997Document7 pagesCost Management Accounting Test 6 Ch 6 Test Paper 1670225997gaur.vinayak31No ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- 2276 Chapter 35Document3 pages2276 Chapter 35tinotendazhuwao63No ratings yet

- Tugas Akuntansi BiayaDocument6 pagesTugas Akuntansi Biayacathy pisaNo ratings yet

- Ama Set 40Document6 pagesAma Set 40uroojfatima21299No ratings yet

- Cost and Management Accounting Midsem PrepDocument25 pagesCost and Management Accounting Midsem PrepSrabon BaruaNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- Services Untuk Bulan Maret: Cabletech Bell Corporation (CTB) Berikut Aktivitas Yang Dilaporkan Oleh Divisi CableDocument23 pagesServices Untuk Bulan Maret: Cabletech Bell Corporation (CTB) Berikut Aktivitas Yang Dilaporkan Oleh Divisi Cableghesna larasatiNo ratings yet

- Budget InformationDocument10 pagesBudget InformationIsabella BattiataNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Problem 3 4 Chapter 14Document6 pagesProblem 3 4 Chapter 14freaann03No ratings yet

- Chap 03Document10 pagesChap 03Farooq HaiderNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Managerial Accounting and Cost ConceptDocument20 pagesManagerial Accounting and Cost ConceptNavidEhsanNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- Activity Cost BehaviorDocument28 pagesActivity Cost BehaviorCPAREVIEWNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- Costing Full Length 2 - May 24 (Solution) 8-4Document16 pagesCosting Full Length 2 - May 24 (Solution) 8-4Jyoti ManwaniNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- (SOAL) Soal Kuis Pararel ABDocument6 pages(SOAL) Soal Kuis Pararel ABAris KurniawanNo ratings yet

- Punto 2: Practical CapacityDocument3 pagesPunto 2: Practical CapacityJosé VisintiniNo ratings yet

- Cost Sheet Questions & SolutionDocument5 pagesCost Sheet Questions & SolutionAbhay SahuNo ratings yet

- FM New SumsDocument13 pagesFM New SumsINTER SMARTIANSNo ratings yet

- Marginal Costing 2-ApplicationDocument11 pagesMarginal Costing 2-Applicationprapulla sureshNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Financial Analysis and InterpretationDocument22 pagesFinancial Analysis and Interpretationirfan_rana4uNo ratings yet

- Wilkerson Company - Class PracticeDocument5 pagesWilkerson Company - Class PracticeYAKSH DODIANo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- SCM Quiz7Document2 pagesSCM Quiz7Krisha Mae Guirigay Dela CruzNo ratings yet

- Group 7 - Class 1 - FADocument5 pagesGroup 7 - Class 1 - FAthuhadt.yes20No ratings yet

- Cheating 101Document1 pageCheating 101api-3744266No ratings yet

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- 608799Document8 pages608799mohitgaba19No ratings yet

- Code 4Document8 pagesCode 4Đỗ Hải MyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportFrom Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportNo ratings yet

- Give Two Examples of Nonfinancial Measures of Customer Satisfaction Relating To QualityDocument1 pageGive Two Examples of Nonfinancial Measures of Customer Satisfaction Relating To QualityElliot RichardNo ratings yet

- The Brightlight Corporation Uses Multicolored Molding To Make Plastic LampsDocument2 pagesThe Brightlight Corporation Uses Multicolored Molding To Make Plastic LampsElliot RichardNo ratings yet

- Description (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Document3 pagesDescription (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Elliot RichardNo ratings yet

- The Brandt Corporation Makes Wire Harnesses For The Aircraft Industry Only Upon Receiving Firm Orders From Its CustomersDocument3 pagesThe Brandt Corporation Makes Wire Harnesses For The Aircraft Industry Only Upon Receiving Firm Orders From Its CustomersElliot RichardNo ratings yet

- Chunky Meatbots Produces A Wide Variety of Unorthodox Bread SaucesDocument3 pagesChunky Meatbots Produces A Wide Variety of Unorthodox Bread SaucesElliot RichardNo ratings yet

- Average Waiting Time For An Order of Z39Document2 pagesAverage Waiting Time For An Order of Z39Elliot RichardNo ratings yet

- Prescott Manufacturing Evaluates The Performance of Its Production Managers Based On A Variety of FactorsDocument3 pagesPrescott Manufacturing Evaluates The Performance of Its Production Managers Based On A Variety of FactorsElliot RichardNo ratings yet

- Give Two Examples of Appraisal CostsDocument1 pageGive Two Examples of Appraisal CostsElliot RichardNo ratings yet

- IVplast Is Still Debating Whether It Should Introduce Y28Document2 pagesIVplast Is Still Debating Whether It Should Introduce Y28Elliot RichardNo ratings yet

- Calculate The Average Waiting Time Per OrderDocument3 pagesCalculate The Average Waiting Time Per OrderElliot RichardNo ratings yet

- To Determine How Much QwakSoda Corporation Is Worse Off by Producing A Defective Bottle in The Bottling DepartmentDocument2 pagesTo Determine How Much QwakSoda Corporation Is Worse Off by Producing A Defective Bottle in The Bottling DepartmentElliot RichardNo ratings yet

- When Evaluating A CompanyDocument1 pageWhen Evaluating A CompanyElliot RichardNo ratings yet

- Weston Corporation Manufactures Auto Parts For Two Leading Japanese AutomakersDocument2 pagesWeston Corporation Manufactures Auto Parts For Two Leading Japanese AutomakersElliot RichardNo ratings yet

- At 420 Students Seen A DayDocument2 pagesAt 420 Students Seen A DayElliot RichardNo ratings yet

- QwakSoda Corporation Makes Soda in Three DepartmentsDocument2 pagesQwakSoda Corporation Makes Soda in Three DepartmentsElliot RichardNo ratings yet

- The Tristan Corporation Sells 250Document2 pagesThe Tristan Corporation Sells 250Elliot RichardNo ratings yet

- Because The Expected Relevant Benefits ofDocument2 pagesBecause The Expected Relevant Benefits ofElliot RichardNo ratings yet

- Describe Two Benefits of Improving QualityDocument1 pageDescribe Two Benefits of Improving QualityElliot RichardNo ratings yet

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDocument2 pagesKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Calculus Company Makes Calculators For StudentsDocument2 pagesCalculus Company Makes Calculators For StudentsElliot RichardNo ratings yet

- Essence Company Blends and Sells Designer FragrancesDocument2 pagesEssence Company Blends and Sells Designer FragrancesElliot Richard100% (1)

- Plots and Regression Lines ForDocument2 pagesPlots and Regression Lines ForElliot RichardNo ratings yet

- Possible Alternative Specifications That Would Better Capture The Link Between SpiritDocument2 pagesPossible Alternative Specifications That Would Better Capture The Link Between SpiritElliot RichardNo ratings yet

- Terry LawlerDocument2 pagesTerry LawlerElliot RichardNo ratings yet

- Preston Department Store Has A New Promotional Program That Offers A Free GiftDocument3 pagesPreston Department Store Has A New Promotional Program That Offers A Free GiftElliot RichardNo ratings yet

- Manulife Smart Call Call MenuDocument1 pageManulife Smart Call Call MenuNazreen AmirdeenNo ratings yet

- COPYRIGHTSDocument16 pagesCOPYRIGHTSMaui IbabaoNo ratings yet

- Accounting ResearchDocument6 pagesAccounting ResearchAnne PanghulanNo ratings yet

- Analytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidDocument30 pagesAnalytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidUğur DemirNo ratings yet

- Shah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfDocument311 pagesShah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfTri4alNo ratings yet

- Braille Actuator Report MAJORDocument32 pagesBraille Actuator Report MAJORSwapnil BeheraNo ratings yet

- Math ResearchDocument4 pagesMath ResearchRaja AliNo ratings yet

- Circuit Note: Integrated Device Power Supply (DPS) For ATE With Output Voltage Range 0 V To 25 VDocument6 pagesCircuit Note: Integrated Device Power Supply (DPS) For ATE With Output Voltage Range 0 V To 25 VswjangNo ratings yet

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdeNo ratings yet

- David M. Kroenke's: Database ProcessingDocument25 pagesDavid M. Kroenke's: Database ProcessingasalajalagiNo ratings yet

- Vehicle Suspension Modeling NotesDocument25 pagesVehicle Suspension Modeling Notesahmetlutfu100% (2)

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- Swot Analysis - Transnational CrimeDocument14 pagesSwot Analysis - Transnational CrimeCharmis Tubil100% (1)

- Soliven vs. FastformsDocument2 pagesSoliven vs. FastformsClaudine Allyson DungoNo ratings yet

- Example of Research Paper About Science and TechnologyDocument6 pagesExample of Research Paper About Science and Technologygz8aqe8wNo ratings yet

- Ed 807 Economics of Education MODULE-14 Activity-AnswerDocument3 pagesEd 807 Economics of Education MODULE-14 Activity-Answerjustfer johnNo ratings yet

- Wireless Communication Using Wimax Technology: Journal of Engineering and Sustainable Development September 2010Document21 pagesWireless Communication Using Wimax Technology: Journal of Engineering and Sustainable Development September 2010ahmed alshamliNo ratings yet

- Master Service Manual Product Family OLDocument478 pagesMaster Service Manual Product Family OLfernando schumacherNo ratings yet

- Cummins ActuatorDocument4 pagesCummins ActuatorLaiq Zaman100% (1)

- Minerals Potential - Minerals Law of Lao PDRDocument44 pagesMinerals Potential - Minerals Law of Lao PDRkhamsone pengmanivongNo ratings yet

- CV Examples Uk StudentDocument8 pagesCV Examples Uk Studente7648d37100% (1)

- Display CAT PDFDocument2 pagesDisplay CAT PDFAndres130No ratings yet

- Compatibilidades Equipos HaierDocument5 pagesCompatibilidades Equipos HaierAndrei AtofaneiNo ratings yet

- Ultra 150 300 Ts FileDocument136 pagesUltra 150 300 Ts FileEmanuel GutierrezNo ratings yet

- Sylvania Lumalux Ordering Guide 1986Document2 pagesSylvania Lumalux Ordering Guide 1986Alan MastersNo ratings yet

% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per Unit

% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per Unit

Uploaded by

Elliot RichardOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per Unit

% of Total Costs That Is Variable Variable Costs Fixed Costs Variable Cost Per Unit

Uploaded by

Elliot RichardCopyright:

Available Formats

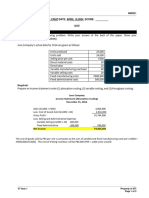

Gower, Inc.

, a manufacturer of plastic products, reports the following manufacturing costs and

account analysis classification for the year ended December 31, 2017.

Account Classification Amount

Direct materials All variable $300,000

Direct manufacturing labor All variable 225,000

Power All variable 37,500

Supervision labor 20% variable 56,250

Materials-handling labor 50% variable 60,000

Maintenance labor 40% variable 75,000

Depreciation 0% variable 95,000

Rent, property taxes, and administration 0% variable 100,000

Gower, Inc., produced 75,000 units of product in 2017. Gower’s management is estimating costs

for 2018 on the basis of 2017 numbers. The following additional information is available for

2018.

a. Direct materials prices in 2018 are expected to increase by 5% compared with 2017.

b. Under the terms of the labor contract, direct manufacturing labor wage rates are expected to

increase by 10% in 2018 compared with 2017.

c. Power rates and wage rates for supervision, materials handling, and maintenance are not

expected to change from 2017 to 2018.

d. Depreciation costs are expected to increase by 5%, and rent, property taxes, and administration

costs are expected to increase by 7%.

e. Gower expects to manufacture and sell 80,000 units in 2018.

Required:

1. Prepare a schedule of variable, fixed, and total manufacturing costs for each account category in

2018. Estimate total manufacturing costs for 2018.

2. Calculate Gower’s total manufacturing cost per unit in 2017, and estimate total manufacturing

cost per unit in 2018.

3. How can you obtain better estimates of fixed and variable costs? Why would these better

estimates be useful to Gower?

SOLUTION

(30 min.) Account analysis method.

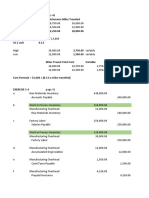

1. Manufacturing cost classification for 2017:

% of

Total Costs That

Total is Variable Fixed Variable

Costs Variable Costs Costs Cost per Unit

Account (1) (2) (3) = (1) × (4) = (1) – (5) = (3) ÷

(2) (3) 75,000

Direct materials $300,000 100% $300,000 $ 0 $4.00

Direct manufacturing 225,000 100 225,000 0 3.00

labor 37,500 100 37,500 0 0.50

Power 56,250 20 11,250 45,000 0.15

Supervision labor 60,000 50 30,000 30,000 0.40

Materials-handling labor 75,000 40 30,000 45,000 0.40

Maintenance labor 95,000 0 0 95,000 0

Depreciation 100,000 0 0 100,000 0

Rent, property taxes,

admin

Total $948,750 $633,750 $315,000 $8.45

Total manufacturing cost for 2017 = $948,750

Variable costs in 2018:

Unit Variable

Cost per Unit for Increase in

2017 Variable Cost Variable

(6) Percentage per Unit Cost per Total Variable

Increase (8) = (6) × (7) Unit Costs for 2018

Account (7) for 2018 (10) = (9) ×

(9) = (6) + (8) 80,000

Direct materials $4.00 5% $0.20 $4.20 $336,000

Direct 3.00 10 0.30 3.30 264,000

manufacturing 0.50 0 0 0.50 40,000

labor 0.15 0 0 0.15 12,000

Power 0.40 0 0 0.40 32,000

Supervision labor 0.40 0 0 0.40 32,000

Materials- 0 0 0 0 0

handling labor 0 0 0 0 0

Maintenance labor

Depreciation

Rent, property

taxes, admin.

Total $8.45 $0.50 $8.95 $716,000

Fixed and total costs in 2018:

Dollar Increase in

Fixed Fixed Costs Fixed Variable Costs Total

Costs Percentag (13) = Costs for 2018 Costs

for 2018 e (11) × (12) for 2018 (15) (16) =

Account (11) Increase (14) = (14) + (15)

(12) (11) + (13)

Direct materials $ 0 0% $ 0 $ 0 $336,000 $ 336,000

Direct 00 0 0 264,000 264,000

manufacturing labor 0 0 0 0 40,000 40,000

Power 45,000 0 0 45,000 12,000 57,000

Supervision labor 30,000 0 0 30,000 32,000 62,000

Materials-handling 45,000 0 0 45,000 32,000 77,000

labor 95,000 5 4,750 99,750 0 99,750

Maintenance labor 100,000 7 7,000 107,000 0 107,000

Depreciation

Rent, property

taxes, admin.

Total $315,000 $11,750 $326,750 $716,000 $1,042,750

Total manufacturing costs for 2018 = $1,042,750

2. Total cost per unit, 2017 = = $12.65

Total cost per unit, 2018 = = $13.03

3. Cost classification into variable and fixed costs is based on qualitative, rather than

quantitative, analysis. How good the classifications are depends on the knowledge of individual

managers who classify the costs. Gower may want to undertake quantitative analysis of costs,

using regression analysis on time-series or cross-sectional data to better estimate the fixed and

variable components of costs. Better knowledge of fixed and variable costs will help Gower to

better price his products, to know when he is getting a positive contribution margin, and to better

manage costs.

You might also like

- Midterm - Ch. 10, 11Document14 pagesMidterm - Ch. 10, 11Cameron BelangerNo ratings yet

- Model Chapter 12 - ThipDocument14 pagesModel Chapter 12 - ThipThipparatM60% (5)

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Nandita Summers Works at ModusDocument3 pagesNandita Summers Works at ModusElliot RichardNo ratings yet

- The Central Valley Company Has Prepared Department Overhead Budgets For BudgetedDocument4 pagesThe Central Valley Company Has Prepared Department Overhead Budgets For BudgetedElliot RichardNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- The IVplast Corporation Uses An Injection Molding Machine To Make A Plastic ProductDocument2 pagesThe IVplast Corporation Uses An Injection Molding Machine To Make A Plastic ProductElliot RichardNo ratings yet

- IProtect Produces Covers For All Makes and Models of IPadsDocument2 pagesIProtect Produces Covers For All Makes and Models of IPadsElliot Richard0% (1)

- Regression Line of Overhead Costs On LaborDocument3 pagesRegression Line of Overhead Costs On LaborElliot Richard100% (1)

- 1MRB520176 Ben RIO580Document20 pages1MRB520176 Ben RIO580alimaghamiNo ratings yet

- Top 20 Countries Found To Have The Most CybercrimeDocument5 pagesTop 20 Countries Found To Have The Most CybercrimeAman Dheer KapoorNo ratings yet

- The Challenges of Managerial Accounting 2Document5 pagesThe Challenges of Managerial Accounting 2therhine100% (2)

- An Assignment On Business Ethics..Document11 pagesAn Assignment On Business Ethics..Rahul Dhurka100% (1)

- Oral Notes Rupesh PillaiDocument172 pagesOral Notes Rupesh PillaiRachit100% (4)

- CH 10 SolDocument7 pagesCH 10 SolNotty SingerNo ratings yet

- Ca Ipcc Costing and Financial Management Suggested Answers May 2015Document20 pagesCa Ipcc Costing and Financial Management Suggested Answers May 2015Prasanna KumarNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- MGT Acc 2019 SolutionDocument9 pagesMGT Acc 2019 SolutionSayeed AhmadNo ratings yet

- SA - Syl12 - Jun2015 - P8 (1) FDocument16 pagesSA - Syl12 - Jun2015 - P8 (1) FMuhamed Muhsin PNo ratings yet

- Course Name: 2T7 - Cost AccountingDocument56 pagesCourse Name: 2T7 - Cost Accountingjhggd100% (1)

- Paper8 SolutionDocument25 pagesPaper8 SolutionHeba_Al_KhozaeNo ratings yet

- EntornoDocument2 pagesEntornoaggniNo ratings yet

- ACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDocument8 pagesACFrOgB RMmDOyNGnH6OC7MUXs7ooL-fMhVbs7t gTrgusxdECM3XrREt29Ozsh44LglDesXMLNmlPC9XDJ6WpbaqKJCLQrxnXbM1k1dDzC0gOeq7RVY8wo2NLiZEZfz41KEgegyBxN-eg4WRW2yDollarNo ratings yet

- CostAccounting - Assignment IDocument11 pagesCostAccounting - Assignment Ifrancisco cavoliNo ratings yet

- Discussion Question 2Document6 pagesDiscussion Question 2Sadhna MaharjanNo ratings yet

- Acctg 6 CH 13Document11 pagesAcctg 6 CH 13Bea TiuNo ratings yet

- Charles AKMENDocument11 pagesCharles AKMENCharles GohNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- Cost Accounting Week 3 - AnswersDocument10 pagesCost Accounting Week 3 - AnswersFiles OrganizedNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- Cost Management Accounting Test 6 Ch 6 Test Paper 1670225997Document7 pagesCost Management Accounting Test 6 Ch 6 Test Paper 1670225997gaur.vinayak31No ratings yet

- Requirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Document5 pagesRequirement 1:: (Leave No Cells Blank - Be Certain To Enter "0" Wherever Required. Omit The "$" Sign in Your Response.)Md AlimNo ratings yet

- 2276 Chapter 35Document3 pages2276 Chapter 35tinotendazhuwao63No ratings yet

- Tugas Akuntansi BiayaDocument6 pagesTugas Akuntansi Biayacathy pisaNo ratings yet

- Ama Set 40Document6 pagesAma Set 40uroojfatima21299No ratings yet

- Cost and Management Accounting Midsem PrepDocument25 pagesCost and Management Accounting Midsem PrepSrabon BaruaNo ratings yet

- Answers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyDocument10 pagesAnswers To Test Your Understanding: Cost Accounting Chapter 1 Cost Classification, Concepts and TerminologyAnonymous vA2xNfNo ratings yet

- Services Untuk Bulan Maret: Cabletech Bell Corporation (CTB) Berikut Aktivitas Yang Dilaporkan Oleh Divisi CableDocument23 pagesServices Untuk Bulan Maret: Cabletech Bell Corporation (CTB) Berikut Aktivitas Yang Dilaporkan Oleh Divisi Cableghesna larasatiNo ratings yet

- Budget InformationDocument10 pagesBudget InformationIsabella BattiataNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Problem 3 4 Chapter 14Document6 pagesProblem 3 4 Chapter 14freaann03No ratings yet

- Chap 03Document10 pagesChap 03Farooq HaiderNo ratings yet

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Managerial Accounting and Cost ConceptDocument20 pagesManagerial Accounting and Cost ConceptNavidEhsanNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- Activity Cost BehaviorDocument28 pagesActivity Cost BehaviorCPAREVIEWNo ratings yet

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Document3 pagesKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniNo ratings yet

- Costing Full Length 2 - May 24 (Solution) 8-4Document16 pagesCosting Full Length 2 - May 24 (Solution) 8-4Jyoti ManwaniNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- (SOAL) Soal Kuis Pararel ABDocument6 pages(SOAL) Soal Kuis Pararel ABAris KurniawanNo ratings yet

- Punto 2: Practical CapacityDocument3 pagesPunto 2: Practical CapacityJosé VisintiniNo ratings yet

- Cost Sheet Questions & SolutionDocument5 pagesCost Sheet Questions & SolutionAbhay SahuNo ratings yet

- FM New SumsDocument13 pagesFM New SumsINTER SMARTIANSNo ratings yet

- Marginal Costing 2-ApplicationDocument11 pagesMarginal Costing 2-Applicationprapulla sureshNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Financial Analysis and InterpretationDocument22 pagesFinancial Analysis and Interpretationirfan_rana4uNo ratings yet

- Wilkerson Company - Class PracticeDocument5 pagesWilkerson Company - Class PracticeYAKSH DODIANo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- SCM Quiz7Document2 pagesSCM Quiz7Krisha Mae Guirigay Dela CruzNo ratings yet

- Group 7 - Class 1 - FADocument5 pagesGroup 7 - Class 1 - FAthuhadt.yes20No ratings yet

- Cheating 101Document1 pageCheating 101api-3744266No ratings yet

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- 608799Document8 pages608799mohitgaba19No ratings yet

- Code 4Document8 pagesCode 4Đỗ Hải MyNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportFrom Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportNo ratings yet

- Give Two Examples of Nonfinancial Measures of Customer Satisfaction Relating To QualityDocument1 pageGive Two Examples of Nonfinancial Measures of Customer Satisfaction Relating To QualityElliot RichardNo ratings yet

- The Brightlight Corporation Uses Multicolored Molding To Make Plastic LampsDocument2 pagesThe Brightlight Corporation Uses Multicolored Molding To Make Plastic LampsElliot RichardNo ratings yet

- Description (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Document3 pagesDescription (1) Amount (2) Percentage of Total COQ (3) (2) ÷ $1,820,000 Percentage of Revenues (4) (2) ÷ $45,000,000Elliot RichardNo ratings yet

- The Brandt Corporation Makes Wire Harnesses For The Aircraft Industry Only Upon Receiving Firm Orders From Its CustomersDocument3 pagesThe Brandt Corporation Makes Wire Harnesses For The Aircraft Industry Only Upon Receiving Firm Orders From Its CustomersElliot RichardNo ratings yet

- Chunky Meatbots Produces A Wide Variety of Unorthodox Bread SaucesDocument3 pagesChunky Meatbots Produces A Wide Variety of Unorthodox Bread SaucesElliot RichardNo ratings yet

- Average Waiting Time For An Order of Z39Document2 pagesAverage Waiting Time For An Order of Z39Elliot RichardNo ratings yet

- Prescott Manufacturing Evaluates The Performance of Its Production Managers Based On A Variety of FactorsDocument3 pagesPrescott Manufacturing Evaluates The Performance of Its Production Managers Based On A Variety of FactorsElliot RichardNo ratings yet

- Give Two Examples of Appraisal CostsDocument1 pageGive Two Examples of Appraisal CostsElliot RichardNo ratings yet

- IVplast Is Still Debating Whether It Should Introduce Y28Document2 pagesIVplast Is Still Debating Whether It Should Introduce Y28Elliot RichardNo ratings yet

- Calculate The Average Waiting Time Per OrderDocument3 pagesCalculate The Average Waiting Time Per OrderElliot RichardNo ratings yet

- To Determine How Much QwakSoda Corporation Is Worse Off by Producing A Defective Bottle in The Bottling DepartmentDocument2 pagesTo Determine How Much QwakSoda Corporation Is Worse Off by Producing A Defective Bottle in The Bottling DepartmentElliot RichardNo ratings yet

- When Evaluating A CompanyDocument1 pageWhen Evaluating A CompanyElliot RichardNo ratings yet

- Weston Corporation Manufactures Auto Parts For Two Leading Japanese AutomakersDocument2 pagesWeston Corporation Manufactures Auto Parts For Two Leading Japanese AutomakersElliot RichardNo ratings yet

- At 420 Students Seen A DayDocument2 pagesAt 420 Students Seen A DayElliot RichardNo ratings yet

- QwakSoda Corporation Makes Soda in Three DepartmentsDocument2 pagesQwakSoda Corporation Makes Soda in Three DepartmentsElliot RichardNo ratings yet

- The Tristan Corporation Sells 250Document2 pagesThe Tristan Corporation Sells 250Elliot RichardNo ratings yet

- Because The Expected Relevant Benefits ofDocument2 pagesBecause The Expected Relevant Benefits ofElliot RichardNo ratings yet

- Describe Two Benefits of Improving QualityDocument1 pageDescribe Two Benefits of Improving QualityElliot RichardNo ratings yet

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDocument2 pagesKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Calculus Company Makes Calculators For StudentsDocument2 pagesCalculus Company Makes Calculators For StudentsElliot RichardNo ratings yet

- Essence Company Blends and Sells Designer FragrancesDocument2 pagesEssence Company Blends and Sells Designer FragrancesElliot Richard100% (1)

- Plots and Regression Lines ForDocument2 pagesPlots and Regression Lines ForElliot RichardNo ratings yet

- Possible Alternative Specifications That Would Better Capture The Link Between SpiritDocument2 pagesPossible Alternative Specifications That Would Better Capture The Link Between SpiritElliot RichardNo ratings yet

- Terry LawlerDocument2 pagesTerry LawlerElliot RichardNo ratings yet

- Preston Department Store Has A New Promotional Program That Offers A Free GiftDocument3 pagesPreston Department Store Has A New Promotional Program That Offers A Free GiftElliot RichardNo ratings yet

- Manulife Smart Call Call MenuDocument1 pageManulife Smart Call Call MenuNazreen AmirdeenNo ratings yet

- COPYRIGHTSDocument16 pagesCOPYRIGHTSMaui IbabaoNo ratings yet

- Accounting ResearchDocument6 pagesAccounting ResearchAnne PanghulanNo ratings yet

- Analytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidDocument30 pagesAnalytical Investigation of Entropy Production With Convective Heat Transfer in Pressure Driven Flow of A Generalised Newtonian FluidUğur DemirNo ratings yet

- Shah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfDocument311 pagesShah Fahad (editor), Osman Sönmez (editor), Shah Saud (editor), Depeng Wang (editor), Chao Wu (editor), Muhammad Adnan (editor), Muhammad Arif (editor), Amanullah (editor) - Engineering Tolerance in C.pdfTri4alNo ratings yet

- Braille Actuator Report MAJORDocument32 pagesBraille Actuator Report MAJORSwapnil BeheraNo ratings yet

- Math ResearchDocument4 pagesMath ResearchRaja AliNo ratings yet

- Circuit Note: Integrated Device Power Supply (DPS) For ATE With Output Voltage Range 0 V To 25 VDocument6 pagesCircuit Note: Integrated Device Power Supply (DPS) For ATE With Output Voltage Range 0 V To 25 VswjangNo ratings yet

- Chase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestDocument3 pagesChase: Eventhough This Case Shows How Campany Hires and Layoffs Strategy Would Work Best Due To Unstable Demand ForcestCristhian ValverdeNo ratings yet

- David M. Kroenke's: Database ProcessingDocument25 pagesDavid M. Kroenke's: Database ProcessingasalajalagiNo ratings yet

- Vehicle Suspension Modeling NotesDocument25 pagesVehicle Suspension Modeling Notesahmetlutfu100% (2)

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- Swot Analysis - Transnational CrimeDocument14 pagesSwot Analysis - Transnational CrimeCharmis Tubil100% (1)

- Soliven vs. FastformsDocument2 pagesSoliven vs. FastformsClaudine Allyson DungoNo ratings yet

- Example of Research Paper About Science and TechnologyDocument6 pagesExample of Research Paper About Science and Technologygz8aqe8wNo ratings yet

- Ed 807 Economics of Education MODULE-14 Activity-AnswerDocument3 pagesEd 807 Economics of Education MODULE-14 Activity-Answerjustfer johnNo ratings yet

- Wireless Communication Using Wimax Technology: Journal of Engineering and Sustainable Development September 2010Document21 pagesWireless Communication Using Wimax Technology: Journal of Engineering and Sustainable Development September 2010ahmed alshamliNo ratings yet

- Master Service Manual Product Family OLDocument478 pagesMaster Service Manual Product Family OLfernando schumacherNo ratings yet

- Cummins ActuatorDocument4 pagesCummins ActuatorLaiq Zaman100% (1)

- Minerals Potential - Minerals Law of Lao PDRDocument44 pagesMinerals Potential - Minerals Law of Lao PDRkhamsone pengmanivongNo ratings yet

- CV Examples Uk StudentDocument8 pagesCV Examples Uk Studente7648d37100% (1)

- Display CAT PDFDocument2 pagesDisplay CAT PDFAndres130No ratings yet

- Compatibilidades Equipos HaierDocument5 pagesCompatibilidades Equipos HaierAndrei AtofaneiNo ratings yet

- Ultra 150 300 Ts FileDocument136 pagesUltra 150 300 Ts FileEmanuel GutierrezNo ratings yet

- Sylvania Lumalux Ordering Guide 1986Document2 pagesSylvania Lumalux Ordering Guide 1986Alan MastersNo ratings yet