Professional Documents

Culture Documents

Malaysia Equity Company Update Padini Ho

Malaysia Equity Company Update Padini Ho

Uploaded by

hema lathaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Malaysia Equity Company Update Padini Ho

Malaysia Equity Company Update Padini Ho

Uploaded by

hema lathaCopyright:

Available Formats

PP10551/07/2012 (030567)

14 Mar 2012

MALAYSIA EQUITY

Investment Research

Daily

Company Update

The Research Team

+60 (3) 9207 7688

research2@my.oskgroup.com Padini Holdings

Rising to The Occasion

We recently had a follow-up visit to Padini, which is one of our Top Buys for 2012.

We continue to like the stock’s resilient performance amid an increasingly

BUY turbulent operating environment. Despite the volatility in cotton prices and

Fair Value RM1.80 intense competition in the retail space, we remain confident that the company’s

Previous RM1.80 high inventory and wider retail network relative to its peers will hold it in good

Price RM1.45 stead. Maintain BUY, with a FV of RM1.80, based on 14x FY12 EPS.

CONSUMER /RETAIL Gaining prominence. After providing 3 Good reasons (Good track record, Good growth

Padini is involved in the retailing of apparel, story and Good pricing) why investors should like Padini in our previous report, the

footwear and accessories.

share price has rallied by a strong 13.3% to RM1.45 in just one month. Although the

volatility in cotton prices and entry of new competitors might affect garment retailers in

general, we continue to believe that Padini will stand strong amid the tough environment

Stock Statistics given its high inventory level and wide network of outlets versus its peers.

Bloomberg Ticker PAD MK

Share Capital (m) 657.9

Market Cap 954.0 Unfazed by the challenges ahead. From a macro perspective, India‟s cotton export

52 week H | L Price 1.59 0.82 ban will definitely affect textile and garment retailers but we believe Padini will be able to

3mth Avg Vol (000) 1,826.2 weather the storm in view of its high level of inventory and cash pile. The entry of big

YTD Returns 33.0

Beta (x) 1.23 overseas retailers such as Top Shop, Zara, MNG, Cotton On and Uniqlo in recent years

has certainly raised the bar for local garment retailers. Another fashion retailer, Hennes

Shariah Compliant YES & Mauritz‟s (H&M), will also open its first store in Malaysia this year. We think that

Padini‟s strong retail network and wide customer base will continue to support its

Major Shareholders (%)

growth, although the competition is becoming tougher.

Yong Pang Chaun 44.0

5.0

Skim Amanah Saham

Spreading its wings overseas. FJ Benjamin Holdings, an industry leader in brand

Bumiputera

building and management, and the development of retail and distribution networks, has

approached Padini with the view to franchising the “Vincci” brand (under the brand

Share Performance (%) name of „VNC‟) in Indonesia. The VNC franchise stores in Indonesia have been

Month Absolute Relative languishing due to pricing problems relating to a luxury tax on its products. The

1m 20.6 10.6

discussions are still at the early stage but if the deal goes through, it would see Padini

3m 47.7 28.2

6m 74.0 46.7 making a significant breakthrough in expanding overseas. Similarly, the group is also in

12m 51.8 28.4 the midst of revamping its franchisee model in Thailand.

6-month Share Price Performance

Maintain BUY. Going forward, the group aims to introduce apparel based on overseas

1.80

styles and fashion at a faster pace to Malaysians by ramping up its efficiency and come

1.60

1.40 up with new garments in 3 to 4 weeks. Maintain BUY, with the stock‟s fair value

1.20 unchanged at RM1.80.

1.00

0.80

0.60

0.40

0.20

0.00 FYE June (RMm) FY09 FY10 FY11 FY12f FY13f

Sep-11 Oct-11 Nov-11 Dec-11 Jan-12 Jan-12 Feb-12

Revenue 475.5 518.8 568.5 668.7 738.9

Net Profit 49.5 61.0 75.7 86.2 97.1

% chg y-o-y 18.7 23.1 24.2 13.9 12.7

Consensus - - - 81.6 90.6

EPS (sen) 7.3 9.0 11.2 12.8 14.4

DPS (sen) 2.7 3.0 4.0 6.1 5.7

Dividend yield (%) 1.9 2.1 2.8 2.8 3.2

ROE (%) 24.3 26.0 26.8 26.3 25.2

ROA (%) 17.1 17.1 17.0 17.6 17.6

PER (x) 19.8 16.1 12.9 11.4 10.1

BV/share 0.30 0.35 0.42 0.48 0.57

P/BV (x) 4.8 4.2 3.5 3.0 2.5

EV/EBITDA (x) 10.7 8.1 6.9 5.9 4.7

OSK Research | See important disclosures at the end of this report 1

OSK Research

The Challenges Ahead

1) Cotton Export Ban

Oops, India does it again. India, the world‟s second largest cotton exporter with a global market share of

about 20%, banned its cotton exports on 5 March 2012. It last suspended cotton shipments on 21 April 2010,

and that lasted until 31 Oct. The international Cotton Association (ICA) stated that this will have serious

ramifications on world cotton trade. On 12 March, India partially ended the one-week ban on exports after

protests from growers, traders and China, its biggest customer. The exports registered before the ban will be

revalidated within 10 days but no new registrations will be allowed until further notice. The ban will result in

supply shortages that will directly hit the global garment industry, especially with China‟s textile industry being

the largest buyer of India‟s cotton.

Padini’s high inventory will save the day. Padini will be impacted by the cotton ban to a certain degree, but

the group has cautiously stocked up on inventory over the past two years. Management stocked up as it was

concerned over the volatility of cotton prices and as a result, Padini now has a higher inventory compared to

its peers. Such foresight has allowed the company to mitigate the risks arising from India‟s cotton export ban.

In the worst case of a prolonged supply shortage, cash-rich companies like Padini will have no problem

securing products as they can pay up-front. While the company will not be completely shielded from rising

cotton prices, its margins and market share should at least hold up better against most of its peers. The group

will normally keep five months of inventory, and such high inventory levels will likely normalize in the future.

Figure 1: Padini’s inventory level Figure 2: Inventory levels of peers

RM'm RM'm

250

180

200 160

140

150 120

100

100 80

60

50

40

20

-

0

1QCY10 2QCY10 3QCY10 4QCY10 1QCY11 2QCY11 3QCY11 4QCY11

Padini Cheetah Bonia Voir

*As of FY11

Source : Annual Report Source : Annual Report, Bloomberg

2) More Competitors

H&M is coming to town. Swedish fashion retailer, Hennes & Mauritz‟s (H&M), will open its long-awaited

maiden store in Malaysia at Lot 10 in Bukit Bintang this year. This will be followed by Abercrombie & Fitch‟s (a

US casual wear retailer) entry into Malaysia. Over the years, the influx of foreign retail brands, namely Top

Shop, Zara and MNG and more recently Cotton On and Uniqlo, into the local retail market has spiced up the

shopping scene in Malaysia.

Padini has wider coverage, clientele. With rising competition from both local and also foreign established

brands, Padini expects to defend its dominant position with its extensive network throughout Malaysia. Most

of the foreign fashion players‟ outlets are concentrated in the Klang Valley and the number of stores opened

is somewhat limited. Home-grown brands like Padini have a broader network of outlets not only in the Klang

Valley, but also in the relatively untapped cities such as Kuching and Kota Bharu. The group is opening three

Brands Outlets and three multi-brand concept stores in 2HFY12, increasing its retail floor space by

OSK Research | See important disclosures at the end of this report 2

OSK Research

approximately 66,000 sq ft. The Brands Outlet, catering to the mid-range to lower-end shoppers currently not

served by the other brands, will also attract value-oriented customers in the future. Thanks to its wide network

coverage and clientele, we believe the group will reign in an increasingly competitive landscape.

Figure 3: Fashion retailers’ outlets in Malaysia

Brands Outlets in Malaysia Origin

Cotton On 5 Australia

MNG 16 Spain

Padini 235 Malaysia

Topshop 8 UK

Uniqlo 3 Japan

Zara 6 Spain

*As of FY11 figures

Source: Company website

OSK Research | See important disclosures at the end of this report 3

OSK Research

EARNINGS FORECAST

FYE June (RM m) FY09 FY10 FY11 FY12f FY13f

Turnover 475.5 518.8 568.5 668.7 738.9

EBITDA 88.8 109.2 128.5 147.1 166.3

PBT 67.6 86.3 105.1 118.1 133.1

Net Profit 49.5 61.0 75.7 86.2 97.1

EPS (sen) 7.3 9.0 11.2 12.8 14.4

DPS (sen) 2.7 3.0 4.0 6.1 5.7

Margin

EBITDA (%) 18.7 21.0 22.6 22.0 22.5

PBT (%) 14.2 16.6 18.5 17.7 18.0

Net Profit (%) 10.4 11.8 13.3 12.9 13.1

ROE (%) 24.3 26.0 26.8 26.3 25.2

ROA (%) 17.1 17.1 17.0 17.6 17.6

Balance Sheet

Fixed Assets 75.9 80.8 83.6 95.3 92.2

Current Assets 208.2 264.3 349.8 381.7 447.9

Total Assets 289.4 356.6 444.4 490.1 553.1

Current Liabilities 81.8 111.4 138.0 135.3 145.8

Net Current Assets 126.4 153.0 211.8 246.4 302.1

LT Liabilities 3.5 10.9 23.7 16.6 11.6

Shareholders Funds 204.0 234.3 282.7 327.5 385.8

Net Gearing (%) Net cash Net cash Net cash Net cash Net cash

OSK Research | See important disclosures at the end of this report 4

OSK Research

OSK Research Guide to Investment Ratings

Buy: Share price may exceed 10% over the next 12 months

Trading Buy: Share price may exceed 15% over the next 3 months, however longer-term outlook remains uncertain

Neutral: Share price may fall within the range of +/- 10% over the next 12 months

Take Profit: Target price has been attained. Look to accumulate at lower levels

Sell: Share price may fall by more than 10% over the next 12 months

Not Rated (NR): Stock is not within regular research coverage

All research is based on material compiled from data considered to be reliable at the time of writing. However, information and opinions expressed will be

subject to change at short notice, and no part of this report is to be construed as an offer or solicitation of an offer to transact any securities or financial

instruments whether referred to herein or otherwise. We do not accept any liability directly or indirectly that may arise from investment decision-making

based on this report. The company, its directors, officers, employees and/or connected persons may periodically hold an interest and/or underwriting

commitments in the securities mentioned.

Distribution in Singapore

This research report produced by OSK Research Sdn Bhd is distributed in Singapore only to "Institutional Investors", "Expert Investors" or "Accredited

Investors" as defined in the Securities and Futures Act, CAP. 289 of Singapore. If you are not an "Institutional Investor", "Expert Investor" or "Accredited

Investor", this research report is not intended for you and you should disregard this research report in its entirety. In respect of any matters arising from,

or in connection with, this research report, you are to contact our Singapore Office, DMG & Partners Securities Pte Ltd ("DMG").

All Rights Reserved. No part of this publication may be used or re-produced without expressed permission from OSK Research.

Published by OSK Research Sdn. Bhd., 6th Floor, Plaza OSK, Jalan Ampang, 50450 Kuala Lumpur

Printed by Xpress Print (KL) Sdn. Bhd., No. 17, Jalan Lima, Off Jalan Chan Sow Lin, 55200 Kuala Lumpur

OSK RESEARCH SDN. BHD. (206591-V)

(A wholly-owned subsidiary of OSK Investment Bank Berhad)

Kuala Lumpur Hong Kong Singapore

Malaysia Research Office OSK Securities DMG & Partners

OSK Research Sdn. Bhd. Hong Kong Ltd. Securities Pte. Ltd.

6th Floor, Plaza OSK 12th Floor, 10 Collyer Quay

Jalan Ampang World-Wide House #09-08 Ocean Financial Centre

50450 Kuala Lumpur 19 Des Voeux Road Singapore 049315

Malaysia Central, Hong Kong Tel : +(65) 6533 1818

Tel : +(60) 3 9207 7688 Tel : +(852) 2525 1118 Fax : +(65) 6532 6211

Fax : +(60) 3 2175 3202 Fax : +(852) 2810 0908

Jakarta Shanghai Phnom Penh

PT OSK Nusadana OSK (China) Investment OSK Indochina Securities Limited

Securities Indonesia Advisory Co. Ltd. No. 1-3, Street 271,

Plaza CIMB Niaga, Room 6506, Plaza 66 Sangkat Toeuk Thla, Khan Sen Sok,

14th Floor, No.1266, West Nan Jing Road Phnom Penh,

Jl. Jend. Sudirman Kav. 25, 200040 Shanghai Cambodia

Jakarta Selatan 12920 China Tel: (855) 23 969 161

Indonesia Tel : +(8621) 6288 9611 Fax: (855) 23 969 171

Tel : (6221) 2598 6888 Fax : +(8621) 6288 9633

Fax : (6221) 2598 6777

Bangkok

OSK Securities (Thailand) PCL

191, Silom Complex Building

16th Floor, Silom Road,Silom,

Bangrak, Bangkok 10500

Thailand

Tel: +(66) 2200 2000

Fax : +(66) 2632 0191

You might also like

- Pidilite Industries: Robust Recovery Margin Pressure AheadDocument15 pagesPidilite Industries: Robust Recovery Margin Pressure AheadIS group 7No ratings yet

- Gadang 3QFY20 Results PDFDocument4 pagesGadang 3QFY20 Results PDFAHMADNo ratings yet

- This Study Resource Was: Coursework ReportDocument6 pagesThis Study Resource Was: Coursework ReportKar EngNo ratings yet

- Fast Retailing (9983 JP) : A Global Winner in Apparel RetailingDocument20 pagesFast Retailing (9983 JP) : A Global Winner in Apparel RetailingAndi WangNo ratings yet

- 3.best Specility ChemicalsDocument97 pages3.best Specility Chemicalsbeza manojNo ratings yet

- MAPI Equity Research ReportDocument20 pagesMAPI Equity Research ReportSri NingsihNo ratings yet

- Pidilite Industries: A Near-Monopoly With A 'Sticky' Business MoatDocument42 pagesPidilite Industries: A Near-Monopoly With A 'Sticky' Business MoatKaustubh SaksenaNo ratings yet

- PadiniDocument22 pagesPadinizephyryu100% (1)

- Safari Industries BUY: Growth Momentum To Continue.Document20 pagesSafari Industries BUY: Growth Momentum To Continue.dcoolsamNo ratings yet

- Marico LTD: A Safe Parachute!: Recommendation: BUYDocument14 pagesMarico LTD: A Safe Parachute!: Recommendation: BUYAnandNo ratings yet

- Nestle India Limited: High Growth Phase To Continue Despite Industry HeadwindsDocument9 pagesNestle India Limited: High Growth Phase To Continue Despite Industry HeadwindsAmit KapoorNo ratings yet

- Dixcy March 2020 ICRADocument7 pagesDixcy March 2020 ICRAPuneet367No ratings yet

- Team Beanstalk: Yes Bank - Businessworld Transformation SeriesDocument10 pagesTeam Beanstalk: Yes Bank - Businessworld Transformation SeriesDeepak L JainNo ratings yet

- Divi's Laboratories: ADD Target Price (INR) 894 Mature Cash Flows, Strong Growth Make A Good MixDocument22 pagesDivi's Laboratories: ADD Target Price (INR) 894 Mature Cash Flows, Strong Growth Make A Good MixSamad PatanwalaNo ratings yet

- RHB Equity - 4 May 2010 (Construction, Semiconductor, Kencana, Daibochi, Hunza Technical: Proton)Document4 pagesRHB Equity - 4 May 2010 (Construction, Semiconductor, Kencana, Daibochi, Hunza Technical: Proton)Rhb InvestNo ratings yet

- Kumpulan 2 - Kancil Group ProjectDocument58 pagesKumpulan 2 - Kancil Group ProjectYamunasri Mari100% (2)

- The Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: OCTOBER 2020Vighnesh KurupNo ratings yet

- Group 5 - Mergers & AcquisitionsDocument14 pagesGroup 5 - Mergers & Acquisitions1005Ritushree GoswamiNo ratings yet

- PEVC Society - M - A 101Document15 pagesPEVC Society - M - A 101Ayan MurmuNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: September 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: September 2020ASIFNo ratings yet

- CFA Institute Research Challenge: CFA Society India (IAIP) Team Code - ArtumeDocument31 pagesCFA Institute Research Challenge: CFA Society India (IAIP) Team Code - Artumeshreyansh naharNo ratings yet

- October 2020 FactsheetDocument2 pagesOctober 2020 FactsheetMohit AgarwalNo ratings yet

- 4Q2018 Investor Presentation VF1Document20 pages4Q2018 Investor Presentation VF1LCK DimasNo ratings yet

- Course: MBA 546 (International Financial Management) : Independent University, BangladeshDocument15 pagesCourse: MBA 546 (International Financial Management) : Independent University, Bangladeshmohiuddin alamgirNo ratings yet

- Company Update 6M22Document34 pagesCompany Update 6M22MichaelNo ratings yet

- Company Update FY20 AuDocument34 pagesCompany Update FY20 AuA. NurhidayatiNo ratings yet

- Rossari Biotech IC Mar21Document42 pagesRossari Biotech IC Mar21Vipul Braj Bhartia100% (1)

- Grasim Annual Report FY10Document151 pagesGrasim Annual Report FY10Vikas RalhanNo ratings yet

- RHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Document3 pagesRHB Equity 360° - 19 October 2010 (ILB, Public Bank Technical: Ann Joo)Rhb InvestNo ratings yet

- V.I.P. Industries LTD.: On Acquisition SpreeDocument3 pagesV.I.P. Industries LTD.: On Acquisition SpreeShikha Shikha SNo ratings yet

- Share India Securities Results Update Q3 FY22Document7 pagesShare India Securities Results Update Q3 FY22captkranthiNo ratings yet

- 2018 Ar PDFDocument241 pages2018 Ar PDFRaymondNo ratings yet

- OPENSYS - Investment Idea - 9 June 2020Document2 pagesOPENSYS - Investment Idea - 9 June 2020MegatzimranNo ratings yet

- Dark Horse EDocument2 pagesDark Horse ERanjan BeheraNo ratings yet

- The Right Time ToInvestDocument10 pagesThe Right Time ToInvestPrabu RagupathyNo ratings yet

- One 97 Communications (ONE97 IN) : Too Many Fingers in Too Many PiesDocument56 pagesOne 97 Communications (ONE97 IN) : Too Many Fingers in Too Many PiesSubhro Sengupta100% (1)

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- OTB - 170623 - Still A Nice Cup of Coffee - ADBSDocument10 pagesOTB - 170623 - Still A Nice Cup of Coffee - ADBSNishanth K SNo ratings yet

- The Best Stock To Add To Your Portfolio This Month Is Here!: December 2020Document9 pagesThe Best Stock To Add To Your Portfolio This Month Is Here!: December 2020Vighnesh KurupNo ratings yet

- Avenue Supermarts LTD BUY: Retail Equity ResearchDocument13 pagesAvenue Supermarts LTD BUY: Retail Equity ResearchVishal ShahNo ratings yet

- An Review On Shinepukur Ceramics and Its OperationsDocument24 pagesAn Review On Shinepukur Ceramics and Its OperationsMd Saddam HossainNo ratings yet

- Equity Research (Titan Biotech Limited)Document9 pagesEquity Research (Titan Biotech Limited)Dhruv ThakkarNo ratings yet

- NOVA Business Case Deloitte FA FinalDocument18 pagesNOVA Business Case Deloitte FA FinalRodrigo ZabalagaNo ratings yet

- Fin Chronicles - AdaniDocument7 pagesFin Chronicles - AdaniT ForsythNo ratings yet

- Company Update FY2 AuDocument37 pagesCompany Update FY2 AuFariz AlNo ratings yet

- Gmfi PDFDocument23 pagesGmfi PDFIlham FajarNo ratings yet

- Gmfi PDFDocument23 pagesGmfi PDFIlham FajarNo ratings yet

- Meghmani Organics SMIFS PDFDocument20 pagesMeghmani Organics SMIFS PDFAkCNo ratings yet

- Significance Effect Cost of Goods Sold and InventoryDocument6 pagesSignificance Effect Cost of Goods Sold and InventoryptinonetechnologyindonesiaNo ratings yet

- IA TheLannisters LPPFDocument19 pagesIA TheLannisters LPPFnandaNo ratings yet

- State Ment of Cash FlowsDocument22 pagesState Ment of Cash Flowslakshay chawlaNo ratings yet

- The Effect of Audit Commitee, Liquidity, Profitability, and Leverage On Dividend Policy in Consumer Goods Sector Companies Listed On The Indonesian Stock ExchangeDocument9 pagesThe Effect of Audit Commitee, Liquidity, Profitability, and Leverage On Dividend Policy in Consumer Goods Sector Companies Listed On The Indonesian Stock ExchangeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Company Report Adani Ports SEZDocument4 pagesCompany Report Adani Ports SEZDivya ChauhanNo ratings yet

- Adani GreenDocument1 pageAdani GreenKpNo ratings yet

- Spark Pidilite Industries - Update - Mar2021Document28 pagesSpark Pidilite Industries - Update - Mar2021Akshaya SrihariNo ratings yet

- JM Financial - Initiating CoverageDocument11 pagesJM Financial - Initiating Coveragerchawdhry123No ratings yet

- Bharat Rasayan - Deep Dive - Template - Rohit BalakrishnanDocument8 pagesBharat Rasayan - Deep Dive - Template - Rohit BalakrishnanAnil RainaNo ratings yet

- Education Technology Sector PDFDocument9 pagesEducation Technology Sector PDFArnav BhardwajNo ratings yet

- Fin420 - Comparative Analysis (Mac 2024)Document11 pagesFin420 - Comparative Analysis (Mac 2024)Alissa FahmiNo ratings yet

- FL-Japanese SEM-II Notes - MBA 22-24Document15 pagesFL-Japanese SEM-II Notes - MBA 22-24opppanubisNo ratings yet

- BOXED Zipper Pouch Free Pattern by AppleGreenCottageDocument6 pagesBOXED Zipper Pouch Free Pattern by AppleGreenCottageTaylorNo ratings yet

- Dress CrochetDocument7 pagesDress Crochetmuma_paduriiNo ratings yet

- Bài tập tiếng anh 9 cũ Unit 2Document24 pagesBài tập tiếng anh 9 cũ Unit 2Ác TưỚngNo ratings yet

- Distressed Brown Motorcycle Leather Jacket: JE Men Blue Punk Silver LongDocument1 pageDistressed Brown Motorcycle Leather Jacket: JE Men Blue Punk Silver Longsara markNo ratings yet

- The Evolution of Fashion in The XVIII-XIX CenturyDocument16 pagesThe Evolution of Fashion in The XVIII-XIX CenturyAndrea HusztiNo ratings yet

- Elements of Design Tle 8Document8 pagesElements of Design Tle 8Arabelle MorilloNo ratings yet

- Dress Code Thesis StatementDocument6 pagesDress Code Thesis StatementCollegePaperWritingServicesSingapore100% (2)

- Em Portfolio 26.06Document36 pagesEm Portfolio 26.06ErynNo ratings yet

- Essay Scotland-3Document2 pagesEssay Scotland-3Nicol SalinasNo ratings yet

- A Play About: School UniformsDocument12 pagesA Play About: School UniformsMuhammad ArsalanNo ratings yet

- AO 83 24 Guidelines On The Grant of Uniform or Clothing Allowance and Wearing of Prescribed DOLE Uniform For CY 2024Document4 pagesAO 83 24 Guidelines On The Grant of Uniform or Clothing Allowance and Wearing of Prescribed DOLE Uniform For CY 2024Joseph CabreraNo ratings yet

- 15.12.2020 Update Quotation KS PPE Supplier PDFDocument73 pages15.12.2020 Update Quotation KS PPE Supplier PDFNaing TunNo ratings yet

- Julian Szyszka Revision 3Document12 pagesJulian Szyszka Revision 3api-549458467No ratings yet

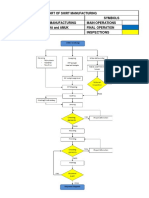

- Process Flow Chart of Shirt ManufacturingDocument8 pagesProcess Flow Chart of Shirt ManufacturingAASTHA KUMARINo ratings yet

- Take A Walk in Their ShoesDocument3 pagesTake A Walk in Their ShoesRez HabloNo ratings yet

- Party PackDocument12 pagesParty PackMr.Nasser HassanNo ratings yet

- Clothing Retail Business Plan TemplateDocument7 pagesClothing Retail Business Plan TemplateTrang NguyễnNo ratings yet

- Introduction To MAX FASHIONDocument8 pagesIntroduction To MAX FASHIONMohsin AhmadNo ratings yet

- Denim (Men) DocketDocument212 pagesDenim (Men) DocketMukund Verma100% (1)

- Level 1 - Unit 7: Brushenka Izquierdo Del Barco TeacherDocument14 pagesLevel 1 - Unit 7: Brushenka Izquierdo Del Barco TeacherEDGAR TUCNO PACOTAYPENo ratings yet

- Unit 1 Traditional Clothes TVDocument7 pagesUnit 1 Traditional Clothes TVArzu TaghiNo ratings yet

- G10 - 4TH Quarter ExamDocument3 pagesG10 - 4TH Quarter ExamLujille AnneNo ratings yet

- AssetsDocument10 pagesAssetspaula.barajasNo ratings yet

- Sewing Pattern - Dress 5204: CuttingDocument2 pagesSewing Pattern - Dress 5204: Cuttingmr kdramaNo ratings yet

- 192-029-811 Ratul HasanDocument22 pages192-029-811 Ratul HasanRatul HasanNo ratings yet

- MKTG 183 Lululemon Final Project Write UpDocument25 pagesMKTG 183 Lululemon Final Project Write Upapi-612560840No ratings yet

- Primer Parcial Ingles Técnico I - UtecoDocument18 pagesPrimer Parcial Ingles Técnico I - Utecopolarscloset0377No ratings yet

- KNC Design Thinking NotesDocument176 pagesKNC Design Thinking NotesRohit kumarNo ratings yet

- Womanless Pageant Chapter 1Document8 pagesWomanless Pageant Chapter 1JulietteVANo ratings yet