Professional Documents

Culture Documents

Introduction (Sri Ganesh Indestries)

Introduction (Sri Ganesh Indestries)

Uploaded by

joginder1009Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Introduction (Sri Ganesh Indestries)

Introduction (Sri Ganesh Indestries)

Uploaded by

joginder1009Copyright:

Available Formats

Dear Sir,

We have pleasure in introducing ourselves as professionally managed consultancy

organization in the field of import-export and allied matters, having our office in

commercial complex in Faridabad.

We have been in this line over a decade now and over the period have developed

close contacts with the connected Ministries and agencies which certainly help in

faster disposal of the cases.

We have well equipped office with modern facilities in Faridabad backed by the

qualified and experienced team to interpret Government policies correctly for the

maximum advantage, of course within the parameters of the policies and also to

handle assignment efficiently and promptly. Our success lies in the combined

expertise and skills of some of the best brains in the line added to the vast

experience gained over the years. Powered by a multi-disciplinary team of

specialists and professionals.

Our key focus areas include

COMPLIANCE WITH LAWS

The Foreign Trade Policy issued by the Ministry of Commerce as revised from time to

time, states that all Exporters and Importers are required to comply with the

provisions of the Foreign Trade (Development and Regulation) Act, 1992, the Rules

and Orders made there under, the provisions of this policy and the terms and

condition of the Authorizations granted to them as well as provisions of any other law

for the time being in force.

New levels of accountability, which come from new & amended laws and regulations

have elevated the concerns of the professional organizations to ensure effective

compliance.

There is also an increased awareness that this needs to be supported with right

attitudes in a manner that protects reputation of the organization.

In addition, there is a need to provide more relevant and timely information on the

developments on the rules and procedures.

This has heightened the focus on transparency, as well as on increased need to

provide accurate and periodic reporting of issues/events and certifications.

We provide our Expertise and Experience in Compliance with the Laws & statutory

Procedures of Exports and Imports.

EXPORT PROMOTION CAPITAL GOODS SCHEME

We under take Application, Submission, Compliance of statutory provisions,

Extension, Regularization of bonafide default, Clubbing and Redemption of EPCG

licence for Import of Capital Goods under concessional Duty.

DUTY EXEMPTION & REMISSION SCHEMES

• Advance Authorisations where the SION have been published.

• Self Declared Authorisation where SION are not published Advance

Authorisation for Annual Requirement

• DEPB

• DFIA (Duty Free Import Authorisation)

DGFT , NEW DELHI

• Fixation of SION Norms.

• Authorisation for import of items covered under Negative List.

• Specialized in Representing Enforcement cases, providing solutions for

complex problems, Regularization and Closure of old licences, Encashment of

bank guarantees in customs and RLA offices.

• Specialised in Representing Enforcement cases, providing solutions for

complex problems, Regularization and Closure of old licences, Encashment of

bank guarantees in customs and RLA offices.

MISCELLANEOUS

• International Trade Terms & Transactions

• Import Export Code Number

• Registration cum Membership Certificate

• Enrollment Number, I Card, Digital signature, etc

• IEM from the SIA, New Delhi.

• SSI registrations.

• Excise matters

• Sales Tax & Service Tax Matters

• Refund of additional duty

• Refund of VAT on Services rendered overseas

• Repatriation of Undrawn / Outstanding / Dead Export Proceeds & or

Settlement/Clearances from Reserve Bank.

100% EXPORT ORIENTED UNIT (EOU)

• Registration with the Development Commissioner Office as 100% EOU

WE ARE ALSO SPECIALIZED IN

• Setting up of 100% EOU unit with O/o the Development Commissioner &

Procuring of licenses for Private Bonded Ware house & Manufacturing in Bond

u/s 58 & u/s 65 of Customs Act 1962.

• De-bonding of 100% EOU unit under EPCG Scheme.

AUTHORIZATIONS UNDER PROMOTIONAL MEASURES

• Duty Credit Scrip for Listed Service providers and Individuals with a Foreign

Exchange Earning in the preceding financial year.

• Duty Credit Scrip for Hotels of One star and above and other service providers

in the tourism sector approved by the Department of Tourism with a Foreign

Exchange earning in the preceding financial year.

• Duty Credit Under Vishesh Krishi and Gram Udyog Yojna.

•

• DUTY CREDIT UNDER FOCUS MARKET SCHEME:

• Exports of all products to the Notified countries, shall be entitled for

duty credit scrip to offset the high freight cost and other disabilities to

select international markets to enhance our export competitiveness to

these countries.

• DUTY CREDIT UNDER FOCUS PRODUCT SCHEME:

• Export of Notified Products to all countries, shall be entitled for Duty

Credit Scrip to incentives export of such products which have high

employment intensity in rural and semi-urban areas so as to offset the

inherent infrastructure inefficiencies and other associated costs

involved in marketing of this products.

• Application for Grant of Star Export House.

Sales tax, service tax, excise cases

AUDIT

We also undertake Internal Audit of the documents related to Export incentives

under various schemes of the FTP.

Should you require any further information /clarification, please let us know for

our immediate compliance.

Thanking you and assuring you of our best services at all times,

Yours faithfully,

For SRI GANESH INDUSTRIES

Joginder Jhamb

5E/14, B.P, N.I.T

Faridabad. Haryana

(India)

E-mail:- joginder1009@yahoo.co.in

Mobile No. 09873161584

You might also like

- Brealey. Myers. Allen Chapter 16 TestDocument11 pagesBrealey. Myers. Allen Chapter 16 Testcasey222100% (2)

- Ic Disc PresentationDocument47 pagesIc Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- BSBFIM601 Manage Finances: Learner WorkbookDocument71 pagesBSBFIM601 Manage Finances: Learner WorkbookGurjinder Hanjra0% (1)

- Export IncentivesDocument42 pagesExport Incentivespriya2210No ratings yet

- Export Promotion Bodies: Prepared By:-Ankit DhankarDocument56 pagesExport Promotion Bodies: Prepared By:-Ankit DhankarmunswiNo ratings yet

- SIMS Exim ManagementDocument56 pagesSIMS Exim ManagementRounaq DharNo ratings yet

- Lms Module On Export - Import of JewelleryDocument45 pagesLms Module On Export - Import of JewelleryRaghu.GNo ratings yet

- Export ImportDocument128 pagesExport ImportPrateek SinghNo ratings yet

- Trading Houses, Star Trading Houses and Status Holders: Presented By-Lalit Sondhi Mba-IbDocument16 pagesTrading Houses, Star Trading Houses and Status Holders: Presented By-Lalit Sondhi Mba-IbLALIT SONDHI0% (1)

- Remaning TopicsDocument7 pagesRemaning TopicsAbhishekNo ratings yet

- Small Scale Industrial Undertakings NewDocument29 pagesSmall Scale Industrial Undertakings NewMohit AgrawalNo ratings yet

- Com.Document24 pagesCom.MALAYALY100% (1)

- Export GuideDocument29 pagesExport GuidemultilinkaddisNo ratings yet

- Export ProcessDocument18 pagesExport ProcessemmabrowneinfoNo ratings yet

- A278955818 - 14952 - 16 - 2019 - UNIT 3 LastDocument33 pagesA278955818 - 14952 - 16 - 2019 - UNIT 3 LastLuser AnomousNo ratings yet

- Five Canadian Government Supports For Small Medium Sized Enterprises (SME) ExportingDocument35 pagesFive Canadian Government Supports For Small Medium Sized Enterprises (SME) ExportingUlusyar TareenNo ratings yet

- DGFT Export PromotionsDocument18 pagesDGFT Export PromotionsSalim MullaNo ratings yet

- Ex Im ProceduresDocument23 pagesEx Im Proceduresr.jeyashankar9550No ratings yet

- Foreign Trade Policy IndiaDocument11 pagesForeign Trade Policy IndiabebuchintuNo ratings yet

- Ibex Module 09Document5 pagesIbex Module 09Gaurav K. DesaiNo ratings yet

- Export GuideDocument28 pagesExport Guidebirhanu100% (1)

- Gist of Foreign Trade Policy - 2015-2020 Must Read Simplification and Merger of Reward SchemessDocument4 pagesGist of Foreign Trade Policy - 2015-2020 Must Read Simplification and Merger of Reward SchemessMukul SoniNo ratings yet

- Article I Osman I Guide To Launching An Import and Export Business in Dubai, UAEDocument2 pagesArticle I Osman I Guide To Launching An Import and Export Business in Dubai, UAEOsman GoniNo ratings yet

- Tax Commentary 2020Document85 pagesTax Commentary 2020Javed MushtaqNo ratings yet

- Export Import DocumentationDocument21 pagesExport Import DocumentationSabir ShaikhNo ratings yet

- Export Promo MeasuresDocument7 pagesExport Promo MeasuresktmshameerNo ratings yet

- EXIM POLICY 2009-2014: Also Called Foreign Trade Policy 2009-2014Document11 pagesEXIM POLICY 2009-2014: Also Called Foreign Trade Policy 2009-2014Shrikant KulkarniNo ratings yet

- Special Economic ZoneDocument13 pagesSpecial Economic Zonejoe80% (5)

- Export Procedure and Documentation Project ReportDocument130 pagesExport Procedure and Documentation Project ReportAagam ShahNo ratings yet

- Regulatory Requirements For ExportsDocument57 pagesRegulatory Requirements For Exportslaponad628No ratings yet

- Fallsem2017-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 05aDocument27 pagesFallsem2017-18 Bmt1018 TH Sjt626 Vl2017181002984 Reference Material I Exim 05aPulkit JainNo ratings yet

- How Can We ExportDocument94 pagesHow Can We ExportUdit PradeepNo ratings yet

- Exim Policy PDF Lyst8415Document35 pagesExim Policy PDF Lyst8415Ashish SinghNo ratings yet

- Export ManagementDocument33 pagesExport ManagementTanmoy ChakrabortyNo ratings yet

- S JaykishanDocument23 pagesS JaykishanKarthik PalaniNo ratings yet

- File 2Document24 pagesFile 2Arvind KumarNo ratings yet

- International Business Management: 4/1/2013 A.velsamy, Sona School of Management 1Document31 pagesInternational Business Management: 4/1/2013 A.velsamy, Sona School of Management 1KARCHISANJANANo ratings yet

- Important Information - Foreign Business in PHDocument4 pagesImportant Information - Foreign Business in PHGraze IsidroNo ratings yet

- Foreign Trade PolicyDocument6 pagesForeign Trade PolicyDushyant ChaudharyNo ratings yet

- Foreign Trade Policy 2004-09Document25 pagesForeign Trade Policy 2004-09Nishant RaoNo ratings yet

- Export Assistance, Import Facility, Tax Concessions and Duty DrawbacksDocument67 pagesExport Assistance, Import Facility, Tax Concessions and Duty Drawbacksmayankgoyal333No ratings yet

- Selection of Best Suited Scheme Under FTP - PUNE - ICAIDocument41 pagesSelection of Best Suited Scheme Under FTP - PUNE - ICAIpramodmurkya13No ratings yet

- Export Incentive AbhishekDocument7 pagesExport Incentive Abhishekpramodbms1369No ratings yet

- Export Procedure and DocumentationDocument11 pagesExport Procedure and DocumentationJebamani IndhraNo ratings yet

- IEC CODE DetailsDocument4 pagesIEC CODE DetailsAmandeep Singh BediNo ratings yet

- Indonesian Customs Guide 2012-Web PDFDocument76 pagesIndonesian Customs Guide 2012-Web PDFLarryMatiasNo ratings yet

- Indonesian Customs Guide 2012-WebDocument76 pagesIndonesian Customs Guide 2012-WebRhama WijayaNo ratings yet

- Bill Rate:: ChargeabilityDocument9 pagesBill Rate:: ChargeabilityNivesh Anand AroraNo ratings yet

- Unit 4d SEZ Economics IIDocument13 pagesUnit 4d SEZ Economics IImayankunstable12No ratings yet

- Introduction: Assessing Export Readiness/ Basic Steps For ExportingDocument97 pagesIntroduction: Assessing Export Readiness/ Basic Steps For ExportingSyedNo ratings yet

- 2.FAQ On How To Start Export BusinessDocument6 pages2.FAQ On How To Start Export Businessamndeep5355No ratings yet

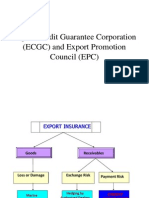

- ECGCDocument24 pagesECGCDrRuchi GargNo ratings yet

- Accounting of Taxes MATDocument56 pagesAccounting of Taxes MATHemanthKumarNo ratings yet

- Special Economic ZonesDocument3 pagesSpecial Economic ZonesUdhayakumar ManickamNo ratings yet

- 2schemes Policies Part II PDFDocument62 pages2schemes Policies Part II PDFShashiSameerNo ratings yet

- Unit 4Document28 pagesUnit 4Nivedita SinghNo ratings yet

- FTP 2015-20 BoiDocument38 pagesFTP 2015-20 BoiNavneet GeraNo ratings yet

- Export Procedure - KohimaDocument22 pagesExport Procedure - KohimavarshatolasariyaNo ratings yet

- Special Economic Zone (SEZ)Document27 pagesSpecial Economic Zone (SEZ)ChunnuriNo ratings yet

- CHAPTER 3: Market Survey & External AnalysisDocument2 pagesCHAPTER 3: Market Survey & External AnalysisShreyaMishraNo ratings yet

- Smooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1From EverandSmooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1No ratings yet

- Vietnam Wine - Final Report - 11.12.2014Document17 pagesVietnam Wine - Final Report - 11.12.2014kateanh2501100% (1)

- TAX 2 Tax Remedies 2020 PDFDocument5 pagesTAX 2 Tax Remedies 2020 PDFAlex Buzarang SubradoNo ratings yet

- Etika AR'10Document128 pagesEtika AR'10Hani BerryNo ratings yet

- Elements of Crime Index CardsDocument142 pagesElements of Crime Index CardsJea Co100% (1)

- Tutorial 3 (1) Q1,2,4,5Document9 pagesTutorial 3 (1) Q1,2,4,5Shan JeefNo ratings yet

- Solved Troy Entered Into A Three Year Lease of A Luxury AutomobileDocument1 pageSolved Troy Entered Into A Three Year Lease of A Luxury AutomobileAnbu jaromiaNo ratings yet

- Arrowsmith v. Commissioner, 344 U.S. 6 (1952)Document5 pagesArrowsmith v. Commissioner, 344 U.S. 6 (1952)Scribd Government DocsNo ratings yet

- Paolo Riguzzi: From Globalisation To Revolution ? The Porfirian Political Economy: An Essay On Issues and InterpretationsDocument22 pagesPaolo Riguzzi: From Globalisation To Revolution ? The Porfirian Political Economy: An Essay On Issues and InterpretationsSantiago Campero SierraNo ratings yet

- Bbap2103 - Management Accounting 2016Document16 pagesBbap2103 - Management Accounting 2016yooheechulNo ratings yet

- MCA PapersDocument769 pagesMCA PapersJayesh WaghNo ratings yet

- A.M. Khanwilkar and Dinesh Maheshwari, Jj. Civil Appeal No. 7865 of 2009 JULY 29, 2020Document46 pagesA.M. Khanwilkar and Dinesh Maheshwari, Jj. Civil Appeal No. 7865 of 2009 JULY 29, 2020Deeptangshu KarNo ratings yet

- Cambridge Ordinary LevelDocument12 pagesCambridge Ordinary LevelkazamNo ratings yet

- Incidence of A TaxDocument5 pagesIncidence of A TaxhotfujNo ratings yet

- Meaning 'A Budget Is A Document Containing A Preliminary Approved Plan of Public Revenues and Expenditure'' - Rene StourmDocument3 pagesMeaning 'A Budget Is A Document Containing A Preliminary Approved Plan of Public Revenues and Expenditure'' - Rene StourmAvi KansalNo ratings yet

- Presentation 1Document10 pagesPresentation 1nicasavio2725No ratings yet

- Guidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 2000 Monthly Documentary Stamp Tax Declaration/ReturnJoselito III CruzNo ratings yet

- Forbes USA - 25 May 2015.bakDocument156 pagesForbes USA - 25 May 2015.bakhugosalazarNo ratings yet

- Corpo - DigestDocument28 pagesCorpo - Digesterikha_aranetaNo ratings yet

- Industry LayoutDocument31 pagesIndustry LayoutGiriraj T KulkarniNo ratings yet

- Singapore - Economic Expansion Incentive ActDocument96 pagesSingapore - Economic Expansion Incentive Actsopheayem168No ratings yet

- NDE 2018 - 06-Mobility Factor in Digital EconomyDocument34 pagesNDE 2018 - 06-Mobility Factor in Digital EconomyelisabethNo ratings yet

- CASE 3.4 Cir Vs Ca, Cta and Ateneo FactsDocument3 pagesCASE 3.4 Cir Vs Ca, Cta and Ateneo FactsNoemiR.NegrilloNo ratings yet

- Week 2 HomeworkDocument2 pagesWeek 2 HomeworkSofiaaleeoNo ratings yet

- EFE... and External AuditDocument21 pagesEFE... and External Auditvicky_00753No ratings yet

- GO (P) No 87-2017-Fin Dated 05-07-2017Document3 pagesGO (P) No 87-2017-Fin Dated 05-07-2017Viswalal ViswanathanNo ratings yet

- Sea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Document5 pagesSea-Land Services, Inc. vs. Court of Appeals (April 30, 2001)Che Poblete CardenasNo ratings yet

- MANAC QuestionsDocument4 pagesMANAC QuestionsPrakhar SethiNo ratings yet

- 504 Chart of AccountsDocument1 page504 Chart of AccountsAJNo ratings yet