Professional Documents

Culture Documents

Exam 15 November 2016, Answers Exam 15 November 2016, Answers

Exam 15 November 2016, Answers Exam 15 November 2016, Answers

Uploaded by

gen sandwellCopyright:

Available Formats

You might also like

- Literary Analysis - The NecklaceDocument5 pagesLiterary Analysis - The NecklaceDanny Hoi33% (3)

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- Tokenization: Practitioner Point of View: All You Need To Know To Tokenize Successfully Any AssetDocument18 pagesTokenization: Practitioner Point of View: All You Need To Know To Tokenize Successfully Any AssetCleórbete Santos100% (1)

- Unilag MSC Economics SAMPLEDocument3 pagesUnilag MSC Economics SAMPLEbdian100% (2)

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Topic 6 - Winding Up Ca 2016-1Document25 pagesTopic 6 - Winding Up Ca 2016-1Maisarah ShahNo ratings yet

- Topic 6 - Winding Up CA 2016Document25 pagesTopic 6 - Winding Up CA 2016Umar Razak100% (1)

- Registered ValueDocument9 pagesRegistered ValueSangram PandaNo ratings yet

- Unit 5Document6 pagesUnit 5Subha LakshmiNo ratings yet

- Company Law Anil k NairDocument154 pagesCompany Law Anil k NairAadith AarjayNo ratings yet

- Company Law Anil K NairDocument154 pagesCompany Law Anil K NairAyush ThumbarathyNo ratings yet

- Chapter-6A-Compromise & Arrangement-F - (250-258)Document9 pagesChapter-6A-Compromise & Arrangement-F - (250-258)s.super2018No ratings yet

- Types of Resolutions Under Companies ActDocument9 pagesTypes of Resolutions Under Companies ActAnil SonarNo ratings yet

- Chapter 5 Compormises and ArrangementDocument41 pagesChapter 5 Compormises and ArrangementDeepsikha maitiNo ratings yet

- Law of Insolvency PresentationDocument39 pagesLaw of Insolvency PresentationSiva NanthaNo ratings yet

- Vdocuments - MX - Fria Flow Chart Final 1 PDFDocument44 pagesVdocuments - MX - Fria Flow Chart Final 1 PDFM Grazielle EgeniasNo ratings yet

- Squish Corp Has Two Divisions Production Which Makes Pillow FoamDocument1 pageSquish Corp Has Two Divisions Production Which Makes Pillow FoamAmit PandeyNo ratings yet

- LAW Imp Sections PDFDocument7 pagesLAW Imp Sections PDFShailesh GajjarNo ratings yet

- Shareholder MeetingDocument4 pagesShareholder MeetingyusehaiNo ratings yet

- COMPANY LAW (Guideline Answers) : Intermediate ExaminationDocument14 pagesCOMPANY LAW (Guideline Answers) : Intermediate Examinationjeevan_v_mNo ratings yet

- Stage Codes ISODocument1 pageStage Codes ISOEshario RenoNo ratings yet

- Company Law (602) : Item Text Option Text 1 Option Text 2 Option Text 3 Option Text 4Document2 pagesCompany Law (602) : Item Text Option Text 1 Option Text 2 Option Text 3 Option Text 4Xiaomi TvNo ratings yet

- FFB ConstitutionDocument70 pagesFFB ConstitutionNatalie EeeNo ratings yet

- Oppo PDFDocument41 pagesOppo PDFSatyam ThakurNo ratings yet

- Delegation of Authority: Duluxgroup LimitedDocument7 pagesDelegation of Authority: Duluxgroup LimitedGaurav WadhwaNo ratings yet

- WWW - Edutap.co - In: Chapter IV of Companies Act - Share Capital & DebenturesDocument17 pagesWWW - Edutap.co - In: Chapter IV of Companies Act - Share Capital & DebenturesJohn AllenNo ratings yet

- Chapter 13 - PCDocument15 pagesChapter 13 - PCnkgoengdunstanNo ratings yet

- Constitution (Bursa)Document71 pagesConstitution (Bursa)Wan Mohd Rushdi AbdullahNo ratings yet

- ProspectusDocument9 pagesProspectusNarasimhaModugulaNo ratings yet

- Flowchart (PAB Lecture)Document32 pagesFlowchart (PAB Lecture)Йонас Руэл100% (1)

- Slides (5) 副本3Document36 pagesSlides (5) 副本3Andrew ChanNo ratings yet

- 中 電 控 股 有 限 公 司 CLP Holdings Limited: (incorporated in Hong Kong with limited liability)Document4 pages中 電 控 股 有 限 公 司 CLP Holdings Limited: (incorporated in Hong Kong with limited liability)ThomasNo ratings yet

- AmalgamationDocument34 pagesAmalgamationsedida1374No ratings yet

- Book of Financial Powers-GENCOsDocument28 pagesBook of Financial Powers-GENCOsHaider AliNo ratings yet

- Corporations Questions: Not Considered A Characteristic of TheDocument5 pagesCorporations Questions: Not Considered A Characteristic of TheHiren BakraniaNo ratings yet

- CRG Directors Part 2Document23 pagesCRG Directors Part 2maiztulshahirahNo ratings yet

- Types of Resolutions Under Companies Act, 1956Document6 pagesTypes of Resolutions Under Companies Act, 1956Soumitra Chawathe0% (1)

- Voluntary WU.Document19 pagesVoluntary WU.Zerq InDaHausNo ratings yet

- Summary Class 11 12Document2 pagesSummary Class 11 12jroflcopterNo ratings yet

- JGSHI Supplier Accreditation PolicyDocument5 pagesJGSHI Supplier Accreditation PolicyRaven VergaraNo ratings yet

- FsfsefsefDocument5 pagesFsfsefsefDaniyal Zahid ButtNo ratings yet

- CMA Final Corporate Laws & Compliance Solution Dec 2019Document20 pagesCMA Final Corporate Laws & Compliance Solution Dec 2019komalc2026No ratings yet

- MBSB - Notice of 54th AGM 20240429Document1 pageMBSB - Notice of 54th AGM 20240429Wong Choon HongNo ratings yet

- Dec 2009Document14 pagesDec 2009Murugesh Kasivel EnjoyNo ratings yet

- Planning Permit Process: Planning Department Office: 1 Market Place Postal: Locked Bag 685Document2 pagesPlanning Permit Process: Planning Department Office: 1 Market Place Postal: Locked Bag 685Bennet LawNo ratings yet

- CA Inter Law Suggested Answer Nov 2022Document20 pagesCA Inter Law Suggested Answer Nov 2022V DHARSHININo ratings yet

- Frameword OtspolcyDocument741 pagesFrameword Otspolcyd_narnoliaNo ratings yet

- VadodaraDocument10 pagesVadodaraAnita NautiyalNo ratings yet

- Chart Book - Corporate Restructuring Insolvency Liquidation and Winding Up - CS Vaibhav Chitlangia - Yes Academy, PuneDocument47 pagesChart Book - Corporate Restructuring Insolvency Liquidation and Winding Up - CS Vaibhav Chitlangia - Yes Academy, PuneJohn carollNo ratings yet

- Acc 109 P3 EXAM AUDocument20 pagesAcc 109 P3 EXAM AUKathleen J. GonzalesNo ratings yet

- Filing of Form MGT-14 For Special Resolutions - Companies Act 2013Document7 pagesFiling of Form MGT-14 For Special Resolutions - Companies Act 2013Krishnendu BhattacharyyaNo ratings yet

- Chapter 4Document9 pagesChapter 4Prince S'Luu HitiNo ratings yet

- Corporate Restructuring Takeover, Buy Back & Delisting: Manoj KumarDocument41 pagesCorporate Restructuring Takeover, Buy Back & Delisting: Manoj KumarVasudev lahotiNo ratings yet

- Dissolution of CVDocument1 pageDissolution of CVNurtri KevianaNo ratings yet

- Corporate GovernanceDocument14 pagesCorporate GovernanceRajesh SharmaNo ratings yet

- SF Substantial Property Transactions v1Document26 pagesSF Substantial Property Transactions v1Aimi AzemiNo ratings yet

- Dissolution of CVDocument1 pageDissolution of CVNurtri KevianaNo ratings yet

- Generalprocedure Export PDFDocument20 pagesGeneralprocedure Export PDFUTTAL RAYNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument20 pagesFinal Examination: Suggested Answers To QuestionsidealNo ratings yet

- Lecture 8 - Companies Winding UpDocument47 pagesLecture 8 - Companies Winding Up1181100577No ratings yet

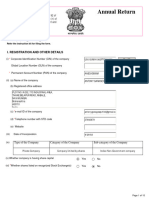

- Form MGT-7-12042016 - SignedDocument15 pagesForm MGT-7-12042016 - SignedPavan SAMEER KUMARNo ratings yet

- Sarbanes-Oxley and the Board of Directors: Techniques and Best Practices for Corporate GovernanceFrom EverandSarbanes-Oxley and the Board of Directors: Techniques and Best Practices for Corporate GovernanceNo ratings yet

- Lincoln Philippine Life Insurance Company, Inc Vs CADocument10 pagesLincoln Philippine Life Insurance Company, Inc Vs CAJazem AnsamaNo ratings yet

- Secretary's CertificateDocument2 pagesSecretary's CertificateRhyz Taruc-ConsorteNo ratings yet

- No.: - Date: - Agency FundDocument12 pagesNo.: - Date: - Agency Fundlegal.darposaranganiNo ratings yet

- Yale EndowmentDocument40 pagesYale Endowmentpurple_panda_pantsNo ratings yet

- Hizar Assignment (4)Document10 pagesHizar Assignment (4)Sohail KhanNo ratings yet

- Income Tax AccountingDocument24 pagesIncome Tax AccountingSYED WAFI100% (1)

- Anon - Housing Thesis 09 12 2011Document22 pagesAnon - Housing Thesis 09 12 2011cnm3dNo ratings yet

- Uttara Bank-Financial PerformenceDocument50 pagesUttara Bank-Financial Performencesumaiya sumaNo ratings yet

- ForfaitingDocument14 pagesForfaitingArun Sharma100% (1)

- 49 Sy Chim v. Sy Siy Ho & Sons, IncDocument35 pages49 Sy Chim v. Sy Siy Ho & Sons, IncBianca LaderaNo ratings yet

- 3.equity Measurement & Management SystemDocument26 pages3.equity Measurement & Management SystemShobhit BoseNo ratings yet

- Ibc 2016Document74 pagesIbc 2016Roshini Chinnappa100% (1)

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 13 PDFDocument44 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 13 PDFFaye Noreen FabilaNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Reckitt BenckiserDocument55 pagesReckitt BenckiserSiddhant Chandel100% (5)

- Business Mathematics: Bba (General)Document30 pagesBusiness Mathematics: Bba (General)Mohit Kapoor0% (1)

- Sale Under TpaDocument16 pagesSale Under Tpashubham100% (3)

- Romnick Bajin - Audit ProgramDocument23 pagesRomnick Bajin - Audit ProgramGm ArchangelNo ratings yet

- Risk ManagementDocument27 pagesRisk ManagementCharu Modi100% (1)

- TSA: James D. Hamilton, Time Series Analysis, Princeton University Press, 1994Document6 pagesTSA: James D. Hamilton, Time Series Analysis, Princeton University Press, 1994aroelmathNo ratings yet

- Introduction To Financial AccountingDocument19 pagesIntroduction To Financial AccountingRONALD SSEKYANZINo ratings yet

- What Is Token?: TrustDocument5 pagesWhat Is Token?: TrustBÙI NGUYÊN LUẬN - VIOLYMPIC TOÁNNo ratings yet

- Hearing TranscriptDocument30 pagesHearing TranscriptDeadspinNo ratings yet

- Your Bill For Mobile Services: Summary of This Bill Period ChargesDocument14 pagesYour Bill For Mobile Services: Summary of This Bill Period ChargesUjjwalPratapSinghNo ratings yet

- Faq Hire Purchase CarloanDocument7 pagesFaq Hire Purchase CarloanIkhwan MohamadNo ratings yet

- Ch18 - Parkin - Econ - Lecture PresentationDocument52 pagesCh18 - Parkin - Econ - Lecture PresentationImam AmbaryNo ratings yet

Exam 15 November 2016, Answers Exam 15 November 2016, Answers

Exam 15 November 2016, Answers Exam 15 November 2016, Answers

Uploaded by

gen sandwellOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exam 15 November 2016, Answers Exam 15 November 2016, Answers

Exam 15 November 2016, Answers Exam 15 November 2016, Answers

Uploaded by

gen sandwellCopyright:

Available Formats

lOMoARcPSD|4334736

Exam 15 November 2016, answers

Financial accounting 300 (University of Pretoria)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

Department of Auditing

AUDITING 300

EXAM

15 NOVEMBER 2016

SUGGESTED SOLUTION

Internal examiners

Mrs M Kirstein

Mrs B Beukes

Miss S Swanepoel

Miss D Ntshabele

External examiner

Mrs J Seligmann (internal)

Prof K Barac (internal)

Mr P Lansdell (University of South Africa)

INSTRUCTIONS

Maximum time: 3 hours (180 minutes) plus 25 minutes reading time

Maximum marks: 120

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

PART 1 (18 marks)

COMPANIES ACT

Section Co Act requirements Application

The buy-back of shares

Section 48 – company or The board of a company The board of directors of

subsidiary acquiring may determine that the Brick Builders took a

company’s shares. (½) company will acquire a decision on 1 February

number of its own shares. 2016 to buy back 25% of

(½) Brick Builders’ ordinary

shares. (1)

The company may not 26% of Brick Builders’

acquire its own shares, if, shares are still owned by

as a result of that the public and 49% by the

acquisition, there would no Tiana family. (1)

longer be any shares of the Thus 75% shares are still in

company in issue other than issue, which are not held by

Shares held by one or subsidiaries of the company

more subsidiaries of the and are not convertible or

company; (½) redeemable, but by the

or public. (1)

Convertible or

redeemable shares.

(½)

The company has to comply

with section 46. (½)

(mark will only be awarded

once)

Section 46 – distributions Distributions are widely

must be authorised by the defined and include share

board. (mark will only be buy backs. (½)

awarded once) A company must not make The board of directors of

any proposed distribution Brick Builders adopted a

unless the distribution is resolution on 1 February

authorised by the board of 2016. (1)

directors by way of a

resolution. (½)

It reasonably appears that The share buyback was

the company will satisfy the financed through cash

solvency and liquidity test reserves and had little effect

immediately after on the cash flow of the

completing the proposed company. (The scenario is

distribution. (½) silent regarding solvency)

(1)

The board, by resolution, No mention is made of

acknowledge that it applied whether the board, by

the solvency and liquidity resolution, acknowledged

test and concluded that the that it applied the solvency

company is solvent and and liquidity test. (1)

liquid. (½)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

Section Co Act requirements Application

The distribution must be The distribution was

completed within 120 days completed within the 120

after the board made the days after the board took

acknowledgement. (½) the decision to carry out a

share buy back, therefore it

must have been within 120

days of the board giving

acknowledgement. (1)

Financial assistance to obtain shares

Section 44 – financial The board may authorise a The board of directors of

assistance for subscription company to provide Brick Builders authorised

of securities. (½) financial assistance by way the financial assistance to

of a loan to any person for the Brick Builders

the purchase of any Employee Trust to

securities of the company. purchase shares in the

(½) company. (1)

The board may authorise The assistance was

financial assistance provided to an employee

pursuant to an employee share scheme thus this is

share scheme that satisfies applicable. (1)

the requirement of section

97; (½)

If the board is satisfied that The share buyback

immediately after providing transaction was financed

the financial assistance, the through cash reserves and

company would satisfy the had little effect on the cash

solvency and liquidity test; flow of the company. (The

and (½) scenario is silent with

regard to solvency) (1)

The terms under which the The terms under which the

financial assistance is financial assistance was

proposed to be given are provided do not seem fair

fair and reasonable to the and reasonable to the

company. (½) company as the loan is

interest free. (1)

Section 97 – standards for An employee share scheme A compliance officer was

qualifying employee share qualifies as an employee appointed and reports

schemes. (½) scheme if the company has directly to the board of Brick

appointed a compliance Builders. (1)

officer for the scheme to be

accountable to the directors

of the company. (½)

States in its annual financial The scenario is silent on

statements the number of whether the number of

shares that it has allotted shares has been disclosed

during that financial year in in the financial statements /

terms of its employee share the assumption is made that

scheme; and (½) it wasn’t disclosed. (1)

A compliance officer has

been appointed to comply

with the requirements of the

companies act. (½) A compliance officer was

appointed to be responsible

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

Section Co Act requirements Application

for all the legal and financial

requirements of the trust.

(1)

Conclusion:

Overall Brick Builders did comply with the requirements set out in the Companies

Act. (1)

mark allocation: 1 mark per aspect, unless indicated otherwise available 24½

maximum 17

Communication skills: Presentation 1

PART 2 (20 marks)

MATTERS THAT RUOK SHOULD HAVE CONSIDERED BEFORE ACCEPTING THE

AUDIT OF BRICK BUILDERS LIMITED

Legal vacancy

An auditor should be appointed each year at a company’s annual general

meeting. RUOK was re-appointed as the auditors of Brick Builders Limited at

the annual general meeting for the 2016 financial year audit. (1)

RUOK did not indicate that they are not willing to be reappointed as the auditors

of Brick Builders. (1)

Therefore there was a legal vacancy and RUOK can again accept the

appointment. (1)

They also rotated the audit partner, even though it was not due yet. (1)

Client considerations:

Client’s integrity

The following reflects positively on the integrity of management:

• Brick Builders has been commended for “being a business that trades

honestly” (1)

• Brick Builders is committed to positively impacting its stakeholders,

society and the environment. (1)

• The board of directors of Brick Builders are representative of the

diversity and demographics of South Africa, therefore complying with

the principles of King III. (1)

• The board of directors of Brick Builders has also established all the

required board committees, therefore complying with the principles of

King III. (1)

• They have an effective internal audit function which enhances the

control environment of the company. (1)

There was no indication of anything suspicious that would lead to RUOK not

accepting the audit of Brick Builders. / The reason for appointing new auditors

is not suspicious as RUOK was simply re-appointed. (1)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

The nature of the business, being a developer, manufacturer and importer of

educational toys, is not questionable and nothing changed in the nature of the

business of Brick Builders that could lead to RUOK not accepting the audit. (1)

The financial manager is a CA(SA) who is guided by the ethical considerations

of the Code of Professional Conduct. (1)

Financial considerations:

Brick Builders was incorporated in 1972 and have grown steadily ever since. (1)

Brick Builders has proven to be financially stable and should be able to pay the

audit fee. (1)

Auditor considerations:

Ethical matters

Section 280 – Objectivity (1)

A chartered accountant shall determine when providing any professional

service whether there are threats to compliance with the fundamental principle

of objectivity resulting from close personal relationships. (1)

A chartered accountant who provides an assurance service shall be

independent of the assurance client. Independence of mind and in appearance

is necessary to enable a charted accountant to express a conclusion, and be

seen to express a conclusion, without bias, conflict of interest, or undue

influence of others. (1)

The audit partner and the CEO, Kris Tiana, have been very close friends from

childhood. (1)

This creates a familiarity threat to objectivity. (1)

This threat will be significant if the necessary safeguards are not put in

place. (1)

Examples of such safeguards include:

o Withdrawing from the engagement team; (1)

o Supervisory procedures; (1)

o Terminating the financial or business relationship giving rise to the

threat; (1)

o Discussing the issue with higher levels of management within the audit firm;

and (1)

o Discussing the issue with those charged with governance of the client. (1)

o Adhering to the firm’s quality control procedures, by appointing a second

review partner. (1)

(maximum of 2)

Auditors’ knowledge and capabilities:

RUOK has performed the audit previously and therefore has obtained the

necessary skills and competences. (1)

The audit team have to visit the head office in Johannesburg and some of the

outlets. RUOK is a medium sized firm with 4 partners, 7 audit managers, 43

trainees. RUOK should have considered whether sufficient staff is available. It

seems as if the staff cohort at RUOK is large enough to perform the audit of

Brick Builders. (1)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

Terms of Engagement

There is no evidence that Brick Builders did not or will not agree to the

engagement terms. (1)

mark allocation: 1 mark per aspect, unless indicated otherwise available 25

maximum 20

PART 3 (9 marks)

RISK AT ASSERTION LEVEL FOR CASH AND CASH EQUIVALENTS

The primary underlying risk for cash and cash equivalents balance is

overstatement, as it is an asset (Existence). (1½)

There is a risk that transfers between bank accounts are not recorded, leading

to kiting (Existence). (1½)

There is a risk that the cash could be stolen from the petty cash at head office

/cash floats at the outlets as there are a lot of money available (Existence).

(1½)

There is a risk that all transactions do not have supporting documentation and

cannot be substantiated concealing fraudulent activities (either from bank

accounts, petty cash and shops) (Completeness/ Existence). (1½)

There is a risk that cash could be counted incorrectly at the shops due to the

vast amount of cash. (Completeness/ Existence) (1½)

There is a risk that not all the cash received from sales / floats at the outlets

have been included as the outlets are spread across South Africa and therefore

also not included in the bank account (Completeness). (1½)

There is a risk that not all the transactions, relating to the cash receipts from the

outlets or charges and interest on the bank account, are recorded as there could

be a delay in the banking processing (Completeness). (1½)

There is a risk that the cash sales information could be lost, as it is send

electronically and therefore may not be included in the bank balance

(Completeness). (1½)

There is a risk that the cash might not be banked daily, or included in the head

office schedule (Completeness). (1½)

There is a risk that the cash and cash equivalents are not correctly presented in

the financial statements accordance with legislation and accounting standards

(Presentation). (1½)

The entity has a foreign bank account that has to be converted into Rands, and

this conversion may be done at the incorrect rate (Accuracy, valuation and

allocation). (1½)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

The reconciliations done might not be accurate and could conceal the rolling of

cash. (Accuracy, valuation and allocation) (1½)

There are numerous bank accounts and it might be possible that amounts might

be allocated to the incorrect account (Accuracy, valuation and allocation could

also be classification) (1½)

The bank accounts might be offered as encumbered or presented as guarantee

(Rights and obligations) (1½)

There is a risk that the Reserve bank regulations regarding the foreign account

is not adhered to, leading to funds not being accessible. (Rights and obligations)

(1½)

mark allocation: 1½ mark per aspect, unless indicated otherwise available 22½

maximum 9

PART 4 (9 marks)

SUBSTANTIVE AUDIT APPROACH AND CIRCUMSTANCES AND FACTORS

WHICH MAY HAVE CONTRIBUTED TO RUOK’S DECISION TO FOLLOW A

SUBSTANTIVE AUDIT APPROACH

a) A substantive approach

A substantive approach means that the auditor has decided not to rely on the

entity’s internal controls. (1)

Therefore, when following a substantive audit approach, the auditor has decided

to audit the related account in the annual financial statements solely by means

of substantive procedures. (1)

Consequently, the required audit assurance is obtained through the

performance of substantive analytical procedures and tests of details. (2)

The auditor has to however, be satisfied that performing only substantive

procedures would be effective in reducing audit risk to an acceptable level. (1)

b) The circumstances and factors that may have contributed to RUOK’s decision

to follow a substantive audit approach

The auditor might decide to follow a substantive approach and not to obtain any

assurance from testing controls because of one of the following factors:

The controls in place do not relate to the relevant assertions. (1)

The controls in place were assessed as ineffective. (1)

Testing the controls is ineffective, in other words the auditor may have

determined that performing only substantive procedures would be more

effective and more efficient (time and cost) than performing tests of

controls as the cash transactions has decreased materially. (1)

The auditor may have identified a significant risk relating to all of the

assertions underlying cash and cash equivalents, in which case the auditor

has to perform substantive procedures and more specifically tests of

details. (1)

There is a smaller number of transactions. (1)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

Brick Builders’ cash balances will be audited at year end through bank

confirmations. (1)

The foreign exchange transactions should be audited through the use of

detail substantive procedures. (1)

c) Conclusion

I do not agree with this approach, because there seem to be effective controls

that the auditor will be able to rely on during the process (2)

A combined approach would be more effective. (1)

The different elements of the cash and cash equivalents will also be addressed

differently, for example petty cash is very small as well as the cash floats at the

shops and will not be tested in detail. (1)

The detail testing of controls of the bank transactions will be included and

addressed during the evaluation of the different business cycles, i.e. receipts

from sales or payment of expenses. (1)

More focus will be placed on the bank accounts and the balance at year end,

which will be verified by substantive procedures such as the bank confirmation

letters. (1)

mark allocation: 1 mark per aspect, unless indicated otherwise available 18

maximum 9

PART 5 (11 marks)

APPLICATION CONTROLS TO BE INCLUDED IN THE BRICK BUILDERS FAIR

ENTRY SYSTEM

The system should be user friendly with appropriate screen layouts, prompts

and error messages to assist in entering all the information. (1)

The system should require the minimum keying of information to reduce

possible input errors as far as possible for example requiring to enter the number

of adults, children and the ages of the children. (1)

The following input validation tests should be applied on the quantity fields:

Sign test, only positive numbers may be entered (1)

Alpha-numeric test, only numbers should be entered. (1)

Field presence test for the number of adults field to ensure all children are

accompanied by an adult. (General mention of field presence test/

mandatory fields, the mark is only awarded once) (1)

Field validation check (dependency check) on the number of children field,

as this field cannot contain a value, if the number of adults’ field is empty.

(1)

If the children field is selected, then another requirement should be added, such

as a dropdown menu with three options, under 3, between 3 and 12 and then

over 12. (1)

Grey shading of fields until certain criteria is met, for example greying out

children until adults is selected. (1)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

A reasonableness test could be performed on the number of tickets selected,

for example 50 tickets will not be accepted. (1)

The system should automatically calculate the amount due by the visitor(s) for

each transaction based on values entered for adults and children. (1)

The system should request the cashier to enter the amount received from the

visitors. (There could also be designated amount buttons to press, such as R200

or R100) (1)

If the amount is entered by the cashier, the system should perform the following

input validation tests on the amount field:

Field presence tests, so that an amount must be entered (only if students

did not address the designated buttons). (1)

Alpha-numeric test as only numbers should be entered. (1)

Sign test as all amounts should be positive. (1)

The correct amount of change due to the visitor should also be calculated and

displayed on the screen in view of the customer. (1)

The entrance ticket transaction file should be updated when the transaction is

finalised. (1)

Logs should be kept of all the transactions. (1)

mark allocation: 1 mark per aspect, unless indicated otherwise available 14

maximum 11

PART 6 (10 marks)

TEST OF CONTROLS ON THE SALES PROCESS AT THE BRICK BUILDERS FAIR

Observe the setup of the temporary shop for example the entry and exit points

to the shop and that the pay point is situated at the exit to ensure that there is

only one entry and exit point and the pay point is situated at the exit. (1½)

Enter a product code on the POS system and observe that the price of the

product automatically appears on the system to ensure that the selling price is

automatically recalled from the master file and displayed on the POS. (1½)

Compare the selling price that appears on the POS system with the selling price

on the masterfile for the specific product to ensure that the selling price that

appears on the POS agrees with the selling price on the Masterfile. (1½)

Try to change/ request the cashier to try and change the selling price displayed

on the POS system to ensure that no adjustments can be done to the selling

price on the POS system. (1½)

Observe the POS screen to ensure that the screen is positioned so that the

customer and cashier can view all details. (1½)

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

Re-perform the reconciliation between the printed sales receipts and cash and

debit/credit card slips to ensure that it was done correctly and agrees. (1½)

Inspect the sales summary for the signature of the cashier to ensure that the

reconciliation is done and the sales receipts agree to the sales summary. (1½)

Inspect the daily reconciliation for the signature of the manager to ensure that

the manager reviews the daily reconciliation. (1½)

Inspect a sample of reconciliations for the dates of the recons to ensure that it

was performed daily for the duration of the fair. (1½)

Enquire from manager as to the processes followed for recording and reviewing

of transactions/ Process if there is reconciling items identified. (1½)

mark allocation: 1 mark per aspect, unless indicated otherwise available 15

maximum 9

Communication skills: Clarity of expression 1

(Communication mark – properly formulated procedures and all should include “to

ensure”)

PART 7 (15 marks)

SUBSTANTIVE PROCEDURES ON RECORDING OF THE CONSIGNMENT

INVENTORY AT THE BRICK BUILDERS FAIR

Recalculate the reconciliation obtained from Noah to ensure that it is accurate.

(1½)

Scrutinise the reconciliation and the inventory lists for any unusual amounts, such

as negative amounts on the inventory lists. (1½)

Enquire from management as to the process followed to assign the other costs to

the inventory and also what they did then differences were identified. (1½)

Obtain the agreement between Brick Builders and the supplier and inspect it for

the following terms and conditions:

o Inventory for the fair will be invoiced in SA Rands. (1½)

o All related costs to inventory is included in the SA Rands tariff to ensure that

no additional costs should be included. (1½)

o The inventory will be delivered on consignment for the fair to ensure that the

ownership is not transferred. (1½)

o That Brick Builders have the option to keep the inventory or to return the

inventory after the fair. (1½)

o That Brick Builders are liable for any stock losses. (1½)

For the total amount from the supplier (Cost per unit will be calculated based on the

cost from the supplier and also other costs incurred)

Obtain the original Supplier Consignment report and recalculate the total value of

the report as well as the total value of the specific deliveries by multiplying the

10

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

quantities with the price, to ensure it was done correctly (Cast and cross cast).

(1½)

Agree the amount per the Supplier Consignment report to the amount included in

the reconciliation. (1½)

Inspect the original supplier invoice that it is denominated in SA Rand and agree

the amount per unit to the amounts used on the report. (1½)

Inspect the supporting documentation for the other costs incurred and add it all

together. (1½)

o Divide the amount calculated to determine the cost to be assigned to each

unit and agree that amount to amount used in the report. (1½)

Recalculate the unit price for units by adding the supplier cost and the other cost.

(1½)

For inventory sold at the fair

Accumulate the daily sales of the fair from the sales journal (1½)

Recalculate the cost of sales using the 20% gross profit percentage and agree the

amount to the amount on the reconciliation. (1½)

For List A and B

Select a sample of items from both lists and agree the prices per unit to the Supplier

Consignment report prices used. (1½)

o And agree the quantities on the lists to the respective count sheets. (1½)

Recalculate the price x quantities and also the total for the list. (Cast and cross

cast) (1½)

Agree the total amount of List A and List B to the amounts on the reconciliation for

inventory bought and inventory returned. (Will also be awarded if only 1 list is

mentioned, but only once.) (1½)

Inspect the inventory records at year end to determine that the inventory on list A

is included in the records and that inventory on list B is excluded. (1½)

Inspect the adjusting journal for the write off of the inventory that could not be

accounted for to ensure that it is correctly debited to inventory write-off/ cost of

sales and credited to the creditor. (1½)

mark allocation: 1½ marks per aspect, unless indicated otherwise available 25½

maximum 14

Communication skills: Clarity of expression 1

11

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

PART 8 (7 marks)

AUDIT PROCEDURES REQUIRED TO BE PERFORMED, IN ORDER TO

DETERMINE WHETHER RUOK COULD RELY ON THE WORK OF INTERNAL

AUDIT

Coordination of work to be performed

Discuss the planned use of the specific work of the internal audit function that

RUOK intends to rely on, with the internal audit function to coordinate the

activities. (1½)

Enquire from the internal audit function on whether they understand the scope

of the work to be performed and what items and shops should be focussed on.

(1½)

Evaluate the appropriateness of work previously performed

Read (review) the other report(s) and documents of the internal audit function

to determine the overall efficiency and reliability of the work performed. (1½)

Evaluate the appropriateness of the work to be relied upon

Inspect the working papers for the specific work performed and determine

whether:

The work had been properly planned, performed, supervised, reviewed

and documented. (1½)

The work has been conducted in a consistent and disciplined

manner. (1½)

Sufficient appropriate evidence had been obtained to enable reasonable

conclusions to be drawn. (1½)

Conclusions reached are appropriate in the circumstances and consistent

with the results of the work performed. (1½)

Enquire from the internal audit function on the procedures followed when

unusual items or differences were identified/ Problems were

incurred. (1½)

Evaluate whether the external auditor’s conclusions regarding the internal audit

function, overall, and in relation to using its work, remains appropriate. (1½)

Organisational status

Inspect the minutes of the audit committee meetings to ensure that the internal

audit reports to them. (1½)

Inspect the qualifications and experience of the internal auditors to ensure that

they are qualified to perform such procedures. (1½)

Enquire from those charged with governance as to the overall organisational

status of the internal audit function, such as regard in the organisation, whether

they have a chief audit executive, whether they are seen as an independent

unit. (1½)

mark allocation: 1½ mark per aspect, unless indicated otherwise available 18

maximum 7

Communication skills: proper formulation of a procedure 1

12

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

PART 9.1 (15 marks)

SCHEDULE OF UNADJUSTED DIFFERENCES

# Description Assets Liabilities Equity / retained Factual/

earnings Judgmental/

Projected

Dr Cr Dr Cr Dr Cr

1 Loss on sale 878 057 Factual (1)

of asset (½) (½)

Sundry 878 057

debtors (½) (½)

2.1 Cash losses 12 000 Projected /

(fraud) (½) (½) judgmental (1)

Stationery 12 000

(½) (½)

2.2 Creditors 75 000 Factual (1)

(½) (½)

Inventory 75 000

(½) (½)

Total 953 057 75 000 0 890 057 12 000 (1)

(10 marks)

Matter 1:

This is an adjusting event, as the matter already existed at year end and now

additional information has become available. (1)

Matter 1 is quantitatively material as the amount of R878 057 exceeds the

materiality figure of R480 000. (1)

The auditors should request management to adjust the financial statements

with the R878 057. (1)

Matter 2:

Misstatement 2.1 (½) and 2.2 (½) are not quantitatively material as they are

below the materiality figure. (1)

However misstatement 2.1 is qualitatively material as it relates to fraud. (1)

The auditors should request from management to adjust the financial

statements with at least matter 2.1. (1)

Matter 3:

This is a non-adjusting event that occurred subsequent to the reporting period.

(1)

Matter 3 is quantitatively material as it exceeds the materiality figure. (1)

It is also qualitatively material, as the non-disclosure affect the judgement of the

users of the financial statements. (1)

It would not be included in the schedule of unadjusted differences as it occurred

subsequent to year end. (1)

The auditors should ensure that management has disclosed the matter properly

in the financial statements. (1)

mark allocation: 1 mark per aspect, unless indicated otherwise available 20

maximum 15

13

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

lOMoARcPSD|4334736

PART 9.2 (6 marks)

EFFECT ON AUDIT OPINION

Matter 1:

If the amount is not adjusted in the financial statements there is a material

uncorrected misstatement in the financial statements. (Classification and

considerations of materiality has already been discussed – factual

misstatement and it is material) (1)

The matter is material, but not pervasive (½), because it is isolated to specific

items on the financial statements and it does not form a substantial part of the

financial statements (½). (1)

Therefore a qualified opinion will be expressed, which contains the wording

“except for”. (1)

Matter 3:

The auditor has not issued his audit report yet and is in a position to modify the

audit opinion. (1)

This is a material factual uncorrected misstatement. (mark will only be awarded

once, either here or in 9.1) (1)

As the failure to disclose the information is unlikely to be fundamental to the

users’ understanding of the financial statements (i.e. not affecting the going

concern) (½), its effect is not pervasive (½). (1)

Therefore a qualified “except for” opinion should be expressed. (1)

mark allocation: 1 mark per aspect, unless indicated otherwise available 6

maximum 5

Communication skills: Logical argument 1

14

Downloaded by Genevieve Sandwell (u18094865@tuks.co.za)

You might also like

- Literary Analysis - The NecklaceDocument5 pagesLiterary Analysis - The NecklaceDanny Hoi33% (3)

- Chapter 1 - Buyback Additional QuestionsDocument9 pagesChapter 1 - Buyback Additional QuestionsMohammad ArifNo ratings yet

- Tokenization: Practitioner Point of View: All You Need To Know To Tokenize Successfully Any AssetDocument18 pagesTokenization: Practitioner Point of View: All You Need To Know To Tokenize Successfully Any AssetCleórbete Santos100% (1)

- Unilag MSC Economics SAMPLEDocument3 pagesUnilag MSC Economics SAMPLEbdian100% (2)

- Bir Ruling - Exemption of Donation From DSTDocument10 pagesBir Ruling - Exemption of Donation From DSTDenise Capacio LirioNo ratings yet

- Topic 6 - Winding Up Ca 2016-1Document25 pagesTopic 6 - Winding Up Ca 2016-1Maisarah ShahNo ratings yet

- Topic 6 - Winding Up CA 2016Document25 pagesTopic 6 - Winding Up CA 2016Umar Razak100% (1)

- Registered ValueDocument9 pagesRegistered ValueSangram PandaNo ratings yet

- Unit 5Document6 pagesUnit 5Subha LakshmiNo ratings yet

- Company Law Anil k NairDocument154 pagesCompany Law Anil k NairAadith AarjayNo ratings yet

- Company Law Anil K NairDocument154 pagesCompany Law Anil K NairAyush ThumbarathyNo ratings yet

- Chapter-6A-Compromise & Arrangement-F - (250-258)Document9 pagesChapter-6A-Compromise & Arrangement-F - (250-258)s.super2018No ratings yet

- Types of Resolutions Under Companies ActDocument9 pagesTypes of Resolutions Under Companies ActAnil SonarNo ratings yet

- Chapter 5 Compormises and ArrangementDocument41 pagesChapter 5 Compormises and ArrangementDeepsikha maitiNo ratings yet

- Law of Insolvency PresentationDocument39 pagesLaw of Insolvency PresentationSiva NanthaNo ratings yet

- Vdocuments - MX - Fria Flow Chart Final 1 PDFDocument44 pagesVdocuments - MX - Fria Flow Chart Final 1 PDFM Grazielle EgeniasNo ratings yet

- Squish Corp Has Two Divisions Production Which Makes Pillow FoamDocument1 pageSquish Corp Has Two Divisions Production Which Makes Pillow FoamAmit PandeyNo ratings yet

- LAW Imp Sections PDFDocument7 pagesLAW Imp Sections PDFShailesh GajjarNo ratings yet

- Shareholder MeetingDocument4 pagesShareholder MeetingyusehaiNo ratings yet

- COMPANY LAW (Guideline Answers) : Intermediate ExaminationDocument14 pagesCOMPANY LAW (Guideline Answers) : Intermediate Examinationjeevan_v_mNo ratings yet

- Stage Codes ISODocument1 pageStage Codes ISOEshario RenoNo ratings yet

- Company Law (602) : Item Text Option Text 1 Option Text 2 Option Text 3 Option Text 4Document2 pagesCompany Law (602) : Item Text Option Text 1 Option Text 2 Option Text 3 Option Text 4Xiaomi TvNo ratings yet

- FFB ConstitutionDocument70 pagesFFB ConstitutionNatalie EeeNo ratings yet

- Oppo PDFDocument41 pagesOppo PDFSatyam ThakurNo ratings yet

- Delegation of Authority: Duluxgroup LimitedDocument7 pagesDelegation of Authority: Duluxgroup LimitedGaurav WadhwaNo ratings yet

- WWW - Edutap.co - In: Chapter IV of Companies Act - Share Capital & DebenturesDocument17 pagesWWW - Edutap.co - In: Chapter IV of Companies Act - Share Capital & DebenturesJohn AllenNo ratings yet

- Chapter 13 - PCDocument15 pagesChapter 13 - PCnkgoengdunstanNo ratings yet

- Constitution (Bursa)Document71 pagesConstitution (Bursa)Wan Mohd Rushdi AbdullahNo ratings yet

- ProspectusDocument9 pagesProspectusNarasimhaModugulaNo ratings yet

- Flowchart (PAB Lecture)Document32 pagesFlowchart (PAB Lecture)Йонас Руэл100% (1)

- Slides (5) 副本3Document36 pagesSlides (5) 副本3Andrew ChanNo ratings yet

- 中 電 控 股 有 限 公 司 CLP Holdings Limited: (incorporated in Hong Kong with limited liability)Document4 pages中 電 控 股 有 限 公 司 CLP Holdings Limited: (incorporated in Hong Kong with limited liability)ThomasNo ratings yet

- AmalgamationDocument34 pagesAmalgamationsedida1374No ratings yet

- Book of Financial Powers-GENCOsDocument28 pagesBook of Financial Powers-GENCOsHaider AliNo ratings yet

- Corporations Questions: Not Considered A Characteristic of TheDocument5 pagesCorporations Questions: Not Considered A Characteristic of TheHiren BakraniaNo ratings yet

- CRG Directors Part 2Document23 pagesCRG Directors Part 2maiztulshahirahNo ratings yet

- Types of Resolutions Under Companies Act, 1956Document6 pagesTypes of Resolutions Under Companies Act, 1956Soumitra Chawathe0% (1)

- Voluntary WU.Document19 pagesVoluntary WU.Zerq InDaHausNo ratings yet

- Summary Class 11 12Document2 pagesSummary Class 11 12jroflcopterNo ratings yet

- JGSHI Supplier Accreditation PolicyDocument5 pagesJGSHI Supplier Accreditation PolicyRaven VergaraNo ratings yet

- FsfsefsefDocument5 pagesFsfsefsefDaniyal Zahid ButtNo ratings yet

- CMA Final Corporate Laws & Compliance Solution Dec 2019Document20 pagesCMA Final Corporate Laws & Compliance Solution Dec 2019komalc2026No ratings yet

- MBSB - Notice of 54th AGM 20240429Document1 pageMBSB - Notice of 54th AGM 20240429Wong Choon HongNo ratings yet

- Dec 2009Document14 pagesDec 2009Murugesh Kasivel EnjoyNo ratings yet

- Planning Permit Process: Planning Department Office: 1 Market Place Postal: Locked Bag 685Document2 pagesPlanning Permit Process: Planning Department Office: 1 Market Place Postal: Locked Bag 685Bennet LawNo ratings yet

- CA Inter Law Suggested Answer Nov 2022Document20 pagesCA Inter Law Suggested Answer Nov 2022V DHARSHININo ratings yet

- Frameword OtspolcyDocument741 pagesFrameword Otspolcyd_narnoliaNo ratings yet

- VadodaraDocument10 pagesVadodaraAnita NautiyalNo ratings yet

- Chart Book - Corporate Restructuring Insolvency Liquidation and Winding Up - CS Vaibhav Chitlangia - Yes Academy, PuneDocument47 pagesChart Book - Corporate Restructuring Insolvency Liquidation and Winding Up - CS Vaibhav Chitlangia - Yes Academy, PuneJohn carollNo ratings yet

- Acc 109 P3 EXAM AUDocument20 pagesAcc 109 P3 EXAM AUKathleen J. GonzalesNo ratings yet

- Filing of Form MGT-14 For Special Resolutions - Companies Act 2013Document7 pagesFiling of Form MGT-14 For Special Resolutions - Companies Act 2013Krishnendu BhattacharyyaNo ratings yet

- Chapter 4Document9 pagesChapter 4Prince S'Luu HitiNo ratings yet

- Corporate Restructuring Takeover, Buy Back & Delisting: Manoj KumarDocument41 pagesCorporate Restructuring Takeover, Buy Back & Delisting: Manoj KumarVasudev lahotiNo ratings yet

- Dissolution of CVDocument1 pageDissolution of CVNurtri KevianaNo ratings yet

- Corporate GovernanceDocument14 pagesCorporate GovernanceRajesh SharmaNo ratings yet

- SF Substantial Property Transactions v1Document26 pagesSF Substantial Property Transactions v1Aimi AzemiNo ratings yet

- Dissolution of CVDocument1 pageDissolution of CVNurtri KevianaNo ratings yet

- Generalprocedure Export PDFDocument20 pagesGeneralprocedure Export PDFUTTAL RAYNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument20 pagesFinal Examination: Suggested Answers To QuestionsidealNo ratings yet

- Lecture 8 - Companies Winding UpDocument47 pagesLecture 8 - Companies Winding Up1181100577No ratings yet

- Form MGT-7-12042016 - SignedDocument15 pagesForm MGT-7-12042016 - SignedPavan SAMEER KUMARNo ratings yet

- Sarbanes-Oxley and the Board of Directors: Techniques and Best Practices for Corporate GovernanceFrom EverandSarbanes-Oxley and the Board of Directors: Techniques and Best Practices for Corporate GovernanceNo ratings yet

- Lincoln Philippine Life Insurance Company, Inc Vs CADocument10 pagesLincoln Philippine Life Insurance Company, Inc Vs CAJazem AnsamaNo ratings yet

- Secretary's CertificateDocument2 pagesSecretary's CertificateRhyz Taruc-ConsorteNo ratings yet

- No.: - Date: - Agency FundDocument12 pagesNo.: - Date: - Agency Fundlegal.darposaranganiNo ratings yet

- Yale EndowmentDocument40 pagesYale Endowmentpurple_panda_pantsNo ratings yet

- Hizar Assignment (4)Document10 pagesHizar Assignment (4)Sohail KhanNo ratings yet

- Income Tax AccountingDocument24 pagesIncome Tax AccountingSYED WAFI100% (1)

- Anon - Housing Thesis 09 12 2011Document22 pagesAnon - Housing Thesis 09 12 2011cnm3dNo ratings yet

- Uttara Bank-Financial PerformenceDocument50 pagesUttara Bank-Financial Performencesumaiya sumaNo ratings yet

- ForfaitingDocument14 pagesForfaitingArun Sharma100% (1)

- 49 Sy Chim v. Sy Siy Ho & Sons, IncDocument35 pages49 Sy Chim v. Sy Siy Ho & Sons, IncBianca LaderaNo ratings yet

- 3.equity Measurement & Management SystemDocument26 pages3.equity Measurement & Management SystemShobhit BoseNo ratings yet

- Ibc 2016Document74 pagesIbc 2016Roshini Chinnappa100% (1)

- Test Bank Cost Accounting 6e by Raiborn and Kinney Chapter 13 PDFDocument44 pagesTest Bank Cost Accounting 6e by Raiborn and Kinney Chapter 13 PDFFaye Noreen FabilaNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Reckitt BenckiserDocument55 pagesReckitt BenckiserSiddhant Chandel100% (5)

- Business Mathematics: Bba (General)Document30 pagesBusiness Mathematics: Bba (General)Mohit Kapoor0% (1)

- Sale Under TpaDocument16 pagesSale Under Tpashubham100% (3)

- Romnick Bajin - Audit ProgramDocument23 pagesRomnick Bajin - Audit ProgramGm ArchangelNo ratings yet

- Risk ManagementDocument27 pagesRisk ManagementCharu Modi100% (1)

- TSA: James D. Hamilton, Time Series Analysis, Princeton University Press, 1994Document6 pagesTSA: James D. Hamilton, Time Series Analysis, Princeton University Press, 1994aroelmathNo ratings yet

- Introduction To Financial AccountingDocument19 pagesIntroduction To Financial AccountingRONALD SSEKYANZINo ratings yet

- What Is Token?: TrustDocument5 pagesWhat Is Token?: TrustBÙI NGUYÊN LUẬN - VIOLYMPIC TOÁNNo ratings yet

- Hearing TranscriptDocument30 pagesHearing TranscriptDeadspinNo ratings yet

- Your Bill For Mobile Services: Summary of This Bill Period ChargesDocument14 pagesYour Bill For Mobile Services: Summary of This Bill Period ChargesUjjwalPratapSinghNo ratings yet

- Faq Hire Purchase CarloanDocument7 pagesFaq Hire Purchase CarloanIkhwan MohamadNo ratings yet

- Ch18 - Parkin - Econ - Lecture PresentationDocument52 pagesCh18 - Parkin - Econ - Lecture PresentationImam AmbaryNo ratings yet