Professional Documents

Culture Documents

The Following Information Is For The Newport Stationery Store Balance Sheet

The Following Information Is For The Newport Stationery Store Balance Sheet

Uploaded by

Amit PandeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Following Information Is For The Newport Stationery Store Balance Sheet

The Following Information Is For The Newport Stationery Store Balance Sheet

Uploaded by

Amit PandeyCopyright:

Available Formats

Solved: The following information is for the Newport

Stationery Store Balance Sheet

The following information is for the Newport Stationery Store Balance Sheet

The following information is for the Newport Stationery Store.

Balance Sheet Information as of September 30

Current assets:

Cash ................... $ 14,400

Accounts receivable ............. 12,000

Inventory ................. 76,320

Equipment, net .............. 120,000

Liabilities ................ None

Recent and Anticipated Sales

September ............... $48,000

October ................ 57,600

November ............... 72,000

December ............... 96,000

January ................ 43,200

• Credit sales. Sales are 75% for cash and 25% on credit. Assume that credit accounts are all

collected in the month following the sale. The accounts receivable on September 30 are the

result of the credit sales for September (25% of $48,000). Gross margin averages 30% of sales.

Newport treats cash discounts on purchases in the income statement as “other income.”

• Operating costs. Salaries and wages average 15% of monthly sales; rent, 5%; other operating

costs, excluding amortization, 4%. Assume that these costs are disbursed each month.

Amortization is $1,200 per month.

• Purchases. Newport keeps a minimum inventory of $36,000. The policy is to purchase

additional inventory each month in the amount necessary to provide for the following month’s

Reach out to freelance2040@yahoo.com for enquiry.

sales. Terms on purchases are 2/10, n/30: a 2% discount is available if the payment is made

within ten days after purchase; no discount is available if payment is made beyond ten days

after purchase; and the full amount is due within thirty days. Assume that payments are made in

the month of purchase and that all discounts are taken.

• Light fixtures. The expenditures for light fixtures are $720 in October and $480 in November.

These amounts are to be capitalized.

Assume that a minimum cash balance of $9,600 must be maintained. Assume also that all

borrowing is effective at the beginning of the month and all repayments are made at the end of

the month of repayment. Loans are repaid when sufficient cash is available. Interest is paid only

at the time of repaying principal. The interest rate is 18% per year. Management does not want

to borrow any more cash than is necessary and wants to repay as soon as cash is available.

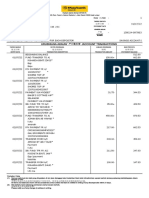

Schedule E

Budgeted Cash Receipts and Disbursements

REQUIRED

1. Based on the preceding facts, complete schedule A.

2. Complete schedule B. Note that purchases are 70% of next month’s sales.

3. Complete schedule C.

4. Complete schedule D.

5. Complete schedule E.

6. Complete schedule F. (Assume that borrowings must be made in multiples of $1,000.)

7. What do you think is the most logical type of loan needed by Newport? Explain your

reasoning.

8. Prepare a budgeted income statement for the fourth quarter and a budgeted balance sheet

as of December 31. Ignore income taxes.

9. Some simplifications have been introduced in this problem. What complicating factors would

be met in a typical business situation?

Reach out to freelance2040@yahoo.com for enquiry.

The following information is for the Newport Stationery Store Balance Sheet

ANSWER

https://solvedquest.com/the-following-information-is-for-the-newport-stationery-store-balance-

sheet/

Reach out to freelance2040@yahoo.com for enquiry.

Powered by TCPDF (www.tcpdf.org)

You might also like

- Questions On Cash Budgets 1 1Document12 pagesQuestions On Cash Budgets 1 1MsKhan0078100% (1)

- Indian School of BusinessDocument5 pagesIndian School of BusinessAnujain JainNo ratings yet

- Your Company Is Considering Investing in Its Own Transport FleetDocument2 pagesYour Company Is Considering Investing in Its Own Transport FleetAmit Pandey0% (1)

- Hillyard CompanyDocument18 pagesHillyard CompanyShellyn Erespe Gomez100% (4)

- Camp and Fevurly Financial Planners Have Forecasted Revenues For TheDocument1 pageCamp and Fevurly Financial Planners Have Forecasted Revenues For TheTaimour HassanNo ratings yet

- 3.7 ExercisesDocument6 pages3.7 ExercisesGeorgios MilitsisNo ratings yet

- Yummi Lik Makes Really Big Lollipops in Two Sizes Large andDocument2 pagesYummi Lik Makes Really Big Lollipops in Two Sizes Large andAmit PandeyNo ratings yet

- Short Term Financial PlanningDocument8 pagesShort Term Financial PlanningHassan MohsinNo ratings yet

- 1 ACC 2234 Hand-In Assignment 1 v2 2019Document4 pages1 ACC 2234 Hand-In Assignment 1 v2 2019Sameer Shabbir0% (2)

- You Are Employed As The Assistant Accountant in Your CompanyDocument1 pageYou Are Employed As The Assistant Accountant in Your CompanyAmit PandeyNo ratings yet

- York PLC Was Formed Three Years Ago by A GroupDocument2 pagesYork PLC Was Formed Three Years Ago by A GroupAmit PandeyNo ratings yet

- X PLC Manufactures Product X Using Three Different Raw MaterialsDocument2 pagesX PLC Manufactures Product X Using Three Different Raw MaterialsAmit Pandey100% (1)

- Wise Company Began Operations at The Beginning of 2018 TheDocument2 pagesWise Company Began Operations at The Beginning of 2018 TheAmit PandeyNo ratings yet

- Winter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsDocument1 pageWinter Sports Manufacture Snowboards Its Cost of Making 2 100 BindingsAmit PandeyNo ratings yet

- When The Fraud at Pepsico Occurred The Company Had FiveDocument2 pagesWhen The Fraud at Pepsico Occurred The Company Had FiveAmit PandeyNo ratings yet

- Warren S Sporting Goods Store Sells A Variety of Sporting GoodsDocument2 pagesWarren S Sporting Goods Store Sells A Variety of Sporting GoodsAmit PandeyNo ratings yet

- Retrieve DocumentDocument4 pagesRetrieve DocumentStrahinja AndreasNo ratings yet

- Prepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4UDocument31 pagesPrepare A Cash Budget - by Quarter and in Total ... - GlobalExperts4USaiful IslamNo ratings yet

- Cash Budgets 2Document9 pagesCash Budgets 2Kopanang LeokanaNo ratings yet

- AE24 Lesson 5Document9 pagesAE24 Lesson 5Majoy BantocNo ratings yet

- BudgetDocument6 pagesBudgetshobuzfeni100% (1)

- Nordic CompanyDocument6 pagesNordic CompanySally ZansNo ratings yet

- FSA M.com IVDocument5 pagesFSA M.com IVAli HaiderNo ratings yet

- Cash Budgeting TutorialDocument4 pagesCash Budgeting Tutorialmichellebaileylindsa100% (1)

- Asignación 4 LSFPDocument3 pagesAsignación 4 LSFPElia SantanaNo ratings yet

- Cash Budget - Cash Budgeting:: Definition and ExplanationDocument5 pagesCash Budget - Cash Budgeting:: Definition and ExplanationPrajay KhNo ratings yet

- BU127 Quiz Q&aDocument14 pagesBU127 Quiz Q&aFarah Luay AlberNo ratings yet

- Econ 3a Midterm 1 WorksheetDocument21 pagesEcon 3a Midterm 1 WorksheetZyania LizarragaNo ratings yet

- 100 S-Fundamental Accounting R 2014Document9 pages100 S-Fundamental Accounting R 2014api-250674550No ratings yet

- KTQT LMS1 27 - 08Document14 pagesKTQT LMS1 27 - 08Khánh Vy Hà VũNo ratings yet

- C 10chap10Document103 pagesC 10chap10Aya ObandoNo ratings yet

- Financial Accounting Final AssessmentDocument17 pagesFinancial Accounting Final AssessmentroydkaswekaNo ratings yet

- Business Finance: Formula and Budget PreparationDocument15 pagesBusiness Finance: Formula and Budget PreparationJims OlanoNo ratings yet

- S 2 Accounting Paper 1 (Final)Document15 pagesS 2 Accounting Paper 1 (Final)Muhammad Salim Ullah KhanNo ratings yet

- Financial Accounting Test One (01) James MejaDocument21 pagesFinancial Accounting Test One (01) James MejaroydkaswekaNo ratings yet

- Institute of Business Management Final Assessment - Spring 2020Document6 pagesInstitute of Business Management Final Assessment - Spring 2020Shaheer KhurramNo ratings yet

- Incomplete Records - Principles of AccountingDocument8 pagesIncomplete Records - Principles of AccountingAbdulla Maseeh100% (2)

- Budgeted Cash Disbursements For Merchandise PurchasesDocument27 pagesBudgeted Cash Disbursements For Merchandise PurchasesMavis LiuNo ratings yet

- Cash Book - Principles of AccountingDocument13 pagesCash Book - Principles of AccountingAbdulla MaseehNo ratings yet

- Chapter 7 PracticeDocument9 pagesChapter 7 Practicehola holaNo ratings yet

- Unit 2 TestDocument7 pagesUnit 2 TestThetMon HanNo ratings yet

- AP - Audit of CashDocument4 pagesAP - Audit of CashRose CastilloNo ratings yet

- Exercise For Mid TestDocument11 pagesExercise For Mid TestNadia NathaniaNo ratings yet

- 3.00 Points: Problem 4-19 Schedule of Cash Receipts (LO2)Document11 pages3.00 Points: Problem 4-19 Schedule of Cash Receipts (LO2)Ebtisam. G.aNo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- Acca Paper F3 / Fia Ffa Financial Accounting: May 2014 For Marking)Document11 pagesAcca Paper F3 / Fia Ffa Financial Accounting: May 2014 For Marking)bingbongmyloveNo ratings yet

- Sales BudgetDocument57 pagesSales BudgetBea NicoleNo ratings yet

- Regression Analysis MethodDocument6 pagesRegression Analysis MethodMiccah Jade CastilloNo ratings yet

- Cash Budgeting and Fraud Management: Topic 4Document16 pagesCash Budgeting and Fraud Management: Topic 4sv03No ratings yet

- 1098Document30 pages1098heyderbequioNo ratings yet

- FINAN204-23A - Tutorial 3Document19 pagesFINAN204-23A - Tutorial 3Xiaohan LuNo ratings yet

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Revision - Gacc102Document13 pagesRevision - Gacc102Khang VũNo ratings yet

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoNo ratings yet

- Working Capital ManagementDocument67 pagesWorking Capital ManagementAam aadmiNo ratings yet

- Exercises Budgeting ACCT2105 3s2010Document7 pagesExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Modul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662Document30 pagesModul Akuntansi Manajemen II 2019-2020-Converted-Converted - 209630662hendy DidoNo ratings yet

- Cash To Accrual Basis of AccountingDocument6 pagesCash To Accrual Basis of AccountingChocobetternotNo ratings yet

- Lecture Budgeting Trading Co 205Document4 pagesLecture Budgeting Trading Co 205Sh Mati Elahi0% (3)

- Required: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterDocument6 pagesRequired: Using The Data Above, Complete The Following Statements and Schedules For The First QuarterteferiNo ratings yet

- Auditing 2019 P S CH 8Document16 pagesAuditing 2019 P S CH 8barakat801No ratings yet

- Intermidate AssignmentDocument6 pagesIntermidate AssignmentTahir DestaNo ratings yet

- Accouting Test V2.1finalDocument5 pagesAccouting Test V2.1finalShamel LaylaNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Financial Management PORTFOLIO MidDocument8 pagesFinancial Management PORTFOLIO MidMyka Marie CruzNo ratings yet

- Cash BudgetingDocument5 pagesCash BudgetingAnissa GeddesNo ratings yet

- C02 Sample Questions Feb 2013Document20 pagesC02 Sample Questions Feb 2013Elizabeth Fernandez100% (1)

- tổng hợp đề KTQT 2Document60 pagestổng hợp đề KTQT 2NHI HUYNH MANNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- Your Company Produces Cookies in A Two Step Process The MixingDocument1 pageYour Company Produces Cookies in A Two Step Process The MixingAmit PandeyNo ratings yet

- Xander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXander Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- You Have Recently Been Hired by Layton Motors Inc LmiDocument1 pageYou Have Recently Been Hired by Layton Motors Inc LmiAmit PandeyNo ratings yet

- Zanella S Smart Shawls Inc Is A Small Business That ZanellaDocument1 pageZanella S Smart Shawls Inc Is A Small Business That ZanellaAmit PandeyNo ratings yet

- Xellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetDocument2 pagesXellnet Provides e Commerce Software For The Pharmaceuticals Industry XellnetAmit PandeyNo ratings yet

- Xerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeDocument2 pagesXerxes Manufacturing Company Manufactures Blue Rugs Using Wool and DyeAmit PandeyNo ratings yet

- Zits LTD Makes Two Models For Rotary Lawn Mowers TheDocument1 pageZits LTD Makes Two Models For Rotary Lawn Mowers TheAmit PandeyNo ratings yet

- You Have Been Asked To Assist The Management of IronwoodDocument2 pagesYou Have Been Asked To Assist The Management of IronwoodAmit PandeyNo ratings yet

- Video Technology PLC Was Established in 1987 To Assemble VideoDocument3 pagesVideo Technology PLC Was Established in 1987 To Assemble VideoAmit PandeyNo ratings yet

- Watercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetDocument2 pagesWatercooler Office Supply S March 31 2016 Balance Sheet Follows The BudgetAmit PandeyNo ratings yet

- Xy Limited Commenced Trading On 1 February With Fully PaidDocument2 pagesXy Limited Commenced Trading On 1 February With Fully PaidAmit PandeyNo ratings yet

- Wild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsDocument1 pageWild Ride Manufactures Snowboards Its Cost of Making 1 900 BindingsAmit PandeyNo ratings yet

- Williams and Dimaggio Architects Have Been Using A Simplified CostingDocument1 pageWilliams and Dimaggio Architects Have Been Using A Simplified CostingAmit PandeyNo ratings yet

- Wildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsDocument1 pageWildride Sports Manufactures Snowboards Its Cost of Making 24 900 BindingsAmit PandeyNo ratings yet

- Warren LTD Is To Produce A New Product in ADocument2 pagesWarren LTD Is To Produce A New Product in AAmit PandeyNo ratings yet

- Wholesome and Happy Foods Is A Farm To Family Grocery Store LocatedDocument1 pageWholesome and Happy Foods Is A Farm To Family Grocery Store LocatedAmit PandeyNo ratings yet

- Wilson Manufacturing Inc Has Implemented Lean Manufacturing IDocument1 pageWilson Manufacturing Inc Has Implemented Lean Manufacturing IAmit PandeyNo ratings yet

- Visit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Document1 pageVisit WWW Pearsonhighered Com Horngren To View A Link To Starbucks Corporation 2011Amit PandeyNo ratings yet

- West Coast Designs Produces Three Products Super Deluxe and GDocument1 pageWest Coast Designs Produces Three Products Super Deluxe and GAmit PandeyNo ratings yet

- Vassar Corp Has Incurred Substantial Losses For Several Years ADocument2 pagesVassar Corp Has Incurred Substantial Losses For Several Years AAmit PandeyNo ratings yet

- Wilson Manufacturing Started in 2014 With The Following Account BalancesDocument1 pageWilson Manufacturing Started in 2014 With The Following Account BalancesAmit PandeyNo ratings yet

- PPT On Raghunandan MoneyDocument17 pagesPPT On Raghunandan MoneyAmarkantNo ratings yet

- QNB Tariff of ChangeDocument7 pagesQNB Tariff of ChangeIrfan Noor HidayatNo ratings yet

- Accounting For Business CombinationsDocument13 pagesAccounting For Business CombinationsDan MorettoNo ratings yet

- Yale University - Financial Market CourseDocument26 pagesYale University - Financial Market CourseNitendo CubeNo ratings yet

- Ventura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Document5 pagesVentura, Mary Mickaella R - Noncurrentassetsheldforsale (2) - Group 3Mary VenturaNo ratings yet

- Ibs Ipoh Main, Jsis 1 31/07/22Document6 pagesIbs Ipoh Main, Jsis 1 31/07/22azman ab wahabNo ratings yet

- AnnexDocument10 pagesAnnexapi-3810664No ratings yet

- Chola MS Insurance Annual Report 2019 20Document139 pagesChola MS Insurance Annual Report 2019 20happy39No ratings yet

- People of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Document3 pagesPeople of The Phils. v. Gilbert Reyes Wagas, G.R. No. 157943, September 4, 2013Lexa L. DotyalNo ratings yet

- Texas Certified Lienholders ListDocument62 pagesTexas Certified Lienholders ListJose CeceñaNo ratings yet

- Field Report JackyDocument31 pagesField Report JackyGracey KinimoNo ratings yet

- QuarterlyBo 12081800 80530853 30062022Document1 pageQuarterlyBo 12081800 80530853 30062022Hrishikesh BedreNo ratings yet

- Financial ControllershipDocument7 pagesFinancial ControllershipKaye LaborteNo ratings yet

- Ais255 Case StudyDocument4 pagesAis255 Case StudyNoor SyazaniNo ratings yet

- Black Book Project With CorrectionDocument80 pagesBlack Book Project With CorrectionAbhishek BandalNo ratings yet

- Module 8Document3 pagesModule 8Rainielle Sy DulatreNo ratings yet

- Card ConfirmationDocument1 pageCard Confirmationkilo6954No ratings yet

- ApplicationDocument5 pagesApplicationAkula Gopi KrishnaNo ratings yet

- Item Description Start Date End Date Unit Price Qty Amount VAT Rate% NoteDocument2 pagesItem Description Start Date End Date Unit Price Qty Amount VAT Rate% NoteDisthira RahadiNo ratings yet

- Module 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikDocument21 pagesModule 3: Nominal and Effective Interest Rates: SI-4151 Ekonomi TeknikSanjika IlhamNo ratings yet

- Monetary PolicyDocument9 pagesMonetary Policyrahul5335No ratings yet

- AEC MANUAL Class NotesDocument65 pagesAEC MANUAL Class NotesManimegalai.VNo ratings yet

- OpTransactionHistoryUX320 12 2023Document41 pagesOpTransactionHistoryUX320 12 2023Jamnas JamaludheenNo ratings yet

- CHAPTER 6 10.docx-1Document39 pagesCHAPTER 6 10.docx-1Tristan demesaNo ratings yet

- OBU & FactoringDocument16 pagesOBU & FactoringSha D ManNo ratings yet

- Basic Accounting Prequalifying SolManDocument12 pagesBasic Accounting Prequalifying SolManAnj SueloNo ratings yet

- Create Your Own Promissory NotesDocument2 pagesCreate Your Own Promissory NotesvalytenNo ratings yet

- Bsa3b Ia Ipppe BaltazarDocument6 pagesBsa3b Ia Ipppe BaltazarElaine Joyce GarciaNo ratings yet

- Ref - No. 2302875-11218095-5: Sakib AkhtarDocument5 pagesRef - No. 2302875-11218095-5: Sakib AkhtarMONISH NAYARNo ratings yet