Professional Documents

Culture Documents

Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGEST

Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGEST

Uploaded by

HarleneCopyright:

Available Formats

You might also like

- The Caravan - December 2022Document116 pagesThe Caravan - December 2022Viju Menon100% (1)

- Domingo Vs GarlitosDocument1 pageDomingo Vs GarlitosRon AceNo ratings yet

- Sison Vs AnchetaDocument1 pageSison Vs AnchetaJf Maneja100% (3)

- Fisher V TrinidadDocument2 pagesFisher V TrinidadEva Marie Gutierrez Cantero100% (1)

- CASE17THc - Hospital de San Juan de Dios Vs Pasay CityDocument1 pageCASE17THc - Hospital de San Juan de Dios Vs Pasay CityMico TanNo ratings yet

- Final Exam For Comm 440 Political CommunicationDocument4 pagesFinal Exam For Comm 440 Political CommunicationMarcelo Alves Dos Santos JuniorNo ratings yet

- Sacrament of Holy Orders THEO REPORTDocument32 pagesSacrament of Holy Orders THEO REPORTAivy Rose VillarbaNo ratings yet

- Building Pang A EaseDocument9 pagesBuilding Pang A EaseAnthony Gonzalez0% (2)

- Lladoc Vs CIRDocument2 pagesLladoc Vs CIRBryne Angelo BrillantesNo ratings yet

- 9 City of Ozamis V LumapasDocument1 page9 City of Ozamis V LumapasJackie Canlas100% (1)

- Casanovas vs. HordDocument1 pageCasanovas vs. HordKath LeenNo ratings yet

- CASE DIGEST: Abra Valley College Inc. vs. Aquino G.R. No. L-39086Document2 pagesCASE DIGEST: Abra Valley College Inc. vs. Aquino G.R. No. L-39086Lyka Angelique Cisneros100% (2)

- 08 CIR V Baier-NickelDocument1 page08 CIR V Baier-NickelAnn QuebecNo ratings yet

- Aguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedDocument2 pagesAguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedCharmila SiplonNo ratings yet

- Tolentino vs. Secretary of Finance - G.R. No. 115455 - October 30, 1995Document1 pageTolentino vs. Secretary of Finance - G.R. No. 115455 - October 30, 1995Andrew Gallardo100% (1)

- 27 CIR V La Tondena G.R. No. L-10431Document1 page27 CIR V La Tondena G.R. No. L-10431Emmanuel Alejandro YrreverreIiiNo ratings yet

- Madrigal v. Rafferty, 38 Phil 414Document1 pageMadrigal v. Rafferty, 38 Phil 414Homer SimpsonNo ratings yet

- YMCA v. CIR, 298 SCRA - THE LIFEBLOOD DOCTRINE - DigestDocument2 pagesYMCA v. CIR, 298 SCRA - THE LIFEBLOOD DOCTRINE - DigestKate GaroNo ratings yet

- PILMICO-MAURI FOODS CORP., Petitioner, v. COMMISSIONER OF INTERNAL REVENUE, Respondent.Document2 pagesPILMICO-MAURI FOODS CORP., Petitioner, v. COMMISSIONER OF INTERNAL REVENUE, Respondent.lexxNo ratings yet

- CIR Vs Bank of CommerceDocument2 pagesCIR Vs Bank of CommerceAster Beane AranetaNo ratings yet

- Philippine Long Distance Telephone Company, Inc. vs. City of BacolodDocument1 pagePhilippine Long Distance Telephone Company, Inc. vs. City of Bacolodmei atienzaNo ratings yet

- II. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Document37 pagesII. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Polo MartinezNo ratings yet

- Madrigal V RaffertyDocument2 pagesMadrigal V RaffertyiptrinidadNo ratings yet

- Case Digest Cir Vs SC JohnsonDocument4 pagesCase Digest Cir Vs SC JohnsonHannah Desky100% (1)

- American Bible Society v. City of Manila DigestsDocument4 pagesAmerican Bible Society v. City of Manila Digestspinkblush717100% (3)

- Marcelo Steel Corporation vs. Collector of Internal RevenueDocument2 pagesMarcelo Steel Corporation vs. Collector of Internal RevenuesakuraNo ratings yet

- PAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Document2 pagesPAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Elaine Belle OgayonNo ratings yet

- CIR Vs CA and YMCA, (298 SCRA 83)Document3 pagesCIR Vs CA and YMCA, (298 SCRA 83)Kye GarciaNo ratings yet

- City of Baguio v. Fortunato de Leon GR L-24756Document1 pageCity of Baguio v. Fortunato de Leon GR L-24756Charles Roger RayaNo ratings yet

- Cagayan Electric Power V CommissionerDocument1 pageCagayan Electric Power V CommissionerTon Ton Cananea100% (1)

- Alexander Howden Co. Ltd. v. CIR 13 SCRA 601 G.R. No. L 19392 April 14 1965Document1 pageAlexander Howden Co. Ltd. v. CIR 13 SCRA 601 G.R. No. L 19392 April 14 1965Oro Chamber100% (2)

- Commissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestDocument2 pagesCommissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestAbilene Joy Dela CruzNo ratings yet

- Reyes v. AlmanzorDocument5 pagesReyes v. AlmanzorPatricia BautistaNo ratings yet

- 1 - Conwi vs. CTA DigestDocument2 pages1 - Conwi vs. CTA Digestcmv mendozaNo ratings yet

- G.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsDocument1 pageG.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsGeorginaNo ratings yet

- Title: Calanoc v. CIR Doctrine: Facts:: WON The Assessment Is Correct. - YESDocument1 pageTitle: Calanoc v. CIR Doctrine: Facts:: WON The Assessment Is Correct. - YESGSS100% (1)

- Ormoc Sugar Co V Treasurer of Ormoc CityDocument1 pageOrmoc Sugar Co V Treasurer of Ormoc CityAndré Jan Lee Cardeño100% (1)

- Pepsi-Cola Bottling Co. of The Phil., Inc. vs. City of Butuan, G.R. No. L-22814 (Case Digest)Document1 pagePepsi-Cola Bottling Co. of The Phil., Inc. vs. City of Butuan, G.R. No. L-22814 (Case Digest)AycNo ratings yet

- Roxas Vs RaffertyDocument3 pagesRoxas Vs RaffertyChelle BelenzoNo ratings yet

- National Development Company V CIR (1987)Document2 pagesNational Development Company V CIR (1987)BernadetteGaleraNo ratings yet

- Digests 1Document5 pagesDigests 1Jopet EstolasNo ratings yet

- Philex Mining Corporation vs. CIRDocument3 pagesPhilex Mining Corporation vs. CIRRobNo ratings yet

- Lutz Vs AranetaDocument1 pageLutz Vs AranetaIshNo ratings yet

- Osmena v. Orbos DigestDocument3 pagesOsmena v. Orbos Digestpinkblush717No ratings yet

- Philippine Bank of Communications V. Cir G.R. No. 112024 January 28, 1999 Quisumbing, JDocument2 pagesPhilippine Bank of Communications V. Cir G.R. No. 112024 January 28, 1999 Quisumbing, Jbrendamanganaan100% (1)

- Conwi v. CTA, 213 SCRA 83Document2 pagesConwi v. CTA, 213 SCRA 83Homer Simpson100% (2)

- Howden Vs CollectorDocument2 pagesHowden Vs CollectorLouise Bolivar DadivasNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument2 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Pagcor Vs BirDocument1 pagePagcor Vs Bir001nooneNo ratings yet

- Case 59 CS Garments Vs CirDocument3 pagesCase 59 CS Garments Vs CirJulian Guevarra0% (1)

- Cir V Itogon-Suyoc MinESDocument2 pagesCir V Itogon-Suyoc MinESkeloNo ratings yet

- Consti2Digest - Victorias Milling Co., Inc. Vs Municipality of Victorias, GR L-21183 (27 Sept. 1968)Document1 pageConsti2Digest - Victorias Milling Co., Inc. Vs Municipality of Victorias, GR L-21183 (27 Sept. 1968)Lu CasNo ratings yet

- CIR V GuerreroDocument2 pagesCIR V GuerreroJamesRyanAlbaNo ratings yet

- Citizen's Alliance V Energy Regulatory CommissionDocument1 pageCitizen's Alliance V Energy Regulatory CommissionJason KingNo ratings yet

- CIR V Vda. de PrietoDocument2 pagesCIR V Vda. de PrietoSophiaFrancescaEspinosa100% (1)

- CN Hogdes v. Mun Board of IloiloDocument2 pagesCN Hogdes v. Mun Board of IloiloMirellaNo ratings yet

- Courage VS Commissoner of Internal Revenue DigestDocument3 pagesCourage VS Commissoner of Internal Revenue DigestCharles Roger Raya100% (1)

- Republic V CaguioaDocument3 pagesRepublic V CaguioaViolet Parker100% (2)

- DigestDocument2 pagesDigestJeepers KreepersNo ratings yet

- Wells Fargo vs. CIR, 70 Phil. 505Document1 pageWells Fargo vs. CIR, 70 Phil. 505ArahbellsNo ratings yet

- Chapter Vi: Taxation NO. 3: Hilado and Hilado For Petitioner. Office of The Solicitor General For RespondentsDocument3 pagesChapter Vi: Taxation NO. 3: Hilado and Hilado For Petitioner. Office of The Solicitor General For RespondentsIncess CessNo ratings yet

- Hilado and Hilado For Petitioner. Office of The Solicitor General For RespondentsDocument40 pagesHilado and Hilado For Petitioner. Office of The Solicitor General For Respondentsheidi marieNo ratings yet

- Donors Tax CasesDocument66 pagesDonors Tax CasesMai ReamicoNo ratings yet

- Lladoc Vs Commissioner of Internal Revenue (G.R. No. L-19201, June 16, 1965) PDFDocument4 pagesLladoc Vs Commissioner of Internal Revenue (G.R. No. L-19201, June 16, 1965) PDFFrancis Gillean OrpillaNo ratings yet

- CASE #110 Philippine Steel Coating Corp. vs. Eduard Quinones G.R. No. 194533, April 19, 2017 FactsDocument2 pagesCASE #110 Philippine Steel Coating Corp. vs. Eduard Quinones G.R. No. 194533, April 19, 2017 FactsHarleneNo ratings yet

- CASE #104 Bureau of Internal Revenue, Et. Al. vs. Lepanto Ceramics, Inc. G.R. No. 224764, April 24, 2017 FactsDocument2 pagesCASE #104 Bureau of Internal Revenue, Et. Al. vs. Lepanto Ceramics, Inc. G.R. No. 224764, April 24, 2017 FactsHarleneNo ratings yet

- CASE #106 Sps. Elvira and Edwin Alcantara vs. Sps. Zenaida and Florante Belen, Et. Al G.R. No. 200204 Dated April 25,2017 FactsDocument2 pagesCASE #106 Sps. Elvira and Edwin Alcantara vs. Sps. Zenaida and Florante Belen, Et. Al G.R. No. 200204 Dated April 25,2017 FactsHarleneNo ratings yet

- CASE # 105 BERNADETTE S. BILAG, Et. Al. Vs ESTELA AY-AY, Et. Al. G.R. No. 189950, April 24, 2017 FactsDocument2 pagesCASE # 105 BERNADETTE S. BILAG, Et. Al. Vs ESTELA AY-AY, Et. Al. G.R. No. 189950, April 24, 2017 FactsHarleneNo ratings yet

- CASE #112 Asiatrust Development Bank, Inc. vs. Commissioner of Internal Revenue G.R. No. 201530, April 19, 2017 FactsDocument2 pagesCASE #112 Asiatrust Development Bank, Inc. vs. Commissioner of Internal Revenue G.R. No. 201530, April 19, 2017 FactsHarleneNo ratings yet

- CASE #103 Joselito Bustos vs. Millians Shoe, Inc., Sps. Fernando and Amelia Cruz G.R. No. 185024, April 4, 2017 FactsDocument2 pagesCASE #103 Joselito Bustos vs. Millians Shoe, Inc., Sps. Fernando and Amelia Cruz G.R. No. 185024, April 4, 2017 FactsHarleneNo ratings yet

- CASE #108 University of Santo Tomas (Ust) vs. Samahang Manggagawa NG Ust, Et. Al. G.R. No. 184262, April 24, 2017 FactsDocument2 pagesCASE #108 University of Santo Tomas (Ust) vs. Samahang Manggagawa NG Ust, Et. Al. G.R. No. 184262, April 24, 2017 FactsHarleneNo ratings yet

- CASE #107 Pablo and Pablina Marcelo-Mendoza vs. Peroxide Phils., Inc., Herein Represented by ROBERT R. NAVERA, G.R. No. 203492, April 24, 2017 FactsDocument2 pagesCASE #107 Pablo and Pablina Marcelo-Mendoza vs. Peroxide Phils., Inc., Herein Represented by ROBERT R. NAVERA, G.R. No. 203492, April 24, 2017 FactsHarleneNo ratings yet

- CASE #111 Bankard, Inc. vs. Luz P. Alarte G.R. No. 202573, April 19, 2017 FactsDocument1 pageCASE #111 Bankard, Inc. vs. Luz P. Alarte G.R. No. 202573, April 19, 2017 FactsHarleneNo ratings yet

- CASE #113 Baclaran Marketing Corp. vs. Fernando C. Nieva and Mamerto Sibulo, Jr. G.R. No. 189881, April 19, 2017 FactsDocument2 pagesCASE #113 Baclaran Marketing Corp. vs. Fernando C. Nieva and Mamerto Sibulo, Jr. G.R. No. 189881, April 19, 2017 FactsHarlene100% (1)

- C.F. Sharp Crew Management, Inc., Et. Al. vs. Rhudel A. Castillo G.R. No. 208215, April 19, 2017Document2 pagesC.F. Sharp Crew Management, Inc., Et. Al. vs. Rhudel A. Castillo G.R. No. 208215, April 19, 2017HarleneNo ratings yet

- CASE #121 Nenita de Guzman Ferguson vs. Atty. Salvador P. Ramos A.C. No. 9209, April 18, 2017 FactsDocument2 pagesCASE #121 Nenita de Guzman Ferguson vs. Atty. Salvador P. Ramos A.C. No. 9209, April 18, 2017 FactsHarleneNo ratings yet

- New Guidelines On The Filing of Applications For Optional Retirement) For Continuing To Function As ADocument1 pageNew Guidelines On The Filing of Applications For Optional Retirement) For Continuing To Function As AHarleneNo ratings yet

- CASE #137 CONCEPCION C. DAPLAS, City Treasurer, Pasay City vs. DEPARTMENT OF FINANCE, Et. Al G.R. No. 221153, April 17, 2017 FactsDocument2 pagesCASE #137 CONCEPCION C. DAPLAS, City Treasurer, Pasay City vs. DEPARTMENT OF FINANCE, Et. Al G.R. No. 221153, April 17, 2017 FactsHarleneNo ratings yet

- CASE #124 Eduardo Quimvel vs. People of The Philippines G.R. No. 214497, April 18, 2017 FactsDocument2 pagesCASE #124 Eduardo Quimvel vs. People of The Philippines G.R. No. 214497, April 18, 2017 FactsHarlene100% (1)

- CASE #114 TGN Realty Corporation vs. Villa Teresa Homeowners Association, Inc. G.R. No. 164795, April 19, 2017 FactsDocument2 pagesCASE #114 TGN Realty Corporation vs. Villa Teresa Homeowners Association, Inc. G.R. No. 164795, April 19, 2017 FactsHarlene100% (1)

- Joseph C. Dimapilis vs. Commission On Elections G.R. No. 227158, April 18, 2017Document2 pagesJoseph C. Dimapilis vs. Commission On Elections G.R. No. 227158, April 18, 2017HarleneNo ratings yet

- NINI A. LANTO, Then Director II of Admin Branch of POEA Vs COMMISSION ON AUDIT (COA) G.R. No. 217189, April 18, 2017Document2 pagesNINI A. LANTO, Then Director II of Admin Branch of POEA Vs COMMISSION ON AUDIT (COA) G.R. No. 217189, April 18, 2017HarleneNo ratings yet

- CASE #129 Spouses Proceso O. Pontillas, Jr. and Helen S. Pontillas vs. Carmen Oliy Ares Vda. de Pontillas G.R. No. 207667, April 17, 2017 FactsDocument1 pageCASE #129 Spouses Proceso O. Pontillas, Jr. and Helen S. Pontillas vs. Carmen Oliy Ares Vda. de Pontillas G.R. No. 207667, April 17, 2017 FactsHarleneNo ratings yet

- Development Bank of The Philippines vs. Commission On Audit G.R. No. 216538, April 18, 2017Document2 pagesDevelopment Bank of The Philippines vs. Commission On Audit G.R. No. 216538, April 18, 2017HarleneNo ratings yet

- Respondents: Land Bank of The Philippines vs. West Bay Colleges, Inc., Et. Al. G.R. No. 211287, April 17, 2017Document1 pageRespondents: Land Bank of The Philippines vs. West Bay Colleges, Inc., Et. Al. G.R. No. 211287, April 17, 2017HarleneNo ratings yet

- CASE #126 Lo Loy Unduran, Et. Al. vs. Ramon Aberasturi, Et. Al. G.R. No. 181284, April 18, 2017 FactsDocument1 pageCASE #126 Lo Loy Unduran, Et. Al. vs. Ramon Aberasturi, Et. Al. G.R. No. 181284, April 18, 2017 FactsHarleneNo ratings yet

- CASE #122 Gloria Macapagal Arroyo vs. People of The Philippines and Sandiganbayan G.R. No. 220598, April 18, 2017 FactsDocument2 pagesCASE #122 Gloria Macapagal Arroyo vs. People of The Philippines and Sandiganbayan G.R. No. 220598, April 18, 2017 FactsHarleneNo ratings yet

- CASE #133 Re: Dropping From The Rolls of Rowie A. Quimno, Utility Worker I, MCTC, Lpil, Zamboanga Sibugay, A.M. No. 17-03-33-MCTC, April 17, 2017 FactsDocument1 pageCASE #133 Re: Dropping From The Rolls of Rowie A. Quimno, Utility Worker I, MCTC, Lpil, Zamboanga Sibugay, A.M. No. 17-03-33-MCTC, April 17, 2017 FactsHarleneNo ratings yet

- CASE #132 City of Davao vs. Robert E. Olanolan G.R. No. 181149, April 17, 2017 FactsDocument2 pagesCASE #132 City of Davao vs. Robert E. Olanolan G.R. No. 181149, April 17, 2017 FactsHarleneNo ratings yet

- CASE #131 Sumifru (Philippines) Corporation vs. Bernabe Baya G.R. No. 188269, April 17, 2017 FactsDocument2 pagesCASE #131 Sumifru (Philippines) Corporation vs. Bernabe Baya G.R. No. 188269, April 17, 2017 FactsHarleneNo ratings yet

- CASE #130 Ultra Mar Aqua Resource, Inc. vs. Fermida Construction Services G.R. No. 191353, April 17, 2017 FactsDocument2 pagesCASE #130 Ultra Mar Aqua Resource, Inc. vs. Fermida Construction Services G.R. No. 191353, April 17, 2017 FactsHarleneNo ratings yet

- CASE #127 Ramon R. Villarama vs. Atty. Clodualdo C. de Jesus G.R. No. 217004, April 17, 2017 FactsDocument2 pagesCASE #127 Ramon R. Villarama vs. Atty. Clodualdo C. de Jesus G.R. No. 217004, April 17, 2017 FactsHarleneNo ratings yet

- CASE #134 Roberto P. Fuentes vs. People of The Philippines G.R. No. 186421, April 17, 2017 FactsDocument2 pagesCASE #134 Roberto P. Fuentes vs. People of The Philippines G.R. No. 186421, April 17, 2017 FactsHarlene100% (1)

- CASE #135 Herma Shipyard, Inc, and Mr. Herminio Esguerra vs. Danilo Oliveros, Et. Al. G.R. No. 208936, April 17, 2017 FactsDocument1 pageCASE #135 Herma Shipyard, Inc, and Mr. Herminio Esguerra vs. Danilo Oliveros, Et. Al. G.R. No. 208936, April 17, 2017 FactsHarleneNo ratings yet

- Literature QuizDocument3 pagesLiterature QuizDulce J. Luaton100% (1)

- 1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessDocument5 pages1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessdhaiwatNo ratings yet

- RSS-China MOU?Document3 pagesRSS-China MOU?cbcnnNo ratings yet

- 4th Quarter Examination in Empowerment TechnologyDocument2 pages4th Quarter Examination in Empowerment TechnologyCris Fredrich AndalizaNo ratings yet

- Porter's Generic StrategiesDocument2 pagesPorter's Generic StrategiesSubhan Uddin KhattakNo ratings yet

- 22 Commissioner of PWH Vs San DiegoDocument21 pages22 Commissioner of PWH Vs San DiegoAira Mae P. LayloNo ratings yet

- Employee LeasingDocument8 pagesEmployee LeasingAarav DahiyaNo ratings yet

- John Duda - Cybernetics, Anarchism and Self-OrganisationDocument21 pagesJohn Duda - Cybernetics, Anarchism and Self-OrganisationBloomNo ratings yet

- Key Challenges Facing Public Sector LeadersDocument6 pagesKey Challenges Facing Public Sector LeadersSifa MtashaNo ratings yet

- Ce Feb16 FinalDocument76 pagesCe Feb16 Finaltest2012No ratings yet

- Machiavelli Against RepublicanismDocument29 pagesMachiavelli Against RepublicanismWaterscarsNo ratings yet

- 2021 CPT CodesDocument8 pages2021 CPT CodesSundar RamanathanNo ratings yet

- New TIP Course 6 DepEd TeacherDocument100 pagesNew TIP Course 6 DepEd TeacherHelen HidlaoNo ratings yet

- Reflection Paper: My Maid Invest in The Stock MarketDocument4 pagesReflection Paper: My Maid Invest in The Stock MarketMarifie PatiuNo ratings yet

- Revelation Chapter 7 28.6Document7 pagesRevelation Chapter 7 28.6Norman Green-PriceNo ratings yet

- Chapter 7Document4 pagesChapter 7MALTI MAHESH VASHISTHNo ratings yet

- Portfolio Analysis BCGDocument21 pagesPortfolio Analysis BCGAnuranjanSinha100% (2)

- The Taming of The Shrew EssayDocument5 pagesThe Taming of The Shrew Essayurdpzinbf100% (2)

- 1.18.2024 SBFCC Create Morre Eopt Beps 2.0Document70 pages1.18.2024 SBFCC Create Morre Eopt Beps 2.0b86120298alexlinNo ratings yet

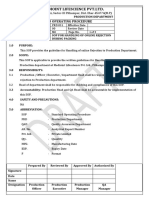

- Medioint Lifescience PVT - LTD.: Standard Operating ProcedureDocument3 pagesMedioint Lifescience PVT - LTD.: Standard Operating ProcedureChoudhary DhirajNo ratings yet

- Sir SYedDocument9 pagesSir SYedsalkhan123No ratings yet

- Accounting EquationDocument14 pagesAccounting EquationDindin Oromedlav LoricaNo ratings yet

- Integrated Coastal Resources Management Project (ICRMP) : Sustaining Our Coasts: The Ridge-to-Reef ApproachDocument47 pagesIntegrated Coastal Resources Management Project (ICRMP) : Sustaining Our Coasts: The Ridge-to-Reef ApproachCHOSEN TABANASNo ratings yet

- Republic v. Science Park of The Philippines 2021Document13 pagesRepublic v. Science Park of The Philippines 2021f919No ratings yet

- FP Bhopal Edition 12 January 2023Document19 pagesFP Bhopal Edition 12 January 2023Abhishekh GuptaNo ratings yet

- Maclean Power Systems - Hardware A-FDocument1 pageMaclean Power Systems - Hardware A-FBams ArifinNo ratings yet

Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGEST

Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGEST

Uploaded by

HarleneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGEST

Lladoc vs. CIR (G.R. No. L-19201 June 16, 1965) - H DIGEST

Uploaded by

HarleneCopyright:

Available Formats

G.R. No.

L-19201 June 16, 1965

REV. FR. CASIMIRO LLADOC, petitioner, vs.

The COMMISSIONER OF INTERNAL REVENUE and The COURT of TAX APPEALS, respondents.

TOPIC: Constitutional Limitations -> Tax exemption of traditional exemptees

ABOUT: Donation of P10K to Priest for construction of church subject to Donee’s Gift Tax

FACTS:

Sometime in 1957, the M.B. Estate, Inc., of Bacolod City, donated P10,000.00 in cash to Rev. Fr. Crispin Ruiz,

then parish priest of Victorias, Negros Occidental, and predecessor of herein petitioner, for the construction

of a new Catholic Church in the locality. The total amount was actually spent for the purpose intended.

On March 3, 1958, the donor M.B. Estate, Inc., filed the donor's gift tax return. Under date of April 29, 1960,

the respondent Commissioner of Internal Revenue issued an assessment for donee's gift tax against the

Catholic Parish of Victorias, Negros Occidental, of which petitioner was the priest. The tax amounted to

P1,370.00 including surcharges, interests of 1% monthly from May 15, 1958 to June 15, 1960, and the

compromise for the late filing of the return.

Petitioner lodged a protest to the assessment and requested the withdrawal thereof. The protest and the

motion for reconsideration presented to the Commissioner of Internal Revenue were denied. The petitioner

appealed to the Court of Tax Appeals on November 2, 1960.

In the petition for review, the Rev. Fr. Casimiro Lladoc claimed, among others, that at the time of the

donation, he was not the parish priest in Victorias; that there is no legal entity or juridical person known as

the "Catholic Parish Priest of Victorias," and, therefore, he should not be liable for the donee's gift tax. It was

also asserted that the assessment of the gift tax, even against the Roman Catholic Church, would not be

valid, for such would be a clear violation of the provisions of the Constitution.

CTA decision: decision of the respondent Commissioner of Internal Revenue appealed from, is hereby

affirmed except with regard to the imposition of the compromise penalty in the amount of P20.00

ISSUE:

Whether the assessed donee's gift tax on the P10,000.00 donated for the construction of the Victorias Parish

Church is valid.

If yes, who should be called upon to pay the gift tax?

HELD:

#1 YES; #2 Petitioner herein is not personally liable for the said gift tax, but the Head of the Diocese, herein

substitute petitioner, is presently ordered to pay the said gift tax.

Section 22 (3), Art. VI of the Constitution of the Philippines, exempts from taxation cemeteries, churches and

parsonages or convents, appurtenant thereto, and all lands, buildings, and improvements used exclusively

for religious purposes. The exemption is only from the payment of taxes assessed on such properties

enumerated, as property taxes, as contra distinguished from excise taxes.

In the present case, what the Collector assessed was a donee's gift tax; the assessment was not on the

properties themselves. It did not rest upon general ownership; it was an excise upon the use made of the

properties, upon the exercise of the privilege of receiving the properties (Phipps vs. Com. of Int. Rec. 91 F 2d

627).

Manifestly, gift tax is not within the exempting provisions of the section just mentioned. A gift tax is not a

property tax, but an excise tax imposed on the transfer of property by way of gift inter vivos, the imposition

of which on property used exclusively for religious purposes, does not constitute an impairment of the

Constitution. As well observed by the learned respondent Court, the phrase "exempt from taxation," as

employed in the Constitution (supra) should not be interpreted to mean exemption from all kinds of taxes.

And there being no clear, positive or express grant of such privilege by law, in favor of petitioner, the

exemption herein must be denied.

In order to put things in their proper light, this Court, in its Resolution of March 15, 1965, ordered the

parties to show cause why the Head of the Diocese to which the parish of Victorias pertains, should not be

substituted in lieu of petitioner Rev. Fr. Casimiro Lladoc it appearing that the Head of such Diocese is the real

party in interest.

In view here of and considering that as heretofore stated, the assessment at bar had been properly made

and the imposition of the tax is not a violation of the constitutional provision exempting churches,

parsonages or convents, etc. (Art VI, sec. 22 [3], Constitution), the Head of the Diocese, to which the parish

Victorias Pertains, is liable for the payment thereof.

-harl- 1

You might also like

- The Caravan - December 2022Document116 pagesThe Caravan - December 2022Viju Menon100% (1)

- Domingo Vs GarlitosDocument1 pageDomingo Vs GarlitosRon AceNo ratings yet

- Sison Vs AnchetaDocument1 pageSison Vs AnchetaJf Maneja100% (3)

- Fisher V TrinidadDocument2 pagesFisher V TrinidadEva Marie Gutierrez Cantero100% (1)

- CASE17THc - Hospital de San Juan de Dios Vs Pasay CityDocument1 pageCASE17THc - Hospital de San Juan de Dios Vs Pasay CityMico TanNo ratings yet

- Final Exam For Comm 440 Political CommunicationDocument4 pagesFinal Exam For Comm 440 Political CommunicationMarcelo Alves Dos Santos JuniorNo ratings yet

- Sacrament of Holy Orders THEO REPORTDocument32 pagesSacrament of Holy Orders THEO REPORTAivy Rose VillarbaNo ratings yet

- Building Pang A EaseDocument9 pagesBuilding Pang A EaseAnthony Gonzalez0% (2)

- Lladoc Vs CIRDocument2 pagesLladoc Vs CIRBryne Angelo BrillantesNo ratings yet

- 9 City of Ozamis V LumapasDocument1 page9 City of Ozamis V LumapasJackie Canlas100% (1)

- Casanovas vs. HordDocument1 pageCasanovas vs. HordKath LeenNo ratings yet

- CASE DIGEST: Abra Valley College Inc. vs. Aquino G.R. No. L-39086Document2 pagesCASE DIGEST: Abra Valley College Inc. vs. Aquino G.R. No. L-39086Lyka Angelique Cisneros100% (2)

- 08 CIR V Baier-NickelDocument1 page08 CIR V Baier-NickelAnn QuebecNo ratings yet

- Aguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedDocument2 pagesAguinaldo Industries Corporation vs. Commissioner of Internal Revenue Services Actually RenderedCharmila SiplonNo ratings yet

- Tolentino vs. Secretary of Finance - G.R. No. 115455 - October 30, 1995Document1 pageTolentino vs. Secretary of Finance - G.R. No. 115455 - October 30, 1995Andrew Gallardo100% (1)

- 27 CIR V La Tondena G.R. No. L-10431Document1 page27 CIR V La Tondena G.R. No. L-10431Emmanuel Alejandro YrreverreIiiNo ratings yet

- Madrigal v. Rafferty, 38 Phil 414Document1 pageMadrigal v. Rafferty, 38 Phil 414Homer SimpsonNo ratings yet

- YMCA v. CIR, 298 SCRA - THE LIFEBLOOD DOCTRINE - DigestDocument2 pagesYMCA v. CIR, 298 SCRA - THE LIFEBLOOD DOCTRINE - DigestKate GaroNo ratings yet

- PILMICO-MAURI FOODS CORP., Petitioner, v. COMMISSIONER OF INTERNAL REVENUE, Respondent.Document2 pagesPILMICO-MAURI FOODS CORP., Petitioner, v. COMMISSIONER OF INTERNAL REVENUE, Respondent.lexxNo ratings yet

- CIR Vs Bank of CommerceDocument2 pagesCIR Vs Bank of CommerceAster Beane AranetaNo ratings yet

- Philippine Long Distance Telephone Company, Inc. vs. City of BacolodDocument1 pagePhilippine Long Distance Telephone Company, Inc. vs. City of Bacolodmei atienzaNo ratings yet

- II. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Document37 pagesII. INCOME - Bir Rulings Revenue Regulations: in General Statutory "Inclusions"Polo MartinezNo ratings yet

- Madrigal V RaffertyDocument2 pagesMadrigal V RaffertyiptrinidadNo ratings yet

- Case Digest Cir Vs SC JohnsonDocument4 pagesCase Digest Cir Vs SC JohnsonHannah Desky100% (1)

- American Bible Society v. City of Manila DigestsDocument4 pagesAmerican Bible Society v. City of Manila Digestspinkblush717100% (3)

- Marcelo Steel Corporation vs. Collector of Internal RevenueDocument2 pagesMarcelo Steel Corporation vs. Collector of Internal RevenuesakuraNo ratings yet

- PAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Document2 pagesPAPER INDUSTRIES CORPORATION OF THE PHILIPPINES (PICOP) v. CA, CIR and CTA, G.R. Nos. 106949-50 (1995)Elaine Belle OgayonNo ratings yet

- CIR Vs CA and YMCA, (298 SCRA 83)Document3 pagesCIR Vs CA and YMCA, (298 SCRA 83)Kye GarciaNo ratings yet

- City of Baguio v. Fortunato de Leon GR L-24756Document1 pageCity of Baguio v. Fortunato de Leon GR L-24756Charles Roger RayaNo ratings yet

- Cagayan Electric Power V CommissionerDocument1 pageCagayan Electric Power V CommissionerTon Ton Cananea100% (1)

- Alexander Howden Co. Ltd. v. CIR 13 SCRA 601 G.R. No. L 19392 April 14 1965Document1 pageAlexander Howden Co. Ltd. v. CIR 13 SCRA 601 G.R. No. L 19392 April 14 1965Oro Chamber100% (2)

- Commissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestDocument2 pagesCommissioner of Internal Revenue vs. Tokyo Shipping Co. LTD G.R. No. L-68252 May 26, 1995 DigestAbilene Joy Dela CruzNo ratings yet

- Reyes v. AlmanzorDocument5 pagesReyes v. AlmanzorPatricia BautistaNo ratings yet

- 1 - Conwi vs. CTA DigestDocument2 pages1 - Conwi vs. CTA Digestcmv mendozaNo ratings yet

- G.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsDocument1 pageG.R. No. 109289 October 3, 1994 TAN V. DEL ROSARIO FACTS FactsGeorginaNo ratings yet

- Title: Calanoc v. CIR Doctrine: Facts:: WON The Assessment Is Correct. - YESDocument1 pageTitle: Calanoc v. CIR Doctrine: Facts:: WON The Assessment Is Correct. - YESGSS100% (1)

- Ormoc Sugar Co V Treasurer of Ormoc CityDocument1 pageOrmoc Sugar Co V Treasurer of Ormoc CityAndré Jan Lee Cardeño100% (1)

- Pepsi-Cola Bottling Co. of The Phil., Inc. vs. City of Butuan, G.R. No. L-22814 (Case Digest)Document1 pagePepsi-Cola Bottling Co. of The Phil., Inc. vs. City of Butuan, G.R. No. L-22814 (Case Digest)AycNo ratings yet

- Roxas Vs RaffertyDocument3 pagesRoxas Vs RaffertyChelle BelenzoNo ratings yet

- National Development Company V CIR (1987)Document2 pagesNational Development Company V CIR (1987)BernadetteGaleraNo ratings yet

- Digests 1Document5 pagesDigests 1Jopet EstolasNo ratings yet

- Philex Mining Corporation vs. CIRDocument3 pagesPhilex Mining Corporation vs. CIRRobNo ratings yet

- Lutz Vs AranetaDocument1 pageLutz Vs AranetaIshNo ratings yet

- Osmena v. Orbos DigestDocument3 pagesOsmena v. Orbos Digestpinkblush717No ratings yet

- Philippine Bank of Communications V. Cir G.R. No. 112024 January 28, 1999 Quisumbing, JDocument2 pagesPhilippine Bank of Communications V. Cir G.R. No. 112024 January 28, 1999 Quisumbing, Jbrendamanganaan100% (1)

- Conwi v. CTA, 213 SCRA 83Document2 pagesConwi v. CTA, 213 SCRA 83Homer Simpson100% (2)

- Howden Vs CollectorDocument2 pagesHowden Vs CollectorLouise Bolivar DadivasNo ratings yet

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayDocument2 pagesEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaNo ratings yet

- Pagcor Vs BirDocument1 pagePagcor Vs Bir001nooneNo ratings yet

- Case 59 CS Garments Vs CirDocument3 pagesCase 59 CS Garments Vs CirJulian Guevarra0% (1)

- Cir V Itogon-Suyoc MinESDocument2 pagesCir V Itogon-Suyoc MinESkeloNo ratings yet

- Consti2Digest - Victorias Milling Co., Inc. Vs Municipality of Victorias, GR L-21183 (27 Sept. 1968)Document1 pageConsti2Digest - Victorias Milling Co., Inc. Vs Municipality of Victorias, GR L-21183 (27 Sept. 1968)Lu CasNo ratings yet

- CIR V GuerreroDocument2 pagesCIR V GuerreroJamesRyanAlbaNo ratings yet

- Citizen's Alliance V Energy Regulatory CommissionDocument1 pageCitizen's Alliance V Energy Regulatory CommissionJason KingNo ratings yet

- CIR V Vda. de PrietoDocument2 pagesCIR V Vda. de PrietoSophiaFrancescaEspinosa100% (1)

- CN Hogdes v. Mun Board of IloiloDocument2 pagesCN Hogdes v. Mun Board of IloiloMirellaNo ratings yet

- Courage VS Commissoner of Internal Revenue DigestDocument3 pagesCourage VS Commissoner of Internal Revenue DigestCharles Roger Raya100% (1)

- Republic V CaguioaDocument3 pagesRepublic V CaguioaViolet Parker100% (2)

- DigestDocument2 pagesDigestJeepers KreepersNo ratings yet

- Wells Fargo vs. CIR, 70 Phil. 505Document1 pageWells Fargo vs. CIR, 70 Phil. 505ArahbellsNo ratings yet

- Chapter Vi: Taxation NO. 3: Hilado and Hilado For Petitioner. Office of The Solicitor General For RespondentsDocument3 pagesChapter Vi: Taxation NO. 3: Hilado and Hilado For Petitioner. Office of The Solicitor General For RespondentsIncess CessNo ratings yet

- Hilado and Hilado For Petitioner. Office of The Solicitor General For RespondentsDocument40 pagesHilado and Hilado For Petitioner. Office of The Solicitor General For Respondentsheidi marieNo ratings yet

- Donors Tax CasesDocument66 pagesDonors Tax CasesMai ReamicoNo ratings yet

- Lladoc Vs Commissioner of Internal Revenue (G.R. No. L-19201, June 16, 1965) PDFDocument4 pagesLladoc Vs Commissioner of Internal Revenue (G.R. No. L-19201, June 16, 1965) PDFFrancis Gillean OrpillaNo ratings yet

- CASE #110 Philippine Steel Coating Corp. vs. Eduard Quinones G.R. No. 194533, April 19, 2017 FactsDocument2 pagesCASE #110 Philippine Steel Coating Corp. vs. Eduard Quinones G.R. No. 194533, April 19, 2017 FactsHarleneNo ratings yet

- CASE #104 Bureau of Internal Revenue, Et. Al. vs. Lepanto Ceramics, Inc. G.R. No. 224764, April 24, 2017 FactsDocument2 pagesCASE #104 Bureau of Internal Revenue, Et. Al. vs. Lepanto Ceramics, Inc. G.R. No. 224764, April 24, 2017 FactsHarleneNo ratings yet

- CASE #106 Sps. Elvira and Edwin Alcantara vs. Sps. Zenaida and Florante Belen, Et. Al G.R. No. 200204 Dated April 25,2017 FactsDocument2 pagesCASE #106 Sps. Elvira and Edwin Alcantara vs. Sps. Zenaida and Florante Belen, Et. Al G.R. No. 200204 Dated April 25,2017 FactsHarleneNo ratings yet

- CASE # 105 BERNADETTE S. BILAG, Et. Al. Vs ESTELA AY-AY, Et. Al. G.R. No. 189950, April 24, 2017 FactsDocument2 pagesCASE # 105 BERNADETTE S. BILAG, Et. Al. Vs ESTELA AY-AY, Et. Al. G.R. No. 189950, April 24, 2017 FactsHarleneNo ratings yet

- CASE #112 Asiatrust Development Bank, Inc. vs. Commissioner of Internal Revenue G.R. No. 201530, April 19, 2017 FactsDocument2 pagesCASE #112 Asiatrust Development Bank, Inc. vs. Commissioner of Internal Revenue G.R. No. 201530, April 19, 2017 FactsHarleneNo ratings yet

- CASE #103 Joselito Bustos vs. Millians Shoe, Inc., Sps. Fernando and Amelia Cruz G.R. No. 185024, April 4, 2017 FactsDocument2 pagesCASE #103 Joselito Bustos vs. Millians Shoe, Inc., Sps. Fernando and Amelia Cruz G.R. No. 185024, April 4, 2017 FactsHarleneNo ratings yet

- CASE #108 University of Santo Tomas (Ust) vs. Samahang Manggagawa NG Ust, Et. Al. G.R. No. 184262, April 24, 2017 FactsDocument2 pagesCASE #108 University of Santo Tomas (Ust) vs. Samahang Manggagawa NG Ust, Et. Al. G.R. No. 184262, April 24, 2017 FactsHarleneNo ratings yet

- CASE #107 Pablo and Pablina Marcelo-Mendoza vs. Peroxide Phils., Inc., Herein Represented by ROBERT R. NAVERA, G.R. No. 203492, April 24, 2017 FactsDocument2 pagesCASE #107 Pablo and Pablina Marcelo-Mendoza vs. Peroxide Phils., Inc., Herein Represented by ROBERT R. NAVERA, G.R. No. 203492, April 24, 2017 FactsHarleneNo ratings yet

- CASE #111 Bankard, Inc. vs. Luz P. Alarte G.R. No. 202573, April 19, 2017 FactsDocument1 pageCASE #111 Bankard, Inc. vs. Luz P. Alarte G.R. No. 202573, April 19, 2017 FactsHarleneNo ratings yet

- CASE #113 Baclaran Marketing Corp. vs. Fernando C. Nieva and Mamerto Sibulo, Jr. G.R. No. 189881, April 19, 2017 FactsDocument2 pagesCASE #113 Baclaran Marketing Corp. vs. Fernando C. Nieva and Mamerto Sibulo, Jr. G.R. No. 189881, April 19, 2017 FactsHarlene100% (1)

- C.F. Sharp Crew Management, Inc., Et. Al. vs. Rhudel A. Castillo G.R. No. 208215, April 19, 2017Document2 pagesC.F. Sharp Crew Management, Inc., Et. Al. vs. Rhudel A. Castillo G.R. No. 208215, April 19, 2017HarleneNo ratings yet

- CASE #121 Nenita de Guzman Ferguson vs. Atty. Salvador P. Ramos A.C. No. 9209, April 18, 2017 FactsDocument2 pagesCASE #121 Nenita de Guzman Ferguson vs. Atty. Salvador P. Ramos A.C. No. 9209, April 18, 2017 FactsHarleneNo ratings yet

- New Guidelines On The Filing of Applications For Optional Retirement) For Continuing To Function As ADocument1 pageNew Guidelines On The Filing of Applications For Optional Retirement) For Continuing To Function As AHarleneNo ratings yet

- CASE #137 CONCEPCION C. DAPLAS, City Treasurer, Pasay City vs. DEPARTMENT OF FINANCE, Et. Al G.R. No. 221153, April 17, 2017 FactsDocument2 pagesCASE #137 CONCEPCION C. DAPLAS, City Treasurer, Pasay City vs. DEPARTMENT OF FINANCE, Et. Al G.R. No. 221153, April 17, 2017 FactsHarleneNo ratings yet

- CASE #124 Eduardo Quimvel vs. People of The Philippines G.R. No. 214497, April 18, 2017 FactsDocument2 pagesCASE #124 Eduardo Quimvel vs. People of The Philippines G.R. No. 214497, April 18, 2017 FactsHarlene100% (1)

- CASE #114 TGN Realty Corporation vs. Villa Teresa Homeowners Association, Inc. G.R. No. 164795, April 19, 2017 FactsDocument2 pagesCASE #114 TGN Realty Corporation vs. Villa Teresa Homeowners Association, Inc. G.R. No. 164795, April 19, 2017 FactsHarlene100% (1)

- Joseph C. Dimapilis vs. Commission On Elections G.R. No. 227158, April 18, 2017Document2 pagesJoseph C. Dimapilis vs. Commission On Elections G.R. No. 227158, April 18, 2017HarleneNo ratings yet

- NINI A. LANTO, Then Director II of Admin Branch of POEA Vs COMMISSION ON AUDIT (COA) G.R. No. 217189, April 18, 2017Document2 pagesNINI A. LANTO, Then Director II of Admin Branch of POEA Vs COMMISSION ON AUDIT (COA) G.R. No. 217189, April 18, 2017HarleneNo ratings yet

- CASE #129 Spouses Proceso O. Pontillas, Jr. and Helen S. Pontillas vs. Carmen Oliy Ares Vda. de Pontillas G.R. No. 207667, April 17, 2017 FactsDocument1 pageCASE #129 Spouses Proceso O. Pontillas, Jr. and Helen S. Pontillas vs. Carmen Oliy Ares Vda. de Pontillas G.R. No. 207667, April 17, 2017 FactsHarleneNo ratings yet

- Development Bank of The Philippines vs. Commission On Audit G.R. No. 216538, April 18, 2017Document2 pagesDevelopment Bank of The Philippines vs. Commission On Audit G.R. No. 216538, April 18, 2017HarleneNo ratings yet

- Respondents: Land Bank of The Philippines vs. West Bay Colleges, Inc., Et. Al. G.R. No. 211287, April 17, 2017Document1 pageRespondents: Land Bank of The Philippines vs. West Bay Colleges, Inc., Et. Al. G.R. No. 211287, April 17, 2017HarleneNo ratings yet

- CASE #126 Lo Loy Unduran, Et. Al. vs. Ramon Aberasturi, Et. Al. G.R. No. 181284, April 18, 2017 FactsDocument1 pageCASE #126 Lo Loy Unduran, Et. Al. vs. Ramon Aberasturi, Et. Al. G.R. No. 181284, April 18, 2017 FactsHarleneNo ratings yet

- CASE #122 Gloria Macapagal Arroyo vs. People of The Philippines and Sandiganbayan G.R. No. 220598, April 18, 2017 FactsDocument2 pagesCASE #122 Gloria Macapagal Arroyo vs. People of The Philippines and Sandiganbayan G.R. No. 220598, April 18, 2017 FactsHarleneNo ratings yet

- CASE #133 Re: Dropping From The Rolls of Rowie A. Quimno, Utility Worker I, MCTC, Lpil, Zamboanga Sibugay, A.M. No. 17-03-33-MCTC, April 17, 2017 FactsDocument1 pageCASE #133 Re: Dropping From The Rolls of Rowie A. Quimno, Utility Worker I, MCTC, Lpil, Zamboanga Sibugay, A.M. No. 17-03-33-MCTC, April 17, 2017 FactsHarleneNo ratings yet

- CASE #132 City of Davao vs. Robert E. Olanolan G.R. No. 181149, April 17, 2017 FactsDocument2 pagesCASE #132 City of Davao vs. Robert E. Olanolan G.R. No. 181149, April 17, 2017 FactsHarleneNo ratings yet

- CASE #131 Sumifru (Philippines) Corporation vs. Bernabe Baya G.R. No. 188269, April 17, 2017 FactsDocument2 pagesCASE #131 Sumifru (Philippines) Corporation vs. Bernabe Baya G.R. No. 188269, April 17, 2017 FactsHarleneNo ratings yet

- CASE #130 Ultra Mar Aqua Resource, Inc. vs. Fermida Construction Services G.R. No. 191353, April 17, 2017 FactsDocument2 pagesCASE #130 Ultra Mar Aqua Resource, Inc. vs. Fermida Construction Services G.R. No. 191353, April 17, 2017 FactsHarleneNo ratings yet

- CASE #127 Ramon R. Villarama vs. Atty. Clodualdo C. de Jesus G.R. No. 217004, April 17, 2017 FactsDocument2 pagesCASE #127 Ramon R. Villarama vs. Atty. Clodualdo C. de Jesus G.R. No. 217004, April 17, 2017 FactsHarleneNo ratings yet

- CASE #134 Roberto P. Fuentes vs. People of The Philippines G.R. No. 186421, April 17, 2017 FactsDocument2 pagesCASE #134 Roberto P. Fuentes vs. People of The Philippines G.R. No. 186421, April 17, 2017 FactsHarlene100% (1)

- CASE #135 Herma Shipyard, Inc, and Mr. Herminio Esguerra vs. Danilo Oliveros, Et. Al. G.R. No. 208936, April 17, 2017 FactsDocument1 pageCASE #135 Herma Shipyard, Inc, and Mr. Herminio Esguerra vs. Danilo Oliveros, Et. Al. G.R. No. 208936, April 17, 2017 FactsHarleneNo ratings yet

- Literature QuizDocument3 pagesLiterature QuizDulce J. Luaton100% (1)

- 1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessDocument5 pages1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessdhaiwatNo ratings yet

- RSS-China MOU?Document3 pagesRSS-China MOU?cbcnnNo ratings yet

- 4th Quarter Examination in Empowerment TechnologyDocument2 pages4th Quarter Examination in Empowerment TechnologyCris Fredrich AndalizaNo ratings yet

- Porter's Generic StrategiesDocument2 pagesPorter's Generic StrategiesSubhan Uddin KhattakNo ratings yet

- 22 Commissioner of PWH Vs San DiegoDocument21 pages22 Commissioner of PWH Vs San DiegoAira Mae P. LayloNo ratings yet

- Employee LeasingDocument8 pagesEmployee LeasingAarav DahiyaNo ratings yet

- John Duda - Cybernetics, Anarchism and Self-OrganisationDocument21 pagesJohn Duda - Cybernetics, Anarchism and Self-OrganisationBloomNo ratings yet

- Key Challenges Facing Public Sector LeadersDocument6 pagesKey Challenges Facing Public Sector LeadersSifa MtashaNo ratings yet

- Ce Feb16 FinalDocument76 pagesCe Feb16 Finaltest2012No ratings yet

- Machiavelli Against RepublicanismDocument29 pagesMachiavelli Against RepublicanismWaterscarsNo ratings yet

- 2021 CPT CodesDocument8 pages2021 CPT CodesSundar RamanathanNo ratings yet

- New TIP Course 6 DepEd TeacherDocument100 pagesNew TIP Course 6 DepEd TeacherHelen HidlaoNo ratings yet

- Reflection Paper: My Maid Invest in The Stock MarketDocument4 pagesReflection Paper: My Maid Invest in The Stock MarketMarifie PatiuNo ratings yet

- Revelation Chapter 7 28.6Document7 pagesRevelation Chapter 7 28.6Norman Green-PriceNo ratings yet

- Chapter 7Document4 pagesChapter 7MALTI MAHESH VASHISTHNo ratings yet

- Portfolio Analysis BCGDocument21 pagesPortfolio Analysis BCGAnuranjanSinha100% (2)

- The Taming of The Shrew EssayDocument5 pagesThe Taming of The Shrew Essayurdpzinbf100% (2)

- 1.18.2024 SBFCC Create Morre Eopt Beps 2.0Document70 pages1.18.2024 SBFCC Create Morre Eopt Beps 2.0b86120298alexlinNo ratings yet

- Medioint Lifescience PVT - LTD.: Standard Operating ProcedureDocument3 pagesMedioint Lifescience PVT - LTD.: Standard Operating ProcedureChoudhary DhirajNo ratings yet

- Sir SYedDocument9 pagesSir SYedsalkhan123No ratings yet

- Accounting EquationDocument14 pagesAccounting EquationDindin Oromedlav LoricaNo ratings yet

- Integrated Coastal Resources Management Project (ICRMP) : Sustaining Our Coasts: The Ridge-to-Reef ApproachDocument47 pagesIntegrated Coastal Resources Management Project (ICRMP) : Sustaining Our Coasts: The Ridge-to-Reef ApproachCHOSEN TABANASNo ratings yet

- Republic v. Science Park of The Philippines 2021Document13 pagesRepublic v. Science Park of The Philippines 2021f919No ratings yet

- FP Bhopal Edition 12 January 2023Document19 pagesFP Bhopal Edition 12 January 2023Abhishekh GuptaNo ratings yet

- Maclean Power Systems - Hardware A-FDocument1 pageMaclean Power Systems - Hardware A-FBams ArifinNo ratings yet