Professional Documents

Culture Documents

Ahmed - 21075 - MID TERM TAX 4

Ahmed - 21075 - MID TERM TAX 4

Uploaded by

Khurram SherazOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ahmed - 21075 - MID TERM TAX 4

Ahmed - 21075 - MID TERM TAX 4

Uploaded by

Khurram SherazCopyright:

Available Formats

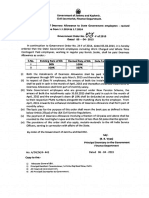

FEDERAL URDU UNIVERSITY OF ARTS, SCIENCE AND

TECHNOLOGY, ISLAMABAD

DEPARTMENT OF COMMERCE

MID-TERM EXAM B.COM-4TH SEMESTER AUTUMN-2020

Subject: Business Taxation Total Marks: 30

Time Allowed: 3 Hours Exam Date: 23-07-2020

Google Class Room Code: 6kb442l

Email:fmanagementfuu@gmail.com

Section: A Shift: Evening

Q. No. 1 2 3 4 5 6 7 8 9 1 Marks Obtained/total Marks

0

To Marks /30 be

Obtaine

d

Total Marks in Words: Thirty Marks Only.

Name of the Teacher: Miss. Sadia Akhtar

Who taught the course: Signature of Teacher/Examiner:

filled by Student

Student’s MIS ID: 21075 Class Section: Repeater

Session: Evening

Enrolment No: NIl Student’s Name_____Mohammad Ahmed

Farooq___

Student’s Email: sunny.baber.1994@gmail.com

WhatsApp No.________0313-6752627

Instruction to attempt the Midterm paper.

Submit your answer sheet (in pdf) well in time.

Late submissions will not be entertained.

You cannot make changes once the answer sheets are submitted.

The amended copy of your answer sheet will not be accepted at all.

Do not discuss your answers with others during the paper.

PAPER ON NEXT PAGE

Attempt all 3 questions. All questions carry

equal marks

Q...1 Define the following by giving example of each

(10)

Accumulated profit

Accumulated profit is a profit set aside as reserve. All profits accumulated in

whatever shape whether capitalized or cash is termed as accumulated profit before

distribution as profit.\

Example :- A company earns a profit of Rs.1000,000 and retains Rs.400,000 for

future use. The set aside Rs.400,000 will be termed as accumulated profit.

Appellate Tribunal

Appellate Tribunal is the second court of appeal. If a person or a tax department is not

satisfied with the decision of Commissioner Inland Revenue (appeals) they can make

an appeal to Appellate Tribunal.

Appellate Tribunal consist of two members i.e. Judicial and Accountant

Approved Gratuity Fund

The fund in which amount is contributed by the employer only and is paid in lump

sum at the time of retirement to the employee is called approved Gratuity Fund. In

case of death of employee Gratuity is paid to the family of the employee

Approved Superannuation Fund

This is a fund maintained by the organisation to provide benefit to its employees

at the time of retirement. In this fund amount is continuously contributed by the

employer. The amount of the fund is paid to the employees on annuity basis.

It is paid at the time of retirement or in the case of disability. In case of death

amount is paid to the family of the deceased employee.

Approval of the Superannuation Fund is necessary for getting some benefits.

For getting approval an application is submitted to the Commissioner. For this

fund 90% of the employees should be based in Pakistan.

Association of Person

As per income tax ordinance Association of persons include Firm, a hindu

undivided family, any artificial judicial person and any body of persons formed

under the foreign law does not include a Company.

Example of AoP are WAPDA, Quaid-e-Azam University

Q…2 Write a detailed note on Agriculture income, types of agriculture income…Non-

agriculture income….and Partly Agriculture and Partly Non-agriculture income with

examples. (10)

Agriculture income,

As per section 41 of the Income Tax ordinance Agriculture income means inc0me:

i. Derived from land

ii. Land is located in Pakistan

iii. Land is used for agriculture purpose

This means that income generated from a Pakistani land as rent revenue or sale of produce of

such land is called agriculture income. Land must be used for agriculture with some human

laboure. This means wild growth on land is not termed as agriculture income.

e.g. income from forest grown in the wild is not included as Agriculture income however if a

farmer grows some trees on his land and derives income from them it will be termed as

agriculture income.

Similarly income derived from a land owned in foreign country is not an agriculture income.

Agriculture income may be in the shape of cash or kind.

Types of agriculture income

1. Income derived from land by cultivation

2. Rent received from agriculture land

3. Income received from the sale of produces by cultivator or rent receiver in kind.

4. Income derived from a building required for agriculture purpose. Such building

should be on agriculture land and used as store room or other activities related with

agriculture.

Examples of Agriculture income are

1. Rent received from lessor

2. Income received from lessee

3. Income from sale of cultivated crops like wheat, sugarcane, wheat, rice, maize etc.

Non –Agriculture Income

Income which do not fall under the category fo agriculture income is called Non-agriculture income

from LAnd. Example of such incomes are:-

1. Income from mining

2. Income of a flour mill

3. Income of cottong ginning factory

4. Income from land used as markets

5. Income from sale of earth used for brick making

Partly agriculture income and partly non-agricultural income.

If a person cultivates a crop on his land and then uses the same as raw material for

manufacturing a product it is termed as partly agriculture and partly non-agriculture income.

Example

1. A person or company growing sugarecane and manufacturing Sugar from it.

2. Income of textile mill from growing cotton and producing textile related products.

3. Savour producing rice and then making pulao anad selling the same in the market.

Market value of the agriculture produce will be treated as “Income from Agriculture” and

sale proceed from selling of finished products like Sugar, Cloth, Pulao, Tea etc. will be

treated as “Income from Business.

…Non-agriculture income….and Partly Agriculture and Partly Non-agriculture income with

examples

Q…3 Sodhi Company Limited has a paid up capital of Rs. 500,000 consisting of 50,000

shares of Rs. 10 each. on 31.12.2012, company's balance sheet shows accumulated

profits of Rs. 150,000. The company has to be liquidated. The official liquidator realized

Rs. 450,000 and distribution among the shareholders was made at the rate of Rs. 9 per

share. Mr. Akram had 20,000 shares in the company.

Required. How much of the amount received by Mr. Akram is dividend? Why?

Paid up Capital is Rs. 500,000 (50,000 shares @ Rs. 10 each

Accumulated Profit Rs. 1,50,000

Shares of Mr. Akram 20,000

Amount received by Mr. Akram = 20,000 X 9 = Rs.180,000

Rate of Dividend = Accumulated Profit / No. of Shares = 150,000/50,000 = Rs.3

Hence Dividend received by Mr. Akram is = Rs.3 x 20,000 = Rs.60,000

Because Dividend is to be paid from Accumulated profit

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- IAS2 (Inventory) - QuestionsDocument4 pagesIAS2 (Inventory) - QuestionsKhurram Sheraz88% (8)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Model Paper For English Admission To Class 7 (Max. Marks: 20.0) VocabularyDocument3 pagesModel Paper For English Admission To Class 7 (Max. Marks: 20.0) VocabularyKhurram Sheraz80% (5)

- Siddeeq Public School: VocabularyDocument6 pagesSiddeeq Public School: VocabularyKhurram SherazNo ratings yet

- Contributory Provident FundDocument2 pagesContributory Provident FundKhurram SherazNo ratings yet

- Current Economic Situation of PakistanDocument5 pagesCurrent Economic Situation of PakistanKhurram SherazNo ratings yet

- Budget Manual: First EditionDocument140 pagesBudget Manual: First EditionKhurram SherazNo ratings yet

- Lecture - IsPDMDocument105 pagesLecture - IsPDMKhurram SherazNo ratings yet

- Project Staff Package 2013Document2 pagesProject Staff Package 2013Khurram Sheraz0% (1)

- Period of Duty Government / Deptt Served UnderDocument8 pagesPeriod of Duty Government / Deptt Served UnderKhurram SherazNo ratings yet

- PPRA Rules 2014 (Ammended Upto 06.01.2016)Document43 pagesPPRA Rules 2014 (Ammended Upto 06.01.2016)Aamir Ghazi90% (10)

- Diyat 2016 17Document1 pageDiyat 2016 17Khurram SherazNo ratings yet

- Research Proposal GuideDocument9 pagesResearch Proposal GuideKhurram SherazNo ratings yet

- Pay Scale Chart 2015Document6 pagesPay Scale Chart 2015Khurram SherazNo ratings yet

- Tax Mr0003Document172 pagesTax Mr0003Nigist WoldeselassieNo ratings yet

- The Pittston Dispatch 11-25-2012Document70 pagesThe Pittston Dispatch 11-25-2012The Times LeaderNo ratings yet

- P2 Revision Course MaterialsDocument63 pagesP2 Revision Course MaterialsVidya Rajawasam Mba AcmaNo ratings yet

- Income From SalariesDocument19 pagesIncome From SalariesTaruna ShandilyaNo ratings yet

- Application For Employer Identification Number: Third Party DesigneeDocument2 pagesApplication For Employer Identification Number: Third Party DesigneeKonstantinos KavafisNo ratings yet

- Gsis VS Fernando P. de LeonDocument2 pagesGsis VS Fernando P. de LeonEarvin Joseph BaraceNo ratings yet

- HRX Uk HR Setup r12Document50 pagesHRX Uk HR Setup r12ChakravarthiVedaNo ratings yet

- Utmost Good Faith, Insurable Interest Indemnity Corollaries of Indemnity - Subrogation, Contribution Proximate CauseDocument18 pagesUtmost Good Faith, Insurable Interest Indemnity Corollaries of Indemnity - Subrogation, Contribution Proximate CauseNiranjan BeheraNo ratings yet

- Black BookDocument66 pagesBlack BookYuvrajNo ratings yet

- Chap7 9 RIT Exclusion and InclusionDocument62 pagesChap7 9 RIT Exclusion and InclusionCarmela Dawn DelfinNo ratings yet

- Fsa BooksDocument4 pagesFsa BooksLetsogile BaloiNo ratings yet

- Personal FinanceDocument56 pagesPersonal Financesweetest toothacheNo ratings yet

- National Pension System One Pager V2Document2 pagesNational Pension System One Pager V2ramboNo ratings yet

- AAA Accounting Standards Part 2Document4 pagesAAA Accounting Standards Part 2Gauri WastNo ratings yet

- Income Taxation: General Principles and DefinitionsDocument127 pagesIncome Taxation: General Principles and DefinitionsElizabeth Rivera100% (2)

- GAD 53 OrderDocument2 pagesGAD 53 OrderShowkat Ahmad LoneNo ratings yet

- Syllabus PDFDocument81 pagesSyllabus PDFC RajkumarNo ratings yet

- De Smith & Teri Patterson E-MailsDocument2 pagesDe Smith & Teri Patterson E-MailsRobert LeeNo ratings yet

- Ex-Servicemen Contributory Health Scheme (Echs) Application Form For MembershipDocument14 pagesEx-Servicemen Contributory Health Scheme (Echs) Application Form For Membershipojas nimbusNo ratings yet

- IT - Cal - With - Form - 16 - 2011-12Document13 pagesIT - Cal - With - Form - 16 - 2011-12seeyem2000No ratings yet

- Employeement Form JACPLDocument5 pagesEmployeement Form JACPLJaymit PatelNo ratings yet

- pd24 09eDocument2 pagespd24 09eTommy DuNo ratings yet

- HDFC Life New Immediate Annuity PlanDocument8 pagesHDFC Life New Immediate Annuity Plansharad_mumNo ratings yet

- Ias 19 Employee BenefitsDocument21 pagesIas 19 Employee BenefitszulfiNo ratings yet

- Chapter 2 - Interest and Money Time Relationships Week 4Document5 pagesChapter 2 - Interest and Money Time Relationships Week 4Jouryel Ian Roy TapongotNo ratings yet

- Activity 5 Gross IncomeDocument6 pagesActivity 5 Gross IncomeRussel Jay CardeñoNo ratings yet

- Icici Complete Project Mba 3Document106 pagesIcici Complete Project Mba 3Javaid Ahmad MirNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- Lic 1Document72 pagesLic 1Subramanya DgNo ratings yet