Professional Documents

Culture Documents

Adjusting Entries: Prepaid Expenses (Its An Assets)

Adjusting Entries: Prepaid Expenses (Its An Assets)

Uploaded by

Hira SialOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entries: Prepaid Expenses (Its An Assets)

Adjusting Entries: Prepaid Expenses (Its An Assets)

Uploaded by

Hira SialCopyright:

Available Formats

Abdul Rahim Suriya www.arsuriya.

com

ADJUSTING ENTRIES

ACCRUED - The word accrue is used for both income and expenses.

When services are rendered but money is not received , then we use word to accrue

income it.

Like wise when expense is incurred but money not paid , we say accrue expenses.

1 a ) ACCRUED REVENUES

Example : Till year end as of June 30 .2020 . five students did not pay fee for previous semester .

The IBA CFO will make adjusting entry to accrue this income which is earned but not yet

received to IBA

Adjusting Entry

Account Receivable from Student Dr ( different terminology like debtors Dr)

Income Cr ( or say accrued income

1 b ) ACCRUED EXPENES

Expenses incurred but not yet recorded at the statement date are accrued expenses

Example :

ABC Corporation did not receive electricity expenses bill for year end . The estimated

cost Rs 30 000

Adjusting Entry

Expenses Dr 30 000

Payable Cr 30 000

2-Prepaid Expenses ( its an assets )

Example :

Paid office rent Rs 2000 pm for 12 month on Jan 1 , 2020

Journal entry Jan 1,2020

Pre-paid Rent ( assets ) Dr 24 000

Cash ( assets ) Cr 24 000

Abdul Rahim Suriya www.arsuriya.com

Adjusting entry MARCH 31 ,2020

Rent expenses Dr Rs 6000

Prepaid Rent Cr 6000

If we make balance sheet on March 31 Prepaid Rent on Balance Sheet will be Rs 18000.

3- Un-earned revenue or income ( it’s a liability )

Example : We gave office portion to another party on rent basis . Recovered whole year rent in

advance say Rs 3000 pm on jan1, 2020

Journal entry Jan 1,2020

Cash ( assets ) Dr 36 000

Un-earned income ( liability ) Cr 36 000

Adjusting entry MARCH 31 ,2020

Un-earned income ( liability ) Dr Rs 9000

Rent Income Cr 9000

If we make balance sheet on March 31 Un- earned Rent on Balance Sheet will be Rs 27000 and

will be shown as liability

4- Depreciation

Example :

On jan 1 , 2019 ---we purchased a machine or Rs 400 000—life 5 years and depreciation

at straight line method -

Journal entry _-- Machine Dr 400 000

Cash Cr 400 000

Depreciation per year 400 000/5 = 80 000

Dec3 1, 2019 Adjusting entry

Depreciation Dr 80 000

Allowance for Depreciation Cr 80 000

If we make balance sheet on Dec 31 ,2019– what will be amount of Machine

BALANCE SHEET

Machine cost 400 000

Less Allowance for depreciation (80 000)

Book value 320 000

Abdul Rahim Suriya www.arsuriya.com

You might also like

- Atal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Document2 pagesAtal Pension Yojana (Apy) - Account Closure Form (Voluntary Exit)Rising Star CSC67% (3)

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Answer Key - Exercises - Adjusting EntriesDocument4 pagesAnswer Key - Exercises - Adjusting EntriesAlexa AbaryNo ratings yet

- Fundamentals of Accounting Part 2Document20 pagesFundamentals of Accounting Part 2MICHAEL DIPUTADO100% (1)

- Share Based Compensation Share Based Compensation: Accounting (Mapua University) Accounting (Mapua University)Document6 pagesShare Based Compensation Share Based Compensation: Accounting (Mapua University) Accounting (Mapua University)Peri Babs100% (1)

- Week 6 Financial Accoutning Homework HWDocument7 pagesWeek 6 Financial Accoutning Homework HWDoyouknow MENo ratings yet

- Entrepreneurial Process 1Document38 pagesEntrepreneurial Process 1Marc Andrei MacatugalNo ratings yet

- Adjusting Entries For Bad DebtsDocument6 pagesAdjusting Entries For Bad DebtsKristine IvyNo ratings yet

- ACCTG1 PrefinalsDocument23 pagesACCTG1 PrefinalsJAN RAY CUISON VISPERAS100% (1)

- Lecture 5Document25 pagesLecture 5Tanveer AhmedNo ratings yet

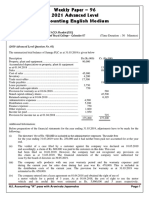

- Accounting English Medium: Weekly Paper - 96 2021 Advanced LevelDocument2 pagesAccounting English Medium: Weekly Paper - 96 2021 Advanced LevelMalar SrirengarajahNo ratings yet

- 18. Accounts from Incomplete RecordsDocument68 pages18. Accounts from Incomplete RecordsAPS Apoorv prakash singhNo ratings yet

- Fa May June - 2019Document5 pagesFa May June - 2019xodic49847No ratings yet

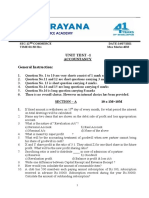

- Class Test Fundamentals and Goodwill Set A 01.05.2023 1Document2 pagesClass Test Fundamentals and Goodwill Set A 01.05.2023 1ANTECNo ratings yet

- Partnership Fundamentals 2Document6 pagesPartnership Fundamentals 2sainimanish170gmailcNo ratings yet

- Adjusting Entries-IM BSEpdfDocument11 pagesAdjusting Entries-IM BSEpdffoxban298No ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- LECTURE NOTES - Adjusting Entries - Prepayments & AccrualsDocument25 pagesLECTURE NOTES - Adjusting Entries - Prepayments & Accrualshua chen yuNo ratings yet

- Gr12ACC 2020 21 B1 & B2 Online Exam Midterm3 Full Portion TillDocument22 pagesGr12ACC 2020 21 B1 & B2 Online Exam Midterm3 Full Portion TillAviNo ratings yet

- 12 Acc 1 ModelDocument11 pages12 Acc 1 ModeljessNo ratings yet

- Accounts Mock 2Document6 pagesAccounts Mock 2Aryan AggarwalNo ratings yet

- Accounting Tutor Faculty of Economics & Business Brawijaya UniversityDocument4 pagesAccounting Tutor Faculty of Economics & Business Brawijaya UniversitySilvi 684No ratings yet

- Fundamentals of AccountingDocument50 pagesFundamentals of AccountingCarmina Dongcayan100% (2)

- Financial Accounting (CBCS Hons)Document7 pagesFinancial Accounting (CBCS Hons)Devil GamerNo ratings yet

- Accounts and Business Studies Question BankDocument5 pagesAccounts and Business Studies Question BankAkshat TiwariNo ratings yet

- Adjusting Entries 2Document77 pagesAdjusting Entries 2Lianne Grace Diomino100% (1)

- ACCOUNTING Chap.4. Adjusting The AccountsDocument6 pagesACCOUNTING Chap.4. Adjusting The AccountsKyla NavaretteNo ratings yet

- Abm 1 AdjustingDocument19 pagesAbm 1 AdjustingCarmina DongcayanNo ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- Chapter - 03 Final Accounts With AdjustmentsDocument114 pagesChapter - 03 Final Accounts With AdjustmentsAuthor Jyoti Prakash rath100% (1)

- CH 3 - FudDocument15 pagesCH 3 - FudbavanthinilNo ratings yet

- Adjustment EntriesDocument12 pagesAdjustment EntriesthachuuuNo ratings yet

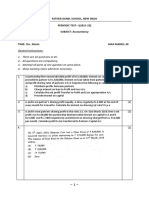

- Father Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40Document4 pagesFather Agnel School, New Delhi PERIODIC TEST-I (2021-22) SUBJECT: Accountancy Class: Xii TIME: 1hr. 30min Max Marks: 40fffffNo ratings yet

- Accounting Assignment 2 BSAF QuestionsDocument3 pagesAccounting Assignment 2 BSAF QuestionsShahzad C7No ratings yet

- Goodwill: ICM 12 Standard Gautam BeryDocument9 pagesGoodwill: ICM 12 Standard Gautam BeryGautam KhanwaniNo ratings yet

- 5 Categories of Adjusting Entries NotesDocument4 pages5 Categories of Adjusting Entries NotesBảo TrânNo ratings yet

- Lesson 3b Adjusting The AccountsDocument3 pagesLesson 3b Adjusting The AccountsBenedict CladoNo ratings yet

- 1st Semester Accounts Selected Question PDFDocument32 pages1st Semester Accounts Selected Question PDFVernon Roy100% (1)

- Final Bank Reconciliation StatmentDocument4 pagesFinal Bank Reconciliation StatmentTahir HussainNo ratings yet

- PREPAYMENTS and ACCRUALSDocument7 pagesPREPAYMENTS and ACCRUALSJoshua BrownNo ratings yet

- Lecture-6 Adjusted Trial BalanceDocument22 pagesLecture-6 Adjusted Trial BalanceWajiha NadeemNo ratings yet

- AF2108 Week 1-4 StudentDocument6 pagesAF2108 Week 1-4 Studentw.leeNo ratings yet

- Allama Iqbal Open University, Islamabad: (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad: (Department of Commerce)ilyas muhammadNo ratings yet

- DDA 1 Niaga C Materials - 4th MeetingDocument32 pagesDDA 1 Niaga C Materials - 4th MeetingZenalina Hadi PutriNo ratings yet

- CB Chap 3Document39 pagesCB Chap 3Christianne Joyse MerreraNo ratings yet

- Additional Questions 3Document4 pagesAdditional Questions 3Shyam SoniNo ratings yet

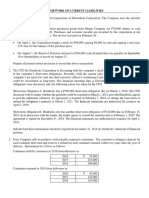

- Homework On Current Liabilities 1st Term Sy2018-2019Document4 pagesHomework On Current Liabilities 1st Term Sy2018-2019RedNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- 2 Financial Accounting ReportingDocument5 pages2 Financial Accounting ReportingBizness Zenius HantNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Accounting LM3Document6 pagesAccounting LM3Nathan Kurt LeeNo ratings yet

- Adjusting Entries A. Short ProblemsDocument3 pagesAdjusting Entries A. Short ProblemsFeiya LiuNo ratings yet

- Assignment On Fundamentals of PartnershipDocument8 pagesAssignment On Fundamentals of Partnershipsainimanish170gmailc100% (1)

- Wa0000 PDFDocument12 pagesWa0000 PDFsipheleleNo ratings yet

- Financial Accounting 3.1Document6 pagesFinancial Accounting 3.1Tawanda HerbertNo ratings yet

- Assignment Accounting AJE GUIANGDocument14 pagesAssignment Accounting AJE GUIANGIce Voltaire B. GuiangNo ratings yet

- COMPLETEQuarter 2-Week 6-Lesson 1 - The Adjusting Entries - Prepayments Using The Asset Method PDFDocument6 pagesCOMPLETEQuarter 2-Week 6-Lesson 1 - The Adjusting Entries - Prepayments Using The Asset Method PDFErickvann Jabeson RuizalNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- 1 The Basics of Adjusting EntriesDocument9 pages1 The Basics of Adjusting Entriescyrize mae fajardoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- DOW ACCOUNTING Jan 11,2021Document8 pagesDOW ACCOUNTING Jan 11,2021Hira SialNo ratings yet

- Classification of Companies Note Third ScheduleDocument3 pagesClassification of Companies Note Third ScheduleHira SialNo ratings yet

- DOW Exam Practise DEC 28 2020Document4 pagesDOW Exam Practise DEC 28 2020Hira SialNo ratings yet

- Practical Exercises: AccountingDocument7 pagesPractical Exercises: AccountingHira SialNo ratings yet

- The Institute of Business and Health Management: Financial Accounting, BBA, FALL 2020Document3 pagesThe Institute of Business and Health Management: Financial Accounting, BBA, FALL 2020Hira SialNo ratings yet

- Equal Payment SeriesDocument5 pagesEqual Payment SeriesMaya OlleikNo ratings yet

- Img 20230108 0001Document1 pageImg 20230108 0001Medhansh BhardwajNo ratings yet

- Carta de La Junta de Supervisión FiscalDocument2 pagesCarta de La Junta de Supervisión FiscalEl Nuevo DíaNo ratings yet

- Required: 1. Compute The Net Present Value (NPV) of This Investment Project 2. Should The Equipment Be Purchased According To NPV Analysis?Document5 pagesRequired: 1. Compute The Net Present Value (NPV) of This Investment Project 2. Should The Equipment Be Purchased According To NPV Analysis?carinaNo ratings yet

- Efisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten JemberDocument12 pagesEfisiensi Biaya Operasional Kendaraan Pada Pelebaran Jalan Brawijaya Kabupaten Jemberashadi asriNo ratings yet

- HinoDocument14 pagesHinoOmerSyedNo ratings yet

- JSW TalenTech-JDDocument2 pagesJSW TalenTech-JDKP KumarNo ratings yet

- Fua Cun vs. Summers, 44 PHIL 705Document3 pagesFua Cun vs. Summers, 44 PHIL 705Vincent BernardoNo ratings yet

- Module 1 - Consumer BehaviourDocument17 pagesModule 1 - Consumer BehaviourPrashansa SumanNo ratings yet

- 109 04 Simple LBO ModelDocument2 pages109 04 Simple LBO ModelTrần Bảo YếnNo ratings yet

- Transunion Cibil ReportDocument39 pagesTransunion Cibil ReportSHREYAS KHANOLKARNo ratings yet

- ZUNG ZANG WOOD PRODUCTS SDN BHD & ORS V KWANDocument23 pagesZUNG ZANG WOOD PRODUCTS SDN BHD & ORS V KWANwedyinganywaysNo ratings yet

- ESG Data Free Trial - RefinitivDocument4 pagesESG Data Free Trial - RefinitivgodkabetaNo ratings yet

- Agency ProblemDocument11 pagesAgency Problemreigh paulusNo ratings yet

- Tempalte e BankingDocument12 pagesTempalte e Bankingcorneles tuanakottaNo ratings yet

- Lifelines of National EconomyDocument6 pagesLifelines of National EconomyjeffreyNo ratings yet

- The Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersDocument4 pagesThe Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersSaurabh PantNo ratings yet

- CH 07Document100 pagesCH 07SamiNaserNo ratings yet

- Types of IndustriesDocument29 pagesTypes of IndustriesMilton MosquitoNo ratings yet

- Strategic Analysis ShivamDocument27 pagesStrategic Analysis ShivamMadanKarkiNo ratings yet

- Feasibility StudiesDocument60 pagesFeasibility Studiesice100% (2)

- Role-Model Leaders: Leadership Traits and ValuesDocument9 pagesRole-Model Leaders: Leadership Traits and ValuesRUTVIKA DHANESHKUMARKUNDAGOLNo ratings yet

- ch06 Time Value of MoneyDocument44 pagesch06 Time Value of MoneyMortarezNo ratings yet

- Viva On Project and CfsDocument7 pagesViva On Project and CfsCrazy GamerNo ratings yet

- Inventory Management FinalDocument32 pagesInventory Management Finaljessa rodene franciscoNo ratings yet

- Cash Flow Part 2 To 7 Term 2 Sunil PandaDocument35 pagesCash Flow Part 2 To 7 Term 2 Sunil PandaAnupama SinghNo ratings yet

- Ratio ShreeDocument12 pagesRatio ShreeMandeep BatraNo ratings yet

- Simple Agreement For Future Tokens - What Are TheyDocument7 pagesSimple Agreement For Future Tokens - What Are TheyellirafaeladvNo ratings yet