Professional Documents

Culture Documents

Market Loan Weekly Prices: Shelled MKT Price

Market Loan Weekly Prices: Shelled MKT Price

Uploaded by

Morgan IngramCopyright:

Available Formats

You might also like

- Social Realism and Representation of The Working Class in Contemporary British CinemaDocument85 pagesSocial Realism and Representation of The Working Class in Contemporary British Cinemastevea18922100% (2)

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- 4 40 20 PDFDocument1 page4 40 20 PDFBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 2, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 2, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - September 23, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - September 23, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Peanut Property SaleDocument1 pageShelled MKT Price Weekly Prices: Peanut Property SaleBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - November 30, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - November 30, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - October 22, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 22, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeNo ratings yet

- 4 51 20 PDFDocument1 page4 51 20 PDFBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- 09 135 20Document1 page09 135 20Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - October 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 15, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - June 20, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - June 20, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - December 9, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 9, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - May 23, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 23, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- 05-55-19 PMNDocument1 page05-55-19 PMNBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - July 17, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 17, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- 07 84 19Document1 page07 84 19Brittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 8, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 8, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Market Loan Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- Harvest Lbs/ac Begin Stocks Imports Seed & Residual: YieldDocument1 pageHarvest Lbs/ac Begin Stocks Imports Seed & Residual: YieldBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideFrom EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Iso 3408 2 2021Document11 pagesIso 3408 2 2021Steve AlissonNo ratings yet

- Ias/Pas 34: Interim Financial ReportingDocument29 pagesIas/Pas 34: Interim Financial ReportingFranz NayangaNo ratings yet

- Project Management & Challenges-1Document10 pagesProject Management & Challenges-1Sonika VermaNo ratings yet

- COMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996Document20 pagesCOMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996dawitNo ratings yet

- Tax SparingDocument5 pagesTax Sparingfrancis_asd2003No ratings yet

- Rekap Ritase N Coly 610 DetailDocument26 pagesRekap Ritase N Coly 610 DetailArief Rakhman HidayatNo ratings yet

- The 5 Hour MillionaireDocument33 pagesThe 5 Hour Millionairehello_ayanNo ratings yet

- Farhan Autocad Civil EngineerDocument9 pagesFarhan Autocad Civil EngineerKhan MuhammadNo ratings yet

- 3.-GE11 EntrepreneurialMind FINALDocument15 pages3.-GE11 EntrepreneurialMind FINALLEA MAE ANAYON100% (2)

- Xteristics of Negotiable InstrumentsDocument4 pagesXteristics of Negotiable InstrumentsBelinda YeboahNo ratings yet

- 03 Quiz 1 AubDocument3 pages03 Quiz 1 Aubken dahunanNo ratings yet

- Product Slate ExportDocument123 pagesProduct Slate ExportVegeta SaiyanNo ratings yet

- Ibps RRB Office Assistant Mains Question Paper 2020 24Document57 pagesIbps RRB Office Assistant Mains Question Paper 2020 24Kiiruthiga ShanmugamNo ratings yet

- GROUP II PPT (2 5pm) Chapter 7, Food IndustryDocument29 pagesGROUP II PPT (2 5pm) Chapter 7, Food IndustryMaryjo RamirezNo ratings yet

- Business PlanDocument8 pagesBusiness Plandynveraldeguer111No ratings yet

- TheMet BrochureDocument18 pagesTheMet BrochuredavidNo ratings yet

- OD429419745237938100Document2 pagesOD429419745237938100jd2saiNo ratings yet

- Humanity's Unsustainable Environmental Footprint - Hoekstra - 2014Document5 pagesHumanity's Unsustainable Environmental Footprint - Hoekstra - 2014David RemolinaNo ratings yet

- GPRO - 330 - 1 - Monthly Process AuditDocument1 pageGPRO - 330 - 1 - Monthly Process Auditsantosh kumarNo ratings yet

- Uniwash UW Series SpecificationsDocument4 pagesUniwash UW Series Specificationsmairimsp2003No ratings yet

- Ironsworn WinterhallDocument7 pagesIronsworn WinterhallÖzgür GüvenNo ratings yet

- Welcome To The TMTC & Gems Training Program Finance ManagementDocument16 pagesWelcome To The TMTC & Gems Training Program Finance ManagementRohan AhujaNo ratings yet

- Animation Magazine 2006 No 157-86Document1 pageAnimation Magazine 2006 No 157-86ShermanNo ratings yet

- 2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemDocument4 pages2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemRaghuNo ratings yet

- Computerisation of A Police Department in Aswi Case Study AnalysisDocument8 pagesComputerisation of A Police Department in Aswi Case Study AnalysisSyed Huzayfah Faisal0% (1)

- Salient Features of TRAIN LawDocument11 pagesSalient Features of TRAIN LawTiffany TuñacaoNo ratings yet

- Notes 3 OptionsDocument12 pagesNotes 3 OptionsAravind SNo ratings yet

- Chapter 3: Forecasting: Anne Liah D. Romero BSA2205 - BSMA 1E Activity 3Document11 pagesChapter 3: Forecasting: Anne Liah D. Romero BSA2205 - BSMA 1E Activity 3Aliah RomeroNo ratings yet

- Preimmersion Ctivity 4Document2 pagesPreimmersion Ctivity 4LOSILEN DONESNo ratings yet

Market Loan Weekly Prices: Shelled MKT Price

Market Loan Weekly Prices: Shelled MKT Price

Uploaded by

Morgan IngramOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Loan Weekly Prices: Shelled MKT Price

Market Loan Weekly Prices: Shelled MKT Price

Uploaded by

Morgan IngramCopyright:

Available Formats

`

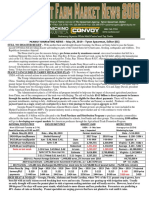

PEANUT MARKETING NEWS – February 24, 2021 – Tyron Spearman, Editor (23)

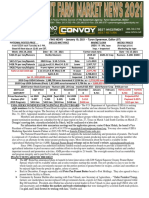

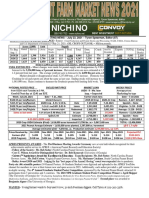

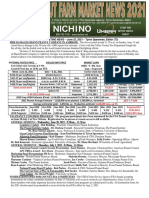

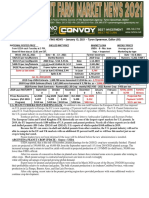

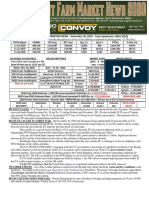

NATIONAL POSTED PRICE SHELLED MKT PRICE MARKET LOAN WEEKLY PRICES

from USDA each Tuesday at 3 PM, USDA - 9 - Mo. loan (Average prices

Good til Next day at 12:01 am EST. insp. = Inspected Marketing by type

Week- Feb 23, 2021 Date – 2-23, 2021 Farmer stock tons Date – 02-13-2021

$424.55 per ton/Runners Shelled Runners 2019-20 Crop 2020-21 Crop Runners - $.206- $412 t

$415.57 per ton/Spanish 2020 Crop - $.50- $.55 lb. Date 3-3-2020 2-23-2021 Spanish - $.234 - $468 t

$428.74 per ton/Valencia 3-3-20 Jum$.67,Med.67, $.66 Loans 2,340,990 2,435,254 Virginias - None

$428.74 per ton/Virginia No sellers /delivery top priority Redeemed 498,864 636,041 Average - $.207- $414 t

Same as last week 3-3-19 Jum $.46 Med, $.45 In Loan 1,842,126 1,799,213 Runners –150,913,000

Splits $.44 Estimate 2,748,043 t 3,067,168 t Virginia – None

Feb 28, 2021 (2020 crop) Inspected 2,752,280 t 3,099,739 t Spanish – 7,458,000#

2019 Crop USDA Estimate- 1,389,700 acres harvested X 3,934 lbs. ac = 2,733,243 tons TOTAL –158,371,000 #

2020 Crop USDA Estimate (Final)- 1,616,000 acres harvested X 3,796 lbs. ac = 3,067,168 tons UP 0.5 ct/lb

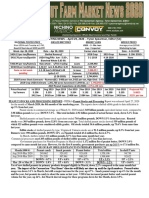

2021 Farmer Stock Contracts – $500 per ton /$475 per ton, plus $25 per ton premium on seed and/or High Oleic (HO)

Runner Pool - $425 per ton now and dividends will be determined at the end of the season.

Mini-Max Runner Pool – Pool has $400 per ton minimum and $500 per ton Max – This week - $475 ton.

Flex Contract (per shelled mkt price: Shelled med runner of $.53 lb = $475 per ton, Max flex of $.63 lb = $600 per ton

VC – Virginias – Some $500/$520 per ton, + $25 per ton for irrigated, Runners -$475 per ton, HO - $500 per ton

Prices Received by Jul 2020 Aug 2020 Sept 2020 Oct 2020 Nov 2020 Dec 2020 Projected PLC

Farmers (PLC $.207 $.205 $.205 $.209 $.212 $.204 Payment $.0575

2019 Program) $414 ton $410 ton $410 ton $418 ton $424 ton $408 ton $115 per ton

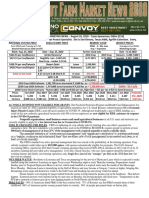

NEW LEADERS IN USDA AGRICULTURE – USDA has appointed of Gloria Montaño Greene as Deputy Under Secretary for

Farm Production and Conservation (FPAC) and Zach Ducheneaux as Administrator of the Farm Service Agency (FSA). They will

begin their positions on Monday, Feb. 22. Montaño Greene is a former State Executive Director for the Farm Service Agency in

Arizona and currently serves as Deputy Director for Chispa Arizona, a program of the League of Conservation Voters focused on the

empowerment of Latino voices.

Ducheneaux is the current Executive Director of the Intertribal Agriculture Council, the largest, longest-standing Native

American agriculture organization in the United States; the Council represents all Federally Recognized Tribes and serves 80,000

Native American producers. He operates his family’s ranch on the Cheyenne River Sioux Reservation in north central South Dakota

with his brother.

GLOBAL PEANUT NEWS - Strong demand by CHINA’s crushing sector, which has seen RISING PEANUT OIL PRICES, has

been the primary driver in CHINA’s domestic peanut market, and also affecting other global markets.

In Argentina, the week (Feb 8 -13) remained without rains, with abnormally low widespread temperatures, with minimum

temperatures below 12-13 ° C, very high relative humidity.

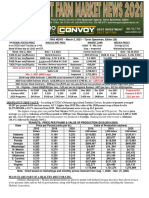

CHINA’S NEW SUPPORT PRICE/FUTURES MARKET - CHINA has generated a MINIMUM SUPPORT PRICE (MSP) for

edible peanuts in all Origins, due to its UNSATISFIED DEMAND for PEANUT OIL, demanding not only PEANUT OIL but also

IN-SHELL & KERNEL PEANUTS for its Crushing Industry.

The projection of growth of the CHINESE economy in 2021 is projected at 9%, which is the GDP of FRANCE in

MAGNITUDE, which implies more population will join the middle class; being another factor of DEMAND for higher value foods

such as the peanut oil.

The PEANUT FUTURES trading at the Zhengzhou Commodity Exchange (ZCE) in central China's Henan Province, can

help improve China's fats and oils market system and ensure the safety of the sector. The launch of PEANUT FUTURES comes

amid CROP PRICE VOLATILITY, and is part of the government's effort to enrich the FUTURE MARKET for agricultural

products.

Considering the price-in-sight, regulators launched FUTURE PEANUT negotiations in the hope that it would guide the spot

market. In the past, farmers only changed their planting volume without much market orientation. Now, they can judge demand for

the crop in part by gains and falls in the futures market, and that will mean more stable and market-driven supplies.

You might also like

- Social Realism and Representation of The Working Class in Contemporary British CinemaDocument85 pagesSocial Realism and Representation of The Working Class in Contemporary British Cinemastevea18922100% (2)

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument1 pageCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau, and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 29, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - November 13, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 13, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 16, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- 4 40 20 PDFDocument1 page4 40 20 PDFBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - April 2, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - April 2, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - September 23, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - September 23, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Peanut Property SaleDocument1 pageShelled MKT Price Weekly Prices: Peanut Property SaleBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - November 30, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - November 30, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - October 22, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 22, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.6ct/lbBrittany EtheridgeNo ratings yet

- 4 51 20 PDFDocument1 page4 51 20 PDFBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- 09 135 20Document1 page09 135 20Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - October 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - October 15, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price Weekly PricesDocument1 pageShelled MKT Price Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - June 20, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - June 20, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - December 9, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 9, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- PEANUT MARKETING NEWS - May 23, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 23, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly PricesDocument1 pageShelled MKT Price Market Loan Weekly PricesMorgan IngramNo ratings yet

- 05-55-19 PMNDocument1 page05-55-19 PMNBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - July 17, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 17, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Document1 pageShelled MKT Price Market Loan Weekly Prices: F Om USDA Each Tuesday at 3 PM, Average Prices (USDA)Brittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- National Posted Price Shelled MKT Price Market Loan Weekly PricesDocument1 pageNational Posted Price Shelled MKT Price Market Loan Weekly PricesBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - July 15, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- 07 84 19Document1 page07 84 19Brittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 8, 2019 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 8, 2019 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Market Loan Weekly Prices: Same As Last WeekDocument1 pageShelled MKT Price Market Loan Weekly Prices: Same As Last WeekBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,318,000 Tons, Up 8.2 % DOWN - $0.4ct/lbBrittany EtheridgeNo ratings yet

- Harvest Lbs/ac Begin Stocks Imports Seed & Residual: YieldDocument1 pageHarvest Lbs/ac Begin Stocks Imports Seed & Residual: YieldBrittany EtheridgeNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Prairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideFrom EverandPrairie Farmer, Vol. 56: No. 12, March 22, 1884 A Weekly Journal for the Farm, Orchard and FiresideNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 87.3%Morgan IngramNo ratings yet

- Export Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Document1 pageExport Raw-Shelled Peanuts (MT) In-Shell Peanuts (MT) UP + 67.4%Morgan IngramNo ratings yet

- Peanut Marketing News - January 22, 2021 - Tyron Spearman, EditorDocument1 pagePeanut Marketing News - January 22, 2021 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Cotton Marketing NewsDocument1 pageCotton Marketing NewsMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Crop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualDocument2 pagesCrop Production and Peanut Stocks and Processing, NASS, USDA, Census Bureau and U.S. Department of Commerce Harvest Lbs/ac Begin Stocks Imports Seed & ResidualMorgan IngramNo ratings yet

- Market Loan Weekly Prices: Shelled MKT PriceDocument1 pageMarket Loan Weekly Prices: Shelled MKT PriceMorgan IngramNo ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Broiler Hatchery 01-06-21Document2 pagesBroiler Hatchery 01-06-21Morgan IngramNo ratings yet

- PEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - December 17, 2020 - Tyron Spearman, EditorMorgan IngramNo ratings yet

- Cit 0121Document4 pagesCit 0121Morgan IngramNo ratings yet

- 1,000 Acres Pounds/Acre TonsDocument1 page1,000 Acres Pounds/Acre TonsMorgan IngramNo ratings yet

- Florida Crop Progress and Condition ReportDocument2 pagesFlorida Crop Progress and Condition ReportMorgan IngramNo ratings yet

- Iso 3408 2 2021Document11 pagesIso 3408 2 2021Steve AlissonNo ratings yet

- Ias/Pas 34: Interim Financial ReportingDocument29 pagesIas/Pas 34: Interim Financial ReportingFranz NayangaNo ratings yet

- Project Management & Challenges-1Document10 pagesProject Management & Challenges-1Sonika VermaNo ratings yet

- COMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996Document20 pagesCOMPETING SCHOOLS OF THOGHT IN MACROECNOMICS Gerrard1996dawitNo ratings yet

- Tax SparingDocument5 pagesTax Sparingfrancis_asd2003No ratings yet

- Rekap Ritase N Coly 610 DetailDocument26 pagesRekap Ritase N Coly 610 DetailArief Rakhman HidayatNo ratings yet

- The 5 Hour MillionaireDocument33 pagesThe 5 Hour Millionairehello_ayanNo ratings yet

- Farhan Autocad Civil EngineerDocument9 pagesFarhan Autocad Civil EngineerKhan MuhammadNo ratings yet

- 3.-GE11 EntrepreneurialMind FINALDocument15 pages3.-GE11 EntrepreneurialMind FINALLEA MAE ANAYON100% (2)

- Xteristics of Negotiable InstrumentsDocument4 pagesXteristics of Negotiable InstrumentsBelinda YeboahNo ratings yet

- 03 Quiz 1 AubDocument3 pages03 Quiz 1 Aubken dahunanNo ratings yet

- Product Slate ExportDocument123 pagesProduct Slate ExportVegeta SaiyanNo ratings yet

- Ibps RRB Office Assistant Mains Question Paper 2020 24Document57 pagesIbps RRB Office Assistant Mains Question Paper 2020 24Kiiruthiga ShanmugamNo ratings yet

- GROUP II PPT (2 5pm) Chapter 7, Food IndustryDocument29 pagesGROUP II PPT (2 5pm) Chapter 7, Food IndustryMaryjo RamirezNo ratings yet

- Business PlanDocument8 pagesBusiness Plandynveraldeguer111No ratings yet

- TheMet BrochureDocument18 pagesTheMet BrochuredavidNo ratings yet

- OD429419745237938100Document2 pagesOD429419745237938100jd2saiNo ratings yet

- Humanity's Unsustainable Environmental Footprint - Hoekstra - 2014Document5 pagesHumanity's Unsustainable Environmental Footprint - Hoekstra - 2014David RemolinaNo ratings yet

- GPRO - 330 - 1 - Monthly Process AuditDocument1 pageGPRO - 330 - 1 - Monthly Process Auditsantosh kumarNo ratings yet

- Uniwash UW Series SpecificationsDocument4 pagesUniwash UW Series Specificationsmairimsp2003No ratings yet

- Ironsworn WinterhallDocument7 pagesIronsworn WinterhallÖzgür GüvenNo ratings yet

- Welcome To The TMTC & Gems Training Program Finance ManagementDocument16 pagesWelcome To The TMTC & Gems Training Program Finance ManagementRohan AhujaNo ratings yet

- Animation Magazine 2006 No 157-86Document1 pageAnimation Magazine 2006 No 157-86ShermanNo ratings yet

- 2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemDocument4 pages2nd Year Sem IV IFS ANSWER KEY Indian Financial SysytemRaghuNo ratings yet

- Computerisation of A Police Department in Aswi Case Study AnalysisDocument8 pagesComputerisation of A Police Department in Aswi Case Study AnalysisSyed Huzayfah Faisal0% (1)

- Salient Features of TRAIN LawDocument11 pagesSalient Features of TRAIN LawTiffany TuñacaoNo ratings yet

- Notes 3 OptionsDocument12 pagesNotes 3 OptionsAravind SNo ratings yet

- Chapter 3: Forecasting: Anne Liah D. Romero BSA2205 - BSMA 1E Activity 3Document11 pagesChapter 3: Forecasting: Anne Liah D. Romero BSA2205 - BSMA 1E Activity 3Aliah RomeroNo ratings yet

- Preimmersion Ctivity 4Document2 pagesPreimmersion Ctivity 4LOSILEN DONESNo ratings yet