Professional Documents

Culture Documents

Meeting 9 - 10 - Assignment

Meeting 9 - 10 - Assignment

Uploaded by

Kevin ChandraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Meeting 9 - 10 - Assignment

Meeting 9 - 10 - Assignment

Uploaded by

Kevin ChandraCopyright:

Available Formats

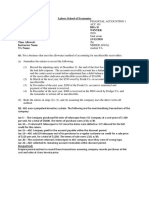

Accounting for Merchandising Operations

Challenge Exercise 1

Information related to Pagnucci Co. is presented below.

1. On April 5, purchased merchandise from Mockingbird Company for $20,000 terms 2/10,

net/30, FOB shipping point.

2. On April 6 paid freight costs of $500 on merchandise purchased from Mockingbird.

3. On April 7, purchased equipment on account for $29,000.

4. On April 8, returned damaged merchandise to Mockingbird Company and was granted a

$3,000 credit for returned merchandise.

5. On April 15 paid the amount due to Mockingbird Company in full.

Instructions:

(a) Prepare the journal entries to record these transactions on the books of Pagnucci Co.

under a perpetual inventory system.

(b) On April 20, Pagnucci sold 60% of the goods purchased from Mockingbird. What amount

would they record as cost of goods sold?

(c) How would the April 6 entry be different if the $500 was paid to ship goods to a customer

(rather than to ship goods purchased from a supplier)?

(d) Assume that Pagnucci Co. paid the balance due to Mockingbird Company on May 4

instead of April 15. Prepare the journal entry to record this payment.

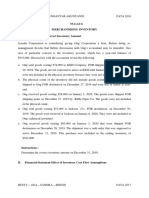

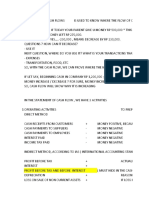

Challenge Exercise 2

Craig Ferguson Company had the following account balances at year-end: Cost of Goods

Sold $70,000; Inventory $17,500; Operating Expenses $33,000; Sales Revenue $126,000;

Sales Discounts $1,400; and Sales Returns and Allowances $1,950. A physical count of

inventory determines that inventory on hand is $16,450.

Instructions:

(a) Prepare the adjusting entry necessary as a result of the physical count.

(b) Prepare closing entries.

(c) Assume that the physical count of inventory indicated that inventory on hand is $17,800

(the account still shows a balance of $17,500 due to errors made during the year. Prepare the

adjusting entry necessary as a result of the physical count.

(d) What is Craig Ferguson Company’s net income for the year?

AF©2020

You might also like

- CHAPTER 1 Caselette - Accounting CycleDocument51 pagesCHAPTER 1 Caselette - Accounting CycleAnna Parcia75% (4)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Group Assignment 2014Document3 pagesGroup Assignment 2014Samuel AberaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CH 05Document9 pagesCH 05Tien Thanh DangNo ratings yet

- Acc. QuestionsDocument5 pagesAcc. QuestionsFaryal MughalNo ratings yet

- CH 06Document8 pagesCH 06Tien Thanh DangNo ratings yet

- Accounting UC3M Midterm Mock ExamDocument5 pagesAccounting UC3M Midterm Mock ExamInterecoNo ratings yet

- Inventory 2 (Theories & Problems) With AnswersDocument11 pagesInventory 2 (Theories & Problems) With AnswersUzziehllah Ratuita100% (3)

- CH 5Document3 pagesCH 5Raeha Tul Jannat BuzdarNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingAnmol ChahalNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- CH 05Document6 pagesCH 05Rabie HarounNo ratings yet

- Acct CH.6Document12 pagesAcct CH.6j8noelNo ratings yet

- A + Tutorial Guaranteed: Acc 290 Final Exam Click Here To Get The AnswersDocument3 pagesA + Tutorial Guaranteed: Acc 290 Final Exam Click Here To Get The AnswersMishi LinkonNo ratings yet

- Intermediate Assignment 1Document3 pagesIntermediate Assignment 1tilahuntsigewoldeNo ratings yet

- Chapter 5 ExercisesDocument8 pagesChapter 5 ExercisesRaihan Rohadatul 'AisyNo ratings yet

- Inv 4-7Document21 pagesInv 4-7lynguyen2996No ratings yet

- Chang Converted MergedDocument8 pagesChang Converted MergedEbAd ZuberiNo ratings yet

- FoA II-Individual AssignmentDocument6 pagesFoA II-Individual Assignmentmedhane negaNo ratings yet

- Chapter 11 Corporations: Organization, Capital Stock Transactions, and DividendsDocument12 pagesChapter 11 Corporations: Organization, Capital Stock Transactions, and Dividendsehab_ghazallaNo ratings yet

- Excercises MerchandisingDocument4 pagesExcercises MerchandisingRenz AbadNo ratings yet

- ACEFIAR Quiz No. 7Document2 pagesACEFIAR Quiz No. 7Marriel Fate CullanoNo ratings yet

- Final Exam Finacc1Document11 pagesFinal Exam Finacc1Grace A. ManaloNo ratings yet

- IFRS 15 Revenue MathsDocument2 pagesIFRS 15 Revenue MathsTanvir PrantoNo ratings yet

- Pengantar Akuntansi S1Document4 pagesPengantar Akuntansi S1Ela SelaNo ratings yet

- Final Mock Test BBUSDocument19 pagesFinal Mock Test BBUSGia LâmNo ratings yet

- CH 05Document9 pagesCH 05api-274120622No ratings yet

- POFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredDocument3 pagesPOFA (ACCT 100) Tutorial: Week 2 Chapter 2 - The Recording Process Topics CoveredAli Zain ParharNo ratings yet

- QS09 - Class ExercisesDocument4 pagesQS09 - Class Exerciseslyk0texNo ratings yet

- @2015 Assignment I IFA IIDocument2 pages@2015 Assignment I IFA IIgenenegetachew64No ratings yet

- POA1-Assignment - Chapter 6 - Q SentDocument6 pagesPOA1-Assignment - Chapter 6 - Q SentYusniagita EkadityaNo ratings yet

- Fundamentals of Accounting IDocument7 pagesFundamentals of Accounting IDawit TilahunNo ratings yet

- Set eDocument4 pagesSet eKurt HendiveNo ratings yet

- Forum ACC WM - Sesi 3 (REV)Document9 pagesForum ACC WM - Sesi 3 (REV)Windy Martaputri100% (2)

- 84 164046 5994Document3 pages84 164046 5994Afaq ZaimNo ratings yet

- AaaDocument4 pagesAaaMjoyce A. BruanNo ratings yet

- Chapter4 KTQT-PDF SVDocument12 pagesChapter4 KTQT-PDF SVPhong Phạm NghĩaNo ratings yet

- Final Exercise Revision: Chap 6: InventoriesDocument3 pagesFinal Exercise Revision: Chap 6: InventoriesDieu ThiNo ratings yet

- Final Exercise Revision: Chap 6: InventoriesDocument3 pagesFinal Exercise Revision: Chap 6: InventoriesDieu ThiNo ratings yet

- BUS 145 In-Class Exercises CH 7 - CLDocument6 pagesBUS 145 In-Class Exercises CH 7 - CLjasonchahal05No ratings yet

- Tugas Lab 6 - Merchandising InventoryDocument2 pagesTugas Lab 6 - Merchandising InventoryRandomly StoreNo ratings yet

- Tugas MK Dasar Akuntansi Pertemuan Ke-15Document2 pagesTugas MK Dasar Akuntansi Pertemuan Ke-15Mochamad Ardan FauziNo ratings yet

- Final Exam (Add)Document3 pagesFinal Exam (Add)samuel debebeNo ratings yet

- Exercise For Chapter 5 6Document16 pagesExercise For Chapter 5 6Ngọc Ánh VũNo ratings yet

- ACT 2100 Worksheet IIIDocument4 pagesACT 2100 Worksheet IIIAshmini PershadNo ratings yet

- Financial Reporting (Cma1c)Document4 pagesFinancial Reporting (Cma1c)Alyssa AnnNo ratings yet

- Final Exam BSC 2nd 2020Document3 pagesFinal Exam BSC 2nd 2020NadeemNo ratings yet

- Accounting CycleDocument17 pagesAccounting CycleAnonymous 1P4Me8680% (1)

- Problems 1 - Accounting Cycle PDFDocument17 pagesProblems 1 - Accounting Cycle PDFEliyah JhonsonNo ratings yet

- ADP Accounting 2020 SIR SALEEMDocument1 pageADP Accounting 2020 SIR SALEEMhhaiderNo ratings yet

- Review ExercisesDocument5 pagesReview ExercisesThy Tran HongNo ratings yet

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinNo ratings yet

- 3311 CH 8 REVIEWDocument5 pages3311 CH 8 REVIEWVernon Dwanye LewisNo ratings yet

- Intacc Q2Document4 pagesIntacc Q2Juliana Reign RuedaNo ratings yet

- Reviewer Acc 1101Document4 pagesReviewer Acc 1101Sheen CaválidaNo ratings yet

- Inventories QuestionnaireDocument9 pagesInventories QuestionnaireKristine JavierNo ratings yet

- Exercises For Accounting For Merchandise StoresDocument4 pagesExercises For Accounting For Merchandise StoresAnne Dorene ChuaNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- HMPSA TALE (Tutoring and Learning Ease) : Accounting For Merchandising OperationsDocument53 pagesHMPSA TALE (Tutoring and Learning Ease) : Accounting For Merchandising OperationsKevin Chandra100% (1)

- TALE - Meeting 4 (Lesson 6)Document17 pagesTALE - Meeting 4 (Lesson 6)Kevin ChandraNo ratings yet

- Meeting 14 - AssignmentDocument1 pageMeeting 14 - AssignmentKevin ChandraNo ratings yet

- T.A.L.E.: Accounting Principles 1Document44 pagesT.A.L.E.: Accounting Principles 1Kevin ChandraNo ratings yet

- Accounting Principles 1: Accounting For Merchandising Operations InventoriesDocument41 pagesAccounting Principles 1: Accounting For Merchandising Operations InventoriesKevin Chandra100% (1)

- Meeting 9 - 10 - Student VersionDocument72 pagesMeeting 9 - 10 - Student VersionKevin ChandraNo ratings yet

- Challenge Exercise 2 (9 - 10)Document3 pagesChallenge Exercise 2 (9 - 10)Kevin ChandraNo ratings yet

- Cash Flow - Turtorial 8Document33 pagesCash Flow - Turtorial 8Kevin ChandraNo ratings yet

- Instructions:: E5.10 Prepare Multiple-Step and Single-Step Income StatementDocument16 pagesInstructions:: E5.10 Prepare Multiple-Step and Single-Step Income StatementKevin ChandraNo ratings yet

- 8178 - Lec 8Document7 pages8178 - Lec 8Kevin ChandraNo ratings yet

- Reading Explorer Foundations Target Vocabulary DefinitionsDocument5 pagesReading Explorer Foundations Target Vocabulary DefinitionsKevin ChandraNo ratings yet

- 4 Production Possibilities CurveDocument12 pages4 Production Possibilities CurveKevin ChandraNo ratings yet