Professional Documents

Culture Documents

Name Usama Mazhar Vu Id BC200410001 Satustion:: Allowances

Name Usama Mazhar Vu Id BC200410001 Satustion:: Allowances

Uploaded by

Malik Usama Mazhar0 ratings0% found this document useful (0 votes)

14 views2 pagesThe document provides accounting information for Usama Mazhar including:

1) Net purchases of Rs. 40,000 are to be presented in the income statement.

2) Gross profit of Rs. 45,000 is to be presented in the income statement.

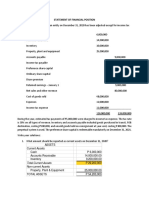

3) The net book value of machinery of Rs. 85,000 is to be presented in the balance sheet.

4) Owner's equity of Rs. 316,547 is to be presented in the balance sheet.

Original Description:

Original Title

MGT101 Assignment

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides accounting information for Usama Mazhar including:

1) Net purchases of Rs. 40,000 are to be presented in the income statement.

2) Gross profit of Rs. 45,000 is to be presented in the income statement.

3) The net book value of machinery of Rs. 85,000 is to be presented in the balance sheet.

4) Owner's equity of Rs. 316,547 is to be presented in the balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views2 pagesName Usama Mazhar Vu Id BC200410001 Satustion:: Allowances

Name Usama Mazhar Vu Id BC200410001 Satustion:: Allowances

Uploaded by

Malik Usama MazharThe document provides accounting information for Usama Mazhar including:

1) Net purchases of Rs. 40,000 are to be presented in the income statement.

2) Gross profit of Rs. 45,000 is to be presented in the income statement.

3) The net book value of machinery of Rs. 85,000 is to be presented in the balance sheet.

4) Owner's equity of Rs. 316,547 is to be presented in the balance sheet.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Name

Usama Mazhar

Vu id

BC200410001

SATUSTION:

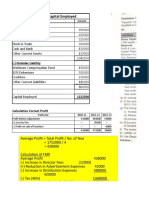

1. Net purchases to be presented in Income Statement.

Net purchase = Gross Profit - purchase return – Allowances – Discount

Net purchase = 50000-10000-0-0

Net purchase =40000 RS

2. Gross profit to be presented in Income Statement

Gross Profit = Sales Revenue

Gross Profit = Sales Revenue - Cost of goods sold

Gross profit = (Net sales - return inwards) - cost of goods sold

Gross profit = (85000 - 5000) - 35000

Gross profit = 80000 - 35000

Gross profit = 45000 Rs

3. Net Book Value of machinery to be presented in Balance Sheet

Net book value = original purchase cost - accumulated depreciation

Net book value = 100000 - (100000 x 15%)

Net book value = 100000 – 15000

Net book value = 85000 Rs

4. Value of debtors to be presented in Balance Sheet.

Opening stock 13000 Cash 12800

Credit sales 16800 Return inwards 5000

Closing stock 12000

29800 29800

5. Owner’s equity to be presented in Balance Sheet.

Owners' equity = capital + net profit - drawings ………. (1)

Net profit = gross profit - financial expenses - administrative expenses – depreciation

Net profit = 45000 - 8000 – 5453 – 15000

Net profit = 16547

Put net profit in Equation (1) Owners' equity = 300000 + 16547 - 0

Owners' equity = 316547 Rs

You might also like

- Activity 3 CAMINGAWAN BSMA 2B PDFDocument7 pagesActivity 3 CAMINGAWAN BSMA 2B PDFMiconNo ratings yet

- Cash Flows From Operating Activities (Indirect Method) : Net Profit/Loss Before Tax and Extraordinary ItemsDocument13 pagesCash Flows From Operating Activities (Indirect Method) : Net Profit/Loss Before Tax and Extraordinary ItemsALEKHYA BANERJEENo ratings yet

- Ratio Analysis: Profitability RatiosDocument10 pagesRatio Analysis: Profitability RatiosREHANRAJ100% (1)

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- 11 To 20Document96 pages11 To 20JorniNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- Student Name: Student ID: Class: DateDocument4 pagesStudent Name: Student ID: Class: DateKinNo ratings yet

- Section 4Document3 pagesSection 4com01156499073No ratings yet

- PAS 1 Application - SCIDocument43 pagesPAS 1 Application - SCICzanelle Nicole EnriquezNo ratings yet

- CH 4 (Income Statement)Document40 pagesCH 4 (Income Statement)Study OuoNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Quiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFDocument3 pagesQuiz - Solution - PAS - 1 - and - PAS - 2.pdf Filename - UTF-8''Quiz (Solution) % PDFSamuel BandibasNo ratings yet

- Quiz Finma 0920Document5 pagesQuiz Finma 0920Danica RamosNo ratings yet

- PRACTICEDocument4 pagesPRACTICEGleeson Jay NiedoNo ratings yet

- Financial Statements Formate 3.2Document21 pagesFinancial Statements Formate 3.2vkvivekkm163No ratings yet

- Week 11 Sole Trader AccountsDocument24 pagesWeek 11 Sole Trader AccountsGaba RieleNo ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- Impairment PDFDocument7 pagesImpairment PDFKhensaniNo ratings yet

- Written Assignment Unit01Document6 pagesWritten Assignment Unit01Michael Aboelkhair100% (1)

- CFS Company Has The Following Details For Two-Year Period, 2019 and 2018Document7 pagesCFS Company Has The Following Details For Two-Year Period, 2019 and 2018MiconNo ratings yet

- Capital Structure.Document22 pagesCapital Structure.Puneet ShirahattiNo ratings yet

- BBS - 1st - Financial Accounting and AnalysisDocument46 pagesBBS - 1st - Financial Accounting and AnalysisJALDIMAINo ratings yet

- Tut-1 TaxDocument3 pagesTut-1 Taxbolaemil20No ratings yet

- Bharat ChemicalDocument6 pagesBharat ChemicalgauravpalgarimapalNo ratings yet

- Management Accounting - Assignment - Iv (Unit-Iv)Document13 pagesManagement Accounting - Assignment - Iv (Unit-Iv)Ujwal KhanapurkarNo ratings yet

- Final Accounts Without AdjustmentsDocument22 pagesFinal Accounts Without AdjustmentsFaizan MisbahuddinNo ratings yet

- Profitability RatiosDocument9 pagesProfitability RatiosfasmekbakerNo ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- M.Sc. Materials and Manufacturing Management: To FinanceDocument21 pagesM.Sc. Materials and Manufacturing Management: To FinanceHoàngAnhNo ratings yet

- Cash Flow FADocument10 pagesCash Flow FAWafa SehbaiNo ratings yet

- Zinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Document3 pagesZinnia Ltd. Has Furnished Its Income Statement and Balance Sheet For The Year Ended 31 March 2012Amit GodaraNo ratings yet

- ExerciseDocument8 pagesExerciseKhanh Ly TruongNo ratings yet

- Chapter 2 - Statement of Cash FlowsDocument23 pagesChapter 2 - Statement of Cash FlowsCholophrex SamilinNo ratings yet

- Name: Mukarram Ali Siddiqui (18020) Topic: Financial Statements On CorporationDocument4 pagesName: Mukarram Ali Siddiqui (18020) Topic: Financial Statements On CorporationAreeba NaeemNo ratings yet

- Financial Reporting and Analysis 101Document7 pagesFinancial Reporting and Analysis 101Samrat KanitkarNo ratings yet

- Working Lecture 7Document17 pagesWorking Lecture 7Sara KarenNo ratings yet

- Bbfa 4034 Accounting Theory Pratice LatestDocument27 pagesBbfa 4034 Accounting Theory Pratice LatestwensinNo ratings yet

- ProfitDocument12 pagesProfitAshwini SakpalNo ratings yet

- Calculation of Capital Employed: Trading AssetsDocument13 pagesCalculation of Capital Employed: Trading Assetssejal ambetkarNo ratings yet

- Annai Therasa Arts and Science College: Model ExaminationDocument6 pagesAnnai Therasa Arts and Science College: Model ExaminationJayaram JaiNo ratings yet

- Lecture 20 IA 2022 EELUDocument48 pagesLecture 20 IA 2022 EELUGeorge SobhyNo ratings yet

- FinStat and FinAnaDocument38 pagesFinStat and FinAnaHaizii PritziiNo ratings yet

- Ratio Analysis-1Document4 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- BUS 5110 - Assignment 1Document6 pagesBUS 5110 - Assignment 1michelle100% (1)

- Jaiib Accounting Module C and Module DDocument340 pagesJaiib Accounting Module C and Module DAkanksha MNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- ACC 401 Homework CH 4Document4 pagesACC 401 Homework CH 4leelee03020% (1)

- Xii Acc Worksheetss-30-55Document26 pagesXii Acc Worksheetss-30-55Unknown patelNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Business Management Notes - Final Accounts (Balance Sheet and P&L Account)Document8 pagesBusiness Management Notes - Final Accounts (Balance Sheet and P&L Account)vaanya guptaNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow StatementABOOBAKKERNo ratings yet

- CBSE Class-12 Economics Important Questions - Macro Economics 02 National Income AccountingDocument10 pagesCBSE Class-12 Economics Important Questions - Macro Economics 02 National Income AccountingSachin DevNo ratings yet

- Quiz Finma 0920Document6 pagesQuiz Finma 0920Danica Jane RamosNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Accounting Equation: Increase in Creditors 100000Document11 pagesAccounting Equation: Increase in Creditors 100000karunakar vNo ratings yet

- Financial StatementDocument48 pagesFinancial StatementShakir IsmailNo ratings yet

- IGCSE Business Studies - AccountsDocument53 pagesIGCSE Business Studies - Accountsdenny_sitorusNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- MRK - Fall 2020 - PAK301 - 1 - BC200410001Document2 pagesMRK - Fall 2020 - PAK301 - 1 - BC200410001Malik Usama MazharNo ratings yet

- MRK - Fall 2020 - PAK301 - 1 - BC200410001Document2 pagesMRK - Fall 2020 - PAK301 - 1 - BC200410001Malik Usama MazharNo ratings yet

- PAK301 Assignment No.1Document2 pagesPAK301 Assignment No.1Malik Usama MazharNo ratings yet

- PAK301 Assignment No.1 2020Document2 pagesPAK301 Assignment No.1 2020Malik Usama MazharNo ratings yet