Professional Documents

Culture Documents

33 Introduction To M A - 5 Jun 2020

33 Introduction To M A - 5 Jun 2020

Uploaded by

Bhavin SagarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

33 Introduction To M A - 5 Jun 2020

33 Introduction To M A - 5 Jun 2020

Uploaded by

Bhavin SagarCopyright:

Available Formats

© Copyright Dhananjay Satarkar. All rights reserved.

Overview of

Dhananjay Satarkar 5th June 2020

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 Strictly Private and Confidential

Profile

Dhananjay Satarkar E: dhananjay.satarkar@clearviewpartners.in

M: +91 98909 44963

• Founding partner at Clearview Consulting Partners.

• Chartered Accountant, Registered Valuer, Company Secretary, CISA, DISA and Independent Director

from IICA by education. 16 years of post qualification experience.

• Past: Senior Manager / Associate Director in PwC (M&A); Deloitte (Audit).

• Trainings / Faculty: Pune Branch of the Institute of Chartered Accountants of India, Deloitte, SIMS,

Fintree, IMA, USA (Pune Chapter), Bajaj Incubation Centre, Bhau (COEP), etc.

• Experience: Mergers and acquisitions, audit, forensics, Sox and control assurance, etc.

− Financial (PE, VC, etc) and strategic (corporates) investors on domestic and international

transactions.

− Target companies located in India, US, UK, Singapore and Dubai.

− Airlines, automotive, cement, chemicals, dairy, education, media and entertainment, financial

services, FMCG, hospitality, IT/ITES, logistics, oil, pharmaceuticals, power, real estate, retail,

shipping, steel, telecom, etc.

• Select clients served: Altran SA, Ambit, BDO, Cerberus Capital, Citigroup, Cummins Group, Emcure

Pharma, Fidelity PE, France Telecom, Fourcee Infrastructure, HCL Technologies, Unilever, Idea

Cellular, IDFC PE, Kinetic Motor Company, Kirloskar group, KSPG-Pierburg Germany, Mahindra,

Marg, Merck, USA, Mitsui and Co, Japan, Mylan, Nexus, Otsuka Pharma, Prysmian S.P.A.,

Samvardhana Motherson, Sodexo, Tata Motors, Trimble Navigation, Ultratech Cement, UBM, Varde

Partners and Vedanta.

• Performance awards from Hindustan Lever Limited and PwC.

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 2

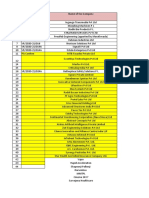

Index

Sr. No Topic

1 M&A Basic Concepts and Trends

2 Fund Structure and Terminology

3 Reasons for Mergers and Acquisitions and Select Examples

4 Mergers and Acquisitions process

5 Deal Structuring - Basics

Note:

This presentation is solely for knowledge sharing purposes only and includes data summarised from information published

by various organisations as available in public domain. There is no intent to infringe upon their copyrights. In certain cases,

specific permission for such usage has been received from such organisations.

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 3

1. Mergers & Acquisitions overview

Mergers & Acquisitions

Acquisition Merger / Demerger

Share Business

Slump sale Consolidation Demerger

purchase purchase

Note: Internal restructuring can be undertaken through buyback or capital reduction.

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 4

Entity Dimensions

• Private Limited

Domestic or International Acquirer Company

• Public Limited

Company

• Listed Company

Regulated or Unregulated • Government

Undertaking

• Angel Network

• Crowdfund

Strategic or Financial

Investor • High Net worth

Individuals (HNI)

• Venture Capital Fund

Stressed or Non-stressed • Venture Debt

• Private Equity Fund

Target

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 5

Types of M&A transactions

Sr. Type / Key Features Particulars

No

1 Nature of Investor Financial (Primarily VC and PE) and Strategic

2 Geography Inbound, Outbound and Domestic

3 Stage of Investment Seed / Friends and Family, Angel, Crowd Funding, Series A, Series B,

Series C, Series D, IPO, etc.

4 Level of Stake Minority, Significant minority, Majority and Buy out / 100%

acquisition, etc.

5 Transaction Structure Amalgamation / merger, Demerger, Slump sale, Primary vs.

Secondary Transaction, etc.

6 Assets Being Transferred Asset Purchase, Business sale, Brand sale, Marketing rights, etc.

7 Consideration Cash, Stock, Shares and Cash, Share Swap, Deferred Consideration,

etc.

8 Accounting Standards Issued by ICAI/Central Government, Indian Accounting Standards,

IFRS, US GAAP, etc.

9 Taxation Income Tax Act, 1961

10 Stressed Pre-IBC, IBC and post IBC

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 6

Key Characters Involved

Sr. No. Type Particulars

1 Startups / Companies Zoomcar, Swiggy, BYJUs, etc

2 High Net worth Individuals Ratan Tata, Mukesh Ambani, Azim Premji, etc

(HNIs)

3 Incubators NCL Innovation Park, Venture Center, Zone Startups India, etc.

4 Accelerators Edugild, NASSCOM (10000 Startups), etc

5 Crowd Funds 1crowd, Ketto, Milap, etc

6 Angel Investors / Angel Indian Angel Network, Mumbai Angels, Pune Angels, Chennai

Networks Angels, etc

7 Venture Capital Sequoia, Tiger Global, Nexus, Helion Ventures, Blume Ventures,

Kalaari Capital, etc

8 Private Equity / Hedge The Blackstone Group, Warburg Pincus, KKR, Fidelity Growth

Funds Partners, General Atlantic, IDFC PE, etc.

Higher Higher Higher Early Smaller

Stake Return Stage of Ticket

Risk

Expectations Expectations Investment Size

Lower Lower Lower Late Larger

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 7

Deal activity in India

M&A activity witnessed sharp decline in 2019 as compared to 2018

140 1,921 2,500

2,106 122

1,872

120 2,000

996 1,177 2,020 1,582

971

100 40 1,500

Deal Value (USD bn)

1,026 947

Deal Volume

80 766 73 1,000

590 62 63 65

60 54 50 500

42

12 43 46 18 36

10 38 30

40 12 82 -

11 7 23

24 10

50 45 45

20 12 35 38 35 37 (500)

31 28 24

12

0 (1,000)

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019*

Mergers & Acquisitions Private Equity No. of Deals

2019* : Data available till November 2019.

• PE investments retained their momentum, showing significant activity in

technology sector in 2019.

• 12 QIP issues of USD 6.5 billion, which is the highest QIP raised till date.

• 2019 recorded only 11 mega deals as compared to 25 in 2018 each

valued at over a billion dollar.

Source: VCCircle, PWC & GT Reports • Total number of deals declined in 2019.

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 8

Deal activity in India

M&A activity witnessed sharp decline in 2019 as compared to 2018

Total 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Total Deal Value 42 24 62 54 43 38 50 46 63 65 122 73

(USD bn)

Total Deal Volume 766 590 971 1,026 996 947 1,177 2,106 2,020 1,872 1,921 1,582

Average Ticket Size 54 41 64 53 43 40 43 22 31 35 63 46

(USD mn)

M&A as % of total 75% 50% 80% 82% 83% 74% 76% 51% 71% 54% 67% 51%

Recent drivers for deals in India

• Valuation concerns • Liquidity challenges • Wholesale and retail NPA

• Sluggish capital market • Global headwinds • Auto and real estate stress

• Slowing consumption growth • Stress in the banking space

Source: PWC & GT Reports

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 9

M&A activity by deal type (USD billion)

Domestic and inbound transactions went down drastically as compared to outbound activities in 2019

• Tata Motors and JLR (2.3 USD bn) • Bharati Airtel and Zain Telecom

• Tata Chemicals and GCIP (10.7 USD bn)

90 82

(1.05 USD bn) • Adani group and Linc Energy

80 • JK Tyres and Tornel (70 USD mn) (2.7 USD bn)

11

Deal Value (USD bn)

70 4

60 50

45 45 22

50 38

35 5 35 37

40 31 23 11 28 5

4

30 6 24 4

15 5 19 3 12

13 9 12 44

20 12 29 9 5

9

10 13 18 6 9 8 25 21

4 16 16

- 5 7 5 6 6 8

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019*

Domestic Inbound Outbound Other

2019* : Data available till November 2019.

• Domestic transactions form major part of deal

activity

• Significant interest from overseas corporates across

sectors including steel, energy, infrastructure &

Source: PWC & GT Reports

financial services

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 10

PE investment in 2019 by stage (USD billion)

PIPE

9% Buy-out

35% Buy-out

Early

Growth

Late

26% Late

PIPE

Other

Early

Growth 3%

23%

Source: PWC Report

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 11

Top 5 Sectors attraction PE investments (USD billion)

Technology sector saw the highest activity from 2017 till 2019.

14 Year

9 21 23

2015 2016 2017 2018 2019*

28

12 11 11 Total PE deal value (USD bn) 23 18 30 40 36

10

10

Deal Value (USD bn)

9

8

6

6 5 5

4 5

4 4

4 3

2 3 3 3

2 1 1 2 1 1 1

1 1

0

Technology Infrastructure Telecom Energy Financial services

2015 2016 2017 2018 2019*

2019* : Data available till November 2019.

• Technology continued to garner attention form SWFs, PEs & alternative investment platforms

• Telecom recorded two sizable deal in 2019 (one of them in Reliance Industries Limited USD

3.7 bn)

• Energy segment was dominated by renewables

• Financial services witnessed 30% decline in terms of investment value as compared to 2018

• These five sectors constitute 77% of the investment value this year.

Source: PWC Report

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 12

PE exit activity in India (USD billion) (1/2)

2019 witnessed a sharp decline in PE exits in terms of value and volume

• Bharati Airtel and Qatar • Flipkart and Multiple • OYO and RA

Foundation investors (16000 $ mn) Hospitality (1500 $

30 (1480 $ mn) • Intelenet Global Services mn)

26

• Flipkart and Tiger Global and Blacktsone Advisors • ICICI Lombard and

25 (800 $ mn) (1000 $ mn) Fairfax (730 $ mn)

Deal Value (USD bn)

• Global Logic and Apax • RMZ Corporation and

partner multiple investors 1000 $

20 (780 $ mn) mn)

15

15

10 9 10

10 7 7 7 6

4

5

-

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019*

PE exits

2019* : Data available till November 2019. • Public market sale accounted for the major share of PE

exit value

• IPOs witnessed 67% drop in comparison to last year

• 2019 recorded the largest buyback deal in the online

hospitality space

Source: PWC and Bain & Company Report

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 13

PE exit activity in India (USD billion) (2/2)

2019 witnessed a sharp decline in PE exits in terms of value and volume

16 15

14

Deal Value (USD bn)

12

10

10

8

6 5 5

4 4 4 4

4 333 33

3 3

2 2 2 1

2 11

0 0 00

0

Public market Secondary market Buyback Strategic sale Other

sale sale

2015 2016 2017 2018 2019*

2019*: Data available till November 2019

• Public market sale accounted for the major share of PE

exit value

• IPOs witnessed 67% drop in comparison to last year

• 2019 recorded the largest buyback deal in the online

hospitality space

Source: PWC Report

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 14

M&A trends - Global

Indian contributed around 1.78 % of total global M&A activity in 2019.

2,322 2,182 2,165 2,335 2,135

5,000

4,547

-

Deal Value (USD bn)

4,500 4,115 4,095

4,000 1,201 46 3,767 (5,000)

3,559

960 122 902 73

3,500

923 63 (10,000)

3,000 1,003 65

1,094 (15,000)

1,028

2,500 1,185

926

90

2,000 930 90 (20,000)

88 83

1,500 116

(25,000)

1,000 2,162 2,075

1,830 1,887

1,510 (30,000)

500

- (35,000)

2015 2016 2017 2018 2019*

North America Latin America EMEA Asia Pacific No. of (USD) 250 mn+ Deals

Total deals in INDIA • Deal count for deals greater than $250 million was

down 9% globally year over year

• 47 megadeals were announced globally in 2019 ($10bn

Source: JP Morgan Report or greater)

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 15

GDP – Top Countries of the World

Source: IMF World Economic Outlook (Oct.2019)

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 16

FDI trends for Top Countries of World

Foreign Direct Investment - Top 10 Countries Figures in US$ bn

Country Name 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2009-2019

United States 161 264 263 250 288 252 509 494 355 258 311 3,406

China 131 244 280 241 291 268 242 175 166 235 156 2,430

Hong Kong 54 83 96 75 77 130 181 133 126 97 53 1,105

SAR, China

Germany 57 86 98 65 67 19 62 65 118 168 51 857

Brazil 31 82 102 93 75 88 65 74 69 78 79 836

Singapore 23 55 49 55 64 69 70 71 98 91 105 751

Canada 21 30 38 49 67 64 60 34 29 47 45 484

France 18 39 44 33 32 6 43 33 38 60 67 412

India 36 27 36 24 28 35 44 44 40 42 51 407

Japan 12 7 (1) 1 11 20 5 41 19 25 37 177

Top 10 545 918 1,007 887 1,000 950 1,282 1,165 1,057 1,101 955 10,865

United States 161 264 263 250 288 252 509 494 355 258 311 3,406

China including 185 326 376 316 368 398 424 308 292 332 209 3,535

Hong Kong

India 36 27 36 24 28 35 44 44 40 42 51 407

Source: https://data.worldbank.org/indicator/

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 17

Key Factors Impacting Evaluation of an M&A transaction

i. Political and Economic Environment

ii. Ease of Doing Business – India Rank (133 in 2009 vs. 63 in 2019)

iii. Tax and Regulatory Requirements

iv. Market conditions – Demand, Supply and Competitors

v. Cost Structure and Advantage

vi. Technological Environment

vii. Expected Return on Investment

viii. Transaction Structure - Ability to Take his Money and Profit Thereon Back

ix. Foreign Currency Rates and Expectations

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 18

What the Numbers denote ………

………………..GDP Target of India is USD 5 trillion by 2025.

FDI

65

64

64

63

62

(USD bn)

61

61

60

60

59

58

2017 2018 2019

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 19

2. Indicative Fund Structure

Limited Partners

• HNIs

• Institutional investors

Funds Returns / exit value

Private Equity fund / General Partner

USA

Venture Capital fund Management Fees Investment Advisor

and Carried Interest

Returns / exit value

Mauritius SPV

Portfolio Portfolio Portfolio

India

Company Company Company

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 20

Indicative Fund raising & fund closing timeline

Marketing the fund

• Fund raising

• Soliciting the investors

• Initial discussions of terms

6 – 12 months

marketing Negotiating fund terms

period

• Negotiating fund terms with prospective investors

• Finalizing fund structure

• Preparing for initial closing 3 – 6 months

negotiating

period

Initial closing

• Acceptance of initial investor commitments

6 – 12 months • Launch date for the fund

marketing

period

Subsequent closings

• Additional closing on new investor commitments

• Fundraising period ends on fund closing

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 21

Indicative Fund term timeline

Making investments

• Fund makes new investments during the investment

period

4 – 6 years • Some liquidation of investment is possible during this

investment period as well

period from

the date of

initial fund Exiting investments

close

• Fund manages & liquidates the investments during the

term

• Distributions are made as & when proceeds are received

4 – 6 years

Dissolution & Liquidation divestment

• Remaining investments are liquidated period

• Remaining proceeds are distributed

• Limited extension / early termination may be possible

based on certain triggering events

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 22

Select Key Terms

Burn Rate

Down Round

Dry Powder

Earn-Out

Internal Rate of Return

Lock in

Pre-money Valuation

Post-money Valuation

Ratchets

Term Sheet

Tranches

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 23

3. Reasons for M&A

• Scalability and Growth • Funding requirements

• Economies of scale • Regulatory requirements

• Market share and Competition • Reduction of Leverage

• Technology and Innovations • Economic environment

• Intellectual property • Political environment

• Customer contracts and history • Consolidation

• Raw material linkages • Other synergies

• Risk mitigation • Attractive valuation – Opportunistic

• Market entry and / or expansion • Tax efficiencies

• Vertical and / or lateral integration • Stock market trends

• Diversification

Note: The adjacent list is not exhaustive

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 24

Pfizer, Allergan scrap $160 billion deal after U.S. tax rule change (April’16)

Particulars Remarks

Current Status 1) U.S. drugmaker Pfizer Inc (PFE.N) and Ireland-based Allergan Plc (AGN.N) walked away

from their $160 billion merger, a major win for President Barack Obama, who has

been pushing to curb deals in which companies move overseas to cut taxes.

2) Pfizer said the decision was driven by new U.S. Treasury rules aimed at such deals,

called inversions. The merger would have allowed New York-based Pfizer to cut its tax

bill by an estimated $1 billion annually by domiciling in Ireland, where tax rates are

lower.

3) While the new Treasury rules did not name Pfizer and Allergan, one of the provisions

targeted a specific feature of their merger - Allergan's history as a major acquirer of

other companies.

4) Pfizer was required to pay Allergan $150 million to reimburse expenses from its

deal.

5) The decision to call off the deal came in part because Pfizer was concerned that any

tweaks to salvage its deal with Allergan might have provoked new rules by the

Treasury.

Valuation USD 160 billion

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 25

Tata – Corus Deal (2007)

Particulars Remarks

Background Corus' stock market value in 1999 was $6 billion but fell to $230 million in 2003,

prompting Corus to look for a buyer. Many companies, including ArcelorMittal, explored

the option. Finally, in 2007, Tata Steel bought Corus in a $12 billion deal, what was the

biggest foreign acquisition by an Indian company till then.

Transaction / Steel was at the peak of its cycle and Tata Steel paid 608 pence a share, a premium of 34

Investment per cent to the original offer price to ward off a challenge from Brazilian miner and

rationale and steelmaker CSN. For CSN, however, it might have been different because of the raw

structure material support. Save for one good year, Corus has remained a problem for Tata Steel.

In hindsight, doing an all-cash deal funded by debt may have been a big

mistake. For one, a part stock deal may have softened the blow a fair bit.

Valuation USD 12 billion – Now Valued at USD ??.

Current status of A decision to explore all options for portfolio restructuring, including the potential

operations divestment of Tata Steel UK in whole or in part has been taken.

Hindsight 20-20 Almost a decade later, however, and Tata Steel has finally conceded it got it wrong. In

view March 2016, Tata Steel’s finance director, admitted the British businesses now had a book

value of “almost zero”. The Tata’s board rejected a turnaround plan for the assets that

once made up British Steel.

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 26

AOL – Time Warner – The Biggest Disaster (2001)

Particulars Remarks

Transaction / 1) In 2001, AOL completed the USD 164 billion acquisition of Time Warner.

Investment 2) However, Time Warner soon realised that the merger was not in its best interest

rationale and leading to a loss of USD 99 billion in 2002.

structure 3) The entities demerged in 2009.

4) AOL before the merger at its peak had been valued at USD 226 billion, which

dwindled to USD 20 billion soon after the merger.

5) The companies did not really merge.

6) The biggest nail was the revelation that AOL had overstated sales for 2000 and 2001

by 190 million.

Valuation USD 164 billion in 2001

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 27

4. M&A Process – Macro View

Identify Entry

Holding

Exit

Period

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 28

Indicative Acquisition Process

Creating

Identifying Give Non- Diligence

Acquisition competitive tension

Potential binding and

Strategy and Value

Targets bid negotiations

Realisation

Receive teaser / Identify potential

Agree on Strategy Shortlist Targets

documentation Targets

Distribute / Receive

Give purchase Obtain management Give non binding

NDA and process

document presentations bids

letters

Virtual / Physical Shortlist final list of

Give final offers Final negotiation

data room Targets

Share purchase

Integration (as

agreement and

appliable)

closure

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 29

Defining and Selecting a Target

• Type of Investor − Market share and Competition

• Investment Philosophy and Return expectations − Technology and Intellectual property

• Ticket size and Valuation − Risk mitigation

• Relative sizes of Investor and Target − Market entry and / or expansion

• Shareholding pattern – Majority / minority, − Vertical and / or lateral integration

Government, Funds, etc.

− Reduction of Leverage

• Target Group Structure

• Funding requirements and options

• Industry and Geography

• Regulations

• Economic, Business and Investment Cycle

• Foreign Currency rates

• Transaction Perimeter

• Tax incentives / subsidies and efficiencies

• Rationale for Transaction:

• Attractive Valuations – Opportunistic

− Customer contracts and history

• No Succession Plan

− Scalability and Growth

• Exit options and Timelines

Note: The adjacent list is not exhaustive

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 30

Transaction Documents

• Non-Disclosure Agreements and Letter of • Disclosure Documents

Intent

• Representations and Warranties

• Term Sheet

• Other Transaction Related Agreements

• Dataroom Information

• Information Request List

• Management Questions and Answers

• Business Plan

• Advisor’s Reports and Opinions

• Share Purchase Agreement

• Shareholders Agreement

• Share Subscription Agreement

Note: The adjacent list is not exhaustive

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 31

Governing Laws - India

Key Laws/ Regulations* Regulatory Authorities*

• Income-tax Act, 1961 • Securities & Exchange Board of India (SEBI)

• Companies Act, 2013 (to the extent notified) • Reserve Bank of India (RBI)

• Insolvency and Bankruptcy Code • Registrar of Companies (ROC)

• Stamp duty laws • Competition Commission of India (CCI)

• Patents Act / Trademarks Act • Director General of Foreign Trade (DGFT)

• FDI Policy • Insolvency and Bankruptcy Board of India (IBBI)

• SEBI Takeover Code • High Court / NCLT / NCLAT

• Copyrights Act

• Special Economic Zones (SEZ) Act

• Labor Laws

• Foreign Exchange & Management Act, 1999

• Accounting Standards and IFRS

• Limited Liability Partnership Act, 2008

Note: The adjacent list is not exhaustive Source: PwC publications and publically available information

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 32

5. Deal Structuring – Key Aspects

• Type of Entities • Transaction Structure

• Timeline • Type of Security

• Routes of Investments and Tax Implications • Consideration

• Transaction Perimeter • Ancillary Agreements

• Level of Stake: • Regulatory Framework

− 100%, Significant majority, majority, minority • Prohibited Sectors

• Voting Rights and Control • Currency

“How you come in determines how and at what value you will exit!!”

Note: The adjacent list is not exhaustive

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 33

Routes of Investment – Inbound and Domestic

Approval Requirements Inbound Investment Routes

Automatic Route

• Government Mauritius Route

Approval Route • Ministries

Netherlands Route

Competition

Commission of India

Singapore Route

SEBI / RBI

Registrar of Companies

Cayman Islands Route

NCLT / NCLAT

Note: The adjacent list is not exhaustive

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 34

Transaction Structure – Basic Structures

M&A

Capital

Arrangement Acquisitions

Reorganisation

Asset Shares Capital

Merger Demerger Buy-back

Purchase Purchase Reduction

Forward Merger Slump Sale

Reverse Merger Itemized Sale

Note: The adjacent list is not exhaustive

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 35

Consideration

Cash Equity Shares Preference Shares Debentures

• Investor / Investor Group • Mode / Mix of Consideration (Cash, stock,

CCPS, CCD, etc.) and Pricing

• Target / Target Group

• Remittance and Repatriation Modes and

• Existing / Proposed Entity and Shareholding Timelines

Structure

• Existing Regulations / Proposed Regulations

• Existing Owners / Shareholders of Target

• Existing Business / Proposed Business

• Existing Investment Instruments / Proposed

Investment Instruments • Target’s Country / Investor’s Country

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 36

Contact Details

Dhananjay Satarkar

Mobile : +91 98909 44963

Email : dhananjay.satarkar@clearviewpartners.in

Website : www.clearviewpartners.in

© Copyright Dhananjay Satarkar. All rights reserved.

Overview of Mergers & Acquisitions – Dhananjay Satarkar – 5 June 2020 37

You might also like

- Unit 3 Personal & Business Finance LODDocument54 pagesUnit 3 Personal & Business Finance LODAngelaNo ratings yet

- ICOF II PresentationDocument32 pagesICOF II PresentationAarambh wagh100% (1)

- Case Study 2 - Starting Right Corporation (Group 4)Document8 pagesCase Study 2 - Starting Right Corporation (Group 4)JanNo ratings yet

- Statement of Transactions: Sundaram Finance LimitedDocument1 pageStatement of Transactions: Sundaram Finance LimitedBhavin SagarNo ratings yet

- 21U 2093 H MidtermDocument14 pages21U 2093 H MidtermAkshit GoyalNo ratings yet

- Capital Market Corporate ProfileDocument40 pagesCapital Market Corporate ProfilePinank TurakhiaNo ratings yet

- Portfolio Activity Unit 3Document2 pagesPortfolio Activity Unit 3klm klm100% (1)

- Financial Statement Analysis of TataDocument32 pagesFinancial Statement Analysis of TataVISHNU SATHEESHNo ratings yet

- 03 Success of Equity Funding Deal v2 11-07-2020 AJDocument42 pages03 Success of Equity Funding Deal v2 11-07-2020 AJarunjoshi12345No ratings yet

- Understanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Document17 pagesUnderstanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Dharmik SolankiNo ratings yet

- Guide To Project Reports, Project Appraisal & Project FinanceDocument26 pagesGuide To Project Reports, Project Appraisal & Project FinanceSALONI GOYALNo ratings yet

- Basic Corporate FinanceDocument36 pagesBasic Corporate FinanceGirish BhangaleNo ratings yet

- 1.1 Company Profile 1.2 Brief Study of Equity ProductsDocument67 pages1.1 Company Profile 1.2 Brief Study of Equity ProductsRudra SharmaNo ratings yet

- MDLY 4Q19 Investor Presentation v3Document21 pagesMDLY 4Q19 Investor Presentation v3Dan NadNo ratings yet

- Investment Banking: Summers PreparationDocument31 pagesInvestment Banking: Summers PreparationManu JanardananNo ratings yet

- CFLecture1 2notesDocument30 pagesCFLecture1 2notesYashveer SinghNo ratings yet

- Venture CapitalDocument42 pagesVenture CapitalKellaNo ratings yet

- Scalene Company ProfileDocument13 pagesScalene Company Profiledarjimulchand77No ratings yet

- HDFC LTD. MBA Interview QuestiomDocument14 pagesHDFC LTD. MBA Interview QuestiomRohitNo ratings yet

- Financing The New VentureDocument46 pagesFinancing The New Venturearchanasingh22100% (5)

- Saratoga Investor Relation Presentation 9M19 Final - PublicDocument15 pagesSaratoga Investor Relation Presentation 9M19 Final - Publicsigitsutoko8765No ratings yet

- W2 WCorporateDocument14 pagesW2 WCorporateWay2 WealthNo ratings yet

- SIP Presentation On AU Small Finance BankDocument13 pagesSIP Presentation On AU Small Finance BankMadhurNo ratings yet

- Financial ManagementDocument23 pagesFinancial ManagementRiad ChowdhuryNo ratings yet

- B&A ProfileDocument4 pagesB&A ProfileHittMan BajgainNo ratings yet

- Scott Droney - Financing Start-Up and GrowthDocument40 pagesScott Droney - Financing Start-Up and GrowthScott DroneyNo ratings yet

- Corporate Finance: Lecture Note Packet 2 Capital Structure, Dividend Policy & ValuationDocument246 pagesCorporate Finance: Lecture Note Packet 2 Capital Structure, Dividend Policy & ValuationKanchan VarshneyNo ratings yet

- IB - Lecture 1Document42 pagesIB - Lecture 1hoang phuongthao25No ratings yet

- Presentation 5Document27 pagesPresentation 5surendra jaiswalNo ratings yet

- On Debt MarketsDocument73 pagesOn Debt MarketsrashmiNo ratings yet

- Leverage Capital Group - ProfileDocument23 pagesLeverage Capital Group - Profileanon_601430920No ratings yet

- Slide 1Document24 pagesSlide 1Akash SinghNo ratings yet

- Private Equity Overview 3Document22 pagesPrivate Equity Overview 3Dương Thị Lệ QuyênNo ratings yet

- Introduction To Accounting Part 1Document45 pagesIntroduction To Accounting Part 1Катерина ГузманNo ratings yet

- BCK Chapter4 S2 and Ch5 S1Document63 pagesBCK Chapter4 S2 and Ch5 S1krishnaaravindeNo ratings yet

- Jm-Financial-Ltd ProspectusDocument39 pagesJm-Financial-Ltd Prospectusvishakha chaudharyNo ratings yet

- Ranjeet Ranjan2Document23 pagesRanjeet Ranjan2Ranjeet RanjanNo ratings yet

- Startup FundingDocument17 pagesStartup FundingAftab AlamNo ratings yet

- Private EquityDocument9 pagesPrivate Equitysv798dctq9No ratings yet

- UNIT V - VentureexitstrategyDocument23 pagesUNIT V - Ventureexitstrategymevitsn6No ratings yet

- Introduction To Financial AccountingDocument4 pagesIntroduction To Financial AccountingDee soniNo ratings yet

- 01 Fin - Introduction To Financial ManagementDocument19 pages01 Fin - Introduction To Financial Managementshahin shekhNo ratings yet

- Presentation 2 - The Overview of Corporate Finance (Final)Document24 pagesPresentation 2 - The Overview of Corporate Finance (Final)sanjuladasanNo ratings yet

- U E V C /PE: Nderstanding Quity Enture ApitalDocument24 pagesU E V C /PE: Nderstanding Quity Enture ApitalSudhanyu VeldurthyNo ratings yet

- Intermediate Accounting: The Canadian Financial Reporting EnvironmentDocument35 pagesIntermediate Accounting: The Canadian Financial Reporting EnvironmentashleyalicerogersNo ratings yet

- Private Equity Part 1 - LongDocument45 pagesPrivate Equity Part 1 - LongLinh Linh NguyễnNo ratings yet

- Business Plan ReferenceDocument18 pagesBusiness Plan ReferenceAditya KothiwalNo ratings yet

- Venture Capital in Developing Countries: Challenges: DR - Akhil Goyal Nims University-IMCDocument22 pagesVenture Capital in Developing Countries: Challenges: DR - Akhil Goyal Nims University-IMCAKHIL GOYALNo ratings yet

- Lesson 4 - Financing For EntrepreneursDocument42 pagesLesson 4 - Financing For EntrepreneursNazir NasarudiinNo ratings yet

- Cornett Finance 5e Chapter 01Document33 pagesCornett Finance 5e Chapter 01Lu LiNo ratings yet

- Chapter 14Document32 pagesChapter 14erteyNo ratings yet

- Redit Ating AgenciesDocument44 pagesRedit Ating AgencieschumbavambaNo ratings yet

- Unit-1 Important Role of Capital MarketsDocument17 pagesUnit-1 Important Role of Capital Marketsshunlae37No ratings yet

- Econ 371 Business Finance 1: Pirapa TharmalingamDocument26 pagesEcon 371 Business Finance 1: Pirapa TharmalingamSamantha YuNo ratings yet

- Nexus8 (VN-SG Coverage)Document20 pagesNexus8 (VN-SG Coverage)Tran DuongNo ratings yet

- NPK Notes Roshan Desai Sir 5 Financial ManagementDocument43 pagesNPK Notes Roshan Desai Sir 5 Financial ManagementSatwik RaiNo ratings yet

- Presentation DCMDocument5 pagesPresentation DCMsuvarna27No ratings yet

- Introduction To Idfc AmcDocument101 pagesIntroduction To Idfc AmcSAKINAMANDSAURWALANo ratings yet

- PEVC Society - M - A 101Document15 pagesPEVC Society - M - A 101Ayan MurmuNo ratings yet

- 31 The Upscaling Business of Private EquityDocument12 pages31 The Upscaling Business of Private EquityCritiNo ratings yet

- Chandu SvitDocument85 pagesChandu SvitkhayyumNo ratings yet

- Fundamentals of Financial Management: R.P. RustagiDocument16 pagesFundamentals of Financial Management: R.P. Rustagiimranrog11No ratings yet

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1From EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1Rating: 2 out of 5 stars2/5 (1)

- Bse Sme Ipo IndexDocument4 pagesBse Sme Ipo IndexBhavin SagarNo ratings yet

- August 2021 - Shipping Corporation of India LTD by Corporate ProfessionalsDocument10 pagesAugust 2021 - Shipping Corporation of India LTD by Corporate ProfessionalsBhavin SagarNo ratings yet

- Qtrly - Reportq1 FY 2008 2009Document2 pagesQtrly - Reportq1 FY 2008 2009Bhavin SagarNo ratings yet

- Yap 31 1 19Document345 pagesYap 31 1 19Bhavin SagarNo ratings yet

- Nebbia Mutual NDADocument3 pagesNebbia Mutual NDABhavin SagarNo ratings yet

- Revised Market Making Agreement 31.03Document13 pagesRevised Market Making Agreement 31.03Bhavin SagarNo ratings yet

- Revised Underwriting Agreement 31.03Document14 pagesRevised Underwriting Agreement 31.03Bhavin SagarNo ratings yet

- Amalgmation - August 2020 - Arihant Capital Shree Renuka Sugars LTDDocument10 pagesAmalgmation - August 2020 - Arihant Capital Shree Renuka Sugars LTDBhavin SagarNo ratings yet

- List of Valuation ReportsDocument18 pagesList of Valuation ReportsBhavin SagarNo ratings yet

- Capital Reduction - Escorts LTD - GalacticoDocument10 pagesCapital Reduction - Escorts LTD - GalacticoBhavin SagarNo ratings yet

- 01 Business Partnership Powerpoint TemplateDocument12 pages01 Business Partnership Powerpoint TemplateBhavin SagarNo ratings yet

- Revised RV - Draft Valuation Report - Hakuna MatataDocument11 pagesRevised RV - Draft Valuation Report - Hakuna MatataBhavin SagarNo ratings yet

- 01 Business Partnership Powerpoint TemplateDocument12 pages01 Business Partnership Powerpoint TemplateBhavin SagarNo ratings yet

- 02 Corporate Orange Powerpoint Presentations 16x9 1Document13 pages02 Corporate Orange Powerpoint Presentations 16x9 1Bhavin SagarNo ratings yet

- Corporate Deck - InternationalDocument16 pagesCorporate Deck - InternationalBhavin SagarNo ratings yet

- MCA FinanicialsDocument50 pagesMCA FinanicialsBhavin SagarNo ratings yet

- EKI Energy Services Limited: Payments MadeDocument2 pagesEKI Energy Services Limited: Payments MadeBhavin SagarNo ratings yet

- EKI Energy Services Limited: Payments MadeDocument2 pagesEKI Energy Services Limited: Payments MadeBhavin SagarNo ratings yet

- Bulk DealsDocument63 pagesBulk DealsBhavin SagarNo ratings yet

- Valuation Assignement - WIPDocument2 pagesValuation Assignement - WIPBhavin SagarNo ratings yet

- Bhavin Valuation Cases For FY21Document17 pagesBhavin Valuation Cases For FY21Bhavin SagarNo ratings yet

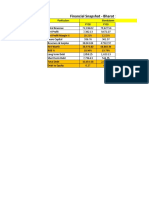

- Bharat Serums & Vaccines LTD - Financial SnapshotDocument2 pagesBharat Serums & Vaccines LTD - Financial SnapshotBhavin SagarNo ratings yet

- Bhavin - Valuation Cases - May 2021Document3 pagesBhavin - Valuation Cases - May 2021Bhavin SagarNo ratings yet

- Capital Budgeting TechniquesDocument60 pagesCapital Budgeting Techniquesaxl11No ratings yet

- Inflation Accounting: Presented ByDocument24 pagesInflation Accounting: Presented ByjasminerathodNo ratings yet

- Credit ProposalDocument43 pagesCredit ProposalndmudhosiNo ratings yet

- Bus 262 Business Finance Student Final Part HW Corona 2020Document4 pagesBus 262 Business Finance Student Final Part HW Corona 2020Olatowode OluwatosinNo ratings yet

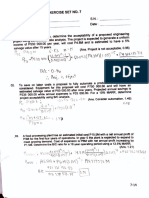

- Business Finance - ACC501 Fall 2006 Assignment 02 SolutionDocument3 pagesBusiness Finance - ACC501 Fall 2006 Assignment 02 Solutionsamuel kebedeNo ratings yet

- Syndicate 5 - Krakatau Steel ADocument19 pagesSyndicate 5 - Krakatau Steel AEdlyn Valmai Devina SNo ratings yet

- Ind AS 102Document86 pagesInd AS 102Deepika GuptaNo ratings yet

- Chapter 23Document6 pagesChapter 23bridge1985No ratings yet

- Editor in chief,+EJBMR 1033+R300821Document7 pagesEditor in chief,+EJBMR 1033+R300821BigPalabraNo ratings yet

- No. SEBI/LAD-NRO/GN/2015-16/013 in Exercise of The Powers Conferred by Section 11Document147 pagesNo. SEBI/LAD-NRO/GN/2015-16/013 in Exercise of The Powers Conferred by Section 11Huzaifa SalimNo ratings yet

- PDF Advanced Accounting Chapter 1 DDDocument20 pagesPDF Advanced Accounting Chapter 1 DDGarp BarrocaNo ratings yet

- IAS 16 Notes.Document8 pagesIAS 16 Notes.Arsalan AliNo ratings yet

- MCQ Direct TaxDocument53 pagesMCQ Direct TaxSwetha MalladiNo ratings yet

- Econ Ex 7Document12 pagesEcon Ex 7manalastas.maridellevictoriaNo ratings yet

- HFUNDSDocument1 pageHFUNDSHernán CornejoNo ratings yet

- Vce Final Report - Vardhan Consulting EngineersDocument18 pagesVce Final Report - Vardhan Consulting EngineersHarshit AroraNo ratings yet

- Angel Investor List - Smallbiz America CapitalDocument6 pagesAngel Investor List - Smallbiz America CapitalJohn BanaskiNo ratings yet

- FA1 BPP Chapter 2 Assets, Liabilities & Accounting EquationDocument19 pagesFA1 BPP Chapter 2 Assets, Liabilities & Accounting EquationS RaihanNo ratings yet

- Consolated Balance Sheet: Advance Accounting-II (Chapter-3.4)Document8 pagesConsolated Balance Sheet: Advance Accounting-II (Chapter-3.4)Md Shah AlamNo ratings yet

- Bond ValuationDocument15 pagesBond Valuationrana ahmedNo ratings yet

- PIMCO ETFs ISS - Smart PassiveDocument4 pagesPIMCO ETFs ISS - Smart Passivefreebanker777741No ratings yet

- Chapter 9 PDFDocument29 pagesChapter 9 PDFYhunie Nhita Itha50% (2)

- Pi 13 Lampiran Peta Okupasi Bidang Logistik Dan Supply ChainDocument81 pagesPi 13 Lampiran Peta Okupasi Bidang Logistik Dan Supply ChainZeo BentNo ratings yet

- NHPC 3Document49 pagesNHPC 3Hitesh Mittal100% (1)

- ThesisDocument72 pagesThesisRaja SekharNo ratings yet

- Financial Management K45Document4 pagesFinancial Management K45Nguyễn LâmNo ratings yet

- FINC521Document20 pagesFINC521Ayushi GargNo ratings yet