Professional Documents

Culture Documents

Business Combination Q3

Business Combination Q3

Uploaded by

Sweet EmmeCopyright:

Available Formats

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Ch18 Spoilage Reword and Scrap TestDocument36 pagesCh18 Spoilage Reword and Scrap TestSweet Emme50% (2)

- AFAR Answer-KeyDocument8 pagesAFAR Answer-KeyShirliz Jane Benitez100% (1)

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Chapter 1 - Business Combination (Part 1) - Theory (Answers)Document2 pagesChapter 1 - Business Combination (Part 1) - Theory (Answers)Mark Anthony Tibule88% (17)

- Raindrop Technique How ToDocument6 pagesRaindrop Technique How Toapi-251091141100% (2)

- Comptia Security Sy0 601 Exam Objectives (2 0)Document24 pagesComptia Security Sy0 601 Exam Objectives (2 0)tha_flameNo ratings yet

- FAR.2936 - Non-Financial Liabilities Summary (DIY) .Document5 pagesFAR.2936 - Non-Financial Liabilities Summary (DIY) .Edmark LuspeNo ratings yet

- Midterm or Pre Final Exam in Bus Com Trimex Pup CampusesDocument8 pagesMidterm or Pre Final Exam in Bus Com Trimex Pup CampusesmahilomferNo ratings yet

- Trade and Other Receivables Discussion ProblemsDocument3 pagesTrade and Other Receivables Discussion ProblemsJim IsmaelNo ratings yet

- Acctg 305 Semi-Final Examination (With Answers)Document4 pagesAcctg 305 Semi-Final Examination (With Answers)Michelle Joyce KuizonNo ratings yet

- Advanced Financial Accounting and ReportingDocument9 pagesAdvanced Financial Accounting and Reportingnavie VNo ratings yet

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyKim Fernandez50% (2)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyFery AnnNo ratings yet

- Nfjpia Mock Board 2016 - AfarDocument8 pagesNfjpia Mock Board 2016 - AfarLeisleiRago50% (2)

- 157 First Grading ExamDocument8 pages157 First Grading Examerica insiongNo ratings yet

- ACC 311 ReviewDocument2 pagesACC 311 ReviewMaricar DimayugaNo ratings yet

- 9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsDocument8 pages9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsandreamrieNo ratings yet

- D4Document13 pagesD4neo14No ratings yet

- Review 105 - Day 4 Theory of AccountsDocument13 pagesReview 105 - Day 4 Theory of Accountschristine anglaNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- Business Combination - TheoriesDocument11 pagesBusiness Combination - TheoriesMILLARE, Teddy Glo B.No ratings yet

- ACC 113 P2 Quiz 1 Key AnswerDocument3 pagesACC 113 P2 Quiz 1 Key Answerpeter pakerNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet

- This Study Resource Was: ExercisesDocument9 pagesThis Study Resource Was: ExercisesNah HamzaNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- FAR 6.3MC - Provisions, Contingent Liabilities and Contingent AssetsDocument5 pagesFAR 6.3MC - Provisions, Contingent Liabilities and Contingent Assetskateangel elleso0% (1)

- Income Tax - Reviewer PDFDocument5 pagesIncome Tax - Reviewer PDFalabwalaNo ratings yet

- Review 105 - Day 4 Theory of AccountsDocument14 pagesReview 105 - Day 4 Theory of AccountsAndre PulancoNo ratings yet

- D3Document13 pagesD3neo14No ratings yet

- QUIZ Debt InstrumentDocument4 pagesQUIZ Debt InstrumentJaimell LimNo ratings yet

- Business CombinationDocument4 pagesBusiness CombinationZoomKoolNo ratings yet

- Buss CombiDocument10 pagesBuss CombiIzzy BNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of AccountsKathleen PardoNo ratings yet

- PFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial StatementsDocument5 pagesPFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial Statementsd.pagkatoytoyNo ratings yet

- Which of The Following Is Not An Essential Characteristic of A LiabilityDocument31 pagesWhich of The Following Is Not An Essential Characteristic of A LiabilityJam PotutanNo ratings yet

- Advacc 1 Question Set ADocument11 pagesAdvacc 1 Question Set AA BNo ratings yet

- National Mock Board Examination 2017 Advanced Financial Accounting and ReportingDocument11 pagesNational Mock Board Examination 2017 Advanced Financial Accounting and ReportingTzaddi Ann DeluteNo ratings yet

- Final Exam CDocument12 pagesFinal Exam Cnhorelajne03No ratings yet

- Review 105 - Day 7 Theory of AccountsDocument11 pagesReview 105 - Day 7 Theory of AccountsKathleen PardoNo ratings yet

- D7Document11 pagesD7neo14No ratings yet

- Business CombinationDocument3 pagesBusiness CombinationJia CruzNo ratings yet

- 7.29.22 Am Trade-And-Other-ReceivablesDocument5 pages7.29.22 Am Trade-And-Other-ReceivablesAether SkywardNo ratings yet

- Polytechnic University of The PhilippinesDocument12 pagesPolytechnic University of The PhilippinesKyla Dane P. Prado0% (1)

- Act 6J03 - Comp2 - 1stsem05-06Document12 pagesAct 6J03 - Comp2 - 1stsem05-06ROMAR A. PIGANo ratings yet

- Acc 106 Receivable FinanceDocument2 pagesAcc 106 Receivable FinanceHeavenneNo ratings yet

- Chap 1 BuscomDocument6 pagesChap 1 BuscomNathalie GetinoNo ratings yet

- DocxDocument14 pagesDocxcrispyy turonNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- A. Business CombinationDocument30 pagesA. Business CombinationJason SheeshNo ratings yet

- Practice Quiz NonFinlLiabDocument15 pagesPractice Quiz NonFinlLiabIsabelle GuillenaNo ratings yet

- Taxation 1 ReviewerDocument5 pagesTaxation 1 ReviewerEISEN BELWIGANNo ratings yet

- CFAS Quiz 1 Final ADocument5 pagesCFAS Quiz 1 Final ADesiree Angelique RebonquinNo ratings yet

- Cfas - Quiz QuestionsDocument3 pagesCfas - Quiz QuestionsNavdeep KaurNo ratings yet

- Afar 2 Testbank Business CombinationDocument30 pagesAfar 2 Testbank Business Combinationjeromedeiparine8No ratings yet

- Act 6J03 - Comp2 - 1stsem05-06Document11 pagesAct 6J03 - Comp2 - 1stsem05-06d.pagkatoytoyNo ratings yet

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- RewiewerDocument34 pagesRewiewerMickaella VergaraNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- b8 Train Biodiversity Plan Subnational enDocument37 pagesb8 Train Biodiversity Plan Subnational enSweet EmmeNo ratings yet

- Prescott Guide enDocument74 pagesPrescott Guide enSweet EmmeNo ratings yet

- Business Combination Q4Document2 pagesBusiness Combination Q4Sweet EmmeNo ratings yet

- COMLAW5 Module 2 Related Laws Banking LawsDocument25 pagesCOMLAW5 Module 2 Related Laws Banking LawsSweet EmmeNo ratings yet

- SAPP HANDOUTS - DESCRIPTIVE ONLY Handouts 1-1Document14 pagesSAPP HANDOUTS - DESCRIPTIVE ONLY Handouts 1-1Sweet EmmeNo ratings yet

- Module 1Document20 pagesModule 1Sweet EmmeNo ratings yet

- Defective GoodsDocument3 pagesDefective GoodsSweet EmmeNo ratings yet

- Data Warehouse Data DesignDocument51 pagesData Warehouse Data DesignSweet EmmeNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- AA2Q1Document1 pageAA2Q1Sweet EmmeNo ratings yet

- BA2, Module 2 GuideDocument11 pagesBA2, Module 2 GuideSweet EmmeNo ratings yet

- Job OrderDocument69 pagesJob OrderSweet EmmeNo ratings yet

- Audit Procedures For Accounts PayableDocument3 pagesAudit Procedures For Accounts PayableSweet Emme100% (1)

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- 04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaDocument10 pages04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaKai XuNo ratings yet

- Practice Questions: Musculoskeletal SystemDocument4 pagesPractice Questions: Musculoskeletal SystemSali IqraNo ratings yet

- Laurel Doll Amigurumi Free PatternDocument21 pagesLaurel Doll Amigurumi Free PatternHuyền TrangNo ratings yet

- Springer Nature Latex TemplateDocument13 pagesSpringer Nature Latex TemplateAndres FloresNo ratings yet

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- Overview: Module 4: Main Aim Subsidiary Aims Personal AimsDocument28 pagesOverview: Module 4: Main Aim Subsidiary Aims Personal AimsIslam TahaNo ratings yet

- Free CV Template 31Document1 pageFree CV Template 31Aaron WilsonNo ratings yet

- Grade 7 Lesson: ReproductionDocument4 pagesGrade 7 Lesson: ReproductionJoedelyn Wagas100% (2)

- Characterising Roof Ventilators: P 2 A Q CDocument4 pagesCharacterising Roof Ventilators: P 2 A Q CDhirendra Singh RathoreNo ratings yet

- Hospice SynopsisDocument6 pagesHospice SynopsisPhalguna NaiduNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- Organic Halides Introduction Class-1 NotesDocument15 pagesOrganic Halides Introduction Class-1 Notessiddhartha singhNo ratings yet

- Partnership in Class Questions 2015Document3 pagesPartnership in Class Questions 2015Nella KingNo ratings yet

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Thrift Banks ActDocument25 pagesThrift Banks ActMadelle Pineda100% (1)

- Mic 2 Mkii Installation Instructions and Reference Handbook 4189320057 UkDocument70 pagesMic 2 Mkii Installation Instructions and Reference Handbook 4189320057 Ukkamel kamelNo ratings yet

- MT2OL-Ia6 2 1Document136 pagesMT2OL-Ia6 2 1QUILIOPE, JUSTINE JAY S.No ratings yet

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- Ent Secretory Otitis MediaDocument3 pagesEnt Secretory Otitis MediaIrena DayehNo ratings yet

- Ultrasonic InterferometerDocument22 pagesUltrasonic InterferometerakshatguptaNo ratings yet

- Chapter 6: The Legal and Political Environment of Global BusinessDocument25 pagesChapter 6: The Legal and Political Environment of Global BusinessMaxineNo ratings yet

- Shapes of NailsDocument14 pagesShapes of NailsIyannNo ratings yet

- AfPS&CS Ch-01Document10 pagesAfPS&CS Ch-01Amelwork AlchoNo ratings yet

- Kalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDocument1 pageKalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDenis AkingbasoNo ratings yet

- Experiencing Postsocialist CapitalismDocument251 pagesExperiencing Postsocialist CapitalismjelisNo ratings yet

Business Combination Q3

Business Combination Q3

Uploaded by

Sweet EmmeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combination Q3

Business Combination Q3

Uploaded by

Sweet EmmeCopyright:

Available Formats

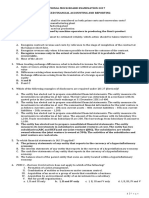

ACCT602_MQ3 – IFRS 3 11.

It is a transaction or other event in which an acquirer obtains control of

one or more businesses. A

1. An acquirer shall at the acquisition date recognize goodwill acquired in the a. Business Combination

business combinations as an asset. Goodwill shall be accounted for as b. Consolidation

which of the following? D c. Merger

a. Recognize as an intangible asset and amortize over its useful life. d. Controlling interest

b. Write off against retained earnings.

c. Recognize as an intangible asset and impairment test when trigger event 12. Viva Co. paid a certain amount to Home Co. with the intention to control

occurs. the operations of the latter. In drafting the agreement, Viva was given the

d. Recognize as an intangible asset and annually test for impairment or more right to direct the relevant activities of Home Co. Because of such fact,

frequently if impairment is indicated. Viva’s returns from its involvement now have potential to vary as a result

of Home’s performance. Viva Co. has showed evidences that it can

2. The acquisition related cost in a business combination to be expensed actually affect its returns from Home Co. Which of the following

immediately include all of the following except: D statements is most correct? C

a. Professional and consulting fees a. Viva Co. obtained control over Home Co.

b. Cost of maintaining an acquisition department b. Viva Co. will be required to prepare consolidated FS

c. Finders’ fees c. Both A and B are correct.

d. Cost of issuing debt securities d. None of the statements is correct.

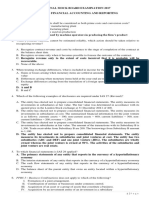

3. In a business combination, any gain on bargain purchase shall: A 13. Samsung is buying out Nokia in a recently signed business merger,

a. Be recognized in the profit or loss. effective December 31, 2012. Samsung and Nokia are still under a non-

b. Be recognized in retained earnings. cancellable lease contract, expiring on October 31, 2013 that requires the

c. Be recognized in the other comprehensive income. former to pay monthly lease payment of P100,000. During the

d. Not be recognized. combination, Samsung paid additional P600,000 to Nokia as settlement of

the contract. Which of the following statements is true following this

4. How shall the acquirer shall account for changes in the fair value of scenario? D

contingent consideration classified as equity that are not measurement a. A contingent consideration amounting to P400,000 shall be reported by

period adjustments? A Samsung as the company might still be required to make the payments.

a. Shall not be re-measured but instead recognized as part of equity. b. Right of use of asset and lease liability are both to be recognized by

b. Shall be re-measured at fair value with any gain or loss included in profit Samsung.

or loss. c. P1,000,000, representing total lease payment of the remaining 10 months

c. Shall be re-measured at fair value with any gain or loss included in the will be included as part of the combination.

retained earnings. d. Neither right of use of asset not lease liability is recognized by Samsung.

d. Shall be re-measured at fair value with any gain or loss included in the

other comprehensive income. 14. In a business combination achieved in stages, how shall the acquirer

account for its previously held equity interest in the acquire? C

5. The following statements relate to a contingent consideration in business a. The acquirer shall not remeasure the previously held equity interest

combination. Which statement is correct? A and any amount previously recognized becomes part of the

I. The acquirer shall recognize the acquisition date fair value of any contingent consideration.

consideration as part of the consideration transferred in a business b. The acquirer shall remeasure any previously held equity interest and

combination. recognize any gain loss, if any in profit or loss.

II. The acquirer shall not recognize the acquisition date fair value of any c. The acquirer shall remeasure any previously held equity interest and

contingent consideration as part of the consideration transferred in a recognize any gain loss, if any in profit or loss or other

business consideration. comprehensive income as appropriate.

a. I only c. Both I and II d. The acquirer shall remeasure any previously held equity interest and

b. II only d. Neither I nor II recognize any gain loss, if any in equity through retained earnings.

6. The consideration transferred in a business combination shall be 15. All of the following are exception to measurement principle of IFRS 3,

measured at: A except: C

a. Fair value a. Reacquired rights c. Contingent Liabilities

b. Fair value determined by the acquirer b. Share-based payment transactions d. Assets held for sale

c. Carrying amount

d. Transaction Value 16. All of the following are required disclosures in IFRS 3, except: A

a. The name and a description of the acquirer

7. It is the equity in the subsidiary not attributable directly to a parent: B b. The acquisition date

a. Controlling interest c. The percentage of voting equity interest acquired

b. Non-controlling interest d. The primary reason for business combination and a description of how the

c. Subsidiary interest acquirer obtained control of the acquiree.

d. Residual Interest

17. Under IFRS 3, how shall non-controlling interest be measured at

8. The following statement relate to an acquisition date of a business acquisition date? C

combination. Which statement is incorrect? I. Fair Value

a. The acquisition date is the date on which the acquirer obtains control over II. A proportionate share of the acquiree’s identifiable net assets.

the acquiree. D a. I only b. II only c. Either I or II d. neither I nor II

b. The acquisition date is normally the closing date, meaning the date on

which the acquirer legally transfers the consideration, acquires the assets 18. Which statement is incorrect concerning the acquirer? D

and assumes the liabilities of the acquiree. a. In a business combination effected by transferring of cash or other assets,

c. Where several dates are key to business combination, the date on which the acquirer is usually the entity that transfers the cash or other assets.

control passes is the acquisition date. b. In a business combination effected by exchanging equity interest, the

d. The acquisition date can never precede the closing date. acquirer is usually the entity that issues equity interest, except in the case

of reverse acquisition.

9. The following statements relate to recognition and measurement of a c. The acquirer is usually the combining entity whose relative size is

business combination. Which statement is correct? C significantly greater than that of the other combining entities.

I. As of acquisition date, the acquirer shall recognize, separate from the d. If a new entity is formed to issue equity interests to effect a business

goodwill, the identifiable assets acquired, liabilities assumed and any non- combination, the new entity formed is necessarily the acquirer.

controlling interest in the acquiree.

II. The acquirer shall measure the identifiable assets acquired and liabilities 19. An acquirer might obtain control of an acquiree in all of the following,

assumed at their acquisition date fair value. except: D

a. I only c. Both I and II a. By transferring cash, cash equivalents or other assets

b. II only d. Neither I nor II b. By issuing equity interests

c. By contract alone, even without consideration

10. The application of the acquisition method accounting for business d. By acquiring interest in a joint arrangement

combination requires all of the following, except:

a. Identifying the acquirer D 20. This is defined as an integral set of activities and assets that is capable of

b. Determining the acquisition date being conducted and managed for the purpose of providing a return

c. Recognizing and measuring the identifiable assets acquired, the liabilities directly to investors or other owners, members or participants. A

assumed and any non-controlling interest in the acquiree. a. Business

d. Not recognizing goodwill or gain form bargain purchase b. Transaction

c. Isolated event

d. Undertaking

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2024 Edition)Rating: 5 out of 5 stars5/5 (1)

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2024 Edition)No ratings yet

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Ch18 Spoilage Reword and Scrap TestDocument36 pagesCh18 Spoilage Reword and Scrap TestSweet Emme50% (2)

- AFAR Answer-KeyDocument8 pagesAFAR Answer-KeyShirliz Jane Benitez100% (1)

- Case 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Document14 pagesCase 1: PFRS 3 - Business Combinations Does Not Apply To Which of The Following?Santiago BuladacoNo ratings yet

- Chapter 1 - Business Combination (Part 1) - Theory (Answers)Document2 pagesChapter 1 - Business Combination (Part 1) - Theory (Answers)Mark Anthony Tibule88% (17)

- Raindrop Technique How ToDocument6 pagesRaindrop Technique How Toapi-251091141100% (2)

- Comptia Security Sy0 601 Exam Objectives (2 0)Document24 pagesComptia Security Sy0 601 Exam Objectives (2 0)tha_flameNo ratings yet

- FAR.2936 - Non-Financial Liabilities Summary (DIY) .Document5 pagesFAR.2936 - Non-Financial Liabilities Summary (DIY) .Edmark LuspeNo ratings yet

- Midterm or Pre Final Exam in Bus Com Trimex Pup CampusesDocument8 pagesMidterm or Pre Final Exam in Bus Com Trimex Pup CampusesmahilomferNo ratings yet

- Trade and Other Receivables Discussion ProblemsDocument3 pagesTrade and Other Receivables Discussion ProblemsJim IsmaelNo ratings yet

- Acctg 305 Semi-Final Examination (With Answers)Document4 pagesAcctg 305 Semi-Final Examination (With Answers)Michelle Joyce KuizonNo ratings yet

- Advanced Financial Accounting and ReportingDocument9 pagesAdvanced Financial Accounting and Reportingnavie VNo ratings yet

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyKim Fernandez50% (2)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyFery AnnNo ratings yet

- Nfjpia Mock Board 2016 - AfarDocument8 pagesNfjpia Mock Board 2016 - AfarLeisleiRago50% (2)

- 157 First Grading ExamDocument8 pages157 First Grading Examerica insiongNo ratings yet

- ACC 311 ReviewDocument2 pagesACC 311 ReviewMaricar DimayugaNo ratings yet

- 9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsDocument8 pages9 - Liabilities Theory of Accounts 9 - Liabilities Theory of AccountsandreamrieNo ratings yet

- D4Document13 pagesD4neo14No ratings yet

- Review 105 - Day 4 Theory of AccountsDocument13 pagesReview 105 - Day 4 Theory of Accountschristine anglaNo ratings yet

- Nfjpia Nmbe Afar 2017 AnsDocument12 pagesNfjpia Nmbe Afar 2017 AnsSamiee0% (1)

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- Business Combination - TheoriesDocument11 pagesBusiness Combination - TheoriesMILLARE, Teddy Glo B.No ratings yet

- ACC 113 P2 Quiz 1 Key AnswerDocument3 pagesACC 113 P2 Quiz 1 Key Answerpeter pakerNo ratings yet

- AFAR IFRS SME Quizzers Acoldnerdlion PDFDocument10 pagesAFAR IFRS SME Quizzers Acoldnerdlion PDFCarl Emerson GalaboNo ratings yet

- This Study Resource Was: ExercisesDocument9 pagesThis Study Resource Was: ExercisesNah HamzaNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of Accountschristine anglaNo ratings yet

- FAR 6.3MC - Provisions, Contingent Liabilities and Contingent AssetsDocument5 pagesFAR 6.3MC - Provisions, Contingent Liabilities and Contingent Assetskateangel elleso0% (1)

- Income Tax - Reviewer PDFDocument5 pagesIncome Tax - Reviewer PDFalabwalaNo ratings yet

- Review 105 - Day 4 Theory of AccountsDocument14 pagesReview 105 - Day 4 Theory of AccountsAndre PulancoNo ratings yet

- D3Document13 pagesD3neo14No ratings yet

- QUIZ Debt InstrumentDocument4 pagesQUIZ Debt InstrumentJaimell LimNo ratings yet

- Business CombinationDocument4 pagesBusiness CombinationZoomKoolNo ratings yet

- Buss CombiDocument10 pagesBuss CombiIzzy BNo ratings yet

- Review 105 - Day 3 Theory of AccountsDocument13 pagesReview 105 - Day 3 Theory of AccountsKathleen PardoNo ratings yet

- PFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial StatementsDocument5 pagesPFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial Statementsd.pagkatoytoyNo ratings yet

- Which of The Following Is Not An Essential Characteristic of A LiabilityDocument31 pagesWhich of The Following Is Not An Essential Characteristic of A LiabilityJam PotutanNo ratings yet

- Advacc 1 Question Set ADocument11 pagesAdvacc 1 Question Set AA BNo ratings yet

- National Mock Board Examination 2017 Advanced Financial Accounting and ReportingDocument11 pagesNational Mock Board Examination 2017 Advanced Financial Accounting and ReportingTzaddi Ann DeluteNo ratings yet

- Final Exam CDocument12 pagesFinal Exam Cnhorelajne03No ratings yet

- Review 105 - Day 7 Theory of AccountsDocument11 pagesReview 105 - Day 7 Theory of AccountsKathleen PardoNo ratings yet

- D7Document11 pagesD7neo14No ratings yet

- Business CombinationDocument3 pagesBusiness CombinationJia CruzNo ratings yet

- 7.29.22 Am Trade-And-Other-ReceivablesDocument5 pages7.29.22 Am Trade-And-Other-ReceivablesAether SkywardNo ratings yet

- Polytechnic University of The PhilippinesDocument12 pagesPolytechnic University of The PhilippinesKyla Dane P. Prado0% (1)

- Act 6J03 - Comp2 - 1stsem05-06Document12 pagesAct 6J03 - Comp2 - 1stsem05-06ROMAR A. PIGANo ratings yet

- Acc 106 Receivable FinanceDocument2 pagesAcc 106 Receivable FinanceHeavenneNo ratings yet

- Chap 1 BuscomDocument6 pagesChap 1 BuscomNathalie GetinoNo ratings yet

- DocxDocument14 pagesDocxcrispyy turonNo ratings yet

- Mock Cpa Board Exams - Rfjpia r-12 - W.ansDocument17 pagesMock Cpa Board Exams - Rfjpia r-12 - W.anssamson jobNo ratings yet

- A. Business CombinationDocument30 pagesA. Business CombinationJason SheeshNo ratings yet

- Practice Quiz NonFinlLiabDocument15 pagesPractice Quiz NonFinlLiabIsabelle GuillenaNo ratings yet

- Taxation 1 ReviewerDocument5 pagesTaxation 1 ReviewerEISEN BELWIGANNo ratings yet

- CFAS Quiz 1 Final ADocument5 pagesCFAS Quiz 1 Final ADesiree Angelique RebonquinNo ratings yet

- Cfas - Quiz QuestionsDocument3 pagesCfas - Quiz QuestionsNavdeep KaurNo ratings yet

- Afar 2 Testbank Business CombinationDocument30 pagesAfar 2 Testbank Business Combinationjeromedeiparine8No ratings yet

- Act 6J03 - Comp2 - 1stsem05-06Document11 pagesAct 6J03 - Comp2 - 1stsem05-06d.pagkatoytoyNo ratings yet

- Financial Analysis Placement TestDocument15 pagesFinancial Analysis Placement TestAbigail SubaNo ratings yet

- Colegio de San Juan de Letran: NAME - SECTIONDocument9 pagesColegio de San Juan de Letran: NAME - SECTIONmaria evangelistaNo ratings yet

- RewiewerDocument34 pagesRewiewerMickaella VergaraNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- b8 Train Biodiversity Plan Subnational enDocument37 pagesb8 Train Biodiversity Plan Subnational enSweet EmmeNo ratings yet

- Prescott Guide enDocument74 pagesPrescott Guide enSweet EmmeNo ratings yet

- Business Combination Q4Document2 pagesBusiness Combination Q4Sweet EmmeNo ratings yet

- COMLAW5 Module 2 Related Laws Banking LawsDocument25 pagesCOMLAW5 Module 2 Related Laws Banking LawsSweet EmmeNo ratings yet

- SAPP HANDOUTS - DESCRIPTIVE ONLY Handouts 1-1Document14 pagesSAPP HANDOUTS - DESCRIPTIVE ONLY Handouts 1-1Sweet EmmeNo ratings yet

- Module 1Document20 pagesModule 1Sweet EmmeNo ratings yet

- Defective GoodsDocument3 pagesDefective GoodsSweet EmmeNo ratings yet

- Data Warehouse Data DesignDocument51 pagesData Warehouse Data DesignSweet EmmeNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- Acct602 PQ2Document4 pagesAcct602 PQ2Sweet EmmeNo ratings yet

- AA2Q1Document1 pageAA2Q1Sweet EmmeNo ratings yet

- BA2, Module 2 GuideDocument11 pagesBA2, Module 2 GuideSweet EmmeNo ratings yet

- Job OrderDocument69 pagesJob OrderSweet EmmeNo ratings yet

- Audit Procedures For Accounts PayableDocument3 pagesAudit Procedures For Accounts PayableSweet Emme100% (1)

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- 04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaDocument10 pages04-46 Analysis of Gold-Copper Braze Joint in Glidcop For UHV Components at The APS W.Toter S.SharmaKai XuNo ratings yet

- Practice Questions: Musculoskeletal SystemDocument4 pagesPractice Questions: Musculoskeletal SystemSali IqraNo ratings yet

- Laurel Doll Amigurumi Free PatternDocument21 pagesLaurel Doll Amigurumi Free PatternHuyền TrangNo ratings yet

- Springer Nature Latex TemplateDocument13 pagesSpringer Nature Latex TemplateAndres FloresNo ratings yet

- Machine Tool TestingDocument4 pagesMachine Tool Testingnm2007k100% (1)

- Overview: Module 4: Main Aim Subsidiary Aims Personal AimsDocument28 pagesOverview: Module 4: Main Aim Subsidiary Aims Personal AimsIslam TahaNo ratings yet

- Free CV Template 31Document1 pageFree CV Template 31Aaron WilsonNo ratings yet

- Grade 7 Lesson: ReproductionDocument4 pagesGrade 7 Lesson: ReproductionJoedelyn Wagas100% (2)

- Characterising Roof Ventilators: P 2 A Q CDocument4 pagesCharacterising Roof Ventilators: P 2 A Q CDhirendra Singh RathoreNo ratings yet

- Hospice SynopsisDocument6 pagesHospice SynopsisPhalguna NaiduNo ratings yet

- Written RequestDocument2 pagesWritten Requestcarvazro100% (1)

- Organic Halides Introduction Class-1 NotesDocument15 pagesOrganic Halides Introduction Class-1 Notessiddhartha singhNo ratings yet

- Partnership in Class Questions 2015Document3 pagesPartnership in Class Questions 2015Nella KingNo ratings yet

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Thrift Banks ActDocument25 pagesThrift Banks ActMadelle Pineda100% (1)

- Mic 2 Mkii Installation Instructions and Reference Handbook 4189320057 UkDocument70 pagesMic 2 Mkii Installation Instructions and Reference Handbook 4189320057 Ukkamel kamelNo ratings yet

- MT2OL-Ia6 2 1Document136 pagesMT2OL-Ia6 2 1QUILIOPE, JUSTINE JAY S.No ratings yet

- In Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDocument7 pagesIn Search of Colonial El Ni No Events and A Brief History of Meteorology in EcuadorDanielNo ratings yet

- Ent Secretory Otitis MediaDocument3 pagesEnt Secretory Otitis MediaIrena DayehNo ratings yet

- Ultrasonic InterferometerDocument22 pagesUltrasonic InterferometerakshatguptaNo ratings yet

- Chapter 6: The Legal and Political Environment of Global BusinessDocument25 pagesChapter 6: The Legal and Political Environment of Global BusinessMaxineNo ratings yet

- Shapes of NailsDocument14 pagesShapes of NailsIyannNo ratings yet

- AfPS&CS Ch-01Document10 pagesAfPS&CS Ch-01Amelwork AlchoNo ratings yet

- Kalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDocument1 pageKalsi® Building Board Cladding: Kalsi® Clad Standard DimensionsDenis AkingbasoNo ratings yet

- Experiencing Postsocialist CapitalismDocument251 pagesExperiencing Postsocialist CapitalismjelisNo ratings yet