Professional Documents

Culture Documents

Intimation of Demand Note

Intimation of Demand Note

Uploaded by

Rishabh jainOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intimation of Demand Note

Intimation of Demand Note

Uploaded by

Rishabh jainCopyright:

Available Formats

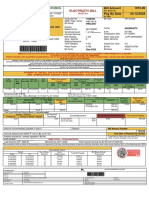

Print Date : 27.02.

2021 TPDDL PAN:AABCN6808R

Intimation of Demand Note TPDDL GST No.: 07AABCN6808R1ZV

Notification No.:2025409412/

District/Zone:MANGOL PURI/Zone Poothkalan

Notification Type:New Connection

Priority:Permanent Connection Generation Date:27.02.2021

Contract Account No.:60027646912 Due Date:01.03.2021

Connection Details

Name:Mr. SACHIN JAIN Sanctioned Load(KW): 1.00

Relationship:S/O Mr. SUBHASH CHAND JAIN Contract Demand(KVA):0.00

Communication Address: Billing Class:EDOM

HOUSE NO 75-76 2ND FLOOR Rate Category: E-DOMESTIC

PKT-3, SEC-22, ROHINI DELHI-85 PKT 3 SEC

110086

Phone No.:7011187761 Pay Using UPI

Supply Address:

HOUSE 75-76 2ND FLOOR PKT-3 SEC-22 ROHINI CITY DELHI

110086 LANDMARK NEAR PARK

Charges Details

S.No. Description Amount CGST CGST Amount SGST SGST Amount Total

Rate Rate

1 Security Deposit 600.00 600.00

2 SLD Charges 3000.00 9% 270.00 9% 270.00 3540.00

Total Payable Amount: 4140.00

Notes

- Be a Digital and Green Customer, make online payment using Net-Banking/Credit Card*/Debit Card*, under option "Pay Demand Note"

on our website www.tatapower-ddl.com/ Mobile App (TPDDL Connect).For Credit/Debit card payments above Rs.5000/-, Customer need

to pay the commission charges to the bank.

- Demand note payment through Cash (upto Rs.20,000 including sum of current and previous security deposit)/Credit Card/Debit

Card/DD/PO in favour of TPDDL payable at Delhi at Cash collection time as per below mail ( 9 AM to 5 PM Monday to Friday and 9 AM

to 3.45 PM on Saturday) Please mention Notification No. 002025409412 ,CA No. 60027646912 and your Contact No. behind the DD/PO, for

correct adjustment of amount

- Energisation of the connection will be subject to augmentation of capacity and/or extension of the electricity network and / or

availability of space by Government of NCT / Developer, if required.

- For any further query/clarification, you may contact at 19124 (24x7 hrs) or visit our Consumer Care Center (9:30 AM to 5:30 PM)

from Monday to Friday and 9:30 AM to 1:00 PM on Saturday

- Security Deposit, if included in above Demand Note, is refundable (subject to clearance of final bill at time of connection

termination/surrender)

Additional Notes

*In wake of the COVID-19 pandemic, for the safety of all the stakeholders, we are operational with limited staffing. Under the circumstances, some

services are likely to be delayed. We thank you for your patience in these challenging time.

A. Please ensure that: a) The details like name /address/load etc. are as per your application, b) The internal wiring is complete and there is a safe place for meter above 2 feet from

the ground, c) For single phase connection : MCB is installed in case of sanctioned load below 2 KW & ELCB for sanctioned load equal to or more than 2 KW, d) For 3 phase

Connection: 4 pole MCCB and ELCB or RCCB is installed, earthing is done and equal load is distributed on all phases, e) Building Height is less than 15 Meters as per approved

Land Owning Agency plans. B. As per DERC regulation 2017, Developer/ applicant taking supply at Low Tension level for any premises or for re-constructed premises, requiring LT

Service connections has to provide the space for installation of distribution transformers as per the required load whose: (i) total cumulative demand of all floors in the plot/ building

for LT service connection exceeds 100 kW/108 kVA; or (ii) total cumulative built up area of the premises in the plot/building exceeds 1000 sqm; or (iii) plot of size above 500 sqm or

above. C. This is not a tax invoice but only an intimation of estimation or actual charges as per DERC guidelines. Tax invoice shall be issued as per provision of GST Act, 2017.

Eligible customer can avail the input tax credit as per the provision of GST Act, 2017 and GST Rules. Therefore, Tata Power - DDL cannot be held responsible for any demand/

penalty/ interest that may be raised by the GST department on the consumer for wrong availing of input tax credit as per the provision and rules of GST Act, 2017. With reference to

section 34 of CGST Act, TATA Power-DDL shall issue credit note adjusting GST only in case of specified circumstances upto 31st August of the next financial year, after considering

the time involved in processing the cases. May please note that beyond the said timelines, TATA Power-DDL shall not be in a position to raise credit note or refund GST Amount D.

As per income tax rules, TDS is deducted for interest earned on Security deposit of amount exceeding Rs.5000/- in a financial year. You are requested to update the PAN in our

records by visiting nearest customer care center along with copy of PAN. In case of non-availability of PAN, TDS will be deducted @20% under Section 206(AA) of Income Tax Act.

Note:* For more details please visit bill payment section on our website www.tatapower-ddl.com

(This is system generated letter & does not require any signature)

Page 1 of 1

Regd. Office: NDPL House, Hudson lines, Kingsway Camp, Delhi-110 009

24x7 Toll Free No: 19124, Mobile App: Tata Power-DDL Connect, Website: www.tatapower-ddl.com, Email: customercare@tatapower-ddl.com

Tata Power-DDL CIN No: U40109DL2001PLC111526, PAN No: AABCN6808R, GST No: 07AABCN6808R1ZV, TIN: 07880254419

You might also like

- NDPLDocument2 pagesNDPLDynamic Pubg0% (1)

- Internet Bill - Ajay Bhoriya - July 2022 To Dec 2022Document4 pagesInternet Bill - Ajay Bhoriya - July 2022 To Dec 2022ajay_bhoriyaNo ratings yet

- Entrepreneurship: Quarter 1 - Module 9: People, Packaging, PositionDocument36 pagesEntrepreneurship: Quarter 1 - Module 9: People, Packaging, PositionRoman Espera100% (2)

- Invoice EB19316-2-1 - 05.03.2020 With LPODocument5 pagesInvoice EB19316-2-1 - 05.03.2020 With LPODumindu Chandana PunchihewaNo ratings yet

- Offer Letter McDermott Onshore - Nitin Kumar PatelDocument3 pagesOffer Letter McDermott Onshore - Nitin Kumar PatelmiteshNo ratings yet

- Intimation of Demand NoteDocument1 pageIntimation of Demand NoteDeepakNo ratings yet

- Intimation of Demand NoteDocument1 pageIntimation of Demand NoteArshNo ratings yet

- Intimation of Demand NoteDocument1 pageIntimation of Demand Notemk2729712No ratings yet

- ELECTRICITYDocument2 pagesELECTRICITYKAMAL SONI0% (1)

- BillDocument2 pagesBilltalib0% (1)

- D2-72 GF Electricity BillDocument3 pagesD2-72 GF Electricity BillMonia Punyani100% (1)

- 1129 BillDocument2 pages1129 BillRishi kant0% (1)

- Total Amount PayableDocument3 pagesTotal Amount PayableAMIT0% (1)

- Electricity BillDocument1 pageElectricity BillSushila Singh0% (1)

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSURYA FREE FIRENo ratings yet

- PDF&Rendition 1 4Document3 pagesPDF&Rendition 1 4jitesh.rajwar100% (1)

- Q1007790763Document1 pageQ1007790763deepsamanta1996No ratings yet

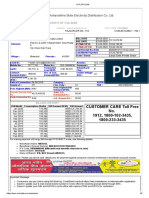

- Maharashtra State Electricity Distribution Co. LTD.: Bill of Supply For The Month ofDocument2 pagesMaharashtra State Electricity Distribution Co. LTD.: Bill of Supply For The Month ofAyush TandonNo ratings yet

- G 1Document1 pageG 1Masum KhanNo ratings yet

- Rural Broadband PVT LTDDocument2 pagesRural Broadband PVT LTDOmPrakashKumarNo ratings yet

- Skylink Nov2022Document3 pagesSkylink Nov2022Dharmaraj ManojNo ratings yet

- Terp Asia Construction Corp.: Statement of AccountDocument4 pagesTerp Asia Construction Corp.: Statement of AccountMark Israel DirectoNo ratings yet

- Inv Ka B1 32251227 102017859871 June 2020Document2 pagesInv Ka B1 32251227 102017859871 June 2020CLS AKNo ratings yet

- Bill of Supply For The Month of May 2021: Maharashtra State Electricity Distribution Co. LTDDocument3 pagesBill of Supply For The Month of May 2021: Maharashtra State Electricity Distribution Co. LTDVishal Vitthalrao Narwade (US)No ratings yet

- Total Amount PayableDocument2 pagesTotal Amount PayableRavi Kumar Panchal0% (1)

- Inv-Ka-B1-36680539-102017859871-14th February-2021 To 13TH September 2021Document2 pagesInv-Ka-B1-36680539-102017859871-14th February-2021 To 13TH September 2021CLS AKNo ratings yet

- 2nd FloorDocument2 pages2nd Floorkeshav Gupta0% (1)

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)anooprchNo ratings yet

- Bill For Current MonthPDF - 221029 - 075144Document3 pagesBill For Current MonthPDF - 221029 - 075144IshWayTime0% (1)

- Bill For Current Month (7) - 1Document1 pageBill For Current Month (7) - 1Ankit Gupta0% (1)

- Maharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022Document4 pagesMaharashtra State Electricity Distribution Co. Ltd. Bill of Supply For The Month of Apr 2022MAHA LAXMINo ratings yet

- MMC/F/010 Service Order: Village - Dongamouha, District: Raigarh (C.G.) - 496108Document16 pagesMMC/F/010 Service Order: Village - Dongamouha, District: Raigarh (C.G.) - 496108ask1968No ratings yet

- Bill 1Document2 pagesBill 1Geetanjali0% (1)

- LIC Combined ReceiptsDocument6 pagesLIC Combined Receiptssumanpal78No ratings yet

- TransactionSummary 920020072211211 161223050859Document2 pagesTransactionSummary 920020072211211 161223050859sushil.ublNo ratings yet

- HT - LTIP E-Bill AprilDocument4 pagesHT - LTIP E-Bill Aprilsudarshan.sanap7080No ratings yet

- Bill of Supply For The Month of Nov 2021: Maharashtra State Electricity Distribution Co. LTDDocument3 pagesBill of Supply For The Month of Nov 2021: Maharashtra State Electricity Distribution Co. LTDAswitaNo ratings yet

- Ishrat Jahan BillDocument2 pagesIshrat Jahan Billanisalways2020100% (1)

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/02/2019pravv vvvNo ratings yet

- Inv 12484-MarchDocument1 pageInv 12484-Marchintegral.shanNo ratings yet

- Vaghela Delhi New Ele BillDocument2 pagesVaghela Delhi New Ele Billjadavbhimraj7810100% (1)

- Demand Pre-Intimation Letter-Sg/8.2.1/F49/R0: Mr. Majid ZamanDocument2 pagesDemand Pre-Intimation Letter-Sg/8.2.1/F49/R0: Mr. Majid Zamanmaajid zamanNo ratings yet

- NTPC Limited: (A Government of India Enterprise)Document11 pagesNTPC Limited: (A Government of India Enterprise)Amit VijayvargiyaNo ratings yet

- BiptDocument1 pageBiptAshishNo ratings yet

- AsianetBill - nw-Aug-Nov21Document2 pagesAsianetBill - nw-Aug-Nov21John XavierNo ratings yet

- PPWC Static MeterDocument3 pagesPPWC Static Meterpant.vk8514No ratings yet

- Light Air Transmission Pvt. Ltd. ANIB032223 00582Document2 pagesLight Air Transmission Pvt. Ltd. ANIB032223 00582kanishkakhanna.inboxNo ratings yet

- BILLDATADocument2 pagesBILLDATALove ChoudharyNo ratings yet

- Bill 4Document2 pagesBill 4Geetanjali0% (1)

- E-Bill KhurdDocument3 pagesE-Bill KhurdTejas kalaskarNo ratings yet

- Bill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDDocument2 pagesBill of Supply For The Month of Feb 2020: Maharashtra State Electricity Distribution Co. LTDAyush TandonNo ratings yet

- MUNIXDocument1 pageMUNIXKUNDAN KUMAR (KING KILLER)No ratings yet

- Terms and Conditions: Atria Convergence Technologies PVT - LTD, Due Date: 10/10/2021Document2 pagesTerms and Conditions: Atria Convergence Technologies PVT - LTD, Due Date: 10/10/2021shubham kashivNo ratings yet

- Mumbai RanjitDocument2 pagesMumbai RanjitJayshreeNo ratings yet

- Bill No. 093252578867Document2 pagesBill No. 093252578867Javed KhatriNo ratings yet

- Invoice 1285669629 I0133P2208135080Document1 pageInvoice 1285669629 I0133P2208135080CA Ramajayam JayachandranNo ratings yet

- 1ms - Mecon LTD (DNS) - blr-Sl22-23113Document1 page1ms - Mecon LTD (DNS) - blr-Sl22-23113Dipan DasNo ratings yet

- Total Amount PayableDocument2 pagesTotal Amount Payablekeshav Gupta0% (1)

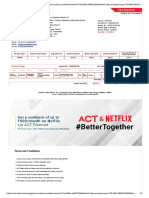

- Helpdesk - Nel@actcorp - In: Atria Convergence Technologies Limited, Due Date: 15/06/2021Document2 pagesHelpdesk - Nel@actcorp - In: Atria Convergence Technologies Limited, Due Date: 15/06/2021Bhanu PrakashNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- Electric Motorcycle Charging Infrastructure Road Map for IndonesiaFrom EverandElectric Motorcycle Charging Infrastructure Road Map for IndonesiaNo ratings yet

- Veg Silver New MenuDocument4 pagesVeg Silver New MenuRishabh jainNo ratings yet

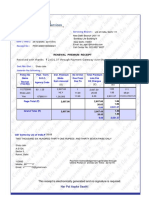

- Received With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromDocument3 pagesReceived With Thanks ' 6,891.00 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- Received With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromDocument2 pagesReceived With Thanks ' 2,631.37 Through Payment Gateway Over The Internet FromRishabh jainNo ratings yet

- 08 - Chapter 5Document72 pages08 - Chapter 5Rishabh jainNo ratings yet

- Research Project Report FinalDocument31 pagesResearch Project Report FinalRishabh jainNo ratings yet

- Chapter - 4 Research MethodologyDocument16 pagesChapter - 4 Research MethodologyRishabh jainNo ratings yet

- ,13 Companies Act, 2013Document21 pages,13 Companies Act, 2013Rishabh jainNo ratings yet

- ,14. Types of CompaniesDocument12 pages,14. Types of CompaniesRishabh jainNo ratings yet

- Directors and Remuneration, Managing Directors-Their Appointment, Qualifications, Powers and Limits On Their RemunerationDocument12 pagesDirectors and Remuneration, Managing Directors-Their Appointment, Qualifications, Powers and Limits On Their RemunerationRishabh jainNo ratings yet

- Examination Form Pending Students ListDocument12 pagesExamination Form Pending Students ListRishabh jainNo ratings yet

- ,3333. Crossing of ChequesDocument13 pages,3333. Crossing of ChequesRishabh jainNo ratings yet

- Capl Tusgeling1Telaiquss Amie: Ttluigu Epilal Kud Ghuj TlanetDocument4 pagesCapl Tusgeling1Telaiquss Amie: Ttluigu Epilal Kud Ghuj TlanetRishabh jainNo ratings yet

- Dividend PolicyDocument3 pagesDividend PolicyRishabh jainNo ratings yet

- Debenture of Market of The: ValueDocument5 pagesDebenture of Market of The: ValueRishabh jainNo ratings yet

- BVUSDE Online Submission Guidelines For Departmental Paper: Note: OneDocument3 pagesBVUSDE Online Submission Guidelines For Departmental Paper: Note: OneRishabh jainNo ratings yet

- Examination Form Filling CircularDocument4 pagesExamination Form Filling CircularRishabh jainNo ratings yet

- 5G Use Cases and System ConceptDocument29 pages5G Use Cases and System Conceptsuhana rahimNo ratings yet

- CE On Receivables T2 AY2021Document4 pagesCE On Receivables T2 AY2021Gian Carlo RamonesNo ratings yet

- ReviseDocument34 pagesRevisefreyaNo ratings yet

- Holiday Test Set FourDocument3 pagesHoliday Test Set FourMUSOKE GERALDNo ratings yet

- Large Shops Over Small Stores EssayDocument3 pagesLarge Shops Over Small Stores EssayMindificent Education KitNo ratings yet

- Inventories Lower of Cost and Net Realizable Value Lower of Cost and Net Realizable Value Work in Process Inventory, Land Held For SaleDocument1 pageInventories Lower of Cost and Net Realizable Value Lower of Cost and Net Realizable Value Work in Process Inventory, Land Held For SaleMikoNo ratings yet

- Annual Report 2018 PDFDocument114 pagesAnnual Report 2018 PDFSalman RahmanNo ratings yet

- Chapter 2 - Defining Business EthicsDocument20 pagesChapter 2 - Defining Business EthicsLena KhalidNo ratings yet

- Meaning: Educational Planning: Meaning, Nature and ImportanceDocument4 pagesMeaning: Educational Planning: Meaning, Nature and ImportanceJOANNA ROSE DELLOMAS-JAVILLONARNo ratings yet

- Everything About Purchase Requisition - 1Document13 pagesEverything About Purchase Requisition - 1Raghu SharmaNo ratings yet

- Responsibilty AccountingDocument3 pagesResponsibilty AccountingRenu PoddarNo ratings yet

- Medc Ledc Settlement EssayDocument2 pagesMedc Ledc Settlement Essayapi-221981095No ratings yet

- Media Metrix Desktop Reach Frequency December 2022Document4 pagesMedia Metrix Desktop Reach Frequency December 2022GAMING TECHNo ratings yet

- Transactions List: Cristina Borlan RO19BRDE250SV39314472500 RON Cristina BorlanDocument5 pagesTransactions List: Cristina Borlan RO19BRDE250SV39314472500 RON Cristina BorlanCrNo ratings yet

- Statement 2022MTH03 303580383Document4 pagesStatement 2022MTH03 303580383Vansh SharmaNo ratings yet

- Supplier Assessment Report-Shenzhen Mingqun Electronic Co., Ltd.Document22 pagesSupplier Assessment Report-Shenzhen Mingqun Electronic Co., Ltd.scirrocco1704No ratings yet

- Advanced Taxation May 2021Document20 pagesAdvanced Taxation May 2021akpanyapNo ratings yet

- Feudalism To Capitalism DebateDocument13 pagesFeudalism To Capitalism DebateHansini PunjNo ratings yet

- Income Taxation ReviewerDocument8 pagesIncome Taxation ReviewerJobelle Marie MahNo ratings yet

- ĐĐNN 1hDocument36 pagesĐĐNN 1hAnh PhạmNo ratings yet

- Melanie S. Samsona Business Tax Chapter 7 ExercisesDocument3 pagesMelanie S. Samsona Business Tax Chapter 7 ExercisesMelanie SamsonaNo ratings yet

- Notes BMGT 211 Introduction To Risk and Insurance May 2020-1Document94 pagesNotes BMGT 211 Introduction To Risk and Insurance May 2020-1jeremieNo ratings yet

- Session II: Topic - Understanding The Role of National Monetization Pipeline PolicyDocument19 pagesSession II: Topic - Understanding The Role of National Monetization Pipeline Policyicreate. psdNo ratings yet

- Dating FormatDocument1 pageDating FormatIredia WilsonNo ratings yet

- Chapter 1 MRP 312Document34 pagesChapter 1 MRP 312Mr.Sandeep LondheNo ratings yet

- Form 29 - Change of Company Secretary and Chief AccountantDocument3 pagesForm 29 - Change of Company Secretary and Chief AccountantHamza NajamNo ratings yet

- Thesis Performance ManagementDocument4 pagesThesis Performance ManagementWhatShouldIWriteMyPaperAboutLittleRock100% (2)

- (Download PDF) Basic Mathematics For Economists 3Rd Edition Mike Rosser Ebook Online Full ChapterDocument53 pages(Download PDF) Basic Mathematics For Economists 3Rd Edition Mike Rosser Ebook Online Full Chapterazhurazarre100% (8)