Professional Documents

Culture Documents

Loan Receivables

Loan Receivables

Uploaded by

Adam CuencaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Receivables

Loan Receivables

Uploaded by

Adam CuencaCopyright:

Available Formats

Let’s Check ULO 2-3

1. True 5. True

2. False 6. True

3. False 7. True

4. False 8. True

MCQ

9. d.

10. b.

Let’s Analyze

Problem 22 – ABC Bank

1.What is the entry to record the receipt of the interest income on December 31, 2019?

Answer:

c. Cash 890,760

Interest Income 890,760

Solution:

Principal amount P 8,000,000

Direct Original cost incurred 123,000

Origination cost received from borrower (700,000)

Carrying amount on Loan receivable - Jan 1, 2019 P 7,423,000

Interest income (7,423,000 x 12%) P 890,760

Interest received (8,000,000 x 10%) (800,000)

Amortization P 90,760

2. What is the interest income for 2019?

Answer: d. 890,760

Solution:

Interest income = 7,423,000 x 12% effective rate = P 890,760

Problem 23 – National Bank

1. What is the entry to recognize the impairment loss?

Answer:

c. Impairment Loss 592,100

Allowance for loan impairment 592,100

Beg. Loan receivable 5,000,000

Principal payment (1,000,000 x 2) (2,000,000)

Loan receivable - Jan/1/20 3,000,000

In a

PV - 2021 (500,000 x 0.9091) 454,550

PV - 2022 (1,000,000 x 0.8264) 826,400

PV - 2023 (1,500,000 x 0.7513) 1,126,950

Total PV of loan 2,407,900

Loan receivable - Jan/1/2020 3,000,000

Total PV of loan (2,407,900)

Impairment loss on L/R 592,100

nutshell

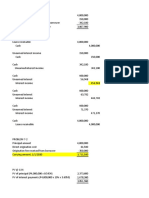

Problem 24 – Safari Bank

Requirement 1

Loan Receivables 7,500,000

Accrued Interest Receivable (12% x 7,500,000) 900,000

Total carrying amount 8,400,000

PV - Dec/31/2021 (500,000 x 0.89) 445,000

PV - Dec/31/2022 (1,000,000 x 0.80) 800,000

PV - Dec/31/2023 (2,000,000 x 0.71) 1,420,000

PV - Dec/31/2024 (4,000,000 x 0.64) 2,560,000

Total PV of loan 5,225,000

Carrying amount 8,400,000

Total PV of loan (5,225,000)

Impairment of loss 3,175,000

Requirement 2

Interest Carrying

Date Income (12%) Projected CF Amortization Value

Dec/31/20 - - - 5,225,000

Dec/31/21 627,000 500,000 127,000 5,352,000

Dec/31/22 642,240 1,000,000 (357,760) 4,994,240

Dec/31/23 599,309* 2,000,000 (1,400,691) 3,593,549

Dec/31/24 406,451 4,000,000 (3,593,549) 0

Requirement 3

Date Particulars Debit Credit

2018 Loan receivable 7,500,000

Cash 7,500,000

2019 Impairment of loss 3,175,000

Accrued Interest Receivable 900,000

Allowance for loan impairment 2,275,000

2020 Cash 500,000

Loan Receivable 500,000

Allowance for loan impairment 627,000

Interest Income 627,000

2021 Cash 1,000,000

Loan Receivable 1,000,000

Allowance for loan impairment 642,240

Interest Income 642,240

2022 Cash 2,000,000

Loan Receivable 2,000,000

Allowance for loan impairment 599,309

Interest Income 599,309

2023 Cash 4,000,000

Loan Receivable 4,000,000

Allowance for loan impairment 406,451

Interest Income 406,451

2024 Cash 8,400,000

Interest income 900,000

Loan Receivable 7,500,000

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- CFASDocument4 pagesCFASAdam CuencaNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- Problem 6-8 Answer A Savage CompanyDocument6 pagesProblem 6-8 Answer A Savage CompanyJurie BalandacaNo ratings yet

- In Acc April Lyn Limsan BsaDocument6 pagesIn Acc April Lyn Limsan BsaJurie BalandacaNo ratings yet

- In Acc Chris Jean Paden BsaDocument6 pagesIn Acc Chris Jean Paden BsaJurie BalandacaNo ratings yet

- Problem 7 - 6 & 7Document2 pagesProblem 7 - 6 & 7Micah April SabularseNo ratings yet

- Problem 7-5Document2 pagesProblem 7-5Micah April SabularseNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- IntAcc GroupingsDocument4 pagesIntAcc GroupingsNikka BigtasNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Acctg 4 Serdan Quiz 3Document7 pagesAcctg 4 Serdan Quiz 3Rica CatanguiNo ratings yet

- Assignment 7 and Problem Solving - LA MADRID, Arianne Leah, V.Document10 pagesAssignment 7 and Problem Solving - LA MADRID, Arianne Leah, V.Leah La MadridNo ratings yet

- Problem 5 On Loan ReceivableDocument6 pagesProblem 5 On Loan Receivablebm1ma.allysaamorNo ratings yet

- Requirement 1 2023 2024 2025 2026Document17 pagesRequirement 1 2023 2024 2025 2026Soria Sophia AnnNo ratings yet

- 7 5 BuenaventuraDocument2 pages7 5 BuenaventuraAnonnNo ratings yet

- 07 Loan Receivable MCPDocument4 pages07 Loan Receivable MCPkyle mandaresioNo ratings yet

- Renton Effective Am21Document5 pagesRenton Effective Am21Kris Hazel RentonNo ratings yet

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- IA - Receivables Addtl ConceptsDocument3 pagesIA - Receivables Addtl ConceptsDiana AcostaNo ratings yet

- 3 Stages ECLDocument4 pages3 Stages ECLPappy TresNo ratings yet

- Adv Acc Prep 2024Document3 pagesAdv Acc Prep 2024Suhail AhmedNo ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- 5 27 LoansDocument9 pages5 27 LoansRengeline LucasNo ratings yet

- Assignment FARDocument2 pagesAssignment FARCykee Hanna Quizo LumongsodNo ratings yet

- Problem 1: ComputationsDocument6 pagesProblem 1: ComputationsClarissa BorbonNo ratings yet

- Property, Plant, & Equipment Problem SetDocument3 pagesProperty, Plant, & Equipment Problem SetSarah Nicole S. LagrimasNo ratings yet

- 7 8 BuenaventuraDocument4 pages7 8 BuenaventuraAnonnNo ratings yet

- Tugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BDocument23 pagesTugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BAdam PalmaleoNo ratings yet

- BANGI, Joshua Celton - Assign2.Document7 pagesBANGI, Joshua Celton - Assign2.Joshua BangiNo ratings yet

- Chapter 14 - Homework AnswerDocument10 pagesChapter 14 - Homework AnswerSaja AlbarjesNo ratings yet

- Intac QuizDocument4 pagesIntac QuizPamela Joy AlvarezNo ratings yet

- Nudjpia Far and Afar Solutions - Government GrantsDocument3 pagesNudjpia Far and Afar Solutions - Government GrantsKyla Artuz Dela CruzNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- Loan ReceivableDocument10 pagesLoan ReceivableClyde SaladagaNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- Acctg Lab 2.Document110 pagesAcctg Lab 2.AngieNo ratings yet

- Sol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionDocument13 pagesSol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- 188073f7174b4401b2d0a1b25da700e9Document4 pages188073f7174b4401b2d0a1b25da700e9520Sri Wahyuni NgabalinNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Audit of Long-Term Liabilities - SDocument6 pagesAudit of Long-Term Liabilities - SEva DagusNo ratings yet

- GE 01.FCAB - .L Solution JUNE 2020 ExamDocument5 pagesGE 01.FCAB - .L Solution JUNE 2020 ExamTameemmahmud rokibNo ratings yet

- Impairment of LoanDocument4 pagesImpairment of LoanaleywaleyNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- False 2. False 3. False 4. False 5. True 6. True 7. False 8. TrueDocument4 pagesFalse 2. False 3. False 4. False 5. True 6. True 7. False 8. TrueRegina Mae CatamponganNo ratings yet

- Answer Key Final Exam IA 2Document4 pagesAnswer Key Final Exam IA 2Carlos arnaldo lavadoNo ratings yet

- Compound Financial InstrumentDocument2 pagesCompound Financial Instrumenthae1234No ratings yet

- Quiz 102 Cash and Cash Equivalents To Loan Impairment PDF FreeDocument13 pagesQuiz 102 Cash and Cash Equivalents To Loan Impairment PDF FreeNashaNo ratings yet

- Quiz 1.02 Cash and Cash Equivalents To Loan ImpairmentDocument13 pagesQuiz 1.02 Cash and Cash Equivalents To Loan ImpairmentJohn Lexter MacalberNo ratings yet

- Total Increase in PPE 9,700,000Document22 pagesTotal Increase in PPE 9,700,000Stephanie gasparNo ratings yet

- NSTP 1 AssignmentDocument3 pagesNSTP 1 AssignmentAdam CuencaNo ratings yet

- IFRS 17 - Insurance ContractsDocument7 pagesIFRS 17 - Insurance ContractsAdam CuencaNo ratings yet

- IFRIC 12 - Service Concession ArrangementsDocument4 pagesIFRIC 12 - Service Concession ArrangementsAdam CuencaNo ratings yet

- IFRS 4 Insurance ContractsDocument27 pagesIFRS 4 Insurance ContractsAdam CuencaNo ratings yet

- Blocking & Forcing Through CombinedDocument1 pageBlocking & Forcing Through CombinedAdam CuencaNo ratings yet

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document32 pagesFinancial Rehabilitation and Insolvency Act (FRIA) of 2010Adam CuencaNo ratings yet

- Pro-Forma Journal EntriesDocument4 pagesPro-Forma Journal EntriesAdam CuencaNo ratings yet

- Maceda LawDocument9 pagesMaceda LawAdam CuencaNo ratings yet

- PFS Chapter 4Document50 pagesPFS Chapter 4Adam CuencaNo ratings yet

- Republic Act No. 11032Document12 pagesRepublic Act No. 11032Adam CuencaNo ratings yet

- ACC 222 Practice SetDocument4 pagesACC 222 Practice SetAdam CuencaNo ratings yet

- Kelley Day Jokes After Tagged 3rd Third Party in Carla AbellanaDocument1 pageKelley Day Jokes After Tagged 3rd Third Party in Carla AbellanaAdam CuencaNo ratings yet

- Art Appreciation EssayDocument1 pageArt Appreciation EssayAdam CuencaNo ratings yet

- Miss USA 2019 Cheslie Kryst Shared Inner Struggles in Heartbreaking EssayDocument1 pageMiss USA 2019 Cheslie Kryst Shared Inner Struggles in Heartbreaking EssayAdam CuencaNo ratings yet

- Winning in Service Markets - Success Through People, Technology and Strategy PDFDocument1 pageWinning in Service Markets - Success Through People, Technology and Strategy PDFPrashanth BangaloreNo ratings yet

- List of Legal Entity Types by Country: Corporate Law BusinessDocument99 pagesList of Legal Entity Types by Country: Corporate Law BusinessSaravanakkumar KRNo ratings yet

- Balance of Payments With A Focus On NigeriaDocument33 pagesBalance of Payments With A Focus On NigeriaJohn KargboNo ratings yet

- ISO 26262 Automotive Functional Safety IDocument12 pagesISO 26262 Automotive Functional Safety IBasel TahboubNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceAnonymous Gg6z0u9IBzNo ratings yet

- Strata ProcessDocument1 pageStrata Processafif.fathi.architectNo ratings yet

- SFM Formulae PDFDocument255 pagesSFM Formulae PDFpiyush bansalNo ratings yet

- MERC 113 Guide (Answer) To Problem Solving Ex and Formative TestDocument15 pagesMERC 113 Guide (Answer) To Problem Solving Ex and Formative TestqemsabaterNo ratings yet

- A Project On Distribution Channel of DABURDocument20 pagesA Project On Distribution Channel of DABURsandyforyou40% (5)

- 1 s2.0 S0019850120308257 MainDocument10 pages1 s2.0 S0019850120308257 MainRio AlfajriNo ratings yet

- Indramayu Coal-Fired Power Plant Project: September 2017Document186 pagesIndramayu Coal-Fired Power Plant Project: September 2017benito siahaanNo ratings yet

- MR Brochure Digital 2021Document12 pagesMR Brochure Digital 2021Harrrya hady WidjayaNo ratings yet

- Brand Manual v2 May 2020Document30 pagesBrand Manual v2 May 2020Pian SopianNo ratings yet

- TRIDGE 2021 Coffee ReportDocument19 pagesTRIDGE 2021 Coffee ReportHany FathyNo ratings yet

- Diary Advanced Business PlanDocument64 pagesDiary Advanced Business PlanSewinet100% (1)

- Inv 8800Document1 pageInv 8800Vincen JunjunNo ratings yet

- Estate Planning: Gumisai Jacob GutuDocument25 pagesEstate Planning: Gumisai Jacob GutuTawanda Tatenda Herbert100% (1)

- Indian Automobile IndustryDocument55 pagesIndian Automobile Industrysaurabhtayal88No ratings yet

- NewProd2 PDFDocument71 pagesNewProd2 PDFMelissa IsaacNo ratings yet

- Salary Slip Format For 25000Document2 pagesSalary Slip Format For 25000Saravanan KNo ratings yet

- B. Statistics ProjectDocument10 pagesB. Statistics ProjectShuvo GhoshNo ratings yet

- TemplateDocument4,397 pagesTemplateakeey4uNo ratings yet

- EnronDocument7 pagesEnronChristine ToledoNo ratings yet

- Macroeconomics - Notes 12thDocument28 pagesMacroeconomics - Notes 12thReddyNo ratings yet

- Topic 1.1 Common-Size Financial Statement Analysis: Page 1 of 54Document54 pagesTopic 1.1 Common-Size Financial Statement Analysis: Page 1 of 54Galeli PascualNo ratings yet

- Wallstreetjournal 20160121 The Wall Street JournalDocument54 pagesWallstreetjournal 20160121 The Wall Street JournalstefanoNo ratings yet

- Credit Risk Interview QuestionsDocument2 pagesCredit Risk Interview QuestionsSahid WahabNo ratings yet

- E Ticket 3Document2 pagesE Ticket 3vijay mishraNo ratings yet

- Production and Operations Management Systems: Chapter 9: Supply Chain Management Sushil K. Gupta Martin K. Starr 2014Document57 pagesProduction and Operations Management Systems: Chapter 9: Supply Chain Management Sushil K. Gupta Martin K. Starr 2014Homeq RealestateNo ratings yet

- Hoover Digest, 2022, No. 4, FallDocument224 pagesHoover Digest, 2022, No. 4, FallHoover InstitutionNo ratings yet