Professional Documents

Culture Documents

BMS-FC-Competitive Forces

BMS-FC-Competitive Forces

Uploaded by

Danish SheikhCopyright:

Available Formats

You might also like

- Case AnalysisDocument20 pagesCase AnalysisViddhi ParekhNo ratings yet

- Bakery Industry Analysis With Porter'S Five Forces Model: Prepared by Group BDocument19 pagesBakery Industry Analysis With Porter'S Five Forces Model: Prepared by Group BThant Thandar100% (1)

- Leadership MCQ Questions TBLDocument14 pagesLeadership MCQ Questions TBLsaira tariqNo ratings yet

- 961 Beer Case PDFDocument22 pages961 Beer Case PDFayunda utariNo ratings yet

- Supply Chain Strategy and Financial MetricsDocument27 pagesSupply Chain Strategy and Financial Metricshappiest1No ratings yet

- Marketing Strategies of Local Business - (Borjan Shoes)Document19 pagesMarketing Strategies of Local Business - (Borjan Shoes)Faizaan Khan86% (7)

- Production & Operations Management - UploadDocument42 pagesProduction & Operations Management - UploadAlison Browne-Ellis100% (2)

- ConsultingDocument10 pagesConsultingkartikeya guptaNo ratings yet

- Environment & Industry Analysis and Firm PerformanceDocument27 pagesEnvironment & Industry Analysis and Firm PerformanceErwin SantosoNo ratings yet

- Five Forces Industry Analysis: Supplier Power Buying Power Intensity of RivalryDocument11 pagesFive Forces Industry Analysis: Supplier Power Buying Power Intensity of RivalryRizki RidwanNo ratings yet

- External Environment ANALYSIS (Competitive Analysis)Document13 pagesExternal Environment ANALYSIS (Competitive Analysis)Putri AnisaNo ratings yet

- Porters Five ForcesDocument13 pagesPorters Five ForcesLawrence MosizaNo ratings yet

- Week 04 Tutorial External EnvironmentDocument15 pagesWeek 04 Tutorial External EnvironmentsundayadedejitremaNo ratings yet

- ExternalDocument16 pagesExternalGarry YeohNo ratings yet

- Nego Legends Roun1 NegocioDocument22 pagesNego Legends Roun1 NegocioFahim DawanNo ratings yet

- OS Preparatory 16-18 BacthDocument14 pagesOS Preparatory 16-18 BacthRajeev MehtaNo ratings yet

- Porter's Five Forces: Barriers To EntryDocument2 pagesPorter's Five Forces: Barriers To EntryNimish JoshiNo ratings yet

- Industry Analysis:: The FundamentalsDocument13 pagesIndustry Analysis:: The FundamentalsChhavi KhuranaNo ratings yet

- Evaluar La Oportunidad de MercadoDocument1 pageEvaluar La Oportunidad de MercadoCarmen CastroNo ratings yet

- Evaluate Market Opportunity AttractivenessDocument1 pageEvaluate Market Opportunity AttractivenessLaura Natalia SalcedoNo ratings yet

- Worksheet 2 - Evaluate Market Opportunity AttractivenessDocument1 pageWorksheet 2 - Evaluate Market Opportunity AttractivenessManoj GoenkaNo ratings yet

- Industry AnalysisDocument14 pagesIndustry AnalysisJorge Humberto Chambi VillarroelNo ratings yet

- Porter 5 Forces Analysis PDFDocument6 pagesPorter 5 Forces Analysis PDFHarland OuiNo ratings yet

- Competitive Advantage: Author-Michael Porter Group No - 3Document50 pagesCompetitive Advantage: Author-Michael Porter Group No - 3rohanNo ratings yet

- 1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsDocument44 pages1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsMohammed AkhtarNo ratings yet

- S3 S4 Industry and Environmental AnalysisDocument19 pagesS3 S4 Industry and Environmental Analysisst123314No ratings yet

- The Five Competitive Forces That Shape StrategyDocument1 pageThe Five Competitive Forces That Shape StrategyMärtïnëz IvänNo ratings yet

- Mapa Conceptaul InglesDocument1 pageMapa Conceptaul InglesMärtïnëz IvänNo ratings yet

- Chapter 4Document56 pagesChapter 4Ameeruddin BugtiNo ratings yet

- Characteristic Perfect Competition: Barriers To EntryDocument1 pageCharacteristic Perfect Competition: Barriers To Entrybhagat103No ratings yet

- Porters Five Forces AnalysisDocument2 pagesPorters Five Forces AnalysisJulio FernandezNo ratings yet

- Eco CH 4 Full Notes by Shrishty AgarwalDocument7 pagesEco CH 4 Full Notes by Shrishty AgarwalDisha SrivastavaNo ratings yet

- 36487fund of Marketing Lecture 4 SP 23Document27 pages36487fund of Marketing Lecture 4 SP 23Muhammad BilalNo ratings yet

- PorterDocument12 pagesPortersalesmuliamakmurNo ratings yet

- Porter'S Five Forces Model Template: Buyer Power Barriers To EntryDocument1 pagePorter'S Five Forces Model Template: Buyer Power Barriers To EntryValters KazeNo ratings yet

- Beige Fashion Minimalist Presentation PDFDocument22 pagesBeige Fashion Minimalist Presentation PDFAlma NatañoNo ratings yet

- Infographics Business CompetitionDocument1 pageInfographics Business CompetitionPrinces Elizabeth P PeñafielNo ratings yet

- Automobile Dealer Industry Analysis 1Document9 pagesAutomobile Dealer Industry Analysis 1Sai Neeraj GundluruNo ratings yet

- Session 2 Competitive Strategies-1Document28 pagesSession 2 Competitive Strategies-1meebvkNo ratings yet

- A Presentation On Hindustan Uniliver (Hul)Document6 pagesA Presentation On Hindustan Uniliver (Hul)Prem GauravNo ratings yet

- A Presentation On Hindustan Uniliver (Hul)Document6 pagesA Presentation On Hindustan Uniliver (Hul)Prem GauravNo ratings yet

- A Presentation On Hindustan Uniliver (Hul)Document6 pagesA Presentation On Hindustan Uniliver (Hul)Prem GauravNo ratings yet

- Market StructuresDocument11 pagesMarket Structureslygiabuu28No ratings yet

- IKEA Case StudyDocument25 pagesIKEA Case StudyShaziya Kabani100% (1)

- Case Study - Overview & AnalysisDocument9 pagesCase Study - Overview & AnalysisNidhi JoshiNo ratings yet

- Strategic Management An Introduction Session 1a: Dr. Chiranjit Das Assistant Professor IBS DehradunDocument21 pagesStrategic Management An Introduction Session 1a: Dr. Chiranjit Das Assistant Professor IBS DehradunSandeep KumarNo ratings yet

- Competitive Adavantage PDFDocument11 pagesCompetitive Adavantage PDFBo BéoNo ratings yet

- Marketing EssayDocument4 pagesMarketing Essaydaves125125No ratings yet

- 5-7 - Market Structures and EfficiencyDocument83 pages5-7 - Market Structures and EfficiencySamiyah Irfan 2023243No ratings yet

- Audit Lingkungan Eksternal (Lanjutan) : Helmina Ardyanfitri, S.M.,M.MDocument17 pagesAudit Lingkungan Eksternal (Lanjutan) : Helmina Ardyanfitri, S.M.,M.MBarron LaksmanaNo ratings yet

- Strategic Management and Small FirmsDocument7 pagesStrategic Management and Small FirmsAhmed AlAdlNo ratings yet

- Mahindra &mahindra - A Strategic Perspective: Group 5Document30 pagesMahindra &mahindra - A Strategic Perspective: Group 5sumon.dasNo ratings yet

- Chapter 5Document41 pagesChapter 5Muhammad Saddam SofyandiNo ratings yet

- Competitive Advantage and Strategic IS: Porter's Competitive Forces ModelDocument7 pagesCompetitive Advantage and Strategic IS: Porter's Competitive Forces ModelJason ImmanuelNo ratings yet

- The "Five Forces" Framework For Industry Analysis: SuppliersDocument28 pagesThe "Five Forces" Framework For Industry Analysis: Suppliersaffinity2924470No ratings yet

- Nature of MarketDocument17 pagesNature of MarketShreya VengurlekarNo ratings yet

- The Positioning Approach. Porter's 5 Forces. Value Chain Analysis. The Generic StrategiesDocument34 pagesThe Positioning Approach. Porter's 5 Forces. Value Chain Analysis. The Generic StrategiesRajat SethiaNo ratings yet

- 5 ForcesDocument42 pages5 Forcesaksr27No ratings yet

- Strategic Market ManagementDocument16 pagesStrategic Market ManagementNoor Ul Ain AnwarNo ratings yet

- CS For PGDM - Framework Templates SetDocument7 pagesCS For PGDM - Framework Templates SetTarun Kalicheti 22No ratings yet

- Porter's Five Forces of Competition Framework: Analyzing Industry AttractivenessDocument7 pagesPorter's Five Forces of Competition Framework: Analyzing Industry AttractivenessChhavi KhuranaNo ratings yet

- Industry Analysis of Toiletries Products: Presented By: Amit Joshi Anil Vishnoi Harshit ShahDocument19 pagesIndustry Analysis of Toiletries Products: Presented By: Amit Joshi Anil Vishnoi Harshit ShahSumit Kumar AgrawalNo ratings yet

- FALABELLADocument7 pagesFALABELLAzav.alvaro1No ratings yet

- Introduction To The Pricing Strategy and PracticeDocument28 pagesIntroduction To The Pricing Strategy and PracticeGis PeeNo ratings yet

- Chapter 1 CompleteDocument34 pagesChapter 1 CompleteDanish SheikhNo ratings yet

- Chapter 2 CompleteDocument20 pagesChapter 2 CompleteDanish SheikhNo ratings yet

- Chapter 3 CompleteDocument31 pagesChapter 3 CompleteDanish SheikhNo ratings yet

- To Discuss The Major Issues in Human Resource Management (HRM)Document20 pagesTo Discuss The Major Issues in Human Resource Management (HRM)Danish SheikhNo ratings yet

- BMS-FC-Corporate FailureDocument6 pagesBMS-FC-Corporate FailureDanish SheikhNo ratings yet

- BMS-FC-Culture and Change CH # 8Document18 pagesBMS-FC-Culture and Change CH # 8Danish SheikhNo ratings yet

- IndiGo Airlines Marketing PlanDocument33 pagesIndiGo Airlines Marketing PlanPurnendu Singh70% (10)

- Porter's Generic StrategiesDocument12 pagesPorter's Generic StrategiesabNo ratings yet

- Greenvolt Mobility ReportDocument30 pagesGreenvolt Mobility ReportHunny MaheshwariNo ratings yet

- The Influence of Product Differentiation StrategyDocument8 pagesThe Influence of Product Differentiation StrategyGeorge BosireNo ratings yet

- MC DraftDocument7 pagesMC DraftBalais, Rachel Anne Camille CubalesNo ratings yet

- 4 Wheeler IndustryDocument21 pages4 Wheeler IndustryJaptej Singh100% (1)

- Unit 3 Strategic ManagementDocument7 pagesUnit 3 Strategic Managementjojie dadorNo ratings yet

- Bc346paper 3Document12 pagesBc346paper 3FALTU MAILNo ratings yet

- Five Developments For Asia Green Development BankDocument5 pagesFive Developments For Asia Green Development BankkaythweNo ratings yet

- Chapter 1 - Defining Marketing For The 21 CenturyDocument32 pagesChapter 1 - Defining Marketing For The 21 CenturyMhagz MaggieNo ratings yet

- Test Bank For Strategic Management and Competitive Advantage 4th Edition BarneyDocument24 pagesTest Bank For Strategic Management and Competitive Advantage 4th Edition BarneyLindaEvansizgo100% (39)

- Titan Case StudyDocument9 pagesTitan Case Studycoolmanvns2No ratings yet

- Industry Analysis Checklist: Impact On Existing Firms in The Industry Negative PositiveDocument3 pagesIndustry Analysis Checklist: Impact On Existing Firms in The Industry Negative PositiveAbhijit PaikarayNo ratings yet

- Thomas4e Test Bank 09 (14670)Document23 pagesThomas4e Test Bank 09 (14670)datijik203No ratings yet

- MM 01 Handout 4 Marketing OpportunityDocument19 pagesMM 01 Handout 4 Marketing OpportunityAsset Dy100% (1)

- COR2100 Economics and Society - Group Project Guidelines and Stylized Report Example (AY2022-23 Term 2)Document4 pagesCOR2100 Economics and Society - Group Project Guidelines and Stylized Report Example (AY2022-23 Term 2)eleora.lim.2022No ratings yet

- Value Creation: The Source of Pricing AdvantageDocument53 pagesValue Creation: The Source of Pricing AdvantageDiani EkaNo ratings yet

- Business-Level Strategy Lecture SlidesDocument57 pagesBusiness-Level Strategy Lecture SlidesBirungi TinishaNo ratings yet

- Market Segmentation, Positioning and TargetingDocument53 pagesMarket Segmentation, Positioning and TargetingHari Naghu100% (3)

- Dokumen - Tips Kotler Chapter 7 MCQDocument42 pagesDokumen - Tips Kotler Chapter 7 MCQIman ChyunaNo ratings yet

- Organisational Behaviour of Nestle: Name - Rahul Surendra Jain Roll No-38 SUB - Organisational BehaviourDocument62 pagesOrganisational Behaviour of Nestle: Name - Rahul Surendra Jain Roll No-38 SUB - Organisational BehaviourHuyen T. MaiNo ratings yet

- Tourism Product Development Strategy (Study On The Botubarani Whale Shark Tourism Object, Bone Bolango Regency)Document8 pagesTourism Product Development Strategy (Study On The Botubarani Whale Shark Tourism Object, Bone Bolango Regency)International Journal of Innovative Science and Research TechnologyNo ratings yet

- 1) Difference Between TCM and SCM: Chapter I: Strategic Cost ManagementDocument25 pages1) Difference Between TCM and SCM: Chapter I: Strategic Cost ManagementTitanicNo ratings yet

- Mgt603 Midterm 13papersfilecomposedbysadiaalisadiiDocument92 pagesMgt603 Midterm 13papersfilecomposedbysadiaalisadiiAmeer Tiamoor100% (1)

- Classic Knitwear and Guardian - A Perfect FitDocument6 pagesClassic Knitwear and Guardian - A Perfect FitSHRUTI100% (1)

BMS-FC-Competitive Forces

BMS-FC-Competitive Forces

Uploaded by

Danish SheikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BMS-FC-Competitive Forces

BMS-FC-Competitive Forces

Uploaded by

Danish SheikhCopyright:

Available Formats

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

OVERVIEW

Objective

! To explain and evaluate the competitive forces model.

COMPETITIVE

FORCES

THE ! Concept

COMPETITIVE ! Model

FORCES MODEL ! New entrants

! Barriers to entry

! Substitutes

! Buyers

! Suppliers

! Rivalry

APPLICATION

AND

EVALUATION

! Application

! Strengths

! Weaknesses

! Market structure

! Government

Copyright Accountancy Tuition Centre Ltd 2001 0401

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

1 COMPETITIVE FORCES

1.1 Introduction

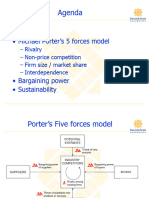

Michael Porter of the Harvard Business School engaged in extensive research into the

competitive position and threats affecting major organisations. His theory of

competitive forces, published in 1980, forced strategists to rethink their views on the

nature of competition.

1.2 The concept of competitive forces

Porter defined competition as “any activity within an industry that affects the levels of

margin earned”. As a result of extensive research, Porter concluded that most business

planners were far too “blinkered” in the way they viewed competition, focusing only

on those organisations within their industry who supplied similar products or services

to similar customers. These Porter called “rivals” and said that the term “competitors”

should be broadened to include not just rivals but also a further four types of

competitor.

Though the idea that an organisation “competes” with its customers and suppliers is

fairly radical, the competitive forces model put forward very compelling arguments,

and is now widely accepted.

Porter claimed that there are five “competitive forces” affecting every industry and

that, in most, some force other than rivalry has the greatest impact on the levels of

margin earned.

Copyright Accountancy Tuition Centre Ltd 2001 0402

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

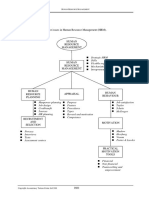

1.3 Competitive forces model

BARRIERS TO ENTRY

! Economic of scale GREATEST WHERE

! Which barriers exist? ! Rivals are of similar size

! Other cost advantages

! To what extent do they ! Slow growth in market

! Capital requirements

limit entry ! High fixed costs

! Access to distribution

! Are we trying to get in ! Price wars to maintain

! Patents

or keep others out? turnover

! Government policy

! Reactions of existing firms ! Lack of differentiation

! High exit barriers

THREAT

OF NEW

ENTRANTS

POWERS GREATEST WHERE

! Concentration of buyers

! Alternative sources of POWERS GREATEST WHERE

supply exist ! Few suppliers

! Cost of purchase is high BARGAINING RIVALRY BARGAINING ! Few substitutes

POWER OF POWER OF ! Switching costs are high

proportion of total cost SUPPLIERS

BUYERS ! Possibility of integrating

! Threat of backward integration

! Low switching costs forward

! Buyers have low profits ! Customers not significant

! Buyer has full information THREAT ! Supplier’s product differentiated

OF SUB-

STITUTES

! Can we find new markets

for our products?

! To what extent is there a danger?

! Can it be minimised by

differentiation or low costs?

Copyright Accountancy Tuition Centre Ltd 2000 0403

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

1.4 Threats posed by new entrants

There are three threats posed by potential new entrants to an industry:

! They bring with them new capacity which may directly affect the pricing

structures of the industry.

! They threaten market share in a very direct way, because they enter the

industry determined to achieve “critical mass” as quickly as possible. This

will allow them to exploit any scale economies.

! The firms within the industry will face increased costs, as they collectively

erect and maintain barriers to entry in order to deter new entrants.

1.5 Barriers to entry

The concept of entry barriers will be familiar to you from economics. A barrier is any

mechanism that deters entrants.

Example 1

What do you think are the main barriers to entry that firms might use to deter new

entrants?

1.6 Threat from substitutes

A substitute is a product or service that satisfies the same set of needs but originates in

a different industry or different state of technology. The threat posed by a substitute is

that the market volume for our product or service might suddenly reduce as customers

switch.

Our only defences against substitutes are:

! to produce and control them ourselves

! to buy them up

! to differentiate our product to such an extent that customers perceive that

there is “no substitute”

Copyright Accountancy Tuition Centre Ltd 2001 0404

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

Example 2

Give examples of industry and technology substitutes for air travel:

! Industry -

! Technology -

1.7 Bargaining power of buyers

Porter suggests that buyers are most powerful when:

! They are relatively large when compared to us

! We represent a significant part of their product cost

! We provide an undifferentiated or standard supply, so they have alternative

suppliers on hand

! There are few switching costs to prevent them buying elsewhere

! They earn low margins, so they want to force our prices down

! The customer threatens backward integration

! They are not quality-sensitive

! They have full information about our cost structure and margins

Example 3

Give examples of powerful buyers in your industry.

1.8 Bargaining power of suppliers

Suppliers are powerful when:

! There are relatively few suppliers of the product or service

! Few or no substitutes exist

! They perceive you to be small or unimportant

! The supplier’s product is an important component in your product or service

! They provide a differentiated or unique product

! They threaten forward integration

Copyright Accountancy Tuition Centre Ltd 2001 0405

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

Example 4

Give examples of common powerful suppliers.

1.9 Rivalry

Porter suggests that rivalry is more powerful where:

! Firms are equally balanced

! Industry growth is slow

! Storage costs are high

! There is little product differentiation and therefore little brand loyalty

! Large capacity increments exist due to high stepped fixed costs or large batch

sizes

! High strategic stakes (such as investment in factory or retail premises) exist

! There are high exit barriers, such as redundancy costs

Copyright Accountancy Tuition Centre Ltd 2001 0406

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

2 APPLICATION AND EVALUATION

2.1 Introduction

It is not sufficient that you are able to describe and explain the model. You may be

asked to apply it to a specific scenario, or to argue its strengths and weaknesses.

2.2 Applying the competitive forces model

Example 5

Prepare a competitive forces analysis based on the following scenario (3 sides in

total):

Lumber is a UK based drinks company whose origins are in cider manufacture. It has

well-established brand names and cider-making remains at the core of its business.

Over the years the company has expanded its operations, first in products closely

associated with cider and its by-product pectin, then into apple juices, and more

recently into other non-alcoholic drinks. The company has also expanded abroad by

acquisition.

Structure

The company is structured along divisional lines of responsibility split into three key

operating sections.

! The UK drinks division, responsible for the production and sale of cider and

apple juice in the UK, and the wholesale distribution of wines, spirits and

other drinks in the UK.

! The Overseas drinks division, responsible for cider and fruit juice operations

in Australia and the USA, and cider, apple juice and associated exports from

the UK.

! The Pectin division, responsible for the citrus and apple pectin production

and their sales in the UK and overseas, and also responsible for pectin

operations in Brazil and the Bahamas.

Each division of the company has a divisional board with its own managing director,

financial director and other functional directors. The three divisions report to the main

board of the company based in Hereford.

The company is an independent drinks company with more than half the equity

controlled by the Lumber family. Lumber is a firm advocate of industrial participation

and has a central corporate aim “the satisfaction of the needs of the shareholders,

customers and employees”. The stated strategic aim of the group is to achieve

sustained growth through the progressive development of the business and its brands,

and to maintain leadership in all of its key activities. A further aim is to stay

independent from the large drinks groups that dominate the market. Lumber believes

that success can only be achieved if every employee understands and supports the

objectives that the company strives to achieve, and through consultation with its

employees it hopes to build co-operative team spirit.

Copyright Accountancy Tuition Centre Ltd 2001 0407

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

Lumber’s trading divisions

The UK drinks division

In order to halt a recent decline in the sales of cider, the company has launched a

number of new brands, namely Special VAT for the premium end of the market

catering for the off-trade (home consumption), and Woodbow 1080, a premium brand

to be distributed through the pub trade. Both of these have been extensively supported

by promotion and advertising. The keg trade in cider is believed to have reached its

optimum level. Lumber still believes in the cider market and has plans to expand its

extraction capacity in Hereford using more locally-grown English fruit.

Soft drinks

Lumber has developed a range of soft drinks to cater for the non-alcoholic market.

Most of the Lumber brands are in the premium sector and are based around apple juice.

More recently Lumber has been developing other juices to increase its range, orange

and grape being the two most important. Carbonated and still juice markets are

growing and Lumber has an agency in the UK for the Perrier range of mineral waters

and these brands play an important role in the Lumber business.

Wines, spirits and other drinks

The wines and spirits business made progress in 20X5/X6 after a slow start. The

market is very competitive and in some cases showing signs of decline. Lumber is

represented by agency businesses in whisky, French brandy, French champagne and

other liqueurs. Lumber is also the marketing company for Domecq sherry. The sherry

market showed a decline of 2 per cent last year and margins are under severe pressure.

Lumber imports a Caribbean beer under the brand Red Stripe. This brand is slowly

making progress, using London as the first area to be covered.

Overseas drinks division

Australia

Lumber has expanded into Australia by a series of acquisitions starting in 20X2 and

continuing into 20X6. The acquisitions have all been in areas closely related to

Lumber’s business. There are plans to import into the country Lumber’s UK cider

brand Woodbow. Tests are being conducted in New South Wales to assess this

decision. The Australian market is new for Lumber and has not been without its

problems. Management has been strengthened with the appointment of a new

management team. The aim is to develop market share in what is a growing market.

United States of America

Lumber has taken an important decision to go into the American market. In 20X4 it

acquired the Red Cheek company, one of the foremost producers of apple juice whose

markets were essentially along the US East Coast. The company believed that by

taking over Red Cheek it would allow Lumber to have an important presence in the US

market where the apple juice market is considered to be a growing one.

Lumber had a number of problems with the Red Cheek acquisition. Severe price

competition meant a squeeze on margins, to which Lumber responded by introducing a

new range of blended fruit juices. The American acquisition cost £18.1 million, a large

sum for a company such as Lumber, and much of this was borrowed.

Copyright Accountancy Tuition Centre Ltd 2001 0408

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

This put up gearing, and finance charges on the loan had a depressing effect on profit in

20X4/X5. Further investment was needed in the Red Cheek business in the last

financial year until April 20X6. More work is needed on the Red Cheek acquisition

before it can be claimed to be a resounding success.

Direct exports

The expansion of the European Community has allowed the company to sell its UK

brands in the tourist areas of Spain and Portugal without suffering import duties.

Canada also appears to show promise, particularly the English-speaking areas such as

British Columbia.

The Pectin division

Lumber is the sole manufacturer of this product in the UK and is one of its main

producers in the world.

The pectin operation is based both in the UK and in plants abroad in Brazil and the

Caribbean. Lumber has an agency arrangement with Sunkist Growers Inc of the USA

to market world-wide the “Exchange” brand of pectin it controls. Overseas sales

amount to around 60 per cent of the division’s turnover. Currency movements play a

vital role in the division’s operations.

Outlook

Lumber is still trying to build its business back to the position it held in 20X3/X4.

Slowly the company is being turned around but much work has yet to be done. The

firm is investing substantially in its business and is attempting to reduce the level of its

borrowings. It aims for a complete recovery in the years to come.

2.3 Strengths

The competitive forces model, as you have hopefully found from having to apply it,

certainly changes our view of competition. The specific strengths when compared to

other environment analysis techniques are:

! The structure of the model is very rigorous and formalised

! There is a lot of detail given to support the model and suggest examples to

look for

! The model even suggests or implies some possible responses

2.4 Weaknesses

The competitive forces model does, however, have some weaknesses or difficulties in

application. These include:

! The model is very rigid, and it is sometimes difficult to decide which

category a particular example should go in

Copyright Accountancy Tuition Centre Ltd 2001 0409

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

! It is important to be very precise in the definition of what “our” industry is.

This will help to differentiate between, for example, rivals and substitutes.

! If an organisation operates in several industry segments, it is better to do a

separate analysis for each segment. Often the organisation’s products are

“substitutes” for one another.

2.5 Competitive forces and market structure

There is widespread debate as to whether the structure of the industry determines the

competitive forces that act on it, or vice-versa. This is very much a “chicken and egg”

situation, as the two are so closely related it is difficult to distinguish between them.

2.6 The role of government and legislation

Government has a diverse role in the nature of competitive forces acting on an industry.

It appears that each of the forces can be influenced, for example:

! Rivalry may be affected by competition legislation

! Substitutes may be encouraged or protected by government legislation

! Customer and supplier relationships may be affected by import and export

controls or subsidies

! Legal entry barriers such as patents or trademarks may protect the industry

FOCUS

You should now be able to

! understand the general competitive forces model

! discuss the intensity of rivalry among existing competitors

! discuss the bargaining power of suppliers

! discuss the bargaining power of buyers

! discuss the threat of new entrants

! discuss the threat of substitutes

! evaluate the weaknesses of the model

! understand the connection with market structure

! discuss the role of government and regulation.

Copyright Accountancy Tuition Centre Ltd 2001 0410

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

EXAMPLE SOLUTIONS

Solution 1 – Barriers to entry

Porter identifies the following entry barriers:

! Economies of scale

! Product differentiation

! Capital requirements such as investment in plant and machinery or marketing

! Cost advantages independent of size (the experience curve effect)

! Access to distribution channels such as retail outlets or “prime sites”

! Government policy

! The expected hostile and aggressive reaction of the firms within the industry

Solution 2 – Substitutes to air travel

! Industry - Rail or cruise

! Technology - Videoconferencing or e-mail

Solution 3 – Powerful buyers

This will obviously depend on your industry, but you might consider any customer or

client that represents a large percentage of your turnover, or perhaps a government

department.

Solution 4 – Powerful suppliers

You might include:

! Electricity or telephone suppliers

! Banks

! Suppliers of scarce raw materials

! Staff (if they have skills that are scarce they can demand high salaries)

Solution 5 – Lumber

This is a very detailed answer, but it does give you some idea of the volume of points

available from the scenario.

Within its drinks operations Lumber is involved in several products and markets.

These can be categorised as cider, soft drinks and other alcoholic drinks, for home and

overseas sales. This report will analyse the competitive nature of Lumber’s industry,

first within the cider market and then its other business activities.

CIDER OPERATIONS

Cider is Lumber’s core business, the firm being involved in manufacture and

distribution on an international basis.

Copyright Accountancy Tuition Centre Ltd 2001 0411

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

Suppliers

Industry profitability can be threatened by the presence of powerful suppliers.

Although little information is available on suppliers to the cider business, the following

points should be noted.

! Apple growers in the Hereford region are likely to be the most important

suppliers.

! Suppliers are likely to be small in relation to Lumber plc.

! Within the EC alternative sources of supply are likely to exist.

In conclusion, powerful suppliers are unlikely to prove a threat.

Buyers

Powerful buyers can also pressurise industry profit margins. The major buyers of

Lumber’s cider appear to be the UK pub trade (dominated by UK brewers),

supermarkets and off-sales chains. Details on cider sales overseas are sketchy but sales

are likely to be made to similar businesses. The following points should be noted.

! Some purchasers will be much larger than Lumber.

! Few switching costs exist.

! Buyers’ profit margins are likely to be low.

! Backward integration by public house chains is possible.

There does appear to be a threat from powerful buyers. Lumber’s major protection

here is the strength of its brand names, which could dissuade buyers from switching.

Substitutes

Cider is a traditional product and substitutes could come in many forms. These include

the following.

! Non-alcoholic drinks, particularly in view of health awareness.

! Other alcoholic drinks, for example lagers.

! Home-brewing sales in periods of recession.

The recent decline in cider sales is of concern and more details are required as to

whether this is a market trend, representing a switch away from cider drinking. If the

switch is towards non-alcoholic drinks Lumber has some protection due to its other

operations.

New entrants

New entrants to an industry can make that industry more competitive by price cutting,

promotional activities to build market share and bidding-up the costs of factors of

production. Barriers to entry to an industry protect against new entrants. Barriers to

entry to cider manufacturing and distribution include the following.

! Economies of scale – Lumber believes it is operating at an optimal level in

the production of keg cider; this could be high enough to deter new entrants.

! Product differentiation – through its existing brand names.

! Access to distribution channels – Lumber has established relationships with

the pub trade and off-sales; it is also building up a world-wide distribution

network.

Copyright Accountancy Tuition Centre Ltd 2001 0412

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

Whether these barriers would be sufficient to deter a new entrant is open to question.

The industry has a low technology level and capital requirements are likely to be small.

However, if cider consumption is falling the existence of excess capacity might deter

new entrants because of the fear of a price war with existing producers.

Rivals

Little information is available on Lumber’s rivals. However, the company appears

relatively small as compared to the large drinks groups that dominate the market. A

thorough analysis of other cider manufacturers is therefore required. The following

points are worthy of note.

! Decline in cider sales is likely to increase competition.

! Current advertising campaigns by Lumber and innovation in cider production

could be a sign of increased rivalry.

! If Lumber is trying to break into overseas cider markets, the reverse could

also occur and foreign manufacturers could attempt to import into the UK.

OTHER DRINKS

Many of the comments on competitive forces made above could apply equally to

Lumber’s other products. The following additional points should be noted.

Suppliers

! Apple juice operations are likely to have a similar supplier relationship to

cider. This could enhance Lumber’s power over suppliers.

! Perrier agency plays an important role in Lumber’s business and the threat of

forward integration or pressure on margins should be considered.

! Similar comments could be made on wine and spirits supply.

! Suppliers of finance could have great potential influence on the US

subsidiary due to high gearing levels.

Buyers

! Relationships are likely to be similar to cider, but with more emphasis on

supermarket trade for distribution of soft drinks.

! More information is needed on buyers in the USA and other foreign markets.

Substitutes

Decline in wine and spirits sales needs investigation. To which products are consumers

moving?

New entrants

New entrants could be deterred by

! Lumber’s brand names

! the highly competitive nature of the drinks industry

! access to distribution channels: Lumber’s traditional strength in cider

distribution will help here.

However, as many of the wine, spirit and soft drink brands are not owned by Lumber,

this position could be undermined.

Copyright Accountancy Tuition Centre Ltd 2001 0413

ENVIRONMENT ANALYSIS – COMPETITIVE FORCES

Rivals

! Soft drinks, wines and spirits markets all appear highly competitive.

! More information is needed on rivals in all markets.

! As margins are under pressure in some markets, direct sales by Lumber’s

suppliers could be a threat.

Copyright Accountancy Tuition Centre Ltd 2001 0414

You might also like

- Case AnalysisDocument20 pagesCase AnalysisViddhi ParekhNo ratings yet

- Bakery Industry Analysis With Porter'S Five Forces Model: Prepared by Group BDocument19 pagesBakery Industry Analysis With Porter'S Five Forces Model: Prepared by Group BThant Thandar100% (1)

- Leadership MCQ Questions TBLDocument14 pagesLeadership MCQ Questions TBLsaira tariqNo ratings yet

- 961 Beer Case PDFDocument22 pages961 Beer Case PDFayunda utariNo ratings yet

- Supply Chain Strategy and Financial MetricsDocument27 pagesSupply Chain Strategy and Financial Metricshappiest1No ratings yet

- Marketing Strategies of Local Business - (Borjan Shoes)Document19 pagesMarketing Strategies of Local Business - (Borjan Shoes)Faizaan Khan86% (7)

- Production & Operations Management - UploadDocument42 pagesProduction & Operations Management - UploadAlison Browne-Ellis100% (2)

- ConsultingDocument10 pagesConsultingkartikeya guptaNo ratings yet

- Environment & Industry Analysis and Firm PerformanceDocument27 pagesEnvironment & Industry Analysis and Firm PerformanceErwin SantosoNo ratings yet

- Five Forces Industry Analysis: Supplier Power Buying Power Intensity of RivalryDocument11 pagesFive Forces Industry Analysis: Supplier Power Buying Power Intensity of RivalryRizki RidwanNo ratings yet

- External Environment ANALYSIS (Competitive Analysis)Document13 pagesExternal Environment ANALYSIS (Competitive Analysis)Putri AnisaNo ratings yet

- Porters Five ForcesDocument13 pagesPorters Five ForcesLawrence MosizaNo ratings yet

- Week 04 Tutorial External EnvironmentDocument15 pagesWeek 04 Tutorial External EnvironmentsundayadedejitremaNo ratings yet

- ExternalDocument16 pagesExternalGarry YeohNo ratings yet

- Nego Legends Roun1 NegocioDocument22 pagesNego Legends Roun1 NegocioFahim DawanNo ratings yet

- OS Preparatory 16-18 BacthDocument14 pagesOS Preparatory 16-18 BacthRajeev MehtaNo ratings yet

- Porter's Five Forces: Barriers To EntryDocument2 pagesPorter's Five Forces: Barriers To EntryNimish JoshiNo ratings yet

- Industry Analysis:: The FundamentalsDocument13 pagesIndustry Analysis:: The FundamentalsChhavi KhuranaNo ratings yet

- Evaluar La Oportunidad de MercadoDocument1 pageEvaluar La Oportunidad de MercadoCarmen CastroNo ratings yet

- Evaluate Market Opportunity AttractivenessDocument1 pageEvaluate Market Opportunity AttractivenessLaura Natalia SalcedoNo ratings yet

- Worksheet 2 - Evaluate Market Opportunity AttractivenessDocument1 pageWorksheet 2 - Evaluate Market Opportunity AttractivenessManoj GoenkaNo ratings yet

- Industry AnalysisDocument14 pagesIndustry AnalysisJorge Humberto Chambi VillarroelNo ratings yet

- Porter 5 Forces Analysis PDFDocument6 pagesPorter 5 Forces Analysis PDFHarland OuiNo ratings yet

- Competitive Advantage: Author-Michael Porter Group No - 3Document50 pagesCompetitive Advantage: Author-Michael Porter Group No - 3rohanNo ratings yet

- 1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsDocument44 pages1.deciding Where You Want Your Business To Go, And: Basically, STRATEGY Is About Two ThingsMohammed AkhtarNo ratings yet

- S3 S4 Industry and Environmental AnalysisDocument19 pagesS3 S4 Industry and Environmental Analysisst123314No ratings yet

- The Five Competitive Forces That Shape StrategyDocument1 pageThe Five Competitive Forces That Shape StrategyMärtïnëz IvänNo ratings yet

- Mapa Conceptaul InglesDocument1 pageMapa Conceptaul InglesMärtïnëz IvänNo ratings yet

- Chapter 4Document56 pagesChapter 4Ameeruddin BugtiNo ratings yet

- Characteristic Perfect Competition: Barriers To EntryDocument1 pageCharacteristic Perfect Competition: Barriers To Entrybhagat103No ratings yet

- Porters Five Forces AnalysisDocument2 pagesPorters Five Forces AnalysisJulio FernandezNo ratings yet

- Eco CH 4 Full Notes by Shrishty AgarwalDocument7 pagesEco CH 4 Full Notes by Shrishty AgarwalDisha SrivastavaNo ratings yet

- 36487fund of Marketing Lecture 4 SP 23Document27 pages36487fund of Marketing Lecture 4 SP 23Muhammad BilalNo ratings yet

- PorterDocument12 pagesPortersalesmuliamakmurNo ratings yet

- Porter'S Five Forces Model Template: Buyer Power Barriers To EntryDocument1 pagePorter'S Five Forces Model Template: Buyer Power Barriers To EntryValters KazeNo ratings yet

- Beige Fashion Minimalist Presentation PDFDocument22 pagesBeige Fashion Minimalist Presentation PDFAlma NatañoNo ratings yet

- Infographics Business CompetitionDocument1 pageInfographics Business CompetitionPrinces Elizabeth P PeñafielNo ratings yet

- Automobile Dealer Industry Analysis 1Document9 pagesAutomobile Dealer Industry Analysis 1Sai Neeraj GundluruNo ratings yet

- Session 2 Competitive Strategies-1Document28 pagesSession 2 Competitive Strategies-1meebvkNo ratings yet

- A Presentation On Hindustan Uniliver (Hul)Document6 pagesA Presentation On Hindustan Uniliver (Hul)Prem GauravNo ratings yet

- A Presentation On Hindustan Uniliver (Hul)Document6 pagesA Presentation On Hindustan Uniliver (Hul)Prem GauravNo ratings yet

- A Presentation On Hindustan Uniliver (Hul)Document6 pagesA Presentation On Hindustan Uniliver (Hul)Prem GauravNo ratings yet

- Market StructuresDocument11 pagesMarket Structureslygiabuu28No ratings yet

- IKEA Case StudyDocument25 pagesIKEA Case StudyShaziya Kabani100% (1)

- Case Study - Overview & AnalysisDocument9 pagesCase Study - Overview & AnalysisNidhi JoshiNo ratings yet

- Strategic Management An Introduction Session 1a: Dr. Chiranjit Das Assistant Professor IBS DehradunDocument21 pagesStrategic Management An Introduction Session 1a: Dr. Chiranjit Das Assistant Professor IBS DehradunSandeep KumarNo ratings yet

- Competitive Adavantage PDFDocument11 pagesCompetitive Adavantage PDFBo BéoNo ratings yet

- Marketing EssayDocument4 pagesMarketing Essaydaves125125No ratings yet

- 5-7 - Market Structures and EfficiencyDocument83 pages5-7 - Market Structures and EfficiencySamiyah Irfan 2023243No ratings yet

- Audit Lingkungan Eksternal (Lanjutan) : Helmina Ardyanfitri, S.M.,M.MDocument17 pagesAudit Lingkungan Eksternal (Lanjutan) : Helmina Ardyanfitri, S.M.,M.MBarron LaksmanaNo ratings yet

- Strategic Management and Small FirmsDocument7 pagesStrategic Management and Small FirmsAhmed AlAdlNo ratings yet

- Mahindra &mahindra - A Strategic Perspective: Group 5Document30 pagesMahindra &mahindra - A Strategic Perspective: Group 5sumon.dasNo ratings yet

- Chapter 5Document41 pagesChapter 5Muhammad Saddam SofyandiNo ratings yet

- Competitive Advantage and Strategic IS: Porter's Competitive Forces ModelDocument7 pagesCompetitive Advantage and Strategic IS: Porter's Competitive Forces ModelJason ImmanuelNo ratings yet

- The "Five Forces" Framework For Industry Analysis: SuppliersDocument28 pagesThe "Five Forces" Framework For Industry Analysis: Suppliersaffinity2924470No ratings yet

- Nature of MarketDocument17 pagesNature of MarketShreya VengurlekarNo ratings yet

- The Positioning Approach. Porter's 5 Forces. Value Chain Analysis. The Generic StrategiesDocument34 pagesThe Positioning Approach. Porter's 5 Forces. Value Chain Analysis. The Generic StrategiesRajat SethiaNo ratings yet

- 5 ForcesDocument42 pages5 Forcesaksr27No ratings yet

- Strategic Market ManagementDocument16 pagesStrategic Market ManagementNoor Ul Ain AnwarNo ratings yet

- CS For PGDM - Framework Templates SetDocument7 pagesCS For PGDM - Framework Templates SetTarun Kalicheti 22No ratings yet

- Porter's Five Forces of Competition Framework: Analyzing Industry AttractivenessDocument7 pagesPorter's Five Forces of Competition Framework: Analyzing Industry AttractivenessChhavi KhuranaNo ratings yet

- Industry Analysis of Toiletries Products: Presented By: Amit Joshi Anil Vishnoi Harshit ShahDocument19 pagesIndustry Analysis of Toiletries Products: Presented By: Amit Joshi Anil Vishnoi Harshit ShahSumit Kumar AgrawalNo ratings yet

- FALABELLADocument7 pagesFALABELLAzav.alvaro1No ratings yet

- Introduction To The Pricing Strategy and PracticeDocument28 pagesIntroduction To The Pricing Strategy and PracticeGis PeeNo ratings yet

- Chapter 1 CompleteDocument34 pagesChapter 1 CompleteDanish SheikhNo ratings yet

- Chapter 2 CompleteDocument20 pagesChapter 2 CompleteDanish SheikhNo ratings yet

- Chapter 3 CompleteDocument31 pagesChapter 3 CompleteDanish SheikhNo ratings yet

- To Discuss The Major Issues in Human Resource Management (HRM)Document20 pagesTo Discuss The Major Issues in Human Resource Management (HRM)Danish SheikhNo ratings yet

- BMS-FC-Corporate FailureDocument6 pagesBMS-FC-Corporate FailureDanish SheikhNo ratings yet

- BMS-FC-Culture and Change CH # 8Document18 pagesBMS-FC-Culture and Change CH # 8Danish SheikhNo ratings yet

- IndiGo Airlines Marketing PlanDocument33 pagesIndiGo Airlines Marketing PlanPurnendu Singh70% (10)

- Porter's Generic StrategiesDocument12 pagesPorter's Generic StrategiesabNo ratings yet

- Greenvolt Mobility ReportDocument30 pagesGreenvolt Mobility ReportHunny MaheshwariNo ratings yet

- The Influence of Product Differentiation StrategyDocument8 pagesThe Influence of Product Differentiation StrategyGeorge BosireNo ratings yet

- MC DraftDocument7 pagesMC DraftBalais, Rachel Anne Camille CubalesNo ratings yet

- 4 Wheeler IndustryDocument21 pages4 Wheeler IndustryJaptej Singh100% (1)

- Unit 3 Strategic ManagementDocument7 pagesUnit 3 Strategic Managementjojie dadorNo ratings yet

- Bc346paper 3Document12 pagesBc346paper 3FALTU MAILNo ratings yet

- Five Developments For Asia Green Development BankDocument5 pagesFive Developments For Asia Green Development BankkaythweNo ratings yet

- Chapter 1 - Defining Marketing For The 21 CenturyDocument32 pagesChapter 1 - Defining Marketing For The 21 CenturyMhagz MaggieNo ratings yet

- Test Bank For Strategic Management and Competitive Advantage 4th Edition BarneyDocument24 pagesTest Bank For Strategic Management and Competitive Advantage 4th Edition BarneyLindaEvansizgo100% (39)

- Titan Case StudyDocument9 pagesTitan Case Studycoolmanvns2No ratings yet

- Industry Analysis Checklist: Impact On Existing Firms in The Industry Negative PositiveDocument3 pagesIndustry Analysis Checklist: Impact On Existing Firms in The Industry Negative PositiveAbhijit PaikarayNo ratings yet

- Thomas4e Test Bank 09 (14670)Document23 pagesThomas4e Test Bank 09 (14670)datijik203No ratings yet

- MM 01 Handout 4 Marketing OpportunityDocument19 pagesMM 01 Handout 4 Marketing OpportunityAsset Dy100% (1)

- COR2100 Economics and Society - Group Project Guidelines and Stylized Report Example (AY2022-23 Term 2)Document4 pagesCOR2100 Economics and Society - Group Project Guidelines and Stylized Report Example (AY2022-23 Term 2)eleora.lim.2022No ratings yet

- Value Creation: The Source of Pricing AdvantageDocument53 pagesValue Creation: The Source of Pricing AdvantageDiani EkaNo ratings yet

- Business-Level Strategy Lecture SlidesDocument57 pagesBusiness-Level Strategy Lecture SlidesBirungi TinishaNo ratings yet

- Market Segmentation, Positioning and TargetingDocument53 pagesMarket Segmentation, Positioning and TargetingHari Naghu100% (3)

- Dokumen - Tips Kotler Chapter 7 MCQDocument42 pagesDokumen - Tips Kotler Chapter 7 MCQIman ChyunaNo ratings yet

- Organisational Behaviour of Nestle: Name - Rahul Surendra Jain Roll No-38 SUB - Organisational BehaviourDocument62 pagesOrganisational Behaviour of Nestle: Name - Rahul Surendra Jain Roll No-38 SUB - Organisational BehaviourHuyen T. MaiNo ratings yet

- Tourism Product Development Strategy (Study On The Botubarani Whale Shark Tourism Object, Bone Bolango Regency)Document8 pagesTourism Product Development Strategy (Study On The Botubarani Whale Shark Tourism Object, Bone Bolango Regency)International Journal of Innovative Science and Research TechnologyNo ratings yet

- 1) Difference Between TCM and SCM: Chapter I: Strategic Cost ManagementDocument25 pages1) Difference Between TCM and SCM: Chapter I: Strategic Cost ManagementTitanicNo ratings yet

- Mgt603 Midterm 13papersfilecomposedbysadiaalisadiiDocument92 pagesMgt603 Midterm 13papersfilecomposedbysadiaalisadiiAmeer Tiamoor100% (1)

- Classic Knitwear and Guardian - A Perfect FitDocument6 pagesClassic Knitwear and Guardian - A Perfect FitSHRUTI100% (1)